Money management isn't just about pinching pennies or looking for the next big investment opportunity. It’s about making smarter choices every day that lead to a stable financial future. While there’s no one-size-fits-all formula, the small, consistent habits you develop can have a lasting impact.

Whether you’re planning for a rainy day or working toward a bigger goal, learning how to spend and save wisely can give you more control over your financial life. Here are 10 practical tips that can help you do just that.

Key Takeaways

- Automate Savings for Consistency: Set up automatic transfers or utilise apps to ensure regular contributions to your savings without manual effort.

- Distinguish Between Needs and Wants: Prioritise essential spending over impulse purchases to maintain financial discipline and allocate more for savings.

- Build Emergency and Long-Term Funds: Focus on short-term savings like emergency funds (3-6 months’ expenses) and long-term goals like retirement and education.

- Use Discounts and Smart Shopping: Always look for deals, cashback, and discounts before making purchases to maximise savings on everyday items.

- Set Clear Savings Goals: Whether short or long-term, having specific financial goals helps you stay focused and motivated to save consistently.

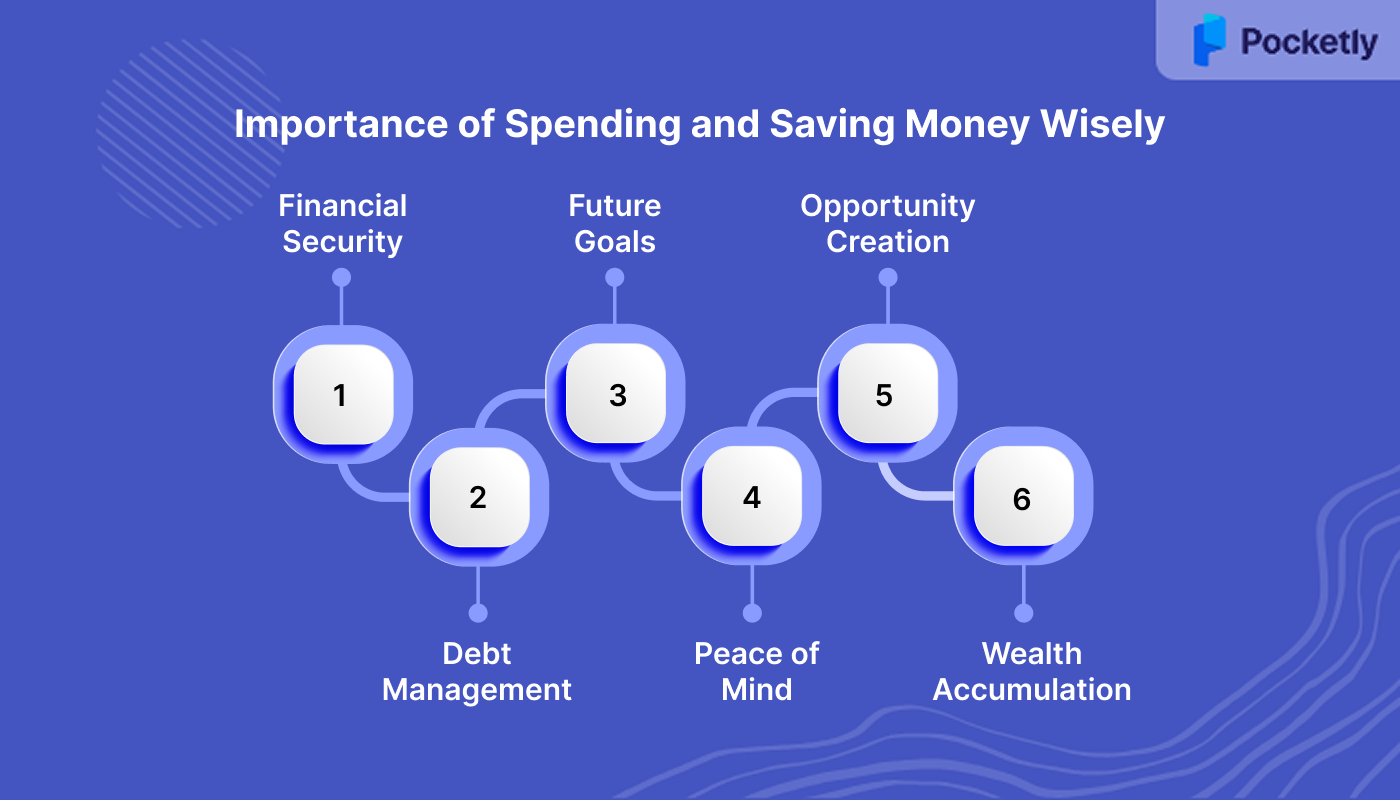

Importance of Spending and Saving Money Wisely

By saving and spending wisely, you can reduce stress, increase opportunities, and build a foundation that allows for greater flexibility in life. Here are key reasons why it’s important:

- Financial Security: Wise spending and saving create a safety net for emergencies, preventing financial hardship when unexpected events occur.

