In India, the "Shop Now, Pay Later" (SNPL) model has gained traction, allowing consumers to make purchases and pay in easy installments without immediate interest. This approach has become prevalent in sectors like electronics, fashion, and travel.

For instance, reports indicate that Indians spend a third of their salary on Loan EMIs. Additionally, the Buy Now Pay Later (BNPL) market in India was valued at USD 30.88 billion in 2025.

While SNPL offers the allure of immediate gratification, it's essential to understand the underlying mechanics. Often, these "no cost" schemes may involve hidden charges, such as processing fees or higher product prices, which can offset the perceived benefits. Therefore, it's crucial to assess the total cost of ownership, including any potential hidden fees, before opting for such payment plans.

In this blog, we will look into the intricacies of No Cost EMI options, exploring how they function, their benefits, pitfalls, and more.

Key Takeaways

- While marketed as "interest-free," No Cost EMI plans may include hidden costs like processing fees, GST, and product price inflation, making the total cost higher than expected.

- To qualify for No Cost EMI, a good credit score and steady income are typically required. These plans may also block your credit limit, affecting future purchases.

- No Cost EMI offers flexible repayment tenures, typically ranging from 3 to 12 months. Shorter tenures reduce the impact of hidden charges and allow quicker repayment.

- The ease of using No Cost EMI can encourage unnecessary purchases and debt accumulation. It’s essential to evaluate whether the item is truly necessary before committing to EMI.

- Timely payments can improve your credit score, while missed payments can damage your credit profile and affect future borrowing opportunities.

What is No Cost EMI or Shop Now Pay Later Option?

No Cost EMI is a financing option that allows consumers to purchase products and pay for them in installments without any interest charges. Unlike standard EMIs, where interest is added to the product’s cost, No Cost EMI means that the consumer only pays the exact price of the product, broken down into smaller payments over a set period.

However, in many cases, the scheme may seem "no-cost," but the interest is absorbed by the seller, the lender, or both, and might be factored into the product's price.

The major difference between standard EMI and No Cost EMI lies in how the interest is handled; standard EMI adds interest to the principal, while No Cost EMI offers the product at a fixed price without any additional charges.

Common Uses of No Cost EMI

In India, No Cost EMI has become a popular payment option, especially for high-ticket items like the following:

- Smartphones: Making high-end smartphones more affordable with easy installment plans.

- Appliances: Purchasing home appliances like refrigerators, washing machines, and air conditioners.

- Electronics: Buying electronics such as laptops, TVs, and tablets.

- Travel and Vacation Packages: Paying for travel bookings and holiday packages in installments.

- Fashion and Lifestyle Products: Availing No Cost EMI for clothing, accessories, and other lifestyle items.

Also Read: What is EMI: Definition, Types, Advantages, and How it Works

The adoption of No Cost EMI across these categories stems from the advantages it offers consumers. These benefits extend beyond simple payment convenience, creating real value for shoppers who want to manage their cash flow effectively.

What are the Benefits of No Cost EMI or Shop Now, Pay Later Options?

No Cost EMI and Shop Now, Pay Later (SNPL) options offer numerous benefits to consumers looking for flexible and budget-friendly ways to manage purchases. These payment schemes have gained popularity, especially in India, due to their ability to make expensive products more affordable.

Here's a detailed breakdown of the benefits:

- Interest-Free Payments: As the name suggests, No Cost EMI ensures that the consumer pays the exact price of the product, divided into equal monthly payments. There are no added interest charges.

- Transparent Costing: Unlike standard EMI options, where interest is added to the original price, the No Cost EMI option has no hidden fees or surprises, providing transparency in the repayment process.

- Flexible Payment Terms: No Cost EMI and SNPL options offer flexible repayment terms, ranging from 3 to 12 months, allowing consumers to choose an installment plan that best suits their financial situation.

- Easy Access to High-Value Products: With No Cost EMI and SNPL, consumers can access high-ticket items like electronics, home appliances, and even travel packages without having to pay the full amount upfront.

- No Collateral Required: Unlike traditional loans, No Cost EMI and SNPL options do not require collateral or security. The only requirement is a good credit history or eligible financial standing, which simplifies the application process.

