Turning 18 opens the door to independence, but it also comes with financial responsibilities that can feel overwhelming. For many young Indians, the first taste of managing money often collides with the reality of needing a credit history to access even the simplest financial products. You may find yourself wanting to buy a laptop on EMI, apply for a student credit card, or secure a small loan, only to be met with rejection because your financial record doesn’t exist yet.

Building credit from scratch may seem complicated, but it is possible to start early and take small, practical steps that set the foundation for future financial stability.

This blog will walk you through how to build a credit score at 18, the right ways to begin, and how small, consistent actions can shape a healthy financial journey.

Key Takeaways

- Start Building Credit Early: Beginning at 18 will give young adults time to build a good credit history, thereby securing better loans and financial opportunities down the line.

- Keep Credit Utilisation Low: Use less than 30% of your credit limit to achieve a healthy score. High utilisation can hurt your chances of getting approved for future credit.

- Utilise Authorised User Status: Joining a family member’s credit account can help you gain access to their positive credit history, accelerating your credit-building process.

- Monitor Your Credit Regularly: Keep an eye on your credit report, make timely payments, and avoid excessive credit inquiries to maintain a strong score.

- Stay Disciplined and Avoid Debt: Practice responsible spending, avoid impulse purchases, and always aim to pay off your balance in full each month.

Understanding Credit Basics

The credit score, often known as the CIBIL score in India, is a 3-digit number that ranges from 300 to 900 that reflects your creditworthiness. The credit score is calculated by bureaus like the CIBIL, Experian, Equifax, and CRIF High Mark to determine whether to approve your loan or credit application based on your borrowing and repayment behaviour.

A credit report will show your:

- Credit accounts (loans, credit cards)

- Repayment history

- Outstanding debts

- Frequency and recency of new credit inquiries

- Any defaults or settlements

A high credit score, that is 750 or above, indicates good credit health. This boosts your chances of loan approvals and access to better terms, like higher amounts or lower interest rates.