- Debt Management: Managing how you spend can help keep your debt levels low, preventing high-interest charges from overwhelming your finances.

- Future Goals: By saving consistently, you can fund future goals, whether it’s buying a home, funding your child’s education, or retiring comfortably.

- Peace of Mind: Knowing that your finances are in order reduces stress and allows you to focus on other aspects of your life.

- Opportunity Creation: With savings in place, you’re in a better position to take advantage of investment opportunities or new ventures that could enhance your financial situation.

- Wealth Accumulation: Smart saving habits, such as investing in the right accounts, help build wealth over time, ensuring long-term financial growth.

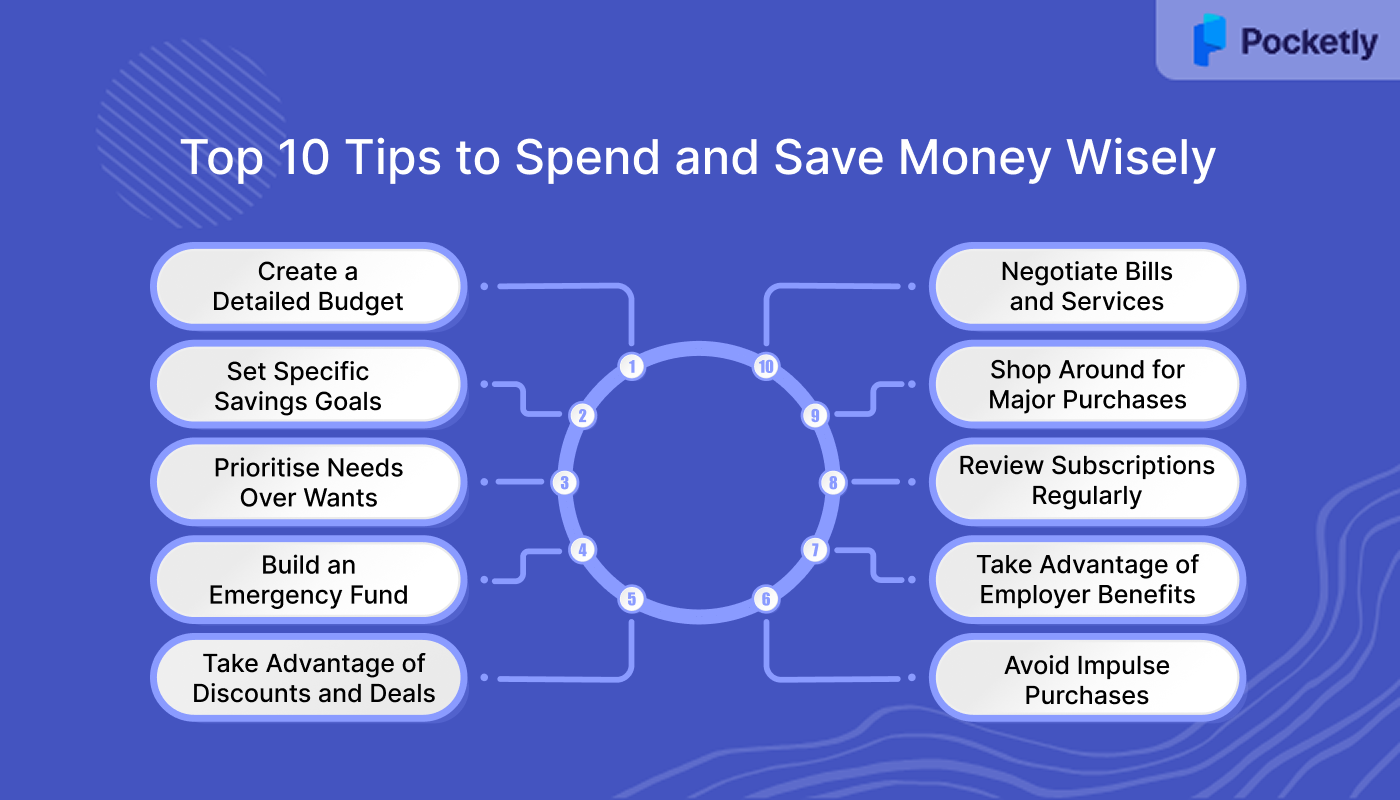

Top 10 Tips to Spend and Save Money Wisely

1. Create a Detailed Budget

A budget is more than just a list of expenses; it’s a blueprint for your financial life. By tracking where your money goes, you can identify areas to cut back and prioritise spending. For example, try using budgeting apps like Mint or YNAB (You Need a Budget) to track your income and expenses in real time.

