Building credit with a credit card is one of the most effective ways to lay a strong financial foundation, though it takes time. In India, a credit score of 750 or higher is crucial for accessing better loan offers, lower interest rates, and greater financial flexibility. Still, many wonder how long it really takes to build credit and what methods to use to improve their scores.

Recent data reveals that 46% of consumers who actively monitor their credit scores saw improvements within just six months, underscoring the benefits of consistent, informed credit management.

In this blog, we’ll explore the timeline and how fast can you build credit with a credit card and share practical strategies to improve your creditworthiness over time.

Key Takeaways

- Building credit with a credit card takes time, typically 6 months of consistent usage to generate a credit score.

- Payment history is the most crucial factor, accounting for 35% of your score, making timely payments essential for credit growth.

- Credit utilisation should stay below 30% to maintain a healthy score; higher utilisation signals risk.

- Opening multiple credit cards in a short period can hurt your score due to multiple hard inquiries, affecting 10% of your credit score.

- Diversifying your credit mix (including loans and credit cards) and maintaining old accounts positively impact your score over time.

What is a Credit Score?

A credit score is a numerical representation of your creditworthiness, reflecting how likely you are to repay borrowed money. It is calculated based on factors like your payment history, credit utilisation, length of credit history, types of credit used, and recent credit inquiries. Credit scores range from 300 to 900, with higher scores indicating better credit health.

A higher score makes it easier to secure loans, credit cards, and favourable interest rates, while a lower score may result in higher borrowing costs or difficulty obtaining credit.

How Credit Scores Are Calculated

Understanding how credit scores are determined can help you work toward improving yours with confidence. While various scoring models exist, FICO® is commonly used for assigning scores that range from 300 to 850. A score of 670 is often considered a good baseline.

The exact algorithms used to calculate credit scores are proprietary, but FICO® offers the following general guidelines, which should be viewed as estimates since the actual calculations may vary:

- 35%: Payment history

- 30%: Credit utilization

- 15%: Length of credit history

- 10%: Credit mix

- 10%: Recent credit inquiries

To improve your credit score, focus on paying bills on time, maintaining a low credit utilisation rate, and managing a diverse mix of credit types.

Building Your First Credit Score: How Long Does it Take

It will take around 6 months of responsible credit usage to generate your first credit score. During this period, credit bureaus start receiving data on your payment history, credit utilisation, and overall credit behaviour. While you won’t see a score overnight, consistent on-time payments, improving credit utilisation, and keeping your credit utilisation low can set you on the right path. By the six-month mark, your credit score will begin to reflect your credit habits, giving you a solid foundation to build from.

