The rapid expansion of India's fintech sector has revolutionised financial services, offering greater accessibility and efficiency. However, this swift growth has also introduced challenges related to governance, consumer protection, and regulatory oversight. In response, the Reserve Bank of India (RBI) introduced the "Framework for Self-Regulatory Organisation(s) for Fintechs" (SRO-FTs) in May 2024.

This initiative empowers fintech companies to establish their own self-regulatory bodies, ensuring adherence to industry standards and fostering a culture of responsible innovation.

By promoting self-regulation, the RBI aims to balance the dynamic nature of fintech with the need for robust oversight, thereby enhancing consumer trust and supporting sustainable growth in the sector.

Key Takeaways

- RBI’s Self-Regulation Framework aims to balance fintech innovation with necessary regulatory oversight to ensure industry growth while safeguarding consumer interests.

- Self-Regulatory Organizations (SROs) play a central role in setting industry standards, conducting audits, and resolving disputes, all while collaborating with the RBI to maintain compliance.

- Fintech’s Rapid Growth: The fintech market in India is projected to reach $990 billion by 2032, highlighting the need for a robust framework that supports both innovation and accountability.

- Focus on Consumer Protection: SROs are responsible for ensuring that fintech companies adhere to ethical practices, protect user data, and offer transparent financial products.

- Collaborative Approach: The RBI’s framework emphasizes continuous collaboration with fintech entities, ensuring that the industry evolves responsibly while aligning with national financial regulations.

Understanding of RBI's Self-Regulation Framework in FinTech

The Reserve Bank of India’s (RBI) Self-Regulation Framework for the fintech sector aims to promote innovation while ensuring robust compliance within India's expanding digital financial system.

With the fintech market projected to reach $990 billion by 2032 at a 30.2% CAGR, the RBI recognizes the need for a balanced approach that promotes technological advancement and safeguards against emerging risks such as cybersecurity threats, data privacy concerns, and operational failures.

The framework establishes Self-Regulatory Organizations (SROs) to set industry standards, conduct audits, resolve disputes, and collaborate with the RBI so that the sector evolves responsibly. Thus, maintain consumer trust and financial stability while supporting the sector's growth and innovation.

