Overspending has quietly become part of modern life. With online shopping, instant UPI payments, and constant social plans, it is easy to lose track of money.

Expense control is not about strict restrictions. It is about learning how to direct your spending toward what truly matters and avoiding what drains your finances.

When you control your expenses, you control your future choices. You build stability, confidence, and freedom from last-minute money stress.

This guide will help you understand why expense control matters, how to fix hidden spending leaks, and simple ways to stay financially steady, no matter your income level.

Key Takeaways

- Expense control is about choice, not restriction. When you decide where your money goes, you gain freedom, not limitation. Small, conscious decisions build long-term stability.

- Awareness turns into action. Tracking shows you the pattern, but control comes from acting on it, cutting leaks, setting limits, and saying no to unplanned spends.

- Discipline beats income. Even with irregular or modest earnings, consistent habits like weekly reviews and realistic budgets make all the difference.

- Use support wisely. If emergencies arise, responsible short-term help like Pocketly can bridge the gap safely, but only after you’ve controlled your spending first.

What Is Expense Control and Why Does It Matter?

Expense control means making conscious choices about how, when, and why you spend money. It is the next step after awareness, turning knowledge into action.

When you control expenses, you decide what deserves your money instead of letting emotions or habits decide for you. It builds balance and helps you live within your means without feeling restricted.

Expense control vs expense management: The real difference

Both terms sound similar, but they serve different goals.

| Aspect | Expense Management | Expense Control |

| Focus | Tracking and analysing spending | Reducing and limiting spending |

| Goal | Awareness | Discipline and savings |

| Mindset | “Where did my money go?” | “How do I stop it from going?” |

| Approach | Organised and systematic | Decisive and proactive |

In short, management helps you see patterns; control helps you change them.

Why expense control is the foundation of financial independence

Financial freedom begins when you can say no to unnecessary expenses. Expense control allows you to separate needs from wants, protect your savings, and plan your future confidently.

Even small changes, like skipping a daily takeaway coffee or cancelling an unused subscription, can free up funds for goals that truly matter. Each conscious decision adds up over time, building stability and confidence.

Common signs you are losing control of your expenses

If you often feel like your money disappears too fast, you might already be overspending.

Look out for these signs:

- You reach mid-month with little left for essentials.

- You borrow or use credit for regular bills.

- You regret non-essential purchases after making them.

- You avoid checking your balance to escape anxiety.

Recognising these early helps you take corrective action before financial pressure builds up.

Now that we understand what expense control means, let us explore why it can feel so difficult to maintain, and how psychology influences our spending habits.