- Boosts Credit Score: Timely payments through No Cost EMI can help build or improve a consumer’s credit score. Regular, on-time repayments are reported to credit bureaus and contribute to strengthening one’s credit profile. Thus, consumers may find it easier to qualify for larger loans.

- Quick and Convenient Approval: The application process for No Cost EMI and SNPL options is fast, with many platforms offering instant personal loan approval within minutes or hours. This speed allows consumers to make purchases without delays.

Given these compelling advantages, numerous financial institutions and fintech companies have entered the market, each offering distinct features and terms.

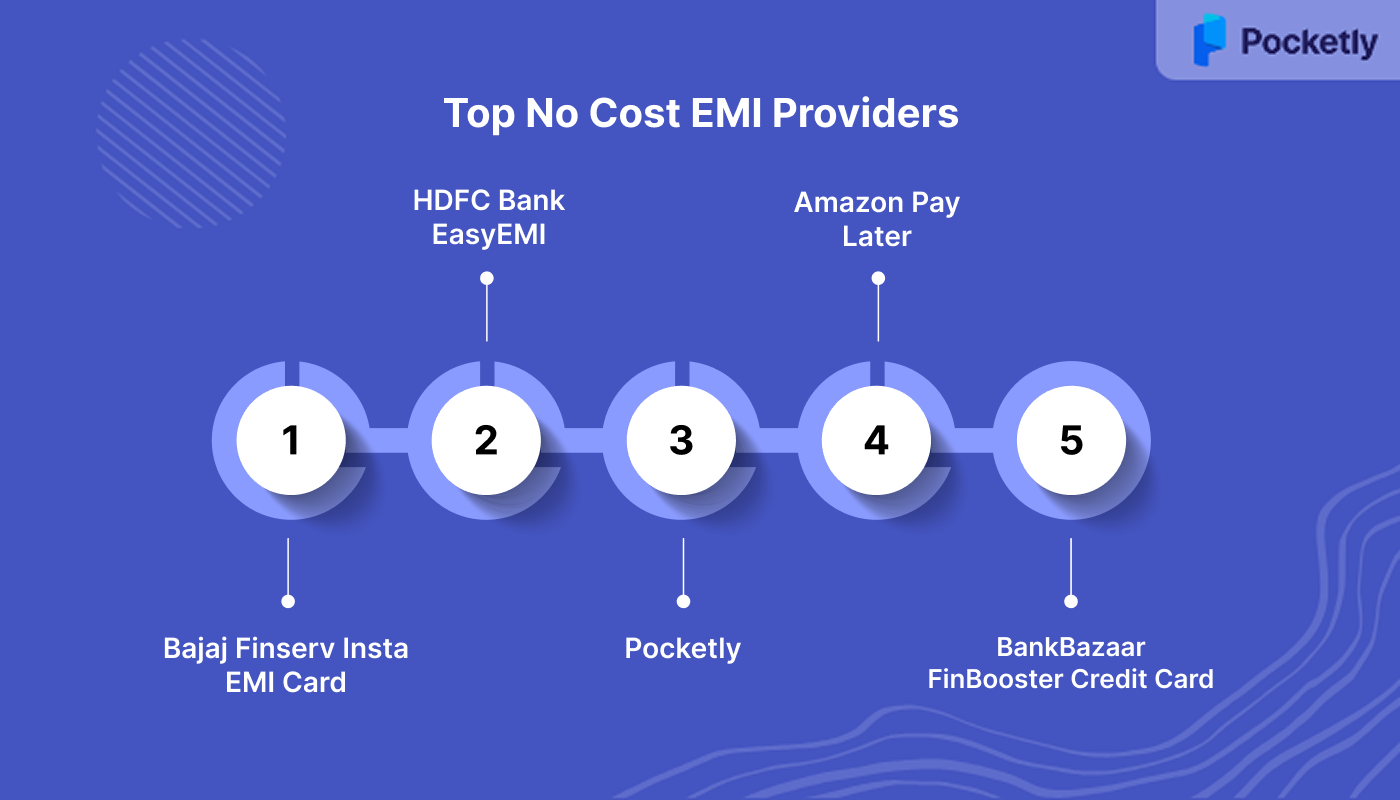

Top No Cost EMI Providers: Features, Eligibility, and Repayment Terms

Each provider offers unique features catering to different consumer needs. Bajaj Finserv provides a high loan limit with extended repayment options, making it suitable for larger purchases. Pocketly caters to individuals seeking smaller loan amounts with flexible, short-term repayment plans.

