Managing your money can be tough, especially when your income is unpredictable, and every purchase seems to be made digitally, from UPI payments to card swipes. With the explosion of online payments and subscription services, it’s easy to lose track of where your money is actually going.

Without a clear view of your spending habits, it’s hard to stay on top of your finances. This is where a spend analyzer app can offer the clarity you need by categorising your expenses and giving you actionable insights.

Whether you’re looking to curb overspending, keep track of your bills, or simply gain a better understanding of where your money is going, the top apps with features designed to simplify tracking make it easier and offer better financial habits.

Key Takeaways

- Automated Expense Tracking: Apps like Axio and Monarch Money automatically sync with your bank accounts, eliminating the need for manual entry and giving you real-time insights into your spending.

- Customizable Budgets & Alerts: YNAB and Spendee allow users to set flexible budgets, track their progress visually, and get alerts when they approach their limits, helping you stay disciplined with your spending.

- Shared Wallets & Collaborative Budgeting: Apps like Spendee and Goodbudget enable collaboration on budgets, making it easier for families, partners, or co-households to manage their finances together.

- Privacy & Data Control: FinArt stands out with its focus on privacy, allowing users to keep all their data local without requiring any registration.

- Goal Tracking & Savings: Goodbudget and YNAB offer goal-setting features, where you can allocate funds for specific savings targets, ranging from emergency funds to long-term savings.

What is a Spend Analyzer App and How Can It Improve Your Budgeting?

A spend analyzer app is a financial tool designed to help you track, manage, and optimise your spending. By categorising your expenses, offering real-time insights, and creating budget alerts, these apps give you the clarity and control you need to make better financial decisions.

- Automatic Transaction Syncing: Seamlessly links to your bank accounts or payment methods (UPI, cards) to automatically track transactions.

- Expense Categorization: Organises your spending into categories (e.g., groceries, entertainment, bills) for easy tracking.

- Budget Setting & Alerts: Helps you set spending limits and sends reminders when you're close to exceeding them.

- Data Visualisation: Offers pie charts, bar graphs, and reports for a clear overview of your financial habits.

- Simple User Interface: Easy-to-use design that makes tracking and managing your finances quick and simple.

- Goal-Based Savings: Allows you to set financial goals (e.g., saving for a trip or an emergency fund) and track your progress.

List of 10 Spend Analyzer Apps for Effortless Money Tracking

Managing your finances has never been easier with the right tools. These 15 top spend analyzer apps for 2025 offer a variety of features to help you keep track of your spending, set budgets, and gain insights into your financial habits.

1. Monarch Money

Monarch Money is a personal finance management platform designed for users who want an all‑in‑one view of their financial life. It aggregates bank accounts, investments, and expenses into a unified dashboard, offering deeper financial insights.

The app allows users to set goals, track net worth, and create detailed reports to help manage spending. Monarch is ideal for individuals or households looking for a more advanced tool to manage their money over time, with the ability to collaborate on budgets and financial goals.

Key Features

- Account Aggregation: Connect multiple accounts (bank, credit card, investments) for a holistic view of your finances.

- Custom Dashboards: Tailor your dashboard to focus on spending, savings, investments, or financial goals.

- Recurring Transaction Tracking: Identify ongoing costs like subscriptions or regular payments to spot areas for savings.

- Flexible Budgeting: Offers both category‑based and flexible budgeting to match your financial habits.

- Shared Access: Share access with household members or partners to collaborate on financial planning and goal‑setting.

2. YNAB (You Need a Budget)

YNAB is a budgeting tool built around its unique method of “giving every dollar a job”, ideal for users who want more structure in how they allocate each rupee or dollar. It offers real‑time sync across devices, helping you track your spending, set financial goals, and stay ahead with a clear plan rather than reacting to expenses. For those ready to be proactive with their money, YNAB offers a solid framework.

Key Features

- Shared budget access: One subscription lets up to six people (partners, family, flat‑mates) collaborate.

- Real‑time transaction sync: Link accounts and keep your budget current on web and mobile.

- Goal tracking & budget categories: Define savings or spending targets and monitor progress visually.

- Debt payoff planning: Built‑in tools to plan and accelerate debt reduction.

- Flexible budgeting: Adapt when your income or priorities change (“resilience” and “flexibility” principles).

Also Read: Expense Tracking Categories for Budgeting

3. AXIO

Axio is an Indian expense‑tracker app built to automate everyday money management. It reads transactional SMS from bank, card, and wallet notifications, categorises expenses, and presents clear visual breakdowns of where your money is going.

With features like bill reminders, split‑expense tools, and bank‑account/UPI balance monitoring, it offers an end‑to‑end tracking experience, from spotting uses to planning budgets.

Key Features

- SMS‑based automatic expense detection: Automatically reads and categorises transactions from your bank, UPI, or credit cards, reducing the need for manual entry.

