When was the last time you visited a bank branch? Probably ages ago, right? From splitting bills to paying your rent, almost everything now happens through your phone. Digital tools have turned everyday transactions into something seamless, smart, and instant.

The shift is massive. In 2024, India recorded almost 164 billion digital payments, a significant jump from previous years. This surge highlights just how deeply digital finance is woven into your daily life, whether it’s mobile wallets or instant lending apps.

In this blog, you’ll find out what digital finance really means, how it benefits you, and the technologies behind it. We’ll also give a sneak peek into the future trends of digital money and tips to stay ahead.

A Quick Snapshot:

- Digital finance uses technology to simplify banking, payments, and lending for faster, easier money management.

- Technologies like AI, blockchain, and cloud computing make financial systems safer, faster, and data-driven.

- Examples include digital lending, mobile banking, digital wallets, and online insurance and investment platforms.

- Challenges like cybersecurity, data privacy, and infrastructure gaps exist, but future trends promise wider access and innovation.

- As technology grows, digital finance will continue shaping smarter, more inclusive financial solutions worldwide.

What Exactly Is Digital Finance?

People barely go to banks anymore. From paying bills to investing, everything happens through a few taps on your phone. That’s digital finance: the smarter, faster version of traditional financial services, powered entirely by technology.

In simple terms, digital finance is about using digital tools and platforms to manage money. Instead of endless paperwork or waiting for approvals, you can now handle your finances in minutes, from anywhere. Pretty convenient, right?

But digital finance isn’t just about convenience; it’s changing how you think about and use money every single day. Let’s see how it actually benefits you.

