You find yourself scrolling through a shopping app late at night, and suddenly you have bought a pair of shoes. That instant rush of excitement feels great until you realise your bank balance cannot support your lifestyle for the rest of the month.

This cycle of quick purchases and later regret is a common struggle for many young Indians trying to manage their first salaries. Recent data shows that over 60% of Gen Z in India engages in social commerce, with impulse buys being particularly common for fast fashion, gadgets, and gaming products.

The pressure to keep up with these digital trends often leads to financial stress that stays with you long after the package arrives. In this guide, we explore the psychology behind impulsive spending and provide actionable strategies to help you reclaim your financial independence.

Quick Look

- Over 60% of Gen Z Indians engage in social commerce, frequently buying fast fashion and gadgets influenced by social media trends.

- Retailers use psychological nudges like "limited-time offers" to force you into making hurried and irrational financial decisions.

- The 48-hour cooling-off rule is a simple yet effective way to distinguish between a temporary want and a genuine need.

- Tracking even the smallest unplanned expenses reveals the hidden "leakage" that prevents you from reaching your larger savings goals.

- Building a dedicated "fun fund" allows you to enjoy occasional treats without compromising your ability to pay for essentials.

- Nearly 47.6% of shoppers admit to making unplanned purchases based solely on a friend’s recommendation.

What Is Impulsive Spending

Impulsive spending is the act of purchasing items without any prior planning or a clear necessity for the product. It occurs when you experience an immediate urge to buy something the moment you see it in a store or online.

For example, you might go to the pharmacy for medicine but leave with three expensive skincare products you did not intend to buy. This behaviour is usually a reactive response to emotions or marketing rather than a logical financial decision.

Understanding the causes of these sudden urges is the first step toward building more disciplined money habits for your future.

