Being unemployed can be stressful, especially when bills and unexpected expenses keep piling up. So, how do you plan for emergencies when income isn’t coming in?

The thing is, building a strong credit score doesn’t necessarily have to wait for a steady income. With smart strategies and a little planning, you can begin shaping a healthy financial profile today. Gradually, these small steps can steadily grow into long-term credit strength and stability.

In this blog, we’ll guide you on how to build credit with no job and explore practical steps to manage your finances responsibly. Stick till the end to get inside tips that help you take control of your credit and achieve financial independence even during tough times.

In A Nutshell:

- You don’t need a job to build credit if your financial habits are strong and consistent.

- Start establishing credit with secured cards, authorized user status, and low credit utilization under 30%.

- Build your score further using BNPL, credit-builder loans, and even timely utility bill payments.

- Stay on track with smart habits like disputing report errors, avoiding new debt, and using credit wisely.

- Manage debt without panic by prioritizing essentials, cutting non-essentials, and seeking flexible loan options.

Why Credit Still Matters Even Without A Job?

You may feel that credit only matters once you start earning. But in reality, it’s relevant even while you’re studying or searching for work.

With a healthy score, you get:

- Easier loan and credit card approvals

- Smoother rental applications

- Lower interest rates

- Higher chances of approval when needed

In short, credit is like a financial passport that can open doors even when your income is uncertain.

Does Being Unemployed Affect Your Credit Score?

Your credit score isn’t linked directly to whether you have a job or not. Credit bureaus do not record your employment status. Instead, they evaluate how you handle your payments and outstanding balances.

The challenge comes indirectly. If you’re unemployed and unable to pay bills on time, your score could dip. For example, late credit card payments or skipped EMIs are quickly reflected in your report. That’s why even during unemployment, financial discipline becomes crucial.

Since unemployment does not erase your ability to build credit, let’s look at ways to start creating a score without a steady income.

Also Read: How to Build and Improve Your Credit Score

How To Establish Credit With No Income?

Even without a monthly salary, your financial behaviour still counts. The two areas you must pay attention to are payment history and credit utilisation ratio. Payment history shows if you clear dues on time, while utilisation reveals how dependent you are on borrowed money. Keeping these in check is the first step to building your credit profile.

Here’s what you can focus on:

- Keep credit utilisation under 30%: Avoid exhausting your entire limit. For example, with a ₹20,000 limit, restrict your spends to around ₹6,000.

- Avoid overusing cards: Depending too much on credit raises your utilisation ratio and weakens your score.

When you apply these basics consistently, you start establishing credit. The idea is to show lenders you’re disciplined even without a regular income.

Once this foundation is steady, you can go ahead with learning how to build credit with no job.