Also Read: Understanding Digital Payments: Meaning, Types, and Functions

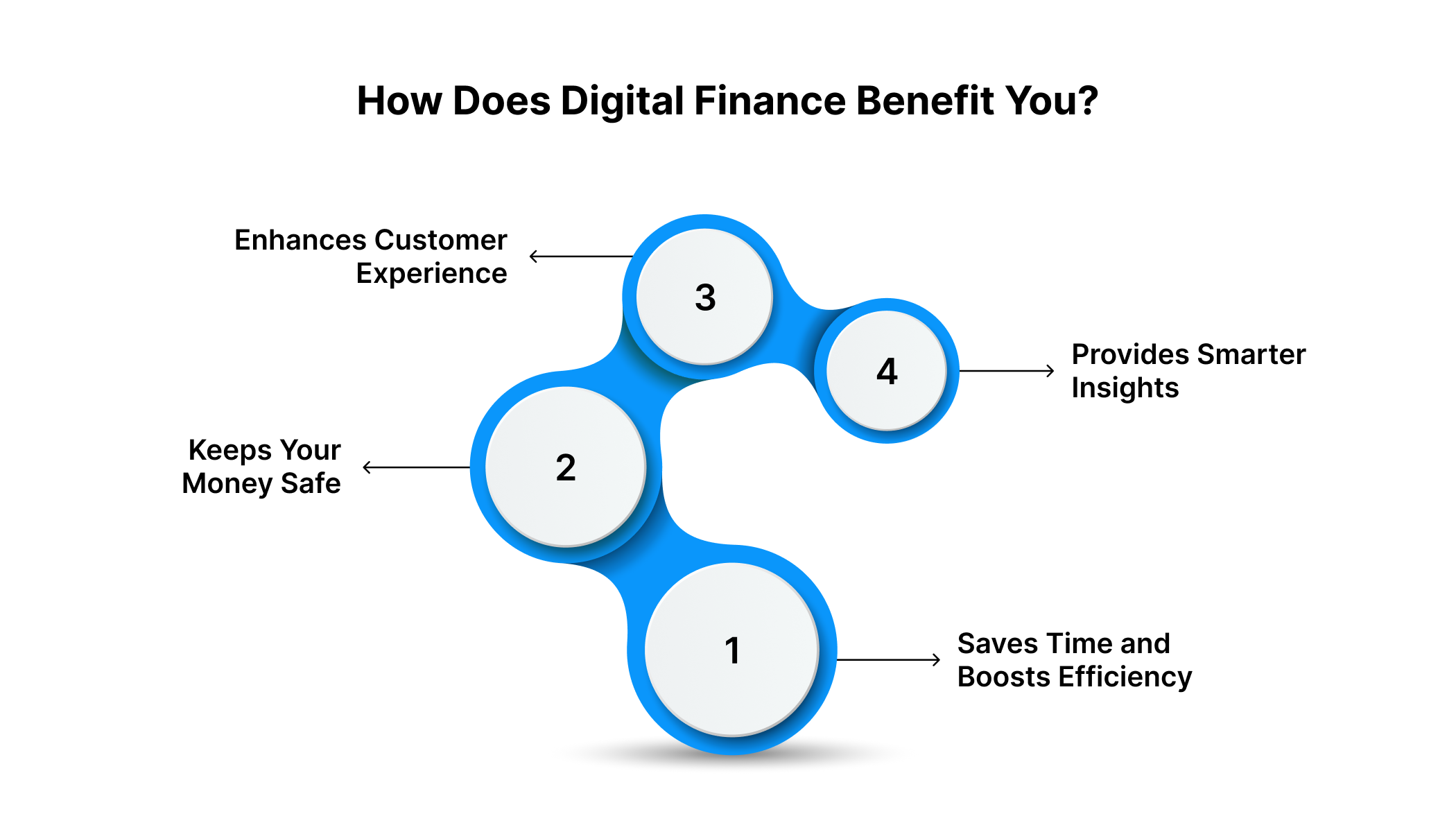

How Does Digital Finance Benefit You?

If you’ve ever scanned a QR code at a café or paid rent online, you’re already using digital finance. Here’s how it’s making your financial life smoother:

Saves Time and Boosts Efficiency

Digital finance takes the hassle out of handling money. Whether it’s splitting bills or tracking expenses, everything happens in seconds on your phone. No need to fill out forms; you stay in control anytime, anywhere.

Keeps Your Money Safe

Online transactions can sound risky. Thankfully, most digital finance platforms are built with strong security systems to protect your data. It’s safer than carrying cash or sharing card details manually.

Enhances Customer Experience

Today’s generation expects smooth service, and digital finance delivers just that. You can get instant access to loans, credit, or payments right when you need them. It’s quick, reliable, and designed for people who can’t afford to waste time.

Provides Smarter Insights

Most apps now come with features that track spending, analyse patterns, and send helpful reminders. You start noticing where your money goes and how to use it better. Over time, that awareness helps you build real financial confidence.

With all these benefits, it’s clear that digital finance helps you stay in control of your money without the usual stress. But what exactly makes this transformation possible? Read on to explore some cool technologies driving this change.

Key Technologies Shaping Digital Finance

Behind every tap, transfer, and transaction is a powerful tech stack working in the background. Here are some of the key technologies making digital finance faster, safer, and smarter:

- Artificial Intelligence (AI): Detects fraud, gives spending insights, and even suggests better saving or loan options.

- Machine Learning (ML): Learns from your financial behaviour to make smarter, personalised recommendations.

- Blockchain: Keeps your transactions transparent and secure — especially helpful for cross-border payments.

- Cloud Computing: Stores and processes data instantly, so your apps run smoothly 24/7.

- Big Data Analytics: Helps banks and fintechs understand user needs and create more relevant products.

- APIs (Application Programming Interfaces): Connect apps and platforms like your budgeting app with your bank for a seamless experience.

- SaaS (Software as a Service): Let fintechs provide advanced tools to you without heavy setup or cost.

Tech sounds great in theory, but how does it actually change your day-to-day money habits? Let's find out.

Examples Of Digital Transformation In Finance

Think your smartphone is just for social media and memes? Think again. Digital finance is quietly reshaping how you pay, borrow, and invest, often without you even noticing. Here are a few real-life examples:

UPI & QR Payments

- Transfer money instantly between bank accounts, even late at night or during weekends.

- Pay at small street vendors, cafes, or tuition centres without needing cash.

- Track your transactions easily in one app, making budgeting simpler.

- Safe and secure, with in-built fraud protection and PIN authorisation.

Example: You buy a cup of coffee before class and pay instantly through UPI instead of fishing for change. That’s digital finance saving you time and effort.

Digital Lending Platforms

- Apply for short-term loans or instant cash without visiting a bank branch.

- Loan approval is based on digital records and financial behaviour, reducing paperwork.

- Flexible repayment options help you manage small emergencies like laptop repairs or project expenses.

- Quick disbursal ensures you get funds when you need them the most.

Example: You suddenly need around ₹7,000 to cover an unexpected bill. Instead of stressing, you turn to a digital lending platform like Pocketly, apply online, get quick approval, and have the money credited within minutes.

Insurance & Investment Platforms

- Compare multiple policies and choose plans suited to your lifestyle, all online.

- Invest in mutual funds or start small SIPs without visiting financial advisors.

