Every major retailer today, from Amazon and Flipkart to Apple and Samsung, flashes “no-cost EMI” at checkout. It sounds irresistible: buy now, pay later, and supposedly pay no interest.

But is it really free? Or is the cost simply hidden somewhere else in the transaction?

“No-cost EMI” has become a popular marketing phrase across credit cards, digital lenders, and fintech platforms. The promise is simple: spread your payments across months without incurring any extra fees. Yet, what many consumers don’t realise is that someone is paying that cost, and it might, indirectly, still be them.

This article breaks down exactly how no-cost EMI works, how lenders and merchants share the cost, the hidden mechanics behind “zero interest”, and what you should check before choosing such an offer.

TL;DR:

- No-cost EMI isn’t truly free. The interest is paid by the merchant or manufacturer as a subsidy or built into the product’s price.

- Banks still earn. They recover costs through merchant fees (MDR), interchange income, or hidden processing charges.

- Always check the fine print. Review the Key Facts Statement (KFS), processing fees, GST, and late-payment clauses.

- Compare prices before buying. The same product might cost more under EMI than on full payment.

- Responsible borrowing matters. If you need short-term liquidity, choose transparent credit options like Pocketly, not hidden-interest offers.

What is a no-cost EMI?

A no-cost EMI (Equated Monthly Instalment) is a repayment option that allows buyers to split a purchase amount into smaller monthly instalments without paying visible interest.

For example, if you buy a smartphone for ₹30,000 under a six-month no-cost EMI, you’ll pay ₹5,000 per month, apparently without any added interest.

How it differs from a regular EMI

In a regular EMI, the lender charges interest on the principal amount. For instance, a ₹30,000 loan at 12% annual interest over six months would cost you roughly ₹30,900, ₹900 being the interest.

In a no-cost EMI, the customer pays exactly ₹30,000 in total, not ₹30,900. So, where did that missing ₹900 go? That’s where the “no-cost” illusion begins; the merchant or manufacturer absorbs that interest by offering an upfront discount or marking up the product price.

Typical forms of no-cost EMI in India

- Credit card-based EMI: The bank offers an EMI option at checkout. The interest charged by the bank is offset by a discount from the merchant.

- Debit card or cardless EMI: NBFCs or banks pre-approve eligible users, splitting the payment into instalments without needing a credit card.

- Consumer finance NBFCs: Financiers like Bajaj Finserv or HDB Finance partner with stores to offer “no-cost” options on electronics, appliances, and lifestyle products.

According to the RBI’s 2013 circular, lenders are not allowed to advertise zero-interest loans. However, the scheme is technically valid when the interest component is paid by the merchant or manufacturer, not waived entirely.

