Building a credit history is a key step toward financial independence, especially for those just starting their journey into the world of finance. The idea of taking out a first-time loan can be intimidating, particularly without any previous credit experience. Many new borrowers find themselves unsure of how to begin with a blank slate. Whether it’s for a car, personal use, or even a credit card, understanding how these loans work and how they can impact your credit score is crucial.

This guide will walk you through the basics of first-time loans, their role in credit building, and offer tips on how to manage them wisely, ensuring you take the right steps toward a strong and lasting credit profile.

Key Takeaways

- First-Time Loans are Essential for Credit Building: Taking out a first-time loan is crucial for establishing a positive credit history, which helps you qualify for better financial products in the future.

- Types of Loans for Beginners: Secured credit cards, credit builder loans, and small personal loans are excellent options for first-time borrowers to start building their credit profiles.

- Start Small for Better Approval: Requesting a small loan or applying with a guarantor increases your chances of approval when you have no credit history.

- Understanding Credit Inactivity: A lack of credit history is different from having bad credit, so be transparent with lenders about your borrowing experience to avoid misunderstandings.

- Responsible Loan Management: Timely payments, staying within budget, and avoiding excessive debt are key to building a solid credit profile and improving your credit score over time.

Understanding First-Time Loans

A first-time loan is a loan taken by someone with little or no previous credit history. It is often offered with the intention of helping individuals establish or improve their credit score.

First-time loans are crucial for building credit because they provide an opportunity to exhibit responsible borrowing and repayment behavior. Successfully managing such loans, by making timely payments, helps build a positive credit history, which further qualifies for larger loans, credit cards, and better interest rates in the future.

Why is it Important to start a Credit Profile with First-Time Loans?

Starting a credit profile with first-time loans will help you achieve financial stability and independence. A strong credit history not only opens doors to better financial opportunities, such as loans with lower interest rates, but also reflects your ability to manage money responsibly.

- Establishes Your Credit History: Without any credit history, it’s challenging to get approved for future loans. First-time loans provide the opportunity to start building your credit profile from scratch.

- Helps Build Your Credit Score: Timely repayment of a first-time loan demonstrates financial responsibility, boosting your credit score and improving your chances of qualifying for larger loans.

- Access to Better Financial Products: A positive credit profile allows you to access better loan terms, lower interest rates, and more favorable credit card offers in the future.

- Increases Borrowing Power: A solid credit history makes you a more attractive borrower to lenders, which can increase your chances of getting approved for larger loans when needed.

- Financial Confidence: Successfully managing a first-time loan provides confidence and a sense of financial control, teaching valuable skills in budgeting and managing debt.

Now, the practical question becomes: which path should you take? The lending ecosystem offers several distinct routes for building credit, each with unique advantages that cater to different financial situations and risk tolerances.