- Receive personalised suggestions based on spending habits, goals, and risk tolerance.

- Easy tracking of premiums and investments in one dashboard.

Example: You’ve just started your first job and want to save while staying protected. A digital insurance and investment platform lets you compare plans, buy coverage, and start investing, all in minutes.

Digital Wallets & Mobile Banking

- Store money digitally and pay instantly without cash or cards.

- Track all transactions in one app to plan and control your spending.

- Recharge phones, pay utility bills, or transfer money to friends easily.

- Often comes with rewards, cashback, or discounts for regular use.

Example: You’re travelling and your Metro Card runs out of balance. With a digital wallet, you can instantly top it up or buy a ticket online with no queues or cash needed.

These tools are revolutionary, but with new tech comes new hurdles. Let’s explore the common challenges that often come in the way.

Also Read: Guide to Best Digital Wallets in India

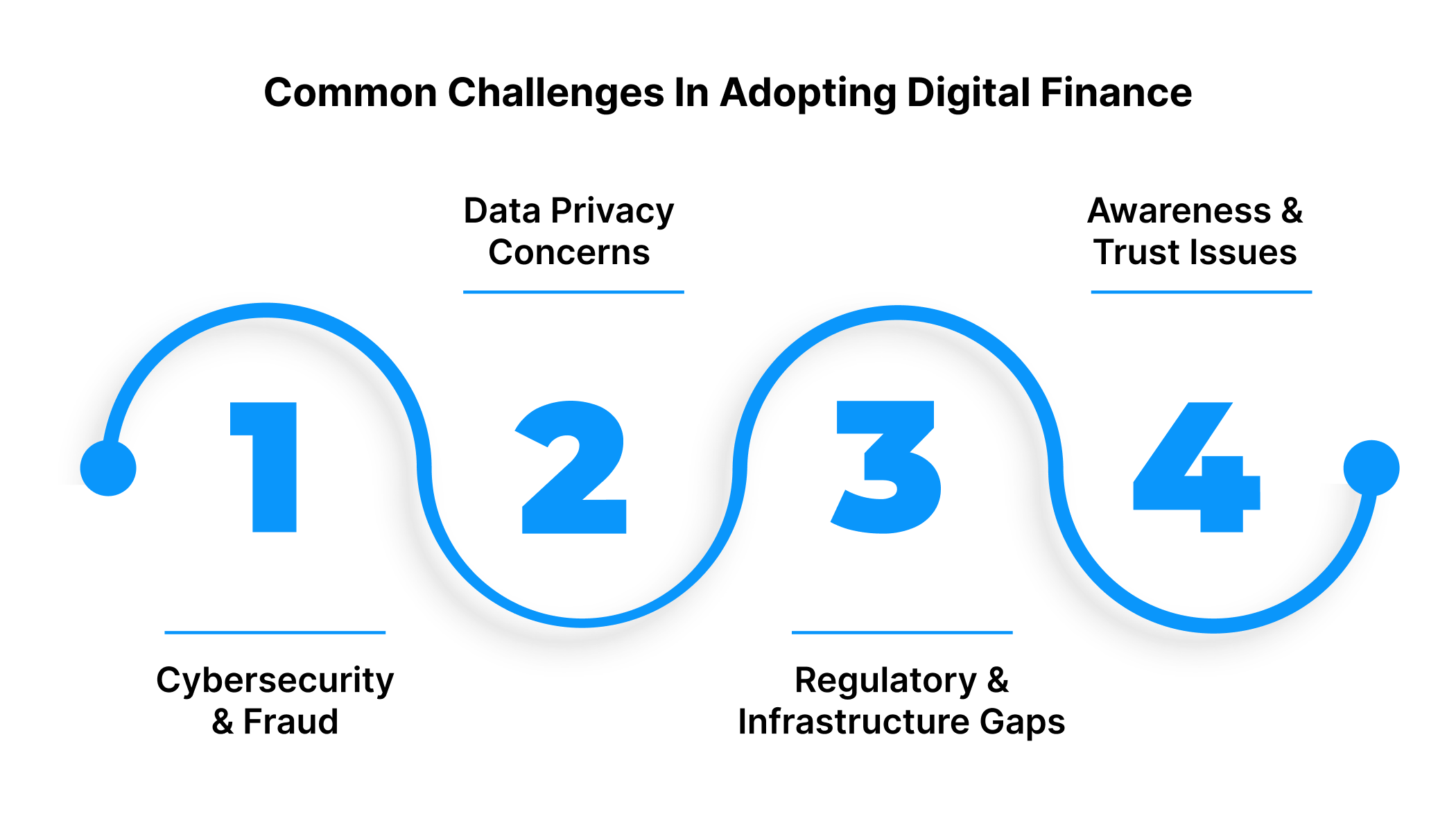

Common Challenges In Adopting Digital Finance

Digital finance is convenient, but it’s not without risks. Even as apps simplify payments and lending, there are some precautions you need to consider:

Cybersecurity & Fraud

- Problem: Online platforms can be targeted by phishing attacks, identity theft, or account hacking.

