As a freelancer, managing your finances can feel like juggling multiple balls in the air. You’re not only focused on delivering projects but also handling marketing, client outreach, and the unpredictable nature of your income. With no steady paycheck, it becomes a challenge to manage monthly expenses, save for the future, and plan for lean periods.

That’s where effective budgeting comes in. It's not just about tracking day-to-day expenses, but about creating a plan that helps you thrive, even when your income fluctuates.

In this blog, we’ll dive into essential budgeting tips for freelancers that will help you take control of your finances, make the most of your changing income, and achieve long-term financial stability.

Key Takeaways

- The Importance of Budgeting for Freelancers: Budgeting helps freelancers manage income fluctuations, plan for taxes, set goals, and promote savings, ensuring financial stability.

- Creating a Financial Safety Net: Building an emergency fund for 3-6 months of living expenses and diversifying income sources is crucial for handling lean months and unexpected costs.

- Practical Budgeting Tips: Using methods like the 50/30/20 rule, regularly tracking income and expenses, and separating business and personal finances help freelancers stay organised.

- Managing Taxes and Legal Responsibilities: Freelancers must set aside money for taxes, maintain records, and use contracts to avoid legal and tax issues while protecting their business.

- Investing in Financial Tools and Resources: Utilising accounting software, invoicing platforms, and time-tracking apps can streamline operations, save time, and keep finances in check.

What is the Importance of Budgeting for a Freelancer?

- Manage Income Fluctuations: Budgeting helps freelancers manage inconsistent income by setting aside funds during high-earning months to cover lean periods.

- Ensures Financial Stability: Proper budgeting allows freelancers to cover essential expenses (rent, utilities, business costs) and maintain financial stability despite income variability.

- Prevents Overspending: It keeps freelancers aware of their cash flow, so that they don’t overspend and are prepared for any unexpected expenses.

- Facilitates Goal Setting: Budgeting helps freelancers set both short-term and long-term financial goals, such as saving for retirement, investments, or business expansion.

- Improves Financial Decision-Making: With a clear budget, freelancers can make decisions on business expenses, project pricing, and savings without relying on guesswork.

- Promotes Saving and Investing: Freelancers who do budgeting set aside a portion of their earnings for savings or investments, securing their future and helping build wealth.

- Helps with Tax Planning: Budgeting allows freelancers to account for taxes throughout the year, avoiding surprises at tax time, and set aside enough funds for tax payments.