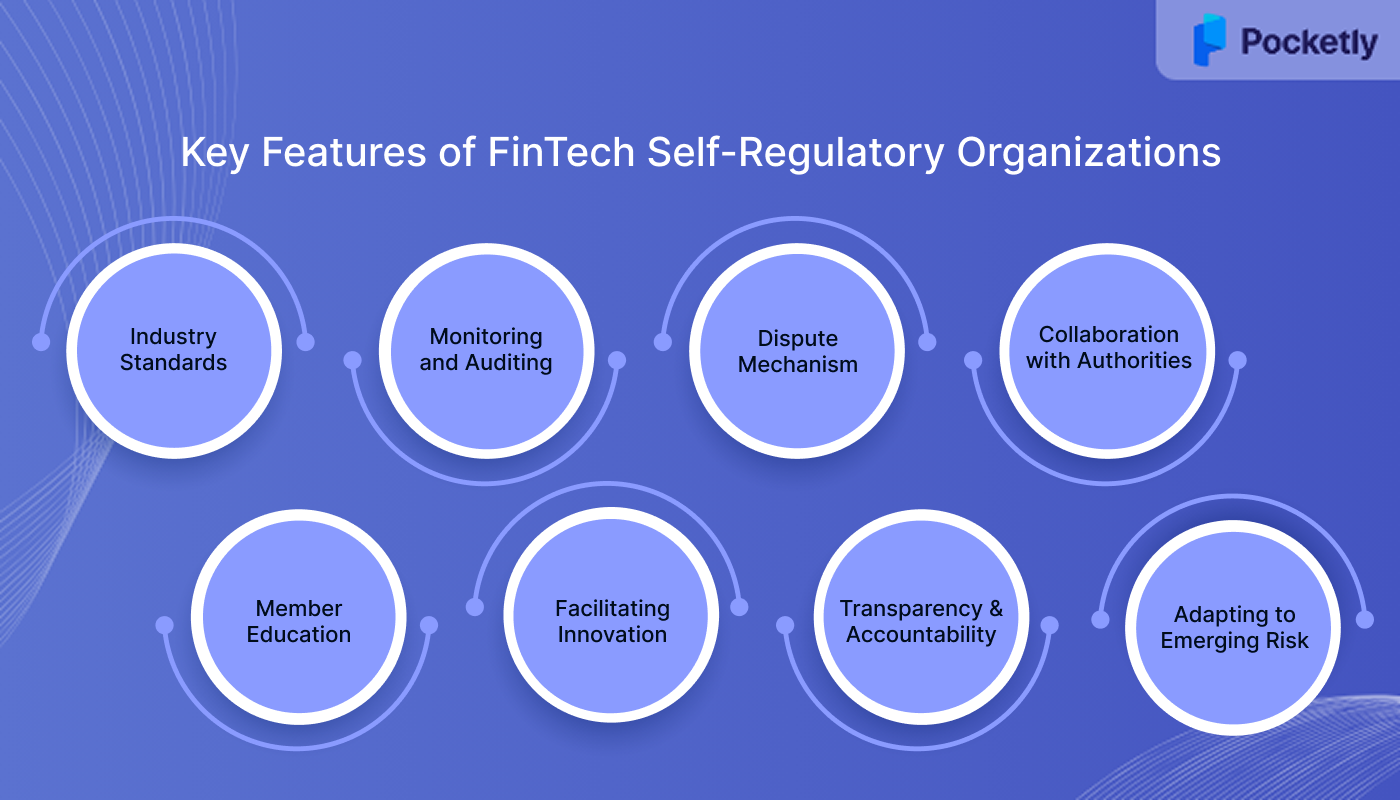

Key Features of FinTech Self-Regulatory Organizations (SROs)

FinTech Self-Regulatory Organizations (SROs) are a vital part of the regulatory framework introduced by the Reserve Bank of India (RBI) to ensure that the rapidly growing fintech sector adheres to industry standards while fostering innovation. These organizations serve as intermediaries between the fintech companies and the regulatory authorities, allowing the sector to self-regulate while maintaining transparency and accountability.

Here are the key features of FinTech SROs:

1. Industry Standards and Compliance

One of the core features of FinTech SROs is their role in establishing and enforcing industry standards. These standards cover various aspects of fintech operations, including data security, consumer protection, privacy regulations, and operational transparency. By adhering to these guidelines, fintech companies can be compliant with best practices, which ultimately helps protect consumers and maintain trust in the sector.

Example: An SRO may require member companies to adopt stringent encryption protocols for handling customer data, ensuring that all fintech products meet high cybersecurity standards.

2. Monitoring and Auditing

SROs are tasked with overseeing the activities of their member organizations to ensure that they comply with the established guidelines. This includes conducting regular audits, monitoring business practices, and reviewing customer complaints. Through this oversight, SROs help prevent unethical practices, fraud, and operational failures within the sector.

Example: An SRO might regularly audit member companies to ensure compliance with Anti-Money Laundering (AML) and Know Your Customer (KYC) regulations.

3. Dispute Resolution Mechanism

FinTech SROs resolve disputes between fintech companies and consumers or other stakeholders. They provide a structured framework for handling grievances, ensuring that conflicts are addressed quickly and fairly. This mechanism builds consumer confidence and helps to prevent prolonged legal battles.

Example: If a customer faces an issue with a digital payment platform, the SRO can mediate the situation, ensuring that the customer receives compensation or that the issue is resolved in line with industry standards.

4. Collaboration with Regulatory Authorities

While SROs allow for self-regulation within the fintech industry, they still collaborate closely with the RBI and other regulatory bodies. This collaboration ensures that the fintech ecosystem aligns with national financial regulations and that the SROs themselves are operating within the legal framework. It also helps inform policy changes and ensures that fintech activities are in line with government goals, such as promoting financial inclusion.

