Money between friends or family often moves without paperwork. A quick ₹5,000 for a laptop repair, ₹10,000 to relocate, or ₹15,000 for an emergency; these are everyday realities.

But what happens when someone forgets the amount or the date it’s due?

Without a written record, even small loans can turn uncomfortable. Promises are forgotten, timelines blur, and relationships feel the strain. The higher the amount, the bigger the risk of confusion or miscommunication.

In such moments, promissory notes for personal loans offer a structured fix. It’s a simple way to put everything in writing, so no one forgets what was promised or when.

If you’ve ever lent or borrowed money without clarity, this guide shows a smarter way to keep it secure and simple.

Key Takeaways

- A promissory note for personal loans is a legal document that secures informal lending.

- It should clearly mention the loan amount, interest rate, due date, and repayment terms.

- They offer legal backing and flexibility, though not ideal for high-risk or instant borrowing.

- Writing one involves setting terms, drafting the note, and signing it with clear agreement.

- Repayment can be flexible, through instalments, lump sum, or on demand, as pre-decided.

What Are Promissory Notes For Personal Loans?

A promissory note for a personal loan is a legal agreement between two parties: borrower and lender. It’s a signed commitment to repay a specific loan amount within a defined timeline, typically with agreed-upon interest.

You can think of it as a formal "IOU" (I Owe You) that outlines the loan terms, interest rate, due date, and any applicable conditions. Once both parties sign, the document becomes legally binding under Indian law, offering clarity and accountability for both sides.

Promissory notes are most commonly used for personal loans taken from friends, family, or lenders outside the traditional banking system. Many fintech lending platforms use these to provide digital loans quickly and efficiently.

What Are The Types Of Promissory Notes?

Not all promissory notes are the same. Their structure and level of risk depend on the type of agreement you make. Here are some common types of promissory notes for personal loan purposes:

- Secured Promissory Note

- This note uses collateral, like a vehicle or jewellery, as security. If the borrower defaults, the lender can claim the asset to recover the loan amount.

- Unsecured Promissory Note

- No collateral is involved here. The lender relies on the borrower's credibility, which often means higher interest rates to compensate for the risk of non-repayment.

- Demand Promissory Note

- There’s no fixed repayment date. The borrower must repay whenever the lender requests, offering flexibility but also unpredictability in terms of repayment timing.

- Instalment Promissory Note

- The borrower agrees to repay the loan through regular instalments. This type is common in personal loans due to its predictable and manageable repayment structure.

- Joint and Several Promissory Note

- More than one person signs the note, and each is fully liable. If one party defaults, the lender can recover the full amount from any co-signer.

- Convertible Promissory Note

- Primarily used in business finance, this note can convert into equity under specific conditions. This allows the lender to become a shareholder instead of seeking repayment.

Each type brings different levels of flexibility, risk, and enforcement. But how exactly do these work in real borrowing situations? Let’s break it down.

How Does A Promissory Note Work In India?

In India, once a promissory note is signed, it becomes legally enforceable. You, as the borrower, are bound to repay the agreed amount within the specified timeframe. The lender can take legal action if you default, especially if the note includes default terms or is backed by collateral.

For instance, let’s say you borrow ₹30,000 from a friend to fund an online course. You both agree on a 5% interest rate, to be repaid in 3 months. You record all terms: amount, interest, repayment schedule, and signatures, on a promissory note. If you default, your lender can either renegotiate or take legal steps to recover the dues.

To be more effective, a promissory note must contain a few important features. Read about them below.

What Are The Features Of A Promissory Note?

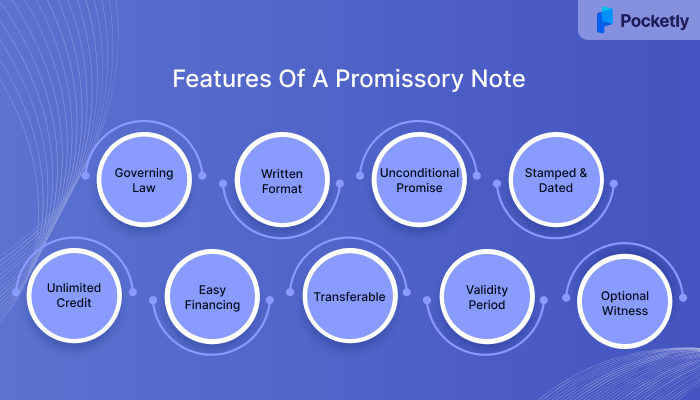

Here are some key features of promissory notes for personal loan use in India:

- Governing Law: It must comply with Section 4 of the Negotiable Instruments Act, 1881.