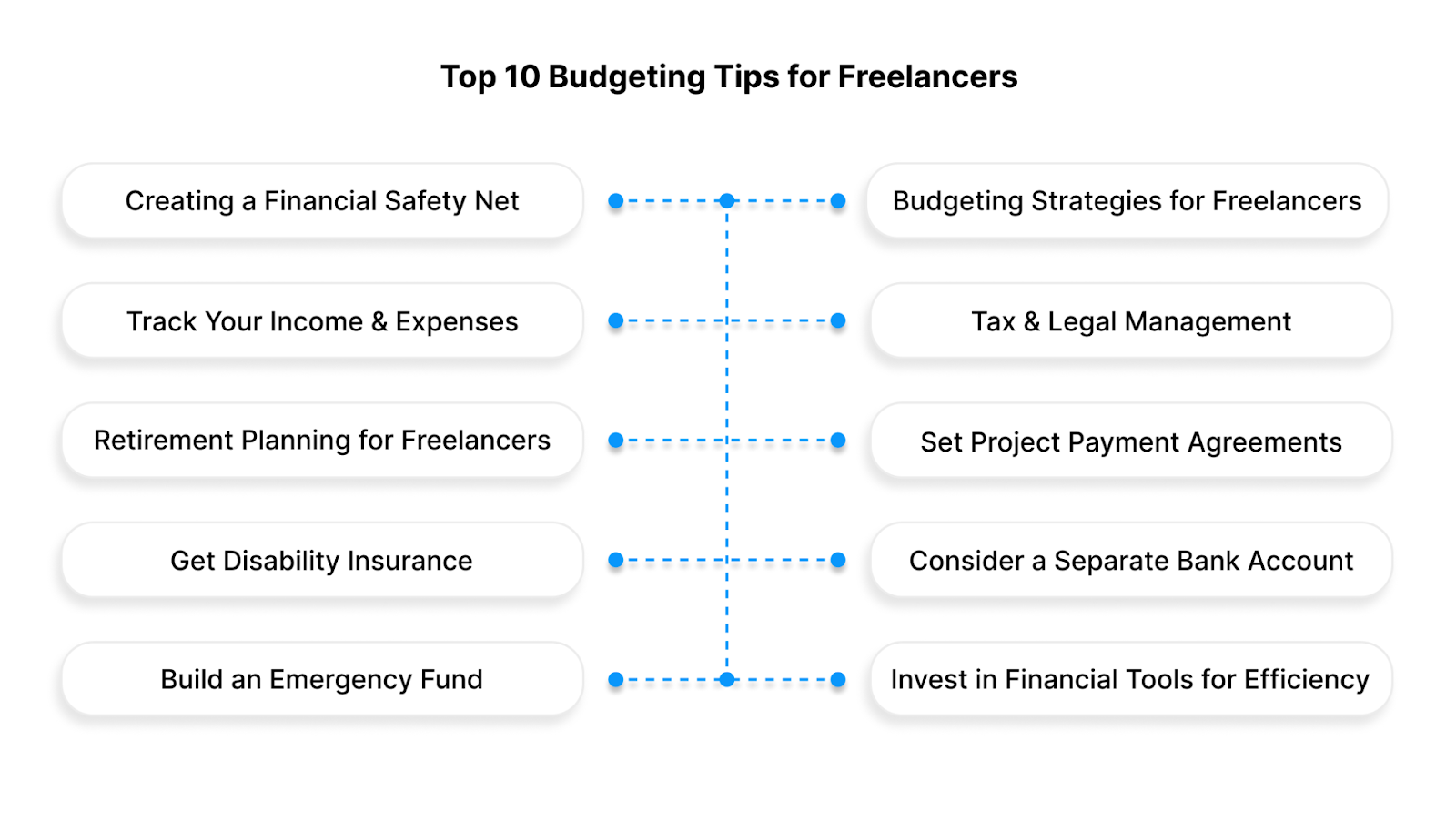

Top 10 Budgeting Tips for Freelancers

1. Creating a Financial Safety Net

As a freelancer, creating a financial safety net is crucial to navigating income fluctuations and unexpected expenses. Unlike salaried employees, freelancers face periods of both high earnings and lean months. A well-structured safety net ensures that you are financially secure during slower periods and can weather any unforeseen challenges.

Key Tips for Creating a Financial Safety Net

- Set a Realistic Savings Goal: Aim to save at least 3 - 6 months' worth of living expenses to cover unexpected events.

- Automate Savings: Set up automatic transfers to a separate savings account to consistently build your emergency fund.

- Diversify Your Income Sources: Rely on multiple clients or side gigs to ensure steady cash flow and reduce the risk of relying on one income stream.

- Track Your Expenses: Regularly review your spending to identify areas where you can cut back and save more.

- Budget for Lean Months: Plan for the seasonal fluctuations in income and set aside extra funds during peak months to cover slower periods.

- Keep an Emergency Fund Liquid: Ensure your emergency fund is easily accessible in a high-yield savings account or money market account for quick access when needed.

2. Budgeting Strategies for Freelancers

Budgeting is essential for freelancers to manage fluctuating income and expenses. Since income can vary from month to month, having a clear plan for both personal and business finances helps cover necessary costs, save for taxes, and plan for future growth. A simple, structured approach allows you to stay on top of your finances and reduce stress during slower months.

Key Budgeting Strategies for Freelancers

- Use the 50/30/20 Rule: Allocate 50% for essential expenses (business and personal), 30% for discretionary spending (marketing, education), and 20% for savings and taxes.

- Track Your Income and Expenses: Keep a detailed record of earnings and spending. Use tools like QuickBooks or Mint to automate this process.

- Set Monthly Income Targets: Set a target income goal for each month to cover expenses and save. Aim for a buffer above your monthly needs for lean months.

- Separate Business and Personal Finances: Keep separate accounts for business expenses and personal savings to make budgeting simpler.

- Adjust Based on Cash Flow: In high-income months, increase savings and tax contributions. In lean months, reduce discretionary spending and focus on essentials.

- Use Envelope Budgeting: For variable costs, like business supplies or marketing, set a fixed amount for each category and stick to it.