Also read: Best Expense Tracker Apps In India For 2025

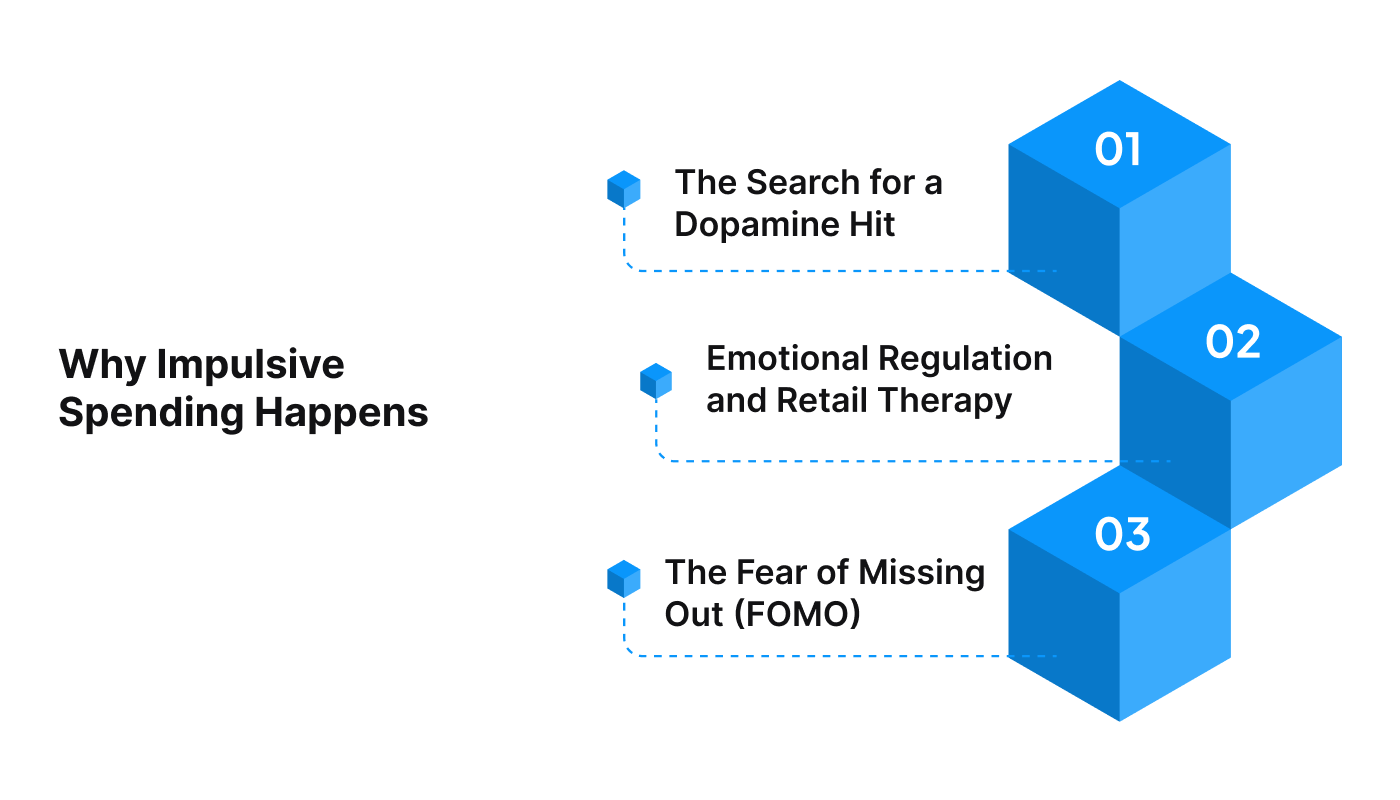

Why Impulsive Spending Happens

Understanding the roots of your spending habits is the first step toward changing them for the better. Most unplanned purchases stem from internal feelings or external cues that trick your brain into choosing instant gratification.

Here are the primary reasons why you might feel compelled to spend money without thinking:

The Search for a Dopamine Hit

When you buy something new, your brain releases dopamine, which is a chemical that makes you feel temporary pleasure. This "buyer's high" provides a quick escape from daily stress or a monotonous routine.

Unfortunately, this feeling fades quickly, which often leaves you searching for the next item to buy to repeat the sensation.

Emotional Regulation and Retail Therapy

Many people use shopping as a way to cope with negative emotions like sadness, anxiety, or even extreme boredom. You might feel that a new purchase will improve your mood or solve a personal problem in your life.

This habit creates a dangerous cycle where you spend money to feel better, but end up feeling worse due to financial strain.

The Fear of Missing Out (FOMO)

Social media platforms often showcase the curated lifestyles of others, which can make you feel like you are falling behind. When you see friends or influencers with the latest gadgets, you might spend impulsively just to feel a sense of belonging.

This pressure to maintain a certain image often leads to spending money that you do not actually have.

Clever Digital Marketing Tactics

Online retailers use sophisticated algorithms and "limited-time" countdown timers to create a false sense of urgency in your mind. These tactics are designed to bypass your logical thinking and force you to make a snap decision before the "deal" disappears.

You end up buying things you do not need simply because you think you are saving money on a discount.

Recognising these triggers allows you to pause and reflect before you reach for your wallet during a moment of weakness. Now you can begin to quantify the actual cost of these habits.

Knowing why these triggers happen is the first step toward stopping them. However, if a past impulse has already left you struggling to cover your essentials this month, don't let the stress spiral. Download the Pocketly app to get a quick, small loan that bridges the gap while you work on building your new financial habits.

