Money moves faster in 2025. With UPI, online shopping, food delivery, and subscription payments, most young Indians make several transactions a day without thinking twice.

But when spending becomes quick, tracking must become quicker too. Manual methods cannot keep up with instant digital payments, and this leads to confusion, overspending, and end-of-month stress.

Real-time expense tracking offers a simple solution. It shows where your money goes the moment you spend it. This creates awareness, helps you avoid unnecessary purchases, and improves long-term financial habits.

In this guide, we’ll explore why manual tracking no longer works, how real-time tracking supports better behaviour, and how it fits today’s UPI-driven lifestyle.

Key Takeaways

- Real-time expense tracking brings instant awareness. It shows every spend the moment it happens, helping you understand your money clearly and avoid impulse decisions.

- Manual tracking can’t keep up with fast UPI spending. Frequent digital payments make manual entries unreliable, leading to hidden leaks and inaccurate budgets.

- Digital tracking builds stronger daily habits. Alerts, categories, and summaries help you stay disciplined, reduce overspending, and maintain balance throughout the month.

- Awareness leads to responsible borrowing. When you track in real time, you borrow only for genuine needs, and tools like Pocketly support those moments with clarity and transparency.

What Real-Time Expense Tracking Means Today

Real-time expense tracking is the modern way of understanding money flow. It does not wait for you to write things down, open a spreadsheet, or check expenses at the end of the week. It updates automatically the moment you make a payment.

This matters in a world where money moves quickly and in small amounts. Real-time tracking helps young Indians stay aware, avoid impulsive decisions, and manage their monthly budget with confidence.

How real-time tracking works (UPI, SMS alerts, bank sync)

Real-time tracking uses simple digital tools you already rely on. It pulls information from UPI payments, bank SMS alerts, and app notifications to update your spending instantly.

Once you pay, the system categorises your transaction within seconds. There is no typing, no recording, and no remembering later.

Everything stays accurate because the information updates automatically. This makes digital expense tracking reliable, quick, and effortless, even on a busy day.

Real-time vs manual tracking, accuracy, and behaviour

Manual tracking depends on memory. Most people forget entries, underestimate small spends, or skip updates when life gets busy.

Real-time tracking removes these gaps. It captures every UPI payment, card swipe, subscription renewal, or delivery fee the moment it happens.

This leads to:

- Accurate budgets

- Fewer surprises

- Better decisions in the moment

- Stronger financial discipline

Manual tracking gives you past information. Real-time tracking gives you information when it matters.

Why instant visibility matters in fast digital spending

Today’s spending is fast, frequent, and often emotional. A quick delivery order or a late-night app purchase barely feels like money leaving your account.

Instant visibility brings awareness back. When you see your balance change immediately, you think twice before spending again.

It also helps you stay aligned with your goals, instead of reacting to impulses. Real-time tracking turns every payment into a moment of clarity, not regret.

Also Read: Understanding Digital Payments: Meaning, Types, and Functions

Why Manual Expense Tracking Fails Young Indians Today

Manual expense tracking once worked. People paid in cash, had fewer transactions, and spent mainly on essentials. But spending patterns in 2025 look nothing like that.

Young Indians today use UPI for almost everything — from snacks and cabs to groceries and online shopping. The number of transactions is high, and most of them are small.

Recording each one manually is exhausting, and most users stop trying after a few days. This leads to errors, missed entries, and budgets that never reflect reality.

High-frequency UPI payments make manual entry impossible

If you make ten or twenty transactions a day, manual tracking becomes unrealistic. Each UPI payment feels small, but together they add up quickly.

No one has the time or patience to write down every ₹20 chai or ₹150 snack. Over time, these unrecorded expenses create large, invisible money leaks.

Real-time expense tracking captures these instantly. Nothing slips through.

Forgetting entries leads to distorted budgets

Manual tracking depends on perfect memory. But busy schedules, late nights, or rushed mornings mean entries get skipped.

These gaps distort your budget. It may look like you spent less than you actually did, which creates a false sense of control.

Real-time expense tracking removes the need to remember anything. Every spend is recorded automatically and accurately.

No automated categorisation or insights

Manual systems only record numbers. They do not show where your money actually goes. Digital expense tracking categorises:

- Food

- Travel

- Shopping

- Subscriptions

- Bills

- Entertainment

When you see spending patterns clearly, it is easier to adjust habits. Manual tracking cannot provide this clarity.

Lack of reminders → out-of-sight overspending

Manual tracking stays in a notebook or spreadsheet. You only see the numbers when you decide to look. But most overspending happens because we don’t look often enough.

Real-time tracking sends alerts when:

- You overspend in a category

- Your daily budget is crossed out

- A subscription renews

- Your balance is dipping

Awareness comes in the moment, not weeks later.

