Did your monthly savings plan slip through your fingers again? Between bills, weekend plans, and those “just this once” splurges, keeping up with your finances can feel tougher than it should be. Financial wellness is something many people struggle to achieve, no matter how much they earn.

Interestingly, research shows that financial wellness for corporate workers is just 54, while it’s 63 for the general population. That means even with stable incomes, money stress is still running high. Surprising, right? So how do you take charge of your finances?

In this blog, we’ll break down what financial wellness really means, why it matters, and how you can start improving yours today. Read on for easy steps to build better money habits and feel more in control of your finances.

Brief Overview:

- Financial wellness means managing money confidently while balancing spending, saving, borrowing, and planning.

- Building financial literacy empowers smarter decisions and long-term financial stability in everyday life.

- Track your well-being by assessing how comfortably you handle expenses, savings, and unexpected costs.

- Improve your financial wellness through mindful budgeting, saving habits, reducing debt, and future planning.

What Does Financial Wellness Really Mean?

Let’s be honest, when most people hear the term financial wellness, they instantly think of having more money. But that’s not the full picture. True financial wellness is less about how much you earn and more about how you manage what you have.

It’s about the balance between your earnings, spending, saving, and borrowing. When you’re financially well off, you’re not constantly anxious about bills or unexpected expenses. Instead, you have clarity, control, and a plan that lets you enjoy life without money stress lurking in the background.

Here are the four main pillars of financial wellness:

| Element | What It Means |

| Daily Control | Managing monthly expenses without constant money stress. |

| Emergency Readiness | Having savings to handle sudden financial shocks. |

| Goal Progress | Staying consistent with short and long-term financial goals. |

| Freedom to Enjoy | Spending on what you love without guilt or worry. |

So, understanding money is great, but what difference does it make if you don’t use it smartly? Let’s find out.

