Building a strong credit score is essential for getting approved for loans, securing better interest rates, and even renting an apartment. Banks and lenders often check your credit score before approving your loan applications, making it a crucial factor in your financial journey.

But do I need a credit card to build credit? The answer is no, while credit cards can help, they are not the only way to improve your credit. There are several methods to build and monitor your credit score, even without using a credit card.

In this blog, we’ll explore how you can strengthen your credit through alternative approaches and achieve your financial goals.

Key Takeaways

- Build Credit Without a Credit Card: There are several effective ways to build credit without relying on a credit card, including credit-builder loans, rent reporting services, and small installment loans.

- Alternative Credit Methods: Methods like using alternative credit data, becoming an authorised user, or opting for a secured credit card can help in creating a positive credit history without the risks of traditional cards.

- Manage Your Credit Utilisation: It’s important to keep your credit utilisation under 30% and avoid overspending on credit cards to maintain a good credit score.

- Understand Credit Score Factors: Your payment history, amounts owed, length of credit history, credit mix, and new credit all play a significant role in determining your credit score.

- Avoid Common Mistakes: Ensure timely payments, avoid only paying the minimum due, and maintain a diverse mix of credit accounts to avoid harming your credit score.

What is a Credit Score?

It is a 3-digit number that indicates your creditworthiness and how likely you are to repay borrowed money. It ranges from 300 - 850, with higher scores indicating better credit. Lenders, banks, and financial institutions assess your score to evaluate the risk of loaning you money.

A good credit score can help in the approval of loans, credit cards, and even a rental property. It’s based on factors like your payment history, debt, credit history length, and types of credit used.

What is the Importance of Building Credit Without a Credit Card?

Building credit without a credit card offers a smart, manageable way to establish your creditworthiness without taking on the risks associated with credit card usage. Let’s take a look at the benefits of credit without a credit card.

- Avoid Credit Card Debt: Building credit without a credit card helps you steer clear of high-interest charges and late fees, which can negatively impact your credit score.

- Alternative Credit-Building Methods: You can build credit by paying bills on time, using rent payment services that report to credit bureaus, or taking out small loans, which help establish a positive credit history without needing a credit card.

- Prevents Overspending: By avoiding credit cards, you eliminate the risk of overspending and accumulating debt, allowing you to maintain better control over your finances.

- Financial Discipline: Building credit without relying on credit cards encourages disciplined financial management, helping you improve your credit score safely and steadily.

Understanding the benefits is just the beginning, the real value lies in implementing practical strategies that work for your situation.

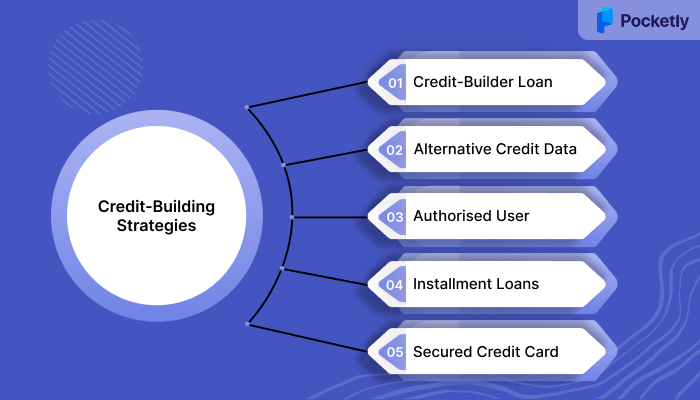

Top 5 Strategies to Build a Credit Score Without a Credit Card

Building a strong credit score doesn't require a credit card. Many individuals successfully establish excellent creditworthiness through alternative methods that are often safer and more manageable. Here are 5 proven strategies to build your credit score without traditional credit cards:

1. Consider a Credit-Builder Loan

Credit-builder loans operate in reverse of conventional loans and are specifically designed for people with no credit history or poor credit scores. Unlike traditional loans, where you get the money upfront, with credit-builder loans, the lender places the loan money into a secured savings account or a certificate of deposit.

These loans are accessible than traditional loans, making them the ideal option if you are looking to enhance your credit score.

2. Make Use of Alternative Credit Data

Alternative credit data includes payments like rent, utilities, and insurance, which are usually not reported to credit bureaus. However, platforms such as Experian Boost make it possible to include these payments in your credit report, which can help boost your credit score. This method is particularly helpful for salaried and self-employed individuals with little or no credit history. By showcasing your consistent payment habits, you can also increase your likelihood of loan approval and receive more favorable interest rates.

