Positive cash flow is more than just a number on a balance sheet; it’s a fundamental pillar of financial health. Without it, you're stuck in a cycle of uncertainty, where even the best financial plans can collapse under the weight of mounting expenses.

It's the cushion that allows for growth, the stability that enables smart investments, and the safety net that protects you in lean times. Understanding how positive cash flow works isn’t just for accountants or business owners; it’s for anyone who wants control over their finances.

In this blog, we’ll explore how to create and maintain positive cash flow, and why it’s essential for anyone serious about securing their financial future.

Key Takeaways

- Positive Cash Flow is Essential for Financial Health: It ensures liquidity to cover daily expenses, manage debt, and fund business or personal growth without relying on external financing.

- Cash Flow is Not the Same as Profit: While profit is about revenue minus expenses on paper, cash flow reflects actual money movement and can be influenced by unpaid invoices or investments.

- Accounts Receivable Directly Impacts Cash Flow: Efficiently managing accounts receivable, such as shortening collection times and offering early payment incentives, can improve cash flow.

- Effective Cash Flow Management Requires Regular Monitoring: Consistent tracking of inflows and outflows, forecasting future cash needs, and adjusting for seasonal changes helps maintain healthy cash flow.

- Building a Cash Reserve is Crucial: Establishing an emergency fund helps ensure you can handle unexpected costs without disrupting operations or personal finances.

What is Positive Cash Flow?

Positive cash flow refers to the situation where the inflow of cash exceeds the outflow over a given period. It is crucial for sustaining daily operations, paying bills, and enabling growth without resorting to external financing. Unlike profit, which represents the difference between revenue and expenses on paper, cash flow focuses solely on actual cash movement.

Profit can be high while cash flow is negative if revenue is tied up in unpaid invoices or long-term investments. Maintaining positive cash flow ensures that you have enough liquidity to handle unexpected expenses and reinvest in opportunities that drive future growth.

Positive Cash Flow Example

Let’s consider a small business that sells handmade jewellery. In a given month, the business generates ₹100,000 in revenue from sales. During the same period, its expenses include ₹30,000 for raw materials, ₹15,000 for employee salaries, ₹10,000 for rent, and ₹5,000 for utilities.

Here’s how the cash flow looks:

- Total Revenue: ₹100,000

- Total Expenses: ₹60,000 (₹30,000 for materials + ₹15,000 salaries + ₹10,000 rent + ₹5,000 utilities)

Positive Cash Flow: ₹100,000 (Revenue) - ₹60,000 (Expenses) = ₹40,000 (Positive Cash Flow). In this example, the business has ₹40,000 in positive cash flow, meaning it has more income than expenses.

This surplus of ₹40,000 represents more than just a number on paper; it's the foundation for everything the business can achieve moving forward. The advantages of maintaining such a healthy cash flow extend far beyond immediate financial relief.