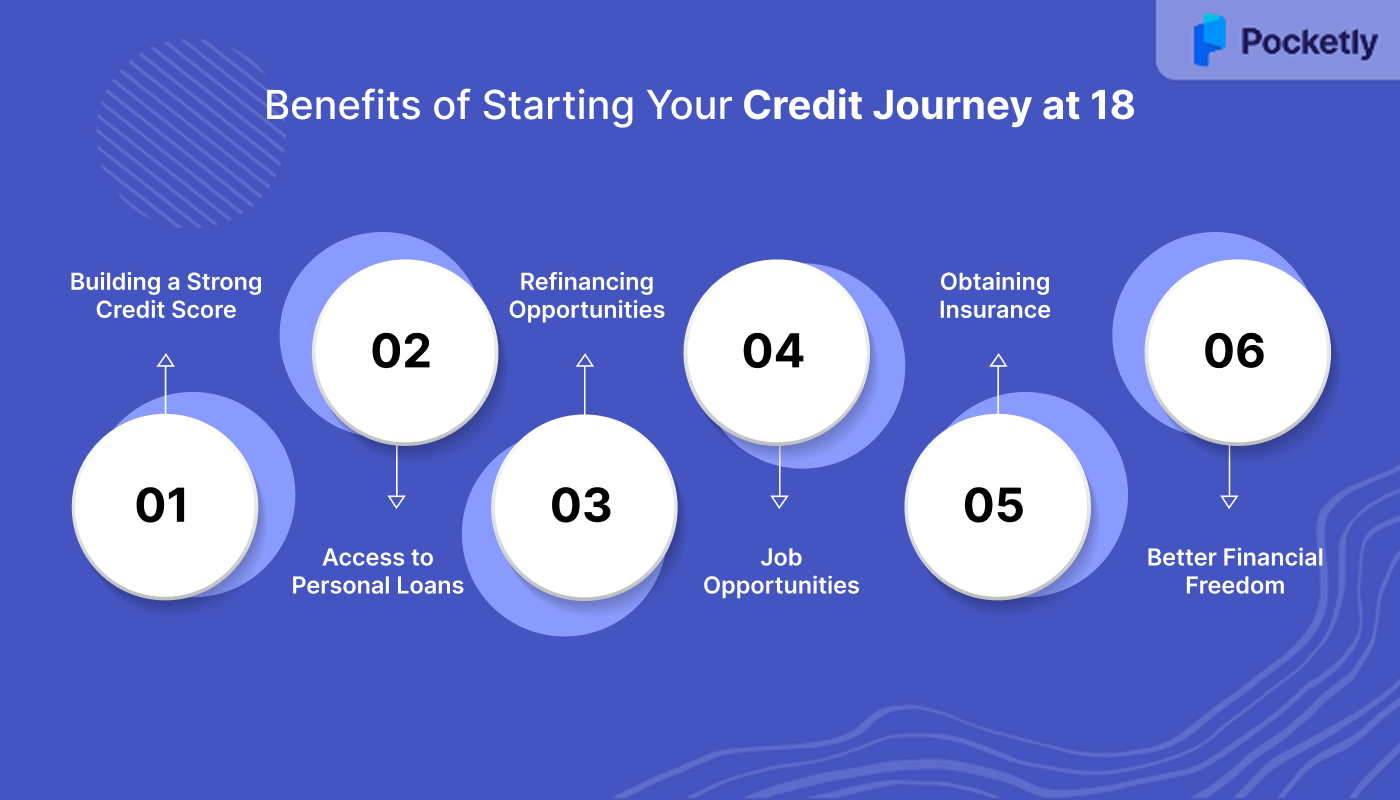

What are the Benefits of Starting Your Credit Journey at 18?

Starting your credit journey at 18 opens up a world of financial opportunities. By building your credit early, you can access loans, qualify for better interest rates, and even secure essential services like insurance.

- Building a Strong Credit Score: Establishing credit early gives you time to build a strong credit history, which is essential for future loans, credit cards, or even renting a home.

- Access to Personal Loans: With a healthy credit score, you can qualify for personal loans, credit cards, or student loans with better terms and lower interest rates.

- Refinancing Opportunities: A good credit score helps when refinancing loans or consolidating debt, making it easier to enjoy a lower interest rate and reduced monthly payments.

- Job Opportunities: Many employers, especially in the financial and corporate sectors, check your credit score as part of their hiring process. A good score reflects responsibility.

- Obtaining Insurance: Insurance companies often use your credit score to determine premiums. A better score can result in cheaper premiums for car, health, or home insurance.

- Better Financial Freedom: With a good credit score, you’re seen as a responsible borrower, giving you financial flexibility for future purchases or in emergencies.

