You get your salary, feel rich for a week, and then suddenly, broke again. Sounds familiar? You promise yourself that this month will be different, but somehow, it never is. Between food deliveries, subscriptions, and random weekend plans, money just slips away.

Here’s the thing: adulting comes with endless financial surprises. Without a proper plan, these small hiccups can throw your whole month off track. Smart budgeting gives you a flexible way to control your cash flow without giving up on your morning coffee.

In this blog, we’ll break down how smart budgeting works, explore different planning methods, and help you find one that fits your lifestyle. Stay till the end for a fun budgeting challenge to test your money skills.

Key Takeaways:

- Smart budgeting helps you plan, track, and control money based on realistic financial goals.

- The SMART method makes budgeting effective by keeping it Specific, Measurable, Achievable, Relevant, and Time-bound.

- Break your goals into short- and long-term plans to stay motivated and financially consistent.

- Choose a budgeting method like 50/30/20 or zero-based, based on your income and lifestyle.

- Using digital tools simplifies tracking expenses, builds consistency, and helps you stick to your budget with less effort.

What Exactly Is SMART Budgeting?

When you think of budgeting, you probably imagine a long list of “don’ts” and endless Excel sheets, right? But SMART budgeting flips that idea. It’s not about cutting every expense, but about spending with purpose. SMART stands:

- Specific: Define exactly what you aim to accomplish and where your money should go.

- Measurable: Set clear numbers or milestones so you can easily track your progress.

- Achievable: Make sure your targets are practical and fit within your current income and expenses.

- Relevant: Focus on goals that genuinely support your overall financial plans and lifestyle.

- Time-bound: Attach a clear timeframe to each goal to stay disciplined and motivated.

For instance, instead of saying “I’ll save more this year,” you say, “I’ll save ₹2,000 each month for 6 months to build an emergency fund.” Suddenly, you have a concrete plan, not just a vague wish.

What Makes It Different From Regular Budgeting?

Traditional budgeting focuses mainly on numbers, income in, expenses out. SMART budgeting adds direction and accountability, giving every rupee a reason. Here’s how it stands apart:

| Aspect | Regular Budgeting | SMART Budgeting |

| Goal Type | Broad and unclear (“save money”) | Clear and detailed (“save ₹2,000 for 6 months”) |

| Tracking | Often skipped or inconsistent | Regularly measured and adjusted |

| Motivation | Short-lived | Linked to personal, meaningful goals |

| Outcome | Hard to sustain | Builds discipline and visible progress |

So, you get the idea behind SMART budgeting, but how do you make it work in real life? Let’s find out.

