Can your company really make smarter financial decisions just by tracking expenses? In 2026, the difference between a business that saves strategically and one that simply cuts costs often lies in how well it reads its own spend data.

Finance teams today face an environment where every purchase, contract, and supplier decision carries measurable weight, and where instinct is no longer enough.

According to Gartner’s October 2024 survey of 251 CFOs, metrics, analytics, and reporting were ranked as top priorities for finance leaders in 2025. This growing focus reflects a clear shift from passive tracking to proactive financial intelligence.

This blog explores the ten most effective spend analysis tools shaping financial strategy in 2026, comparing how each turns data into real-world savings and sharper budget control.

Key Takeaways

- Spend analytics in 2026 is a strategic tool that helps businesses move from tracking costs to making data-led financial decisions with speed and accuracy.

- The global procurement analytics market is on track to hit USD 8 billion by 2026, showing a clear shift toward real-time visibility and smarter forecasting.

- Top performers — Coupa, SAP Ariba, Sievo, Zycus, and GEP SMART — lead the space with automation, integration, and predictive intelligence that drive measurable savings.

- Choosing the right platform means prioritising clean data, quick setup, intuitive use, and strong compliance — not just flashy dashboards.

- The future is intelligent and responsible: AI-driven forecasting, voice-based dashboards, and ESG-linked metrics are setting the new standard for financial strategy.

What Exactly Is Spend Analysis—and Why It’s Crucial in 2026

At its core, spend analysis means collecting, cleansing, and categorising all company expenditures to see how money flows across the organisation. It answers three essential questions:

- Where is the money going?

- Who is being paid?

- What value is being gained in return?

When those questions are answered with precision, organisations can identify inefficiencies that spreadsheets and monthly reports often overlook.

Why It Matters in 2026

Finance teams are under greater pressure than ever to justify every rupee spent. Inflationary markets, supply chain instability, and tighter budgets have made spend visibility a boardroom concern.

For CFOs, procurement heads, and founders alike, understanding spend patterns is the difference between reacting late and planning.

Modern spend analytics tools help businesses gain real-time visibility into expenses and supplier performance, creating a single source of truth across departments.

Instead of waiting for quarterly reviews, teams can now see spending trends as they happen and make decisions that prevent losses before they occur.

What’s New in 2026 Tools

Earlier tools focused on static reporting and manual uploads. The new generation brings:

- Connected systems: Seamless integration with ERPs, procurement suites, and accounting software.

- Live data feeds: Continuous updates that flag anomalies or duplicate payments.

- Predictive capabilities: Algorithms that forecast spend fluctuations based on patterns, seasonality, and supplier performance.

This combination transforms analytics from observation into foresight, helping finance leaders act on data rather than react to it.

Pain Points Spend Analysis Solves

Spend analysis tools address long-standing financial blind spots that quietly erode profit margins:

- Duplicate or shadow vendors that inflate procurement costs.

- Unseen leakages where small, untracked expenses accumulate.

- Delayed or inconsistent reporting that hides overspending until audits.

- Fragmented data across departments making accountability impossible.

By cleaning, merging, and analysing this data in one view, these platforms help teams spot trends that would otherwise remain buried.

The Impact of Visibility: A Quick Example

A mid-sized retail firm recently used automated spend categorisation to audit its vendor network. The analysis revealed that 12% of payments overlapped across regional branches, with different departments paying the same suppliers under slightly altered names. Consolidating those contracts saved several lakhs annually and cut invoice approval time in half.

Take control of your spending with smarter choices, just as the right tools simplify business finances, Pocketly helps you manage personal cash flow with instant, transparent short-term loans from ₹1,000 to ₹25,000.

Apply in minutes and experience borrowing that’s fast, flexible, and built for your financial independence.

Also Read: What Is Credit Underwriting in Digital Lending?