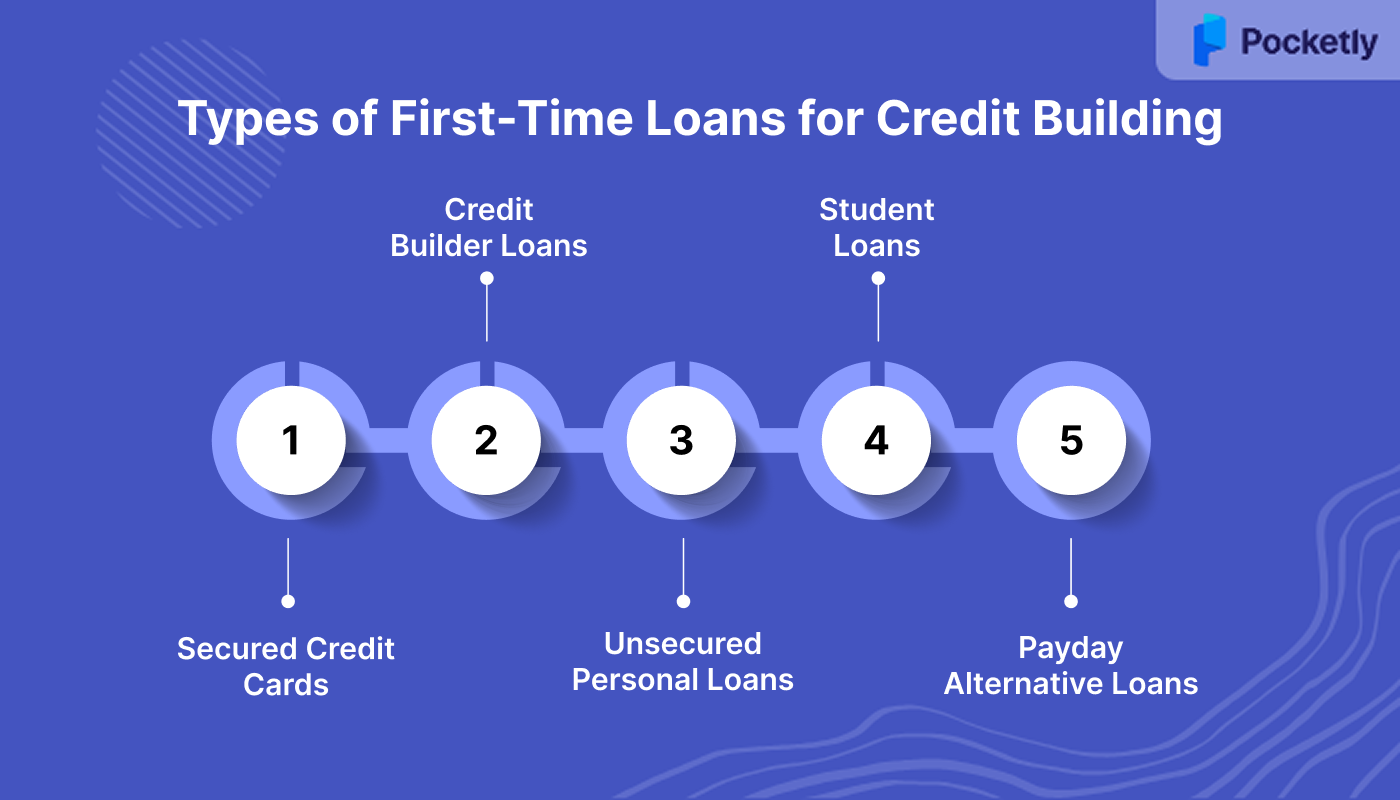

Types of First-Time Loans for Credit Building

First-time loans help establish a solid credit profile, and there are several types of loans that individuals can consider when starting their credit-building journey. Here’s a breakdown of the most common types of first-time loans for credit building:

1. Secured Credit Cards

Secured credit cards are one of the most accessible types of loans for individuals with no credit history. Unlike traditional unsecured credit cards, secured credit cards require a security deposit. This deposit serves as collateral, which is equal to the credit limit on the card. The primary benefit of using a secured credit card is that it allows you to build your credit history by making purchases and paying off the balance monthly.

- How it builds credit: By making consistent, on-time payments, you demonstrate responsible borrowing, which is reported to the credit bureaus, helping to establish your credit history.

- Things to keep in mind: Ensure you don’t exceed your credit limit and make payments on time to avoid interest charges and negative impacts on your credit score.

Also Read: How Secured Credit Cards Build Credit Score

2. Credit Builder Loans

A credit builder loan is a small, short-term loan designed specifically for individuals with no credit history. Credit unions, banks, or online lenders offer these loans. Unlike other loans, where you receive the loan amount upfront, with a credit builder loan, the amount borrowed is held in a savings account while you make monthly payments. Once you've completed the payments, the funds are released to you, and the loan is reported to the credit bureaus.

- How it builds credit: The timely payments on the loan are reported to credit bureaus, allowing you to establish a positive credit history. Credit builder loans are often easier to get approved for because they are low-risk for the lender.

- Things to keep in mind: The loan amount is usually small, and interest rates may vary. Make sure you make timely payments, as missed payments can harm your score.

3. Unsecured Personal Loans

An unsecured personal loan is another option for first-time borrowers, although it may be a bit harder to qualify for compared to secured options. These loans are not backed by collateral, meaning the lender is taking a higher risk in lending to you. As such, interest rates on unsecured loans can be higher than secured ones. However, if you have a reliable source of income and show the ability to repay the loan, you may be able to secure an unsecured loan to help build your credit.