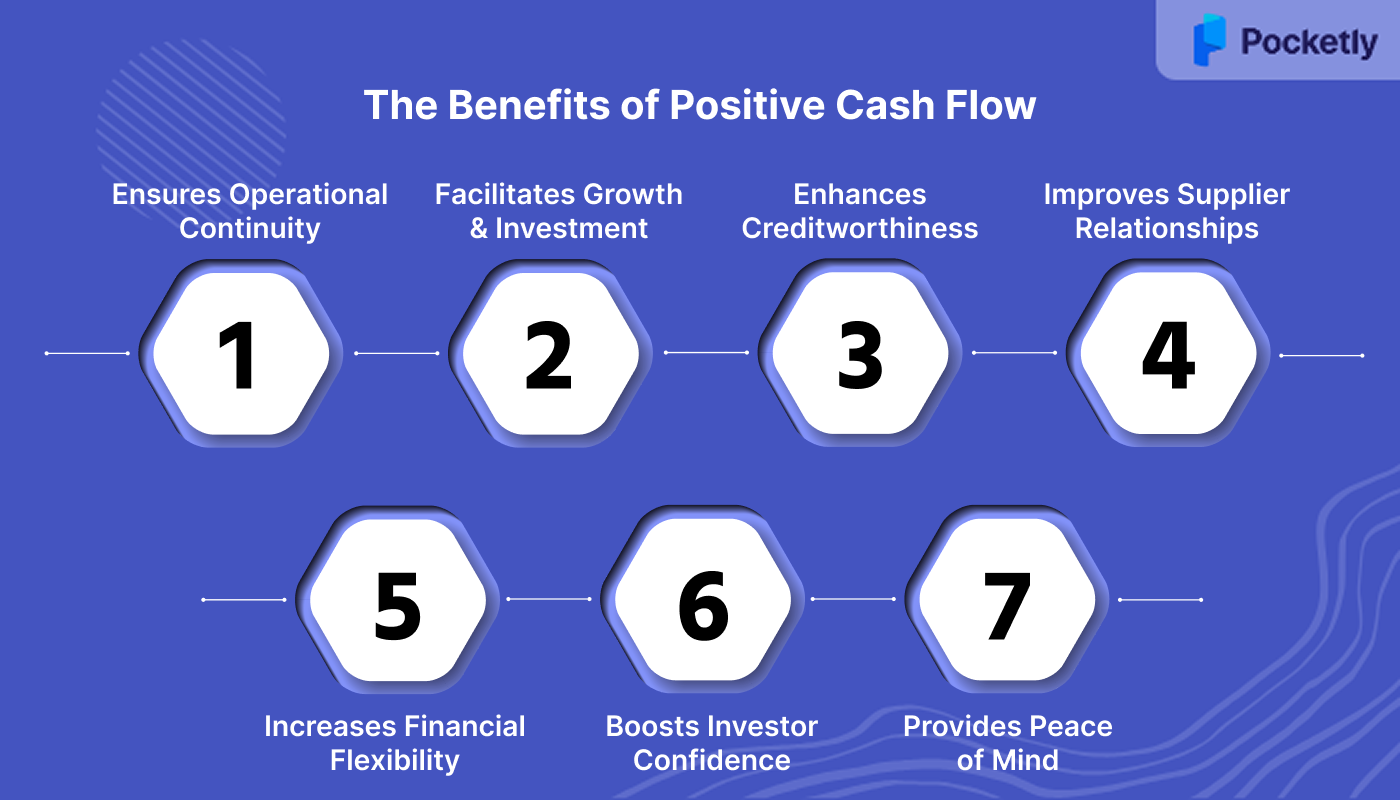

The Benefits of Positive Cash Flow

Positive cash flow is essential for financial stability and growth, both for individuals and businesses. It ensures you can cover daily expenses, manage debt, and avoid relying on credit. It also provides the resources needed for growth, reinvestment, and seizing new opportunities.

- Ensures Operational Continuity: Provides the liquidity needed to cover day-to-day expenses such as salaries, rent, and utilities, ensuring smooth business operations.

- Facilitates Growth and Investment: Enables reinvestment into the business for expansion, equipment upgrades, or new projects, fostering growth.

- Enhances Creditworthiness: Demonstrates financial stability to lenders and investors, potentially leading to better financing terms.

- Improves Supplier Relationships: Allows timely payments to suppliers, strengthening business relationships and possibly securing favourable terms.

- Increases Financial Flexibility: Offers the ability to navigate economic downturns or unexpected expenses without resorting to debt.

- Boosts Investor Confidence: Shows consistent cash generation, making the business more attractive to potential investors.

- Provides Peace of Mind: Reduces financial stress, allowing business owners to focus on strategic planning and innovation.

While recognising these benefits is important, achieving them requires deliberate action and consistent effort. The difference between businesses that thrive and those that struggle often lies in their approach to cash flow management.

