Buying your first car is exciting, isn’t it? But along with the thrill comes a set of responsibilities, from fuel and maintenance to unexpected repairs. And of course, you can’t ignore the importance of car insurance.

When you think about car insurance, you probably consider factors like your driving record, the type of car you own, or even your age. But have you ever wondered if your credit plays a role, too? One less-talked-about factor that can make a real difference is your credit score.

If you’ve been asking yourself, “Does paying car insurance build credit?”, you’re in the right place. In this blog, we’ll break down how your payments and credit history can impact insurance costs and share practical tips to manage both effectively.

Key Takeaways:

- Paying car insurance doesn’t directly build credit, but timely payments reflect financial responsibility.

- Missing premiums can lead to higher future rates, legal penalties, and loss of coverage benefits.

- Cancelling a policy properly doesn’t affect credit, but coverage gaps may increase future premiums.

- Insurers often check your credit to determine risk, influencing premium amounts and eligibility.

- A good credit score can help lower car insurance rates and get better coverage options.

Does Paying Car Insurance Affect Your Credit?

If you are looking for answers for “Does paying car insurance build credit?”, the simple answer is yes, but only indirectly. Your regular car insurance payments are not reported to credit bureaus, so they don’t directly increase your score.

But here’s the catch: missing or delaying your premium payment can still affect your financial life indirectly. Insurers may cancel your policy or even send unpaid bills to a collection agency. Once that happens, it gets reported to credit bureaus, pulling your CIBIL score down.

Think of it this way:

- On-time payments → No direct credit boost, but you build trust with lenders.

- Missed payments → Higher chances of rejection or higher interest rates on loans.

So while paying insurance won’t show up as a credit entry, it silently shapes your creditworthiness.

Now, if insurers aren’t reporting your premiums to credit bureaus, does that mean they don’t check your credit at all? Let’s find out.

