Introduction

Financial difficulties often appear when you least expect them to. For many young Indians, the need for immediate financial assistance can feel overwhelming, regardless of whether they are self-employed, managing irregular income, a salaried professional handling month-end bills, or a student juggling fees.

The available loan options at these times frequently seem complicated, and terms like senior, junior, unsecured, and secured only serve to muddle matters further.

You are not the only one who has ever wondered, "What is a senior unsecured loan?" Understanding this type of loan is crucial as it influences your access to funds, the necessity of collateral, and the repayment process.

When money matters most, you can make better financial decisions and steer clear of expensive blunders by simplifying this idea.

At a Glance

- A senior unsecured loan is a short-term loan that doesn’t require collateral but has priority over other unsecured loans in terms of repayment.

- Key aspects include no collateral, repayment priority, flexible usage, short tenures, higher interest rates, and impact on credit score.

- Benefits are fast access to funds, no risk of losing assets, flexible spending, credit history building, and short-term cash flow relief.

- Risks include higher interest costs, strict repayment timelines, potential damage to your credit score, eligibility checks, over-borrowing, and legal consequences.

- Pocketly offers small, flexible loans (₹1,000–₹25,000) with instant approval, transparent costs, and no collateral for young Indians.

What is a Senior Unsecured Loan?

A senior unsecured loan is a type of loan that does not require you to pledge any collateral, such as property or jewellery. Still, it holds a higher repayment priority compared to other unsecured loans.

To break it down:

- Unsecured means you don't need to back the loan with assets. The lender relies mainly on your creditworthiness and repayment ability.

- Senior means that if a borrower defaults, this loan takes priority over junior unsecured loans when repayments are recovered.

For young Indians, this can be a helpful way to obtain money quickly without collateral, but it's also crucial to be aware of the obligations involved.

To truly grasp how these loans operate, it is helpful to see a real-world example; simply knowing the definition is only the first step.

Must Read: First-Time Loans to Build Credit: A Beginner's Guide

Real-Life Example of a Senior Unsecured Loan

Let's imagine a scenario to make this concept easier to understand.

Rohit is a 24-year-old software engineer living in Bengaluru. Towards the end of the month, he faces an unexpected medical expense of ₹15,000. His savings are limited, and borrowing from family isn't an option. Instead of pledging valuables like gold or property, Rohit applies for a senior unsecured loan.

Since the loan does not require collateral, the approval is quick, and the money is transferred directly to his bank account. Because it is "senior," if Rohit ever defaulted, his lender would have priority in repayment compared to other lenders who might have given him junior unsecured loans.

For Rohit, the benefits are clear:

- He gained immediate access to funds without having to pledge any assets.

- He had the freedom to use the money for his emergency.

- Repaying on time helped him strengthen his credit score, improving his chances of qualifying for bigger loans later in life.

This example illustrates how a senior unsecured loan can be a practical solution for young professionals, students, or self-employed individuals who require urgent financial support without compromising their personal assets.

While Rohit's case demonstrates the benefits of such loans, it's essential to examine their general features to determine whether they're the right fit for you.