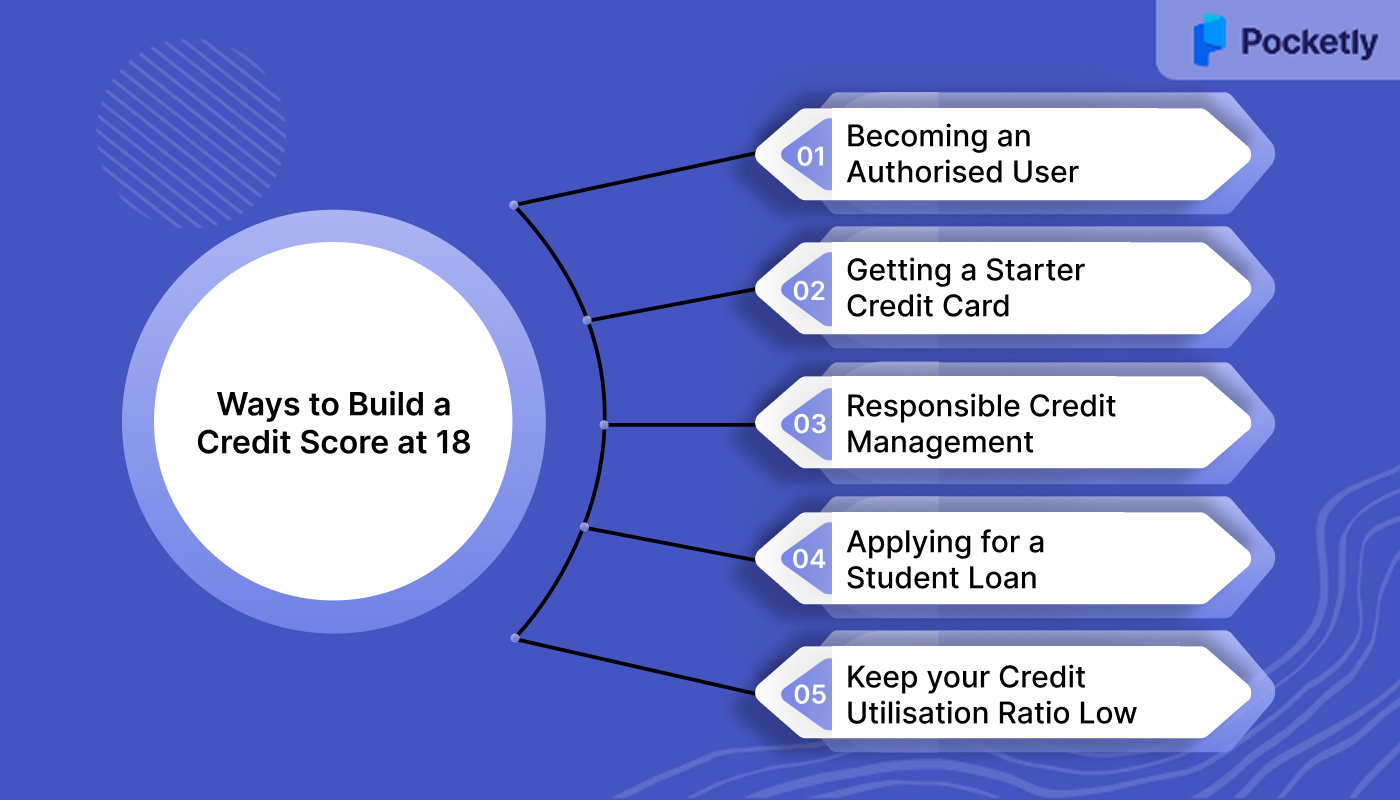

What are the Top 5 Ways to Build a Credit Score at 18?

Starting to build your credit at 18 is crucial for setting a strong financial foundation. While the process may seem intimidating, there are simple and effective strategies to help you establish a solid credit history. Below are the top five ways to start building your credit.

1. Becoming an Authorised User

Becoming an authorised user involves being added to an existing credit card account, typically of a parent or relative, as an additional cardholder. This can fast-track the credit-building process for an 18-year-old by benefiting from the primary cardholder’s established credit history and payment behaviour.

Key factors to consider:

- No Credit or Income Needed: You don’t need prior credit history or income proof. The primary cardholder’s creditworthiness largely impacts the process.

- Credit Score Enhancement: When the bank reports your activity to credit bureaus, you can inherit the positive payment history of the account, boosting your own credit score within a few months.

- Choose the Right Account: Only join accounts who has a good record of timely payments and low credit utilisation. Being added to an account with poor credit habits or a high balance could harm your score.

- Clear Expectations: Discuss how the card will be used—whether you’re actively using it or simply benefiting from the score boost—and ensure that the primary cardholder stays consistent with repayments.

- No Liability: While the primary cardholder is responsible for the debt, any misuse of the card could impact both parties’ credit scores and personal relationships.

Note: Not all credit card issuers report authorised user activity to credit bureaus, so it's essential to confirm this with the card issuer.

Also Read: How to Calculate and Improve Credit Utilisation Ratio

2. Getting a Starter Credit Card

For 18-year-olds, entry-level credit cards are generally available as secured cards (against a fixed deposit), student credit cards, or select “low-limit” cards from major banks. These cards are designed for those with little or no credit history and lower income.

Key factors to consider:

- Secured Credit Cards: Backed by a fixed deposit (as low as ₹5,000–₹10,000), these cards ensure approval and provide a manageable limit, usually up to 80-90% of the FD value.

- Student Credit Cards: Offered to college students above 18, these require proof of enrollment but not regular income. They often come with zero or nominal annual fees and basic rewards on routine spending.

- Minimal Documentation: Most starter cards need basic KYC documents, age proof, a guarantor in personal loans, or a parental co-signer if no income.