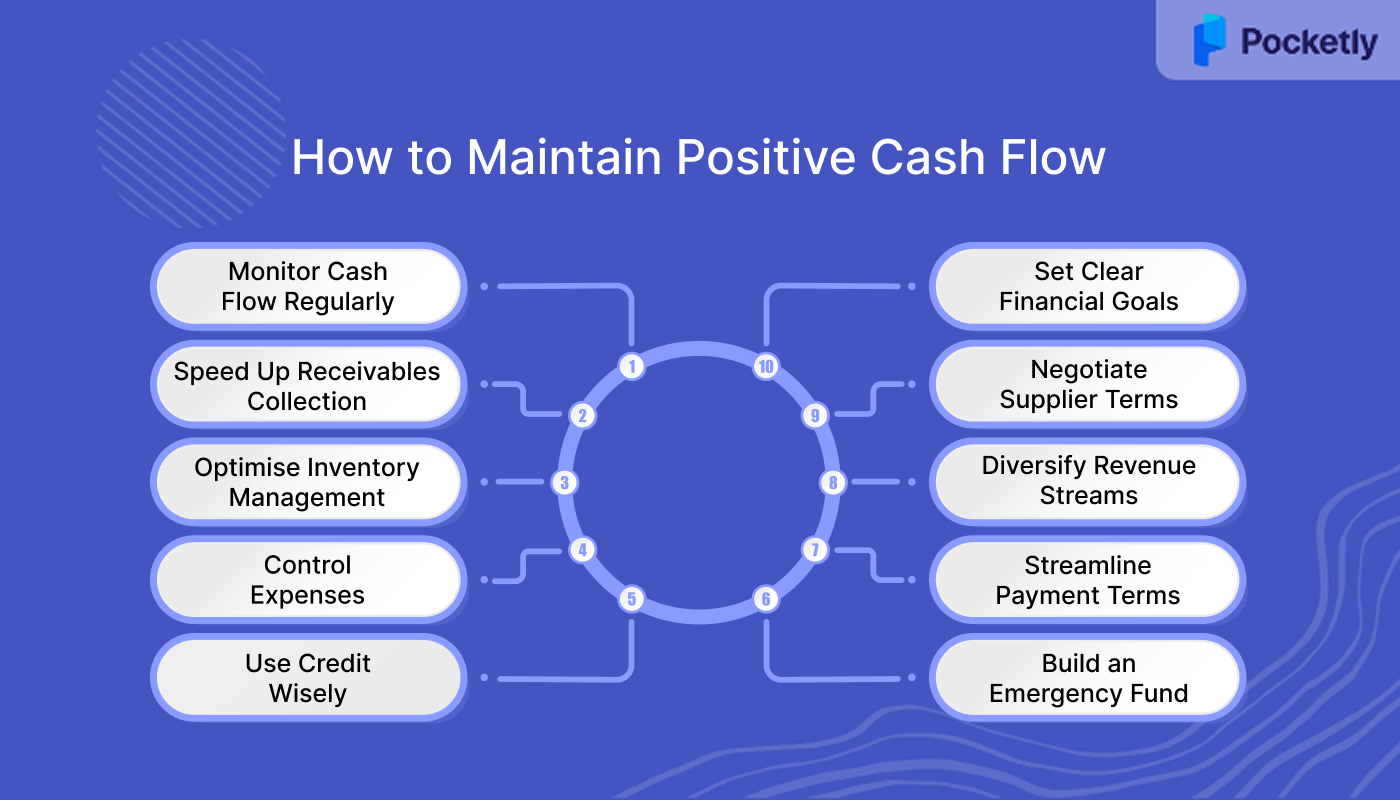

How to Maintain Positive Cash Flow

Maintaining positive cash flow is crucial for the financial health of both individuals and businesses. It requires proactive management, strategic planning, and careful monitoring. Here are some key strategies to help ensure consistent positive cash flow:

- Monitor Cash Flow Regularly: Regularly review your cash flow through statements or budgeting apps to track income and expenses. This helps identify any patterns or potential shortfalls early.

- Speed Up Receivables Collection: Invoice quickly and follow up on overdue payments to ensure timely collections. Offering early payment discounts can also encourage faster payments.

- Optimise Inventory Management: Avoid tying up cash in excess inventory. Use just-in-time inventory systems or conduct periodic stock audits to ensure inventory levels align with sales needs.