- Written Format: You can create it by hand or digitally. There’s no legal requirement to print it.

- Unconditional Promise: The note should clearly promise to pay without any “if” or “but”.

- Stamped and Dated: It must carry a valid stamp and be dated to confirm when it was issued.

- No Maximum Loan Limit: There’s no upper limit on the amount that can be mentioned.

- Personal Loan Friendly: This document is often used for short-term personal loans, especially among individuals or small lenders.

- Transferable: Unless restricted, the note can be endorsed and passed on to another party.

- Validity Period: It remains legally valid for three years from the date of signing.

- Optional Witness: A witness signature adds credibility but isn’t mandatory.

These features offer legal backing and mutual confidence between the borrower and lender. But before you consider writing or signing one, it's essential to know what details make a promissory note legally valid and enforceable.

What Is Included In A Promissory Note?

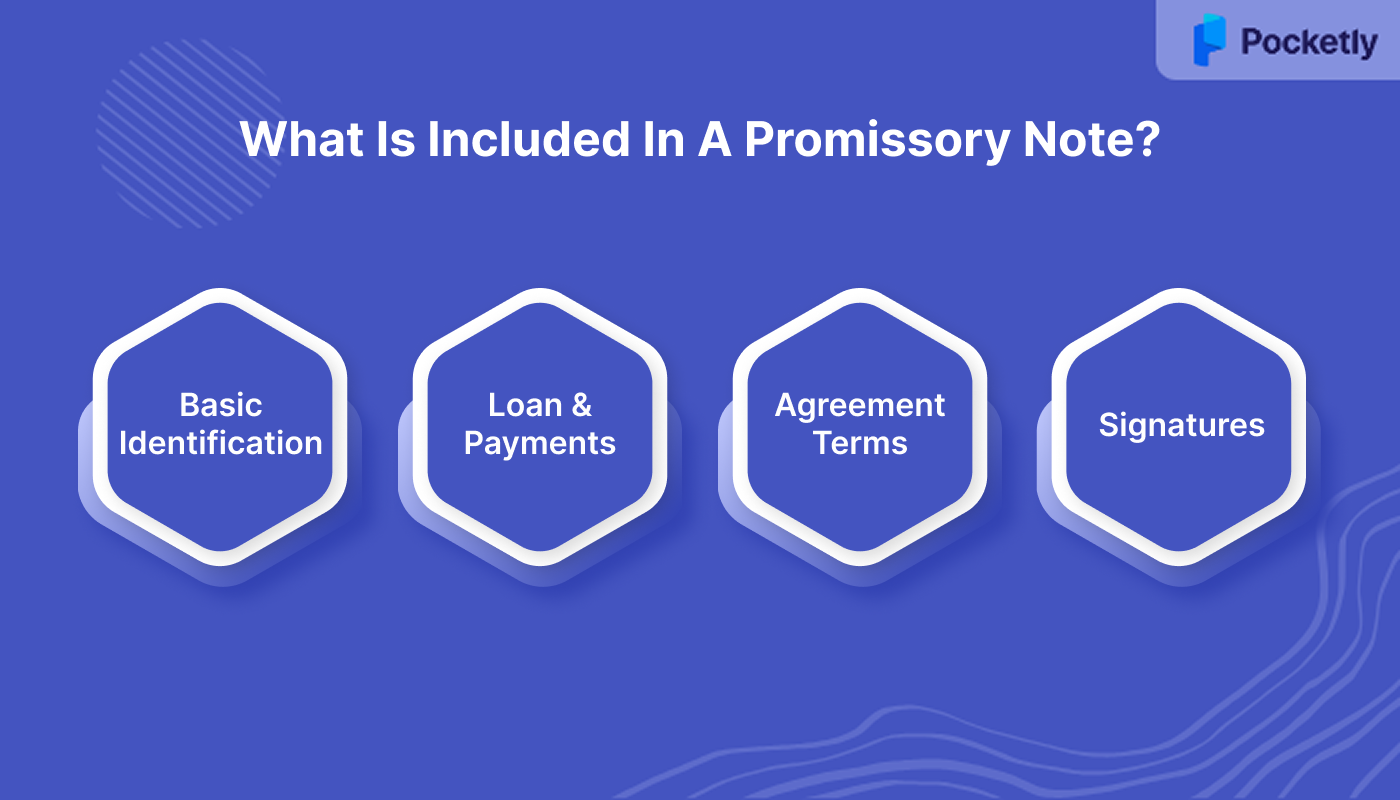

Every good promissory note must include the right details to hold up in legal or personal disputes. If you're writing or reviewing one, here’s what to look for:

Basic Identification

Every promissory note must begin with basic details such as the names and contact addresses of both borrower and lender. These help identify the parties involved and create a clear point of reference for any legal correspondence.