Also Read: How to Build and Improve Your Credit Score

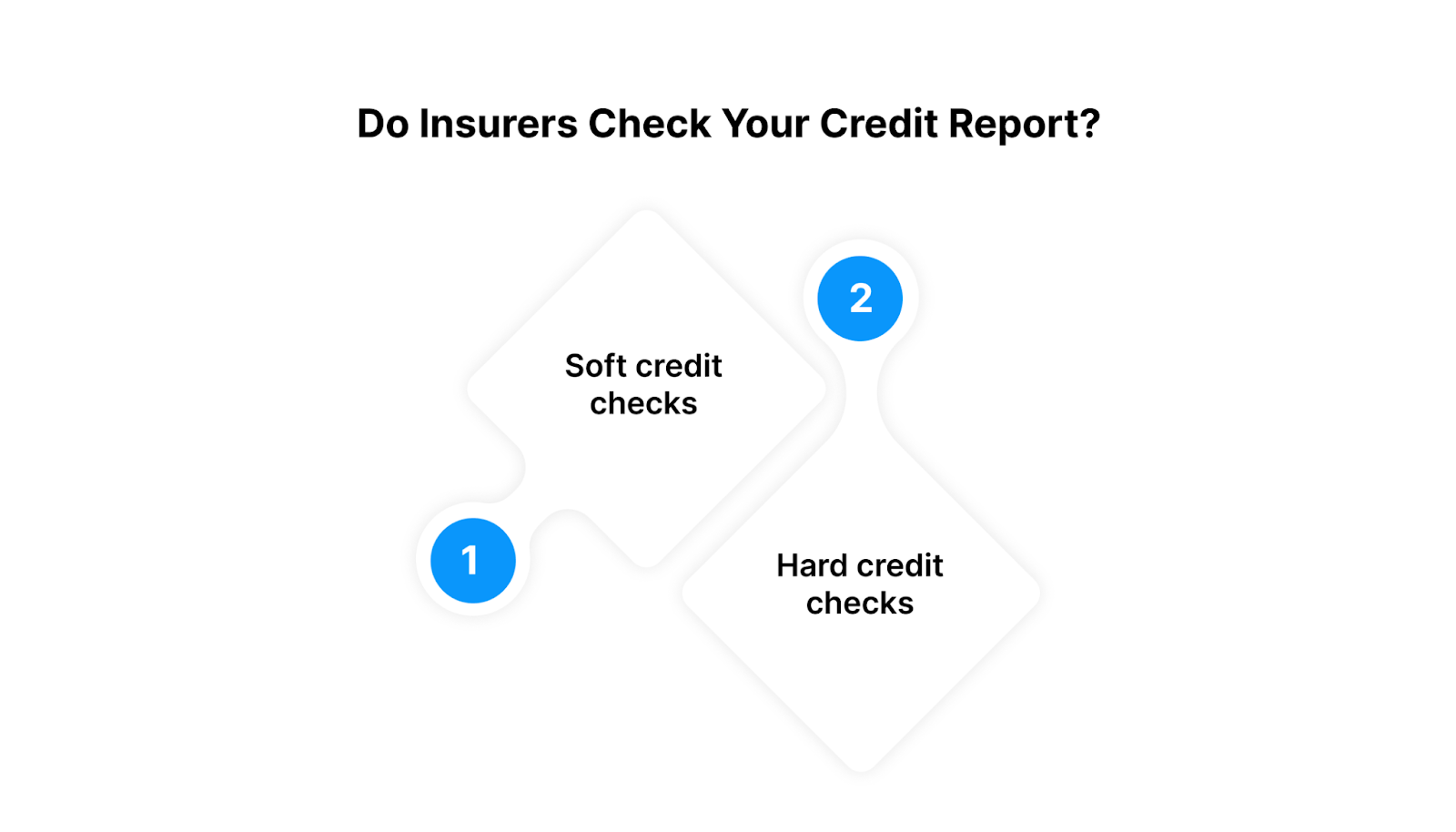

Do Insurers Check Your Credit Report?

Here’s where things get interesting. Most insurers in India will check your credit report before giving you a policy. But the type of check they run makes a big difference.

They use two different kinds of checks:

- Soft credit checks: A basic identity check that doesn’t affect your credit score. For example, if you pay your annual premium in one go, insurers usually just run a soft check.

- Hard credit checks: A deeper look at your history, usually done if you opt for monthly instalments. These checks appear on your report and can temporarily lower your score, especially if there are too many in a short time.

So, if you’re a youngster managing tight cash flow, opting for monthly payments may seem easier, but it also means facing a hard check. On the other hand, if you manage to pay upfront, you avoid that risk.

But the story doesn’t stop at credit checks. Your score actually influences how much you’ll end up paying for car insurance.

Also Read: How to Download and Check Your CIBIL Report Online

How Credit Impacts Car Insurance Rates?

Your credit score plays a surprisingly important role in deciding how much you pay for car insurance. Insurers often use it as an indicator of risk. Lower scores increase costs for insurers; that’s why companies charge higher premiums to those with weaker credit histories.

On the flip side, if your CIBIL score is high, insurers see you as more financially responsible. This not only helps you qualify for better coverage options but also reduces the overall cost of your premiums.

| Credit Situation | Likely Impact on Insurance Rates |

| Good credit score | Lower premiums, better coverage options |

| Low credit score | Higher premiums, possible plan restrictions |

| Recently improved score | Eligibility for cheaper insurance rates |

We’ve answered the big question: Does paying car insurance build credit? But what happens when you don’t pay at all?

Also Read: Car Loan vs Home Loan: Which One Should You Pay Off First?