3. Become an Authorised User

You can boost your credit score by being added as an authorised user on someone else’s credit card. The primary cardholder's payment history and credit usage will show on your credit report.

This strategy is useful for people with little credit history, such as students or newcomers to credit. However, it's essential to ensure that the primary cardholder maintains a strong payment record, as any negative impact on their credit can affect yours.

4. Small Installment Loans

Small installment loans are a highly effective strategy for improving your credit score. These loans are designed with fixed loan repayment modes and schedules, which means you’ll have a set amount to pay each month until the loan is fully repaid. Unlike revolving credit, like credit cards, where the balance can fluctuate, installment loans offer predictable payments with clear timelines for payoff.

5. Use a Secured Credit Card

The card requires a deposit, which acts as your credit limit. Further, using a secured credit card, you can make small purchases and pay the balance in full each month can improve your credit score.

It reports your payment history to credit bureaus, allowing you to build a solid credit history. Over time, consistent use of a secured credit card can help you qualify for unsecured credit products.

Also Read: Credit Card for Low CIBIL Score in India

Successfully implementing these strategies requires understanding how credit scoring actually works. Behind every credit score lies a complex algorithm that weighs different aspects of your financial behavior.

What are the Factors Influencing Credit Score?

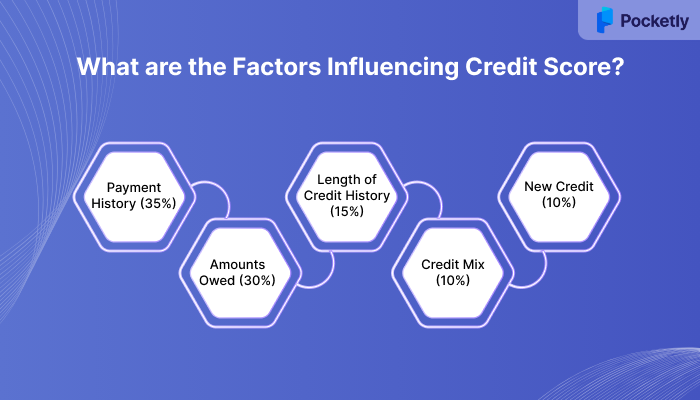

Your credit score is influenced by key factors that reflect your financial habits and creditworthiness. The most important factor is payment history, which makes up 35% of your score and shows whether you've made payments on time. Let’s look at other factors:

1. Payment History (35%)

The biggest impact on your score is the payment history. It tracks whether you’ve paid your bills on time, including loans, credit cards, and other financial obligations. Missed or late payments, defaults, bankruptcies, and foreclosures can significantly lower your score. On the other hand, a record of consistent, timely payments shows lenders you are trustworthy, which helps improve your credit score.

2. Amounts Owed (30%)

The amount of debt you owe includes both the total amount you owe across various accounts and how much credit you’ve used compared to your available credit limit, also known as the credit utilisation ratio. High utilisation (i.e., using a large portion of your credit) can lower your score.

3. Length of Credit History (15%)

The longer you've had credit accounts, the better, as it provides more insight into your credit behavior. This factor considers the age of your oldest, recent, and the average age of all your accounts.

4. Credit Mix (10%)

Credit mix is the range of credit accounts you hold, including credit cards, mortgages, and installment loans. A healthy mix shows that you can manage different types of credit. However, you don't need to have every type of account to boost your score; responsibly managing the types of credit you already have is enough. A balanced mix can improve your score, especially if you use each type wisely.

5. New Credit (10%)

New credit inquiries and account openings impact 10% of your credit score. When you apply for credit, the lender makes an inquiry into your credit report, which can slightly lower your score temporarily. Opening several accounts in a short period can signal to lenders that you're a higher-risk borrower. Therefore, it's important to be mindful of how often you apply for new credit and try to space out your applications.

Even with the best strategies and solid understanding of credit factors, many well-intentioned individuals sabotage their progress through preventable errors. Let’s understand the pitfalls early on to save you time, money, and frustration.

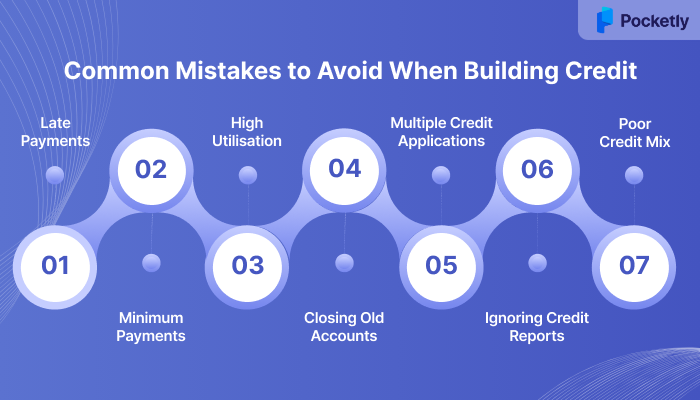

Common Mistakes to Avoid When Building Credit

Building credit is a crucial financial milestone, but people unknowingly make mistakes that damage their credit scores and hinder their financial progress. Understanding these common pitfalls is essential for establishing and maintaining healthy creditworthiness.