- Daily and monthly overviews: View clear breakdowns of your spending across categories like food, bills, travel, and shopping for better tracking of your spending patterns.

- Bill, credit‑card, and utility‑payment reminders: Built‑in reminders to help you stay on track with your payments, avoiding late charges and promoting better budget discipline.

- Custom tags, notes, receipt uploads, and searches: Personalise your transactions with tags, detailed notes, and receipt uploads, enabling deeper insights and an easy audit of your spending.

- Multi‑source aggregation: Combines data from bank accounts, wallets, cards, and even fixed deposits, offering a holistic view of your finances within the app ecosystem.

4. Spendee

Spendee is a visually appealing budgeting and expense‑tracking app that brings all your financial data into one place, whether it's cash, cards, wallets, or bank accounts. It uses intuitive graphs and dashboards to help you understand your spending habits, set budgets, and monitor progress over time. With features like shared wallets and multi‑currency support, Spendee works well for both solo users and group budgets (friends, family, flat‑mates) who want clarity and simplicity.

Key Features

- Bank account synchronisation: Connect your bank/credit card accounts so transactions flow automatically into the app.

- Smart budgeting & visualisation: Create budgets for categories, track when you are nearing limits, and view spending across time periods via charts.

- Shared wallets & multi‑user access: Invite others to collaborate on a wallet—useful for households, couples, or group finances.

- Custom categories and multiple wallets: Set up separate wallets for different purposes (travel, events, everyday) and customise categories for a tailored view.

- Multi‑currency support & cross‑platform sync: Supports managing finances in different currencies and works across devices with data backed up.

5. Wallet: Budget Expense Tracker

Wallet is a feature‑rich personal finance tracker designed for users who want a clear, unified view of income, expenses, bills, and budgets. It allows you to link multiple bank or card accounts, track spending across currencies, and visualise patterns via intuitive graphs and dashboards. With cloud sync and shared access, Wallet is helpful when you want to compare spending trends, collaborate, or discuss money-saving strategies.

Key Features

- Automatic bank account synchronisation: Transactions from linked accounts are automatically synced and smartly categorised, from thousands of banks globally.

- Flexible budgeting: Set daily, weekly, or monthly budgets across any category, and receive visual alerts when you approach or exceed limits.

- Shared wallets & multi‑user access: Enable collaboration or household budgeting by sharing specific accounts or wallets with others.

- Multi‑currency support & cross‑device sync: Manage accounts in different currencies and seamlessly access your data across mobile and web platforms.

- Comprehensive reports & export options: View detailed charts and overviews of your finances; export data (CSV/XLS/PDF) for deeper analysis or record‑keeping.

6. FinArt – Expense Tracker

FinArt is an Indian market expense tracker that utilises AI and SMS/notification parsing to capture transactions from banks, cards, and wallets automatically. It focuses on privacy‑aware users; no registration is needed, and data processing can stay entirely on the device if required. It is built for those who want minimal manual effort but maximum control over their everyday expenses.

Key Features

- Automatic categorisation & trends: The app automatically categorises transactions and shows monthly spending trends.

- Bill & subscription reminders: Keeps track of recurring bills and subscription payments so you avoid late fees or surprise debits.

- Multi‑device & family budget planner: Syncs across devices, supports separate profiles for personal vs business expenses, and enables sharing across household members.

- Privacy‑first design: No email/phone registration required; SMS analysis happens locally (if you opt‑in); Google Drive backup option; data never leaves your device unless you choose it.

- Multi‐source & multi‑currency support: Tracks balances from banks, wallets, and cards; supports different currencies and lets you set a custom start day of the month to match your income cycle.

7. Goodbudget

Goodbudget is built on the time‑tested “envelope” budgeting method. Instead of tracking spending after the fact, you allocate income into virtual envelopes for categories like groceries, travel, or bills. This makes it easier to control how much you plan to spend, share budgets with family or partners, and stay on the same page about finances. The app works on web and mobile, and emphasises simplicity and shared budgeting.

Key Features

- Budget sharing & sync: Sync across multiple devices and share your budget with family, partner, or co‑household ‑ enabling alignment on spending and goals.

- Goal and debt tracking: Beyond everyday budgets, you can set aside money for big expenses, track debt payoff progress, and review how you’re doing over time.

- Insightful reports: See spending by envelope, income vs. spending reports, and export history for a deeper review of your habits.

- Manual entry focus: While it doesn’t emphasise full automatic bank sync for all regions, the app gives you control to log transactions and keep data complete.

8. Monefy

Monefy is a sleek and minimalist expense‑tracker designed for users who want rapid input, clear visualisation, and straightforward budget‑awareness. Instead of linking to multiple bank/UPI accounts, it excels at fast manual or imported entries, with a focus on ease of use, category clarity, and multi‑device sync.

