A loan close application is not a formality. It is the document that gets your loan marked as officially closed on record even after you have repaid the final EMI. Lenders cannot update CIBIL or issue a No Objection Certificate unless there is a formal request on record. Without this, many closed loans continue to appear as active which affects future eligibility.

Have you ever repaid a loan and still not received a closure letter?

Gen Z now accounts for 41 per cent of first time or new to credit borrowers, and digital loans form around 2.5 per cent of all retail loan disbursements in FY24. This shows how many young borrowers could face compliance issues if they skip this basic step.

This guide will explain how to write a loan close application, what information to include, the correct submission process for banks and digital lenders, ready to use formats you can copy, and the common mistakes that cause delays or credit disputes.

If You Only Have 30 Seconds: Read This

- A loan close application is mandatory to get a loan marked as closed in the lender’s system and on CIBIL.

- Closure is different from foreclosure and settlement and only a documented closure preserves future approval chances.

- Banks expect a formal letter or email, while digital lenders require an in-app ticket or message with proof attached.

- A closure is not complete until the NOC is issued and the lender pushes the update to credit bureaus.

- Most rejections or delays come from borrower-side errors such as missing IDs, wrong channels, or no acknowledgement trail.

What Is a Loan Close Application and Why Is It Important?

A loan close application is the written instruction you send to your lender asking them to mark your loan as closed in their system after you have paid the final amount due. Repayment clears the money you owed but it does not update the lender’s reporting trail or your credit record until a formal closure is processed. Lenders are required to maintain a documented trigger before they issue a No Objection Certificate and update bureaus.

A large portion of credit disputes in India come from missing closures. According to a 2025 report, out of over 22 lakh complaints received by CIBIL in FY24–25, about 5.8 lakh were linked to errors, including unclosed loans shown as active. When a file remains open on record, your score and future loan approvals are affected even though you have already paid the dues.

Difference Between Loan Closure, Foreclosure and Settlement

You will encounter three terms when a loan reaches the end of its life cycle. Each one means a different outcome on your record and is treated differently by lenders and bureaus.

Use the table below to isolate the differences.

| Term | What it means | Effect on score |

| Loan closure | All dues are paid and lender formally closes the account | Neutral to positive once updated |

| Foreclosure | You pay off the full balance before due tenure | Slight positive but depends on product rules |

| Settlement | You pay less than the actual outstanding and the lender writes off the rest | Negative flag for many future applications |

Only loan closure and foreclosure keep your long term profile healthy. A settlement tag stays visible for years and blocks approvals.

Get a small personal loan when you actually need it and close it cleanly with a documented loan close application for a clear credit record. Apply now for ₹1,000–₹25,000 and choose a repayment plan that fits your timing.

Prerequisites Before Writing a Loan Close Application

Before you write to the lender, you need to be sure the account is clean on numbers and identity. Otherwise closure is delayed or rejected and you keep waiting without progress.

Keep the following ready:

- Complete loan account number, product name and lender name as shown in the sanction or agreement

- Final repayment receipt or bank proof such as UPI ref ID or statement line that shows the last EMI cleared

- Check if any EMI bounced earlier and whether the charge has been adjusted

- Confirm if any foreclosure or processing fee balance is still pending

- Check the instructed closure channel used by this lender such as branch desk, support email, or app ticket panel

- Record the date of your request so you can follow up if updates are not made on CIBIL within the stated window

Also Read: How to Pay Off Loans Quickly and Easily?

Having these in place prevents back and forth and keeps the closure traceable. Knowing the difference is not enough. The account only dies on paper when you actually file the request in the right channel.

Step-by-Step Process to Submit a Loan Close Application

You can submit a loan close application through a physical or email channel when the lender is a bank or NBFC, or through an in-app request panel when the lender operates digitally. The steps are the same in principle. The difference is only in the submission route and the way acknowledgements are tracked. The sections below break the two paths separately so you do not mix formats.

1. Loan Close Application for Banks and NBFCs

When the lender operates with branches or back-office mail desks, you must send the request through their instructed channel. You will need written proof that your closure request was received so that delays do not sit on your record silently.

Send the request using one of these channels:

- Physical letter at branch service desk

- Official support email published by the lender

- Registered post if branch refuses written intake

Attach repayment proof and your ID page. Ask for an acknowledgement slip or an email reply that records the date of intake. Follow up if there is no update after 15 working days.

Also Read: Get Debt Consolidation Loan Online: How It Works

2. Loan Close Application Through Digital Lending Platforms

When the lender runs on an app, the request is usually filed through a ticket panel or a help centre menu instead of a branch desk. The system generates a request ID which serves as proof of intake. Pocketly uses this route and closure is fully digital without branch visits.

You should have access to three outputs once the lender completes closure:

- NOC or closure letter in PDF

- Final statement showing nil balance

- CIBIL update push within the stated SLA

Keep the ticket ID and closure letter safely in case a bureau dispute ever arises. With the route sorted, the only thing left is wording it in a way a lender cannot reject or misinterpret.