Bajaj Finserv Insta EMI Card

Features:

- Pre-approved Limit: Offers a pre-qualified loan amount of up to ₹3,00,000.

- Wide Acceptance: Usable at over 1.5 lakh partner stores across 4,000+ cities.

- Flexible Repayment: Choose repayment tenures ranging from 1 to 60 months.

- Minimal Documentation: Requires basic KYC documents and a signed ECS mandate.

- Zero Down Payment: Available on select products during festive seasons.

Eligibility:

- Age: 21 to 65 years.

- Nationality: Indian.

- Income: Must have a regular source of income.

- Credit Score: As per Bajaj Finance's risk policies.

Repayment Terms:

- Tenure: Flexible options from 1 to 60 months.

- Processing Fees: Up to ₹1,017, depending on the product and dealer.

- Pre-closure Charges: ₹500 per bounce.

HDFC Bank EasyEMI

Features:

- Automatic EMI Conversion: Transactions above ₹10,000 are converted into EMIs for 9 months.

- Nominal Charges: Processing fee of ₹99 and an interest rate of 20% per annum.

- Card Usage: Can be used as a regular credit card for transactions below ₹10,000.

Eligibility:

- Cardholders: Open to select HDFC Bank credit cardholders.

- Card Type: Not available on select Corporate, Purchase, and Commercial credit cards.

Repayment Terms:

- Tenure: Fixed at 9 months for eligible transactions.

- Interest Rate: 20% per annum.

- Processing Fee: ₹99 per transaction

Pocketly

Features:

- Loan Amount: Offers loans ranging from ₹1,000 to ₹25,000.

- No Physical Documentation: Fully digital process with minimal paperwork.

- Flexible Repayment: Choose repayment schedules from 2 to 6 months.

- Transparent Charges: Processing fees between 1% to 8%

Eligibility:

- Age: Typically 18 and above

- Nationality: Indian.

- Income: Have a stable, verifiable monthly income, such as a salary or income from self-employment.

- Credit Score: As per Pocketly's risk assessment.

Repayment Terms:

- Tenure: Flexible options from 2 to 6 months.

- Interest Rate: Starting from 2% per month.

Amazon Pay Later

Features:

- Instant Credit Approval: Eligible users can receive instant credit approval without the need for a credit card.

- Flexible EMI Options: Offers EMI plans ranging from 3 to 12 months, allowing customers to choose a repayment schedule that suits their financial situation.

- No Processing Fees: There are no processing or cancellation fees associated with Amazon Pay Later, making it a cost-effective option for customers.

- Wide Acceptance: Amazon Pay Later is accepted across various categories on Amazon.in, including electronics, fashion, and home appliances.

Eligibility Criteria

- Age: Applicants must be between 23 and 70 years of age.

- Residency: Must be a resident of India.

- Credit Assessment: Eligibility and credit limit are determined based on an instant evaluation by the lending partner.

Repayment Terms

- Due Date: For purchases made between the 1st and the end of the month, the due amount is calculated on the 1st day of the next month.

- No Pre-closure Charges: There are no charges for foreclosure or pre-closure of EMI with Amazon Pay Later.

- GST on Interest: While the EMI is interest-free, Goods and Services Tax (GST) may be applicable on the interest component, which the seller bears.

BankBazaar FinBooster Credit Card

Features

- Lifetime Free Membership: No joining or annual fees, ensuring cost-effective ownership.

- Instant EMI Conversion: Convert purchases of ₹2,500 and above into No Cost EMIs with upfront interest waived off during checkout.

- Accelerated Reward Points: Earn 5X points on online dining, 3X on apparel and groceries, and 2X on other retail spends.

- Credit Health Monitoring: Complimentary access to CreditStrong reports, allowing users to track and improve their credit scores.

