Why do so many young Indians feel broke even after getting their first job or side income? It isn’t about how much they earn, it’s about how they spend.

The spending patterns of students and early professionals show that money decisions are increasingly emotional, convenience-driven, and shaped by instant access to credit.

Recent data shows that Indian households now spend an average of ₹56,000 per quarter, a 33% rise since 2022.

This blog looks at what’s driving these shifts, how technology and quick credit access influence spending behaviour, and what these changing patterns say about young India’s approach to money.

Key Takeaways

- Spending habits in India are shifting fast — young earners now spend more on lifestyle and experiences than essentials, driven by digital convenience and instant payments.

- Digital payments dominate — 99.8% of transactions are now digital, making spending quicker, easier, and more frequent across all income groups.

- Short-term loans are reshaping financial behaviour — micro-credit fills month-end gaps and supports flexible cash flow for students and young professionals.

- Financial awareness is rising — over 100 million Indians now track their credit scores, showing a stronger link between spending and credit discipline.

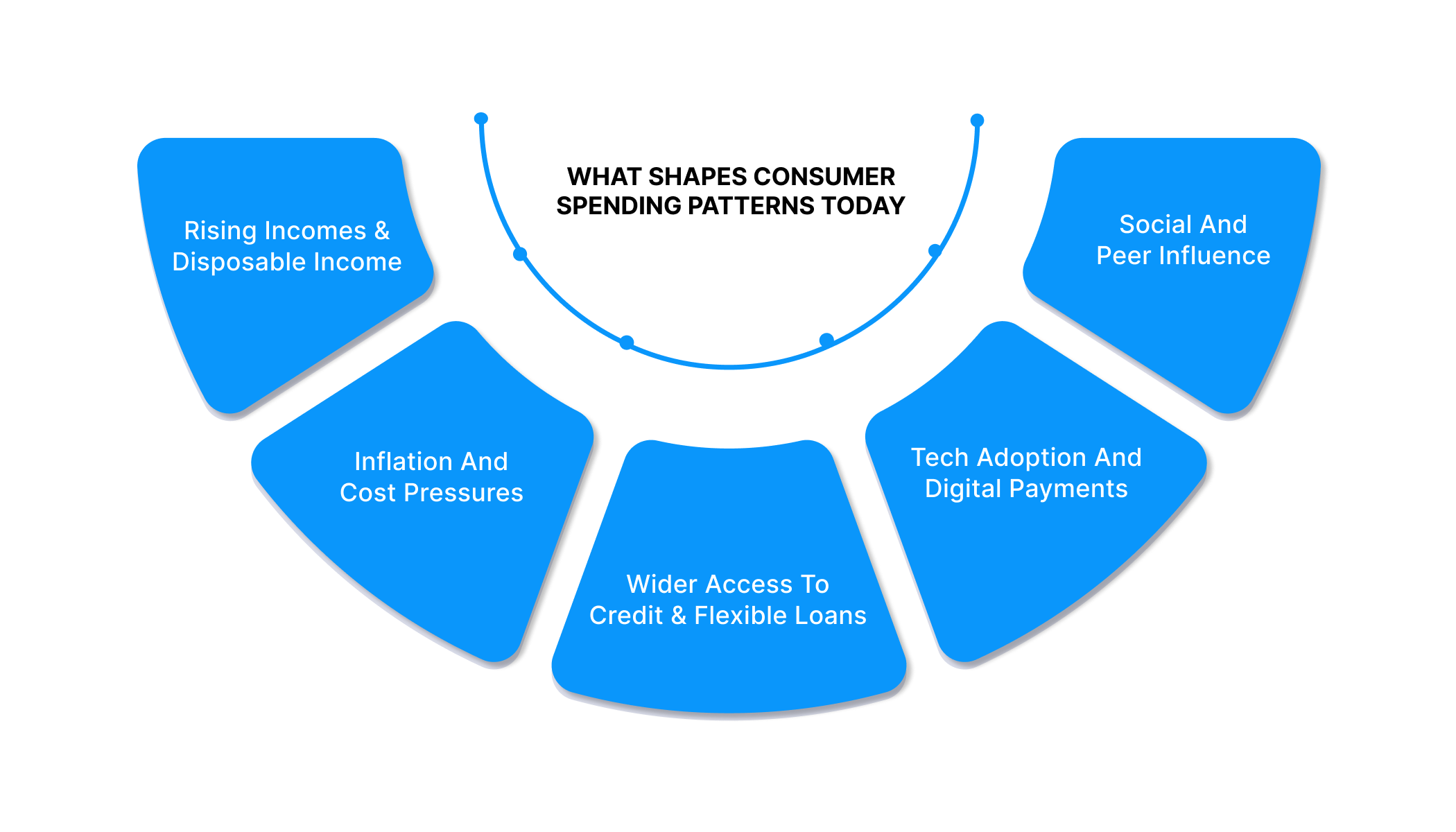

What Shapes Consumer Spending Patterns Today

Spending patterns describe how people distribute their income between essentials, lifestyle choices, savings, and borrowing.

Looking at recent data shows that spending is shifting as non-food items now make up 60% of per capita monthly expenditure in urban areas, and 53% in rural areas.

That means many households now spend more on non-essentials, transport, clothing, and entertainment than on basic food or staples.

Key forces behind changing spending habits

1. Rising incomes and disposable income

Average per-capita income and disposable income have been increasing in recent years. As income rises, households gradually shift from mainly spending on necessities to including lifestyle choices and occasional splurges.

2. Inflation and cost pressures

With rising prices, households may adjust how they divide their spending — sometimes cutting discretionary spending, other times relying on credit or short-term loans to manage cash flow. Data from recent national surveys (like HCES 2023–24) show increases in overall consumption, signalling both inflation and incremental spending capacity.

3. Wider access to credit and flexible loans

When borrowing options become easier, through microloans or short-term credit, people might use loans rather than savings to fund non-essential or urgent needs. This affects how spending patterns change: more comfort with credit can shift purchases earlier or more frequently.

4. Tech adoption and digital payments