Also read: What Is a Personal Loan: Definition, Types, and Benefits

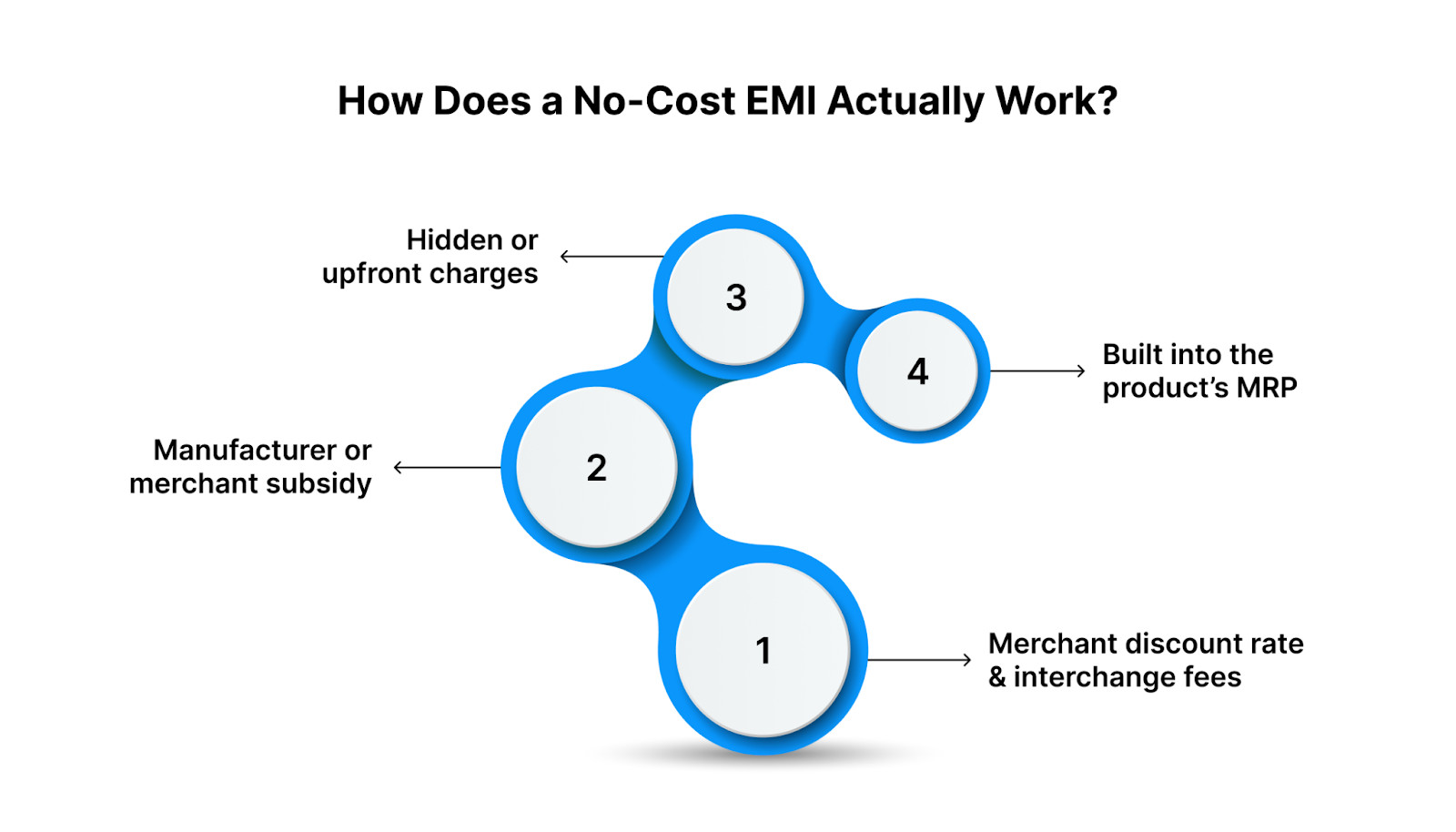

How Does a No-Cost EMI Actually Work?

The truth is simple: a no-cost EMI is not truly “free”. The interest still exists, it’s just being subsidised or built into the price by the seller or brand partner.

1. Merchant discount rate (MDR) and interchange fees

Whenever a customer makes a purchase on EMI using a card, the bank or payment provider charges the merchant a small fee, known as the Merchant Discount Rate (MDR), typically ranging from 1.5% to 3% of the transaction value.

In a no-cost EMI, this fee, along with the interest component, is usually absorbed by the merchant as part of their marketing costs.

2. Manufacturer or merchant subsidy

Sometimes, the manufacturer (brand) pays the bank the equivalent of the interest as a subsidy, so that the customer’s EMI appears interest-free.

For example, a smartphone company might offer the bank a 6% upfront discount to enable a 6-month no-cost EMI scheme.

3. Hidden or upfront charges

Certain offers still include processing fees, foreclosure penalties, or GST on interest, even if the principal instalments appear even.

A ₹499 “convenience fee” or 18% GST on the interest portion are common small costs that make the scheme not entirely free of charge.

4. Built into the product’s MRP

Some merchants simply raise the product price slightly, effectively embedding the total interest into the final tag.

