Managing expenses can feel tricky when income is limited, irregular, or just starting to flow in. Between college costs, rent, and social spending, money tends to disappear faster than expected.

Expense management is simply about planning, tracking, and reviewing where your money goes so that you can make every rupee count. It is not about restriction; it is about control and choice.

In this guide, you will learn how to build a simple expense system, manage short-term cash gaps responsibly, and make confident money decisions with a clear plan.

Now that we know what this guide will cover, let us start with what expense management really means.

Key Takeaways

- Expense management is about control, not restriction. When you know where your money goes, you gain the power to plan, save, and make confident choices every month.

- Small habits build big results. Tracking spending weekly, setting limits, and reviewing your budget regularly help you stay on top of your finances without stress.

- Borrow only when it truly matters. Short-term loans can help during real emergencies, as long as you understand the cost, plan repayments, and borrow responsibly.

- Transparency builds trust. Use RBI-compliant platforms like Pocketly that show every fee upfront, follow safe KYC processes, and keep borrowing simple and fair.

What Is Expense Management? (Personal vs Business — In 60 Seconds)

Most people think expense management is a business term. They are partly right. In offices, it refers to tracking company spending, travel, reimbursements, and operational costs. It ensures policies are followed and budgets stay under control.

However, the same logic applies to personal finances. Expense management for individuals means understanding where your money goes each month, setting limits, and planning future expenses. It helps you spend intentionally instead of reacting to money shortages.

Here is a quick comparison that clarifies both versions:

| Aspect | Business Expense Management | Personal Expense Management |

| Purpose | Monitor and control company expenses | Track and plan individual spending |

| Process | Policy-driven approvals and reports | Budgeting, recording, and reviewing |

| Frequency | Monthly or quarterly audits | Daily or weekly tracking |

| Tools | ERP or finance software | Apps, spreadsheets, or notes |

| Benefit | Cost control and compliance | Financial clarity and savings |

For young Indians, personal expense management is not about complexity; it is about awareness. Knowing your spending pattern is the first step to building stability and confidence.

Now that we understand what expense management really means, let us see why it is so valuable for students and young professionals.

Also Read: How to Manage Monthly Expenses Smartly in 2025

Why Expense Management Matters for Students and Young Professionals

Money often feels tight in the early years of work or education. Small incomes, delayed stipends, and unplanned costs make it harder to stay on track. That is where expense management becomes powerful. It turns chaos into control.

Month-end crunch and irregular cash flows

Students and freelancers often face gaps between income and expenses. For example, a college student might receive ₹7,000 at the start of the month but run out before the third week. Tracking spending weekly helps adjust early, avoiding stressful borrowing or missed payments.

From control to opportunity: saving for essentials and goals

Effective expense management allows you to redirect small savings toward meaningful goals. Setting aside even ₹500 a week can build a ₹6,000 fund in three months, enough for books, travel, or emergencies. Planning prevents last-minute panic spending.

How good expense habits support your creditworthiness

Managing expenses well also builds a strong financial record. Paying bills or EMIs on time improves your CIBIL score, which reflects how reliably you handle credit. For young professionals, this score decides future access to bigger loans or credit cards.

When your spending, savings, and borrowing are balanced, money stops being a constant worry. Instead, it becomes a tool that supports your choices.

Now that we know why expense management matters, the next step is learning how to create a simple system that fits your lifestyle.