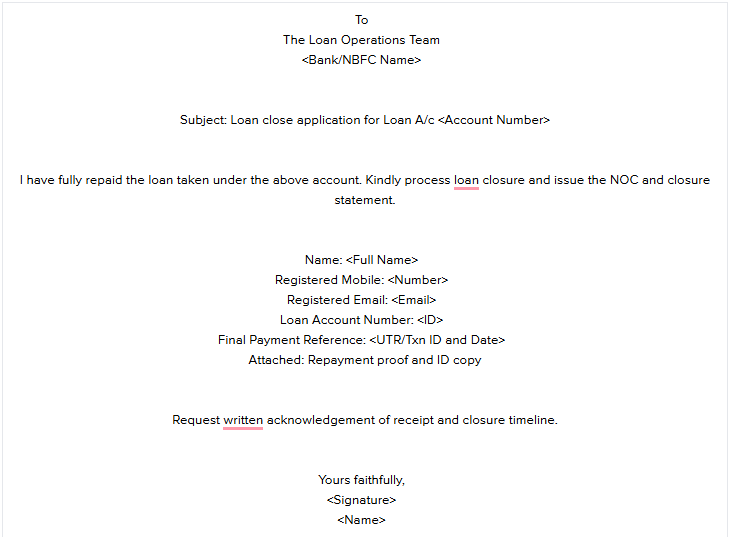

Loan Close Application Format (Copy-Ready Template)

You can submit your request in a full formal format when writing to a bank or NBFC, or in a short email or in-app message when the lender operates digitally. Use the full version when you need a documented paper trail with every field present. Use the short version only where the lender already holds your KYC and account context.

Full formal template:

Short email or SMS version (for digital lenders):

| This is a loan close application for A/c |

A salaried loan gives you breathing room when cash is tight and lets you close the account cleanly later through a proper loan close application. If your salary is ₹15,000 or more, you can get up to ₹25,000 instantly. Apply now!

Sending the letter is not the finish line, it is the trigger that starts the lender’s internal closure workflow.

What Happens After You Submit the Loan Close Application

Once you send a loan close application, the lender does not close it blindly. They first validate that the account is fit for closure and that no unbilled charges are pending. If the account qualifies, the closure is recorded and the relevant documents are issued. The effect then moves to your credit file.

Here is what typically follows in order:

- Validation of repayment status and audit of any residual fees

- Pause and re-contact if any due or fee is still open

- Issue of closure confirmation and NOC in PDF or hard copy

- Push of the closure status to credit bureaus such as CIBIL

- Bureau reflection within 30 to 45 days depending on cycle

You should save both the NOC and the intake acknowledgement. If a bureau dispute appears later, these two records make it straightforward to prove that the account was closed correctly.

Also Read: Lending Service Providers Explained and Defined

Most failures in this stage do not come from the lender’s side, they come from preventable mistakes in the way borrowers file the request.

