Are you a young Indian constantly juggling expenses, only to see your bank balance disappear before the month ends? You’re not alone. Students, young professionals, and entrepreneurs across India struggle with limited income, rising costs, and the pressure to maintain a comfortable lifestyle.

The result? Financial stress. That affects your peace of mind, productivity, and long-term goals. Financial wellness isn't just about earning more; it’s about spending smarter. When you manage money wisely, you free up your budget, reduce stress, and prepare for a secure future.

This blog shares 10 practical spending tips tailored for young Indians to help you take control, make better financial choices, and move toward financial stability with confidence.

Key Takeaways

- Financial wellness starts with tracking every rupee and creating a realistic budget using the 50-30-20 rule to control spending and build savings consistently.

- Distinguish needs from wants, cut unused subscriptions, and cook at home to save ₹20,000 to ₹40,000 annually without sacrificing quality of life.

- Build a ₹10,000 emergency fund first, then plan for big expenses in advance to avoid debt traps and handle financial surprises confidently.

- Avoid lifestyle inflation by saving 50% of every raise instead of upgrading spending, allowing wealth to grow faster than expenses.

- Pocketly offers instant loans from ₹1,000 to ₹25,000 at 2% monthly interest for genuine emergencies while you build long-term financial wellness through smart spending habits.

What is Financial Wellness and Why Does It Matter?

Financial wellness means having control over your daily finances while preparing for future goals and emergencies. It’s when money supports you instead of stressing you.

Why care about this now? Because your twenties and early thirties shape your financial future. Every spending decision compounds over time. Poor habits lead to debt, missed opportunities, and delayed goals.

Consider the typical challenges you face:

- Unpredictable income: Freelancers and gig workers struggle with irregular cash flows, making budgeting difficult.

- Rising living costs: Rent, food, transportation, and education expenses keep climbing while salaries remain stagnant.

- Social pressure: The need to keep up with peers' lifestyles drains resources on unnecessary expenses.

- Emergency situations: Medical emergencies, family needs, or sudden job loss can derail finances instantly.

- Lack of financial education: Most young Indians never learned practical money management in school or at home.

Financial wellness addresses all these pain points. When you achieve financial wellness, you sleep better, stress less, and make decisions based on logic rather than desperation. So let's find out how you can reach one.

Also Read: Financial Planning in Your 30s: Smart Money Guide (2025)

10 Smart Spending Tips for Financial Wellness

Achieving financial wellness requires concrete action. These 10 spending tips form the foundation of sound money management. Each strategy addresses a specific challenge young Indians face and provides practical solutions you can implement immediately.

Track Every Rupee You Spend

You can’t manage what you don’t measure. Many people don’t realise where their money goes and wonder why savings never grow. Tracking builds awareness—and awareness drives change.

Record every expense for at least 30 days using a notebook, spreadsheet, or budgeting app. Don’t judge yourself; just observe. You’ll spot surprising patterns—daily chai and snacks may touch ₹3,000, weekends ₹5,000, forgotten subscriptions ₹1,500.

How to track effectively:

- Pick a method you’ll stick to, such as apps like Walnut or an Excel sheet.

- Categorise: food, transport, entertainment, utilities, etc.

- Review weekly for 15 minutes.

- Be honest, log cash, digital payments, everything.

Once you see where money flows, you can cut unnecessary spending and make decisions with clarity.

Create a Realistic Budget Using the 50-30-20 Rule

Budgeting isn’t a restriction; it’s control. A budget tells your money where to go instead of wondering where it went. The 50-30-20 rule is a simple framework for young Indians.

Allocate 50% to needs, rent, groceries, utilities, EMIs, insurance, and transport. 30% to wants, dining, shopping, entertainment, hobbies. 20% to savings/investments, emergency fund, retirement, wealth creation, and extra debt repayment.

Adjust as needed:

- High-rent cities: 60% needs, reduce wants to 20%.

- Living with parents: push savings to 40%.

- Extra income: direct bonuses to savings instead of lifestyle upgrades.

- Debt phase: cut wants to 15–20% and clear debt faster.

Review monthly and modify based on life changes.