- Insurance Coverage: Provides accidental death cover of ₹2.5 lakh for the primary cardholder.

- Fuel Surcharge Waiver: 1% waiver on fuel transactions between ₹400 and ₹5,000 across India..

Eligibility Criteria

- Age: Between 21 and 60 years.

- Income: Minimum net monthly salary of ₹25,000 or an annual Income Tax Return (ITR) of ₹7.5 lakh.

- Employment Status: Open to both salaried and self-employed individuals.

- Existing Cardholders: Not eligible if currently holding any YES Bank credit card.

Repayment Terms

- EMI Tenure: Flexible options ranging from 3 to 12 months.

- Interest Charges: Interest is waived off upfront during the purchase; no additional interest charges.

- Processing Fees: No processing fees for eligible users.

- Late Payment Charges: Applicable as per YES Bank's standard credit card terms.

While these providers offer attractive features, the right choice requires careful evaluation of factors. The decision shouldn't be based solely on provider reputation or promotional offers, but on how well the terms align with your financial circumstances.

Key Criteria for Choosing No Cost EMI Plans

When opting for a No Cost EMI plan, consumers should consider the following essential factors to make an informed and financially sound decision:

- Hidden Costs and Fees: No Cost EMI schemes may appear attractive, but they often involve hidden charges like processing fees (ranging from ₹99 to ₹299) and GST on the interest component. Even if the EMI is labeled "no cost," customers may end up paying more due to these additional costs.

- Foregone Discounts and Opportunity Cost: Some retailers offer significant upfront discounts (10-15%) for immediate payments, which are forfeited when opting for No Cost EMI. For instance, a ₹40,000 product may cost ₹4,000 more if purchased via EMI compared to a discount applied for an upfront payment.

- Eligibility Criteria: Most No-Cost EMI providers require a minimum credit score (650-700) and income verification. Credit card eligibility is also essential for some platforms, and some may offer alternatives through NBFCs for those without credit cards, but these options often carry higher costs.

- Income and Repayment Capacity: It's crucial to ensure that EMI payments fit comfortably within your budget without straining other financial commitments. Experts recommend having savings of at least three times the product value before opting for No Cost EMI to avoid financial stress during income disruptions.

- Repayment Terms and Tenure: No Cost EMI is most beneficial for higher-value purchases, where processing fees are a smaller percentage of the total cost. Tenure options range from 3 to 24 months, with shorter tenures reducing the impact of GST and processing fees.

- Product and Retailer Policies: Not all products are eligible for No Cost EMI. Electronics and appliances are the most commonly covered categories. Terms also vary across online and offline platforms, and certain purchase thresholds may apply.

- Prepayment and Cancellation Policies: Some plans may impose penalties for early closure or not allow prepayment at all. Cancellation policies can vary, and consumers may incur processing fees even for canceled transactions.

With these evaluation criteria, you can approach No Cost EMI decisions more strategically. However, even the best-chosen plan can become problematic without proper management.

Strategies and Tips for No Cost EMI, Shop Now Pay Later

No Cost EMI can be a great way to manage big-ticket purchases, but it’s important to approach it with caution. These tips will help you avoid hidden costs and penalties, and manage your repayments effectively.

- Compare the Total Cost: Even though "No Cost" EMI suggests no added charges, be mindful of hidden fees like processing charges and GST, which can increase the total cost. Compare the EMI price with the upfront price to see if the EMI option is truly beneficial.

- Ensure You Qualify: Check if you meet the eligibility requirements, such as a good credit score, steady income, and credit card eligibility. Be aware that using a credit card for EMI will block your available credit, affecting your future purchases.

- Choose Shorter Tenure Options: Shorter tenures (3–6 months) come with lower additional charges. By opting for a shorter repayment period, you can reduce the overall cost and pay off the balance quicker, leaving more flexibility in the future.

- Use for Essential Purchases: No Cost EMI is best for essential items like home appliances or electronics that offer immediate value. Avoid using EMI for impulse purchases, as it can lead to unnecessary financial strain.

- Pay on Time: Timely payments are crucial to avoid penalties and interest charges, which can turn the No Cost EMI into a more expensive option. Setting up auto-payments or reminders can help ensure you stay on track.