Also read: How to Manage Monthly Expenses Smartly in 2025

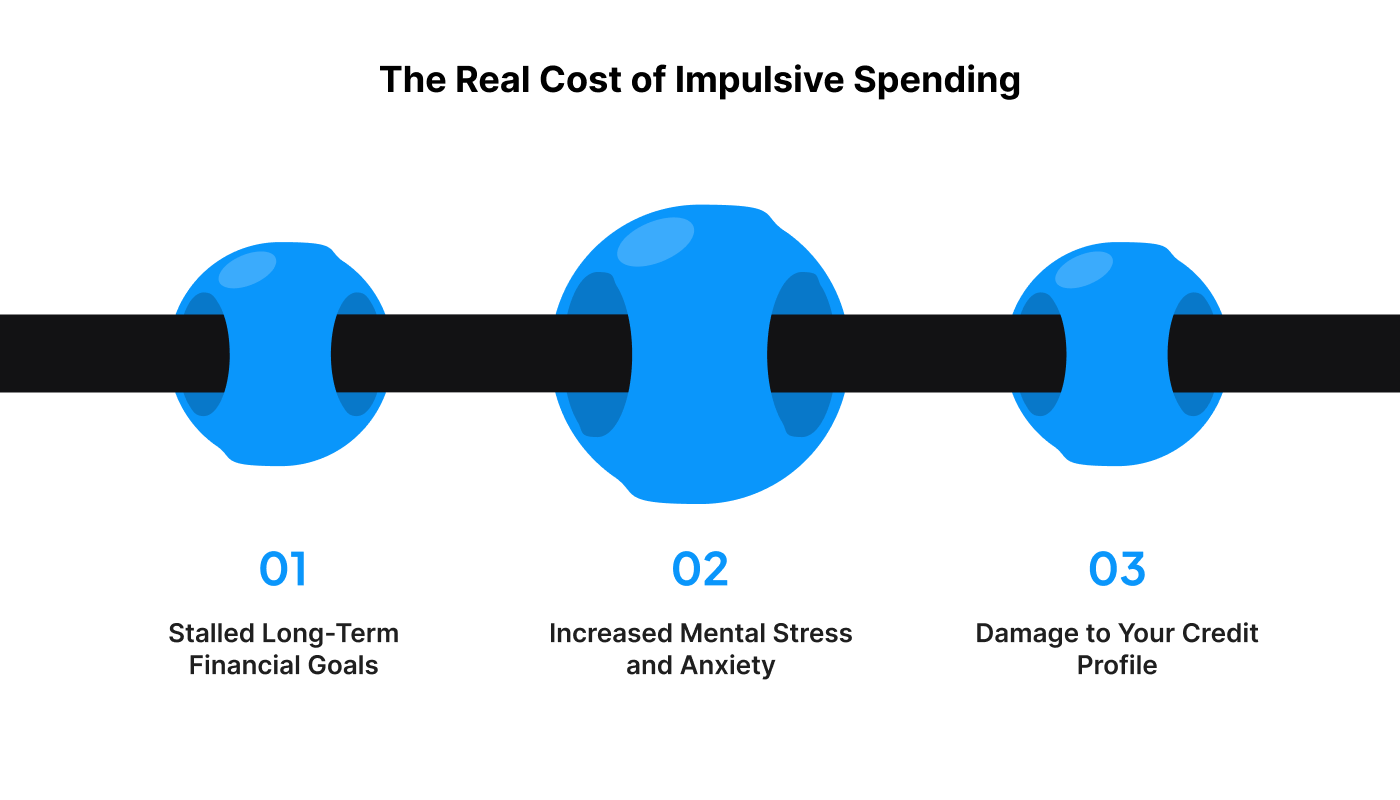

The Real Cost of Impulsive Spending

The impact of a single unplanned purchase goes far beyond the price tag on the receipt you receive at the counter. It creates a ripple effect that touches your long-term financial goals and your overall mental well-being throughout the month.

The true cost of giving in to every shopping urge includes the following factors:

Stalled Long-Term Financial Goals

Every small amount spent on a whim is money taken away from your future house, car, or emergency fund. Over a year, these small "leaks" can add up to thousands of rupees that could have earned interest in an investment.

You might find yourself working longer hours just to pay for things that no longer bring you any joy.

Increased Mental Stress and Anxiety

Living from paycheck to paycheck because of unplanned spending creates a constant state of worry about your financial security. You might fear the end of the month or worry about how you will handle a genuine medical emergency.

This financial instability can affect your sleep, your work performance, and your personal relationships with family and friends.

