Spend management optimisation sounds like a term reserved for big firms, but many organisations bleed money simply because they don’t track or control their spending effectively.

Could a structured, transparent system help reduce wasted spend, without hurting flexibility or growth? Yes. Firms that treat spend management as a core process often cut costs and reduce financial waste. For example, companies that apply solid spend‑management practices can reduce overall costs by 5–15 %.

Good spend management means combining data, discipline and smart supplier‑handling so every rupee spent delivers value. This blog will lay out what spend management optimisation looks like in practice, highlight common pitfalls, and show how you can track progress and savings over time.

Key Takeaways

- Cut costs by 5-15%: Optimising spend management reduces waste and improves financial control.

- Centralised spend data provides real-time visibility, enabling smarter decisions and better cash flow.

- Automation saves time: Streamlined approval and expense processes free up teams to focus on growth.

- Predictive analytics improves budget accuracy by forecasting future expenses and identifying potential issues early.

- Regular audits and supplier reviews lead to smarter contracts and significant cost savings.

- AI and automation will further shape spend management in 2026, enhancing forecasting accuracy and streamlining procurement with better predictive insights.

What is Spend Management Optimisation and Why It Matters

Spend management optimisation refers to the way a business tracks, analyses, and controls all its spending beyond just salaries. This includes procurement, vendor payments, subscriptions, travel expenses, software licences, and any outflows tied to running the organisation.

The goal is more than just cutting costs. A good spend‑management approach aims to:

- Gain visibility over where money goes

- Prevent duplicate spending or overspending

- Standardise procurement and expense practices

- Use data to guide financial planning

When a business manages spending this way, it can see direct benefits. For example, one vendor‑management tool provider reports that nearly half of companies (43%) say “lack of visibility into spend” is one of their top pain points.

Also Read: Expense Management: A Simple Guide for Young Indians (and How to Do It Right)

Now that we understand the importance, let’s discuss how businesses can implement effective spend management strategies.

How Businesses Can Actually Implement Spend Management Optimisation

If spend management sounds useful, putting it in place requires certain concrete steps. Below is a practical way to approach it, with real tools and examples.

The process begins by understanding all spending and building a system for control and visibility.

Set Up From the Ground Up

- List all spending categories. Begin by categorising both direct and indirect expenses, such as procurement, subscriptions, software licences, vendor payments, travel, and operational costs.

- Use a centralised system. Instead of relying on disconnected spreadsheets, consolidate all spend data, orders, invoices, and reimbursements into a single system. Business spend management (BSM) platforms like NetSuite or GetPluto allow you to centralise and streamline this process.

- Clean and categorise the data. Before analysing, remove duplicates, standardise vendor names, and group similar expenses. This will ensure accurate tracking and analysis moving forward. Tools like Tipalti can help automate this process.

Analyse Spend and Spot Inefficiencies

Once the data is clean and organised, it’s time to uncover opportunities for optimisation:

- Identify unused subscriptions or licences. In SaaS-heavy businesses, wasted software licences can drain budgets. For example, research shows that over half of software licences often go unused, leading to thousands of dollars in wasted spend per employee.

- Spot redundant suppliers or vendors. If multiple teams are purchasing similar items independently, consolidating vendors can cut costs and reduce complexity.

- Review small recurring expenses. These can add up significantly over time. Look for opportunities to buy in bulk or consolidate purchases to secure better discounts.

Set Policies, Automate Workflows, and Train Teams

Effective implementation also requires clear guidelines and automation:

- Define procurement and spend policies. Set clear approval workflows and vendor criteria. Ensure employees understand who can approve purchases and what needs higher scrutiny. Platforms like SAP Taulia can help enforce these policies.

- Automate workflows. Use software tools to automate approval processes, invoicing, and contract renewals. This reduces manual errors, speeds up procurement cycles, and ensures compliance. Solutions like NetSuite and OmniCard provide comprehensive automation.

- Train your teams. Ensure employees across finance, procurement, and operations know how to submit expenses, follow approval flows, and adhere to vendor guidelines. This promotes consistency and accountability across departments.

Example of success: reducing tech costs

Take a company that used a spend‑management tool to audit its SaaS stack. Once it reviewed licences and usage, it found many tools were underused or overlapping. The company cut nearly 40% of its SaaS costs without harming operations.

Another firm shortened its procurement cycle by a factor of three and cut its SaaS-related expenses by 30% after shifting to a spend‑management platform.

Ready to take control of your financial future? With Pocketly, you can access fast, hassle-free loans tailored to your needs. Whether you're a student, a salaried professional, or a self-employed individual, Pocketly offers flexible loan amounts starting from ₹1,000, with quick disbursement directly to your bank account.

Also Read: Expense Tracking Categories for Budgeting

Despite its benefits, businesses face several common obstacles to optimizing spend management. Let’s take a closer look at these challenges and how to overcome them.