As payments, banking, and credit move online, it becomes easier and faster to spend. This convenience contributes to increased discretionary spending. According to a recent retail-sector report, young consumers accounted for 43% of India’s total consumption in 2025.

5. Social and peer influence

Young people tend to follow trends in fashion, gadgets, travel, and experiences. These social factors shape spending more than just need or necessity.

For many, spending becomes influenced by lifestyle choices rather than bare essentials, especially when income or credit allows it.

5. How different generations behave

Spending habits aren’t just shaped by income, they also reflect values, priorities, and access to credit. Each generation manages money differently, revealing how attitudes toward saving and borrowing evolve.

Gen Z

- In 2025, Gen Z is expected to contribute about 43% of India’s consumption, with direct spending power estimated at around US $250 billion.

- Many Gen Z individuals across India show an early interest in saving — a 2024 report found that over 60% began saving before age 21.

- Despite interest in savings, a significant portion of young workers live “paycheck to paycheck,” indicating tight budgets and a need for flexible credit or short-term loans.

Millennials

- Millennials also face financial insecurity, along with Gen Z, many struggle to meet monthly expenses or build long-term savings.

- Their spending tends to balance essentials with lifestyle choices, but they may be more cautious about borrowing than younger groups.

Older generations / Traditional households

- In contrast, households depending on older generations or with fixed incomes still allocate larger portions to essentials and less to lifestyle or borrowing.

- Their spending shares reflect older patterns: a higher proportion on food, staples, and savings, with much lower reliance on credit or lifestyle spending.

If your spending habits are shifting with your goals, your credit options should match that pace. Pocketly offers small, flexible loans that fit real-life needs, whether it’s managing a tight month, funding a plan, or simply keeping things steady between paydays.

Explore how Pocketly can help you stay financially confident without overcommitting.

Also Read: Effective Debt Management Strategies and Tips

The biggest change in how Indians manage money isn’t about what they buy, it’s about how they pay. Digital tools have turned every smartphone into a spending gateway.

How Technology and Digital Payments Changed the Way India Spends

Technology has shifted money decisions from planned to instant. What once required queues or paperwork now happens through a few taps. This speed and simplicity mean people act on impulse more often, blending payments and borrowing into their daily routine.