Damage to Your Credit Profile

Consistent overspending can lead to missed payments on your bills or an over-reliance on high-interest credit cards and loans. If you cannot manage your cash flow, your credit score may drop, making it harder to get important loans later.

Maintaining a healthy credit profile is essential for your future financial freedom as a young professional.

Measuring your habits accurately is the only way to understand how much these impulses are truly costing you each year.

Struggling with a month-end crunch? Don’t let an unplanned expense ruin your financial goals. Download the Pocketly app on Android or iOS to get instant access to small, manageable loans when you need them most.

Also read: 7 Best Budgeting Apps In India 2025

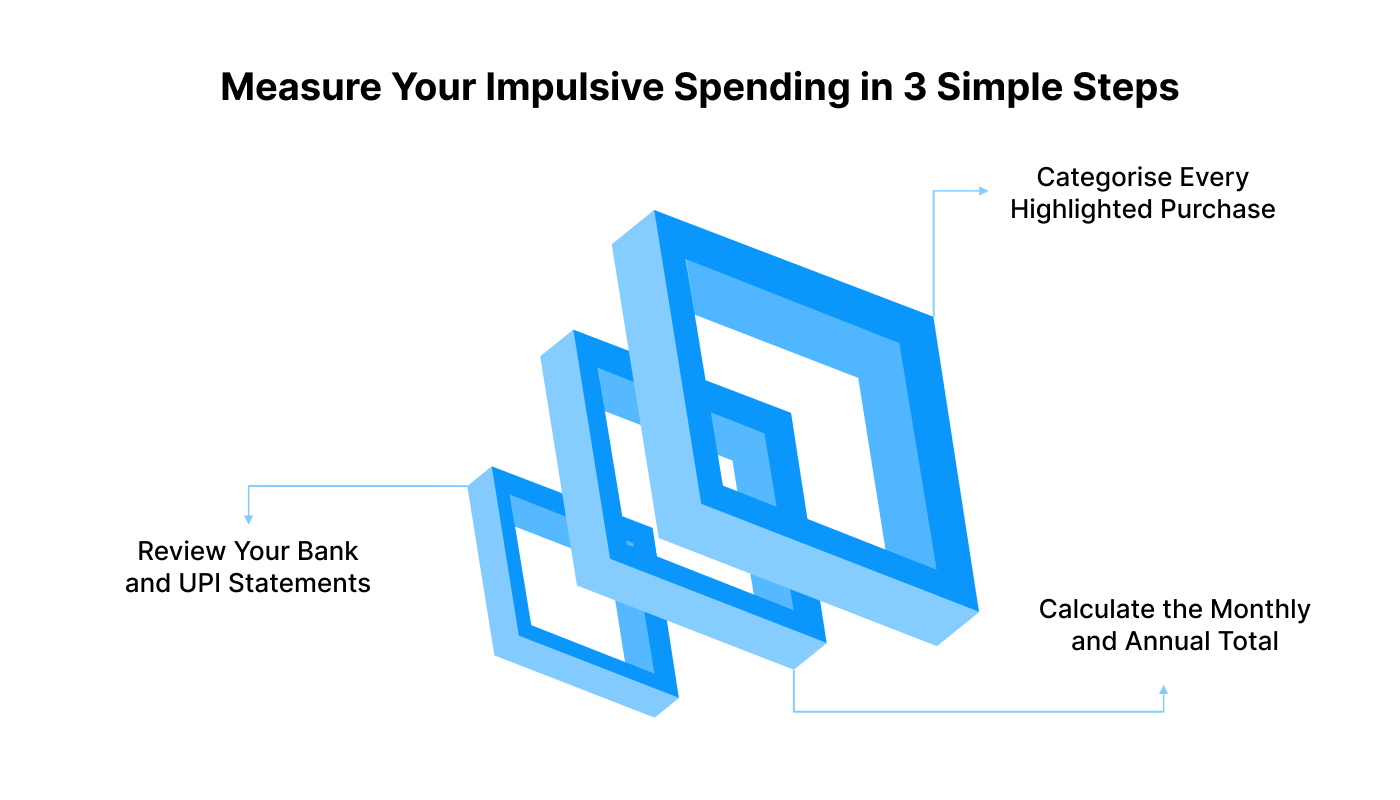

How to Measure Your Impulsive Spending in 3 Simple Steps

You cannot fix what you do not track, so you must conduct a thorough audit of your past spending habits. This process provides a clear and undeniable picture of where your money vanishes each month without your conscious approval.