Also Read: Expense Tracking Categories for Budgeting

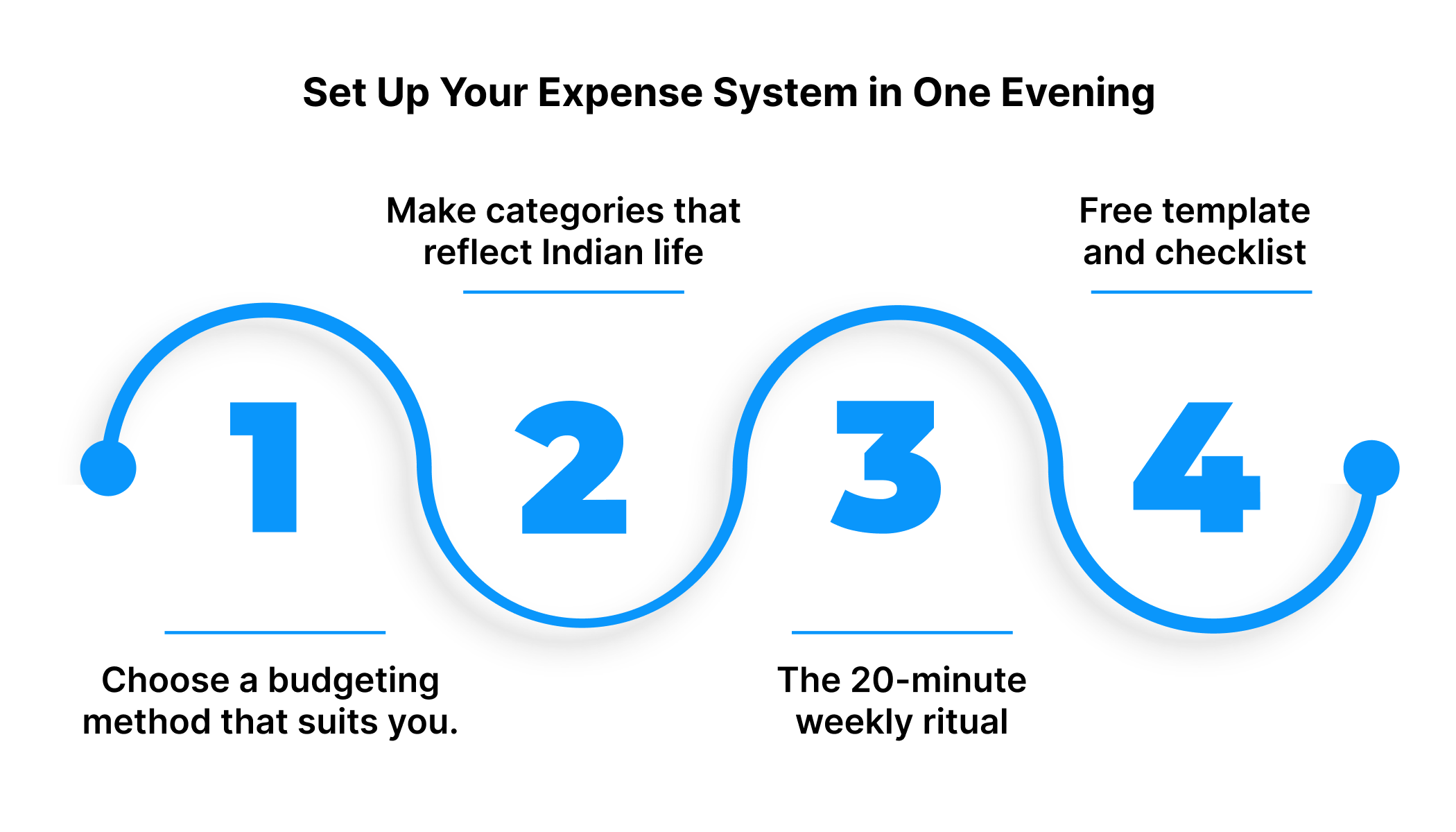

Set Up Your Expense System in One Evening

You do not need complex spreadsheets or a finance degree to start managing your expenses. You only need one evening and a plan that fits your lifestyle.

A good expense system helps you understand your spending patterns and make better choices every week. Here is how to build one step by step.

Pick a budgeting method that works for you

Start with a simple rule like the 50/30/20 model:

- 50% for essentials such as rent, food, and bills

- 30% for personal spending, such as entertainment or travel

- 20% for savings or repayments

If your income fluctuates, try a zero-based budget. In this system, every rupee is assigned a purpose: spend, save, or repay. When income is uncertain, this method gives structure and helps avoid overspending.

Choose the approach that feels natural, not forced. The key is consistency, not perfection.

Make categories that reflect Indian life

Your budget must mirror your actual lifestyle. Common categories include:

| Category | Example Expenses |

| Essentials | Rent, groceries, utilities, travel passes |

| Education | Fees, books, online courses |

| Personal | Streaming, eating out, and shopping |

| Financial | Savings, investments, EMIs |

| Emergencies | Medical, repairs, and unexpected travel |

If you track UPI payments, group similar ones together. For example, all “Swiggy”, “Zomato”, and “Dunzo” payments go under “Personal”. This grouping shows how daily habits impact your budget.

The 20-minute weekly ritual

Once a week, review your expenses. Categorise them, update totals, and note any changes. For example, if you overspent on dining out, reduce that category slightly next week.

This quick review helps you catch problems before they become serious. A small weekly habit saves hours of stress later.