Also Read: How to Manage Monthly Expenses Smartly in 2025

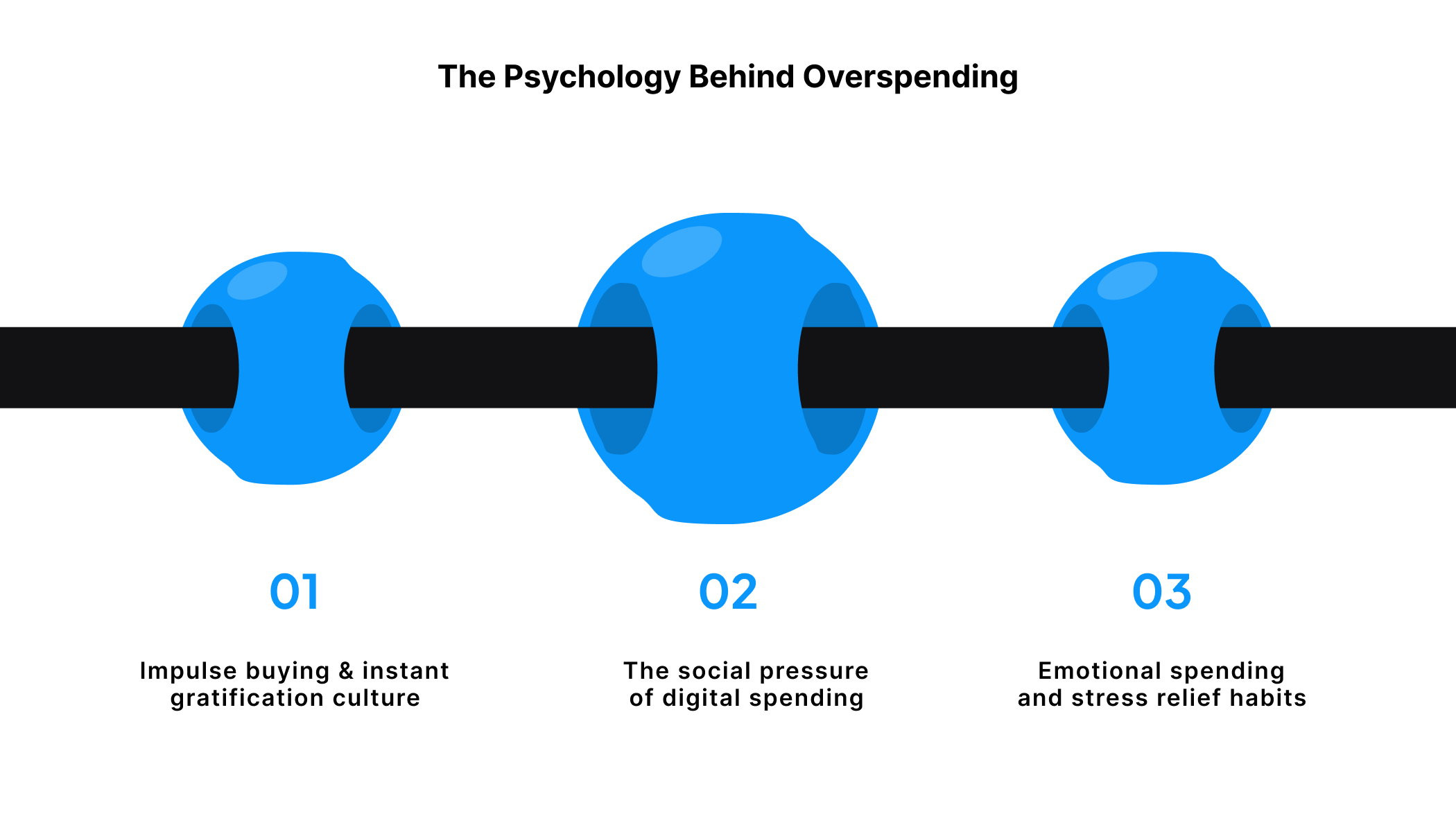

The Psychology Behind Overspending

Understanding why we overspend is the first step to controlling it. Most money problems are not about numbers; they are about behaviour.

1. Impulse buying and instant gratification culture

The ease of online shopping and one-click payments has made spending effortless. A discount notification, flash sale, or limited-time offer creates a sense of urgency.

Our brain enjoys small bursts of excitement when we buy something new, but that feeling fades quickly.

Expense control requires slowing down this reaction. A simple rule like “wait 24 hours before buying anything non-essential” helps reset impulse decisions.

2. The social pressure of digital spending

Social comparison is a major trigger for overspending. When friends eat out frequently, buy new gadgets, or post about expensive experiences, it can make moderation feel boring.

But constant participation can harm your finances. Saying “no” occasionally is not being stingy; it is being smart. True friends respect boundaries, especially when you are clear about your priorities.

For example, instead of dining out three times a week, choose one social evening and cook at home the rest. Small adjustments reduce spending without disconnecting you from friends.

3. Emotional spending and stress relief habits

Many people spend to feel better after a tiring day or a stressful week. Buying something small can create temporary happiness, but repeated emotional spending becomes a hidden drain.

- Recognise when you are spending out of boredom, sadness, or stress.

- Replace the habit with small, free activities, a walk, music, or journaling.

- The goal is not to eliminate pleasure, but to find joy that does not cost money every time.

When you understand the psychology behind your purchases, expense control becomes easier. You stop reacting and start deciding.

Also Read: 7 Tips to Spend and Save Money Wisely

Now that we have explored the why, let us move to the how, practical steps to identify and eliminate the spending leaks that silently drain your income.

Identify and Eliminate Spending Leaks

Most people think big expenses cause financial stress, but small, repeated costs are often the real culprits.