Differentiate Between Needs and Wants

Sounds simple, but marketing blurs the line. A new phone feels necessary when your old one works. Food delivery replaces cooking. Branded clothes appear essential for success.

Before buying, ask: Do I need this to function? Will it add real value? Can I afford it without hurting goals? If not, it’s likely a want disguised as a need.

Try these habits:

- 24-hour rule: wait a day before any non-essential purchase over ₹500.

- Cost-per-use: Divide the price by expected uses to judge value.

- Needs vs wants list: fund needs first, wants later.

- Quality over quantity: fewer good items last longer.

This prevents lifestyle inflation and helps savings grow with income.

Build an Emergency Fund Before Anything Else

Life is unpredictable. Laptop failures, medical emergencies, and layoffs. Without a safety net, you fall into debt. An emergency fund is money reserved only for real crises, not impulse spending. Start with ₹10,000, then aim for three months of expenses, and eventually six.

How to build it:

- Save ₹100/day or ₹500/week to reach your first ₹10,000.

- Automate savings on salary day.

- Keep it accessible in a savings or liquid fund.

- Replenish immediately if you use it.

Emergencies are inevitable; being prepared turns a crisis into an inconvenience. If savings feel tough now, Pocketly offers quick loans from ₹1,000–₹25,000 with fast approval, no collateral, and interest from 2% monthly plus 1–8% processing fees.

Cut Subscriptions You Don’t Actually Use

Subscriptions silently drain money. Gym memberships you never visit, streaming platforms for one series, unused apps, storage plans, and online courses. They look small but pile up fast.

Do a subscription audit. Check bank/card/UPI statements from the last three months and list all recurring charges. Then evaluate usage honestly.

Action steps:

- Cancel unused plans—if unused for 30 days, let it go.

- Consolidate services—one music app is enough.

- Downgrade from premium if features aren’t used.

- Use family plans to split costs.

Many young Indians waste ₹3,000–₹5,000 a month. Cutting even half saves ₹18,000–₹30,000 yearly. Add renewal reminders to review before auto-pay.

Master the Art of Smart Shopping

Shopping isn’t the problem; impulsive shopping is. Smart shoppers buy what they need at the best price without compromising quality.

Adopt these habits:

- Make a list before entering stores or apps, and stick to it.

- Compare prices; the same product can be 20–40% cheaper elsewhere.

- Buy during sales like Big Billion Days or Diwali, only for planned items.

- Avoid emotional shopping; retail therapy leads to regret.

- Use cashback/rewards wisely, but never overspend for points.

- Buy in bulk for non-perishables to save per unit.

Check unit pricing, not just pack size, and always read reviews for big purchases. It saves money and disappointment.

Reduce Transportation and Commute Costs

Commute expenses drain money fast; daily cabs, fuel, tolls, and parking can hit ₹8,000–₹12,000 monthly. Convenience is great, but cheaper alternatives exist.

Consider options:

- Public transport, like the metro/bus, is far cheaper.

- Carpool with colleagues or neighbours.

- Bike-sharing (Yulu, Bounce) for short trips.

- Walk short distances under 2 km—save money and stay fit.

- Work-from-home days reduce commute frequency.

Commute costs can rival rent. Cutting them by 30% saves ~₹36,000 yearly. If feasible, living closer to work may balance higher rent with lower travel costs.

Cook at Home and Plan Your Meals

Food delivery feels harmless, but ₹300 per meal quickly becomes ₹9,000+ monthly—add dinners and snacks, and it can cross ₹15,000. Cooking at home costs 60–70% less and is healthier. A ₹300 delivered meal costs about ₹80–100 when cooked yourself.

Try this:

- Plan weekly menus and shop once.

- Batch cook on weekends for multiple meals.

- Carry lunch to work—save ₹200–300 daily.

- Keep healthy snacks to avoid cafes.

- Eat out occasionally, not by default.

Basic recipes are enough, dal, rice, veggies, eggs, simple curries. If groceries stretch your budget, Pocketly offers small loans from ₹1,000 with transparent terms and flexible repayment to manage essentials.

Avoid Lifestyle Inflation as Income Grows

A raise often triggers upgrades, a new phone, a better flat, and more outings. Soon, despite earning more, stress returns because spending rose with income. This is lifestyle inflation. Even high earners struggle when expenses grow equally fast.