3. Track Your Income and Expenses Regularly

Tracking your income and expenses is one of the most effective ways to stay on top of your finances as a freelancer. Since income can vary from month to month, it's crucial to have a clear understanding of where your money is coming from and how it's being spent. Regular tracking allows you to identify trends, control overspending, and adjust your budget when needed.

Key Tips for Tracking Income and Expenses

- Create Categories for Expenses: Break down your spending into categories such as business expenses (tools, software, marketing) and personal expenses (housing, utilities, groceries).

- Review Monthly Statements: Go through your bank and credit card statements each month to verify and categorise every transaction. This helps spot any discrepancies and ensures everything is accounted for.

- Set a Tracking Schedule: Dedicate a specific time each week or month to update your records. Consistency makes it easier to catch issues early and avoid last-minute rushes.

- Track Outstanding Invoices: Keep an eye on unpaid invoices and payments to maintain a steady cash flow. Consider using apps like Invoice2go or Wave to automate invoicing and reminders.

- Monitor Business vs Personal Expenses: Ensure that personal and business expenses are tracked separately to avoid confusion and for easier tax filing.

Also Read: 6 Simple Budgeting Tips for Better Money Management

4. Managing Taxes and Legal Responsibilities

Unlike salaried employees, freelancers are responsible for calculating and paying their own taxes, including income tax and self-employment tax. Moreover, understanding legal obligations, such as business licenses, contracts, and invoicing regulations, is essential to running a legitimate freelance business. Proper planning and organisation help keep things running smoothly and keep in compliance with tax laws.

Key Tips for Managing Taxes and Legal Responsibilities

- Set Aside Money for Taxes: Set aside 25-30% of your income for taxes each month to avoid last-minute stress during tax season.

- Keep Detailed Records: Maintain a thorough record of your income and business expenses, including receipts, invoices, and contracts.

- Understand Tax Deductions: Freelancers can deduct a variety of business expenses, such as office supplies, internet bills, software subscriptions, and business-related travel.

- File Quarterly Taxes: Freelancers are generally required to file taxes quarterly. Keep track of important dates and set reminders to submit your quarterly estimated taxes to avoid late fees.

- Create Legal Contracts for Clients: Always have a signed contract before starting any work with a client. This protects both parties, clarifies payment terms, project scope, deadlines, and other important details.

- Stay Informed on Local Regulations: Depending on your location, you may need to register as a sole proprietor or LLC or obtain specific business licenses. Research local tax laws and seek legal advice if needed.

5. Retirement Planning for Freelancers

Retirement planning is often overlooked by freelancers, as the unpredictability of income makes long-term saving seem difficult. However, as a freelancer, you don’t have the benefit of employer-sponsored retirement plans like a 401(k), so it’s crucial to take charge of your own retirement savings.

Key Tips for Retirement Planning

- Open a Retirement Account: Explore options like a Public Provident Fund (PPF), National Pension System (NPS), or even a Roth IRA (if you're in the US).

- Contribute Regularly: Set up automatic monthly contributions to your retirement fund, even if it’s a small amount.

- Diversify Your Investments: Consider a mix of stocks, bonds, and mutual funds to grow your retirement savings. A diversified portfolio reduces risk and improves returns over the long term.

- Set a Retirement Goal: Estimate how much money you'll need in retirement based on your desired lifestyle and start planning accordingly. Factor in inflation, healthcare costs, and other potential expenses.

- Consult a Financial Advisor: Working with a financial advisor can help you make decisions about your retirement planning. An advisor can help assess your risk tolerance and recommend appropriate investment vehicles.

- Save Beyond the Basics: Consider other investment vehicles like real estate or stocks to further grow your wealth.

Also Read: Financial Planning Tips for Young Adults

6. Set Project Payment Agreements

Setting clear and structured payment agreements for every project is essential to maintain consistent cash flow, avoiding misunderstandings, and protecting oneself legally. A written agreement outlines the terms of payment, timelines, deliverables, and any penalties for delayed payments, helping both the freelancer and the client stay on the same page.

Key Tips for Setting Project Payment Agreements

- Define Payment Terms Upfront: Agree on a payment schedule before starting any work. Common payment structures include 50% upfront and 50% upon completion, or milestone payments for larger projects.

- Clearly Outline Deliverables: Specify what will be delivered, the expected timelines, and the scope of work to avoid confusion and scope creep.