Free template and checklist

Create a simple table in your notebook or spreadsheet with three columns: Date, Category, and Amount.

Add a “Notes” column to record why a payment was made.

Keep a checklist for weekly reviews:

- Update entries

- Adjust next week’s limits

- Check pending payments

- Mark savings or repayments

Now that your system is ready, let us look at digital tools that make managing expenses faster and easier.

Also Read: Money Management Tips for College Students 2025

Tools That Make Expense Management Easy (Without Switching Banks)

Once you understand your spending pattern, technology can help automate tracking and analysis. You do not need to change your bank; just pick a tool that simplifies your routine.

Must-have features for any expense tracker

Before choosing an app or tool, ensure it has these functions:

- Automatic bank SMS or UPI tracking to capture every transaction

- Receipt scanning for quick entry of offline purchases

- Split bills option for shared costs such as rent or trips

- Data backup for security and syncing across devices

These features save time and reduce manual effort, letting you focus on financial decisions instead of data entry.

Spreadsheet vs app: which one suits you better?

If you prefer full control, a spreadsheet (Excel or Google Sheets) gives flexibility. You can customise formulas, categories, and goals.

If you prefer automation, choose a personal finance app that connects to your bank. Apps automatically sort transactions, create spending summaries, and alert you to overspending.

For students or first-jobbers, apps are often easier to maintain. For entrepreneurs or freelancers, spreadsheets offer deeper visibility and adaptability.

Alerts that actually help

Enable reminders for bill payments, low balances, or overspending in a category. For example, getting an alert when you cross your monthly “Food” limit prevents surprise shortages later.

The right alerts do not just warn you; they teach you about your habits. Once you start noticing patterns, you will find small ways to improve your spending behaviour.

If you ever face a genuine short-term cash gap, Pocketly can help you avoid costlier borrowing. It offers small, transparent loans (₹1,000–₹25,000) to stabilise your expenses when it matters most.

Now that your tools are in place, it is time to understand when borrowing may make sense and when it should be avoided.

Also Read: 6 Simple Budgeting Tips for Better Money Management

How to Manage Expenses with Short-Term Loans

Even with a solid budget, unexpected expenses can appear. An exam fee, medical bill, or travel emergency may arise before your next paycheck. That is when many people consider short-term credit.

A short-term loan can help, but only if it is used responsibly. Borrowing without planning can lead to unnecessary stress. Here is how to make smart choices.

Good use-cases for short-term borrowing

Short-term loans work best for genuine timing gaps, not lifestyle upgrades. Examples include:

- Paying an exam fee before your stipend arrives

- Covering medical expenses for minor emergencies

- Handling urgent travel when family support is delayed

- Managing essential repairs for study or work tools

In these cases, borrowing helps you stay steady without disrupting long-term plans. The key is to borrow with a repayment plan in mind.

Red flags: when to pause before applying

Avoid taking loans to fund non-essentials such as entertainment, gadgets, or repeated lifestyle spends. If you find yourself borrowing every month, that signals a deeper budgeting issue.

Recurring short-term borrowing can create dependency. Instead, revisit your expense system to adjust categories and reduce leaks.

How to assess cost: understanding APR and KFS

Before accepting any loan, check two key details:

- APR (Annual Percentage Rate): the total yearly cost, including interest and fees.

- KFS (Key Fact Statement): a document showing your exact repayment amount, tenure, and fees.

For example, if you borrow ₹5,000 at 2% interest per month for 3 months, your total interest is ₹300.

If the processing fee is 5%, that is ₹250.

You repay ₹5,550 in total.

This small calculation helps you understand the actual cost before saying yes.

Map repayment into your expense plan

A short-term loan should fit inside your monthly budget. Before borrowing, mark your future repayment as an “essential” expense.

For instance, if your next salary is ₹20,000 and your EMI is ₹1,800, adjust your entertainment or shopping budgets to accommodate it.

Borrowing can support you temporarily, but repayment discipline protects your future.

Now that you understand when loans make sense, let us explore how to stay safe under India’s digital lending regulations.