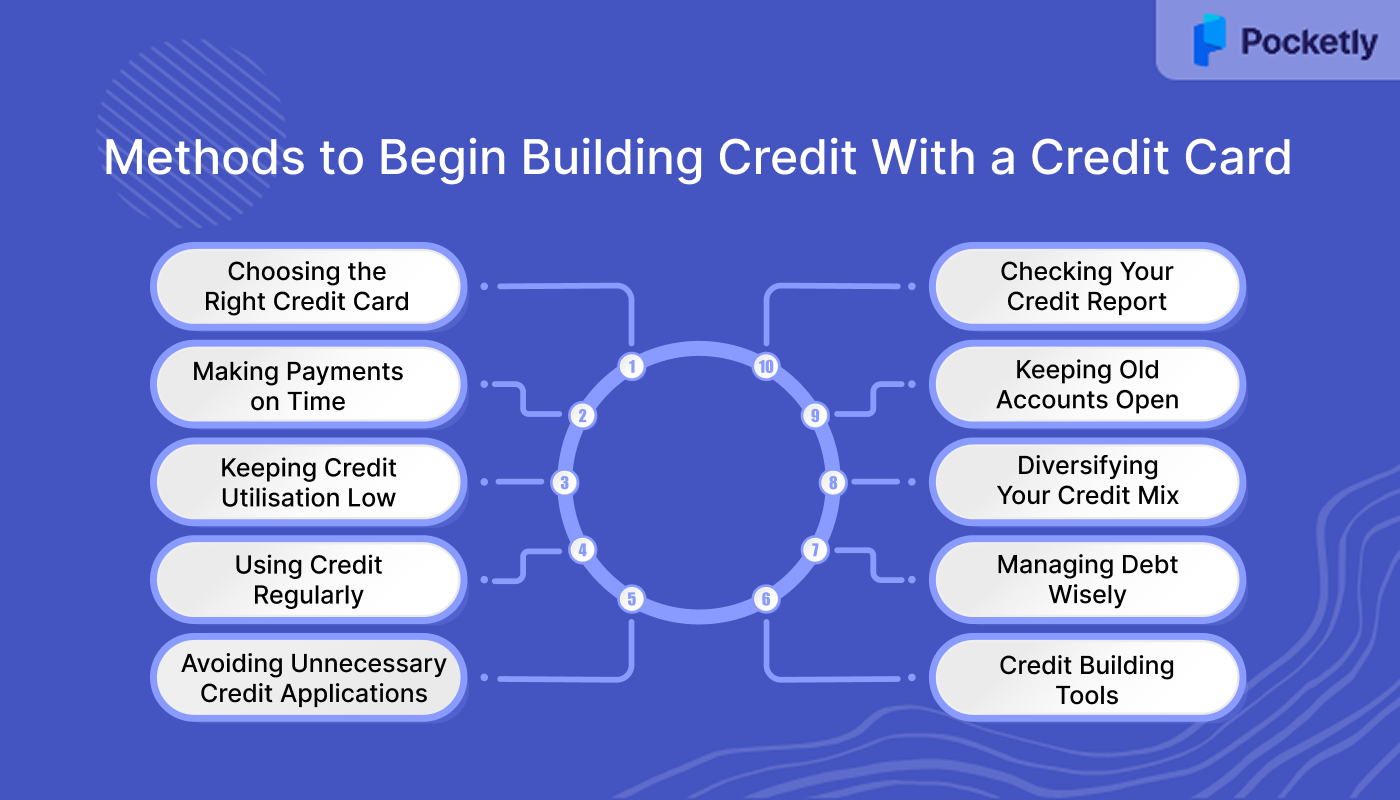

Top 10 Methods to Begin Building Credit With a Credit Card

Building your first credit score is a gradual process, and several factors influence how quickly it develops. Each factor has a specific weight in determining your score, and understanding these can help you in the process effectively.

Here's a breakdown of the methods to build credit faster using a credit card:

1. Choosing the Right Credit Card

The first step in building credit is selecting the right credit card. Not all credit cards are created equal, and picking one that suits your financial habits can make a significant difference in your credit-building journey.

For beginners, secured credit cards build credit scores, and it is a great choice to start with. These cards require you to deposit a certain amount as collateral, which sets your credit limit. They provide an excellent way to demonstrate responsible credit usage, especially if you have no credit history.

On the other hand, unsecured cards may be available if you have a steady income, and some even offer perks like cashback or rewards. When choosing a card, pay attention to fees, interest rates, and whether the card reports to all three major credit bureaus.

Additionally, look for cards with low annual fees or no annual fees, as high fees can diminish the financial benefits.

2. Making Payments on Time

One of the most impactful ways to build credit using a credit card is consistently making on-time payments. Payment history accounts for 35% of your credit score, making it the single most important factor in building credit. Late or missed payments can harm your score and delay your progress in establishing good credit.

To avoid missing a payment, set up payment reminders or auto-pay for at least the minimum payment. Paying the full balance each month is ideal, as it helps avoid interest charges and keeps your credit utilisation ratio low. If you can't pay off the full balance, always pay more than the minimum to reduce interest payments. Over time, your consistent payment behaviour will be recorded by credit bureaus, reflecting positively on your credit score.

3. Keeping Credit Utilisation Low

Credit utilisation, which refers to the percentage of your available credit that you use, plays a significant role in determining your credit score. Ideally, you should aim to keep your credit utilisation rate below 30%. This means if your credit limit is ₹10,000, you should avoid carrying a balance higher than ₹3,000.

High credit utilisation can signal to lenders that you may be over-relying on credit, which could be a red flag. Keeping your balance low, even if you're making frequent purchases, will help maintain a healthy credit profile and demonstrate to credit bureaus that you can manage your credit responsibly.