Key Features

- Intuitive and fast input: Add a new expense or income in one click/tap using its streamlined UI, ideal when you’re on the move.

- Spending distribution charts: View where your money goes via pie‑charts or bar graphs so you can quickly spot large categories and spending alerts.

- Multi‑currency & multiple accounts support: Track expenses in different currencies, create multiple accounts (cash, wallet, card, etc.), and compare across them.

- Sync & cloud backup: Safely sync your data across devices via Google Drive or Dropbox so your budget follows you.

- Data security and export: Secure the app with a passcode, set recurring payments, export your expense history (CSV/XLS), and backup for longer‑term review.

Also Read: Simple Money Management Tips for Personal Finances

9. jUMPP

jUMPP is an AI‑powered financial super‑app developed in India that combines expense tracking with banking, investments, and loans. It offers a unified dashboard where you can monitor transactions, set budgets, invest via SIPs and direct stocks, and access quick loans, all from one platform. With its smart AI assistant (jAI), jUMPP provides personalised insights into your spending patterns, helping you stay aware and proactive about your finances.

Key Features

- AI‑powered personalised insights: The jAI assistant analyses your spend and income patterns, offers recommended budgets, and gives actionable suggestions.

- Automatic expense categorisation: Expenses from linked accounts, cards, or wallets are automatically categorised (e.g., food, shopping, bills) for quick review.

- Unified account view & net‑worth tracking: Link multiple accounts (bank, wallet, investments) to see your full financial picture and track net worth.

- Bill payment & credit tools: Automate bill payments, avoid late fees with reminders, and access quick loans from within the app.

- Full‑service financial platform: Beyond tracking spending, jUMPP allows investments in mutual funds/stocks, savings account setup, and rewards for financial actions.

10. Flow Expense Tracker

Flow Expense Tracker is an open‑source and privacy‑focused app designed for users who prefer a simple yet flexible way to manage their finances. Rather than heavily emphasising bank‑account synchronisation or SMS parsing, it gives you full control over your data by supporting offline operation, custom account and category setups, and manual entries. If you want a lightweight, data‑safe tool that lets you track spending your way, Flow is a solid choice.

Key Features

- Custom accounts & currencies: Create multiple accounts (cash, card, wallet) and track spending in different currencies, giving you flexibility for travel or multi‑payment method usage.

- Full data control & offline mode: Works fully offline with no required login, and lets you backup/export your data (ZIP/JSON/CSV), ideal for privacy‑conscious users.

- Category tagging & customisation: Set up your own categories, tags, icons, and colours so the app reflects your personal spending habits and structure.

- Visual spending overview: Offers charts and statistics to help you analyse your spending and understand where your money goes over time.

- Recurring transactions & attachments: Supports recurring entries (for subscriptions, etc.), and lets you attach notes or files for better tracking of specific payments.