- Set Late Payment Penalties: Include terms that outline any late payment penalties or interest fees to discourage clients from delaying payments. For example, a 5% penalty for every week the payment is delayed can be included.

- Use Contracts for Protection: Always have a signed contract before beginning a project.

- Agree on Payment Methods: Decide on the payment methods that work for both parties, whether it’s bank transfers, PayPal, or UPI.

- Invoice Promptly: Send invoices as soon as a milestone is met or a project is completed. Include detailed descriptions of the work completed, payment due dates, and any agreed-upon terms.

- Include a “Scope of Work” Clause: In case additional work is required beyond the initial agreement, include a clause that specifies how extra work will be billed.

7. Get Disability Insurance

Disability insurance is often overlooked by freelancers, but it is one of the most important types of coverage to protect your income. Since freelancers don't have the safety net of employer-provided disability benefits, securing your own disability insurance ensures that you’ll continue to receive income if you're unable to work due to illness or injury.

Key Tips for Getting Disability Insurance

- Choose the Right Coverage Type: There are 2 main types of disability insurance: short-term and long-term. Short-term disability insurance covers income for up to 6 months, while long-term disability covers several years or until retirement.

- Assess Your Income Needs: When selecting a policy, determine how much of your monthly income you would need to replace if you were unable to work. Generally, disability insurance covers 50-70% of your income.

- Understand the Waiting Period: Disability insurance often has a waiting period before benefits kick in. This can range from a few weeks to several months.

- Check the Definition of Disability: Not all policies define "disability" the same way. Some may cover you if you're unable to perform your specific job, while others may only cover you if you're unable to work at all.

- Look for Own-Occupation Coverage: Own-occupation coverage is especially important for freelancers because it ensures you are covered if you are unable to perform the specific tasks required for your job.

- Compare Plans: Shop around and compare disability insurance policies to find the best coverage at the most affordable rate.

- Review Policies Regularly: As your business grows and your income increases, it's important to review your disability insurance. Adjust your coverage as per the changes in your earnings or lifestyle.

8. Consider a Separate Bank Account

Having a separate bank account for your freelance business is a simple yet crucial step in managing your finances. It helps to distinguish between personal and business expenses, making it easier to track your income, deductions, and tax liabilities. By separating these accounts, you streamline your bookkeeping, improve your financial organisation, and ensure clarity when filing taxes.

Key Tips for Using a Separate Bank Account

- Choose the Right Account Type: Open a dedicated business checking account designed for freelancers. This helps you avoid fees that might be associated with personal accounts and keeps your finances more organised.

- Use for All Business Transactions: Deposit all your freelance earnings into this account and use it exclusively for business-related expenses.

- Track Income and Expenses: Having a separate account allows you to easily track income from clients and business expenses without sifting through personal transactions.

- Set Up Alerts and Notifications: Set up account alerts for any transactions or low balances to stay informed about your business cash flow and avoid overdrafts.

- Maintain a Buffer: Keep a minimum balance in the account as a financial cushion to handle any immediate business-related expenses or emergencies.

- Use a Business Credit Card: Consider pairing your business account with a business credit card to keep track of expenses while building your credit profile.

9. Build an Emergency Fund for Business Expenses

While having a personal emergency fund is important, it’s equally crucial to build an emergency fund specifically for your business expenses. This fund acts as a safety net for unexpected situations that could disrupt your work, such as equipment failure, software malfunctions, or delays in client payments.

Without this fund, you might find yourself scrambling for resources or having to borrow money, which can disrupt your cash flow and impact the sustainability of your freelance business.

Also Read: Simple Money Management Tips for Personal Finances

Key Tips for Building a Business Emergency Fund

- Set Clear Savings Goals: Start by calculating your monthly essential business expenses. This includes recurring costs like software subscriptions, cloud storage, marketing, and tools required for your work.

- Separate Your Fund: Keep your business emergency fund separate from your personal savings account to avoid mixing business and personal finances.

- Allocate a Percentage of Your Income: Treat the business emergency fund as a priority, especially during months of high earnings. Set aside a fixed percentage (e.g., 10-20%) of your income each month for the fund.

- Avoid Using It for Non-Essential Costs: The business emergency fund should be strictly reserved for unexpected expenses that directly affect your ability to work.