Example: The SRO might provide regular reports to the RBI, detailing how its members are complying with regulatory changes or addressing emerging risks in the fintech space.

5. Member Education and Awareness

A significant responsibility of FinTech SROs is to provide continuous education and training to their members. This way, fintech companies are up-to-date with the latest industry trends, regulatory changes, and technological innovations. It also helps companies develop a better understanding of their legal obligations and ethical standards.

Example: The SRO may organize webinars, workshops, or publish newsletters on topics like digital payments security or updates in financial regulations.

6. Facilitating Innovation and Growth

Despite the regulatory oversight, SROs are designed to support innovation within the fintech sector. By allowing the industry to self-regulate, these organizations create an environment where companies can experiment with new technologies, business models, and services without the burden of excessive bureaucracy.

Example: The SRO might offer fintech startups guidance on developing products that comply with regulations while encouraging creative solutions for underserved markets.

7. Transparency and Accountability

FinTech SROs operate under a mandate to ensure that their members are transparent in their operations. This includes regular disclosure of financials, business practices, and customer-related issues. Transparency helps hold companies accountable and reassures consumers and investors that the companies they interact with are trustworthy.

Example: SROs may require member companies to publish annual reports or disclose user data usage policies, ensuring transparency about how customer information is handled.

8. Adapting to Emerging Risks

As the fintech industry evolves rapidly, so do the risks associated with new technologies, products, and market dynamics. SROs must be agile, continuously monitoring the sector for emerging risks such as cybersecurity threats, fraud, and market volatility. This proactive approach helps mitigate risks before they affect the broader financial system.

Example: An SRO might develop a framework to assess and address new risks associated with blockchain technology or cryptocurrency trading platforms.

The RBI has established comprehensive eligibility and membership criteria that determine which organizations can assume the responsibility of sector oversight and which companies can benefit from SRO membership.

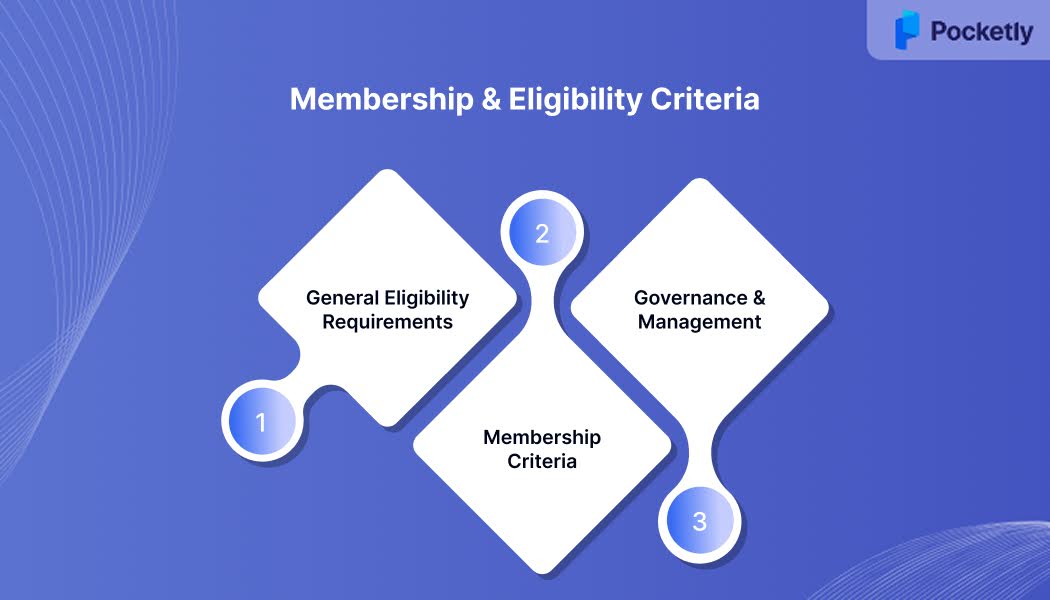

Membership and Eligibility Criteria of RBI's FinTech Self-Regulation Framework

The Reserve Bank of India (RBI) introduced the Self-Regulatory Organisation for FinTechs (SRO-FT) framework to promote innovation. However, to be recognized as an SRO-FT, an entity must meet specific eligibility and membership criteria outlined by the RBI.