What Are the Common Challenges and Strategies in Spend Management Optimisation?

Many organisations struggle with basic spend control because their systems and processes make it hard to see what’s really being spent, where, and by whom. These common problems often prevent spend‑management efforts from providing value.

The table below outlines key challenges and what you can do about them.

| Challenge | What Goes Wrong | How to Address It |

| Visibility Gaps / Fragmented Data | Expense data is spread across spreadsheets, emails, and departments; no unified view. | Consolidate all spend data into one system for real-time, complete visibility. |

| Manual, Inconsistent Processes, and Compliance | Manual invoice/expense processing, approvals via email or paper; inconsistent policy enforcement. | Automate workflows, approvals, and data capture; set clear spending rules. |

| Hidden or Uncontrolled Recurring Costs | Small recurring payments or unused subscriptions accumulate unnoticed. | Periodically audit recurring costs; remove redundant subscriptions and consolidate vendors. |

| Poor Forecasting and Lack of Spend Analysis | Scattered or dirty data leads to unreliable financial planning and budgeting. | Clean and categorise spend data, use analytics to monitor trends, and project future spend. |

| Supplier and Contract Mismanagement | Renewals, vendor overlaps, or unfavourable terms go unnoticed without central records. | Maintain a supplier and contract registry, evaluate vendor performance, and renegotiate terms. |

Also Read: Top 10 Spend Analyzer Apps to Manage Your Money Better in 2025

Looking ahead, spend management will continue to evolve. Here’s what businesses can expect in the near future.