Also Read: How to Manage Monthly Expenses Smartly in 2025

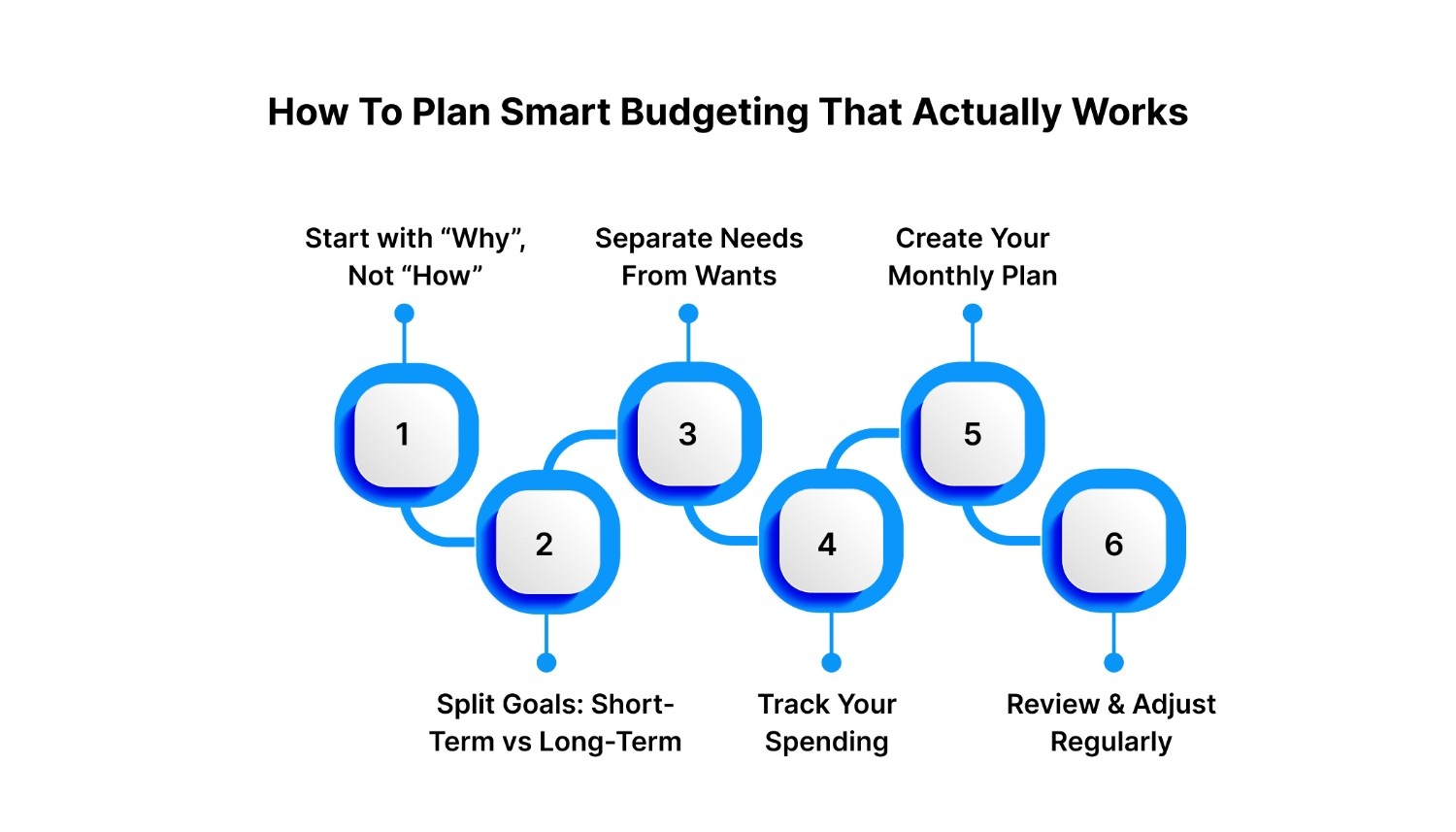

How To Plan Smart Budgeting That Actually Works

Budgeting doesn’t need to be rigid or complicated. The trick is to build a plan that reflects your current lifestyle, income flow, and spending habits. Here’s a simple structure to guide you:

1. Start with “Why”, Not “How”

Before diving into numbers, think about your motivation. Why do you want to budget in the first place? Most people skip this step, but it’s what keeps you consistent. When your goal has personal meaning, you’re more likely to stay on track.

For instance, maybe you want to:

- Stop relying on friends or credit cards before payday.

- Save up for a phone upgrade or a short trip.

- Build a small emergency fund for unexpected costs.

Try This: Write your reason down. Seeing it in writing makes it more real as a reminder every time you feel tempted to overspend.

2. Divide Goals into Short-Term and Long-Term

Every financial journey needs a mix of quick wins and bigger dreams. Breaking your goals into short- and long-term plans helps you stay motivated while keeping your focus steady.

Short-Term (Within 3 months):

- Saving ₹3,000 for a concert

- Creating an emergency fund

- Reducing food delivery costs

Long-Term (6 months to 2 years)

- Paying off education loans

- Saving for a new laptop

- Planning for a future investment

Try This: Automate small savings every month for your long-term goals. That way, you’re growing your savings in the background without constant effort.

3. Separate Needs From Wants

Here’s where budgeting gets real- understanding the difference between what you need and what you want. Needs are essential for daily life; wants make life more enjoyable. Both matter, but balance is key.

- Needs usually include: Rent or hostel fee, food and groceries, transportation & basic healthcare or phone bills.

- Wants can include: Streaming subscriptions, weekend outings or concerts and online shopping splurges.

Try This: When you’re about to spend on something fun, ask yourself, “Does this align with my financial goal?” If the answer is no, save it for later.

4. Track Your Spending for 30 Days

Here’s where most people go wrong: they jump into budgeting without understanding where their money goes. Tracking expenses for at least a month helps you see the bigger picture.

Start by recording:

- Income sources: salary, freelance work, side gigs, allowances.