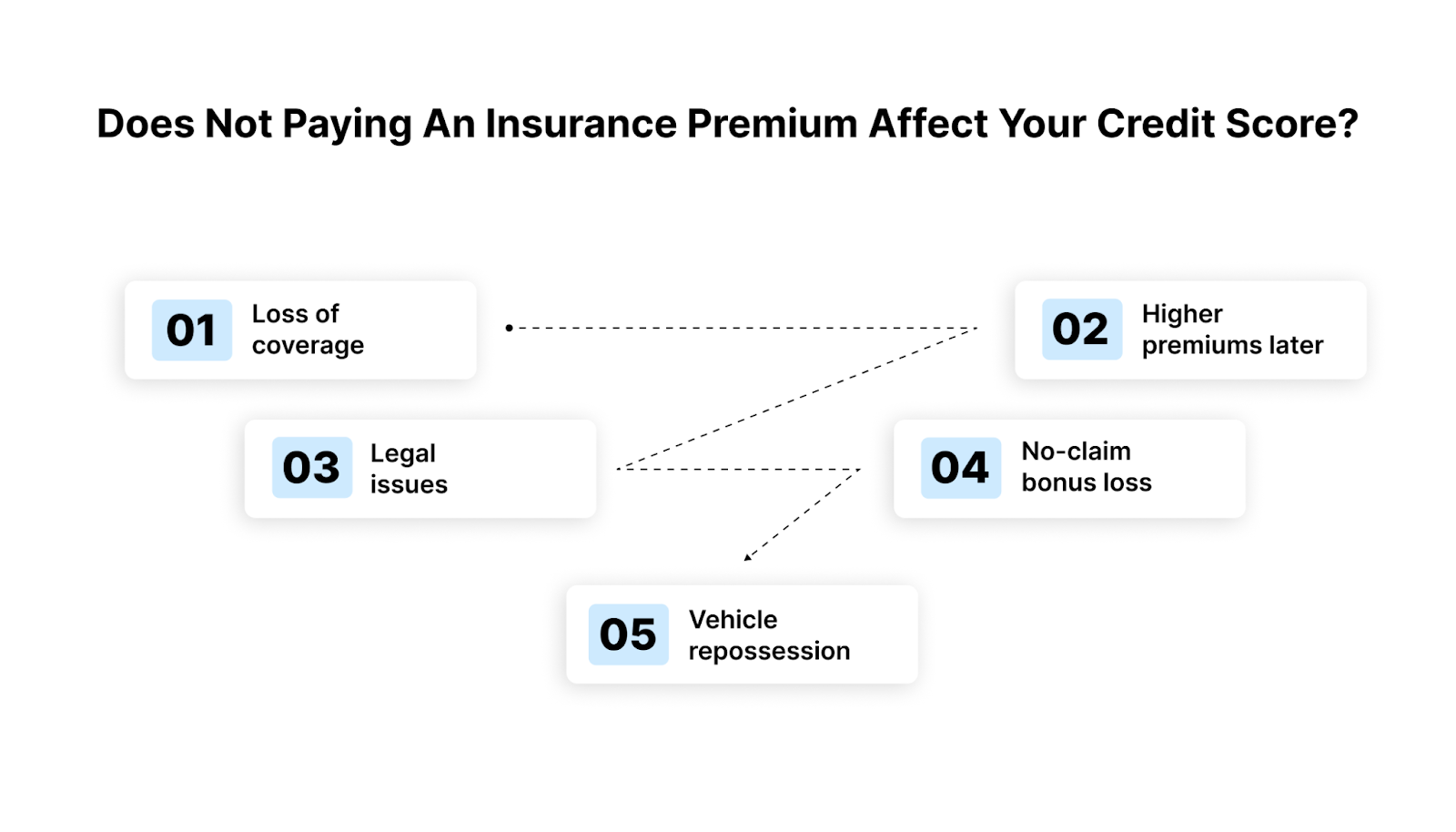

Does Not Paying An Insurance Premium Affect Your Credit Score?

Skipping an insurance premium might not affect much at first, but it can come back to bite you. Insurers generally don’t report missed payments to credit bureaus straight away. However, if your account remains unpaid, they may hand it over to a collection agency. Once that happens, your debt will appear on your credit report, lowering your CIBIL score.

Before cancellation, most insurers give you a grace period of 10-30 days. This window allows you to catch up on your missed payment. But if you ignore the notices, the consequences can be bigger than you expect.

- Loss of coverage: Once your policy lapses, you lose all financial protection. If an accident or damage occurs during this period, you’ll need to cover all expenses entirely on your own.

- Higher premiums later: Insurers view lapses as risky behaviour. When you apply for a new policy, they usually increase your premium significantly, which can make coverage unaffordable for many.

- Legal issues: Driving without valid car insurance is against the law in India. You could face steep fines, suspension of your licence, or even short-term imprisonment for non-compliance.

- No-claim bonus loss: Missing payments resets your no-claim bonus record. That means you lose the chance to save up to 50% in discounts that come with consecutive claim-free years.

- Vehicle repossession: If your car is financed through a loan or lease, lenders require continuous coverage. Once cancelled, they may repossess your vehicle for violating loan or lease terms.

Late payments affect your score in one way, while canceling your coverage might impact it differently, depending on the situation. Let’s look at that next.

Also Read: What Does a Zero or Negative Credit Score Mean?

Does Canceling Car Insurance Impact Your Score?