This is why the same item may cost more under a “no-cost EMI” offer than if you pay upfront.

So, while the buyer sees equal instalments with no visible interest, the cost is silently distributed among the bank, merchant, and manufacturer, with each taking a smaller cut.

Related: Understanding Cash Flow: Definition, Types, and Analysis

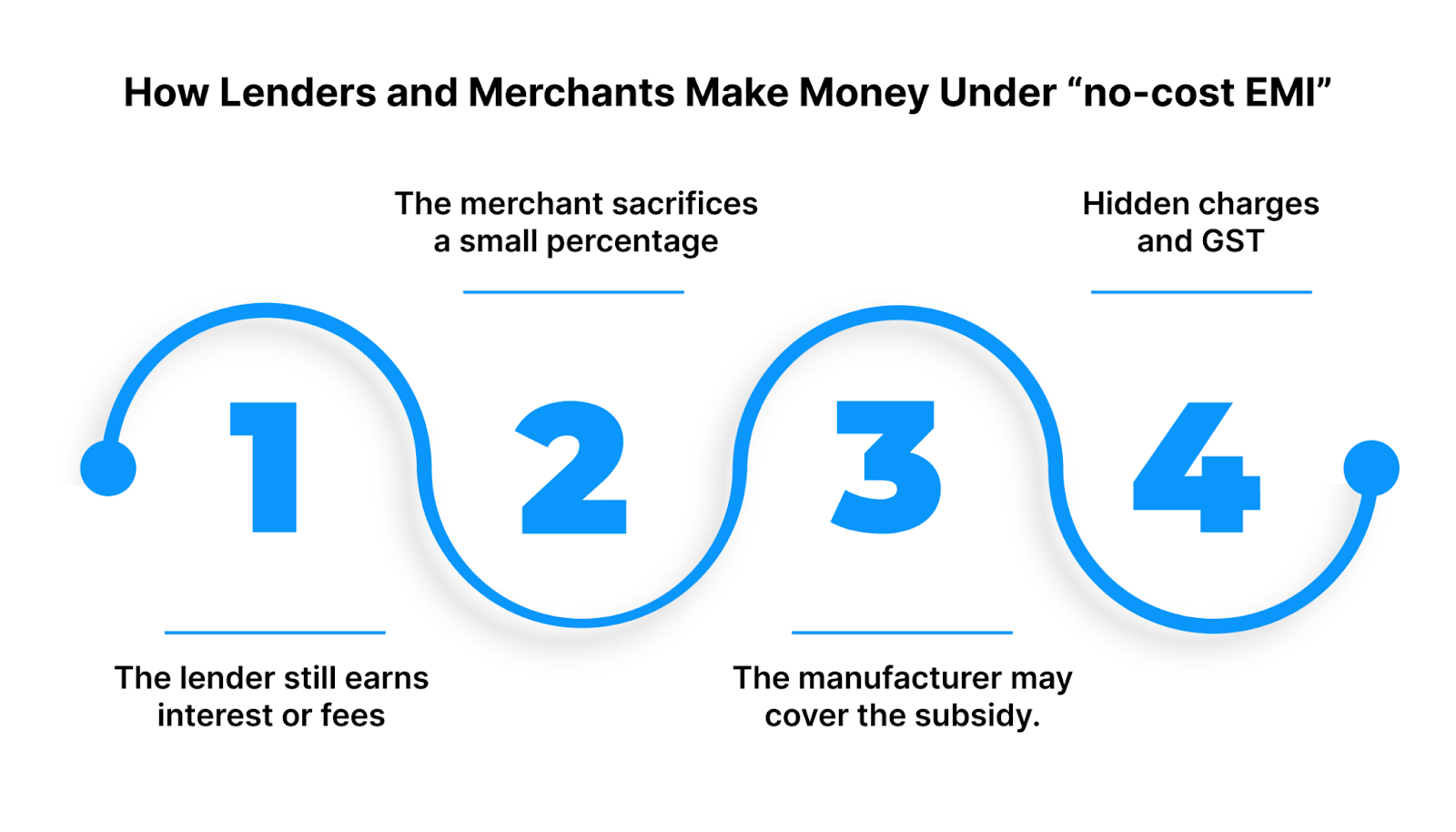

How Lenders and Merchants Make Money Under “no-cost EMI”

Despite the label, a no-cost EMI is never a zero-revenue model. The lender, the merchant, and sometimes even the manufacturer, all participate in redistributing costs so that the customer feels like they’re not paying interest.