- Fixed expenses: rent, Wi-Fi, transport, insurance.

- Variable expenses: groceries, entertainment, shopping, and takeout.

Try This: Use colour codes like green for fixed, yellow for variable, and red for unnecessary expenses. It makes patterns easier to spot at a glance.

5. Create Your Monthly Plan

Now that you’ve tracked your expenses and defined your goals, it’s time to design a monthly plan that brings everything together. Take your total monthly income, then divide it based on your priorities:

| Category | Estimated % | Example Allocation (₹20,000) |

| Fixed Commitments | 45% | ₹9,000 |

| Flexible Spending | 30% | ₹6,000 |

| Savings & Investments | 20% | ₹4,000 |

| Buffer / Miscellaneous | 5% | ₹1,000 |

6. Review and Adjust Regularly

A budget isn’t fixed; it should move with you. Your needs and income will change, and that’s perfectly fine. What matters is staying consistent with regular check-ins.

At the end of each month, review your:

- Progress: Did you hit your savings goal?

- Spending: Which category went over budget?

- Adjustments: What can you tweak for next month?

If you’ve managed to save consistently, treat yourself to maybe a nice dinner or something small. Rewards keep you motivated. And if you miss a goal, don’t give up. Learn, adjust, and try again next month. Budgeting is a habit, and like any habit, it gets easier the more you do it.