Focus on essential spending, groceries, utilities, debt repayment—and trim discretionary expenses, like dining out or subscription services you no longer use.

2. Set Specific Savings Goals

Setting concrete savings targets makes saving feel purposeful. Whether it’s saving for an emergency fund, a vacation, or your retirement, clearly defined goals motivate you to stay on track. Start small if needed. For instance, aim to save a set percentage of your monthly income, such as 10%.

Setting up automatic transfers to your savings account ensures consistency and reduces the temptation to spend the money elsewhere.

3. Prioritise Needs Over Wants

It’s easy to confuse needs with wants, especially with the rise of consumer-driven marketing. Before making a purchase, pause and ask yourself, “Is this something I truly need, or is it an impulse buy?” For example, instead of buying new clothes every season, consider shopping secondhand or waiting for sales. Small lifestyle changes, like cooking at home more often rather than ordering takeout, can also add up over time, helping you save more without sacrificing quality of life.

4 Build an Emergency Fund

Life can be unpredictable, and having an emergency fund can prevent you from falling into debt when unexpected costs arise. Aim to save three to six months’ worth of expenses in a liquid, easily accessible account.

Consider setting up a high-yield savings account for better returns on your emergency fund. If you’re starting small, focus on building a $500 emergency fund as an initial goal to cover unexpected expenses like car repairs or medical bills.

5. Take Advantage of Discounts and Deals

Smart shopping can be a game-changer. Always look for discounts, cashback offers, or coupons before making purchases, whether it’s for groceries, gadgets, or clothing. Use apps like Honey or Rakuten to find online deals or cashback opportunities.

Additionally, consider buying in bulk for household essentials or taking advantage of seasonal sales for bigger-ticket items. By being mindful of how and when you purchase, you can maximise value without overspending.

6. Avoid Impulse Purchases

Impulse buying can quickly derail your budget. To combat this, try implementing a 24-hour rule: before purchasing something non-essential, wait 24 hours to assess if it's truly needed.

For example, if you're eyeing a new gadget, give yourself a day to think it over. This simple step can prevent you from buying on a whim and help you save money for more meaningful purchases.

7. Take Advantage of Employer Benefits

Many employers offer benefits that can save you money, such as contributions to retirement funds, health savings accounts (HSAs), or commuter benefits. Make sure you're fully utilising these options.

For instance, contributing to your employer's retirement plan, especially if they offer matching contributions, is essentially free money that can help secure your financial future.

8. Review Subscriptions Regularly

Subscriptions for streaming services, magazines, and apps often go unnoticed until they start adding up. Take time each month to review your subscriptions and cancel any that you don’t use. You can also consider downgrading to a less expensive plan.

Apps like Trim can help identify subscriptions you might have forgotten about, making it easier to cut unnecessary costs.

.9 Shop Around for Major Purchases

For big-ticket items like electronics or appliances, don’t settle for the first price you see. Shop around, compare prices, and wait for sales events like Black Friday or seasonal clearances. You can also look for refurbished items, which are often in excellent condition and come at a fraction of the price of new ones.

10. Negotiate Bills and Services

Many people don’t realise that bills for services like cable, internet, and insurance are often negotiable. Call your service providers and ask for a better rate, especially if you’ve been a long-time customer. You’d be surprised how often companies are willing to offer discounts to keep you as a customer.

For example, renegotiating your insurance premium or asking for a retention offer from your internet provider could save you hundreds over the course of a year.

What Saving Goals Should You Set to Help You Save Money?

Here’s how you can approach both short-term and long-term savings:

Save for the Short Term (1-3 Years)

Short-term savings typically cover goals that you want to achieve within the next 1 to 3 years. These could be for an emergency fund, a vacation, or buying a car. Since the time frame is relatively short, it's important to keep your money accessible and safe. We can divide the savings for the short term into 3 buckets:

- Emergency Fund: Aim to set aside 3 to 6 months' worth of living expenses in a high-yield savings account. This provides a cushion for unexpected events, like medical bills or urgent repairs.

- Vacation Fund: If you plan to take a vacation soon, break down the total cost and set a monthly savings target. Automating transfers to a dedicated savings account can make this process easy.

- New Car Fund: If buying a car is on your radar, start saving for a down payment. Rather than taking out a large loan, having a significant amount saved will lower your monthly payments and interest rates.

Save for the Long Term (4+ Years)

Long-term savings are typically for goals like retirement, purchasing a home, or funding your children's education. Since these goals are further down the road, you can afford to take on slightly more risk in exchange for higher returns.