Must Read: Self-Regulation in RBI's FinTech Framework Explained

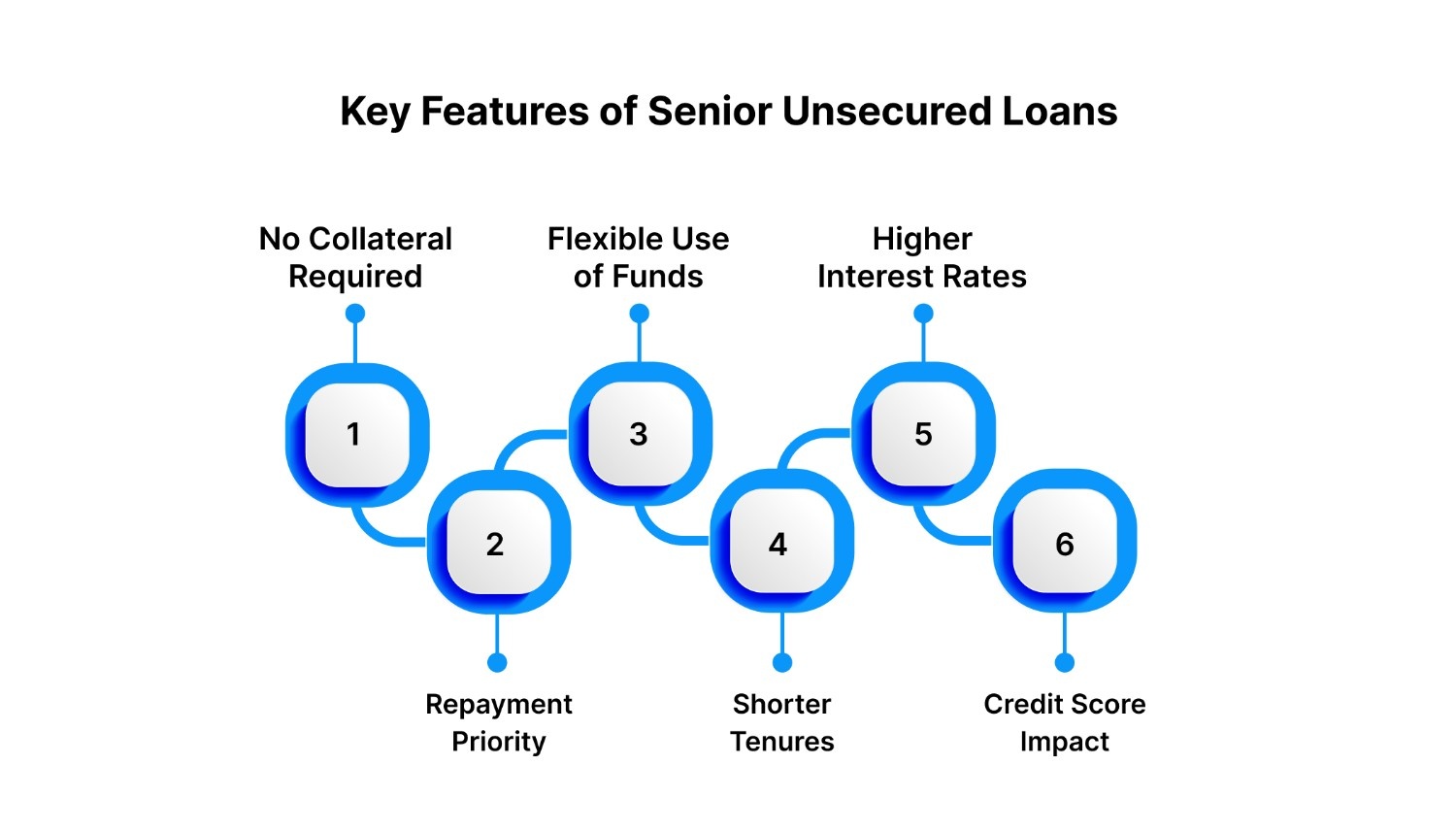

Key Features of Senior Unsecured Loans

Senior unsecured loans stand out because they strike a balance between accessibility and responsibility. Understanding these characteristics can help young Indians determine whether such a loan meets their financial needs, regardless of whether they are self-employed, salaried professionals, or students.

1. No Collateral Required

Unlike secured loans, you don't need to pledge your assets such as property, jewellery, or savings. This makes the loan more accessible, especially for students or young professionals who may not have significant assets to offer. It also reduces the fear of losing something valuable if you miss a repayment.

2. Repayment Priority

The "senior" in senior unsecured loans refers to repayment order. If a borrower fails to repay and the lender takes legal action, this loan will be given priority over other unsecured debts. While this primarily protects the lender, it also explains why these loans are considered relatively safer from a credit institution's perspective. For you as a borrower, the lender might offer quicker approval if you qualify.