Also Read: Understanding the Importance of Financial Education

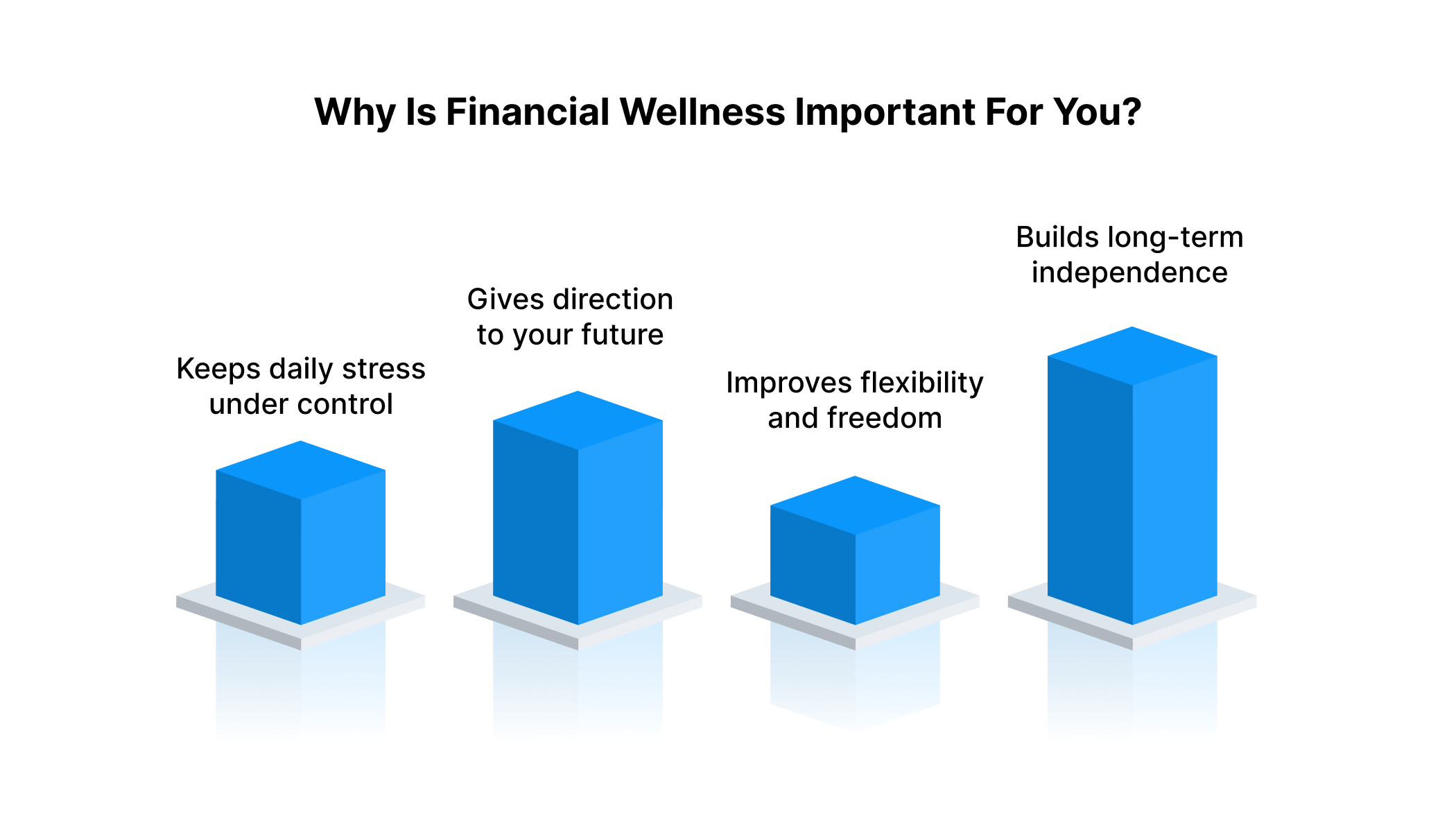

Why Is Financial Wellness Important For You?

Money might not buy happiness, but managing it well definitely brings peace of mind. Financial wellness affects nearly every part of your life, from your daily comfort to your long-term freedom. Here’s why it matters:

- Keeps daily stress under control: Managing essentials like rent, groceries, and bills without worry builds a sense of security. When your day-to-day finances are organised, your mind is free to focus on more meaningful goals.

- Gives direction to your future: Whether you dream of buying a car, travelling, or saving for higher studies, financial wellness ensures those dreams don’t stay distant. With clear plans and smart saving, you can move closer to your goals without constant financial pressure.

- Improves flexibility and freedom: Being financially stable gives you options. You can take a weekend trip, enrol in a new course, or switch jobs without panicking about the next month’s bills. That kind of flexibility is what makes financial wellness truly empowering in daily life.

- Builds long-term independence: When you manage money wisely today, you secure your tomorrow. Reaching a point where you’re not dependent on others for financial support feels like true freedom, and that’s what everyone eventually aims for.

To make the most of your financial well-being, it’s also key to understand how it differs from financial literacy.

Financial Wellness vs. Financial Literacy

At first glance, financial wellness and financial literacy sound interchangeable, but they’re actually two sides of the same coin. Financial literacy is what you know about money, while financial wellness is how you apply that knowledge to live comfortably and confidently.

Here’s how they differ:

| Aspect | Financial Wellness | Financial Literacy |

| Definition | The ability to use financial knowledge for a secure, balanced life. | Knowledge and skills about managing money. |

| Focus Area | Practising healthy financial habits that bring peace and stability. | Learning about budgeting, saving, and borrowing. |

| Goal | To achieve long-term security and satisfaction with your finances. | To understand financial concepts and tools. |

| Example | Having enough savings to handle emergencies confidently. | Knowing how interest rates work or how to invest. |

With that difference clarified, it’s time to see where you personally fall on the financial wellness scale.

Also Read: Top 8 Financial Planning Strategies for Salaried Employees

How To Find Out Your Financial Well-being

Before you can improve your finances, it’s important to know where you currently stand. Think of this step as checking your financial “health report”.