Loan and Payments

Next, it must include the exact loan amount, interest rate (if any), and the final repayment amount. You should also mention the full repayment schedule, whether monthly, quarterly, or lump sum. If collateral is involved, describe the asset being pledged.

Agreement Terms

Clearly outline the terms of the agreement, such as due dates, payment methods (bank transfer, cheque, UPI), and what happens in case of delayed payments or defaults. Mention late fees or penalties, any prepayment options, and whether the note is transferable.

Signatures

Finally, the note must be signed by both parties to make it valid. Although not compulsory, having a witness sign adds an extra layer of security. Also, mention the date and place of issuance, and stamp the document as per legal requirements.

Now that you know what goes into one, let’s weigh whether a promissory note is the right choice.

What Are The Pros & Cons Of A Promissory Note?

Promissory notes for personal loans offer a range of benefits. However, they also come with their own set of challenges. It’s important to consider both factors before entering into such an agreement.

| Advantages ✅ | Disadvantages 🚫 |

| Legally binding and enforceable document | Legal recovery can be time-consuming and expensive |

| Custom terms for interest, repayment, and due dates | May carry high interest due to lack of collateral |

| Simple, low-cost, and easy to draft | Less suited for large or complex transactions |

| Transferable to other parties | Risk of borrower default in unsecured agreements |

| Builds trust and keeps terms transparent | Valid for only 3 years from the date of execution |

This will help you decide whether a promissory note suits your needs. And once you’re clear, the next step is knowing how to write one the right way.

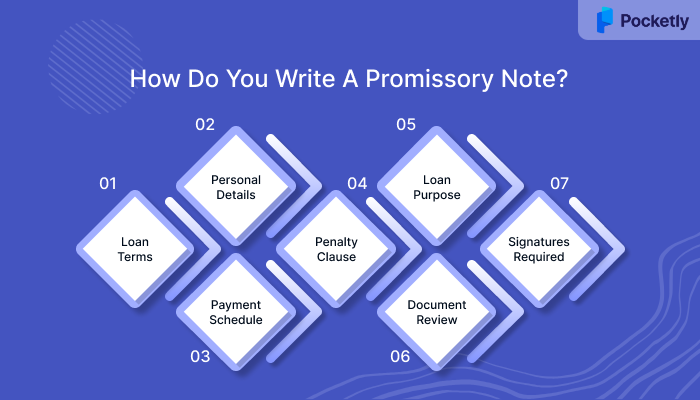

How Do You Write A Promissory Note?

Step 1: Decide the loan amount and terms

Start by agreeing on the loan amount, interest rate (if any), and the repayment timeline. Decide if it will be a one-time repayment or in EMIs.

Discuss whether the repayment includes monthly or yearly interest. Fixing a realistic schedule reduces confusion later and avoids delayed payments.

Step 2: Include personal details

Mention the names, addresses, and contact numbers of both the lender and the borrower. This creates a clear record of who is involved in the agreement.

Double-check these details, especially the contact information, as they may be required if legal issues arise in the future.

Step 3: Specify due date and payment terms

Clearly write the date by which the full amount must be repaid. If repaid in parts, mention the instalment dates and amounts.

The schedule should also explain if the note is repayable on a fixed date or "on demand" (whenever the lender asks).

Step 4: Add a penalty clause

Mention penalties or interest for late payments. This acts as a deterrent for delays and safeguards the lender’s interests.

Late fee terms should be easy to understand and in line with what both parties agree to upfront.

Step 5: State the loan purpose (optional)

If required, include why the loan is being taken. This is optional but adds clarity, especially for business or educational loans.

Lenders may prefer this as it shows intention, which helps in evaluating risk before issuing the loan.

Step 6: Prepare and review the document

Use a clean promissory note format. Make sure all the points are included and clearly worded without legal jargon.

You can use online templates, but review them carefully to match your agreement specifics.

Step 7: Obtain signatures

Finally, both parties must sign the note. The borrower's signature comes first, followed by the lender’s.

Adding a witness signature isn’t mandatory, but it is advisable for added legal strength.