- Evaluate the Terms and Conditions: Carefully review the terms before committing. Some plans may have penalties for early repayment or cancellation fees. Understanding the full terms will help you avoid unexpected costs.

- Use Multiple EMI Providers: Different platforms like Amazon Pay Later, Bajaj Finserv, offer different terms, eligibility, and fees. Compare options to find the best deal, especially during sales.

- Use EMI for High-Value Purchases: No Cost EMI works best for high-value items, as processing fees are a smaller percentage of the total cost. It makes these big-ticket purchases more affordable without affecting your savings.

- Track Your EMI History: Keeping track of all your EMI commitments helps avoid over-leveraging. Timely payments improve your credit score, while multiple outstanding EMIs can hurt your financial profile, so manage your commitments wisely.

Despite these best practices, it's essential to acknowledge that No Cost EMI schemes aren't without their limitations. Understanding these downsides helps you make more balanced decisions and prepare for challenges that might arise.

Drawbacks of No Cost EMI and Shop Now Pay Later (SNPL) Options

While No Cost EMI and SNPL schemes offer convenience, they come with certain drawbacks that you should be aware of:

- Hidden Costs and Inflated Prices: Despite being labeled as "no cost," these plans involve hidden charges such as processing fees and GST on interest components. Additionally, the interest amount is embedded in the product's price, leading to higher upfront costs.

- Risk of Overspending and Debt Accumulation: The ease of purchasing items on installments leads to impulse buying, further leading consumers to spend beyond their means. This can result in accumulating debt if multiple SNPL plans are active simultaneously.

- Impact on Credit Score Due to Missed Payments: Late or missed payments can affect your credit score, making it more challenging to obtain credit in the future.

- Limited Consumer Protections and Refund Challenges: Unlike credit cards, SNPL services may not offer strong consumer protections or easy dispute resolutions. Issues with returns, refunds, or faulty products can be more complicated to address.

Recognizing these drawbacks doesn't mean No Cost EMI is unsuitable for everyone. Instead, it highlights the importance of exploring all available financing options.