- Solution: Use strong passwords, enable two-factor authentication, and regularly monitor account activity.

Data Privacy Concerns

- Problem: Sharing sensitive financial information online can risk breaches or misuse.

- Solution: Stick to apps with secure encryption and clear privacy policies; avoid unsecured networks.

Regulatory & Infrastructure Gaps

- Problem: Digital finance often moves faster than regulations, and rural areas may lack proper access.

- Solution: Check that platforms comply with local regulations and use trusted apps; plan for limited connectivity if needed.

Awareness & Trust Issues

- Problem: Many hesitate to adopt new apps due to fear of scams or confusion with features.

- Solution: Learn about safe usage, read app reviews, and start with small transactions to build confidence.

Understanding the risks also sets the stage for what’s next, i.e., the exciting future of digital finance.

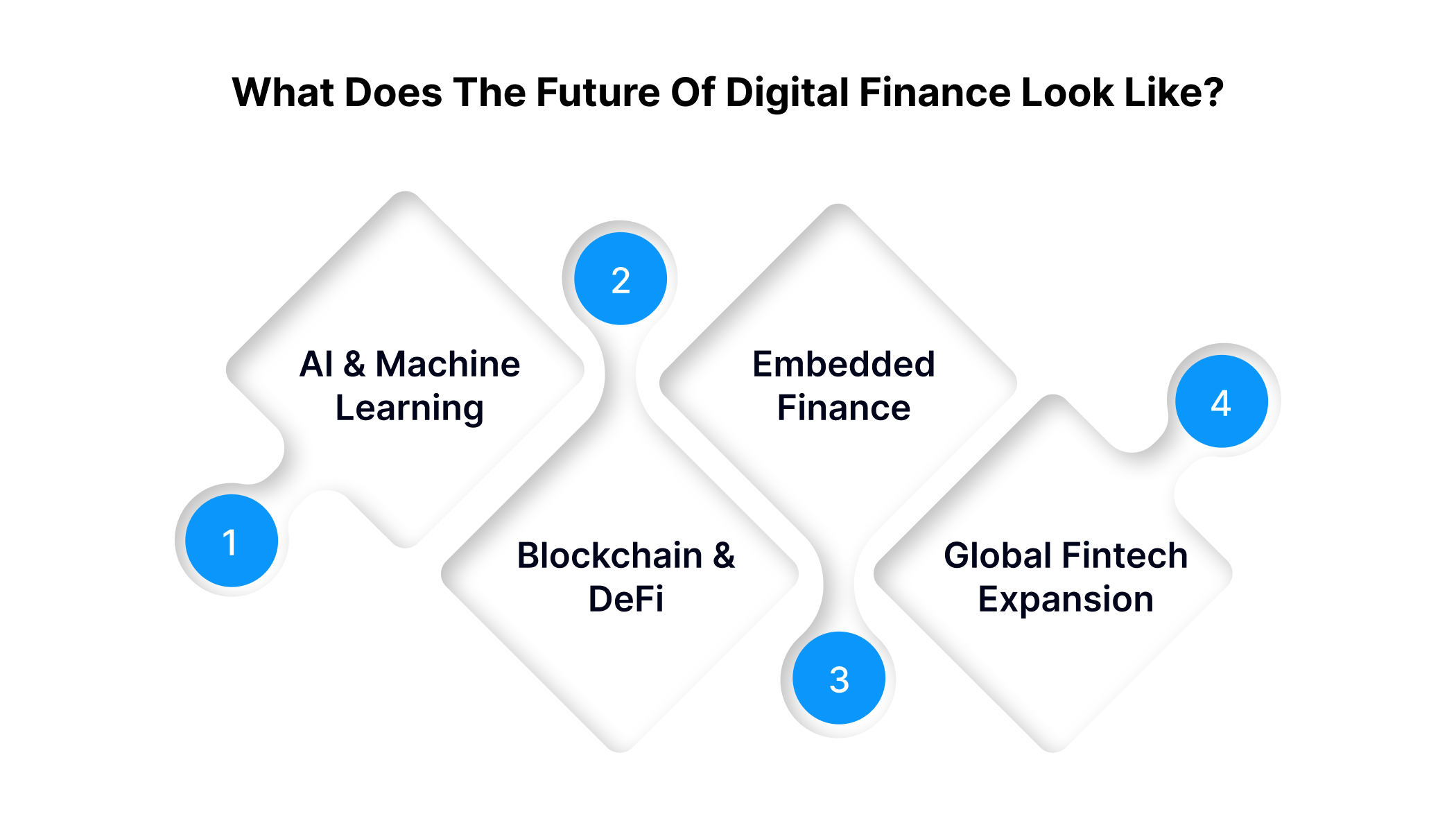

What Does The Future Of Digital Finance Look Like?

Imagine a world where your phone doesn’t just manage your money, but also helps it grow intelligently. That’s the future digital finance is building right now. Here’s a peek at what’s ahead:

AI & Machine Learning

AI and machine learning are helping digital finance become smarter. They analyse patterns, detect fraud, and provide personalised insights, making your transactions safer and guiding you to better decisions. For instance, it could alert you if a suspicious transaction appears in your account.

Blockchain & DeFi

Blockchain and DeFi are set to make transactions secure, transparent, and faster. They can remove traditional banking hurdles, expand access, and allow smoother handling of payments. This means you’d instantly send money to a friend in another city without worrying about delays or hidden fees.

Embedded Finance

Embedded finance integrates payments, loans, and savings directly into apps you already use. You can manage money seamlessly without switching platforms, making everyday transactions far more convenient. For example, you could pay for groceries, split bills, and save for tuition fees in one app.

Global Fintech Expansion

The entry of international fintech players brings fresh technology and competitive offerings to India. Users can expect better products and improved accessibility. This could mean access to smarter budgeting tools or new ways to invest small amounts of money easily.

Also Read: Digital Lending In India: Future Trends and Insights

How Pocketly Makes Digital Finance Truly Accessible

As everything around us goes digital, money emergencies don’t have to slow you down. Whether it’s an unexpected bill or a mid-month cash crunch, Pocketly helps you handle it smoothly through a fully online process.