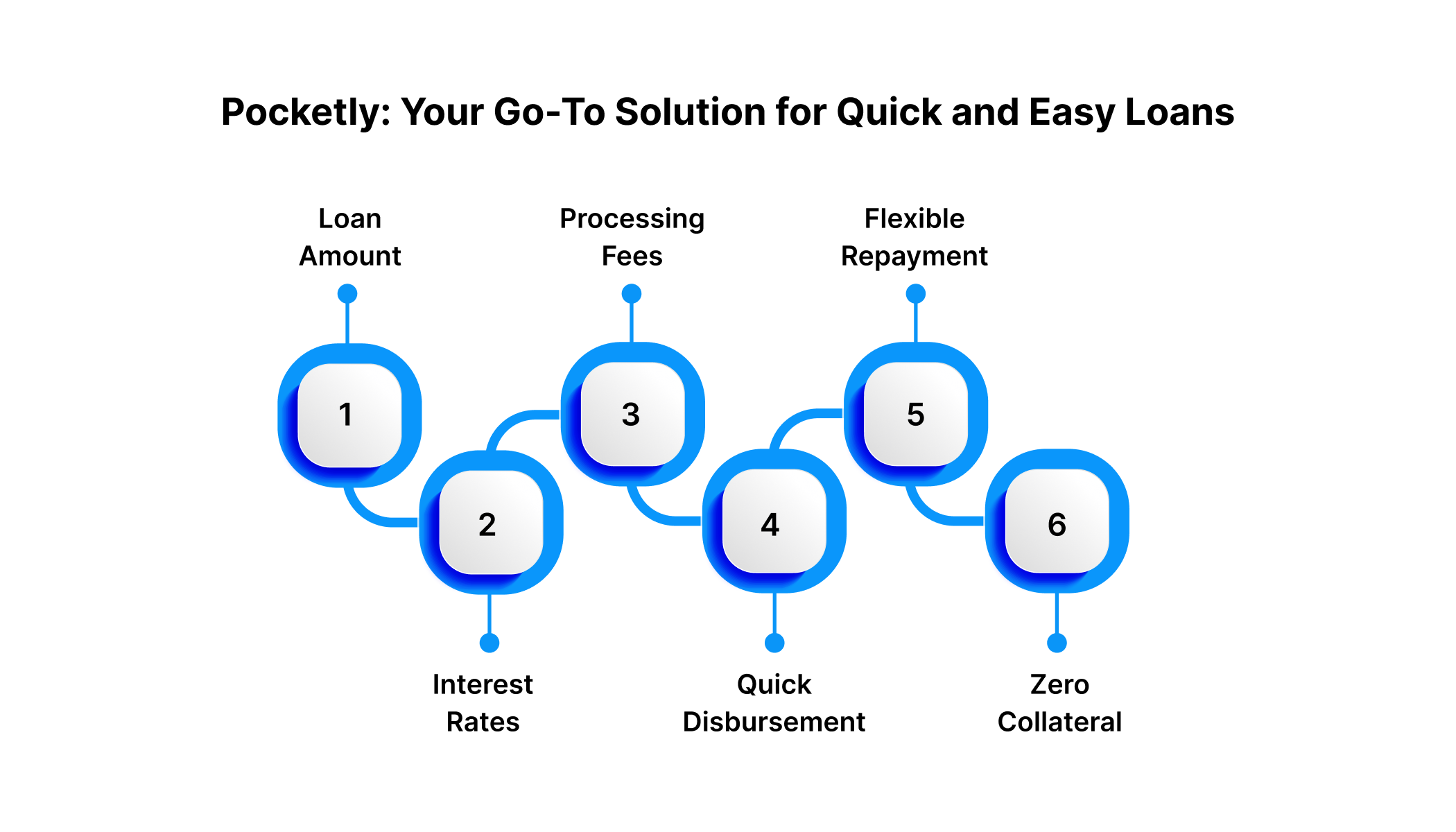

Pocketly: Your Go-To Solution for Quick and Easy Loans

While expense tracker apps help you monitor your finances, sometimes we all face situations where tracking isn’t enough, and immediate financial support becomes necessary. That’s where Pocketly steps in. As a digital lending platform, Pocketly provides fast, flexible, and hassle-free short-term personal loans for students and professionals.

Key Features

- Loan Amount: Pocketly offers loan amounts ranging from ₹1,000 to ₹25,000, making it perfect for urgent needs, whether it's paying for education, covering an emergency, or handling month-end expenses.

- Interest Rates: Pocketly’s interest rates are competitive and start at 2% per month, depending on your eligibility and loan amount.

- Processing Fees: The platform keeps processing fees transparent and minimal, with charges ranging from 1% to 8% based on the loan amount and repayment tenure.

- Quick Disbursement: Loans are approved and disbursed within hours, so that you have access to funds exactly when you need them.

- Flexible Repayment: Pocketly offers flexible repayment plans with options to pay in EMIs over a specified period.

- Zero Collateral: No need for any security or collateral. Pocketly operates on a fully digital KYC process, making the loan application simple, fast, and secure.

Conclusion

Tracking your expenses is key to gaining control over your financial future. The spend analyzer apps featured in this blog provide effective tools to categorise your spending, set budgets, and track your financial progress with ease. Whether you're looking to better understand where your money is going or aiming to stick to a budget, these apps offer the clarity you need to manage your finances more effectively.

When budgeting tools aren’t enough, and you need quick access to funds, Pocketly is here to help. Download Pocketly today for iOS or Android and experience a seamless way to manage both your spending and your financial needs.

FAQs

1. What is the 70/20/10 rule money?

The 70/20/10 rule is a budgeting method where you allocate 70% of your income to living expenses, 20% to savings and investments, and 10% to debt repayment or donations. It’s a simple way to manage your finances and build wealth.

2. How to do a spend analysis?

To do a spending analysis, track all your expenses for a month, categorize them (e.g., food, entertainment, bills), and review where your money is going. This helps you identify areas to cut back and manage your budget more effectively.

3. What is the three-jar method?

The three jar method is a budgeting strategy where you divide your income into three jars: one for savings, one for expenses, and one for fun or discretionary spending. It helps you balance your financial goals while enjoying life.

4. What is the quickest way to pay off debt?

The quickest way to pay off debt is by using the debt avalanche method, where you focus on paying off high-interest debt first while making minimum payments on others. Alternatively, the debt snowball method focuses on clearing the smallest debt first, building momentum.

5. What are the signs of financial trouble?

Signs of financial trouble include missing bill payments, relying on credit cards for everyday expenses, consistently spending more than you earn, and accumulating debt that’s hard to manage. If these happen regularly, it’s time to reassess your budget and spending habits.