Also Read: Expense Tracking Categories for Budgeting

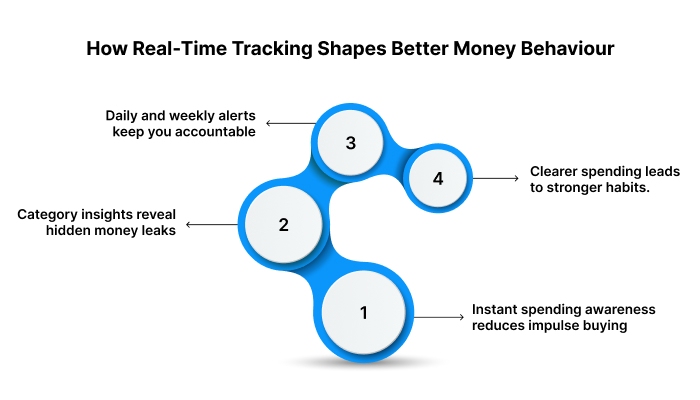

How Real-Time Tracking Shapes Better Money Behaviour

Behaviour is the real power behind real-time tracking. Most financial habits depend on awareness. When you see your money flow instantly, your choices improve naturally.

Digital expense tracking acts like a gentle nudge. It doesn’t restrict you, it reminds you. It helps you pause, reflect, and pick the better option. This creates long-term habits that stick.

1. Instant spending awareness reduces impulse buying

Impulse spending usually happens when we act without thinking. Fast payments make this easier. When real-time tracking shows your spending immediately, it creates a moment of awareness.

That tiny pause is often enough to stop unnecessary purchases. You make clear, intentional decisions, not emotional ones.

Category insights reveal hidden money leaks

Digital tracking highlights patterns you rarely notice.

For example:

- Ordering food too often

- Paying for unused subscriptions

- Overspending on shopping

- Daily small purchases add up

These insights help you adjust behaviour without feeling restricted. You fix the leaks, not your lifestyle.

Daily and weekly alerts keep you accountable

Accountability is a big part of better money habits. Real-time tracking provides regular, gentle reminders.

It tells you when:

- You cross a limit

- You’re close to overspending

- Your balance is falling

- A goal is not on track

These alerts keep you aware every day, not just at month-end.

Spending patterns become clearer → habits become stronger

Real-time expense tracking highlights patterns over time. This allows you to understand your behaviour honestly.

Once patterns are clear, you naturally build better habits. You choose differently without forcing yourself. Awareness becomes discipline. Discipline becomes confidence.

Also Read: How to Manage Monthly Expenses Effectively

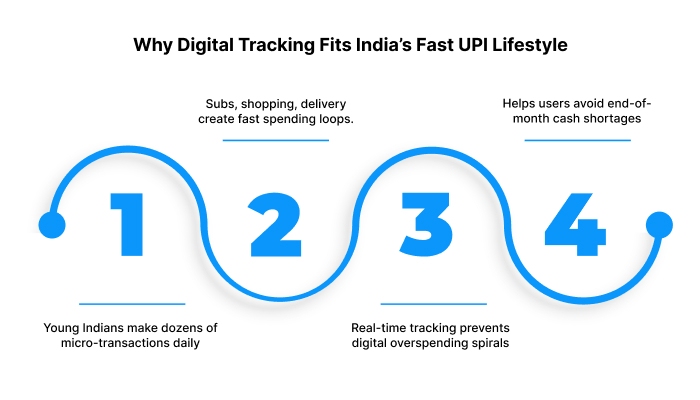

Why Digital Tracking Fits India’s Fast UPI Lifestyle

India’s payment habits have changed completely. UPI has made transactions instant, effortless, and constant. Most young Indians now pay for food, travel, shopping, and daily needs through digital methods several times a day.

When money moves this fast, traditional tracking becomes impossible. Digital expense tracking matches this pace by updating instantly and keeping every payment visible in one place. It fits the rhythm of the digital lifestyle instead of slowing it down.

Young Indians make dozens of micro-transactions daily

A ₹20 chai, a ₹99 recharge, a ₹150 snack. These feel small and harmless. But with 15–20 micro-transactions a day, they create big gaps in the monthly budget.

Real-time tracking captures every spend as it happens. This prevents invisible leaks caused by frequent small payments.

Subscriptions, online shopping, food delivery → fast spending loops

Young earners often juggle:

- OTT subscriptions

- Music apps

- Fitness apps

- Cloud storage

- Food delivery

- Flash sales

- Instant checkout options

These payments renew automatically or occur emotionally. Manual tracking cannot keep up. Real-time tracking catches them the moment they occur. This helps users stay aware and avoid unnecessary renewals or impulse orders.

Real-time tracking prevents digital overspending spirals

Fast UPI payments make it easy to overspend without noticing. Digital expense tracking stops this by showing your balance and category totals instantly.

When you see the impact of every spend in real time, you pause before repeating the behaviour. This naturally breaks overspending patterns.

Helps users avoid end-of-month cash shortages

Many young Indians face month-end pressure. Real-time tracking prevents this by keeping you informed daily.

You know exactly how much you have left. You know where your money went. You know when to slow down. This protects you from unnecessary borrowing caused by avoidable overspending.