1. The lender still earns interest or fees

Banks and NBFCs don’t run charity programmes. Even in a no-cost EMI, they charge interest to the merchant or manufacturer instead of the buyer.

This interest covers their funding cost, risk premium, and interchange fees on card-based EMIs.

Additionally, if a buyer defaults or delays a payment, penal interest typically 18% to 30% p.a. is charged, generating further income for the lender.

2. The merchant sacrifices a small percentage

Merchants accept reduced margins to attract sales volume. The interest the lender would have charged the buyer (say, 6–8%) is absorbed as a marketing cost by the seller.

For high-margin categories like smartphones, laptops, or furniture, this trade-off is worthwhile, as it drives conversions and average order values.

For example, on a ₹30,000 phone, a retailer might surrender ₹1,200–₹1,500 in interest to enable a “no-cost” label, counting on higher sales to offset the loss.

3. The manufacturer may share or fully cover the subsidy

Large brands like Apple, Samsung, and Sony often co-fund the subsidy with the merchant.

They transfer a discount (often 3–6%) directly to the financing partner, making the transaction zero-interest for the consumer.

4. Hidden charges and GST

Even if the principal seems flat, some platforms add processing fees or GST on interest.

So, while the EMI itself appears “no-cost,” there are small overheads buried in the fine print, turning the offer into a “low-cost EMI”, not a no-cost one.

In short, the consumer’s perceived benefit is largely a redistribution of costs among other stakeholders. The financial system still earns its due, just from different pockets.

Step-by-Step Example: How a “no-cost EMI” Is Structured

Let’s see a practical example to understand where the cost actually hides.

Scenario: You buy a smartphone worth ₹30,000 on a 6-month no-cost EMI.

Case 1: Regular EMI

- Product price: ₹30,000

- Tenure: 6 months

- Interest: 12% per annum

- Monthly EMI: ₹5,155

- Total repayment: ₹30,930

- Total interest paid: ₹930

Case 2: no-cost EMI

Here’s what happens behind the scenes:

- The lender still charges ₹930 as interest.

- The merchant or manufacturer offers a ₹930 discount upfront to the lender.

- The buyer pays six instalments of ₹5,000 each (₹30,000 total).

- The lender receives the full principal + interest (₹30,930) but from two sources:

- ₹30,000 from the buyer

- ₹930 from the merchant/manufacturer as a subsidy

From the customer’s perspective, it appears they paid no interest.

In reality, the interest was shifted, not erased.

Sometimes, instead of paying a discount to the bank, the seller simply marks up the product price to ₹30,900 and still offers “no-cost EMI.”

Both routes end in the same result: the buyer pays the interest indirectly.

This example shows why “no-cost EMI” isn’t technically free; it’s a marketing-financed discount mechanism, not a waived loan cost.