Pocketly is a digital lending platform (not an NBFC) that offers short-term personal loans ranging from ₹1,000 to ₹25,000, with no collateral or long waiting time. With interest rates starting at 2% per month and a processing fee of 1–8%, it’s designed to keep things transparent and hassle-free.

Getting started is simple:

- Quick Sign-up: Create your account in just two clicks.

- Paperless KYC: Upload Aadhaar and PAN for instant verification.

- Choose Loan Details: Select your amount and repayment tenure.

- Instant Disbursal: Once approved, funds are transferred directly to your bank account.

With 24/7 support, no hidden charges, and flexible repayments, Pocketly brings the speed and simplicity of digital finance right to your fingertips.

Final Thoughts

As money becomes more digital than ever, understanding digital finance isn’t just useful; it’s a necessity. From UPI payments to online lending and investment platforms, technology is changing how you manage, spend, and even think about money.

Adapting to this change helps you stay in control of your finances, make smarter decisions, and access financial services faster and more securely. Whether you’re planning your next purchase or handling a sudden expense, the digital shift is shaping a smarter, more convenient financial future for everyone.

And when those unexpected expenses show up, Pocketly is there for you. Our fully digital lending platform helps you cover short-term cash needs quickly, without collateral, long paperwork, or hidden charges. Download Pocketly today on iOS or Android to make your digital finance journey just a little smoother.

FAQ’s

Do you think digital finance is safer than carrying cash? Why or why not?

Digital finance is generally safer than carrying cash because transactions are encrypted and traceable. While cash can be lost or stolen, digital payments also allow you to monitor spending and detect fraud quickly.

How to pay utility bills online using digital finance tools?

You can pay utility bills by linking your bank account or card to a digital payment app. Select the biller, enter the required details, confirm the amount, and authorise the payment.

What are the 4 types of digital money?

The four types include digital wallets, cryptocurrencies, central bank digital currencies (CBDCs), and prepaid digital cards. Each allows electronic payments without physical cash.

Are digital finance and fintech the same?

Not exactly. Fintech refers to the technology companies creating financial solutions, while digital finance describes the broader use of technology to manage money digitally.

How to link a bank account to a digital finance app securely?

Use official app channels, enable two-factor authentication, and verify your bank credentials within the app. Avoid sharing sensitive information outside trusted platforms.