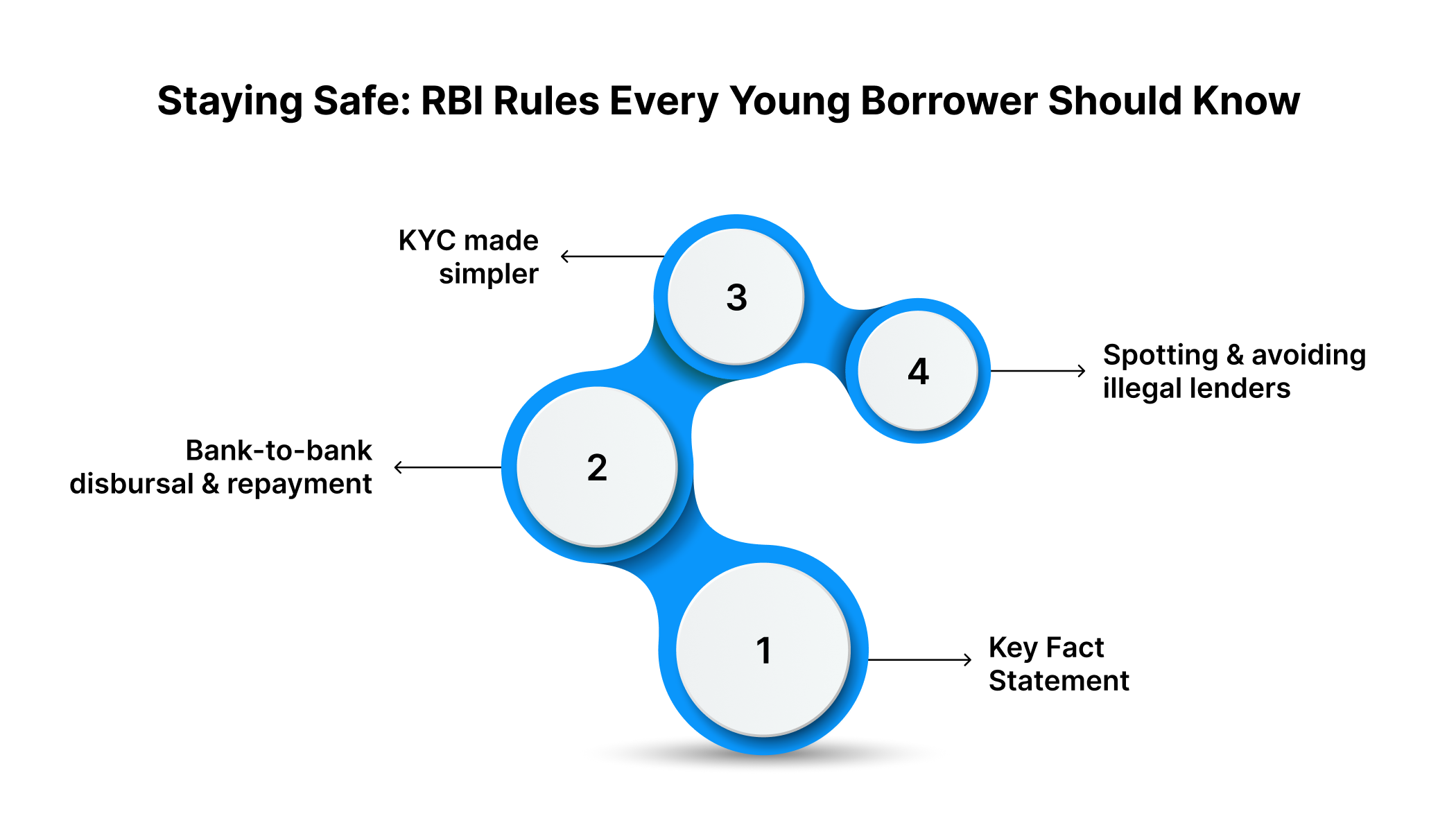

Staying Safe: RBI Rules Every Young Borrower Should Know

India’s financial system now has clear rules for digital lending. These rules protect borrowers from hidden charges and unfair practices. Knowing them helps you borrow safely and confidently.

KFS (Key Fact Statement): what you must read carefully

Every legitimate lender provides a Key Fact Statement (KFS) before you accept a loan.

It lists:

- Loan amount

- Tenure

- Interest rate

- Processing fee

- Total cost (in ₹)

Always read it before confirming your loan. If anything is unclear or missing, ask for clarification.

Bank-to-bank disbursal and repayment

Under RBI Digital Lending Directions, loans and repayments must move directly between bank accounts, not wallets or third-party accounts.

This ensures your money never passes through unknown intermediaries. Always verify that the disbursal comes from a registered NBFC or its authorised partner platform.