- Control Expenses: Keep operational costs in check by cutting unnecessary expenses and negotiating better deals with suppliers. Regularly review discretionary spending and reduce costs where possible.

- Use Credit Wisely: Use lines of credit or credit cards strategically to bridge short-term cash flow gaps, but always aim to pay balances in full each month to avoid interest charges.

- Build an Emergency Fund: Set aside 3-6 months of expenses in an accessible account to protect against unexpected costs without impacting cash flow.

- Streamline Payment Terms: Shorten customer payment terms and offer flexible or early payment discounts to accelerate cash inflow, ensuring quicker access to funds.

- Diversify Revenue Streams: Add new products, services, or income channels to reduce dependency on one source of revenue and ensure more consistent cash flow.

- Negotiate Supplier Terms: Negotiate longer payment terms with suppliers to delay outflows, providing more time to manage cash flow before making payments.

- Set Clear Financial Goals: Establish clear financial objectives for both short- and long-term needs, which will help guide cash flow management and ensure spending aligns with goals.

When cash flow challenges arise or growth opportunities emerge, more targeted strategies become essential for transforming your financial position.

Strategies to Improve Cash Flow

Maintaining a healthy cash flow is essential for ensuring long-term financial stability and growth. Below are several strategies that can help you optimise and improve your cash flow:

1. Accelerate Receivables Collection

One of the most effective ways to improve cash flow is by speeding up the collection of outstanding payments. This can be achieved by invoicing customers immediately after delivering products or services, which reduces the time between the sale and payment.

- Invoice Promptly: Send invoices immediately after delivering goods or services to shorten the payment cycle.

- Offer Early Payment Discounts: Encourage clients to pay sooner by providing small discounts for early payments.

- Implement Late Fees: Apply penalties for overdue payments to incentivise timely settlement.

- Accept Diverse Payment Methods: Facilitate payments through various channels like credit cards, digital wallets, and bank transfers to accommodate customer preferences.

2. Optimise Inventory Management

Efficient inventory management plays a critical role in maintaining positive cash flow. Holding excess inventory ties up cash that could be used elsewhere. Here are some strategies:

- Reduce Overstocking: Excess inventory ties up cash; maintain optimal stock levels to free up funds.

- Implement Just-in-Time (JIT) Practices: Order inventory based on actual demand to minimise holding costs.

- Regularly Review Inventory: Conduct periodic audits to identify slow-moving items and adjust purchasing accordingly.

3. Negotiate Favourable Payment Terms

Improving your cash flow can also be achieved by negotiating better payment terms with suppliers.

- Extend Payables Period: Negotiate longer payment terms with suppliers to delay outflows and improve cash retention.

- Consolidate Purchases: Combine orders to benefit from bulk discounts and reduce transaction costs.

- Review Contracts Regularly: Periodically assess supplier agreements to ensure terms remain competitive.

4. Control Operating Expenses

Controlling operating expenses is another essential strategy for improving cash flow. By regularly reviewing your business’s expenses, you can free up more cash.

- Identify Unnecessary Costs: Regularly review expenses to eliminate or reduce non-essential spending.

- Outsource Non-Core Activities: Consider outsourcing functions like IT support or payroll to reduce overhead costs.

- Invest in Energy Efficiency: Implement energy-saving measures to lower utility bills and operational expenses.

5. Diversify Income Streams

Relying on a single revenue stream can create cash flow risks. By diversifying income sources, businesses can reduce their dependence on one market or product.

- Explore New Markets: Expand into new geographic areas or customer segments to increase revenue.

- Develop Additional Products or Services: Introduce complementary offerings to attract a broader customer base.

- Leverage Digital Platforms: Utilise online sales channels to reach a wider audience and boost sales.

6. Utilise Technology for Automation

Technology can play a key role in streamlining cash flow management.

- Automate Invoicing and Payments: Use software to generate invoices and process payments automatically, reducing administrative workload.

- Implement Cash Flow Forecasting Tools: Utilise forecasting software to predict future cash needs and plan accordingly.