3. Flexible Use of Funds

You can use the loan for various purposes, such as paying tuition fees, managing medical bills, or covering month-end expenses. Unlike some loans that restrict usage to specific needs (like car loans or home loans), senior unsecured loans give you the freedom to manage urgent personal or professional expenses without question asked.

4. Shorter Tenures

These loans are generally designed for short repayment periods. For example, you may borrow funds for a few months to manage an emergency or smooth over cash flow issues until your next salary arrives. This makes them a practical solution for young earners and students who need temporary financial support.

5. Higher Interest Rates

Since the loan is not backed by collateral, lenders consider it a riskier investment. To balance this risk, interest rates tend to be higher than those of secured loans. For borrowers, this means borrowing only what you really need and ensuring timely repayment to avoid the extra costs of extended debt.

6. Credit Score Impact

Every repayment you make is reported to credit bureaus. Timely repayments can strengthen your credit profile, helping you qualify for larger loans, such as car or home loans, in the future. On the other hand, delayed or missed payments can negatively affect your credit score and limit future borrowing options.

These features explain how senior unsecured loans function in practice, but to truly appreciate their value, let's explore the benefits they bring to borrowers.

Must Read: 11 Successful Tips On How To Save Money While In College

Benefits of Senior Unsecured Loans

Senior unsecured loans can be a lifeline for young Indians who need quick access to funds without the hassle of collateral.

Here are the most important benefits you should know:

1. Quick and Convenient Access to Funds

One of the most significant advantages is speed. Since you don't need to provide collateral or go through lengthy paperwork, approvals are faster. For students facing sudden educational costs or salaried professionals facing a medical emergency, this can mean the difference between resolving the issue on time and falling into financial stress.

2. No Risk of Losing Assets

You are exempt from having to pledge valuable assets like savings, gold, or real estate because the loan is unsecured. Young borrowers who might not have holdings in the first place or who wish to protect their assets while still obtaining short-term credit will find it less daunting as a result.

3. Flexible Usage

Unlike some loans that restrict how the funds can be used, senior unsecured loans allow you to spend the money on what matters most to you. This could be covering rent, paying exam fees, handling home repairs, or meeting other urgent personal needs. The freedom to use the loan as you see fit makes it highly practical.

4. Builds Credit History Early

For many young Indians, this type of loan may be their first step into the world of credit. Making repayments on time improves your credit score, which is crucial for future financial opportunities such as car loans, home loans, or even business funding. Establishing good credit habits early can make borrowing easier and cheaper later in life.

5. Short-Term Relief for Cash Flow Gaps

These loans are not designed to burden you with long-term debt. Instead, they are meant to bridge small financial gaps, such as covering expenses between paychecks or managing sudden costs when savings are low. This makes them especially useful for people with irregular incomes, such as freelancers or self-employed professionals.

6. Priority for Lenders, Stability for Borrowers

Lenders are more likely to grant senior unsecured loans because they prioritise repayment over junior unsecured loans. This increases availability for borrowers who qualify, ensuring you have a reliable way to access funds when you need them most.

Even with these advantages, no financial product is perfect. To make an informed decision, you must also weigh the risks and challenges involved.