These small payments, subscriptions, delivery charges, and forgotten auto-renewals silently eat into your budget. Finding and fixing these “money leaks” is the fastest way to take control of your finances.

Subscription traps and unused memberships

Subscription-based services make life convenient but can easily pile up.

Streaming platforms, fitness apps, and online courses often auto-renew even when you rarely use them.

- Check your payment history once a month.

- Cancel anything you have not used in 30 days.

- It is better to resubscribe later if you need it than to pay for unused access now.

Also, avoid signing up for multiple similar services; one streaming or music platform is usually enough.

Delivery apps, micro-spends, and convenience costs

Ordering food, coffee, or groceries online feels harmless because each amount seems small. However, small daily transactions add up fast.

For example, spending ₹150 a day on coffee equals ₹4,500 a month. Add delivery fees, and you might lose another ₹1,000.

Set a weekly limit for such conveniences. If you cross it, switch to homemade meals or pick-up options for the rest of the week. This simple discipline saves more than most people realise.

Hidden monthly leaks: late fees and forgotten auto-payments

Late bill payments and missed deadlines can lead to unnecessary penalties.

Similarly, old auto-pay setups may continue deducting money for services you no longer use.

Do a “money check-up” once a month:

- Review bank and wallet statements.

- Identify repeated charges or delayed fees.

- Set payment reminders to avoid fines.

Treat these reviews as a regular self-audit. It takes ten minutes but saves hundreds of rupees each month.

Now that we have plugged the leaks, let us explore how to create an expense control plan that actually works in real life.