- Build & Upgrade Path: Regular usage, timely repayments, and responsible credit behaviour enhance the score, paving the way to higher-limit unsecured credit cards in 12–18 months.

- Immediate Benefits: These cards often provide digital payment capabilities, basic rewards/cashback, and teach responsible spending habits early on.

Note: Always compare cards for annual fees, eligibility, and reporting to credit bureaus; some bank-issued prepaid cards do not help build credit history.

3. Responsible Credit Management

The biggest determinant of a healthy credit profile is consistent, responsible management, regardless of the account type or limit. This includes making timely payments, keeping credit balances low, and avoiding unnecessary debt. By regularly monitoring your credit report, you can help stay on track and spot any discrepancies.

Key factors to consider:

- Pay Bills On Time: On-time payment is the single most important factor in your credit score; set reminders and automate payments whenever possible.

- Monitor Account Activity: Regularly check statements for unauthorised transactions or mistakes. Use credit monitoring services to track fluctuations and spot errors early.

- Start Small, Scale Gradually: Limit the number of credit lines at first. Don’t apply for multiple cards/loans at once, as every enquiry results in a temporary score dip.

- Debt Avoidance: Never spend more than you can pay in full each month. Avoid carrying forward balances to steer clear of high interest, which can snowball and hurt your score.

- Keep Old Accounts Active: Length of credit history boosts scores, so don’t close your first card even if you upgrade later.

4. Applying for a Student Loan

Taking out an education loan for higher studies not only helps finance your education but also plays a significant role in building your credit. Banks like the SBI offer loans with affordable interest rates for students. Timely repayment of these loans showcases your financial responsibility, impacting your credit history. Additionally, education loans often qualify for tax benefits under Section 80E of the Income Tax Act.

Key factors to consider:

- Loan Reporting to Credit Agencies: Most formal student loans are reported to major credit bureaus like CIBIL or Experian, helping you establish a positive repayment history.

- Financial Discipline: Managing monthly EMIs teaches valuable skills like budgeting and money management, which will be useful when applying for larger loans, securing jobs, or even applying for visas in the future.

- Education Loan Benefits: Government-backed loans often come with lower eligibility criteria, minimal collateral requirements, and are accessible even for students from tier-2 and tier-3 cities.

- Building Account Age: Since student loans typically have long repayment periods, often spanning from 10 to 30 years, they help in boosting your average account age over time, which is a key factor in building your credit score.

Also Read: Getting a Personal Loan with a Low CIBIL Score

5. Keep your Credit Utilisation Ratio Low

Your credit utilisation ratio, which reflects the percentage of your available credit that you're using, has a major impact on your credit score. It’s ideal to keep this ratio under 30%, as it indicates that you're not overly dependent on credit.

For example: If your credit limit is ₹10,000, keep your credit balance under ₹3,000. Paying off the balance in full each month will also help keep your ratio low.

Key factors to consider:

- Make Multiple Payments: Don't wait for the billing cycle; make payments throughout the month to reduce the reported balance, especially after large purchases.

- Request Limit Increases: As your credit history improves, consider requesting a higher credit limit. This will help to improve your credit utilisation ratio and also keep it in check.

- Avoid Hitting Your Limit: Reaching your credit limit, even occasionally, can lower your credit score and make future borrowing more difficult.

- Monitoring: Keep a watch on your credit usage via banking apps or credit monitoring services. If your balance spikes unexpectedly, address it promptly to avoid potential damage.

Common Mistakes When Building a Credit Score at 18

Building credit at 18 can be a valuable step toward financial independence; however, some mistakes can harm your credit score in the long run. Here are some common pitfalls, which include overspending, missing payments, and more.

1. Overspending and Accumulating High Credit Card Balances: Many young adults fall into the trap of spending more on credit cards, which leads to high balances. This significantly impacts your credit utilisation ratio, which in turn signals to lenders that you are over-leveraged, which can lower your credit score.

2. Missing or Late Payments: The history of your payment is the most crucial factor influencing your credit score. These missed payments stay on your credit report for up to 7 years and continue to affect your ability to secure loans or credit in the future.

3. Applying for Multiple Credit Accounts: Whenever you apply for a credit, whether it’s a credit card, personal loan, a hard inquiry is made on your credit report. These inquiries can lower your score temporarily, further harming your credit score.