Start by asking yourself a few simple questions. Be honest; there are no right or wrong answers here, just a clearer picture of where you are financially:

- Can I comfortably handle an unexpected expense without borrowing?

- Do I regularly save for future goals or emergencies?

- Do I feel in control of my monthly expenses?

- Am I confident about my financial future?

- Do I have money left over after essential spending?

- Does my current money situation cause me stress or limit my choices?

If most of your responses lean toward “no”, it might be time to relook at how you manage, plan, and emotionally relate to money.

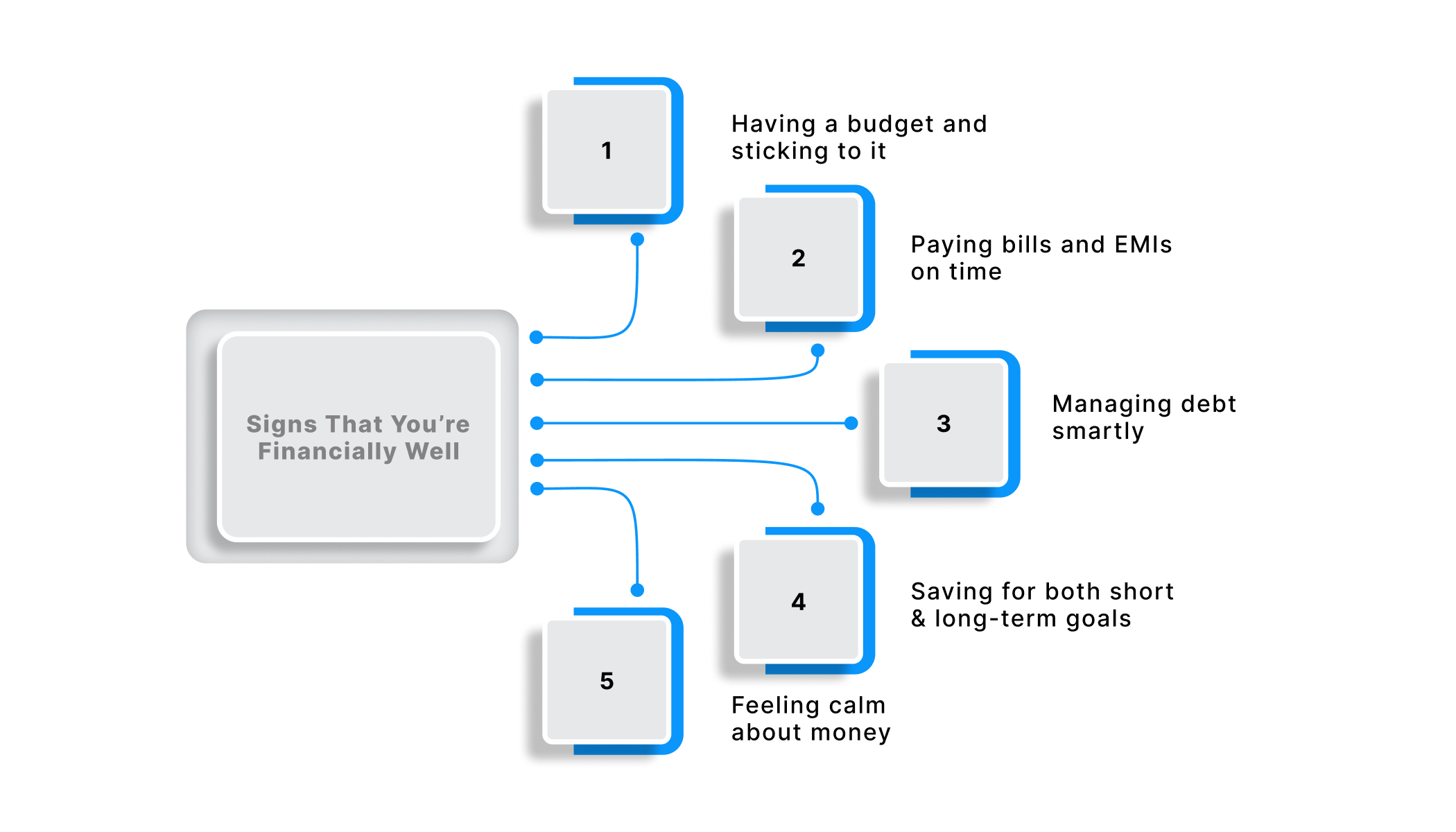

Signs That You’re Financially Well

You don’t need to earn a six-figure salary to feel financially stable. Financial wellness shows up in everyday choices and small habits like:

- Having a budget and sticking to it: You know how much you earn, spend, and save each month.

- Paying bills and EMIs on time: You’re organised and avoid unnecessary late fees or penalties.

- Managing debt smartly: You borrow when needed, but don’t let it control your life.

- Saving for both short and long-term goals: From emergency funds to travel dreams or retirement savings, you’re consistent.

- Feeling calm about money: You’re not constantly anxious about “what ifs”, and your spending aligns with your priorities.

If this sounds like you, great, you’re already on track. If not, don’t worry; improving your financial well-being is absolutely doable.

Not everyone feels financially “well” all the time, and that’s completely normal. When cash runs short, Pocketly provides instant, flexible loans to help you handle emergencies and keep your financial wellness on track.

How To Improve Your Financial Wellbeing: 8 Practical Ways

Improving financial wellness doesn’t require a finance degree; it’s about small, smart shifts that add up. Let’s look at five practical ways you can start today:

1. Track and Understand Where Your Money Goes

You can’t improve what you don’t measure. Keep tabs on where every rupee goes each month- rent, food, subscriptions, shopping, and so on.

Once you know your spending patterns, you can:

- Spot unnecessary expenses and cut them down.

- Create a spending plan that feels realistic, not restrictive.

- Prioritise what truly adds value to your life.

Example: If you notice frequent food delivery spends, plan home-cooked meals for a few days a week. Small switches like this make a big difference.

2. Build a Small “Emergency Cushion”

Life loves throwing surprises; maybe a sudden medical bill, a broken phone, or an unexpected trip home. That’s why even a tiny emergency fund matters.

- Start small: aim for at least one month’s living expenses.

- Keep it separate from your regular account so you don’t touch it easily.

- Refill it whenever you use it.

Example: If your phone suddenly stops working, having even ₹2,000 saved means you won’t need to borrow or delay bill payments.

3. Reduce High-Interest Debt First

Debt isn’t always bad; it depends on why and how you borrow. The key is responsible borrowing.

- List all your credit cards by interest rate and clear the highest-interest ones first.

- Use loans only for genuine needs, not impulsive wants.

- Choose platforms like Pocketly that offer transparent terms and fair interest rates.

Example: Paying off a 24% credit card debt first saves you more in the long run than clearing a 10% personal loan.

4. Set Realistic Financial Goals

You don’t need a 10-year investment plan to start. Just pick goals that make sense now.

- Categorise goals as short-term (next 6 months), mid-term (2 years), and long-term (5+ years).

- Use these goals to decide your monthly savings target.

- Review your progress every few months.

Example: Saving ₹2,000 monthly for a new laptop next year keeps you motivated and builds discipline.

5. Align Your Money Mindset

Money habits are often rooted in emotions like fear, guilt, or instant gratification. Improving financial wellness means working on that mindset too.

- Avoid comparing your finances with others; everyone’s journey is different.

- Reward yourself occasionally to stay motivated.

- Talk openly about money with trusted friends or mentors.

Example: If you feel anxious about saving, start automating transfers so you don’t have to “decide” every month. This way, saving becomes effortless.