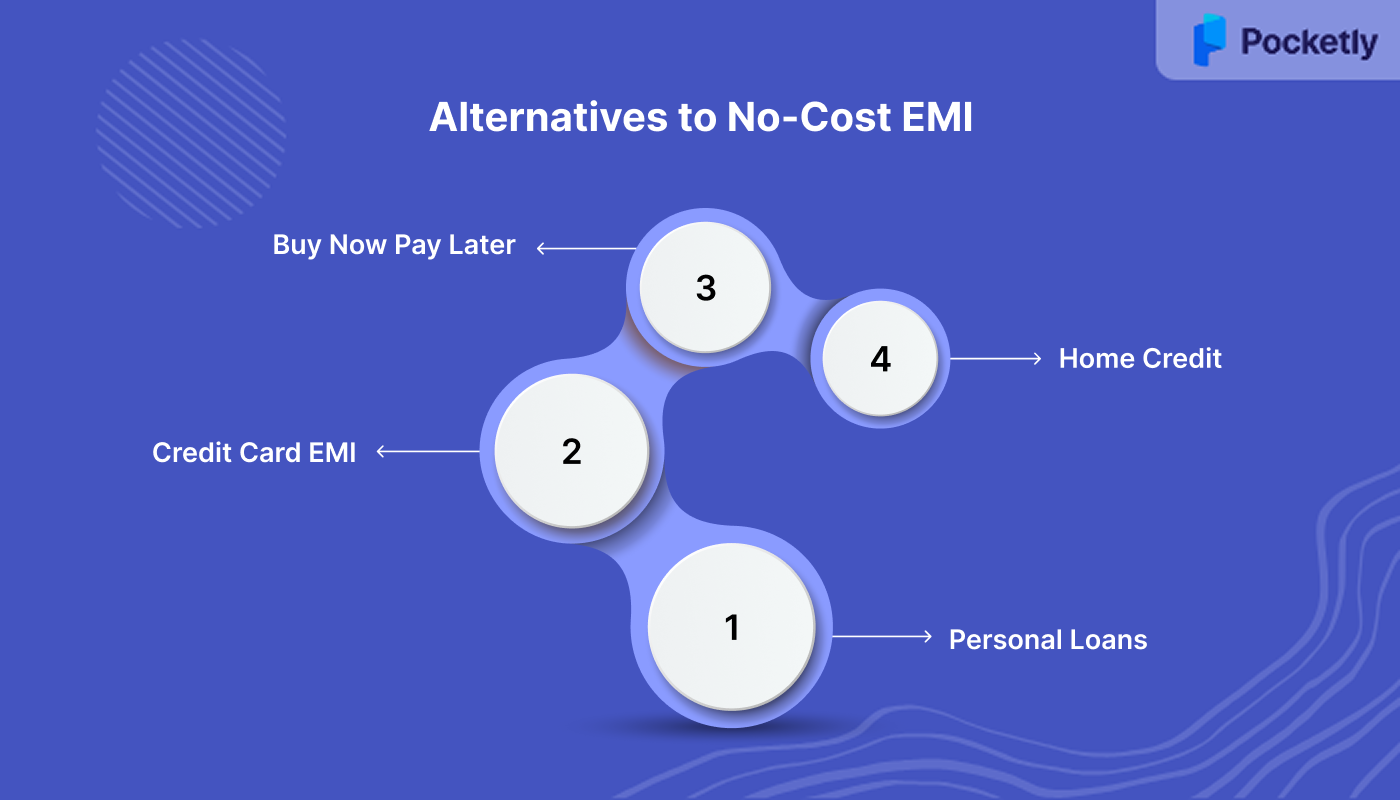

Alternatives to No-Cost EMI

While No-Cost EMI is a popular choice for spreading out payments, there are other financing options that may suit different needs. These alternatives can offer flexibility, lower costs, or broader usage, depending on your financial situation.

- Personal Loans: A flexible option with lower interest rates, available for larger amounts, and can be used for any purpose without restrictions.

- Credit Card EMI: Allows conversion of credit card purchases into EMIs, but may carry interest rates and processing fees if not part of a promotional offer.

- Buy Now Pay Later (BNPL): Short-term financing that allows purchases to be paid in installments over a few weeks or months, often without interest if repaid on time.

- Home Credit: Provides loans specifically for consumer goods, offering flexible payment terms but may come with higher interest rates compared to No-Cost EMI.

Each financing option serves different purposes. The key lies in matching your choice to your financial goals, spending patterns, and repayment capacity. This thoughtful approach ensures that your financing decisions support rather than strain your overall financial health.

Conclusion

No Cost EMI and Shop Now Pay Later options provide flexibility for consumers, making expensive products more accessible by spreading payments over time. However, it's important to carefully assess the hidden costs, repayment terms, and eligibility criteria to ensure these schemes align with your financial goals. While they offer immediate gratification, understanding the total cost and potential pitfalls can help you avoid unnecessary financial strain.

Pocketly is a digital lending platform designed for students, professionals, and loans for self-employed individuals who need quick, flexible financial support. With loan amounts ranging from ₹1,000 to ₹25,000 and easy repayment terms, Pocketly offers an instant personal loan as an accessible way to manage expenses. Download Pocketly now on iOS or Android.

FAQs

1. Are there hidden fees in no-cost EMI?

Yes, No-Cost EMI plans may have hidden costs such as processing fees, GST on interest components, or inflated product prices, which can increase the overall cost of the product.

2. What if I cancel my no-cost EMI?

Cancellation policies vary by provider, but some platforms may charge a cancellation fee or impose penalties. It's essential to check the terms before committing to an EMI plan.

3. What happens if I never pay EMI?

If you fail to repay your EMI, it can lead to late fees, penalties, and a negative impact on your credit score. In extreme cases, lenders may initiate legal action to recover dues.

4. How to freeze loan payments?

Freezing loan payments generally requires a formal request to the lender, usually under exceptional circumstances like financial hardship. Terms vary by lender, so it’s important to check their policies.

5. What if I miss EMI by one day?

Missing an EMI by one day may result in late fees and interest charges. Continuous delays can negatively affect your credit score and may result in further penalties.