4. Using Credit Regularly

While keeping your balance low is essential, it’s also important to use your credit card regularly. A common misconception is that avoiding credit cards entirely is good for your score, but in reality, active use is needed to build credit. Using your card at least a few times a month for everyday purchases, such as groceries or gas, shows creditors that you are responsible with credit and that your card is actively being used.

Use your card for small purchases that you can easily repay, which will help you build credit without risking debt. Regular use combined with timely payments is one of the best ways to quickly establish a credit score.

5. Avoiding Unnecessary Credit Applications

While it may be tempting to apply for multiple credit cards to increase your available credit, this can actually hurt your credit-building efforts. Every time you apply for credit, a hard inquiry (or "hard pull") is made on your credit report. This means the lender checks your credit history to assess whether to approve your application.

While a single inquiry might have a minimal impact, multiple inquiries within a short period can signal to lenders that you are in financial distress, leading to a lower score. In fact, hard inquiries account for about 10% of your credit score, and multiple inquiries can stay on your report for up to 2 years.

6. Checking Your Credit Report

One of the most effective ways to manage and build your credit is by regularly reviewing your credit report. Your credit report provides a detailed summary of your credit history, including the accounts you've opened, your payment history, and any outstanding debts.

In India, you are entitled to a free credit report once a year from each of the major credit bureaus (CIBIL, Experian, Equifax, and CRIF Highmark). Checking your credit report regularly helps you track your credit-building progress and ensures that any discrepancies are promptly addressed. If you spot errors, such as incorrect late payments or accounts that don't belong to you, dispute them with the credit bureau to prevent damage to your score.

7. Keeping Old Accounts Open

One of the key factors in building a strong credit score is the length of your credit history, which accounts for 15% of your credit score. The longer your credit history, the more trustworthy you appear to lenders. Therefore, it's crucial to keep your old credit accounts open, even if you don’t use them regularly.

Closing old accounts may shorten your credit history and increase your credit utilisation rate by reducing your available credit limit, which may hurt your score. Even if you're not using an old card frequently, it’s beneficial to leave it open, as it shows a longer and more stable credit history.

8. Diversifying Your Credit Mix

While having one type of credit (such as a credit card) can help build your credit, diversifying your credit mix can provide additional benefits. Credit mix accounts for 10% of your overall score and refers to the different types of credit you have, such as credit cards, car loans, student loans, or personal loans.

Lenders like to see that you can responsibly manage various forms of credit, as it demonstrates your ability to handle different financial obligations. Having a diverse mix can improve your score, as it shows you're a well-rounded borrower. However, it’s important not to take on credit just for the sake of diversifying. Only consider applying for new types of credit if they align with your financial goals.

9. Managing Debt Wisely

Debt management involves not only keeping your credit utilisation low but also ensuring that you’re able to pay off your balance on time, avoiding interest charges. The goal is to never carry a high balance for too long, as interest can quickly accumulate and impact both your credit score and your financial health.

If you find yourself with multiple outstanding debts, it’s wise to create a budget and prioritise paying off high-interest debts first. Using methods such as the debt snowball or debt avalanche can help you systematically reduce your debt. A key aspect of managing debt wisely is making consistent, on-time payments to prevent late fees and damage to your credit score.

The more responsibly you handle your debt, the more it will positively reflect on your credit score, helping you achieve long-term creditworthiness.

10. Credit Building Tools

Credit-building tools are designed to help individuals improve their credit scores by making responsible use of credit products. These tools can range from secured credit cards, where you deposit a fixed amount as collateral, to credit builder loans that allow you to borrow small amounts and repay them over time.

Credit-builder apps can automate savings or bill payments to help you demonstrate reliable financial behaviour. It is useful for those with no credit history or low scores, as they provide a structured way to build credit gradually. Many financial institutions also offer credit monitoring services, which allow you to track your progress, receive alerts for any changes, and spot discrepancies early.

Why You May Not Have a Credit Score Yet?

Building credit with a credit card will not have an immediate effect on your credit score. If you're just starting, there are several reasons why your credit score might not appear yet. Understanding these reasons will help you identify the steps you need to take to begin building your score.

Here are the common factors that could be preventing you from having a credit score:

- You’re a young adult and haven’t entered the world of credit yet.

- You’re an immigrant and have no credit history in the country.

- You haven’t used credit accounts that are reported to credit bureaus.