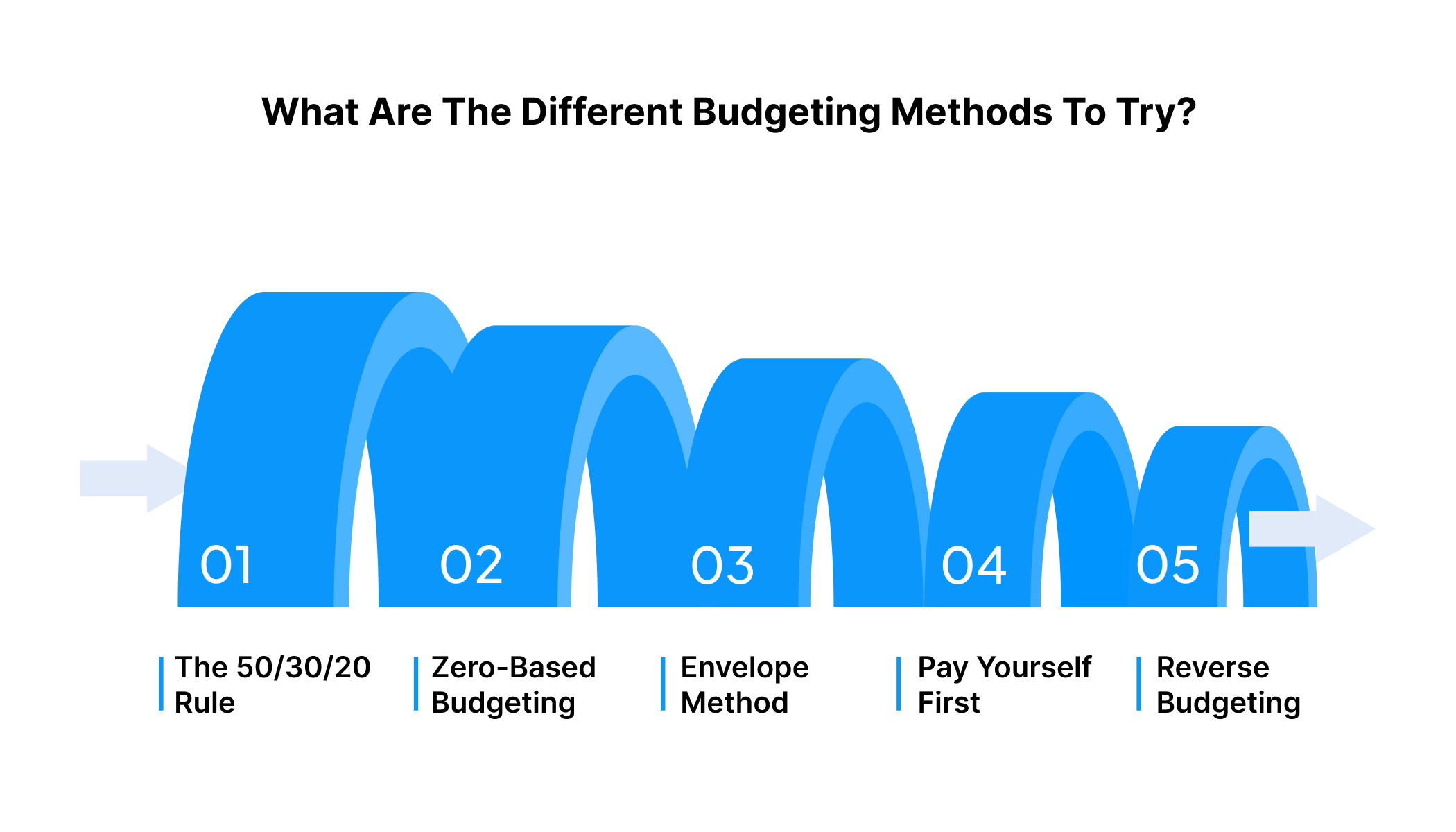

What Are The Different Budgeting Methods To Try?

Budgeting isn’t one-size-fits-all. Some people prefer strict tracking; others like flexibility. The best approach depends on how you earn, spend, and save.

Here are a few tried-and-tested methods worth exploring:

- The 50/30/20 Rule: Divide your monthly income into three parts 50% on needs, 30% on wants, and 20% on savings. It’s a balanced way to stay organised without overthinking numbers.

- Zero-Based Budgeting: Every rupee you earn gets a clear job, whether it’s paying bills, saving, or investing. By the end of the month, your total income minus expenses equals zero, ensuring nothing goes untracked.

- Envelope Method: Traditionally, a cash-based system, this involves setting aside money for each expense category in separate envelopes. Once an envelope is empty, spending for that category stops.

- Pay Yourself First: Before paying bills or spending, you automatically move a fixed amount into savings or investments. This ensures your financial goals always come first.

- Reverse Budgeting: You start by deciding how much you want to save or invest, then plan the rest of your expenses around it. It’s a forward-thinking approach that builds wealth over time.

Quick Comparison:

| Method | Pros | Cons |

| 50/30/20 Rule | Simple, flexible, and encourages saving | Hard to apply with irregular income |

| Zero-Based Budgeting | Total control of spending | Time-consuming |

| Envelope System | Visual and discipline-building | Not suited for digital payments |

| Pay Yourself First | Ensures consistent savings | Less control over monthly cash flow |

| Reverse Budgeting | Goal-based, encourages investment | Can feel restrictive initially |

You’ve seen the options, but how do you pick the one that feels right? Let’s figure that out.

Also Read: 6 Simple Budgeting Tips for Better Money Management

How To Choose The Right Budgeting Method For You

Choosing the right budgeting method isn’t about what’s “best on paper”; it’s about what works best for you. Let’s break down what to look for before you commit to one:

Your Income Type

- If your income is fixed every month, like a salary, structured methods such as the 50/30/20 rule or zero-based budgeting can help you plan more predictably.

- But if your earnings fluctuate, say you freelance or run a small business, you’ll do better with a flexible budget that adjusts as your income changes.

Your Financial Goals

- Someone saving for a vacation will need a completely different approach than someone clearing credit card debt.

- If your focus is on saving, percentage-based methods work well.

- If your goal is to track every rupee, try zero-based budgeting.

- And if you’re trying to control daily spending, the envelope method or a digital tracker keeps you in check.

Your Spending Habits

Are you someone who likes structure, or do you prefer flexibility?

- If you tend to overspend, go for a method that sets clear boundaries, like zero-based or envelope budgeting.

- If you’re naturally disciplined, a high-level approach like percentage budgeting might be enough.

Your Comfort With Tracking

Let’s be real, not everyone enjoys tracking every transaction.

- If you love details, choose something hands-on.

- If you’d rather keep things minimal, pick a budgeting method that does the math for you through automation or pre-set percentages.

Digital Tools That Make SMART Budgeting Simple

Let’s be honest, no one wants to spend hours scribbling numbers in a notebook. The good news is, digital tools make budgeting much easier and more fun. Here are some simple ways to bring technology into your money routine:

1. Budgeting Apps

Use mobile apps that automatically track your income and expenses. They send reminders, show visual breakdowns, and help you stick to limits. For students or young professionals managing cash flow, these apps keep things simple and organised.

