You may have heard the term "provision" when discussing loans, but what does it actually mean, and why is it crucial for lenders, especially in unsecured lending? When lenders offer unsecured loans, they take on a higher level of risk because there’s no collateral to fall back on in case the borrower defaults.

To manage this risk, lenders set aside a certain amount of money, known as a “provision,” to cover potential losses. This provision acts as a financial cushion, helping protect the lender from the impact of defaults.

Provisions are particularly important for unsecured loans, where the lack of collateral increases the risk. In fact, proper provisions can reduce loan losses by up to 20%.

This blog will break down the concept of provisions, explain their role in unsecured loans, and show why they are essential for both lenders and borrowers in managing financial risk.

Key Takeaways

- Provisions are funds set aside by lenders to cover potential loan defaults, significant for unsecured loans where there is no collateral.

- Provision amounts are influenced by factors like credit risk, loan size, borrower profile, and regulatory requirements.

- Banks that properly manage loan provisions experience up to 20% fewer loan losses compared to those that don’t set adequate provisions.

- Inadequate provisions can lead to financial instability, higher interest rates for borrowers, and regulatory penalties for lenders.

- Alternative risk strategies, like AI-based credit scoring or dynamic provisioning, help lenders reduce reliance on provisions while managing risk effectively.

How Are Provisions Calculated for Standard Unsecured Loans

When a lender issues an unsecured loan, there’s always a risk the borrower might default. Without collateral, the lender must anticipate potential losses. Provisions are the buffers lenders set aside to cover that risk.

The size of the buffer depends on a few measurable factors and regulatory guidelines. Below is how that calculation typically works in practice.

1. What lenders look at when estimating provisions

- Credit risk of the borrower — This involves the borrower’s repayment history, creditworthiness, and likelihood of default. The worse the credit risk, the higher the provision.

- Loan size and exposure — Larger loans or higher outstanding balances carry more risk; hence, they require higher provisions.

- Expected probability of default (PD) and loss given default (LGD) — Lenders estimate the chance that a loan will go bad and how much loss they might incur if default happens. These estimates feed directly into provision calculations.

- Overall portfolio composition and diversification — A portfolio heavily skewed toward unsecured loans may see higher aggregate provisions compared to a diversified loan book.

2. Regulatory and accounting rules that guide provision levels

Provisions are not purely discretionary, accounting standards and regulatory requirements influence the amount that must be reserved. For example:

- Under IFRS 9, lenders recognise expected credit losses (ECL) for financial assets, not just when a loan turns bad. That means the provision must cover potential future losses based on current and forecast conditions.

- Banks must also classify loans into asset categories (standard, sub‑standard, non‑performing) and follow the prescribed provisioning norms for each classification. For “standard” performing loans, a small base-level provision is often mandated.

- If a loan becomes non-performing (due to overdue payments, etc.), higher provisioning percentages apply based on the length of the overdue period and the loan's risk level.

Because of these frameworks, lenders cannot under-provision, they must hold enough reserves to cover calculated risks and comply with banking norms.

3. Typical methods used to set provisions

When a lender calculates provisions, they usually follow one of these approaches:

- Expected Loss Model

Forecasts losses based on statistical estimates of default probability and loss severity (PD × LGD × Exposure at Default). This model aligns with IFRS 9 ECL standards.

- Historical Loss Rate Method

Uses actual past loss experience on unsecured loans to estimate likely future losses. This works when a lender has sufficient historical data.

- Bucket or Asset‑Classification Method

Loans are classified as “standard,” “sub-standard,” “doubtful,” etc., and provisions are applied as a percentage of outstanding amount depending on classification. Standard loans get small provisions, while risky or overdue loans get higher provisions. This method is common under local prudential norms.

Also Read: The Rise and Benefits of Fintech Lending

Now that we know how provisions are calculated, it’s important to understand why lenders set them and how they impact their operations.

Why Do Lenders Set Provisions on Unsecured Loans

Lenders set provisions for unsecured loans as a safeguard against losses. Because these loans lack collateral, defaults can directly hit a lender’s balance sheet.

Provisions serve as a financial buffer that helps absorb losses and maintain the institution's stability under stress.

How provisions help manage risk and maintain stability

- Prepare for loan defaults. A provision is a reserve built to cover potential unpaid loans. It ensures the lender is not caught off guard if a borrower doesn’t repay.