General Eligibility Requirements

To be recognized as an SRO-FT, the applicant must meet certain criteria that ensure legal, financial, and operational integrity. These requirements ensure that the organization is equipped to oversee the sector effectively.

- The applicant must be a not-for-profit entity registered under Section 8 of the Companies Act, 2013.

- The Memorandum of Association should explicitly state self-regulation as the primary objective.

- Ownership should be diversified, with no single entity holding more than 10% of the share capital.

- A minimum net worth of ₹2 crore is required within one year of recognition.

- The SRO must demonstrate infrastructure capability to support self-regulation activities.

- The SRO must establish systems to manage instances of user harm, such as fraud or unauthorized transactions.

Membership Criteria

The membership criteria ensure that the SRO represents the interests of the entire fintech ecosystem, including both small and large entities. Membership should be accessible, inclusive, and diverse.

- Membership is open to fintech companies, especially those not regulated by other financial regulators.

- Membership is voluntary but should consist of fintech entities of varying sizes and stages.

- The membership fee structure must be non-discriminatory and reasonable to ensure equal representation.

- The SRO must ensure broad geographic and operational representation within its membership.

Governance and Management

Effective governance and management are key to ensuring that the SRO operates with integrity, independence, and fairness. The leadership must have the expertise and impartiality to oversee the self-regulation process.

- The Board must include independent directors with no active association with the regulated entities.

- At least one-third of the Board must be independent, including the chairperson.

- Directors and key personnel must meet fit-and-proper criteria, with transparency regarding any legal proceedings.

- The RBI reserves the right to grant or refuse recognition, and its decision is final.

- Upon recognition, the RBI will issue a "Letter of Recognition" to the SRO-FT, subject to compliance with the prescribed requirements.

Once established and recognized, these SROs must translate their structural qualifications into actionable governance. The framework assigns specific duties and functions that transform these organizations from mere industry bodies into active guardians of fintech standards and consumer protection.