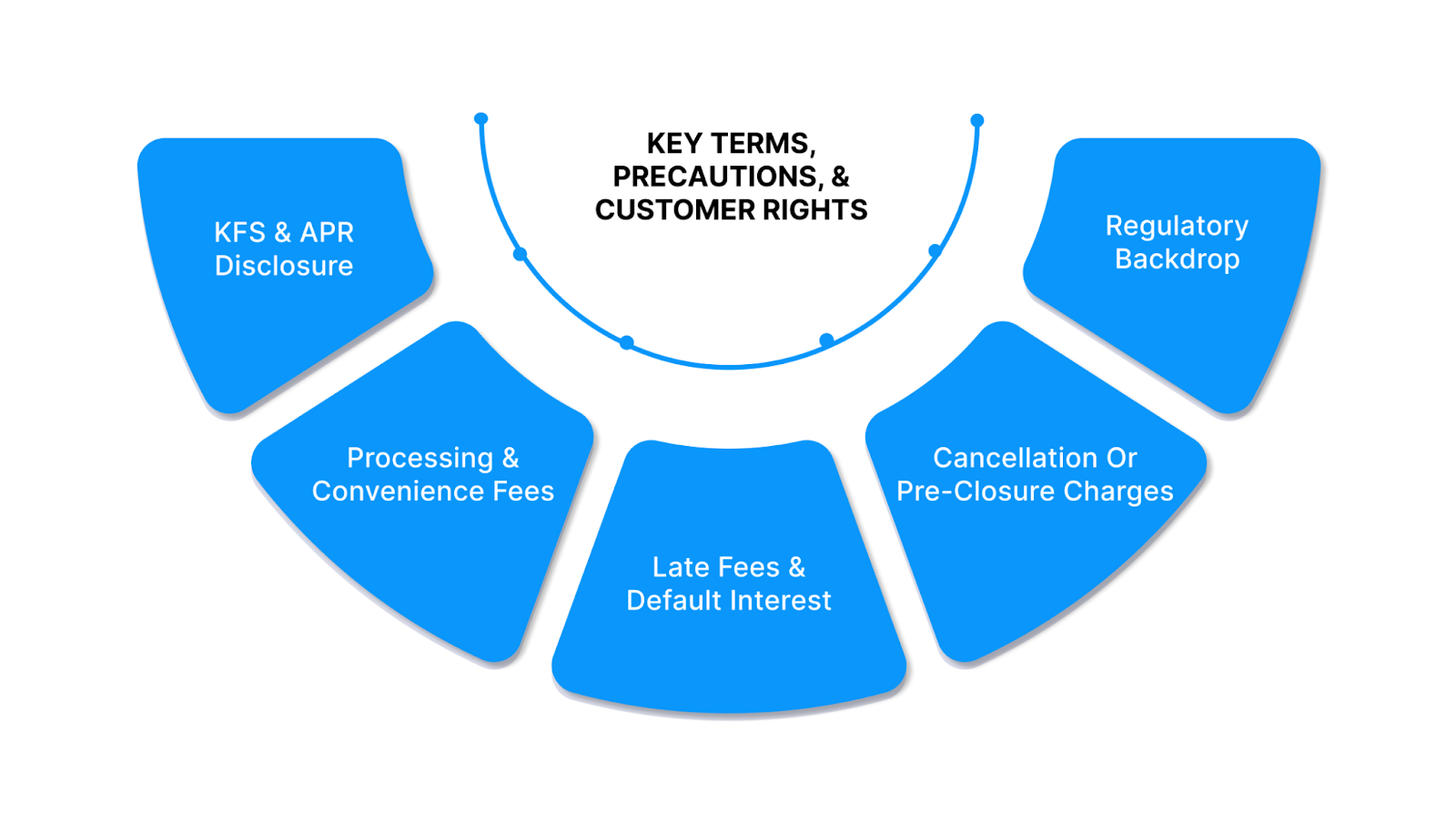

Key Terms, Precautions, and Customer Rights

Before you choose a no-cost EMI, understanding the fine print is crucial. Several hidden clauses can turn a “free” offer into an expensive one if ignored.

1. Key Facts Statement (KFS) and APR disclosure

Under RBI’s digital lending guidelines, all lenders must share a Key Facts Statement (KFS) detailing the Annual Percentage Rate (APR) and every charge before disbursal.

Even in merchant-financed EMI offers, you have the right to ask for this disclosure.

2. Processing and convenience fees

Some lenders charge a processing fee (1–2% of the product cost) or a flat ₹499 fee, even on “no-cost” offers.