- Monitor Financial Metrics: Regularly track key performance indicators like Days Sales Outstanding (DSO) and inventory turnover to identify areas for improvement.

7. Establish an Emergency Fund

Building an emergency fund is one of the most important ways to protect your business from cash flow disruptions.

By saving a portion of your profits in a dedicated account, you create a financial buffer that can be used in times of unexpected expenses, such as equipment breakdowns, economic downturns, or sudden market shifts.

- Save for Unexpected Expenses: Set aside a portion of profits to cover unforeseen costs without disrupting operations.

- Maintain Liquidity: Ensure that the emergency fund is easily accessible to address urgent financial needs promptly.

By implementing these strategies, you can maintain a healthy cash flow, reduce financial stress, and set your business or personal finances up for sustainable growth and success.

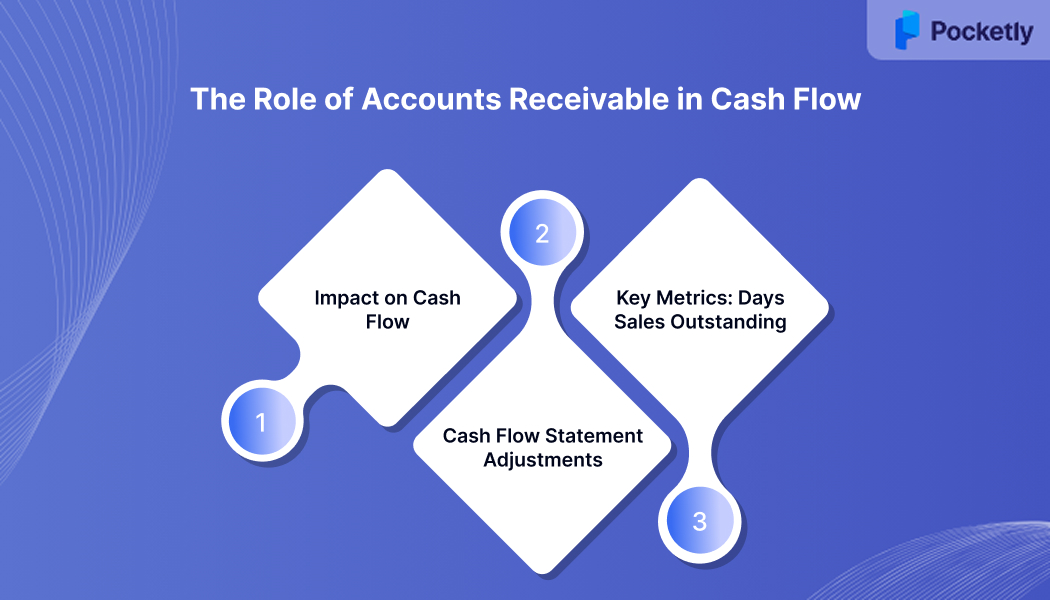

The Role of Accounts Receivable in Cash Flow

Accounts receivable (AR) represents the money owed to a business for goods or services delivered but not yet paid for. It plays a crucial role in determining a company's cash flow, as it directly impacts the liquidity available for operations, investments, and growth.

Impact on Cash Flow

When a business makes a sale on credit, it records the transaction as an increase in accounts receivable. However, this does not immediately translate into cash inflow. The actual cash is received only when the customer settles the invoice.

Therefore, an increase in accounts receivable indicates that more sales are made on credit, which can delay cash inflows and strain working capital. Conversely, a decrease in accounts receivable suggests that customers are paying their dues promptly, improving cash flow and liquidity.

Cash Flow Statement Adjustments

In the cash flow statement, changes in accounts receivable are adjusted to reconcile net income to net cash provided by operating activities. Using the indirect method, an increase in accounts receivable is subtracted from net income, while a decrease is added back. This adjustment ensures that the cash flow statement accurately reflects the actual cash collected during the period, excluding non-cash transactions.