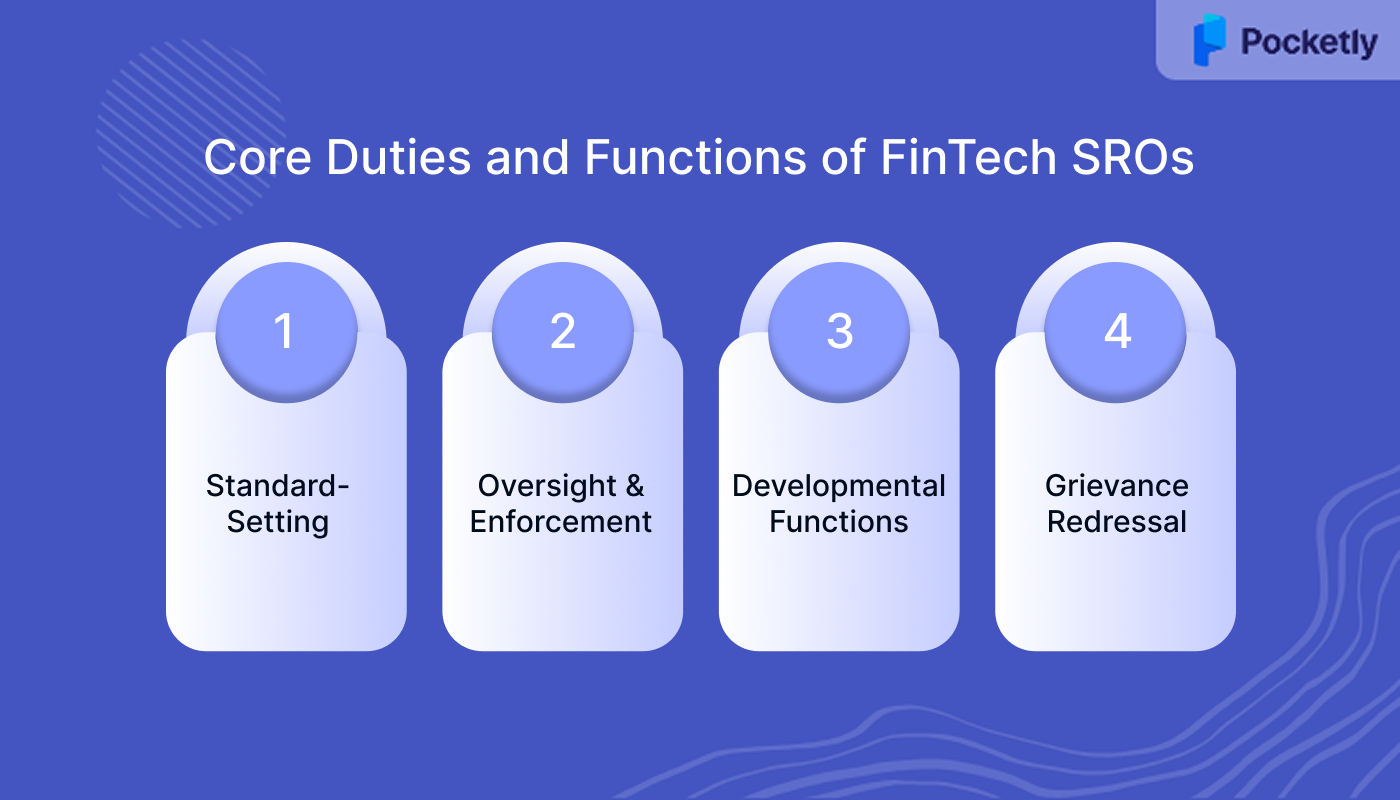

Core Duties and Functions of FinTech SROs

The Reserve Bank of India's (RBI) Self-Regulatory Organisation for the FinTech sector (SRO-FT) framework outlines specific duties, functions, and responsibilities for recognized SROs to maintain industry standards and protect consumer interests.

1. Standard-Setting

- Code of Conduct: Develop and enforce a code of conduct for various fintech activities, ensuring ethical practices across the sector.

- Industry Benchmarks: Establish baseline technology standards, transparency norms, and disclosure requirements to promote consistency and trust.

- Standardized Documents: Create standardized agreements for fintech transactions for compliance with statutory and regulatory requirements.

- Accreditation Mechanism: Implement an accreditation system to improve compliance culture and foster professionalism among members.

2. Oversight and Enforcement

- Surveillance Mechanisms: Deploy tools and techniques to monitor member activities, ensuring adherence to established standards and identifying exceptions.

- Disciplinary Actions: Specify and enforce consequences for violations, including counseling, reprimanding, and expulsion, with reasonable monetary penalties.

- Member Removal: Bar or remove members for non-compliance, either temporarily or permanently, as deemed necessary.

3. Developmental Functions

- Capacity Building: Organize training programs and workshops to understand statutory and regulatory requirements among members.

- Sector Awareness: Disseminate information on industry developments, trends, and best practices through various channels to keep members informed.

- Research and Innovation: Encourage research and development within the fintech sector to promote responsible innovation and address emerging challenges.

4. Grievance Redressal and Dispute Resolution

- Framework Establishment: Set up efficient, fair, and transparent grievance redressal and dispute resolution mechanisms for members and consumers.

- Customer Education: Promote customer awareness regarding fintech products and services to facilitate informed decision-making.

- Service Standards Assessment: Conduct periodic evaluations of customer service standards and review the effectiveness of grievance redressal frameworks.

Beyond their internal governance responsibilities, SROs operate within a broader regulatory ecosystem where coordination with the RBI remains paramount. This relationship defines how industry self-regulation aligns with national financial policy objectives and systemic stability concerns.