Must Read: A Guide to Digital Transactions as Per RBI Regulations

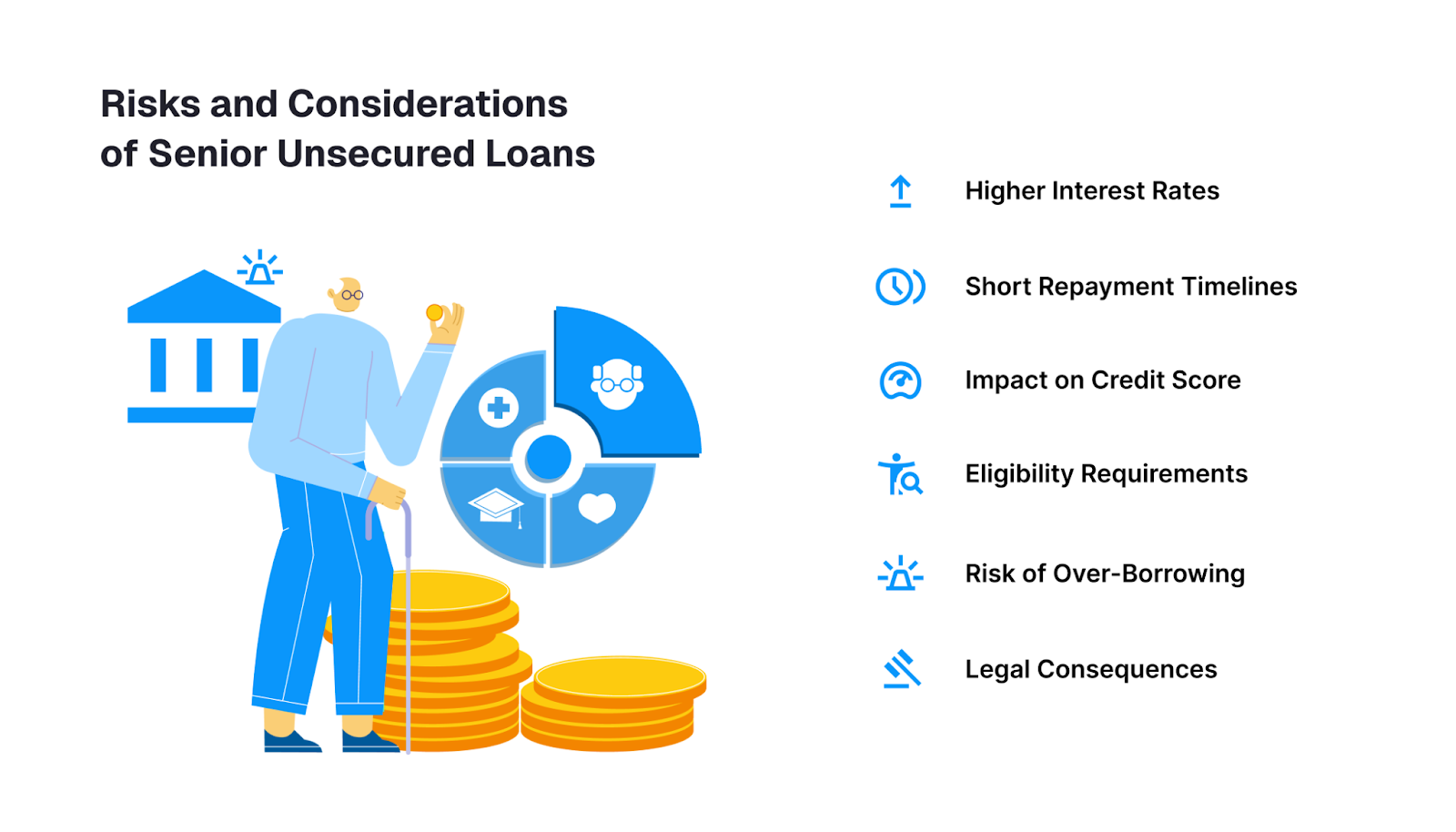

Risks and Considerations of Senior Unsecured Loans

While senior unsecured loans offer flexibility and quick access to funds, they also come with certain risks that every borrower should carefully consider before applying.

1. Higher Interest Rates

Lenders assume more risk because these loans are not secured by collateral. To balance that risk, interest rates are usually higher compared to secured loans. For young borrowers, this means the cost of borrowing can add up quickly if the loan is not repaid on time.

2. Short Repayment Timelines

Senior unsecured loans are often designed for short-term needs. While this helps in avoiding long-term debt, it also means repayment schedules can feel tight. Missing a payment could quickly lead to penalties, late fees, and extra financial pressure.