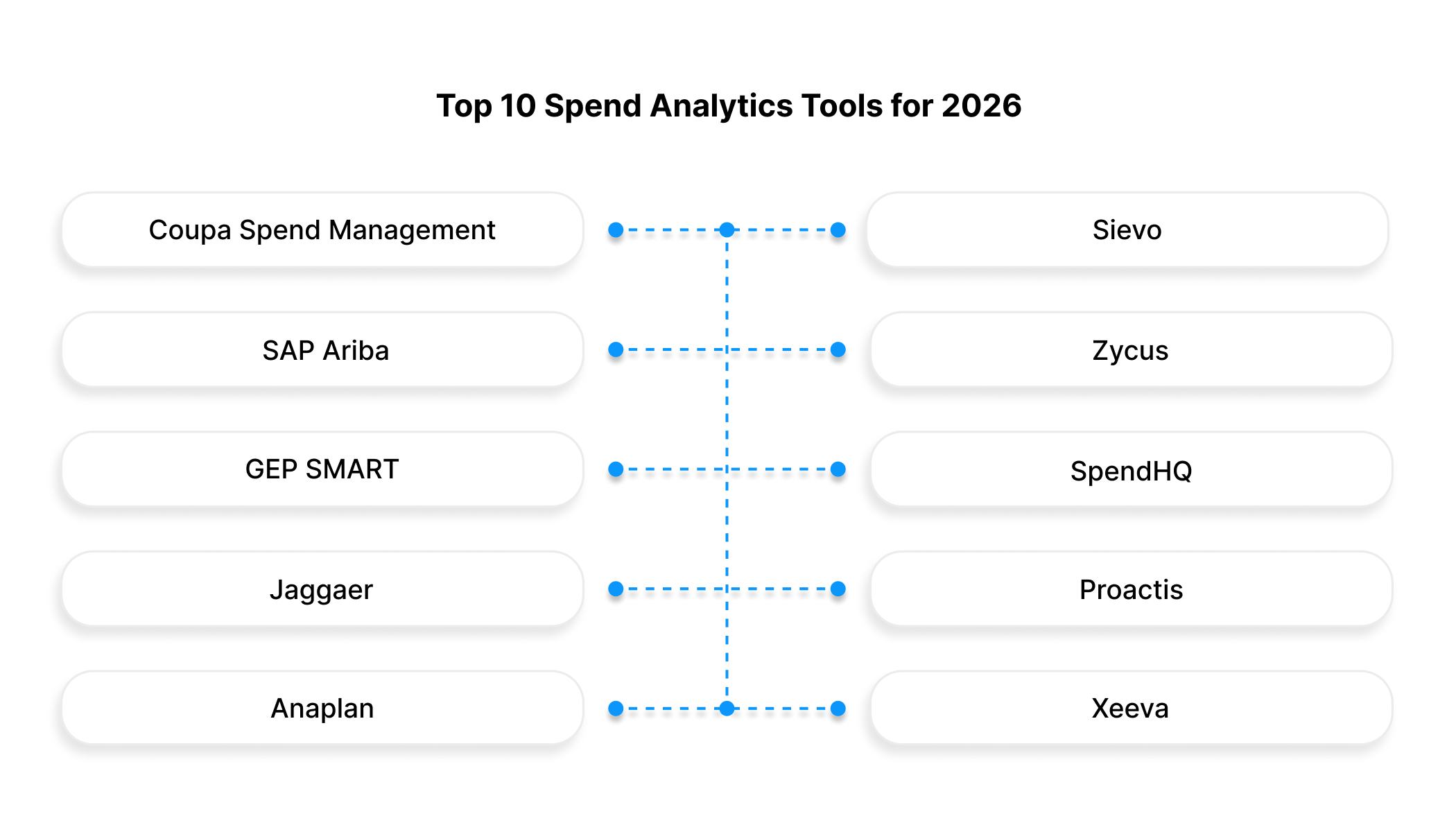

Top 10 Spend Analytics Tools for 2026

With demand for transparent procurement and spend visibility on the rise, the market for spend and procurement analytics tools is expanding rapidly.

According to a recent industry forecast, the global procurement analytics market is expected to reach roughly USD 8.0 billion by 2026, up from USD 2.6 billion in 2021.

These platforms convert scattered spend data into actionable insights. Finance teams can spot inefficiencies, negotiate better supplier contracts, and build budget plans grounded in hard data rather than guesswork.

Below are the ten tools that stand out in 2026 for usability, integration, and measurable financial impact.

1. Coupa Spend Management

Coupa remains the benchmark for enterprise-grade spend management, offering visibility across procurement, expenses, and payments in a single view. Its predictive analytics module identifies cost trends before they affect margins.

Ideal for: Large enterprises managing complex global supply chains

Key Strengths:

- Real-time spend visibility across all categories

- Supplier collaboration for cost optimisation

- Predictive cost modelling powered by spend history

2. Sievo

Sievo is purpose-built for organisations that want analytics depth rather than surface-level reporting. It excels in tracking supplier performance, contract compliance, and cost avoidance through powerful data cleansing and AI-driven categorisation.