Also Read: 7 Tips to Spend and Save Money Wisely

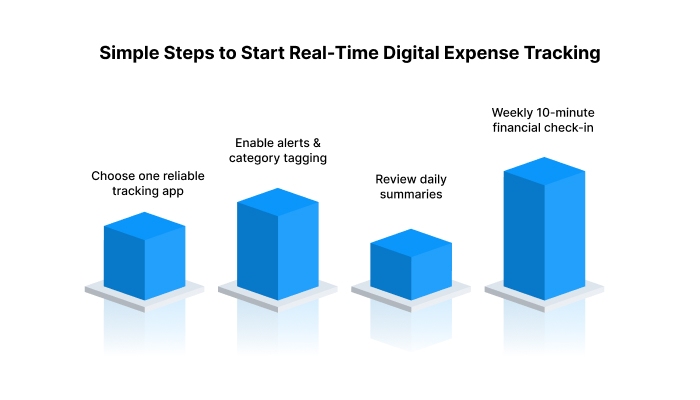

Simple Steps to Start Real-Time Digital Expense Tracking

Starting real-time expense tracking does not require advanced knowledge or complex tools. A few simple steps can give you control and clarity over your money. These small actions build strong habits and long-term financial stability.

Choose one reliable tracking app

Pick one trusted app instead of juggling several tools. Make sure it supports:

- Instant updates

- Automatic categorisation

- Bank and UPI sync

- Alerts and reminders

A single platform creates consistency and reduces confusion.

Enable alerts and category tagging

Alerts help you stay aware throughout the day. Enable notifications for:

- Daily spending

- Category limits

- Low balance

- Subscription renewals

Category tagging shows exactly where your money goes. Once you see the pattern, you can adjust the behaviour.

Review daily summaries (2 minutes)

Spend two minutes each night reviewing your daily summary. This small action builds awareness faster than any manual system.

A quick daily check prevents small spends from becoming big problems.

Weekly 10-minute financial check-in

End-of-week check-ins are simple but powerful. Use ten minutes to review:

- Category totals

- Overspending alerts

- Progress toward your weekly or monthly goals

- Any subscriptions you no longer need

Weekly awareness keeps your finances stable without feeling overwhelming.

Also Read: Top Instant Personal Loan Apps with Low Interest in India

How Pocketly Fits Into a Real-Time Spending System

Real-time expense tracking helps you understand your money clearly. It shows what you can manage with your income, and when you need extra support. When tracking reveals a real shortfall, not a spending mistake, responsible credit can help.

Pocketly offers a simple, transparent solution in those moments.

Pocketly helps when tracking shows a genuine short-term need

Sometimes expenses cannot wait. Real-time tracking helps you catch these situations early, whether it is:

- An urgent bill

- Essential travel

- Medical needs

- Education costs

Pocketly supports such moments with small, short-term loans.

Clear, simple loan amounts and transparent costs

Pocketly provides loans from ₹1,000 to ₹25,000. Every cost is shown upfront.

- Interest rate: starting from 2% per month

- Processing fee: 1–8% depending on loan amount and tenure

- No hidden charges

- Repay anytime, even earlier than planned

Transparency is a key part of responsible borrowing.

Pocketly requires no collateral, uses quick digital KYC, and transfers funds directly to the user’s bank account. This supports young Indians who need clear, simple, and efficient access to short-term credit.

Used together, real-time expense tracking and responsible borrowing create a balanced financial system. Awareness guides your decisions. Pocketly supports you when you genuinely need help.

Conclusion

Real-time expense tracking gives young Indians a clearer, calmer relationship with money. It keeps spending visible, helps prevent overspending, and supports stronger daily habits.

Manual methods cannot match the speed of today’s UPI-driven lifestyle. Digital expense tracking brings awareness into every moment, making financial decisions easier and more intentional.

When real-time tracking shows a genuine short-term need, responsible solutions like Pocketly can help you manage emergencies with clarity and confidence.

Stay aware. Stay in control. Build habits that support your goals every day.

Download the Pocketly App

FAQs

What is real-time expense tracking?

Real-time expense tracking records your spending the moment you make a payment. It updates instantly through UPI alerts, SMS notifications, and bank sync. This gives you a live view of where your money goes throughout the day.

Does real-time tracking improve budgeting accuracy?

Yes. Because every expense is recorded automatically, you avoid errors caused by forgetting entries. It keeps your budget accurate and prevents unexpected gaps at month-end.

Is digital expense tracking safe in India?

Most trusted apps use bank-grade encryption and do not store sensitive passwords. Always use well-known apps and check their permissions before installing. Never share your OTP or UPI PIN with anyone.

How often should I check my tracked expenses?

Check your daily summary once each evening. Do a short weekly review to understand patterns and adjust your spending. These small habits keep your finances stable without pressure.

Does real-time tracking help reduce unnecessary borrowing?

Yes. When you see your spending instantly, you avoid borrowing for impulse purchases or forgotten expenses. You borrow only when a genuine need appears, not because of poor tracking.