3. Impact on Credit Score

Your repayment behaviour is directly reported to credit bureaus. Timely repayment helps build a strong credit profile, but missed or delayed payments can damage your credit score. This can reduce your chances of qualifying for bigger loans in the future, such as a car or home loan.

4. Eligibility Requirements

Even though collateral is not required, lenders still assess factors such as your income, repayment capacity, and sometimes your existing credit history. For students or first-time borrowers with limited financial records, this might create hurdles in approval or result in smaller sanctioned amounts.

5. Risk of Over-Borrowing

Some borrowers might make the mistake of taking out more loans than they can afford to repay because unsecured loans are so easy to obtain. This can lead to a cycle of debt, where you use new loans to cover old ones, which is financially damaging in the long run.

6. Legal Consequences of Default

If you fail to repay the loan, the lender cannot seize your property directly (unlike a secured loan), but they can take legal action. This may include collection processes, additional charges, and a negative impact on your financial credibility.

Given these risks, many young Indians seek more straightforward and more transparent options. This is where Pocketly comes in as a practical alternative.

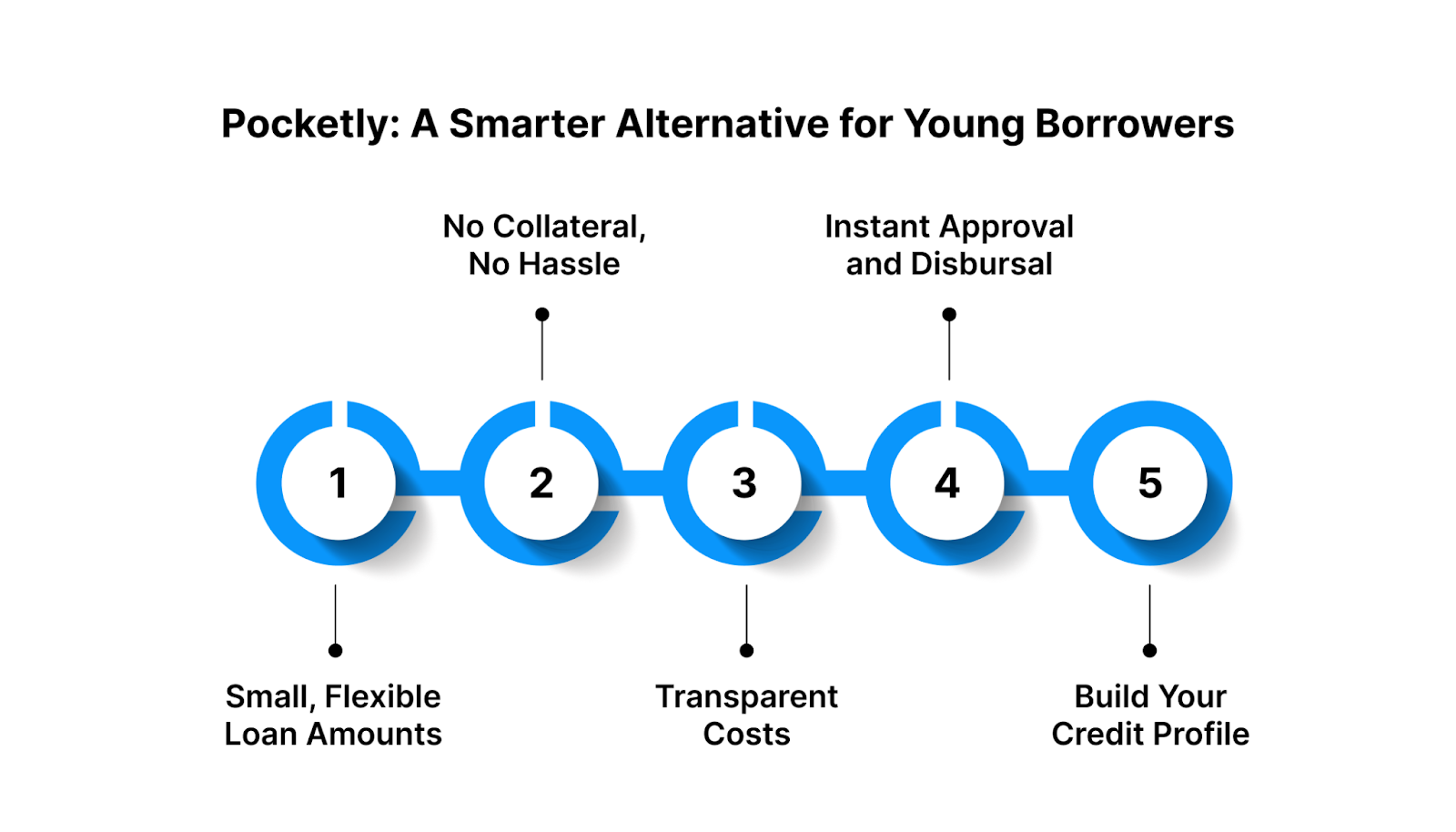

Pocketly: A Smarter Alternative for Young Borrowers

While senior unsecured loans can provide quick relief, they are not always the most suitable or affordable option for young Indians. This is where Pocketly steps in as a digital lending platform explicitly designed with students, salaried professionals, and self-employed individuals in mind.

1. Small, Flexible Loan Amounts

Pocketly offers short-term personal loans starting from as little as ₹1,000 and going up to ₹25,000. This flexibility ensures you only borrow what you need, avoiding unnecessary debt.

2. No Collateral, No Hassle

Just like other unsecured loans, Pocketly does not ask you to pledge assets. The application process is entirely digital, requiring only a quick KYC with no physical documents.

3. Transparent Costs

Pocketly keeps its terms clear and upfront. Interest rates start at 2% per month, with processing fees ranging from 1% to 8% of the loan amount. There are no annual charges, hidden costs, or joining fees.

4. Instant Approval and Disbursal