Also Read: How to Build Credit Without a Credit Card

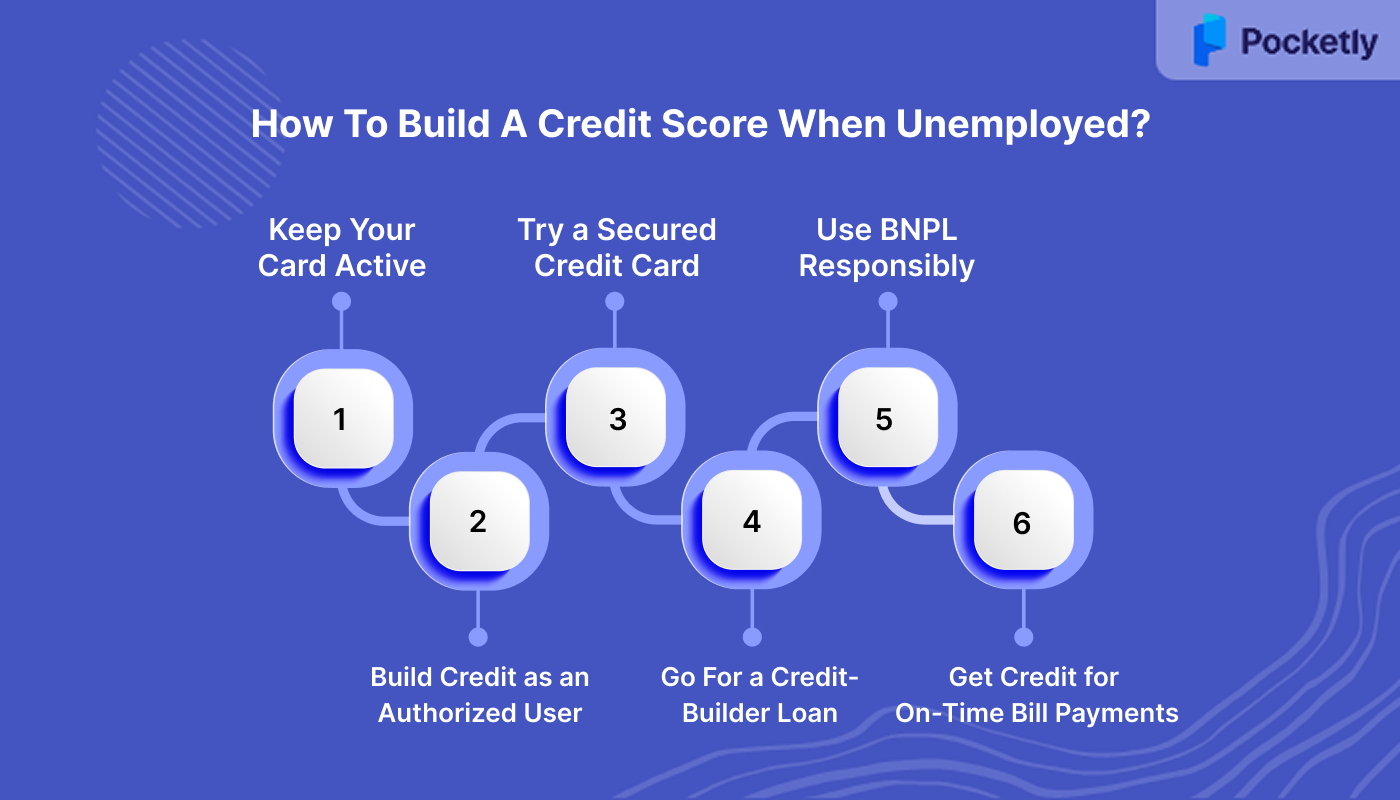

How To Build A Credit Score When Unemployed?

Building credit while unemployed sounds tricky, but it’s absolutely possible. Even without a regular paycheck, you can take steps that steadily improve your credit profile. Here’s how:

Keep Your Credit Card Active (But Controlled)

It might feel safer to stop using your card altogether, but doing so can actually slow down your credit-building efforts. Instead, the trick is to keep transactions small and repay them on time:

- Use your card for small, essential purchases like groceries, mobile recharges, or travel expenses.

- Always aim to pay the full bill instead of just the minimum due to avoid late fees and interest.

- Stay within the 30% limit of your credit to keep utilisation healthy.

Practical Use: If your card limit is ₹15,000, spend around ₹3,000 on groceries and clear it in full by the due date.

Build Credit By Becoming An Authorised User

If your parent, sibling, or relative has a strong repayment record, ask to be added as an authorised user on their card. This way, you can piggyback on their credit behaviour while building your own:

- Your name gets linked to their timely payments, reflecting positively on your credit report

- You can use the card for small purchases without being the primary cardholder, but you must repay them promptly.

- Always have a clear repayment plan and make sure you spend responsibly to avoid straining family relations.

Practical Use: If your elder sibling clears a ₹20,000 monthly bill on time, their positive repayment record boosts your credit as an authorised user.

Consider A Secured Credit Card

When searching for how to build credit with no job, a secured card is one of the easiest ways to begin. It works by linking the card to a fixed deposit, which acts as your security.

- Open a fixed deposit (FD) and get a secured card against it.

- Your FD amount becomes your credit limit, so you’re spending against your own deposit.

- Use it for small payments and clear them on time to grow your score.

Practical Use: Place ₹10,000 in an FD, get a secured card with the same limit, and use it for monthly metro recharges while repaying on time.

Go For A Credit-Builder Loan

Some banks and fintechs offer credit-builder loans, designed purely to help you establish a score. Unlike regular loans, the borrowed money is held in a bank account while you repay in instalments.

- Check repayment terms to ensure you can afford them and then make small monthly repayments over 12–24 months.

- Each repayment is reported to credit bureaus, strengthening your history.

- Once repayments are complete, you get access to the loan amount.

Practical Use: Borrow a ₹12,000 credit-builder loan, repay ₹1,000 every month for a year, and see each repayment reported to your credit file.

Use Buy Now Pay Later (BNPL) Smartly

BNPL options are increasingly popular in India, especially for small-ticket purchases like electronics or clothing. When used smartly, they can also contribute to your credit history.

- Use BNPL only for essentials you can comfortably repay, instead of splurging on luxuries.

- Repay in full before the deadline to avoid interest charges.

- Track your BNPL commitments and avoid piling up multiple accounts, which can become difficult to track.

Practical Use: Buy a ₹3,000 pair of shoes with a BNPL plan, repay within three months on time, and build a positive repayment record.

Get Credit For Timely Bill Payments

Even if you don’t have a credit history, you can still build one through timely bill payments. Some fintech services allow on-time utility or mobile payments to be reported to credit bureaus.

- Treat every bill like an EMI and pay your Wi-Fi, mobile, and electricity bills before deadlines.