- Replenish After Use: If you have to dip into the emergency fund, prioritise replenishing it as soon as possible. Continue contributing until it’s back to your target amount.

10. Invest in Financial Tools and Resources for Efficiency

For freelancers, time is money. Investing in the right financial tools and resources can increase efficiency, streamline business operations, and reduce the time spent on manual tasks. Whether it’s software for tracking income and expenses, invoicing, or tax preparation, the right tools can automate time-consuming tasks, giving you more time to focus on what matters most—your work.

Key Tips for Investing in Financial Tools

- Automate Invoicing and Payments: Use invoicing tools like FreshBooks, Wave, or QuickBooks to generate and send invoices automatically, track payments, and set reminders for overdue invoices.

- Use Accounting Software: Tools like Xero and Zoho Books provide all-in-one solutions for tracking income, managing expenses, and generating tax-ready reports.

- Time-Tracking and Billing Software: For freelancers who charge by the hour, investing in time-tracking tools like Toggl or Harvest can help keep accurate records of billable hours.

- Invest in Tax Preparation Tools: Freelancers need to calculate and set aside taxes regularly. Tools like TaxJar or H&R Block can help you estimate quarterly taxes, generate tax reports, and file tax returns easily.

- Project and Client Management Tools: To stay organised, consider tools like Trello, Asana, or Monday.com for managing tasks, deadlines, and client communication.

- Investment and Retirement Planning Tools: Tools like Wealthfront or Betterment can help you automate retirement savings and manage investments.

- Budgeting Apps: Use apps like Mint or YNAB (You Need A Budget) to track your personal and business expenses.

Effective budgeting is essential for freelancers to manage fluctuating income, cover expenses, and plan for the future. However, even with the best budgeting practices, unexpected financial challenges can arise. That's where Pocketly comes in.

Pocketly’s Personal Loan Details

Pocketly offers flexible personal loans with competitive terms, designed to help freelancers and individuals manage their finances.

- With an interest rate starting at just 2% per month, Pocketly makes it easier to access quick funds when needed.

- The loan amount ranges from ₹1,000 to ₹25,000, making it accessible for a variety of financial needs, from small expenses to larger investments.

- Processing fees range from 1% to 8% of the loan amount, depending on the loan size and other factors, ensuring transparency and clarity in the lending process.

Whether you need to cover an unexpected expense or boost your cash flow during lean months, Pocketly provides an affordable solution with simple terms and quick disbursal.

Download Pocketly now on iOS or Android to apply for a personal loan and manage your finances with ease!

Conclusion

In this blog, we've covered essential tips for freelancers to effectively manage their finances. From creating a financial safety net and implementing budgeting strategies to tracking income and expenses regularly, these practices help ensure consistent cash flow and financial stability. We've also explored key areas like managing taxes, retirement planning, and setting project payment agreements, providing practical insights for freelancers looking to safeguard their income and build long-term wealth.

Additionally, investing in financial tools and disability insurance ensures that freelancers are protected and efficient in their operations. Finally, having a separate bank account for business and building an emergency fund specifically for business expenses adds another layer of financial security.

FAQs

1. What are the 3 P's of budgeting?

The 3 P's of budgeting stand for Plan, Prioritize, and Protect. Plan your budget based on your income and expenses, prioritize essential expenses first, and protect your savings by setting aside funds for emergencies and long-term goals.

2. What is the 50/30/20 rule?

The 50/30/20 rule is a simple budgeting strategy where you allocate 50% of your income to necessities, 30% to discretionary spending, and 20% to savings and debt repayment. This method helps maintain a balanced financial plan.

3. Which skill is highly paid in freelancing?

Skills like web development, graphic design, digital marketing, and content writing are among the most highly paid in freelancing. Advanced technical skills, such as software development and data analysis, also command high rates.

4. What is the 10 10 80 budget?

The 10/10/80 budget is a method where 10% of your income is allocated to savings, 10% to donations or charity, and the remaining 80% goes toward living expenses and discretionary spending. This approach encourages saving while promoting generosity.

5. What is the Dave Ramsey formula?

The Dave Ramsey formula is a budgeting method based on the zero-based budget, where every dollar is assigned a specific purpose, whether it’s for expenses, savings, or debt repayment. It emphasizes living below your means and eliminating debt as a priority.