2. Spreadsheets

If you prefer full control, spreadsheets are your best friend. With Excel or Google Sheets, you can build a customised tracker with your own categories, colour codes, and savings goals. It’s ideal for people who like numbers and hands-on control.

3. Banking Features

Most digital banking platforms now have built-in spending insights. They categorise your expenses, track recurring payments, and alert you when you’re close to your limit. It’s like having a personal finance coach right in your pocket.

Bonus Tip: Set a reminder once a week to check your progress. It only takes five minutes, but it keeps you mindful and on track.

The SMART Budgeting Challenge: Can You Stick To It?

So, you’ve read about budgeting methods and how to choose the right one; now it’s time to test your skills. Think of this as your mini money challenge. No scary spreadsheets, just a fun way to see how “SMART” your budgeting can get.

For Students: The 7-Day Pocket Check

You’ve got classes, maybe a part-time gig, and endless plans with friends, so here’s your challenge:

- For one week, track every single rupee you spend. From snacks to subscriptions, note it down. At the end of the week, divide it into needs, wants, and “oops, I didn’t need that” categories. You’ll be surprised by how much clarity that gives.

For Young Professionals: The Payday Rule

For the next month, apply this simple trick:

- Right after you get your salary, put 20% into savings before you do anything else. This “pay yourself first” move will show you how easily you can save without feeling the pinch.

For Early Earners or Freelancers: The Spend Swap

You don’t have a fixed income, so let’s keep it flexible:

- For two weeks, every time you skip a non-essential spend (like delivery coffee), move that same amount into a “goal fund.” By the end, you’ll see how little swaps can actually add up to something big.

Remember, the goal isn’t to restrict yourself, but to understand your money better and make smarter choices every month. So, take the challenge, have fun with it, and see how a little budgeting consistency can go a long way!

Also Read: Expense Tracking Categories for Budgeting

How Pocketly Supports Smart Budgeting With Smart Borrowing

Even the best budgets can hit a bump with unexpected bills, mid-month expenses, or just a moment of bad timing. In moments like these, Pocketly makes managing your money a little easier.

Pocketly is a digital lending platform (not an NBFC), designed to help you manage short-term cash crunches without disrupting your budget. You can borrow anywhere between ₹1,000 to ₹25,000, with interest rates starting from just 2% per month and a processing fee of 1–8% of the loan amount.

Here’s how simple it is to apply:

- Sign Up: Register on the Pocketly app in just two clicks.

- Simple KYC: Upload Aadhaar and PAN for instant verification.

- Choose Your Loan: Select the amount and tenure as per your needs.

- Instant Transfer: Get funds credited directly to your bank account.

With no collateral, flexible EMIs, and 24/7 support, Pocketly makes emergency financing transparent and stress-free, so your SMART budgeting never goes off track.

Wrapping Up

Budgeting isn’t about restricting yourself; it’s about building control and confidence over your money. Whether you’re just starting out or refining your system, creating a SMART budgeting plan helps you stay realistic, goal-driven, and financially aware.

From understanding where your money goes to choosing a method, every small step adds up to a stronger financial habit. And while smart budgeting keeps you prepared, life doesn’t always wait for payday. That’s where having a quick, flexible solution like Pocketly helps bridge those short-term gaps so your plans don’t fall apart when emergencies show up uninvited.

Download Pocketly today on iOS or Android to get instant, collateral-free loans and stay on track with your financial goals.

FAQ’s

What are some simple budgeting tips for beginners to save money and manage finances?

Start by tracking your expenses, setting realistic spending limits, and separating needs from wants. Automate your savings so a portion of your income goes directly into a savings account every month.

Is saving 50% of salary good?

Yes, saving 50% of your salary is excellent, but it’s not always practical for everyone. The ideal savings rate depends on your income, expenses, and financial goals. Start with a smaller, achievable percentage and increase it gradually as your finances improve.

What are your most effective strategies for extreme budget living?

Cut down on non-essential expenses, plan meals to avoid food waste, and focus on low-cost entertainment options. Try cash envelopes for strict spending control and prioritise essentials before anything else.

What innovative budgeting methods can help families save more effectively?

Families can try zero-based budgeting to assign every rupee a purpose or use percentage-based methods like 50/30/20 for a clear structure. Shared expense-tracking apps also help everyone stay accountable and make saving a collective effort.