- Retirement Fund: Contribute regularly to retirement accounts like a 401(k) or IRA. If your employer offers matching contributions, aim to contribute at least enough to receive the full match. The earlier you start, the more compound interest can work in your favour.

- Home Down Payment: If buying a home is a long-term goal, aim to save for at least 20% of the down payment. This will help you avoid private mortgage insurance (PMI) and secure better loan terms. Consider a mix of savings and low-risk investments like index funds.

- Education Fund: If you’re saving for your child’s education, a 529 plan can be a tax-advantaged way to save. Start contributing regularly to build a significant amount by the time they’re ready for college.

Long-term savings benefit from investment strategies like stocks, bonds, and retirement accounts, where the money has time to grow.

How to Automate Your Savings: Tips for Building Financial Discipline

- Set Up Automatic Transfers with Your Bank: Most Indian banks, including Axis Bank, IDFC First Bank, and ICICI Bank, offer the option to schedule recurring transfers from your salary or checking account to a savings account to promote disciplined saving habits.

- Utilise Recurring Deposits (RDs): Banks offer RDs where a fixed amount is automatically debited from your account monthly and invested for a predetermined period. This is ideal for short-term savings goals.

- Invest in Systematic Investment Plans (SIPs): Platforms such as ET Money and Bajaj Finserv allow you to set up SIPs, where a fixed amount is invested in mutual funds at regular intervals. This method uses the power of compounding and rupee cost averaging.

- Maximise Salary Deductions: Contribute a portion of your salary to the Employee Provident Fund (EPF) and National Pension Scheme (NPS). These contributions are deducted automatically and offer tax benefits under Section 80C.

- Use Financial Apps with Auto-Save Features: Apps like Fi Money and Gullak offer features that automatically transfer small amounts into savings or investment instruments like digital gold.

- Automate Bill Payments and Debt Repayments: Set up auto-debit mandates for recurring expenses such as utility bills, loan EMIs, and credit card payments. This ensures timely payments and prevents late fees.

Even with automated savings strategies in place, unexpected expenses can still throw off your financial plans. One way to prepare for such emergencies is by setting up automatic transfers, recurring deposits, and SIPs. You can build financial security without having to think about it. But what happens when savings alone aren't enough to cover those urgent costs? In such situations, Pocketly can come to your rescue.

Pocketly: Your Trusted Digital Lending Platform for Quick Loans

Pocketly is a digital lending platform designed to offer fast and easy access to personal loans. With a simple application process and minimal documentation, Pocketly makes it easier for you to manage your finances.

Whether you need funds for emergencies, personal expenses, or investments, Pocketly provides a seamless solution with flexible repayment options.

- Loan Amount: Borrow anywhere between ₹1,000 to ₹25,000.

- Interest Rate: Low interest rates starting from just 2%.

- Processing Fee: Transparent fee structure ranging from 1% to 8%.

- Minimal KYC: Simplified KYC process with minimal paperwork required.

- No Physical Documentation: Enjoy a fully digital, paperless loan application process.

- Flexible EMI Repayment: Choose flexible EMIs to suit your financial situation.

Conclusion

Effective money management isn’t about drastic changes—it’s about making small, consistent choices that lead to financial stability. By adopting smart saving and spending habits, you can gain more control over your financial future, whether it’s managing daily expenses or planning for bigger goals like retirement. Setting clear savings goals, avoiding impulse purchases, and automating your savings are all steps that can help ensure long-term financial security.

Pocketly is your go-to digital lending platform for quick and easy loans, offering flexible loan amounts with minimal documentation. Whether you need funds for an emergency or a personal goal, Pocketly provides low-interest loans with flexible repayment options.

Download Pocketly now for iOS or Android to experience hassle-free loans with low interest and no physical documentation required.

FAQs

1. How can I grow my savings?

To grow your savings, consider investing in options like mutual funds, stocks, or high-yield savings accounts. Diversifying your investments allows your money to work harder for you over time.

2. How do I prioritise my savings goals?

Identify your financial priorities by considering the time frame and urgency of each goal. Short-term needs like an emergency fund come first, followed by long-term goals like retirement.

3. What is the 10/20/30/40 rule?

The 10/20/30/40 rule suggests allocating your income into four categories: 10% for savings, 20% for debt, 30% for living expenses, and 40% for discretionary spending.

4. What is the 50/30/20 budget?

The 50/30/20 budget splits your income into three categories: 50% for needs (housing, bills), 30% for wants (entertainment, dining), and 20% for savings and debt repayment.

5. Is saving 50% of my salary ideal?

Saving 50% of your salary is an excellent strategy if feasible, as it builds wealth quickly. However, balance is key; ensure your essential needs and quality of life aren’t sacrificed.