India’s digital financial landscape is making it easier for young people to access credit. However, many students and young professionals find themselves facing lengthy paperwork, delays, and high collateral demands in traditional loan options, making it harder to obtain the funds they need.

As a result, student loan debt has grown to over ₹90,000 crores, but only about 4% of students managed to secure a loan in 2022. At the same time, 57% of borrowers under 30 are turning to loans to upskill, highlighting the need for more accessible alternatives.

This is where lender service providers (LSPs) come in to offer quick, flexible, and collateral-free loans.

In this blog, we will break down what lender service providers are, how they operate, and why they are particularly beneficial for young Indians in need of quick financial solutions.

At a glance

- LSPs are digital intermediaries that connect borrowers with multiple lenders, offering instant loans without collateral.

- Perfect for young Indians who need quick funds for education, skills, or emergencies without traditional banking hassles.

- The process is simple. Apply online, get instant approval, and receive funds in minutes with flexible repayment options.

- Build credit easily by starting small, repaying on time, and using responsible borrowing practices.

What are Lender Service Providers (LSPs)?

Lender Service Providers (LSPs) are agents or outsourcing partners of banks/NBFCs that deliver many lender functions, ranging from acquiring borrowers to supporting loan approval and servicing, on digital channels.

They aggregate loan offers from multiple lenders, offering borrowers the ability to compare and select suitable loans through a marketplace model.

What Roles Do LSPs Play?

- Customer Acquisition: Attract and onboard new borrowers for partner lenders.

- Loan Origination and Application Processing: Manage borrower applications and assist with document requirements, including KYC checks and eligibility.

- Underwriting Support: Use technology, including AI-based credit scoring, to aid lenders in assessing risk and determining loan terms.

- Disbursement Assistance: Facilitate smooth, quick release of loan amounts to approved borrowers.

- Repayment Collections: Handle repayments, automated reminders, and collections processes for lenders.

- Customer Service: Provide ongoing assistance, grievance redressal, and support for both lenders and borrowers over the loan lifecycle.

- Marketplace Access: Offer platforms where borrowers can access multiple loan offers, increasing transparency and choice.

Now that we know what LSPs do, let's dive into the mechanics of how they actually operate in practice.