Ideal for: Procurement and finance teams seeking advanced analytical accuracy

Key Strengths:

- Automated spend categorisation and enrichment

- Dynamic dashboards and trend forecasting

- Strong integration with ERP systems like SAP and Oracle

3. SAP Ariba

SAP Ariba continues to dominate enterprise procurement with its integrated suite covering sourcing, supplier management, and spend analysis. The tool brings a connected procurement network that enhances visibility across the buying process.

Ideal for: Large corporates already within the SAP ecosystem

Key Strengths:

- Unified spend analysis and supplier management

- AI-based data normalisation and spend classification

- Robust compliance and audit trail reporting

4. Zycus

Zycus combines procurement automation with spend analytics to provide complete visibility from sourcing to payment. Its proprietary Merlin AI engine helps detect duplicate vendors and maverick spending in real time.

Ideal for: Mid-to-large enterprises aiming to automate procurement workflows

Key Strengths:

- AI-driven spend categorisation and anomaly detection

- Intuitive dashboards tailored for CFO and CPO visibility

- Seamless integration with finance and ERP platforms

5. GEP SMART

GEP SMART delivers unified spend analytics, sourcing, and contract management in one platform. Its cloud-native design provides flexibility for distributed teams and easy scalability as the business grows.

Ideal for: Global businesses seeking cross-department spend visibility

Key Strengths:

- Intuitive analytics dashboards and deep reporting layers

- Unified suite reducing the need for multiple tools

- Strong support for supplier performance tracking

6. SpendHQ

SpendHQ focuses on clarity and speed, offering finance teams a ready-to-use analytics platform with minimal setup. It’s built for teams that need quick insights without months of implementation.

Ideal for: Mid-size firms seeking immediate ROI through data clarity

Key Strengths:

- Preconfigured dashboards for faster deployment

- Data accuracy through ongoing classification updates

- Spend visibility across indirect and tail-end categories

7. Jaggaer

Jaggaer offers AI-based spend intelligence with strong supplier lifecycle management. It helps procurement teams identify consolidation opportunities and risk factors hidden within supplier networks.

Ideal for: Enterprises balancing cost efficiency with supplier risk control

Key Strengths:

- Supplier risk analytics and diversification tracking

- Predictive insights for cost optimisation

- Workflow automation and collaboration tools

8. Proactis

Proactis combines spend control with process efficiency. It’s especially popular with public sector and service organisations for its strong compliance reporting and budget transparency.

Ideal for: Public sector entities and growing service-based firms

Key Strengths:

- Detailed budget tracking and spend compliance tools

- Intuitive dashboards for finance and procurement alignment

- Strong focus on audit-ready reporting

9. Anaplan

Anaplan integrates spend analytics into its broader connected planning ecosystem, enabling businesses to link budget forecasting with real-time spend data. Its strength lies in scenario modelling and financial simulation.

Ideal for: Businesses prioritising financial planning and strategic forecasting

Key Strengths:

- Real-time scenario planning linked to spend data

- Unified platform for finance and operations planning

- Predictive analytics supporting long-term decisions

10. Xeeva

Xeeva delivers AI-powered spend intelligence that focuses on procurement optimisation. Its algorithms automate data classification and deliver insights that identify saving opportunities across categories.

Ideal for: Procurement teams wanting quick wins and continuous spend improvement

Key Strengths:

- AI-based opportunity identification engine

- Automated supplier normalisation and data validation

- Easy-to-use reporting interface for fast adoption

Also Read: First-Time Loans to Build Credit: A Beginner's Guide

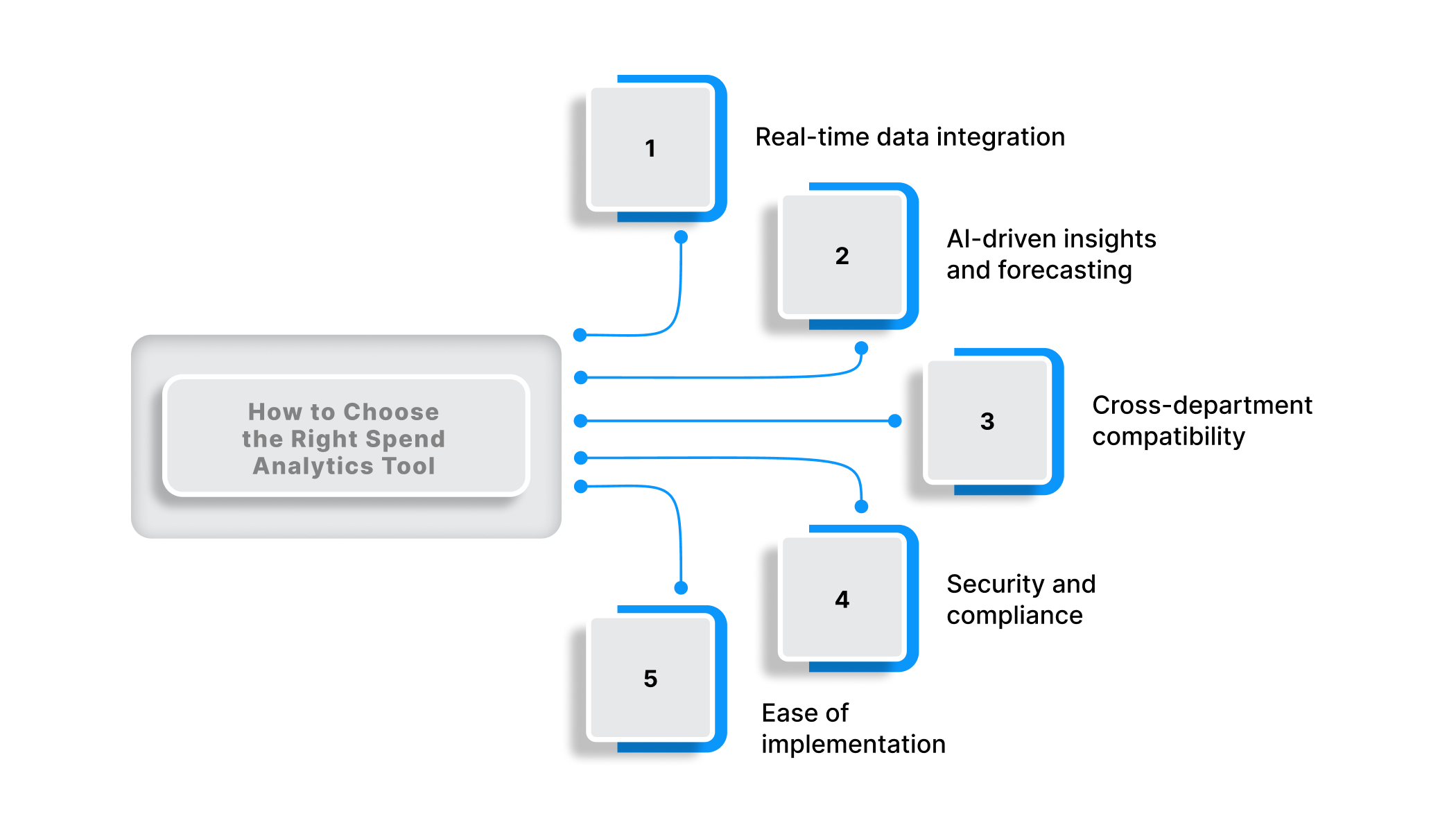

How to Choose the Right Spend Analytics Tool for Your Business

Choosing a spend analytics tool goes beyond a checklist of features. It requires identifying which platform truly fits the way your organisation manages and interprets its spending.

The ideal solution should enable faster financial decision-making, minimise manual effort, and create shared accountability across every department.

Here’s what finance and procurement leaders should focus on when assessing a platform:

- Real-time data integration – The system should automatically sync with ERPs, accounting tools, and procurement platforms to provide a live, unified view of company-wide spending.

- AI-driven insights and forecasting – Look for tools that highlight anomalies and predict spending spikes instead of waiting for manual review.

- Cross-department compatibility – Finance, procurement, and operations should all draw from the same data source without silos.

- Security and compliance – Sensitive financial information must be encrypted and compliant with local data regulations.

- Ease of implementation – A user-friendly interface and smooth onboarding process prevent tool fatigue and ensure wider adoption.

Below is a quick reference comparing core needs across company sizes and tool strengths:

| Feature Type | Must Have | Nice to Have | Best Fit / Tools |

| Data Sync | Continuous integration with ERP and accounting systems | API extensions for niche tools | SAP Ariba, Jaggaer (large enterprises) |

| Analytics | Predictive insights and anomaly detection | Supplier benchmarking and trend forecasting | Coupa, Zycus (automation-focused) |

| Usability | Ready-to-use dashboards and fast setup | Configurable workflows | SpendHQ, GEP SMART (mid-size businesses) |

| Security | Data encryption, audit logs, and compliance checks | Geo-specific data storage options | All enterprise-grade tools |

| Implementation | Quick deployment with minimal training | Advanced customisation | SpendHQ, Zycus, GEP SMART |

Also Read: Differences and Advantages of Installment Credit

The Future of Spend Analytics — What to Expect Beyond 2026

Spend analytics is moving from backward-looking reports to continuous guidance for every spend decision.