Key Metrics: Days Sales Outstanding (DSO)

Days Sales Outstanding (DSO) is a critical metric that measures the average number of days it takes for a company to collect payment after a sale. A high DSO indicates that the company is taking longer to collect receivables, which can negatively affect cash flow. Conversely, a low DSO suggests efficient collection processes and better cash flow management.

Understanding how accounts receivable affects your cash flow is just one piece of the puzzle. The real challenge lies in translating this knowledge into actionable practices that keep your financial statements strong and your business resilient in the face of changing market conditions.

Tips for Keeping Cash Flow Statements in Good Health

A cash flow statement is a financial document that outlines the inflows and outflows of cash in a business over a specific period. It shows how well a company can generate cash to meet its short-term liabilities and fund its operations.

The statement is divided into 3 sections: operating activities, investing activities, and financing activities. For any business, a healthy cash flow statement is crucial as it helps maintain liquidity and reduce the risk of running out of cash.

To keep your cash flow statement in good health, here are some practical tips:

- Tight Control on Expenses: Regularly audit and negotiate better terms with suppliers to cut unnecessary costs and prevent cash flow leaks.

- Forecast Future Cash Flow: Project future inflows and outflows to identify potential cash shortages or surpluses, enabling proactive financial planning.

- Plan for Seasonality: Prepare for seasonal cash flow fluctuations by building reserves during high-sales periods to cover low-sales months.

- Automate Payments and Invoices: Use automated systems to streamline invoicing, reduce errors, and ensure timely payments for better cash flow management.

- Review Profit Margins and Pricing: Regularly evaluate and adjust pricing strategies to align with costs and market demand, ensuring adequate cash inflows.

- Effective Credit Control: Implement clear credit policies, follow up promptly on unpaid invoices, and encourage early payments to maintain steady cash inflows.

- Create Realistic Budgets: Develop flexible budgets that account for changes in revenue, seasonal fluctuations, and unexpected expenses to avoid cash shortfalls.

Even with the most careful planning and management, unexpected financial needs can arise that require immediate attention. When traditional cash flow optimisation isn't enough to bridge temporary gaps, having access to flexible financing solutions helps maintain business continuity.

