Every month begins with optimism: a fresh salary, a clean budget, and a quiet promise to save more. Yet by the third week, reality sets in: food deliveries, impulse buys, forgotten subscriptions, and the sudden reminder that rent is due soon.

If this pattern feels familiar, you’re not alone. Managing monthly expenses is one of the most common financial challenges for working professionals and students alike. The issue isn’t always income; it’s often a lack of structure and awareness about where money actually goes.

A solid money management routine doesn’t have to be complicated. By understanding your spending habits, setting realistic limits, and reviewing your budget regularly, you can gain control without feeling restricted.

This guide walks you through practical, proven methods to manage monthly expenses in 2025, from tracking and budgeting to handling unexpected costs responsibly.

TL;DR (Key Takeaways)

- Track your income and expenses for at least one full month to understand your spending habits.

- Follow a realistic budget framework such as the 50-30-20 rule to balance needs, wants, and savings.

- Review your budget weekly and adjust categories instead of waiting for month-end surprises.

- Build an emergency fund covering three months of essentials to handle irregular or sudden expenses.

- Use technology and automation to simplify tracking, bill payments, and saving habits.

How to Manage Your Monthly Expenses in 2025

Every effective expense plan begins with visibility and consistency. The goal is to create a system where you always know what you earn, what you spend, and where you can adjust without stress. Below are practical steps that help you build financial control and confidence, one habit at a time.

Step 1: Understand where your money goes

The first rule of money management is simple: you can’t control what you can’t see.

Start by mapping your monthly inflows and outflows. This means every single rupee, your main income, freelance projects, tuition fees, side hustle earnings, and yes, even that ₹99 OTT renewal you forgot existed.

Here’s how to get started:

- List your income sources – salary, allowances, side income, bonuses.

- List your fixed expenses – rent, EMIs, insurance, phone, and Wi-Fi bills.

- List your variable expenses – groceries, travel, eating out, subscriptions, personal shopping, etc.

- Add occasional or seasonal costs – annual premiums, vehicle service, festival gifts, or vacations.

Once you’ve got the full picture, categorise expenses as:

- Needs: essentials you can’t skip (rent, groceries, transport)

- Wants: lifestyle choices (streaming, dining out, gadgets)

- Savings/debt repayment: long-term goals and commitments

Pro tip: Track your expenses for one complete month using a spreadsheet or a free app. Most people underestimate their “wants” by 20–30% until they actually record them.

For Indian earners, the average split often looks like this:

- 45–55% essentials

- 25–35% lifestyle spending

- 10–20% savings or investments

Your goal is not to cut every rupee; it’s to make spending intentional.

Also read: Understanding the Basics of Financial Planning and Its Importance

Step 2: Create a realistic monthly budget

A budget isn’t a punishment; it’s a plan that gives your money direction.

Instead of guessing how much to save, use a clear framework that fits your income and lifestyle.

The 50-30-20 rule (simple & flexible)

- 50% for needs (rent, utilities, groceries, transport)

- 30% for wants (restaurants, streaming, hobbies)

- 20% for savings or debt repayment

If you earn ₹40,000 a month, that means:

- ₹20,000 for needs

- ₹12,000 for wants

- ₹8,000 for savings

You can tweak these numbers slightly, for example, if you live in a high-rent city, shift 5–10% from “wants” to “needs.” The key is balance, not rigidity.

Zero-based budgeting (for detail-oriented people)

Zero-based budgeting assigns every rupee a purpose. Your total income minus all allocations should equal zero, ensuring that every rupee is accounted for, whether it’s spent, saved, or invested. This model helps identify leaks and encourages conscious decisions, especially useful for freelancers or individuals with irregular income.

Envelope or “pot” method (great for students)

Divide your income into small digital or physical “pots” — for example, food, transport, personal expenses, and savings. Once a pot runs out, spending in that category stops. This system builds discipline naturally and works well for people managing their first independent budget.

A good budget should be flexible enough to handle real-life surprises but structured enough to guide your spending behaviour.

Also read: 6 Simple Budgeting Tips for Better Money Management

Step 3: Differentiate needs vs wants

Budgets don’t fail because of mathematics; they fail because of impulse. Learning to tell the difference between needs and wants helps you spend with intention rather than emotion.

A few mindset tweaks can make a big difference:

- Delay gratification. Wait 24 hours before making any unplanned purchase.

- More than half the time, the urge fades, and you’ve saved that money effortlessly.

- Audit your “wants.” Review last month’s non-essentials, what truly added value, and what was just impulse?