KYC made simpler: your digital verification options

Every borrower must complete KYC (Know Your Customer) verification. Today, it can be done through:

- Video KYC: A quick video call for ID confirmation

- OTP-based KYC: Using Aadhaar-linked OTP

- Face-to-face KYC: For those preferring in-person verification

Choose the method that suits your comfort level. Pocketly, for instance, follows RBI-approved KYC routes that take only a few minutes.

Spotting and avoiding illegal lenders

Many unregistered apps promise “instant loans” but do not follow RBI rules. Signs of unsafe platforms include:

- No visible company name or NBFC partner listed

- Requests for unnecessary personal permissions

- Hidden processing charges

- Harassment or threats for repayment

To stay safe:

- Check the app’s registration and NBFC partners.

- Search the lender’s name on the RBI’s official list of authorised entities.

- Avoid sharing sensitive data unless KYC is properly explained.

Borrowing from verified, transparent platforms ensures your data and payments remain protected.

By following these basic rules, you protect both your credit record and peace of mind.

Next, let us compare how expense management, BNPL, and credit cards differ, and how to choose what truly fits your financial style.

Also Read: RBI Guidelines for Personal Loan Lending in India

Expense Management vs BNPL vs Credit Cards: Pick What Fits Your Life

Managing expenses is not just about tracking spending; it is also about choosing the right tools for short-term needs. Many young Indians use BNPL (Buy Now, Pay Later) or credit cards to handle small gaps. However, each tool affects your finances differently.

A clear comparison helps you make smart choices without harming your credit score or peace of mind.

Billing timelines and cash flow

BNPL and credit cards both let you delay payments. While this feels convenient, it can create invisible debt. For example, a ₹3,000 BNPL payment split into three parts may look harmless, but missing one instalment can attract penalties.

Expense management, on the other hand, teaches you to plan these payments in advance. Knowing when your bills are due ensures you have funds ready.

Fees, interest, and compounding

BNPL services often advertise “zero interest,” but they may charge processing fees or penalties for late payments. Credit cards charge monthly interest, which can reach 3–4% if you carry unpaid balances.

Expense management prevents this spiral by keeping you aware of due dates and balances. A short-term loan, if used responsibly and repaid on time, can sometimes cost less than ongoing card interest.

Here is a simple comparison table:

| Feature | Expense Management | BNPL | Credit Card |

| Purpose | Budget and track spends | Delay specific payments | Access revolving credit |

| Fees | None | Hidden or delayed | Annual fees, interest |

| Interest | None | Varies | 3–4% per month if unpaid |

| Credit Score Impact | Builds with discipline | Affects if defaults occur | Builds with timely repayment |

| Control | High | Moderate | Depends on usage habits |

Credit score impact and borrowing discipline

Your credit score reflects how reliably you manage debt. Late or missed payments on BNPL or cards can lower your score. Responsible borrowing, however, can strengthen it.

For instance, taking a ₹5,000 loan, repaying it on time, and maintaining a low utilisation rate improve your CIBIL score. This habit builds eligibility for higher credit later, such as education or personal loans.

Now that you understand how each option affects your finances, let us look at real-life examples showing how young Indians apply expense management effectively.