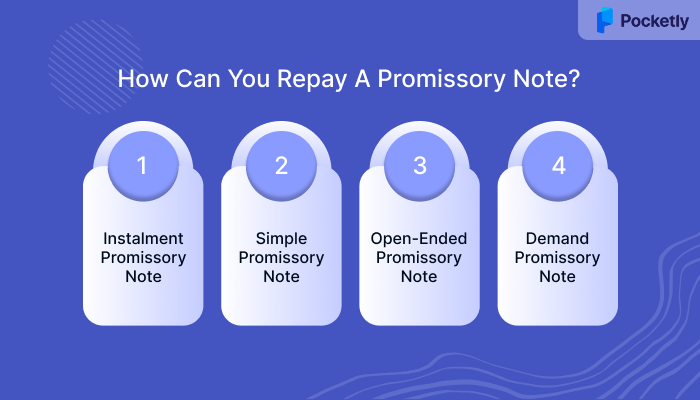

How Can You Repay A Promissory Note?

Once you’ve signed a promissory note for a personal loan, repayment becomes your legal responsibility. The structure of repayment depends on the loan terms you and the lender agree upon.

In most cases, you repay both the principal and interest in either a lump sum or instalments. Here are some common repayment formats:

- Instalment Promissory Note:

- You repay the loan through fixed instalments over a defined period. Each instalment includes a portion of the principal and applicable interest.

- Simple Promissory Note:

- Ideal for smaller loans, this format requires a one-time lump sum payment on a specific date, covering both principal and interest.

- Open-Ended Promissory Note:

- This option allows multiple withdrawals within a credit limit. Repayment includes the borrowed sum and interest, due by a final maturity date.

- Demand Promissory Note:

- Repayment is required whenever the lender requests it. There's no fixed schedule, so you're expected to pay in full once the demand is made.

Why Pocketly Works Better Than Traditional Promissory Notes

Writing promissory notes for personal loans works well when there’s trust, time, and mutual understanding between both parties. But what if you need urgent money? Or what if you don’t have someone willing to lend? And, let’s be honest, nobody wants to hand over property documents or other valuables as collateral.

That’s where Pocketly makes more sense, offering a faster, safer option for short-term borrowing.

Pocketly is a digital lending platform offering personal loans from ₹1,000 to ₹25,000. It’s ideal for students, salaried professionals, and self-employed individuals facing sudden expenses like rent, medical bills, or travel costs.

What makes Pocketly different from traditional loans is how simple and secure the process is:

- No Collateral Needed: You don’t need to submit any gold, papers, or valuables. Pocketly keeps things simple and secure.

- Quick Digital KYC: Just upload your details. No physical paperwork is needed to verify your identity.

- Loan Amounts That Fit You: Borrow exactly what you need, from ₹1,000 to ₹25,000, so you’re never stuck over-borrowing.

- Instant Approval and Payout: Once approved, the loan is disbursed directly to your bank account, with no delays or extra steps.

- Transparent Terms: Interest starts at 2% monthly with 1-8% processing fees. Therefore, no hidden charges at any point.

How to Apply for a Pocketly Loan?

1. Download the Pocketly app (available on Android and iOS).

2. Complete digital KYC where no physical documents are required.

3. Choose a loan amount and submit your request.

4. Get approval and funds directly into your account.

Note: Pocketly is not an NBFC. It works with registered NBFC partners to offer instant, short-term loans for personal needs.

Conclusion

Promissory notes for personal loans may not be everyday conversation, but they hold real weight in casual and formal lending alike. Whether you're borrowing from a friend or lending to a colleague, these notes create clarity, protect trust, and offer legal backing.

That said, not every borrowing situation allows time to draft a detailed agreement. Emergencies rarely wait. And, when those situations arise, remember that Pocketly offers quick, collateral-free loans with instant approvals, so you're never left stranded.

Download Pocketly on Android or iOS to skip the paperwork and manage short-term borrowing with clarity and confidence.

FAQ’s

1. Is a promissory note valid in court?

Yes, a promissory note is legally enforceable in court, provided it includes all necessary details like amount, repayment terms, and signatures. It acts as formal proof of a loan agreement between two parties under Indian contract law.

2. What is an example of a promissory note?

A common example of a promissory note is when someone borrows ₹20,000 from a friend. They write and sign a note promising repayment with, let’s say 8% interest in six months. This note includes terms of repayment, interest rate, and both parties’ signatures.

3. Which is better, a loan agreement or a promissory note?

It depends on the nature of the loan. Promissory notes are ideal for small, informal, and unsecured borrowing. Loan agreements are better suited for higher-value or complex loans that may involve multiple clauses and structured terms.

4. Is a promissory note risky?

Yes, especially if it's unsecured. For lenders, there’s a risk of default without any collateral. For borrowers, unclear terms or high-interest clauses can lead to disputes or legal complications if not properly reviewed before signing.

5. What happens if we break a promissory note?

Breaking a promissory note, by missing payments or violating terms, can lead to legal action from the lender. It may also affect your creditworthiness, increase financial penalties, and complicate future borrowing or personal relationships.