- Reframe spending. Instead of “I can’t afford it,” think “Is this worth delaying my goal?”

- Use digital discipline. Keep one UPI wallet only for discretionary spending, as it helps visualise when you’re nearing your limit.

By separating needs from wants, you don’t just save, you spend with purpose.

Step 4: Use technology and discipline to track expenses

Once you’ve built a budget, the next challenge is consistency, sticking to it every day, not just at the start of the month. Technology can make this easier, but discipline is what makes it work.

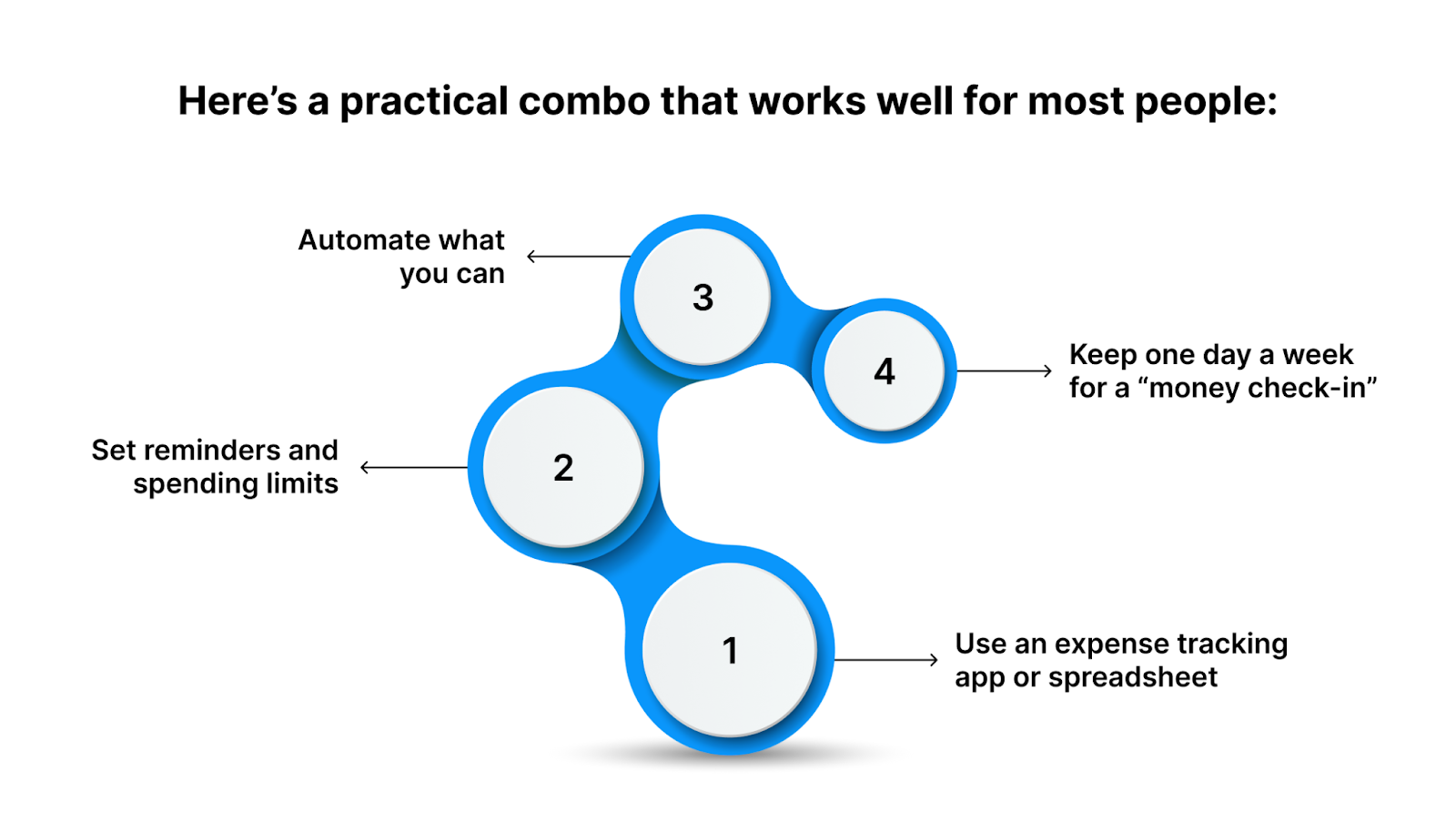

Here’s a practical combo that works well for most people:

1. Use an expense tracking app or spreadsheet

- Apps like Walnut, Money Manager, or ET Money automatically read your SMSes to log spends.