- Protect capital and balance sheet health. Provisions reduce operating income but strengthen the overall financial footing, ensuring lenders can meet obligations even if some loans turn bad.

- Meet regulatory and accounting norms. Under global and local standards, banks must maintain loan‑loss reserves for unsecured exposures. These rules ensure uniform risk management and protect depositors and investors.

Also Read: First-Time Loans to Build Credit: A Beginner's Guide

For borrowers, provisions also have a significant impact. Here’s how provisions can shape your loan approval, interest rates, and terms.

How Do Provisions Affect Borrowers on Standard Unsecured Loans

A comprehensive study of Indian commercial banks found that variables such as asset size, credit growth, NPA levels, and macroeconomic conditions (such as GDP growth) significantly influence the amount of provisions banks set aside.

In effect, macroeconomic health and loan‑book composition directly shape provision norms.

What borrowers need to know

- Provisions shape interest rates and loan costs. To cover the cost of potential defaults, lenders embed provisioning expense into interest rates. Higher-risk borrowers may see higher rates because lenders set aside more capital against the loan.

- Provisions influence approval chances and loan terms. If a borrower’s credit profile signals higher risk, the lender might require smaller loan amounts, shorter repayment periods, or increased interest, or may decline the loan.

- Borrower creditworthiness matters more than ever. A clean repayment history and stable financial background reduce perceived risk. That lowers required provisions and improves loan affordability. On the flip side, a weak profile means costlier loans or possible rejection.

Need quick, unsecured credit with no collateral? Pocketly offers fast, transparent loans of ₹1,000 to ₹25,000 to meet your urgent needs.

Download the Pocketly app on iOS or Android and get the funds you need, when you need them.

Also Read: How Credit Risk Models Help Borrowers Get Loans Quickly

When provisions are insufficient, it can cause major issues for both lenders and borrowers. Let’s take a closer look at the potential consequences:

What Happens If Provisions Aren’t Adequate on Unsecured Loans

Lenders must hold enough provisions to shield themselves from defaults. If they fail to do so, consequences hit both their stability and borrowers’ trust. In recent years, Indian banks have seen the cost of bad loans rise, especially in unsecured segments such as personal loans and microfinance.

For example, during the March 2025 quarter, several private and public banks significantly increased their loan‑loss provisions amid pressure on asset quality in India.

What lenders and borrowers risk when provisions fall short

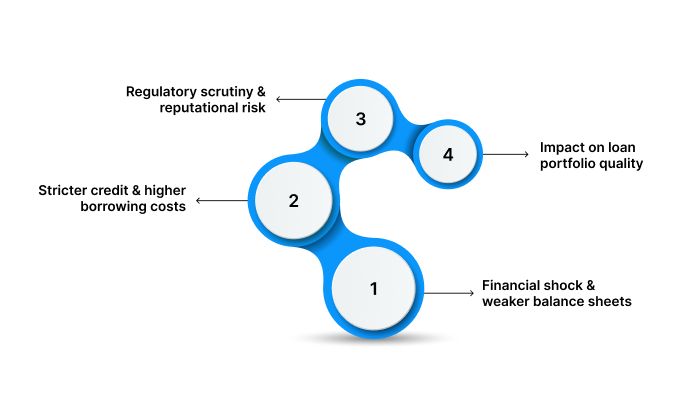

- Financial shock and weaker balance sheets

If defaults spike and provisions are insufficient, lenders may have to absorb losses directly, hurting profitability and reducing capacity to lend further. This can create a liquidity crunch and pressure on capital buffers.

- Tighter credit supply and higher costs for borrowers

Weak provisioning forces banks to compensate by tightening lending norms or raising interest rates — particularly on unsecured loans where risk is higher. For borrowers with lower credit scores, access to credit becomes harder or more expensive.

- Regulatory scrutiny and reputational risk

Inadequate provisioning can trigger regulatory consequences under the norms set by the Reserve Bank of India (RBI). Repeated under‑provisioning may reduce lender credibility, leading to reduced investor confidence and loss of trust among borrowers.

- Impact on overall loan portfolio quality

One weak segment (e.g., unsecured loans) can drag down the entire loan book. Poor provisioning may mask growing stress in loan portfolios, delaying corrective action and amplifying losses over time.

Also Read: Understanding Promissory Notes for Personal Loans

While provisions are important, lenders can also use alternative strategies to manage risk.