Here is where the next wave is heading:

1. Predictive and Generative AI Take Centre Stage

Machine learning is already common in spend analysis for automatic categorisation, vendor matching, and anomaly detection. The next phase is predictive and generative AI working together to guide actions rather than simply showing past trends.

According to The Hackett Group, 47% of organisations already use embedded generative AI features in existing procurement tools, and 30% use custom-built or general-purpose models such as Microsoft Copilot.

This momentum points to a near future where:

- Models forecast category-level spend and cash impact under different scenarios,

- Tools flag likely contract leakage or off-contract spend before month end,

- Generative AI drafts negotiation briefs, supplier emails, and approval notes based on spend patterns.

2. Voice and Natural Language Analytics Become Everyday Tools

AI in procurement is already used to predict and lower costs, automate tasks, and support supplier selection. The next logical step is conversational access to spend data.

Research on 2026 procurement trends highlights that digital dashboards will bring spend analytics, supplier performance, and risk alerts together in one place, with predictive analytics surfacing weak spots early.

3. Deeper Integration With ERP, Risk, and ESG Data

The next phase of spend analytics is tightly tied to risk and sustainability. Several sources point to ESG data becoming a core part of procurement decisions, with teams using supplier information on carbon footprint, labour practices, and waste management to reduce risk and build stronger supplier portfolios.

We can expect future spend analytics tools to:

- Pull financial, risk, and ESG data into a single supplier view,

- Highlight spend exposure to suppliers with poor ESG scores or regulatory red flags,

- Score potential vendors not only on rate and reliability, but also on emissions, social impact, and governance posture.

4. A Data-Backed Direction of Travel

Multiple forecasts now point to rapid AI adoption in procurement. One SaaS procurement study based on USD 15 billion in spend predicts that AI usage in procurement workflows could reach 86% by 2026.

Combined with the strong growth outlook for procurement analytics markets, the signal is clear:

Spend analytics is moving towards:

- Continuous, predictive insight

- Conversational access to data

- Integrated ESG and risk visibility

Pocketly: Financial Agility for India’s Emerging Entrepreneurs

Pocketly extends the same principles that make spend analytics vital for businesses into personal and entrepreneurial finance. As a digital lending platform, Pocketly supports students, salaried professionals, and entrepreneurs who need quick, collateral-free access to short-term credit.

The platform offers instant loans from ₹1,000 to ₹25,000 through a fully digital process, allowing users to manage urgent personal or business expenses without delays or hidden terms.

Why Pocketly stands out:

- Fast digital KYC and approval within minutes

- No collateral or paperwork required

- Transparent interest rates starting from 2% per month

- Flexible repayment options with no hidden charges

Conclusion

The leading spend analytics tools in 2026 provide finance teams with clear direction rather than static reports. They use data to anticipate spending patterns, manage risk, and support faster, better-informed decisions.

With advanced forecasting and integrated sustainability tracking, spend analysis now actively shapes strategy and improves financial performance.

Just as companies rely on analytics to make smarter spending decisions, Pocketly gives young Indians and entrepreneurs the same level of control over their personal and business finances. It turns financial access into a seamless, transparent experience that supports growth and confidence.

Download Pocketly on iOS and Android to manage your short-term financial needs with speed and clarity.

FAQs

Q: What kind of ROI can businesses expect from adopting spend analytics tools?

A: ROI often comes through cost avoidance, supplier consolidation, and reduced manual effort. Companies implementing analytics typically report 5–15% annual savings in procurement and operational expenses within the first year.

Q: How often should spend data be refreshed for accurate insights?

A: The most effective systems update data in real time or at least daily. This frequency helps teams catch errors early, monitor supplier activity, and make timely budget or contract adjustments.

Q: Do spend analytics tools help during supplier negotiations?

A: Yes. They consolidate pricing, performance, and historical spend data, giving procurement teams leverage in negotiations. Data-backed insights often lead to better contract rates and stronger supplier accountability.

Q: How are finance teams using spend analytics to manage risk?

A: Spend analytics identifies concentration risks, supplier dependencies, and compliance gaps. By mapping financial exposure to specific vendors or regions, teams can make informed contingency plans.

Q: What skills are needed to use modern spend analytics tools effectively?

A: Most tools are designed for non-technical users. However, finance professionals benefit from understanding data interpretation, KPI tracking, and category management to turn insights into measurable actions.