- For privacy-conscious users, a simple Google Sheet or Notion template works just as well.

- The goal is not automation alone; it’s awareness. You want to see where every rupee goes.

2. Set reminders and spending limits

- Use your bank app’s budgeting tools or UPI app analytics.

- Many apps now show category-wise spends (food, bills, travel), and review them weekly.

- Set soft alerts when a category reaches 80% of your monthly limit.

3. Automate what you can

- Automate rent transfers, EMIs, SIPs, and recurring bills.

- Automation removes human error; you’ll never forget an EMI again.

4. Keep one day a week for a “money check-in”

Spend 15 minutes each weekend reviewing where your money went.

Ask yourself:

- Did I overshoot any category?

- Did any unplanned expense pop up?

- Can I adjust something next week?

Pro tip: Don’t wait till month-end to face the numbers. Weekly awareness prevents financial surprises.

Step 5: Optimise and cut down without sacrifice

Managing monthly expenses doesn’t mean living like a monk; it means cutting waste, not joy. Small, consistent tweaks can save thousands a month without feeling restrictive.

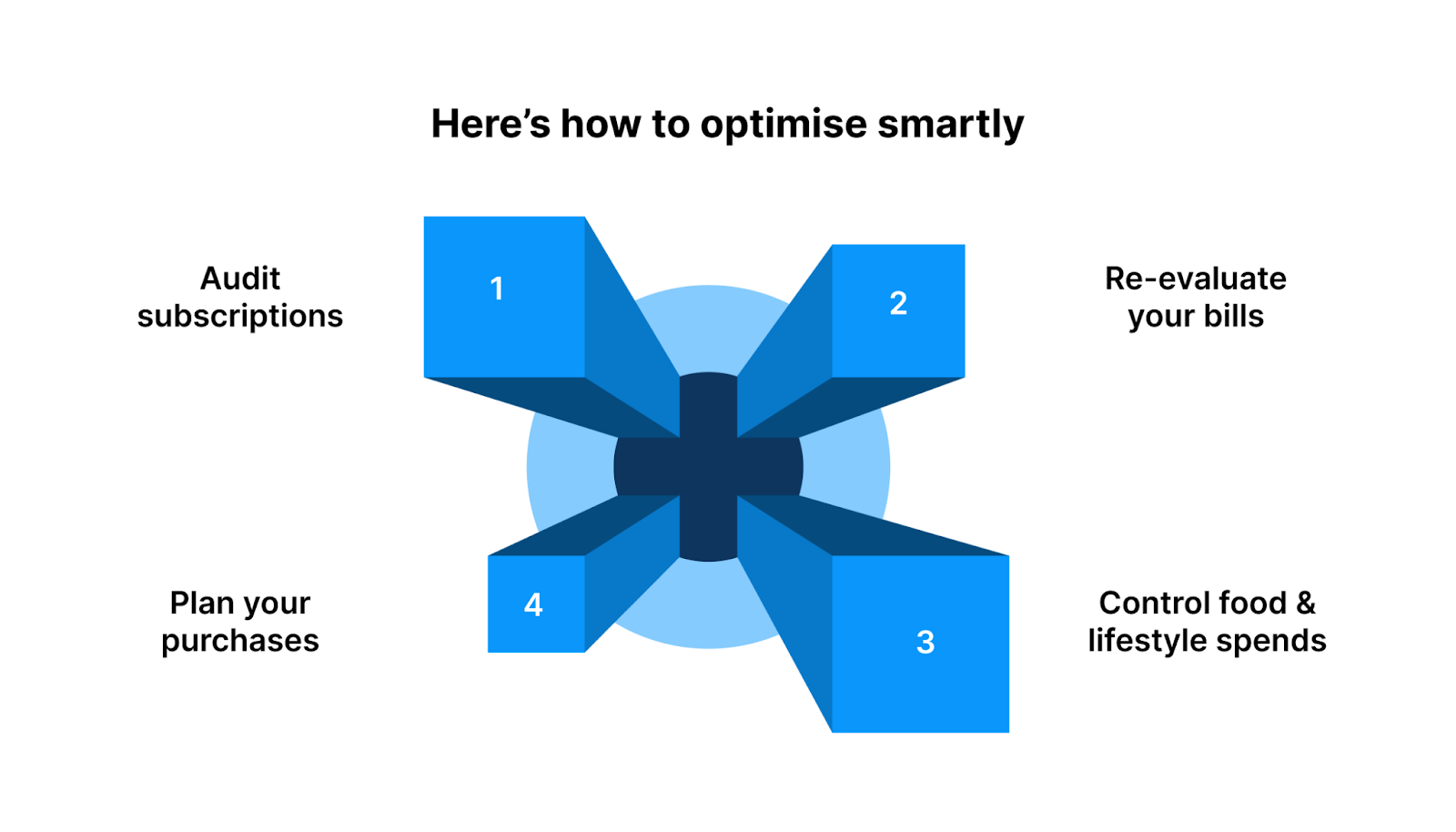

Here’s how to optimise smartly:

Audit subscriptions

Cancel what you don’t use. That ₹149 OTT renewal or “free-trial” app quietly draining money each month? It adds up.

Re-evaluate your bills

- Compare mobile and internet plans; new bundles are often cheaper.

- Use cashback offers and UPI-linked credit cards only if you pay full dues monthly.

Control food & lifestyle spends

- Cook three extra meals a week instead of ordering; that alone saves ₹1,000–₹2,000 monthly.

- Try a “no-spend weekend” challenge once a month.

Plan your purchases

- Buy groceries or essentials in bulk once a month, which is cheaper and results in fewer impulse buys.

- For non-essentials, use the 24-hour pause rule before checkout.

Remember: Cutting down 10% in three expense categories is often easier than slashing 30% in one.

Optimisation is less about deprivation and more about reallocating money to what matters: savings, experiences, or building financial security.

Step 6: Build a buffer and plan for irregular expenses

Life doesn’t follow monthly calendars. Unexpected expenses, such as a phone repair, medical bill, or travel plan, can knock your budget off balance. That’s why every financially stable person builds a buffer.

1. Set up an emergency fund

An emergency fund is the foundation of financial security. Start by saving at least three months’ worth of essential expenses, including rent, groceries, and EMIs. Keep this money in a separate savings account or a low-risk liquid mutual fund for instant access. Even contributing ₹1,000–₹2,000 each month steadily builds resilience over time.

2. Prepare for predictable but irregular costs

Some expenses happen annually or seasonally: insurance premiums, festival shopping, vehicle servicing, or subscriptions.

Divide these by 12 and save that amount monthly; when the bill arrives, you’re already ready.

3. Separate your accounts

Use one bank account for recurring expenses, one for savings, and one for discretionary spending. This simple separation helps you track and control cash flow automatically.

A solid buffer isn’t just financial; it gives you mental space. When you’re prepared, unexpected costs don’t derail your month.

Step 7: When the monthly cash flow gets tight, Pocketly can help

Even the most disciplined budgets can face pressure. A delayed salary, a sudden medical bill, or an unplanned trip can cause short-term cash gaps that derail your plans. In such cases, having access to responsible, transparent short-term credit can help you stay consistent without falling into debt traps.

Pocketly offers a modern, compliant way to bridge these temporary gaps responsibly. Designed for young earners and professionals, it provides instant microloans that support financial stability rather than promote reckless spending.

Here’s how it helps when your monthly cash flow feels stretched:

- Instant access to ₹1,000–₹25,000, short-term personal loans disbursed directly to your bank account.

- 100% digital KYC process, no paperwork, no collateral.

- Transparent APR, no hidden charges, you’ll see your exact repayment amount before confirming.

- Flexible repayment options, pay early, or close the loan anytime.

- Supportive, not predatory, built for responsible borrowing and long-term credit confidence.

Pocketly exists to provide liquidity, not temptation. Used correctly, it can help maintain your credit score, prevent missed EMIs, and keep your financial plan intact when life doesn’t go according to schedule.

Download Pocketly on Android or iOS to explore small-ticket, KFS-compliant loans for emergencies; always borrow responsibly, only when needed.

Step 8: Review your spending monthly and adjust

A budget is not a static document; it should evolve with your life. Prices rise, habits change, and priorities shift. Reviewing your spending regularly ensures that your financial system continues to reflect your real circumstances.

At the end of each month, take time to review three things:

- Plan vs actuals: Compare what you budgeted against what you actually spent. Identify categories where you consistently overshoot.

- Patterns and triggers: Look for repeated spending patterns—maybe food delivery spikes after long workdays, or transport costs rise on weekends. Awareness helps you plan more accurately next month.

- Reallocate consciously: If you underspent in one area, move that surplus to savings or next month’s high-cost categories.