- How it builds credit: Like credit builder loans, timely payments on an unsecured loan will be reported to the credit bureaus, helping to build your credit history.

- Things to keep in mind: Interest rates can be higher for unsecured loans, so it’s essential to compare offers and ensure you can afford the monthly payments.

Explore: Understanding Unsecured Loans: Meaning and Benefits

4. Student Loans

For many, student loans are often their first exposure to borrowing. While they are not designed solely for credit-building, they can be an effective way to start establishing credit, especially if they are repaid on time. Federal student loans are often the best option for first-time borrowers, as they come with fixed, lower interest rates and flexible repayment terms.

- How it builds credit: Like any other loan, student loans reported to the credit bureaus will impact your credit score. On-time payments help build a positive history, while missed payments can harm your credit.

- Things to keep in mind: Federal student loans often offer deferred payment options while you’re in school, but once you graduate or leave school, timely repayment is critical for building a good credit profile.

5. Payday Alternative Loans (PALs)

Offered by credit unions, payday alternative loans (PALs) are small, short-term loans designed to help borrowers avoid payday loans, which often come with very high-interest rates. PALs have lower fees and interest rates compared to payday loans, making them a better option for building credit.

- How it builds credit: By making timely repayments, PALs can help establish a positive credit history. PALs are reported to credit bureaus, so paying them off on time can improve your credit score.

- Things to keep in mind: PALs are small loans, and the repayment term is short, so make sure you can manage the payments without overextending yourself.

Without an established credit history, the application process requires strategic thinking and alternative approaches that demonstrate your creditworthiness through different means.

Ways to Apply for a First-Time Loan

When applying for a first-time loan, especially without a credit history, but with an intention of building credit, there are several strategies and options to improve your chances of approval. Here’s a breakdown of how to navigate the process:

1. Apply with a Guarantor: If you have no credit history, applying with a guarantor, someone with good credit who agrees to repay the loan if you default, can help reduce the lender's risk and increase your approval chances.

2. Request a Small Loan: Requesting a small loan is another approach. Lenders are more likely to approve smaller amounts, as they present less risk. Successfully repaying a small loan can help establish your credit history, making it easier to access larger loans later.

3. Apply for a loan from the Same Bank where You Have a Salary Account: One of the easiest ways to increase your chances of loan approval is to apply for a loan from the same bank where you have your salary account. The bank is already familiar with your income and financial behavior, making it more inclined to offer you a loan. Additionally, having an established relationship with the bank can help you secure better loan terms.

4. Explain Credit Inactivity: If you've never used any credit products, explain this to the lender. Emphasize that no credit history is different from a bad credit history. This helps lenders understand your situation and see you as an unknown risk, not a high-risk borrower.

5. Explore New to Credit (NTC) Programs: Many financial institutions offer loans to individuals new to credit (NTC), using proprietary scoring models. These models assess risk based on income, employment history, and other factors, making it easier to get approved for credit, even without a traditional credit score.

For those seeking instant personal loans without a credit history, Pocketly offers a great solution. Pocketly provides quick, hassle-free loans to young Indians, including students and salaried professionals, even without an existing credit score. With minimal documentation and fast approval, Pocketly helps you build credit while addressing immediate financial needs.

By following these steps, first-time loan applicants can overcome the challenges of having no credit history and secure the financing they need to establish a credit history.