If such a charge exists, it offsets the interest benefit entirely.

3. Late fees and default interest

If you miss an instalment, the lender can apply penal interest up to 24–30% p.a. or flat late fees per month.

These penalties are often buried deep in the loan terms.

4. Cancellation or pre-closure charges

Returning a product or cancelling an EMI before the tenure ends can revoke the merchant subsidy. You may be charged the full interest differential retroactively.

Always check the refund policy tied to your EMI plan.

5. Regulatory backdrop

The RBI’s 2013 circular made it clear that “zero per cent interest” EMIs are misleading if the interest is simply hidden in processing fees or inflated product prices. The regulator clarified that a genuinely interest-free loan doesn’t exist — unless the cost is transparently covered by the merchant or manufacturer as a subsidy.

In May 2025, the RBI issued the Digital Lending Directions, 2025, consolidating and updating its earlier 2022 rules. These directions require every regulated lender to disclose the complete cost of credit through a Key Facts Statement (KFS) showing the Annual Percentage Rate (APR) and all fees upfront. They also prohibit any misleading communication or “dark patterns” that disguise costs or mis-sell credit products.

In essence, only merchant-subsidised “no-cost EMIs” in which the brand genuinely bears the interest comply with RBI norms. Lender-led “zero-interest” schemes that hide costs under fees or price mark-ups violate the spirit of RBI’s fair-practice and transparency requirements.

Also read: RBI Digital Lending Guidelines Explained.

Pros and Cons of No-Cost EMI

Like most financial products, no-cost EMI schemes have both benefits and trade-offs. Understanding both sides helps you decide when it genuinely adds value, and when it quietly costs you more than you think.

Pros

1. Improved affordability and cash flow

Splitting payments into monthly instalments makes big-ticket purchases, such as electronics or furniture, more accessible without immediate financial strain.

2. No visible interest burden

From the buyer’s perspective, the total payment equals the product’s MRP. This is psychologically appealing, especially when compared with high-interest credit card EMIs.

3. Short-term convenience without long-term debt

No-cost EMIs typically last three to six months, unlike personal loans that stretch for years. This helps avoid prolonged credit exposure.

4. Encourages financial discipline

Paying predictable monthly instalments can help users budget and maintain a payment history, which is beneficial for building a positive credit profile when used responsibly.

Cons

1. Hidden costs via inflated MRP or charges

The “interest” you don’t see is often built into the price. You may end up paying the same total as a regular EMI disguised as a discount.

2. Limited eligibility and selective products

Most schemes are available only on select cards, NBFC partners, or pre-approved users, limiting accessibility for new-to-credit customers.

3. Penalties for cancellation or delay

If you cancel a purchase or miss an EMI, the subsidy is withdrawn. The bank can then recover the full interest from you.

4. False sense of affordability

Because EMIs make large purchases look easy, users sometimes overspend, leading to revolving credit balances and late-payment interest.

5. Processing and GST additions

Some issuers still charge processing fees or levy GST on interest, making “no-cost” technically misleading.

In short, no-cost EMI helps when used intentionally, but can easily turn expensive if chosen without reading the fine print.

Also read: 6 Simple Budgeting Tips for Better Money Management

When Should You Choose or Avoid No-Cost EMI?

The most intelligent financial decision isn’t about whether you can use a no-cost EMI, it’s about whether you should.

Here’s a framework to evaluate when it makes sense and when to stay away.

When to Choose It

- Short-term purchases you can repay comfortably:

Ideal for gadgets, education tools, or small appliances under ₹50,000 with tenures up to six months.

- If the product’s price is the same with or without EMI:

Always check whether the “no-cost” price matches the upfront cash price. If yes, you’re likely getting a true subsidy.

- When you qualify for a legitimate merchant-subsidised offer:

Offers backed by credible banks or NBFCs and disclosed in writing are generally compliant and safer.

- If you want to build credit with consistent repayment:

On-time EMI payments can improve your credit score, showing positive repayment behaviour.