Also Read: Expense Tracking Categories for Budgeting

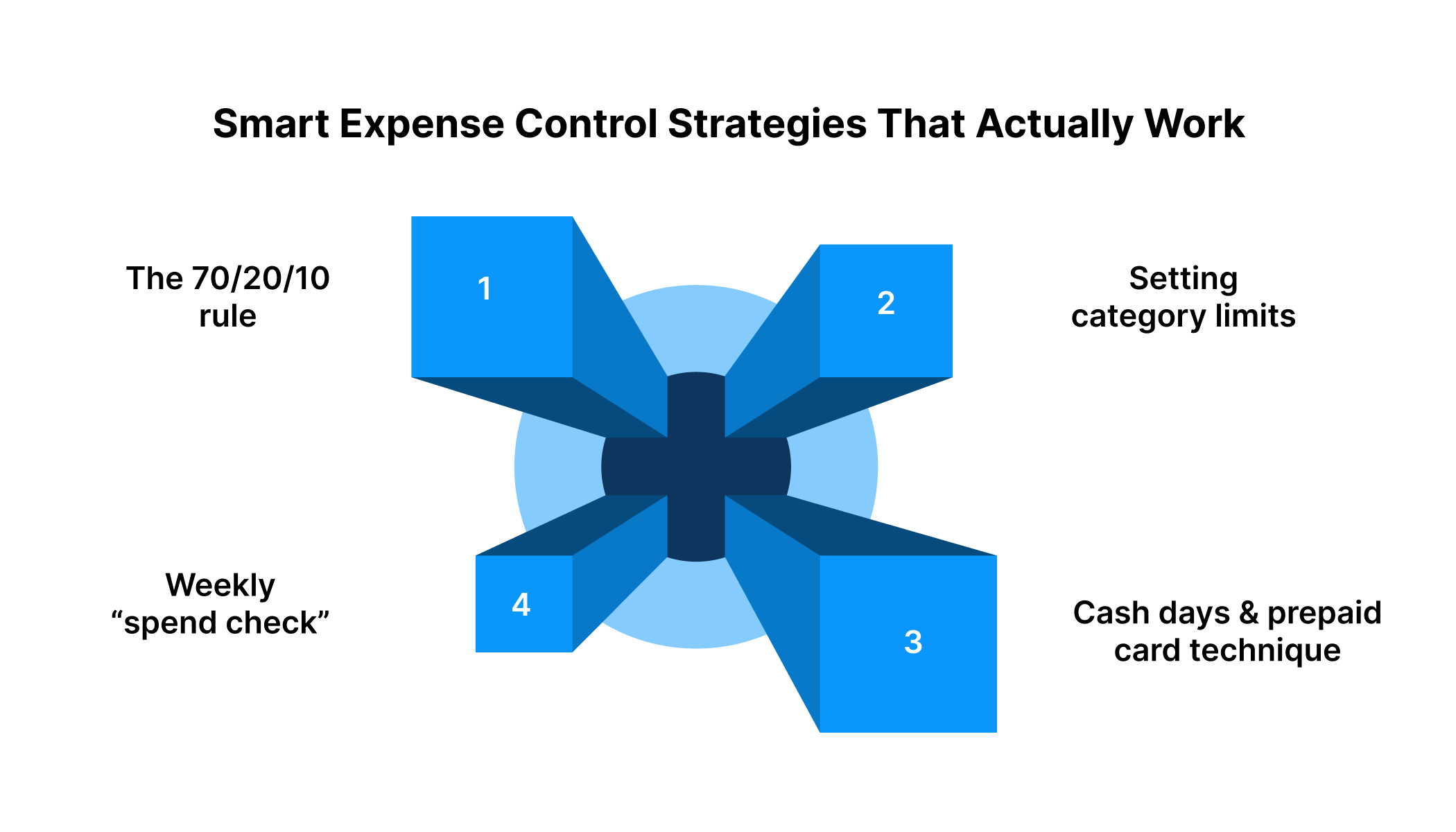

Smart Expense Control Strategies That Actually Work

Expense control is not about living frugally or avoiding joy. It is about being intentional with your money and making space for what truly adds value to your life.

These strategies are simple to apply and easy to maintain over time.

1. The 70/20/10 rule: a flexible formula for all incomes

The 70/20/10 rule is an updated, realistic version of traditional budgeting.

It works well for both students and young professionals.

- 70% of income → Essentials (rent, bills, groceries, travel).

- 20% → Savings or debt repayments.

- 10% → Personal enjoyment or social spending.

If your income is irregular, adjust the percentages slightly but keep the core structure.

This method ensures every rupee has a purpose while still leaving room for small pleasures.

2. Setting category limits that reflect your lifestyle

Instead of vague goals like “spend less,” create clear limits for each spending area.

For example:

- Food delivery: ₹2,000/month

- Entertainment: ₹1,000/month

- Travel or rides: ₹1,500/month

Track your spending weekly to see how close you are to each limit. When one category exceeds its cap, cut back elsewhere instead of dipping into savings. This method trains you to prioritise needs and stay balanced.

3. Cash days and prepaid card technique

Digital payments make it easy to overspend because money feels less “real.” Try switching to cash or prepaid cards once a week.

Withdraw your spending allowance for that week, say ₹2,000, and use only that amount for non-essential expenses. When it runs out, stop spending until the next week begins. This habit builds strong awareness and naturally limits impulse purchases.

4. Weekly “spend check”: a five-minute habit that changes behaviour

Spend five minutes every Sunday reviewing where your money went last week. You do not need detailed tracking, just note which areas felt excessive.

Ask yourself simple questions:

- Was this purchase necessary?

- Did it make me happier or just comfortable?

- Could I avoid it next time?

This reflection keeps you honest with yourself. Expense control does not require perfection, only awareness and small improvements each week.

Smart expense control builds peace of mind. You stop worrying about running out of money because every rupee has direction.

Next, let us see how people with irregular income, like freelancers and gig workers, can apply these same principles to stay financially stable.

Also Read: Money Management Tips for College Students 2025

How to Control Expenses with an Irregular Income

For freelancers, gig workers, and self-employed professionals, money often comes in waves. One month may bring abundance, while the next feels uncertain. This irregular pattern can make expense control challenging, but not impossible.

With a few consistent habits, you can create stability even when income fluctuates.

Plan around your lowest-earning month

Start your budget based on the minimum you earn in a slow month, not your best month. If you usually make between ₹20,000 and ₹30,000, plan your expenses assuming ₹20,000.

This approach builds a cushion during higher-income months. It prevents financial stress during quiet periods because you already live within a sustainable range.

Any extra income later becomes a bonus, not a lifeline.

Maintain a small emergency buffer

Keep a small savings buffer to handle gaps or delays in payments. Even ₹3,000–₹5,000 in a separate account helps you stay calm when income slows down.