Also Read: How to Build Credit Without a Credit Card

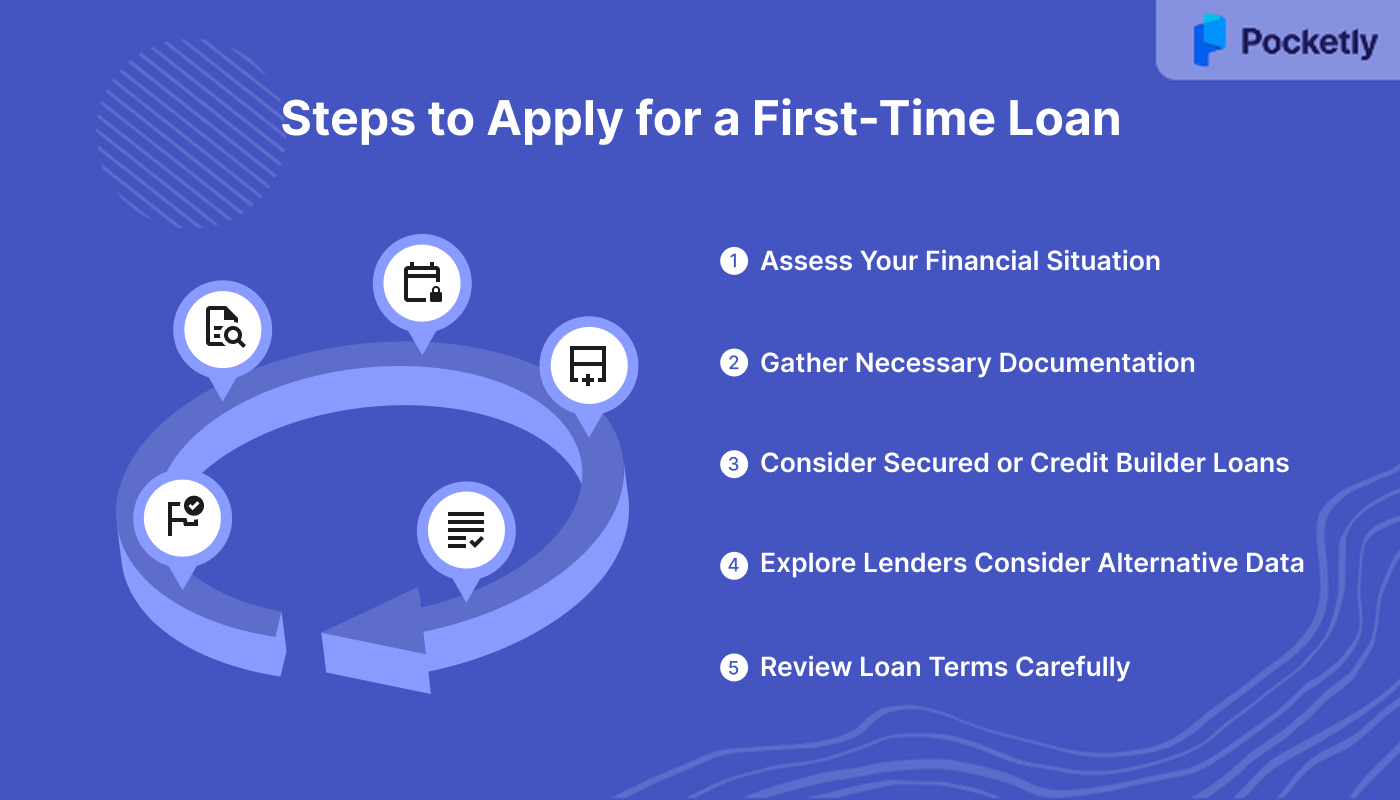

Steps to Apply for a First-Time Loan

Applying for a first-time loan can be an exciting yet challenging process. Here’s a step-by-step guide to help you process the application and increase your chances of approval:

Step 1: Assess Your Financial Situation

Before applying for a loan, evaluate your financial health. Review your income, expenses, and any existing financial commitments. This will help you determine how much you can afford to borrow and ensure you can meet repayment obligations.

Step 2. Gather Necessary Documentation

Lenders typically require specific documents to process your loan application. These include a government-issued ID (passport, driver's license), proof of income (recent pay stubs or tax returns), proof of address (utility bills or rental agreements), and employment details. Having these documents ready will speed up the process.

Step 3: Consider Secured or Credit Builder Loans

If you have no credit history, secured loans or credit builder loans can be a good option. These loans require collateral or are designed to help build credit, making them easier to obtain for first-time borrowers.

Step 4: Explore Lenders That Consider Alternative Data

Some lenders are willing to consider alternative data such as utility payments, rent, or mobile phone bills when assessing your creditworthiness. These lenders may offer loan options even without a traditional credit score.