Also Read: Digital Lending In India: Future Trends and Insights

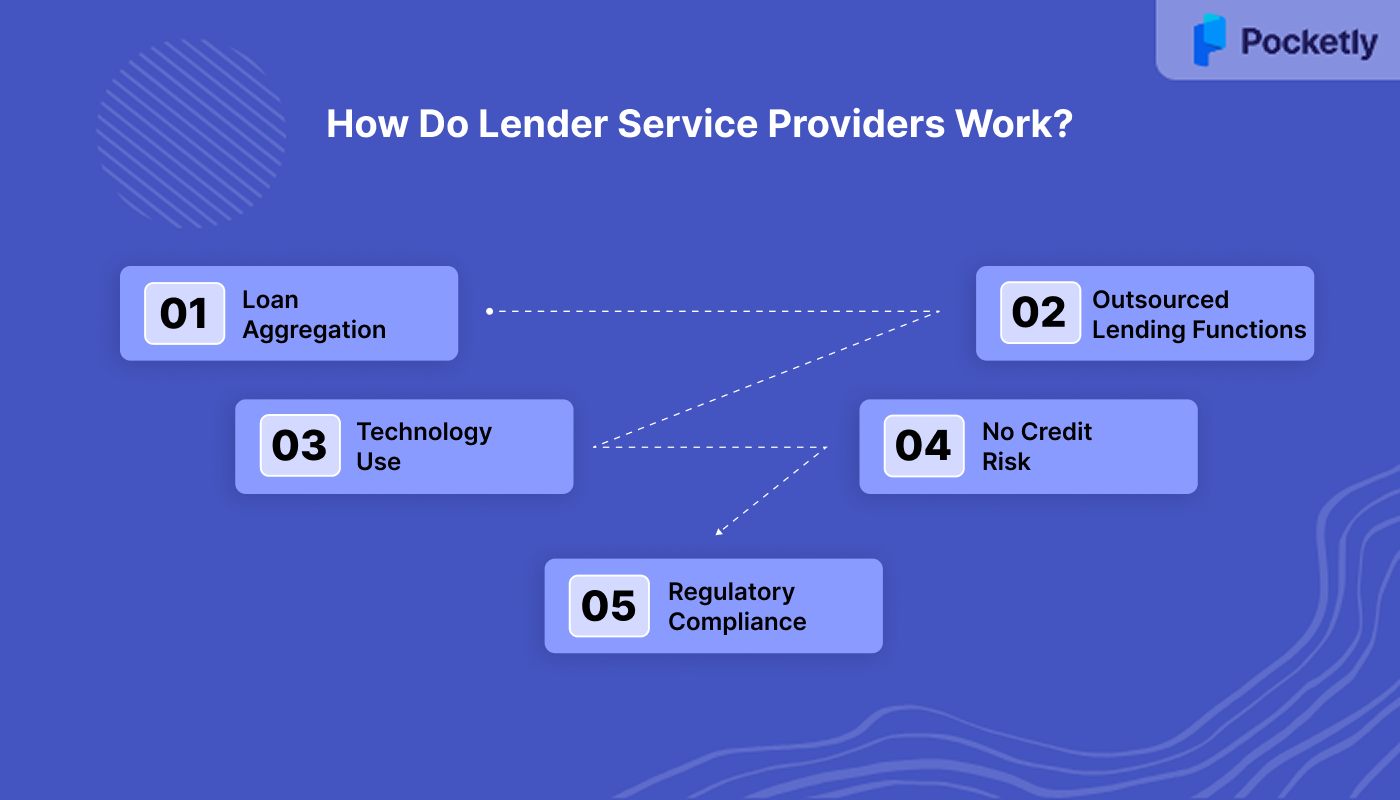

How Do Lender Service Providers Work?

- Loan Aggregation: LSPs gather loan offers from different lenders on a single platform, giving borrowers the chance to compare and pick the best option for their needs.

- Outsourced Lending Functions: LSPs handle various lending tasks for regulated lenders, like acquiring customers, processing loan applications, supporting underwriting, managing pricing, assisting with disbursal, and even collecting repayments.

- Technology Use: They make the process faster and smoother by using advanced tech like AI-based credit scoring, automated KYC verification, and real-time dashboards, simplifying everything for both borrowers and lenders.

- No Credit Risk: LSPs don’t lend money themselves, so they don’t take on any credit risk. Instead, they help regulated lenders scale up their operations and reach underserved, digitally-savvy borrowers.

- Regulatory Compliance: LSPs follow the guidelines set by the RBI, ensuring that the process is transparent, secure, and has proper systems for handling complaints.

In short, LSPs are bridging the gap between borrowers and lenders, creating a smoother borrowing experience. But why does this matter specifically for young Indians?

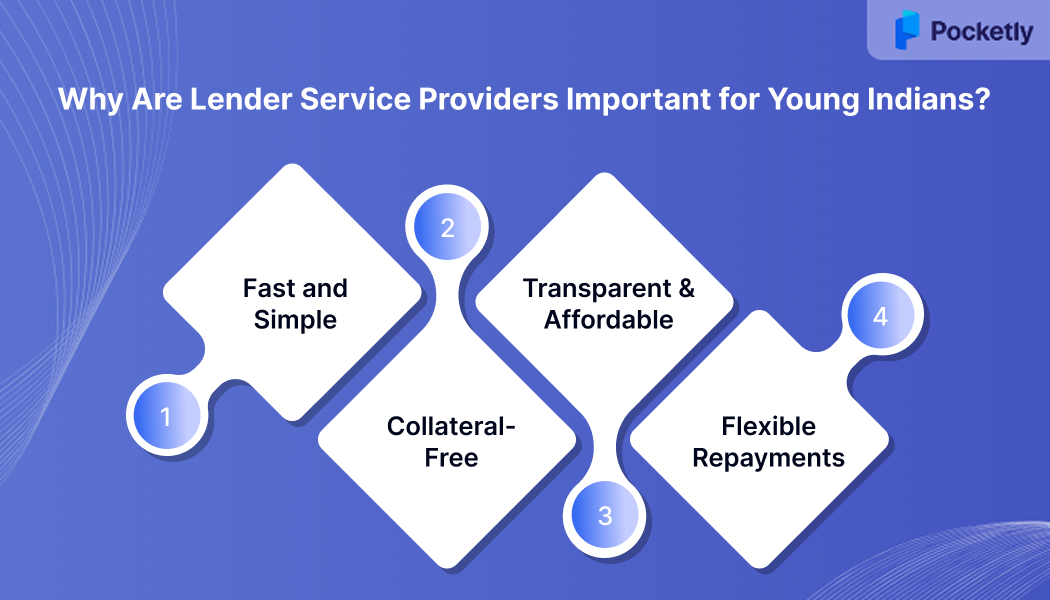

Why Are Lender Service Providers Important for Young Indians?

This is where LSPs are playing a crucial role in providing financial solutions that are:

- Fast and Simple: LSPs offer instant approvals and disbursements, enabling borrowers to access funds quickly, often within minutes.

- Collateral-Free: Unlike traditional banks that require collateral, LSPs offer loans without the need for physical assets, which is ideal for young borrowers just starting their financial journey.

- Transparent and Affordable: Platforms like Pocketly provide clear loan terms, with no hidden fees or annual charges, making it easier for borrowers to understand the total cost of borrowing.

- Flexible Repayments: LSPs allow borrowers to repay loans in easy instalments, making it more manageable, especially for those with variable incomes.

These benefits make LSPs an attractive choice for young people looking for flexible, transparent, and accessible financial solutions. Speaking of variety, let's explore the different types of loans these platforms offer.

Also Read: RBI Digital Lending Guidelines Explained

Types of Loans Offered by Lending Service Providers

- Personal Loans: Unsecured loans that can be used for anything from emergencies to travel, education, or skill development. They are quick to process and don’t require collateral.

- Education Loans: Designed to cover tuition fees, exam fees, and other education-related expenses, helping students fund their higher education.