4. Not Monitoring Your Credit Report: Failing to monitor your credit report is a major mistake. If there are errors or fraudulent activities, they can affect your credit score. Regularly checking your credit report can catch discrepancies early and report them to credit bureaus, so that your credit history is accurate.

5. Co-signing Loans Without Understanding the Risks: Co-signing a loan may seem harmless, but it comes with significant risks. If the primary borrower defaults on the personal loan, you are responsible for the debt. Many young adults co-sign loans for family or friends without fully understanding the implications.

6. Closing Old Credit Accounts: Closing old credit accounts can harm your score by reducing the length of your credit history. A longer credit history positively impacts your score, and shutting down accounts, particularly those with no annual fees, can lower your average account age and decrease your available credit.

7. Using Credit Cards for Non-Essential Purchases: Relying on credit cards for impulse buys can lead to mounting debt, particularly if you're unable to clear the balance. It’s crucial to reserve credit cards for necessary purchases and ensure full payment each month to avoid interest and debt buildup.

8. Not Building an Emergency Fund: Without an emergency fund, unexpected expenses can pile up, leading to reliance on credit, which can harm your credit score. Having an emergency fund provides financial security and reduces the need to use credit cards when unexpected costs arise.

How Pocketly Can Help You Build Credit at 18

Pocketly is a digital lending platform to help young adults manage their financial needs without the hassle of traditional loans. Offering quick access to small personal loans, Pocketly makes it easy for you to take control of your finances while building your credit score.

Here’s how Pocketly can support your credit-building journey:

- Instant Personal Loan Approval: With Pocketly, you can receive loan approval within minutes and have the funds transferred directly to your bank account.

- Flexible Loan Amounts: Whether it’s ₹1,000 or ₹25,000, Pocketly offers flexible loan amounts that can be tailored to your needs, making it easier to manage your finances without taking on more than you can handle.

- Affordable Interest Rates: Pocketly’s interest rates start as low as 2% per month, ensuring that you don’t have to worry about high repayment costs. This can help you manage your loan payments more comfortably and build a positive credit history.

- No Annual Fees or Hidden Charges: There are no annual fees, joining fees, or hidden charges, just the processing fees, which are 1-8% of the loan amount, allowing you to borrow without the stress of extra costs.

- Flexible EMI Options: Pocketly allows you to repay your loan through flexible EMIs, making it easier to manage payments over time. You can also choose to pay off the loan early without any penalties.

By using Pocketly’s loan services responsibly, you can start building your credit score early, all while enjoying financial flexibility and transparency.

Conclusion

Building your credit score at 18 is an essential step toward securing a healthy financial future. By understanding the basics of credit, using the right strategies, and avoiding common mistakes, you can lay down a strong foundation that will benefit you for years to come. Whether it’s becoming an authorised user, getting a starter credit card, or managing your credit utilisation, all these steps can bring you closer to achieving financial freedom.

Pocketly can help you take control of your finances. With flexible loans, affordable interest rates, and no hidden charges, Pocketly offers an instant way to start building your credit at 18. Download the Pocketly app now on iOS or Android.

FAQs

1. What’s a good beginner credit score?

A good beginner credit score is typically around 650–700. This range shows lenders that you are a responsible borrower, even if you’re just starting out. With time and consistent management, your score can improve.

2. How fast can I build credit?

Building credit can take anywhere from 3 to 6 months if you’re using credit responsibly. The key is making timely payments, keeping your credit utilisation low, and starting with a secured card or a small loan.

3. What is the highest credit score?

The highest credit score you can achieve is 900 in India, though most people aim for 750 or above, which is considered excellent and helps secure loans at favourable terms.

4. What’s the lowest credit score?

The lowest credit score possible is 300, which signifies poor credit management. Scores below 600 typically indicate a higher risk to lenders and may result in higher interest rates or loan rejections.

5. What are the 5 C’s of credit?

The 5 C’s of credit are Character, Capacity, Capital, Collateral, and Conditions. These factors help lenders evaluate your ability and reliability in repaying loans based on your credit history, income, assets, and external economic conditions.