When to Avoid It

- When the price is inflated under EMI offers:

If the non-EMI price is lower elsewhere, the supposed “no-cost” is already offset.

- When processing fees or GST are added:

A 2% processing charge on ₹30,000 = ₹600, nearly equal to one month’s interest.

- If you tend to carry card balances:

Rolling over a credit card balance converts your no-cost EMI into a high-interest liability, often above 30% p.a.

- When you don’t need the EMI option:

Paying upfront often gives better negotiation power, cashback, or loyalty rewards, which you lose under EMI deals.

Pocketly Perspective: Short-Term Cash Flexibility Done Right

While no-cost EMI splits your purchase, it’s still a form of credit, one that involves multiple hidden participants and potential mark-ups. Pocketly’s approach to short-term finance is different: transparency first.

Pocketly offers instant, small-ticket digital loans ranging from ₹1,000 to ₹25,000, helping users bridge temporary cash gaps without hidden costs. Here’s how it stands apart from typical EMI schemes:

- Transparent APR disclosure - you know the exact repayment amount upfront.

- 100% digital KYC process - no paperwork or collateral.

- Flexible repayment options - repay early or close anytime without penalty.

- Responsible borrowing - intended for genuine short-term needs, not impulse purchases.

So, while a no-cost EMI may help you split a gadget purchase, Pocketly enables you to handle real-life cash crunches with clarity, compliance, and control.

Related: Shop Now, Pay Later: no-cost EMI Options

Conclusion

The idea of “no-cost EMI” works beautifully on paper; it makes expensive products affordable without adding visible interest. But the reality is more nuanced. Someone always pays for that interest: the merchant, the brand, or sometimes even you, through inflated pricing or hidden fees.

If you’re considering a no-cost EMI:

- Compare the upfront and EMI prices of the product.

- Check the KFS for any processing charges or GST.

- Understand refund and cancellation terms - especially for online purchases.

- Use it only when it aligns with your monthly budget and repayment discipline.

Financial literacy is about transparency, and Pocketly’s mission is to make short-term credit simple, responsible, and fully understood.

Unlike hidden-interest EMI schemes, Pocketly offers clear terms, instant access to ₹1,000 - ₹25,000, and flexible repayment options, all backed by compliance and trust.

If you ever face a short-term financial crunch, opt for Pocketly, which prioritizes clarity over marketing. Because real “no-cost” finance is one where you know every cost upfront. Download Pocketly today!

FAQs About no-cost EMI

1. Is no-cost EMI truly interest-free?

Not exactly. The interest charged by the lender still exists; it’s just absorbed by the merchant or manufacturer as a discount or subsidy. In some cases, the product’s MRP is increased to offset that interest. So, while you don’t see the interest, it hasn’t disappeared.

2. How do banks or lenders make money from no-cost EMI?

Banks earn through merchant discount rates (MDR), interchange fees, and processing charges. They also benefit from penalties on late payments or defaults, which can carry high interest rates.

3. Can I prepay or close a no-cost EMI early?

Yes, but terms vary. Some banks or NBFCs allow pre-closure without charges, while others revoke the subsidy and demand full interest for the remaining tenure. Always check the EMI agreement before opting for early closure.

4. What happens if I default on a no-cost EMI?

A missed payment leads to penal interest (18–30% p.a.), late fees, and a possible negative impact on your CIBIL score. The scheme may also lose its “no-cost” benefit, making the loan more expensive.

5. Does a no-cost EMI affect my credit score?

Yes. It’s treated as a credit transaction. Timely repayments improve your credit score, while delays or defaults reduce it. Even though it’s called “no-cost,” it’s still a form of borrowing reflected in your credit history.

6. Why do some “no-cost EMI” products cost more online than offline?

Because online retailers may adjust prices to recover part of the interest subsidy or payment gateway fee, always compare the same product’s cash price before choosing EMI, as it reveals whether the “no-cost” is truly cost-free.