Follow these steps to calculate the impact of your unplanned purchases:

1. Review Your Bank and UPI Statements

- Download your data: Gather your transaction history for the last three months to see exactly where your money has gone each day.

- Highlight unplanned costs: Use a highlighter to mark every transaction that was not a fixed cost, like rent, utilities, or basic groceries.

- Face the frequency: This visual exercise forces you to confront the frequency of your small, unplanned digital payments.

- Outcome: You will gain immediate clarity on how often you reach for your phone to make a purchase without thinking.

2. Categorise Every Highlighted Purchase

- Group your spending: Divide your unplanned spending into categories like "Dining Out," "Fast Fashion," or "Digital Subscriptions."

- Identify weak spots: This step matters because it helps you identify which specific environments or apps trigger your urge to spend the most.

- Spot the patterns: You will likely discover that one or two categories account for the bulk of your wasted money.

- Outcome: Identifying these "danger zones" allows you to set specific boundaries for the apps or stores that tempt you most.

3. Calculate the Monthly and Annual Total

- Sum the costs: Add up the cost of these impulse buys and multiply the monthly average by twelve to see the yearly impact.

- Identify the trade-off: This total represents the "opportunity cost" of your habits, showing you what you could have achieved with that saved capital.

- Boost your motivation: Knowing this number makes it easier to stay motivated when you try to change your behaviour.

- Outcome: Seeing the high annual cost of small habits provides the logical push needed to stick to a long-term savings plan.

Applying specific frameworks to your decision-making process will help you reduce these numbers in the months to follow.

Also read: Simple Money Management Tips for Personal Finances

Frameworks to Control Impulsive Spending With Examples

Using structured rules makes it much easier to say no when you face a tempting purchase in a store. These frameworks act as a mental shield that protects your budget from the temporary urges that often lead to financial regret.

Try implementing these proven methods to improve your financial discipline:

The 48-Hour Cooling-Off Rule

Whenever you feel the urge to buy something unplanned, you must wait exactly forty-eight hours before completing the transaction. For example, if you see a trendy watch online, add it to your cart but do not hit the "buy" button.

Most of the time, the emotional urge will disappear within two days, and you will realise you do not need it.

The "Hours of Work" Calculation

Before buying an item, divide the total price by your hourly take-home pay to see how much life energy it costs. If a pair of sneakers costs ₹5,000 and you earn ₹500 per hour, ask yourself if they are worth ten hours of work.

This perspective shifts the focus from the item's perceived value to the actual effort required to afford it.

The 1% Spending Rule

Set a rule that any purchase exceeding 1% of your gross annual income requires a mandatory one-week waiting period and research. If you earn ₹6 Lakhs a year, any item over ₹6,000 should be debated and planned for in advance.

This prevents large, life-altering purchases from being made on a whim during a moment of high emotion.

Incorporating these rules into your daily life is easier when you also change the environment around you.

Also read: Money Management Tips for College Students 2025

Practical Ways to Curb Impulsive Purchases in Daily Life

Changing your digital environment can significantly reduce the number of temptations you face throughout the day. Small adjustments to your lifestyle lead to large improvements in financial discipline.

Use these practical tips to make it harder to spend money without thinking:

- Unsubscribe from All Marketing Emails: Retailers send "exclusive" deals to trigger the desire to shop. By removing these visual cues, you ensure you only visit a store when you have a specific, pre-identified need.

- Delete Saved Payment Information: Remove credit card details and UPI links from shopping apps so you must enter them manually. This extra step creates "friction," giving your brain time to reconsider the purchase before it is finalised.