What’s changed

- Digital payments now make up 99.8% of all transactions by volume in India (H1 2025).

- The system Unified Payments Interface (UPI) handled around 172 billion transactions in 2024, up from about 118 billion in 2023.

- Daily UPI transaction values recently crossed ₹ 90,000 crore (in 2025), showing people are more comfortable using digital payments even for bigger spends.

What this means for spending behaviour

- Payments at shops, for food, transport, subscriptions, or services are made instantly on phones. That removes friction, making it easier to spend without overthinking.

- Borrowing or credit has become part of everyday life, with instant-loan apps and digital lenders giving access to money fast. That lowers the barrier to spending when cash is tight.

- For people juggling multiple needs, education, travel, and bills, digital payments offer convenience and flexibility.

Also Read: Understanding How Positive Cash Flow Works and Why It's Important

Are Young Indians Spending More or Spending Smarter?

Rising income and easier credit have made spending more frequent, but not always careless. Many young Indians are learning to balance comfort with caution, tracking expenses, comparing offers, and using short-term credit to manage timing and avoid overspending.

What trends show

- Young users increasingly spend on food delivery, transport, online subscriptions, gadgets, anything that saves time or gives comfort.

- There’s a shift from “buy and wait” to “buy now, pay later, or borrow small.” Short-term, small-ticket borrowing (under ₹25,000) is gaining popularity.

- As one recent report shows, digital lenders disbursed ₹97,381 crore in H1 2025, mostly through small personal loans.

- People use digital payments to grab deals, discounts, and cashback offers, making spending feel more planned, even when it’s frequent.

What smart spending looks like now

- Users compare deals and choose payment or loan modes that suit their cash flow rather than overspend.

- Short-term loans or credit are used for convenience or emergencies rather than long-term debt, loan amounts stay small, and repayment is quick.

- Spending behaviours balance immediate needs and future planning: basic expenses, lifestyle, occasional borrowing, and saving.

Also Read: Can Paying Bills Help Build a Credit Score?

What Do Spending Patterns Reveal About Financial Awareness

Many Indians are borrowing for regular needs, and more of them now check their credit history.

As of FY 2023–24, the number of consumers in India monitoring their credit profiles rose by 51% over the previous year, adding 43.6 million new users of credit-score tracking.

- Rising small-ticket personal loans and credit card borrowing have pushed household debt to 42.9% of GDP by mid-2024.

- Non-housing retail loans (personal, credit card, and consumption) now account for over half of household borrowing, up from the traditional dominance of home loans.

Those numbers suggest people are using credit more, but they are also increasingly aware of how borrowing affects their credit health.

What this awareness looks like and the risks it signals

The growing use of self-monitoring tools shows that people want to track their debt levels and repayment history rather than ignore them.

At the same time, short-term loans are rising fast, for instance, fintechs issued 10.9 crore personal loans in FY 2024–25. But recent data shows that stress, overdue rates for small-value loans reached 3.6% by March 2025.

For many young borrowers, small loans fill cash flow gaps or meet needs. But growing delinquencies show payback capacity matters.

Also Read: How Credit Risk Models Help Borrowers Get Loans Quickly

Furthermore, for lenders and fintechs, these shifts aren’t just numbers, they’re signals. Understanding how people spend is the first step to building products that genuinely fit their lives.

How Businesses Can Respond to Evolving Spending Patterns

Evolving spending and borrowing habits in India offer lenders and fintech firms an opportunity to build products that meet real needs. Data from 2024–25 shows most digital loans now come from fintech lenders, signalling both demand for small, flexible credit and room for responsible lending.

1. Match Products to Borrower Cash Flow

To align with how young earners manage income and expenses, lenders should design products that match their real financial rhythm rather than traditional repayment cycles.

- As of December 2024, 92 % of all fintech-originated personal loans were small-ticket (under ₹50,000).

- For platforms focused on students and young professionals — who often face irregular income or month-end gaps, microloans and short-term personal loans align with their cash flow cycles.

- Lenders can offer smaller loan amounts with reasonable processing fees, flexible repayment terms, and clear repayment schedules to avoid overburdening borrowers.