Break the cycle:

- Save raises first—direct the extra to investments before spending.

- 50% rule: Use only half of the income increase for lifestyle changes.

- Question upgrades: Will it add real value or just look good?

- Delay gratification: wait three months before major upgrades.

Let spending grow slower than income. Earn 10% more? Spend only 5% more. The gap builds wealth and accelerates financial independence.

Plan for Big Expenses in Advance

Festivals, insurance renewals, weddings, maintenance, these aren’t surprises, yet they often feel like financial shocks. Planning turns big expenses into manageable payments.

List expected expenses for the next 12 months:

- Annual: insurance, subscriptions, taxes, gifts.

- Seasonal: vacations, Diwali shopping, ceremonies.

- Maintenance: vehicle servicing, repairs, check-ups.

- Life events: weddings, education fees, certifications.

Divide the cost by the months left and save that amount separately. Saving ₹1,250 monthly makes a ₹15,000 festive spend stress-free, instead of overwhelming.

If expenses arrive before you’ve saved enough, Pocketly offers instant loans up to ₹25,000 with same-day approval, interest from 2% monthly, and 1–8% processing fees to manage urgent needs.

These 10 strategies give you the tools to manage your money wisely. But even with perfect planning, unexpected situations still arise. That's where having the right financial support becomes essential.