- Home Loans: Secured loans for purchasing, building, or renovating a home, often backed by the property itself as collateral.

- Gold Loans: Loans provided against pledged gold jewellery or coins, usually with quick disbursal and flexible repayment options.

- Business Loans: Short-term or working capital loans aimed at entrepreneurs and self-employed individuals to support business needs and growth.

- Instant Loans: Small-ticket, short-term loans that are quickly approved, often catering to urgent or unplanned expenses.

- Loan Against Securities or Insurance: Secured loans where borrowers pledge financial assets like insurance policies or securities.

Platforms like Pocketly focus on offering small, manageable loan amounts starting at 2% interest rate per month, allowing you to meet urgent financial needs, whether it’s for educational expenses, personal needs, or business-related costs.

With all these loan options available, how can you use them strategically to build your financial future?

Also Read: Understanding Different Modes of Loan Repayment

Tips to Build Your Credit Using a Lending Service Provider?

- Start Small and Timely: Begin with smaller loans or credit products offered through LSPs that suit your current financial situation, and ensure you make all payments on time to build a positive repayment history.

- Choose Flexible Repayment Options: Opt for loans with manageable EMI options or flexible repayment plans to avoid defaults and maintain consistent credit behaviour.

- Keep Credit Utilisation Low: Don’t borrow the maximum limit offered. Using only a portion of your available credit and repaying regularly boosts your credit score.

- Diversify Your Credit: Use different types of loans, like personal loans or education loans via LSPs, to demonstrate responsible credit behaviour across products.

- Regularly Monitor Your Credit Score: Use digital tools provided by LSPs or credit bureaus to track your credit health and promptly address any discrepancies.

- Avoid Multiple Loan Applications: Space out your loan requests to prevent multiple hard inquiries, which can negatively impact your credit score.

- Communicate Proactively: If you anticipate repayment difficulties, reach out to your LSP early for possible restructuring or support options to protect your credit standing.

- Use Auto-Debit Facilities: Enable auto-pay to avoid missed payments and build a reliable credit history effortlessly.

Following these tips can help young borrowers use LSPs to establish and maintain a strong credit profile, opening doors to better financial opportunities in the future.

While the LSP market offers numerous options, choosing the right platform can make all the difference in your borrowing experience. The ideal LSP should combine competitive rates, transparent processes, and genuine customer support, qualities that aren't always easy to find.

What Makes Pocketly a Reliable Lending Service Provider?

When it comes to putting theory into practice, Pocketly exemplifies how a well-designed LSP should operate. Rather than just being another lending platform, it has built its reputation by consistently delivering on the core promises that matter most to young borrowers.

Here’s why it works for young Indians:

- Instant Loans: Funds go straight to your bank account. No long waits, no complicated paperwork.

- No Collateral: You don’t need assets or a credit history. Perfect for students and first-time borrowers.

- Flexible Amounts: Borrow from ₹1,000 up to ₹25,000. Choose repayment plans that suit your budget.

- Transparent Terms: Interest starts at 2% per month, processing fees 1–8%, with no hidden charges.

- Tailored for You: Students, salaried professionals, or self-employed, Pocketly’s loans fit your needs.

- Safe and Secure: All loans are backed by RBI-compliant NBFC partners, keeping your data protected.

Pocketly makes borrowing fast, easy, and reliable. It’s built to help young Indians handle short-term financial needs confidently.

Final Words!

Lender Service Providers offer instant approvals, collateral-free loans, and clear terms. They make borrowing simple for students and young professionals. These platforms aggregate multiple loan offers, handle applications and disbursements, and stay compliant with regulations.

Pocketly stands out as a trusted LSP that offers loans from ₹1,000 to ₹25,000 with interest starting at just 2% per month, all backed by RBI-compliant NBFC partners. With instant approvals and zero collateral requirements, Pocketly makes borrowing accessible for students and young professionals alike.

Download the Pocketly app today on iOS or Android and discover how simple, transparent borrowing can support your financial goals. Your journey to smart credit management starts with just a tap

FAQs

1. How Fast Can I Get a Loan Through an LSP?

Most LSPs offer instant approvals and can disburse funds within minutes to a few hours. Once you complete the online application and document verification, approved loans are typically credited to your bank account immediately. Platforms like Pocketly can process loans in under 30 minutes.

2. Do I Need a Credit Score to Apply for a Loan?

No, many LSPs offer loans to borrowers with limited or no credit history. They use alternative data points like income patterns, employment status, and digital footprints to assess creditworthiness. This makes LSPs ideal for students and first-time borrowers who haven't built a credit score yet.

3. Are There Any Hidden Charges in LSPs?

Reputable LSPs like Pocketly maintain full transparency with clear fee structures. All charges, including interest rates, processing fees, and any applicable charges, are disclosed upfront. However, always read the terms carefully and choose platforms that explicitly state "no hidden charges."

4. Can I Repay My Loan Early?

Yes, most LSPs allow early repayment without penalties. In fact, paying off your loan early can save you on interest costs and improve your credit profile. Some platforms even offer discounts for early repayment, making it beneficial for borrowers who receive funds earlier than expected.