Also Read: Simple Money Management Tips for Personal Finances

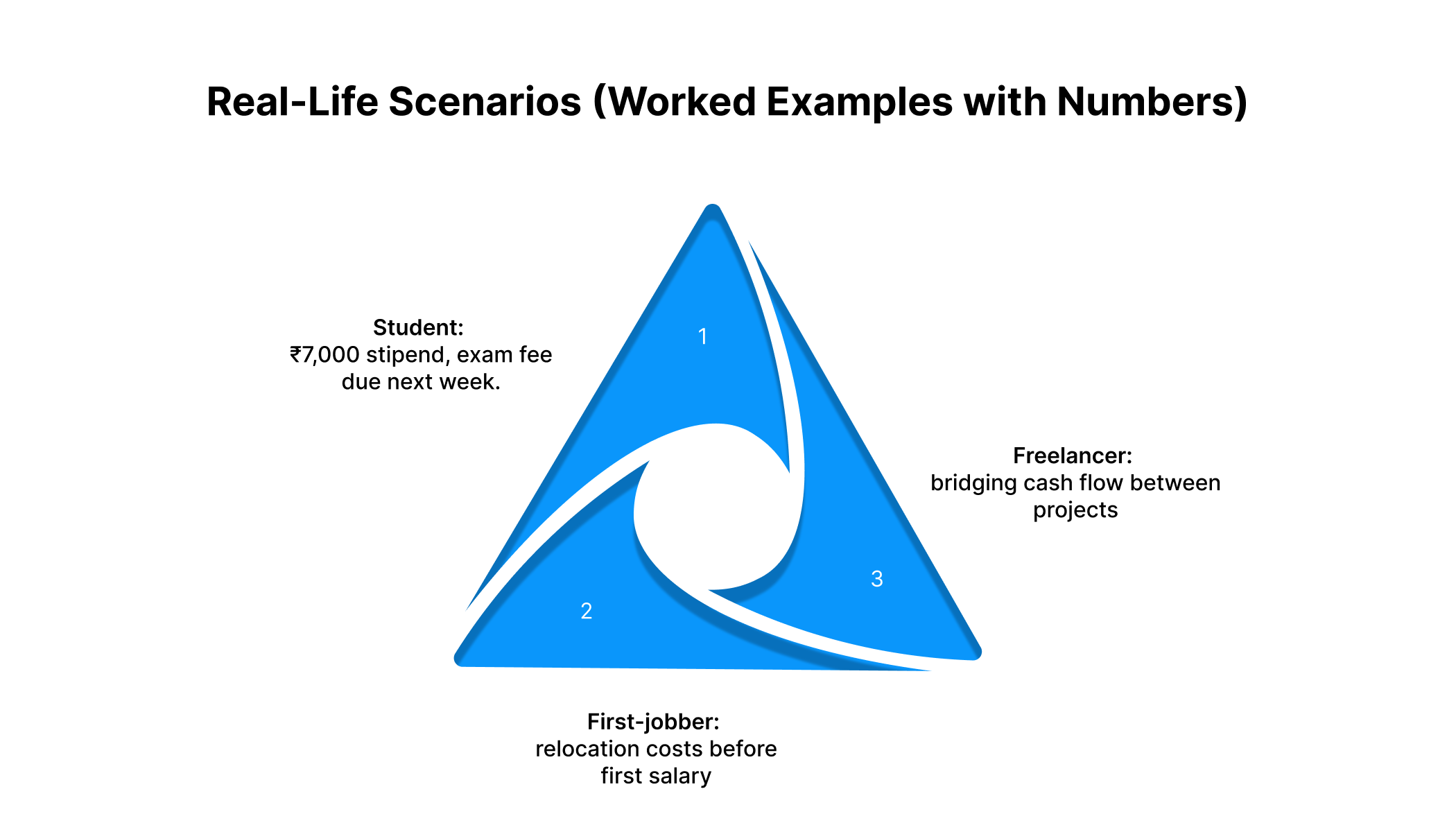

Real-Life Scenarios (Worked Examples with Numbers)

Learning through examples often makes financial concepts easier to understand. Here are three short, realistic situations showing how simple expense management practices can reduce stress and improve control.

1. Student: ₹7,000 monthly stipend and exam fee next week

Riya, a university student, receives ₹7,000 every month. Her exam fee of ₹1,800 is due one week before her next stipend. By tracking weekly spends, she realises that most of her money goes to food delivery and transport.

She cuts her weekly entertainment budget by ₹400 and saves ₹1,200 in three weeks. She covers most of her fee herself and borrows ₹600 using a short-term, low-cost digital loan.

Her repayment plan fits neatly into next month’s budget, keeping her stress-free.

2. First-jobber: relocation costs before first salary

Arjun has joined his first job in Bengaluru. His first salary will arrive after 45 days, but he must pay a ₹10,000 deposit for shared accommodation.

He uses a basic 50/30/20 budget and lists all essentials. A short-term loan of ₹10,000 helps him manage the deposit without asking family for help. He plans repayment in two instalments after his first two paychecks, reducing unnecessary burden.

This decision supports independence while maintaining discipline.

3. Freelancer: bridging cash flow between projects

Maya is a freelance designer. Her income varies every month. Some clients pay early; others delay by weeks.

She tracks both expected income and fixed monthly costs like rent and internet. When two clients delay payment, she uses her savings for half the rent and a small ₹5,000 short-term loan for the balance. She clears it once the invoices are paid.

By maintaining expense records, Maya avoids panic borrowing or missed rent deadlines. Her system ensures every rupee has a plan, even when income is irregular.