When emergencies strike, time matters. Pocketly ensures fast approvals and instant transfers directly into your bank account so you can meet urgent expenses without delay.

5. Build Your Credit Profile

Making every repayment on time helps you establish and improve your credit score. For young borrowers with little or no credit history, this is a valuable way to build long-term financial credibility.

Wrapping Up

Understanding what a senior unsecured loan is gives you the clarity to make better financial decisions. These loans offer quick access to funds without requiring collateral, making them particularly useful in emergencies or for addressing short-term cash flow gaps. But with higher interest rates and strict repayment timelines, they must be managed responsibly to avoid long-term financial stress.

For young Indians who need small, flexible, and transparent borrowing options, Pocketly offers a more innovative alternative. With instant approval, digital KYC, no collateral, and loan amounts starting as low as ₹1,000, Pocketly is designed to give you the support you need, when you need it.

Download the Pocketly app today on iOS or Android and take control of your financial independence with quick, hassle-free loans.

FAQs

Q1. What is a senior unsecured loan in simple words?

It's a loan that doesn't require collateral but has higher repayment priority compared to other unsecured loans if the borrower defaults.

Q2. Who can apply for a senior unsecured loan?

Anyone with a steady income or good creditworthiness can apply, including students, salaried professionals, and self-employed individuals, depending on the lender's requirements.

Q3. Are senior unsecured loans risky for borrowers?

They're safe if repaid on time, but carry higher interest rates and strict timelines. Missing payments can hurt your credit score.

Q4. How are senior unsecured loans different from secured loans?

Secured loans require collateral such as property or gold. Senior unsecured loans don't need collateral but usually have higher interest rates.

Q5. Can taking a senior unsecured loan improve my credit score?

Yes. Timely repayments strengthen your credit profile, but late or missed payments can negatively impact it.

Q6. Is Pocketly a provider of senior unsecured loans?

Pocketly is a digital lending platform, not an NBFC. It offers small, short-term personal loans (₹1,000–₹25,000) through partnered NBFCs, designed to meet emergency and short-term financial needs.