Here are the most critical mistakes to avoid when building credit:

1. Missing or Late Payments: Missing or late payments can have a major impact on your credit score. To avoid this, set up automatic reminders to ensure payments are made on time.

2. Paying Only the Minimum Amount Due: Paying only the minimum due can result in high interest and prolonged debt. It’s best to pay off your balance in full or, if not possible, pay more than the minimum to reduce interest costs.

3. High Credit Utilisation: Using more than 30% of your available credit negatively affects your score. To improve, aim to keep your credit utilisation below 30% and spread balances across multiple cards.

4. Closing Old Credit Accounts Prematurely: Closing old credit accounts can shorten your credit history and increase your utilisation ratio. Keep old accounts open, even if inactive, to maintain a strong credit history.

5. Applying for Multiple Credit Products Simultaneously: Frequent credit inquiries during a short period can reduce your credit score. Space out applications and use pre-qualification tools to assess approval chances before applying.

6. Neglecting Credit Report Reviews: Errors on your credit report can harm your score. Regularly check your credit reports from all bureaus and dispute any mistakes promptly.

7. Poor Credit Mix and Diversification: Having only one type of credit limits your score’s potential. Gradually diversify your credit accounts to improve your credit mix and overall score.

For young adults in India looking to establish their financial foundation, access to appropriate lending products can make all the difference. The right platform can provide both the tools and support needed to build credit responsibly.

Pocketly: Empowering India's Youth with Instant Credit Solutions

Pocketly is a digital-first lending platform designed to provide quick and accessible financial assistance to young adults in India. Whether you're a student, a salaried professional, or a self-employed individual, Pocketly offers tailored loan options to meet your immediate financial needs.

- Instant Loan Disbursement: Apply for loans ranging from ₹500 to ₹25,000 and receive funds directly into your bank account within minutes.

- Minimal Documentation: Simplified application process requiring only basic documents like Aadhaar and PAN cards.

- Flexible Loan Amounts and Repayment Terms: Choose loan amounts and repayment tenures that suit your financial situation, with options ranging from 7 days to 180 days.

- No Collateral Required: Access unsecured personal loans without the need to pledge any assets.

- 24/7 Customer Support: Receive assistance anytime through Pocketly's dedicated online support team.

- Credit Building Opportunities: Timely repayments can help in building a positive credit history, enhancing your credit profile for future financial needs

Conclusion

Building credit without relying on a credit card can offer long-term financial benefits. By using alternative methods like credit-builder loans, becoming an authorised user, or reporting rent and utility payments, you can establish a strong credit history without the risks of high-interest credit card debt.

This approach builds a good credit score and opens doors to greater financial flexibility in the future. Ultimately, managing credit responsibly without a credit card supports better financial health and peace of mind.

Pocketly provides an easy way for small business owners to handle short-term financial needs with fast approval and flexible repayment options. Download Pocketly today on Android or iOS.

FAQs

1 Can I fix my credit in 1 month?

Improving your credit score within a month is challenging but possible, especially if you address issues like late payments or high credit utilisation promptly. While significant changes may take longer, taking immediate action can set you on the right path toward better credit health.

2 How do I delete my bad credit history?

You cannot entirely erase negative items from your credit report unless they are inaccurate or outdated. If you find errors, dispute them with the credit bureaus. For accurate negative entries, focus on rebuilding credit by making payments on time.

3 What is the highest credit score?

The highest possible credit score is 850, according to FICO and VantageScore models. Achieving this requires a long history of on-time payments, low credit utilisation, and a diverse mix of credit accounts.

4 What is the most powerful credit card in the world?

The Centurion® Card from American Express, often referred to as the "Black Card," is considered one of the most exclusive and powerful credit cards globally. It offers extensive benefits, including concierge services and access to luxury travel perks, but it requires an invitation and a significant annual fee.

5 What is a black card limit?

A "black card," such as the American Express Centurion® Card, has no preset spending limit, allowing for flexible purchasing power. However, this doesn't mean unlimited spending; the amount you can charge depends on factors like your spending habits and payment history.