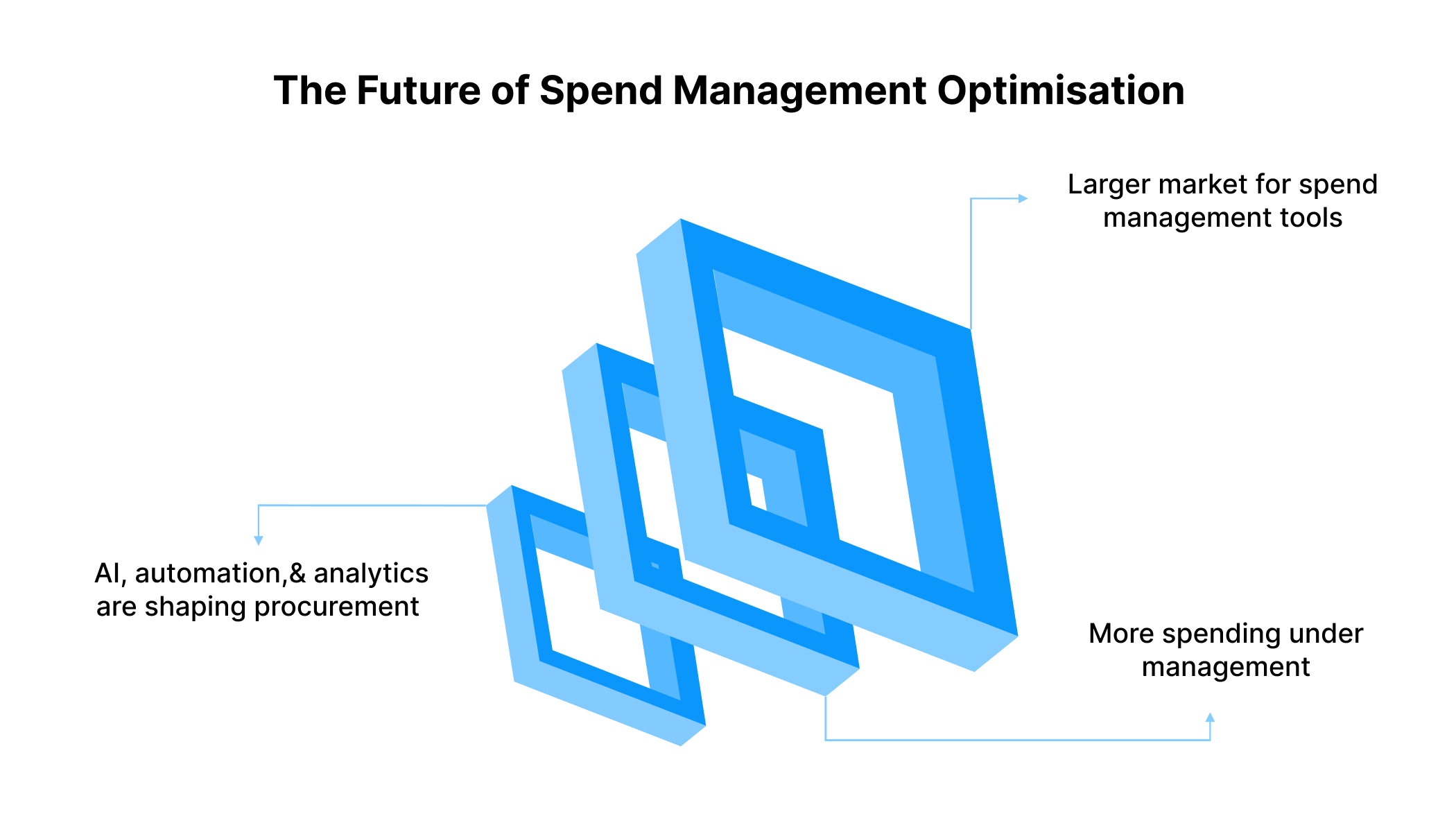

The Future of Spend Management Optimisation

Spend management is changing, driven by technological advancements and evolving business needs. In the coming years, we’ll see a more streamlined, proactive approach to tracking and controlling expenses.

Here’s a structured breakdown of what the future holds.

1. Larger market for spend management tools

- The global market for Business Spend Management (BSM) software was valued at around USD 23.36 billion in 2024 and is projected to nearly double by 2032, reaching around USD 56.30 billion.

- This growth reflects growing demand for tools that streamline procurement, analytics, expense tracking and contract management. As spend management becomes more central to operations, adoption is rising across company sizes.

2. More spending under management and better compliance

- According to a 2025 industry report, organisations that implemented “Source‑to‑Pay” (S2P) or spend‑management platforms saw 46 % of procurement teams bring more spend under management.

- At the same time, 43 % reported improved compliance with contracts and spending policies.

- Procurement teams also noted higher productivity after automating spend processes, which frees up time previously spent on manual tasks.

3. AI, automation, and analytics are shaping procurement functions

- Emerging reports highlight how AI‑driven procurement and spend‑management platforms will shape how companies track and control expenses.

- Advanced analytics and predictive tools are expected to enable smarter forecasting, better spend‑pattern visibility, and early detection of inefficiencies or policy violations.

Also Read: Top 8 Financial Planning Strategies for Salaried Employees

Why Choose Pocketly for Your Financial Needs?

When it comes to managing your finances, especially during times of uncertainty, Pocketly offers a solution designed to fit the unique needs of young Indians. Whether you're a student, a young professional, or a self-employed individual, Pocketly simplifies access to quick, transparent, and flexible loans without the hassle of traditional lending institutions.

What Makes Pocketly Different?

- No Collateral Required: Access loans without collateral, making it easier for more people to qualify.

- Flexible Loan Amounts: Borrow between ₹1,000 and ₹25,000 to meet your personal, educational, or business needs.

- Quick Disbursement: Funds are transferred directly to your bank account after a fast KYC process, ensuring timely access.

- Affordable Interest Rates: Enjoy competitive rates starting at just 2% per month, lower than traditional lenders.

- Minimal Documentation: Apply digitally with no physical paperwork, speeding up the process.

- Easy Repayment Options: Choose flexible EMIs with no penalties for early repayment, giving you control over your finances.

Download the app now for iOS and Android and get access to loans without the hassle, so you can focus on what matters most!

Conclusion

A clear spend‑management system turns scattered invoices, subscriptions, and approvals into organised, actionable data. Companies that centralise spend tracking and analyse expenditure see fewer errors, better budget control, and stronger supplier relationships.

Automation reduces time spent on manual tasks like invoice processing and approvals, allowing teams to focus on strategy rather than paperwork.

Need a smarter way to manage your finances? Pocketly offers flexible, no-collateral loans with quick disbursements and easy repayment options.

FAQs

Q: How does spend management optimisation directly impact profitability?

A: By eliminating inefficiencies, businesses can reduce unnecessary spending, increase cash flow, and ensure that every expense is aligned with their financial strategy, directly impacting the bottom line.

Q: Can spend management tools help in risk management?

A: Yes, spend management platforms can flag irregular spending patterns, identify rogue purchases, and ensure compliance with policies. This proactive approach helps mitigate financial risks and prevent costly mistakes.

Q: How do spend management platforms support vendor consolidation?

A: These platforms allow businesses to track vendor performance, spending trends, and contract terms, making it easier to identify overlapping services. Consolidating vendors can lead to better deals, fewer administrative burdens, and reduced costs.

Q: What role does employee training play in effective spend management?

A: Employee buy-in is essential for success. By training staff on the tools, processes, and spending policies, businesses can ensure compliance, reduce errors, and foster a culture of accountability and cost-consciousness across the organisation.

Q: How do automated spend management tools improve the auditing process?

A: Automated tools provide a comprehensive, real-time overview of all spending, making audits easier and faster. This transparency not only reduces errors but also ensures compliance, enabling businesses to catch issues earlier and improve financial accuracy.