FinTech SROs' Responsibilities Towards the Reserve Bank of India

The role of Self-Regulatory Organizations (SROs) in the fintech sector extends beyond regulating members; they are also responsible for alignment with the Reserve Bank of India’s (RBI) broader regulatory framework. Here are the key responsibilities of SROs towards the RBI:

- Sector Representation: Act as the collective voice for fintech entities when engaging with the RBI, addressing sector-wide concerns, and representing the interests of the industry.

- Regular Updates: Provide the RBI with timely updates on developments in the fintech sector, including major violations or discrepancies among members that could impact the industry.

- Information Sharing: Gather and share relevant information from the fintech sector with the RBI to assist in informed policymaking and regulatory decisions.

- Policy Consultation: Collaborate with the RBI to develop and refine the taxonomy for fintech entities, so that the regulatory framework evolves in line with industry needs.

- Compliance and Reporting: Ensure transparency by submitting annual reports, periodic returns, and other relevant information to the RBI as mandated, supporting accountability in the sector.

The theoretical framework of SRO governance gains practical significance when examined through real-world applications. Companies like Pocketly demonstrate how fintech businesses operate within this evolving regulatory system while delivering financial solutions to underserved markets.

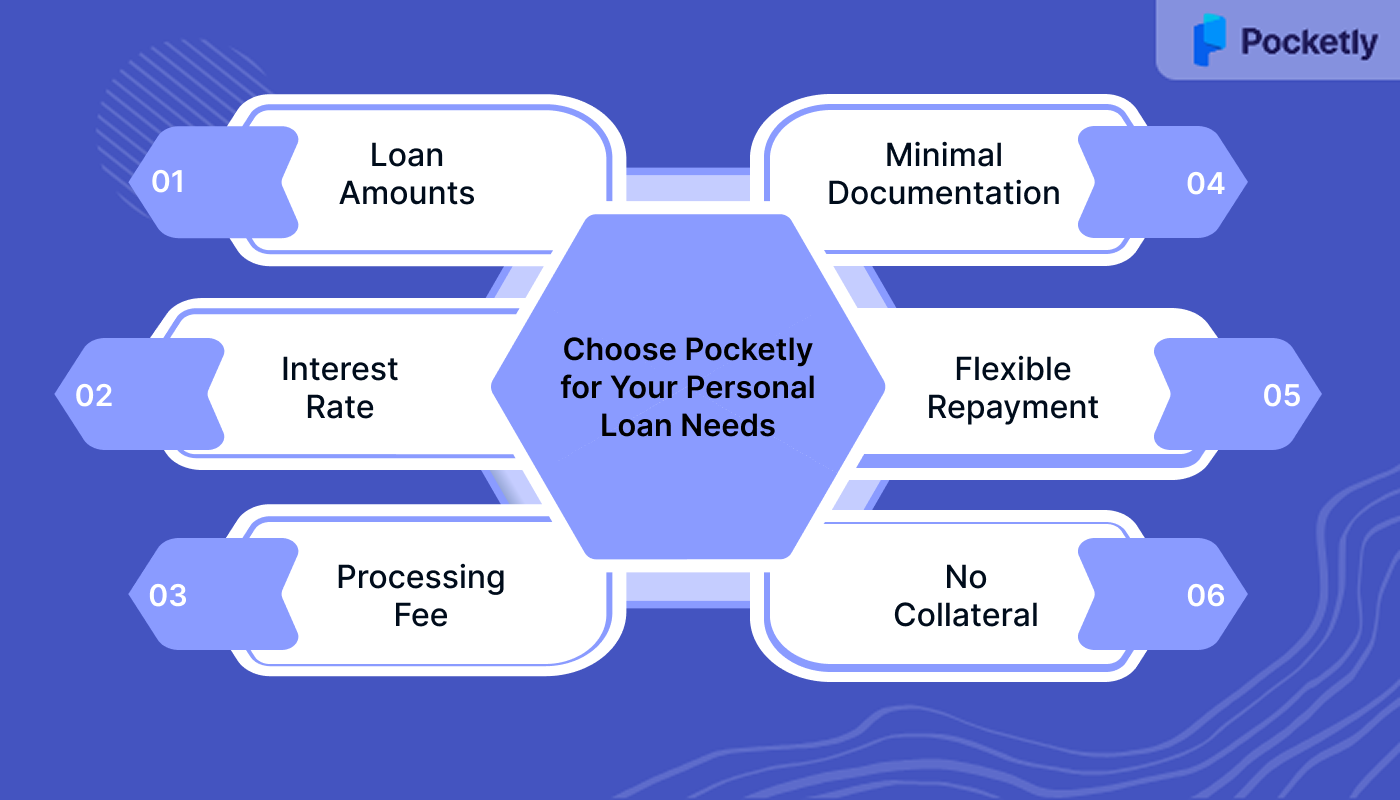

Why Choose Pocketly for Your Personal Loan Needs?

Pocketly, a digital lending platform, offers a seamless way for students and professionals to access instant personal loans, even without an existing credit history. With a focus on simplicity and transparency, Pocketly provides a reliable solution for managing urgent financial needs.

Here are the key features and services Pocketly offers:

- Loan Amounts: Pocketly provides personal loans ranging from ₹1,000 to ₹25,000, catering to a variety of financial needs.

- Affordable Interest Rates: With an interest rate of just 2% per month, Pocketly ensures that repayments are reasonable and clear.

- Processing Fees: A minimal processing fee ranging from 1% to 8% of the loan amount keeps the costs low.

- Minimal Documentation: The loan approval process requires minimal paperwork, ensuring a fast and easy application.

- Flexible Repayment Options: Repay your loan through multiple convenient methods, including bank transfers, UPI, and digital wallets.