- Opt for auto-debit to avoid missed deadlines.

- Explore credit bureau programmes that record non-traditional payments.

Practical Use: Pay your ₹800 mobile bill on time every month, and link it to your report to boost your score.

Wondering how quickly you can go from no score to a decent one? Read ahead to find out.

Also Read: How to Start Building Credit at The Age of 18

How Long Does It Take To Build Credit?

The truth is, credit building doesn’t happen overnight. On average, it takes two to six months of consistent credit activity for bureaus to generate a score. Here’s a general idea:

| Situation | Approximate Time |

| First credit activity started | 2-6 months |

| Building from scratch to “good” | 6-12 months |

| Rebuilding after poor credit | 12 months or more |

While the journey to building your credit may be slow, these practical tips can keep you moving in the right direction.

Also Read: How Long Does it Take to Build Credit Using a Credit Card?

Proven Tips To Stay On Track

Sticking to healthy money habits is crucial when you’re worried about how to build credit with no job. Even small steps can protect your score while keeping financial stress under control.

1. Review Your Credit Report Regularly

Errors like incorrect late payments or wrong accounts can unfairly lower your score. Check your report every quarter, and file disputes immediately if you spot inaccuracies. For example, Riya noticed an old loan still marked as “open.” After disputing it with the bureau, her score improved by 40 points.

2. Avoid New Debt Traps

During unemployment, new loans or heavy card use can create high-interest burdens. Stick to essentials, and repay your card balance promptly. For example, instead of taking a personal loan for a gadget, Aditya postponed the purchase until he was employed again.

3. Build Positive Credit History

Use secured credit cards for small purchases and repay in full monthly. Alternatively, join as an authorised user on a family member’s account. For example, Aarav used a secured card for groceries and cleared it monthly. Within eight months, he had his first credit score.

4. Stay in Touch with Lenders

If you anticipate missing an EMI, inform your bank early. Many lenders offer deferment or restructuring for unemployed individuals. For example, Priya contacted her bank about a missed EMI. They extended her repayment term, saving her from penalties.

These strategies keep your credit on track, but how do you handle debt when you’re temporarily jobless? These next steps will help you do just that.

Also Read: First-Time Loans to Build Credit: A Beginner's Guide

Smart Ways To Handle Debt While Jobless

Debt can feel overwhelming when pay cheques aren’t coming in. But with the right strategies, you can still stay afloat and protect your score. Here’s how:

- Prioritise Your Debts: Pay essentials like rent, utilities, and home loans first, then handle credit cards and negotiate EMIs if needed.

- Use Emergency Savings Wisely: Dip into your emergency fund only for necessary expenses and debt, and refill it once re-employed.

- Explore Part-Time Work: Take up side gigs such as tutoring, delivery, or freelancing to generate income and stay financially active.

- Cut Non-Essential Expenses: Limit unnecessary spending by cancelling subscriptions, cooking at home, and delaying luxury purchases until stable.

- Seek Support If Needed: Ask family for temporary help, share costs, or sell high-value assets to prevent debt from piling up.

Also Read: Personal Loans for Students Without Income in India

Manage Finances Even Without A Job With Pocketly

Sometimes, unexpected expenses can hit when you have little or no income. Pocketly, a digital lending platform, helps young Indians handle short-term cash needs with ease.

Offering personal loans from ₹1,000 up to ₹25,000, Pocketly requires no collateral and ensures fast approval with funds directly transferred to your bank. With interest rates starting at 2% per month and processing fees of 1-8%, it’s transparent and flexible.