- Think of it as your “quiet month fund.”

- Add to it every time you have a strong earning month.

- If you ever use it, refill it gradually once money comes in again.

This small buffer can help you avoid unnecessary borrowing or last-minute panic.

Turn surplus months into future stability

When work goes well, it can be tempting to upgrade lifestyle spending — new gadgets, frequent dining, or spontaneous trips. But turning surplus months into savings builds long-term control.

You can:

- Pay off small debts early.

- Prepay rent or subscriptions.

- Set aside funds for upcoming expenses.

This discipline keeps your financial rhythm steady, no matter how unpredictable your income is.

When your earnings fluctuate, control matters more than the amount you earn. Once you learn to adjust spending instead of chasing consistency, you stay financially secure year-round.

Still, even with strong expense control, unexpected emergencies can happen. Let us see how to handle them responsibly without breaking your financial balance.

Also Read: 6 Simple Budgeting Tips for Better Money Management

When Expense Control Is Not Enough: Responsible Backup Options

Even the most disciplined person can face sudden financial needs. An urgent medical expense, a last-minute travel cost, or a university payment might appear without warning.

In such cases, borrowing can be reasonable if done responsibly.

When it is reasonable to borrow temporarily

Borrow only when the expense is essential and time-sensitive. Ask yourself three questions before applying for a loan:

- Is this expense truly urgent?

- Can I repay within the next month or two?

- Have I already reduced non-essential spending first?

If the answer is “yes” to all three, a short-term loan can help you manage without a long-term impact.

Pocketly is a safe, transparent support option

Pocketly offers quick, short-term loans ranging from ₹1,000 to ₹25,000, designed for young Indians facing genuine financial gaps. There is no collateral, and all processes are 100% digital.

- Interest rate: Starts at 2% per month

- Processing fee: 1–8% depending on the amount and tenure

- Hidden charges: None, all details appear upfront before approval

You can repay anytime, and early repayment reduces your total interest cost.

Use short-term credit only after you have controlled every other expense. Pocketly is a backup plan, not a routine tool. The goal is to help during emergencies, not to fund lifestyle upgrades.

When you treat borrowing as part of responsible financial planning, it complements, not replaces, strong expense control.

Once you have learned when to borrow responsibly, you gain full financial control. Now, let us address some common questions young Indians have about expense control, how to stay consistent, and make the habit last.

Conclusion

Expense control gives you freedom, the freedom to choose how you spend, save, and plan your future. It replaces financial stress with clarity and confidence.

Start small: review your expenses, limit non-essentials, and build your savings buffer. If you ever face a real emergency or a short-term financial gap, Pocketly can help you manage it responsibly.

Pocketly offers instant, transparent personal loans from ₹1,000 to ₹25,000, with no collateral, quick digital KYC, and clear costs upfront. It is a responsible safety net for those moments when expense control alone is not enough.

Take charge of your finances today. Build control, stay consistent, and use help wisely when you truly need it.

📱 Download the Pocketly App

FAQs

1. What are the first steps to start expense control?

Begin by tracking your expenses for one month. List every payment, digital or cash. Once you see where your money goes, reduce or cap the non-essential categories. Awareness always comes before control.

2. How can I stop impulse spending without feeling restricted?

Use a “24-hour rule.” If something is not essential, wait one full day before buying. Most impulsive wants fade with time. This simple pause helps you make decisions that feel deliberate, not emotional.

3. How do I control expenses when everything feels necessary?

When priorities clash, rank your expenses by impact. Ask, “Will this matter next month?” If the answer is no, it is not essential. Expense control is not about cutting everything; it is about focusing on what truly matters.

4. Can small savings really make a difference?

Absolutely. Saving ₹200 every week equals over ₹10,000 a year. Small savings build consistency and create safety buffers for emergencies. Financial progress grows through steady discipline, not big one-time actions.

5. What are good monthly habits to maintain expense control?

Review your expenses weekly.

- Cancel one unnecessary subscription every month.

- Set one category goal to improve (e.g., food delivery).

- Keep a short list of savings goals as motivation.

Consistency turns these small actions into lasting habits.