Step 5: Review Loan Terms Carefully

Once you receive a loan offer, carefully review the terms. Pay attention to the interest rates (APR), repayment terms, and any additional fees. It's important to fully understand the financial commitment before accepting the loan.

Securing the loan is just the beginning; what happens next determines whether this first step becomes the foundation for financial success or a costly mistake. Your management approach during these crucial early months sets the tone for your entire credit journey.

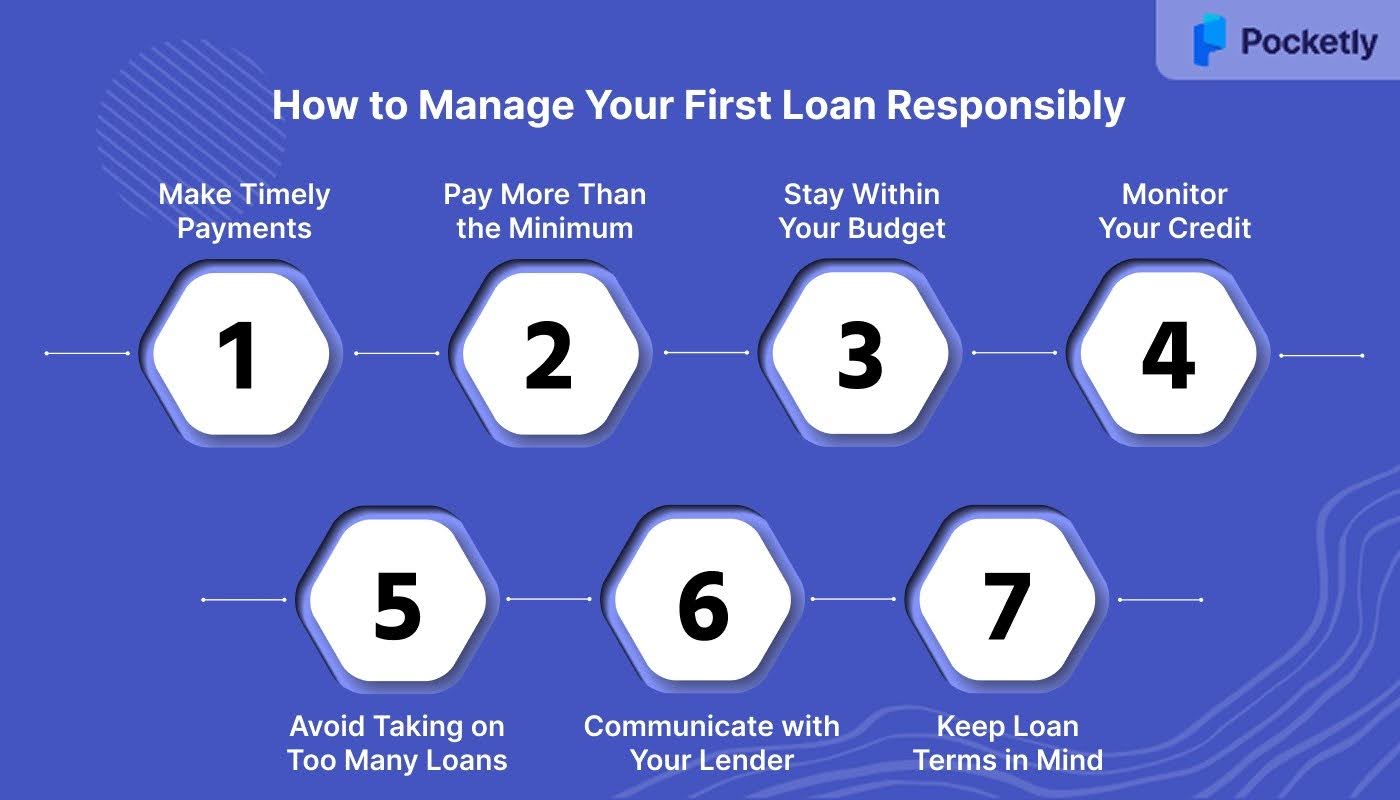

How to Manage Your First Loan Responsibly

Managing your first loan responsibly while staying on top of your payments, keeping track of your spending, and understanding the loan terms is important to improve your credit score over time. Let’s understand the key strategies to help you manage your first loan responsibly:

- Make Timely Payments: Always ensure you make your loan payments on time to avoid late fees and damage to your credit score. Setting up automatic payments or reminders can help you stay on track.