Consistency matters more than perfection. Even a 10-minute monthly review helps you identify leaks early and fine-tune your financial rhythm before problems grow.

Common Challenges While Managing Monthly Expenses and How to Overcome Them

Even with a well-structured budget and consistent tracking, staying financially disciplined every month can be difficult. Real-world factors like lifestyle changes, delayed payments, or emotional spending habits can derail your plan. Recognising these challenges early helps you prepare practical strategies to overcome them.

1. Overspending on Small, Frequent Purchases

Small transactions such as food deliveries, rides, or subscriptions can quietly add up. Many people underestimate these micro-spends because they feel insignificant in isolation.

How to overcome: Set a weekly limit for discretionary spending and use one UPI wallet or prepaid card only for non-essential expenses. When the balance runs out, stop until the next cycle.

2. Difficulty Sticking to the Budget

Most people start with enthusiasm but struggle to follow through by the second or third week of the month. This often happens when the budget is unrealistic or too rigid.

How to overcome: Keep your first few budgets flexible. Track your patterns for two to three months and adjust based on real data. A budget that reflects your actual lifestyle is easier to maintain.

3. Unexpected or Irregular Expenses

Annual fees, insurance renewals, and emergency repairs can suddenly disrupt your monthly cash flow. These aren’t always avoidable, but they can be planned for.

How to overcome: Create a separate “irregular expenses” fund by setting aside a small fixed amount every month. When large payments arise, they won’t feel like a setback.

4. Emotional or Impulsive Spending

Buying to relieve stress or boredom is common, especially with instant digital payments. These purchases may bring short-term satisfaction but long-term imbalance.

How to overcome: Introduce a 24-hour pause rule before any unplanned purchase. If it still feels necessary the next day, buy it; otherwise, skip it.

5. Peer Pressure and Social Spending

Dining out, travel, or celebrations with friends can strain even well-managed budgets. Social obligations often make it difficult to say no.

How to overcome: Plan your social spending as a fixed monthly category. If you exceed it once, balance it the following week. Real friends respect financial boundaries.

6. Lack of Motivation After Initial Progress

Once you get comfortable with a system, it’s easy to lose focus or skip your reviews. Over time, this leads to slipping back into old habits.

How to overcome: Reward progress. Set mini-milestones such as completing three consecutive months of consistent budgeting. Celebrate these achievements modestly — it reinforces discipline.

Related: 6 Simple Budgeting Tips for Better Money Management

Conclusion

Managing monthly expenses isn’t about restriction; it’s about direction. When you understand where your money goes, plan your spending consciously, and review it regularly, financial stability follows naturally.

Start small: track your expenses for one full month, apply a simple framework like 50-30-20, and review your progress every few weeks. With time, these small habits turn into a confident system that keeps your finances steady, even when life gets unpredictable.

And when unexpected needs arise, like a sudden repair, travel, or medical cost—you can rely on a transparent, responsible partner like Pocketly. It offers a simple, responsible way to bridge short-term gaps without disrupting your financial rhythm. With instant access to ₹1,000 to ₹25,000 directly in your bank account, 100% digital KYC, and transparent repayment terms, it’s designed to give you flexibility when you need it most without hidden charges or complicated paperwork.

Whether you’re facing an emergency or managing a temporary cash crunch, Pocketly helps you stay consistent, protect your credit health, and keep your goals on track.

Take control of your finances, build discipline for the long term, and rely on Pocketly when life brings short-term surprises.

Download Pocketly today and experience how responsible credit can simplify your monthly money management.

FAQs

1. What is the best way to manage monthly expenses?

The most effective way is to record every expense, create a realistic budget (for example, the 50-30-20 rule), and review it weekly. Awareness and consistency matter more than complexity.

2. How can I manage expenses if my income fluctuates?

Base your budget on the lowest income you typically receive. Treat extra earnings as a bonus for savings or emergency funds. Freelancers and gig workers benefit from using an average of the past three to six months as a planning baseline.

3. How much of my income should I save each month?

Aim for at least 20% of your income toward savings or investments. If that’s difficult initially, start smaller—5–10%—and gradually increase as your income stabilises.

4. Are budgeting apps safe to use?

Yes, reputable apps are safe if they follow proper encryption and data privacy standards. Always use apps from trusted developers and verify permissions before granting SMS or account access.

5. Should I rely on short-term loans to manage monthly expenses?

Ideally, short-term loans should be a temporary solution, not a regular practice. Platforms like Pocketly can help when emergencies arise, but they should be used responsibly and repaid on time to maintain financial health.