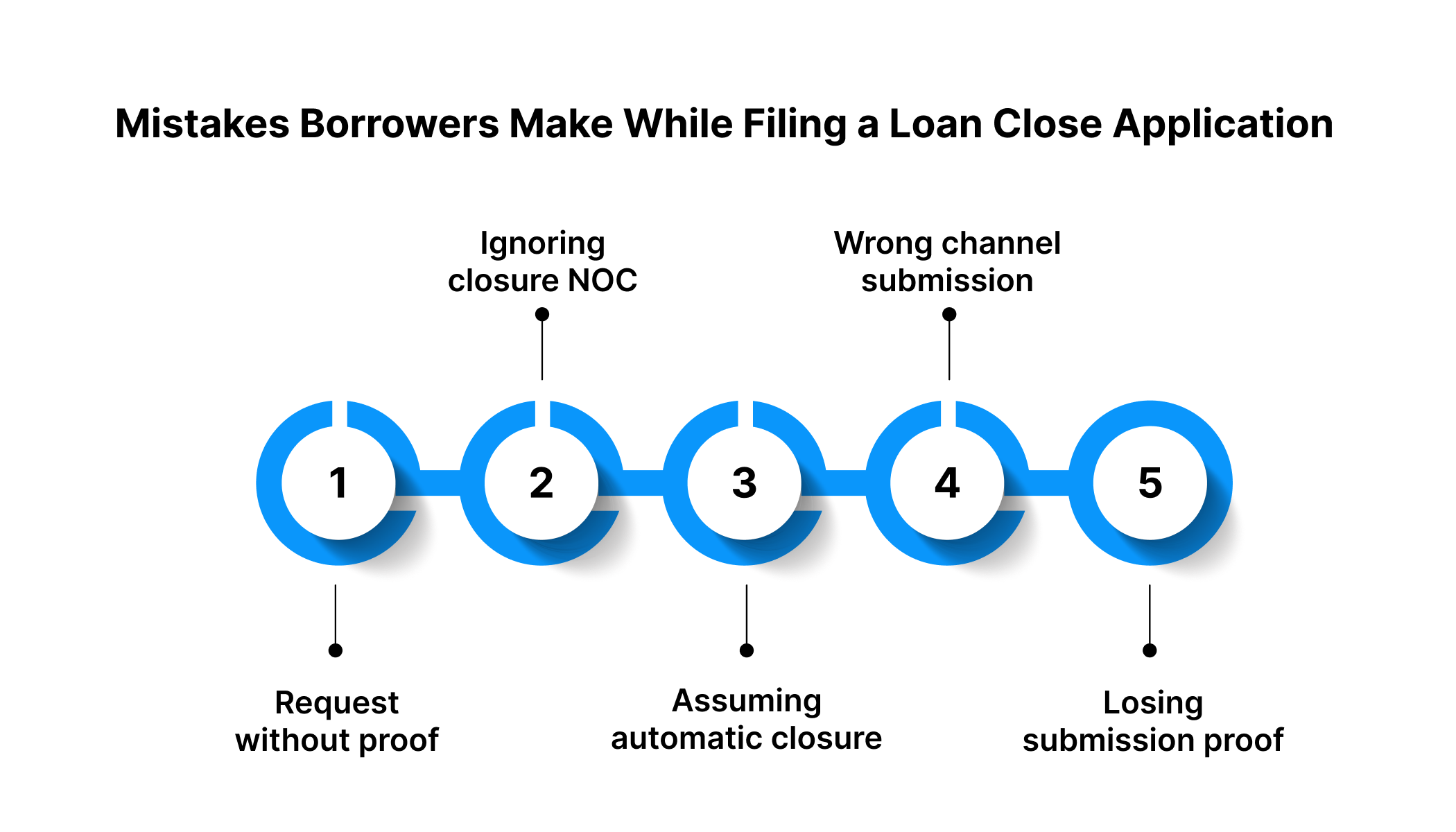

Common Mistakes Borrowers Make While Filing a Loan Close Application

Many closure delays come from basic errors in the way you submit the request. Most of these are preventable if you treat the closure step as a documentation task rather than an afterthought. The list below covers the common errors and the corrective way to handle each one with a clear example.

- Sending a request without the loan account ID or proof of final repayment

- Fix: Attach the loan ID and last payment reference in the body and as attachment

- Example text: “Loan A/c 45789, UPI UTR 9113xxxx on 09 Jan attached”

- Not asking for a closure NOC or ignoring the acknowledgement trail

- Fix: Demand a dated receipt or request ID in writing

- Example text: “Please confirm intake and share NOC issuance timeline by email”

- Assuming closure is automatic after the last EMI is deducted

- Fix: File a written request even for auto-debit contracts

- Example: Auto EMIs closing does not trigger a CIBIL update without your request

- Submitting through the wrong channel or to a sales address instead of ops

- Fix: Use the official support email, branch desk, or app ticket panel only

- Example: A WhatsApp message to a sales agent is not a legal intake

- Not keeping a copy of what was sent and losing proof later

- Fix: Store a PDF of the sent request and the lender reply in cloud or email archive

- Example: Name the file “Loan-close-A/c-ID-Request-Dated-DDMMYY.pdf” for searchability

A self-employed loan gives you controlled liquidity without mixing business cash, and can still be closed cleanly with a documented loan close application. If your income is ₹15,000 or more, you can get up to ₹25,000 instantly. Apply now!

Conclusion

A loan only exits your profile when you apply for closure and the lender records it. Repaying the amount does not by itself clean the trail on CIBIL or generate a No Objection Certificate. A closure request acts as the trigger that moves your account from active to closed and prevents your future applications from being judged against a debt you have already returned.

Pocketly treats closure as a digital service task rather than a manual chore. Once your dues are cleared you can request closure through the app without a branch visit and track the request ID until it is processed. Support remains available at every stage without needing to follow up through phone agents or third parties.

Pocketly offers:

- Digital loans from ₹1000 to ₹25,000 for young borrowers

- Fast disbursal with flexible early closure permitted

- Fully online closure and 24/7 support for queries

Once closure is complete, the NOC is issued and the bureau update is pushed according to the partner NBFC cycle.

If you prefer a lender where closure is digital and traceable, you can start with Pocketly. You apply through the app, get funds after KYC, and close the loan when you are done without visiting a branch. The app is available on Android and iOS. Download it, apply for small-ticket credit responsibly, and close it cleanly when you no longer need the credit line.

FAQs

Q: Can a lender reject my loan close application even after I paid everything?

A: Yes, if your previous repayment bounced and the penalty entry remains unadjusted in their ledger. You must clear that entry first.

Q: What if I lost the original sanction letter or agreement before submitting closure?

A: You can still apply without it. Reference the loan account ID and attach current identity proof, it is sufficient for processing.

Q: Can I request closure while a dispute with the lender is still open?

A: Closure requests are usually parked until disputes are resolved. You need to finish the dispute ticket before closure is taken up.

Q: Does partial prepayment trigger any closure by default?

A: No. Partial payments only reduce principal or tenure. A closure request is treated only when the entire outstanding is cleared.

Q: Can I withdraw a closure request after submitting it if I change my decision?

A: You may, but only before NOC is queued for issue. Once the NOC is generated, the account cannot be reopened.

Q: What if a lender claims they never received my closure request?

A: You will need to resubmit with timestamped proof. Always retain mail headers or ticket IDs so the intake cannot be denied later.