Are There Alternatives to Relying Only on Provisions for Unsecured Loans

Indian lenders and regulators are evolving risk-management strategies to reduce the burden of large provisions while safeguarding against losses.

A major change on the horizon is the RBI's shift toward a forward‑looking provisioning framework.

Emerging and alternative risk‑management approaches

- Expected Credit Loss (ECL) framework

Under the draft 2025–26 guidelines, banks will need to estimate potential losses before default, using borrowers' credit history, macroeconomic forecasts, and portfolio behaviour. This approach ensures provisions are more proactive, not just reactive.

- Risk‑based pricing and adjusted loan terms

Instead of blanket provisioning, banks may price unsecured loans based on individual borrower risk. Higher‑risk borrowers could be charged higher interest rates or face stricter terms, reducing reliance on broad-based buffers.

- Tightened credit underwriting and data‑driven credit evaluation

More rigorous credit checks, ongoing monitoring of repayment behaviour, and careful assessment of borrower track record reduce default risk, thereby lowering the need for heavy provisioning.

- Use of non‑bank lenders and NBFCs under scale‑based regulation

For non-bank lenders operating under regulatory norms, provisions for standard assets vary but remain more modest (e.g., 0.25 –2%) under the guidelines for upper‑layer NBFCs.

This regulation encourages structured lending with calibrated risk, balancing credit access and loss protection.

Also Read: Applying for Urgent Personal Loans with a Low Credit Score

How Pocketly Makes Unsecured Credit Work for You

Need quick credit without the hassle of paperwork or collateral? Pocketly offers a simple, fast, and flexible solution to cover your urgent financial needs, whether it’s for education, business, or unexpected expenses.

Just as provisions help lenders manage risk, Pocketly ensures a smooth, transparent borrowing experience for you.

- Quick, Collateral-Free Loans: Borrow from ₹1,000 to ₹25,000 with no collateral required, perfect for managing unexpected expenses.

- Instant Online Process: Apply, complete your digital KYC, and get funds directly to your bank account, all within minutes.

- Clear, Affordable Pricing: Interest rates start at just 2% per month, with processing fees ranging from 1–8%, so you know exactly what to expect.

- Flexible Repayments: Choose your repayment option with flexible EMIs, and pay off the loan early with no hidden charges.

- For Everyone: Whether you’re a student, salaried professional, or self-employed, Pocketly provides the credit flexibility you need.

Apply now and get fast, unsecured loans with transparent terms and no complicated processes. Download Pocketly on iOS or Android today.

Conclusion

Provisions play a vital role in the world of unsecured loans, directly affecting both lenders and borrowers. For lenders, provisions act as a safety net, ensuring they are financially prepared for potential defaults.

For borrowers, while provisions are necessary for loan stability, they can also influence loan terms, including interest rates and approval chances.

If you're looking for quick, transparent, and flexible credit solutions, Pocketly offers unsecured loans with clear terms and competitive interest rates. With loans ranging from ₹1,000 to ₹25,000, you can get the financial support you need without the complexity.

FAQs

Q: How do provisions impact the availability of unsecured loans?

A: Higher provisions can reduce the availability of unsecured loans, as banks need to offset the cost of potential defaults. This often leads lenders to tighten their lending criteria, making it more difficult for borrowers with lower credit scores to access credit.

Q: Do provisions affect the loan tenure or repayment options?

A: Yes, lenders may adjust loan terms, such as tenure or repayment structure, based on provisions. If provisions are higher, lenders may offer shorter repayment periods or stricter terms to mitigate the risk of defaults, which in turn helps manage their provisions more effectively.

Q: How often do lenders adjust provisions for unsecured loans?

A: Lenders review and adjust provisions regularly, often quarterly or annually, based on the loan portfolio's performance. Changes in borrower repayment behaviour, economic conditions, or credit market trends can prompt lenders to revise provisions to maintain financial stability.

Q: Can lenders offer unsecured loans without provisions?

A: No, provisions are required by law and industry standards to ensure financial stability. Without provisions, lenders would expose themselves to excessive risk, which could destabilise their financial health and violate regulatory requirements.

Q: How does the macroeconomic environment affect provisions on unsecured loans?

A: In periods of economic downturn or high inflation, provisions generally increase due to the higher likelihood of loan defaults. Lenders adjust provisions in response to changing market conditions, ensuring they remain prepared for potential increases in defaults and protecting against financial instability.