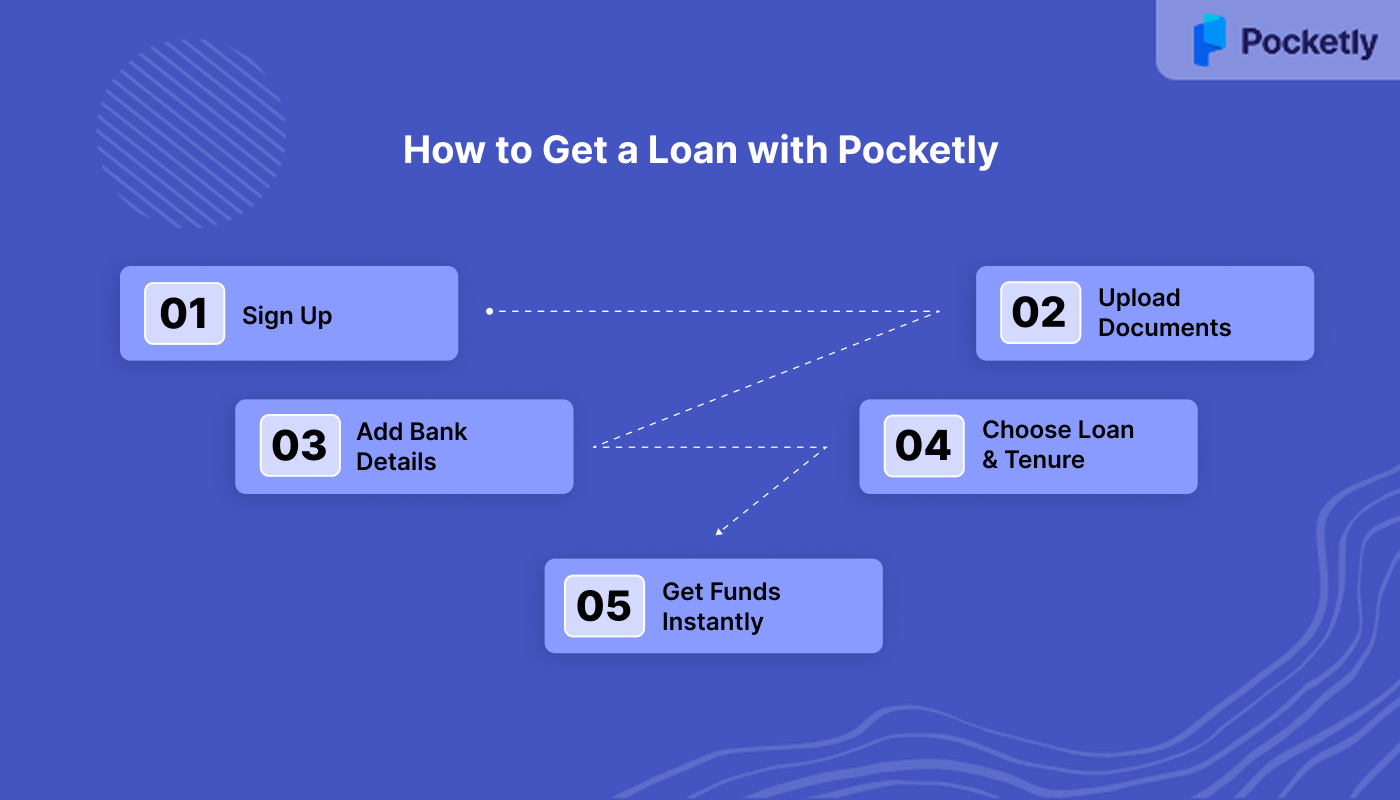

How to Get a Loan with Pocketly:

- Sign Up: Quick 2-click registration using your mobile number.

- Upload Documents: Minimal KYC and PAN verification; no physical submissions required.

- Add Bank Details: Provide your account to receive funds directly.

- Choose Loan & Tenure: Pick an amount and repayment schedule that suits you.

- Get Funds Instantly: Money is transferred to your account within minutes.

Enjoy flexible EMIs, 24/7 support, and a fully online experience. Pocketly makes it easy to manage emergencies responsibly while building credit and maintaining financial independence.

Wrapping Up

Unemployment can feel overwhelming, but it doesn’t have to stall your financial growth. Maintaining and improving your credit score largely depends on responsible financial habits rather than income alone. Small, consistent actions like timely payments, responsible credit usage, and smart budgeting can make a lasting impact on your financial health.

Adjusting your spending and using strategies like secured credit cards, credit-builder loans, or BNPL options can help you stay on track. By being consistent, you are actively learning how to build credit with no job, setting yourself up for future opportunities.

And when times feel difficult, Pocketly is there to back you up. With instant personal loans ranging from ₹1,000 to ₹25,000, minimal documentation, flexible repayment options, and 24/7 support, it’s ideal for first-time borrowers. Download Pocketly today on iOS or Android and start taking control of your credit journey even without a job.

FAQ’s

1. Can you build a credit score without a job?

Yes, you can build a good credit score without a formal job. By paying bills timely, using a credit card responsibly, or becoming an authorised user on someone else’s card, you can establish a positive credit history.

2. How to get 10,000 rupees urgently without a salary?

You can consider options like borrowing from friends or family, taking a small personal loan, using a credit card, or doing short-term freelance work. Platforms like Pocketly also provide quick access to small loans, helping you cover urgent expenses without the usual hassles.

3. What is the average Gen Z credit score?

The average credit score of a Gen Z in India generally hovers around 676, reflecting their limited credit history but growing engagement with financial products. Responsible usage of credit cards, BNPL services, and small personal loans can gradually improve this score.

4. What is the 2 2 2 credit rule?

The 2/2/2 credit rule is a guideline for building a strong credit history: maintain 2 active trade lines for at least 2 years and keep balances low, around ₹1.5-2 lakh depending on the product. Paying these accounts on time each month demonstrates reliability to credit bureaus and helps improve your score steadily.