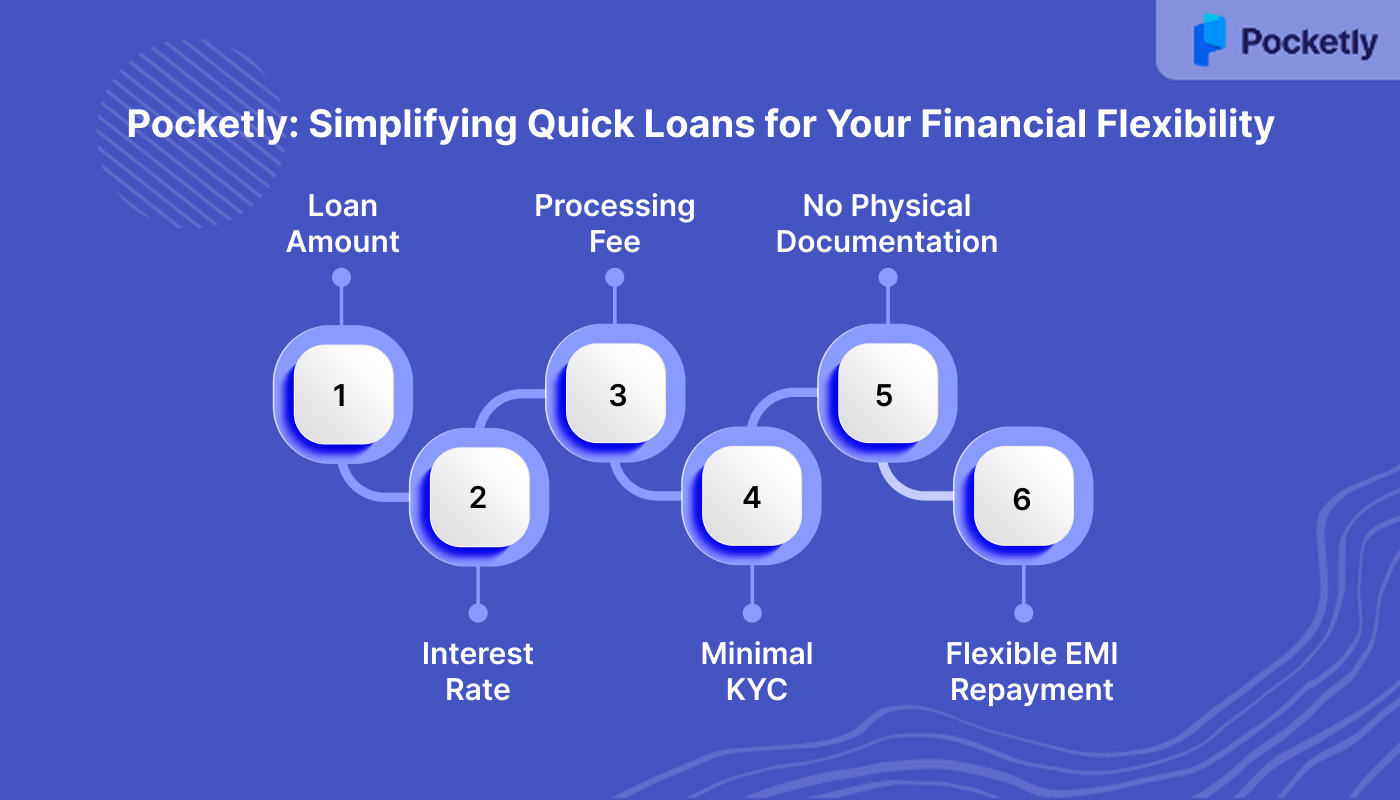

Pocketly: Simplifying Quick Loans for Your Financial Flexibility

Pocketly offers a seamless, user-friendly digital lending platform designed to provide fast financial solutions with minimal paperwork. Whether you need funds for an emergency or planned expenses, Pocketly makes it easy to access the money you need without hassle.

- Loan Amount: Borrow between ₹1,000 to ₹25,000, providing flexibility based on your requirements.

- Interest Rate: Competitive interest rates starting at just 2%, ensuring affordable repayments.

- Processing Fee: Low processing fees ranging from 1% to 8%, depending on the loan amount.

- Minimal KYC: Simple, quick KYC process, requiring minimal documentation.

- No Physical Documentation: Enjoy a completely paperless application process for ease and speed.

- Flexible EMI Repayment: Choose from multiple EMI options that suit your financial situation, with easy repayment terms.

Conclusion

Maintaining positive cash flow is essential for ensuring the financial stability and growth of any business or individual. It provides the flexibility to meet immediate obligations, invest in opportunities, and manage unexpected challenges. By focusing on strategies like improving receivables collection, managing expenses, and forecasting future cash needs, you can keep your cash flow healthy and ensure your financial success.

Pocketly offers a fast and easy way to manage your financial needs with minimal paperwork and flexible loan options. Get the cash you need, when you need it, with interest rates starting at just 2%, low processing fees, and no physical documentation required. Download Pocketly now for iOS or Android to enjoy hassle-free digital lending and smooth financial management.

FAQs

1. What is the best way to understand cash flow?

Understanding cash flow involves reviewing your cash flow statement regularly to track income and expenses. It helps you assess if you have enough funds for operations and spot trends early to prevent cash shortages.

2. What are the three types of cash flow?

The three types of cash flow are operating (money from daily business activities), investing (cash from buying/selling assets), and financing (cash from loans or equity funding).

3. How do I know if my cash flow is correct?

To ensure cash flow is correct, reconcile your statements with bank records and track discrepancies between expected inflows and outflows. Regular reviews will help catch issues early.

4. Is cash flow always positive?

No, cash flow isn’t always positive. Negative cash flow occurs when outflows exceed inflows, often during periods of expansion or investment, but it should be monitored to avoid liquidity problems.

5. How to explain cash flow to dummies?

Cash flow is the movement of money in and out of your account. Positive cash flow means you have enough money to cover expenses, while negative cash flow indicates you're spending more than you're earning.