Also Read: Understanding the Process and Meaning of Credit Control

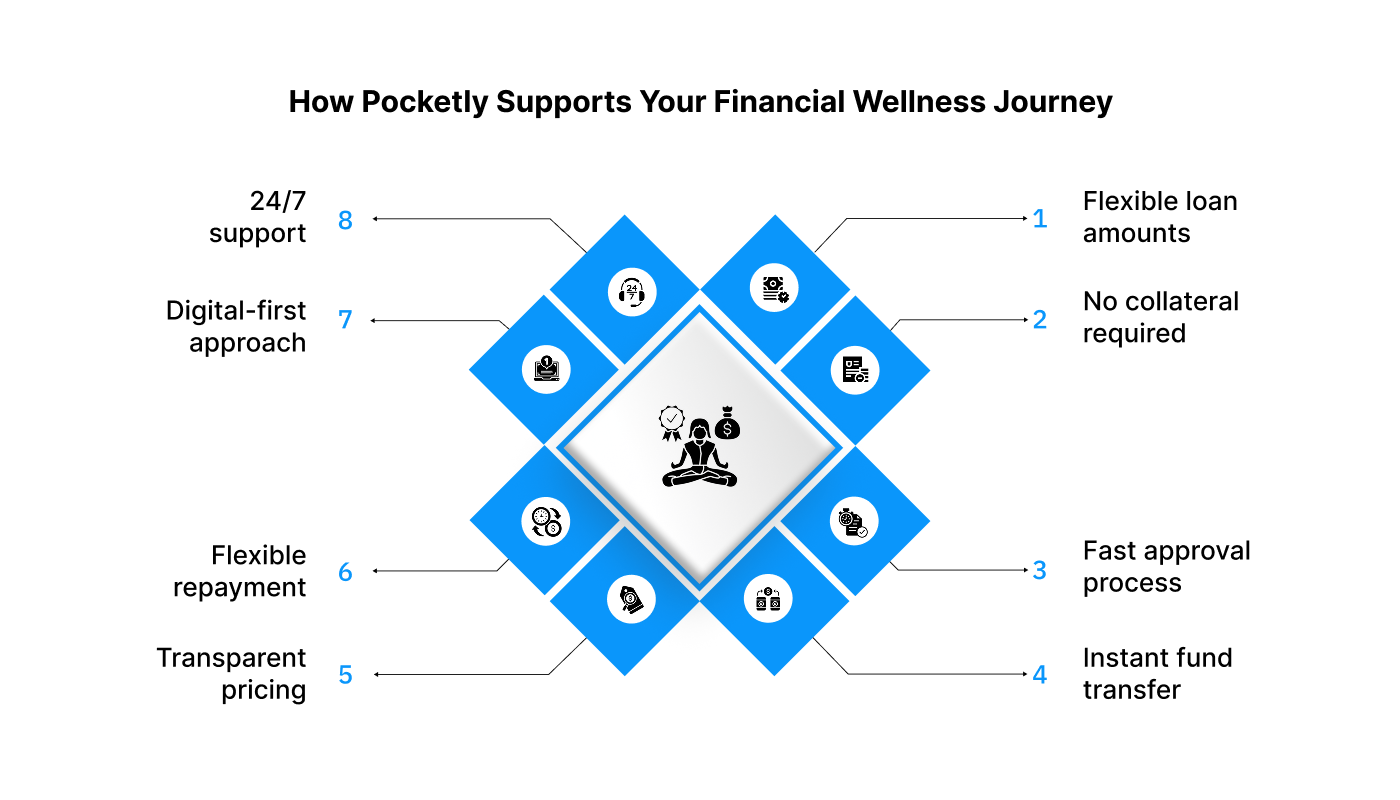

How Pocketly Supports Your Financial Wellness Journey

Smart spending helps you manage expenses, but life doesn’t always follow plans. Medical needs, education deadlines, or urgent laptop repairs can’t wait for payday; short-term support becomes essential.

Pocketly understands young Indians and offers quick personal loans for students, salaried professionals, and self-employed individuals without traditional banking hurdles. It works as a digital lending platform partnering with registered NBFCs, ensuring your borrowing happens through proper financial channels.

Here's what makes Pocketly different:

- Flexible loan amounts: Borrow from ₹1,000 to ₹25,000 based on your actual need, not arbitrary minimum amounts.

- No collateral required: Access funds without pledging assets or providing guarantors.

- Fast approval process: Get decisions within hours, not days or weeks.

- Instant fund transfer: Approved loans reach your bank account immediately.

- Transparent pricing: Interest rates start at 2% per month with processing fees between 1-8% of loan amount.

- Flexible repayment: Choose EMI options that match your income cycle, with freedom to make partial payments or close loans early.

- Digital-first approach: Complete the entire process online without visiting branches or submitting physical documents.

- 24/7 support: Get assistance whenever you need it through online customer service.

Pocketly bridges temporary cash gaps so you stay on track with smart money habits and long-term financial wellness.

Conclusion

Financial wellness is about progress. Every smart decision you make today builds a more secure tomorrow. Start small. Apply two or three tips this week, track expenses for 30 days, build your first ₹10,000 emergency fund, or cancel unused subscriptions. Small wins build momentum and lead to bigger changes.

As it is a journey, mistakes and setbacks will happen, but what matters is consistency and getting back on track. Whether you need emergency funds or want flexible borrowing options, Pocketly offers transparent, accessible solutions to support your financial growth.

Ready to begin? Download the Pocketly app now on iOS and Android and explore tools designed for young Indians.

Frequently Asked Questions

1. How much of my salary should I save each month for long-term financial security?

Aim to save at least 20% of your income for long-term goals like retirement and wealth creation. If you're new to saving, start with 10% and increase gradually. Even ₹2,000 monthly in your twenties can grow significantly through compounding. Prioritise saving before spending, and adjust based on your obligations.

2. What's the difference between savings and investments, and when should I start investing?

Savings stay in low-risk, liquid accounts like bank savings or FDs. Investments go into mutual funds, stocks, or gold for higher returns and risk. Build a 3-month emergency fund first, then start investing—SIPs in diversified mutual funds are ideal for beginners.

3. How do I handle peer pressure to spend on things I cannot afford?

Set clear financial boundaries. Suggest cheaper alternatives or politely decline expensive plans. Remember—social media lifestyles can be misleading. Focus on your goals; financial independence is more valuable than temporary approval.

4. Should I pay off debt first or build savings simultaneously?

Clear high-interest debt (like credit cards) quickly. For lower-interest loans, maintain EMIs while building a basic emergency fund. Once you save ₹10,000–₹15,000, channel extra income toward debt repayment without risking new loans during emergencies.

5. How can I start investing with a small income of ₹15,000 to ₹20,000 monthly?

Yes—start small. Invest ₹500–₹1,000 monthly through SIPs or micro-investment apps. Build the habit first, then increase investments as income grows. Consistency over time creates wealth more than large amounts or perfect timing.