- You’ve recently opened new credit accounts with insufficient history.

- Your credit accounts haven’t been reported recently.

Ways to Build Your Credit History

Building a solid credit history is essential for financial health. Here are some strategies to establish and strengthen your credit profile:

- Open a Bank Account: Establish a financial footprint with checking or savings accounts, even though they don’t directly impact credit scores.

- Pay Bills on Time: Ensure timely payments for utilities and other services, and have them reported to credit bureaus.

- Use a Secured Credit Card: Start with a secured card, make small purchases, and pay the balance in full each month.

- Become an Authorised User: Get added to someone else’s credit card account with a good history to benefit from their credit behaviour.

- Consider a Credit-Builder Loan: Opt for a credit-builder loan, where payments are reported to credit bureaus, helping you build credit.

- Apply for a Store Credit Card: Use store-specific cards to build credit, but ensure timely payments to avoid high-interest charges.

- Use Credit Responsibly: Keep credit utilisation low (under 30%) and avoid multiple applications within short periods.

Build Your Credit with Pocketly: Instant Loans, Flexible Terms

Pocketly offers a convenient solution for building and managing your credit. With Pocketly, you can access quick, flexible loans while maintaining a healthy credit profile. Whether you're a young adult just starting to build your credit or someone looking for short-term financial support, Pocketly is designed to help you along the way.

Key Features of Pocketly:

- Loan Amounts: Borrow between ₹1,000 and ₹25,000, providing the flexibility you need for various financial needs.

- Interest Rate: Low, competitive interest rates starting at 2% per month to make repayments manageable.

- Processing Fee: One-time processing fee of 1%-8% of the loan amount, ensuring transparency with no hidden charges.

- Flexible EMI Options: Choose from flexible EMI plans tailored to your budget and repayment capacity.

- Repayment Terms: Convenient loan repayment options with easy reminders, designed to help you stay on track with your payments.

- No Collateral Required: Quick, paperless KYC process for easy access to loans without the need for collateral.

Conclusion

Building credit using a credit card is a step-by-step process that requires time, discipline, and patience. By understanding the factors that contribute to your credit score, such as timely payments, credit utilisation, and keeping old accounts open, you can steadily improve your financial standing.

Remember, the process takes time, but with consistent effort, you can start seeing results in as little as six months. Following the methods shared in this blog will not only help you build a solid credit foundation but also set you up for better financial opportunities in the future.

Start building your credit today with Pocketly. With easy loans and flexible repayment options, Pocketly helps you improve your credit score while managing short-term financial needs. Download now on iOS or Android to get started!

FAQs

1. How Can You Achieve a 700 Credit Score in 30 Days?

Achieving a 700 credit score within 30 days is ambitious but possible if you have a good starting point. Focus on paying off any outstanding balances, reducing credit utilisation, and ensuring all payments are made on time. Additionally, consider disputing any inaccuracies on your credit report. While you may not reach exactly 700 in a month, significant improvements can be made by following these practises consistently.

2. What Does the "2-2-2" Credit Rule Mean?

The "2-2-2" rule refers to a credit management guideline designed to boost your credit score. It suggests that you should aim for:

- 2 active credit accounts to demonstrate your ability to manage different types of credit.

- 2 years of credit history for a solid foundation of responsible credit usage.

- 2% credit utilisation, meaning you should aim to use no more than 2% of your total available credit.

3. What Credit Score Does an 18-Year-Old Typically Start With?

An 18-year-old typically starts with a "no credit score" or a very low score, as there is limited credit history to report. Without previous credit activity, credit bureaus have little to assess, but that can change quickly by opening a first credit account, using it responsibly, and ensuring timely payments.

4. How Long Should You Wait Between Credit Inquiries?

To minimise the impact on your credit score, it's recommended to wait at least 6 months between hard credit inquiries. This will help avoid any potential negative effects on your score, as multiple inquiries in a short period can suggest financial instability to lenders.

5. How Much Will Your Credit Score Drop After a Hard Inquiry?

A hard inquiry can cause your credit score to drop by about 5 to 10 points, depending on the other factors in your credit profile. However, the impact is usually temporary, and your score can rebound with responsible credit use and on-time payments. The effect diminishes over time as the inquiry ages.