6. Automate Your Finances

Let’s be honest, remembering to transfer money into savings or pay bills on time can feel like a chore. Automating your finances takes that pressure off your shoulders.

Set up automatic transfers for:

- Savings: Move a fixed amount to your savings account right after your salary arrives.

- Bills: Automate payments for rent, EMIs, or subscriptions to avoid late fees.

- Investments: Use auto-debit features for SIPs or recurring deposits.

Example: You could automate SIPs or insurance premiums through your banking app to stay consistent without having to think twice.

7. Learn Before You Leap

You can’t improve what you don’t understand, and money is no exception. Before investing, borrowing, or even swiping that new credit card, learn what you’re signing up for.

You don’t have to be a finance geek; start small with:

- YouTube videos and finance podcasts

- Personal finance blogs

- Free online courses or student finance workshops

Example: Read a short article on interest calculations before picking a loan or EMI plan. You can also watch a five-minute explainer video on SIPs to understand rupee cost averaging and risk basics.

8. Review And Reset Regularly

Your financial goals will change. Maybe you get a part-time job, move cities, or start freelancing. Regularly reviewing your finances helps you stay on track.

- Do a monthly money check-in: track where your money went.

- Revisit goals every 3–6 months: Are you closer to your savings target or overspending somewhere?

- Adjust your plan as your income or priorities shift.

Example: Do a quick monthly audit: did your “eating out” budget actually stay within limits, or did Zomato win again? Every few months, reset your goals.

Once you start understanding your money better, you’ll find that financial wellness naturally follows.

Also Read: 7 Steps to Handle Personal Financial Stress and Crisis

How Pocketly Makes Financial Wellness Simpler For You

When you’re working on building your financial wellness, sudden expenses can easily throw your plans off track. That’s where Pocketly steps in to keep you stress-free.

Pocketly is a digital lending platform that offers short-term personal loans, designed especially for young Indians managing monthly cash crunches. With flexible personal loans starting from ₹1,000 to ₹25,000, an interest rate from 2% per month, and a processing fee of just 1–8%, Pocketly makes borrowing quick and transparent.

Here’s how the simple process works:

- Sign Up: Register with your mobile number in just two clicks.

- Easy KYC: Upload Aadhaar and PAN for hassle-free, paperless verification.

- Set Your Details: Add your bank account for smooth transfers.

- Pick Your Loan: Choose the loan amount and tenure that fits your needs.

- Get Instant Funds: Once verified, the loan is disbursed directly into your account.

No collateral, no hidden charges, just a 100% online process with 24/7 customer support whenever you need help. Pocketly makes sure short-term money issues don’t stop you from focusing on long-term financial growth.

The Bottom Line

By now, you know that true financial wellness isn’t about earning more, but about managing what you have with clarity and confidence. When you understand your money habits and make mindful spending choices, you not only improve your finances but also get mental and emotional balance.

Start small, track your expenses, set achievable goals, and build an emergency fund. Over time, these habits strengthen your financial foundation and bring peace of mind in every aspect of life.

And when an unexpected expense pops up, you know Pocketly will back you up. Download Pocketly today on iOS or Android to get quick, hassle-free access to short-term loans whenever you need a little financial breathing space.

FAQ’s

How do I set financial goals and begin to learn about financial wellness?

Start by defining your priorities and breaking them into short- and long-term goals. Track your spending and savings to build awareness and financial discipline.

Could I be doing anything to improve my overall financial wellness or accumulate money faster?

Yes, reduce high-interest debt, save consistently, and review your expenses regularly. Even small, steady actions can accelerate your financial growth.

What are some strategies for achieving financial wellness and stability in today's economic climate?

Create a realistic budget, maintain an emergency fund, and manage debt wisely. Staying informed and consistent helps build financial wellness.

Give me some ideas for financial wellness journey goals.

Your goals can include creating a monthly budget, saving at least three months’ worth of expenses, or starting an investment plan. You can also aim to clear credit card debt, improve your credit score, or build a retirement fund.