Also Read: Budgeting Tips for Freelancers: Manage Your Finances

Each of these examples highlights the same principle: control before credit. Managing expenses gives you the power to decide when borrowing is necessary, not the other way around.

Next, we will discuss the common mistakes that break budgets and simple fixes that keep your plan strong all year.

Common Pitfalls That Break Budgets (and How to Avoid Them)

Even the best budgets fail when habits go unchecked. The good news is that small changes can prevent big financial stress.

1. UPI micro-spends that quietly add up

Quick UPI payments make spending effortless. However, ten small transactions of ₹150 each equal ₹1,500 gone in a few days.

Track these micro-spends weekly. Setting limits for digital wallets or food apps helps control casual spending without cutting enjoyment completely.

2. Sale season and EMI traps

Online sales make spending feel like saving, but discounts often lead to unplanned buys. Avoid turning every deal into debt.

Ask yourself, Would I buy this if it were not on sale? If the answer is no, skip it. EMIs for non-essential items strain cash flow and reduce savings.

3. Social spending without a cap

Gifting, birthdays, and festivals often stretch budgets. Plan by setting aside a small monthly “social fund.” For example, ₹500 saved each month becomes ₹6,000 a year, enough for gifts or celebrations without touching your essentials.

When you control these spending triggers, your budget becomes realistic and sustainable.

Next, let us see how a transparent lending platform like Pocketly can support you when real emergencies arise.

Also Read:

How Pocketly Fits Into a Healthy Expense Plan

Sometimes, even the best planning cannot cover unexpected needs. A sudden medical bill or exam fee can appear before your next paycheck. That is when a responsible short-term solution can help bridge the gap.

Pocketly offers quick personal loans from ₹1,000 to ₹25,000 for such moments. There is no collateral, and the process is entirely digital.

Interest starts at 2% per month, with a processing fee between 1–8%, clearly shown before you proceed. There are no hidden charges.

Simple and fast loan process

- Download the Pocketly app or visit the website.

- Complete quick KYC — no physical documents needed.

- Select your loan amount and confirm your details.

- Receive instant approval and funds directly in your bank account.

Borrow smart, not often.

Pocketly is not a budgeting app or financial tool; it is a digital lending platform working with registered NBFC partners. Use it only for short-term, genuine needs, never for routine spending. Borrow responsibly, repay on time, and your expense management will improve steadily.

When managed wisely, a short-term loan can be part of a balanced financial plan, not a burden.

Conclusion

Expense management is not a restriction; it is control, awareness, and peace of mind. When you plan your spending, you make better choices and feel more confident about your finances.

Expense management is a skill that grows with consistency. Start by tracking your expenses today, and borrow only when necessary, with a full understanding of costs and commitments.

Sometimes, even with perfect planning, emergencies arise. In such cases, Pocketly provides a transparent and simple way to handle short-term financial gaps responsibly.

With loans ranging from ₹1,000 to ₹25,000, a quick digital KYC process, and no hidden charges, it offers support when you need it most.

Download App Now:

FAQs

1. How can I start expense management if I have irregular income?

Begin by listing your fixed expenses, rent, bills, and transport. For variable income, plan using your lowest expected month as the base. Any extra earnings go towards savings or early repayments. This method ensures stability even when income fluctuates.

2. What is the easiest way to track daily expenses?

Use your phone’s notes, a simple spreadsheet, or an expense tracking app that connects with your bank. Update entries daily or weekly. The key is consistency, not the tool you use.

3. How do I stop overspending through UPI and digital payments?

Set weekly limits for online wallets and delivery apps. Regularly review your UPI statement to identify spending patterns. Turning off auto-pay for non-essential subscriptions also helps.

4. How much of my income should go towards savings?

A general rule is the 50/30/20 method, 50% for essentials, 30% for lifestyle, and 20% for savings or debt repayment. If your income is tight, start smaller and build up gradually.

5. How can students manage expenses without cutting fun completely?

Allocate a “personal” category in your budget for leisure spending. Knowing how much you can safely spend lets you enjoy social events without guilt or financial stress.

6. Why do most budgets fail?

Budgets fail when they ignore reality. Overly strict targets cause frustration. Regular reviews, even 10 minutes weekly, keep your plan flexible and sustainable. Adjust categories based on your current priorities.

7. Can expense management improve my financial confidence?

Yes. Tracking and understanding your spending gives you a clear sense of control. It helps you make informed decisions, avoid impulsive borrowing, and plan better for future goals.