2. Promote Responsible Borrowing

Rising participation from younger users means lenders must combine convenience with education to encourage financially healthy borrowing.

- Users under 30 now make up the bulk of fintech borrowers (61%).

- Lending firms can provide tools such as credit-score dashboards, reminders before EMI due dates, or simple calculators to help borrowers visualise repayment capacity before borrowing.

- Financial-awareness content (budgeting tips, debt-management advice) alongside loan offers can help build trust and protect users — leading to healthier portfolios and lower default risks.

3. Use Behavioural and Demographic Insights to Tailor Outreach

Reaching borrowers effectively requires communication that reflects their daily decisions and local realities, not just broad marketing messages.

- Fintech borrowers increasingly come from a mix of urban and semi-urban/rural areas, broadening the target beyond just metros.

- Communications should reflect the borrower's life stage (student, early-career, self-employed), income patterns (monthly salary vs. side income), and geographic diversity.

- For example, marketing short-term loans after typical paydays or during festival seasons can align with real financial needs, not impulse borrowing.

4. Plan for Growth But Manage Risk

As lending volumes climb, fintech firms need to scale with discipline, balancing opportunity with credit health and transparency.

- Fintech lenders in India now hold around ₹1.3 trillion in outstanding retail credit balances.

- At the same time, market reports note moderating growth in overall personal loan demand and increased regulatory scrutiny.

- For sustainability, firms should diversify their product lines to include higher-ticket, secured, or alternative credit products. At the same time, it maintains a clear focus on creditworthiness and repayment behaviour.

How Pocketly Makes Credit Simple, Transparent, and Human

Pocketly fills a growing need among young Indians for quick, responsible access to small loans. Where traditional lenders slow things down with paperwork and collateral, Pocketly offers an app-based model built for flexibility, trust, and speed.

Why Pocketly Stands Out

- Loans that Match Real Needs: Offers instant short-term loans from ₹1,000 to ₹25,000 — ideal for month-end gaps, education costs, or urgent expenses.

- No Collateral or Hidden Fees: Removes barriers that young borrowers face with banks. Every charge is visible before confirmation.

- Fast Access, Not Guesswork: Funds are disbursed directly to the user’s bank account within minutes after a quick KYC check.

- Smart Repayment Flexibility: Users can repay early or in parts without penalties, keeping control over their loan lifecycle.

- Focus on Financial Confidence: The app helps users build healthy credit habits and supports them with guidance and reminders rather than pressure.

Conclusion

As credit awareness grows and small-ticket loans become normalised, financial behaviour will continue to blend discipline with flexibility. People won’t just borrow to survive; they’ll borrow to stay agile, to act when it matters, and to make better use of their time and money.

In the next few years, the most successful financial tools will be those that keep pace with users’ lives, combining speed with trust and simplicity with control. That’s exactly where Pocketly stands.

Pocketly gives you access to small, quick loans whenever you need them, with full transparency and no hidden fees. Download the Pocketly app on iOS or Android and take charge of your spending with confidence.

FAQs

Q: How are small-ticket loans different from traditional bank loans?

A: Small-ticket loans, such as those from Pocketly, focus on speed and simplicity. They’re unsecured, processed digitally, and often disbursed within minutes — unlike bank loans that involve paperwork, longer approval times, and higher minimum amounts.

Q: Do short-term loans hurt credit scores?

A: Not if managed responsibly. Timely repayment of small loans can actually strengthen credit history and improve credit scores over time, helping young users build long-term financial credibility.

Q: Why are Gen Z and young professionals more likely to borrow digitally?

A: Convenience and control drive this preference. Digital platforms let them borrow, repay, and track activity in real time — fitting easily into mobile-first lifestyles where financial actions happen on the go.

Q: What risks come with the rise in quick digital credit?

A: The main risk is over-borrowing without full awareness of repayment terms. That’s why transparent lenders like Pocketly emphasise clear costs, flexible repayment, and reminders to prevent unnecessary debt stress.

Q: How can fintechs build trust with young borrowers?

A: By prioritising clarity over complexity. Showing fees upfront, providing financial education, and rewarding responsible repayment help fintechs stand out as reliable partners — not just lenders.