- Pay More Than the Minimum: Whenever possible, pay more than the minimum amount due. This will help reduce your loan balance faster and minimize interest charges.

- Stay Within Your Budget: Borrow only what you can afford to repay. Avoid using the loan amount for unnecessary expenses, and stick to your repayment plan.

- Monitor Your Credit: Regularly check your credit report to track your progress and ensure there are no errors or discrepancies that could affect your credit score.

- Avoid Taking on Too Many Loans: Don’t overburden yourself with multiple loans or credit cards. Keep your debt load manageable to maintain a healthy credit profile.

- Communicate with Your Lender: If you’re having trouble making a payment, reach out to your lender immediately. Many lenders offer solutions such as deferment or rescheduling payments to avoid default.

- Keep Loan Terms in Mind: Understand the terms of your loan, including interest rates, repayment period, and any potential fees. This helps you avoid surprises and manage your finances more effectively.

While these principles apply universally, having the right lending partner can make the difference between a stressful experience and a smooth introduction to credit building. Some platforms are designed with first-time borrowers in mind, offering features that align perfectly with beginner needs.

Why Pocketly is Ideal for First-Time Loan Borrowers

For first-time borrowers, finding a loan that is quick, accessible, and flexible can be a challenge. Pocketly offers a perfect solution for individuals looking to build their credit history without the stress of complex paperwork or high-interest rates.

As a digital lending platform, Pocketly provides instant, hassle-free personal loans to young professionals, students, and salaried individuals, making it easier to access funds when needed, even without a credit history.

Here are some key features of Pocketly that make it a great choice for first-time loan borrowers:

- Loan Amounts: Pocketly offers loans ranging from ₹1,000 to ₹25,000, catering to small personal needs without overburdening borrowers.

- Flexible Loan Repayment: Loans come with flexible EMI options, allowing you to repay at a pace that suits your financial situation.

- Affordable Interest Rates: Pocketly charges a competitive interest rate of 2% per month, ensuring that your loan remains affordable and manageable.

- Minimal Processing Fee: Pocketly charges a processing fee ranging from 1% to 8% of the loan amount, keeping the costs low and transparent.

- Multiple Loan Repayment Modes: Pocketly provides convenient repayment options, including bank transfers, UPI, and digital wallets, making it easy to manage repayments.

- No Credit History Required: Pocketly understands that first-time borrowers might not have an established credit score, and offers loans with minimal documentation requirements, focusing more on your ability to repay than your past credit history.

Conclusion

Building a strong credit history is an important step toward financial independence, and first-time loans can provide the foundation you need to start. By understanding the different types of loans, following the right application steps, and managing your loan responsibly, you can begin to establish a positive credit profile.

Whether you choose secured credit cards, credit builder loans, or work with platforms like Pocketly, you are taking the right steps toward securing better financial opportunities in the future.

Pocketly is an ideal choice for first-time borrowers, offering instant personal loans ranging from ₹1,000 to ₹25,000, with minimal documentation and flexible repayment options. Download Pocketly today on iOS or Android to get started on building your credit history!

FAQs

1. How to build a CIBIL score first time?

To build your CIBIL score for the first time, start by applying for a secured credit card or credit builder loan. Ensure you make timely payments and maintain low credit utilization.

2. How long does it take to build credit?

Building credit typically takes 3 to 6 months if you consistently make on-time payments and manage your credit responsibly. It can take longer for a stronger credit profile.

3. How do I check my loan eligibility?

To check your loan eligibility, lenders typically assess your income, employment history, existing debt, and credit score. Some lenders offer prequalification tools that let you check without impacting your credit score.

4. Which type of loan is the cheapest?

Secured loans, such as home loans or car loans, are usually the cheapest because they are backed by collateral, resulting in lower interest rates compared to unsecured loans like personal loans.

5. When not to get a personal loan?

Avoid taking a personal loan when you have high existing debt, when you’re unsure of your repayment ability, or when you need a loan for non-essential purchases that could be avoided.