- No Collateral Needed: Pocketly offers unsecured loans, meaning no need for collateral to access funds.

Conclusion

The RBI's Self-Regulation Framework for the fintech sector plays a pivotal role in balancing innovation with responsibility. By empowering Self-Regulatory Organizations (SROs) to set standards, monitor compliance, and resolve disputes, the RBI ensures that the fintech industry evolves while safeguarding consumer interests and financial stability.

As the fintech market continues to expand, the framework will be crucial in maintaining transparency, promoting ethical practices, and supporting sustainable growth.

Pocketly offers a transparent, easy-to-use platform that helps individuals manage their finances and build their credit with minimal KYC and documentation. Download Pocketly now on iOS or Android to experience a simple and transparent way to manage your financial needs.

FAQs

1. Which is the first self-regulatory organization in the FinTech sector?

The first self-regulatory organization (SRO) in India’s fintech sector, as recognized by the RBI, is the Fintech Association for Consumer Empowerment (FACE). This organization was established to support responsible innovation, provide industry standards, and ensure consumer protection across the sector.

2. What is the minimum net worth for SRO in FinTech?

For an organization to qualify as a self-regulatory body (SRO) in the fintech sector under the RBI’s framework, it must have a minimum net worth of ₹2 crore within one year of recognition or before starting operations, whichever comes first.

3. What is SRO as per RBI?

An SRO, as per the RBI's guidelines, is a not-for-profit organization that works to regulate and set industry standards within specific sectors, such as fintech. These bodies are responsible for monitoring compliance, handling disputes, and ensuring that their members follow ethical practices.

4. What is an example of SRO in India?

One example of an SRO in India is the Fintech Association for Consumer Empowerment (FACE). It represents the interests of fintech companies while promoting self-regulation to ensure ethical practices and consumer protection in the industry.

5. What is the RBI omnibus framework for SRO?

The RBI omnibus framework for SROs establishes a set of guidelines and regulations that govern the operations, standards, and responsibilities of self-regulatory bodies in the fintech sector. It outlines the requirements for setting up SROs, their functions, membership eligibility, and the procedures for oversight, compliance, and dispute resolution.