- Use a Strict Written Shopping List: Never enter a supermarket or mall without a list of specific items. Stick to the list religiously and ignore any "special offers" that are not relevant to your current needs.

Learning how to handle specific high-pressure situations will further strengthen your ability to stay within your monthly budget.

Also read: Apply for Quick Small Personal Loan Online based on Your Salary

Smart Ways To Handle Tricky Spending Situations

Events like festive sales or social outings are high-risk zones for your budget. Learning to manage these moments keeps your financial plan on track even under pressure. In fact, peer influence plays a massive role in our financial choices; a recent study found that 47.6% of respondents made impulse purchases based on friends' recommendations.

Here is how to navigate common spending traps:

- Set a "Social Spending" Limit: Before going out with friends, decide on a maximum amount you are willing to spend. Carrying that specific amount in cash and leaving cards at home ensures you cannot overspend.

- Distinguish Real Emergencies from Desires: An emergency is a broken laptop needed for work, not a sale on your favourite brand. Keep a small emergency fund separate from your spending account to handle surprises without relying on credit.

- Combat the Sale Season FOMO: Remind yourself that a 50% discount on an item you do not need is still a 100% waste of money. Focus on the total amount leaving your bank account rather than the supposed "savings."

Maintaining these habits over time requires a focus on long-term progress rather than seeking instant perfection every single day.

Also read: Expense Management: A Simple Guide for Young Indians (and How to Do It Right)

How Pocketly Fits into Responsible Short-Term Borrowing

Unexpected costs like medical emergencies or urgent repairs can disrupt your budget and cause significant stress. These situations require quick action to prevent minor financial gaps from becoming major crises.

Pocketly offers a practical solution through small, short-term personal loans designed for these temporary cash flow issues. As a digital lending platform owned by RBI-registered NBFC Speel Finance Company Private Limited, we provide a secure way to handle genuine financial needs without the complexity of traditional banks.

With Pocketly, you can:

- Complete a quick KYC process without the need for any physical documents or long wait times.

- Access flexible loan amounts ranging from ₹1,000 to ₹25,000 based on your specific requirements.

- Benefit from transparent interest rates starting at 2% per month with no hidden annual or joining fees.

- Pay a one-time processing fee ranging from 1% to 8% of the total loan amount approved for you.

- Receive instant funds directly into your bank account once your application is approved by the system.

Pocketly ensures you have access to funds when you truly need them while encouraging you to borrow only what you can repay.

Conclusion

Controlling impulsive spending is about making choices that align with your long-term goals rather than depriving yourself of joy. By understanding your triggers and using frameworks like the 48-hour rule, you can build a more secure financial future.

When unexpected expenses exceed your current budget, Pocketly provides responsible credit to assist you. We offer a transparent, collateral-free way to bridge the gap during month-end shortages or sudden emergencies.

Download the Pocketly app on the Google Play Store or iOS App Store to manage your short-term financial needs today.

FAQs

Q. How can I stop spending money impulsively?

Start by identifying your emotional triggers and implementing a 48-hour waiting rule for all unplanned purchases. Deleting saved card details from shopping apps also creates helpful friction that prevents snap buying decisions.

Q. What are the common triggers for impulsive spending?

The most common triggers include stress, boredom, the fear of missing out (FOMO), and clever marketing tactics like flash sales. Recognising these moments allows you to pause and choose a more logical response to the urge.

Q. How does impulsive spending affect my credit score?

If unplanned spending leads to maxed-out credit limits or missed bill payments, your credit score will likely decline. Maintaining a budget ensures you can always meet your financial obligations on time to protect your credit health.

Q. Can a budget help stop impulsive spending?

Yes, a budget gives every rupee a purpose, which makes you more aware of the "opportunity cost" of every purchase. When you see how an impulse buy takes away from your savings, you are less likely to proceed.

Q. What is the 48-hour rule in shopping?

The 48-hour rule requires you to wait two full days before buying anything that was not on your original shopping list. This period allows the initial emotional excitement to fade so you can decide if the item is truly a necessity.