No, cancelling properly doesn’t directly affect your credit score. The real issue lies in how you cancel. Watch out for:

- Unpaid balances: If you stop your policy without paying pending premiums, they may still be sent to collections.

- Pay-monthly policies: These work like small credit agreements. Simply cancelling your direct debit without telling your insurer could result in missed payments showing up on your credit record.

Another side effect of cancellation is a gap in coverage. If you plan to buy another policy later, insurers may charge you higher premiums because of this gap. Even when switching insurers, be mindful that the new company might run a hard enquiry to review your financial record.

To avoid such issues, building a strong credit history is key. So let’s shift from the what-ifs to the what-to-dos.

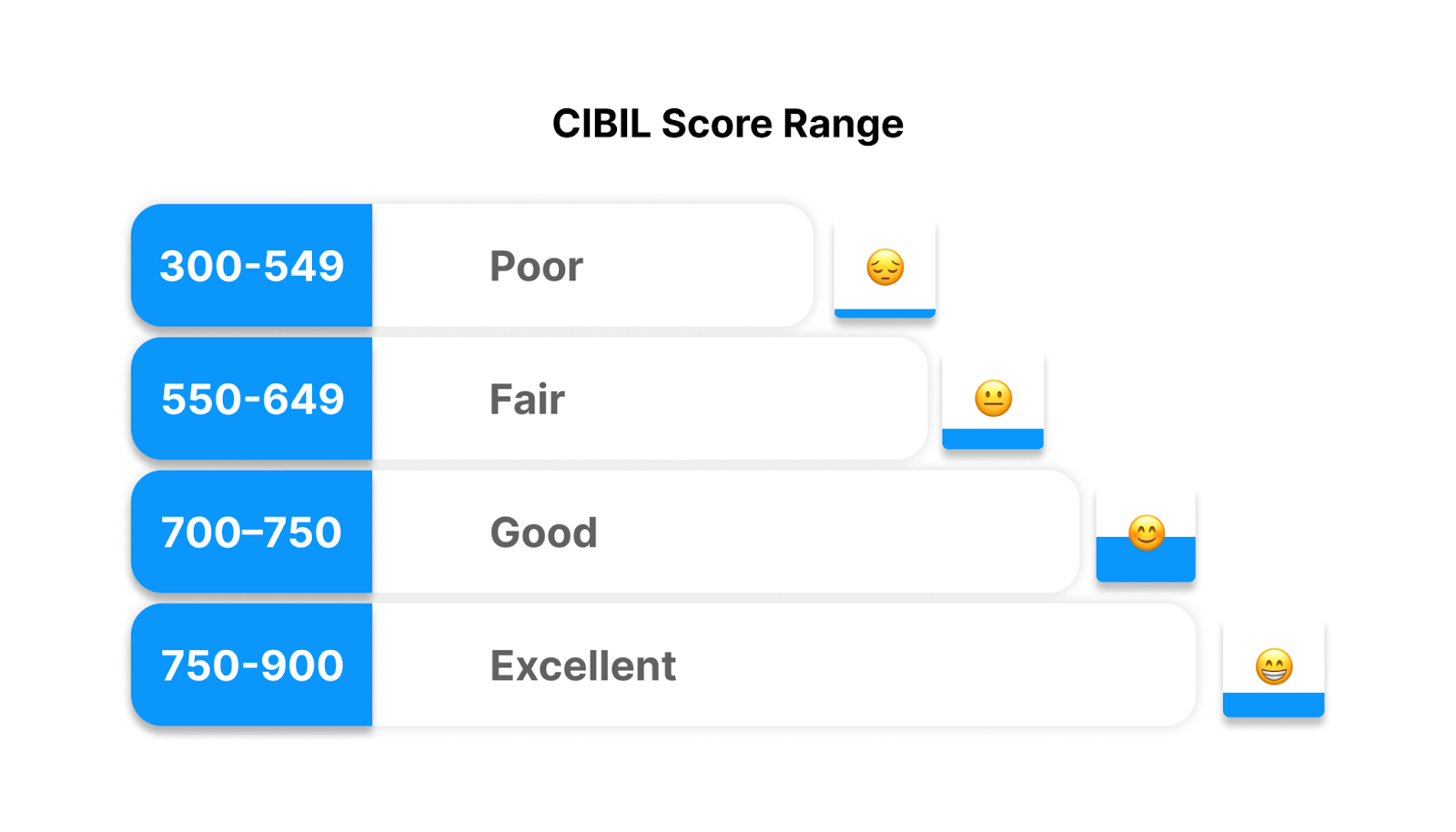

How To Improve Your Credit For Better Rates

When you circle back to the question “Does paying car insurance build credit?”, you know that a better credit score secures better insurance rates. And who doesn’t want to pay less for car insurance, right? Here are two simple steps to begin:

1. Check Your Credit for Opportunities

| CIBIL Score Range | What It Means |

| 750–900 | Excellent. Easy loan approvals and best insurance rates. |

| 700–750 | Good, but lenders may review your credit behaviour closely. |

| 550–700 | Fair. Possible loan approvals, but usually at higher interest rates. |

| 300–550 | Poor. Serious challenges in getting loans or favourable insurance terms. |

2. Tips To Keep Your Car Insurance Rates Low

- Pay bills on time: Consistently paying credit card bills, utilities, and loan instalments builds trustworthiness. It prevents late charges, protects your credit score, and helps you maintain lower car insurance premiums.

- Reduce outstanding debt: Actively clearing personal loans, credit cards, or other obligations strengthens your credit score. This directly helps insurers see you as more reliable, leading to more affordable insurance costs.

- Limit credit applications: Submitting too many credit applications in a short span can hurt your score. Insurers may interpret this as financial instability, which could push your premiums higher.

- Maintain low credit usage: Try not to use more than 30% of your credit card limit. Lower utilisation signals financial discipline and reduces the risk of being charged higher premiums.

- Automate payments: Setting up automatic deductions for insurance premiums and other bills avoids missed deadlines. This small step ensures timely payments, protecting both your credit score and insurance affordability.

Also Read: Getting Personal Loans with a 650 Credit Score

Protect Your Credit Score with Pocketly’s Quick Loans

Unexpected expenses like a missed insurance premium or a sudden emergency can strain your budget. Pocketly helps young Indians bridge these short-term cash gaps with flexible personal loans from ₹1,000 to ₹25,000, no collateral required. The platform ensures fast approval and instant funds transfer directly into your bank account.

Here’s how easy it is:

- Sign up in 2 clicks using your mobile number.

- Upload scanned KYC and PAN details; no physical documents needed.

- Choose your loan amount and tenure, then provide your bank account.

- Receive funds instantly, ready to use for any emergency.

Pocketly offers interest rates starting at 2% per month and a processing fee of 1–8% of the loan amount. With flexible EMIs, good behaviour perks, and 24/7 support, you can manage your finances without stress.

Note: Pocketly is a digital lending platform, not an NBFC, focused on making short-term borrowing simple and reliable.

Final Wordict

Understanding your CIBIL score is key when it comes to managing car insurance costs. When searching for “Does paying car insurance build credit?”, know that while it doesn’t directly impact, making timely payments does help you maintain a healthy credit history. This can eventually lower your premiums and ensure smoother financial planning.

Missed payments on your auto insurance can hurt your credit if sent to collections. To prevent this, always pay on time and stay aware of your coverage. When emergencies strike and you need quick funds to stay on track, Pocketly can help. With flexible short-term loans from ₹1,000 to ₹25,000, instant approval, and hassle-free KYC, you can cover urgent expenses and protect your credit.

Download Pocketly today on iOS or Android to access quick loans, manage payments on time, and keep your credit in check effortlessly.

FAQ’s

1. Does car insurance make your credit score go up?

Paying your car insurance on time does not directly increase your credit score because insurers typically don’t report premiums to credit bureaus. However, consistently meeting financial obligations, like loans or credit cards, indirectly supports a healthier credit profile.

2 Does cancelling car insurance affect future car insurance?

Cancelling a policy doesn’t harm your credit score, but it can affect future premiums. Insurers may charge higher rates if there’s a gap in coverage, as it signals a break in your insurance history.

3. Does insurance add to a credit score?

Insurance payments generally don’t appear on credit reports, so they don’t add to your credit score. Timely payments still demonstrate financial responsibility, which can influence lenders indirectly when evaluating your creditworthiness.

4. Does cancelling car insurance affect no-claims?

Yes, cancelling a policy can impact your no-claim bonus (NCB). If you cancel mid-term or have lapses, you may lose the accumulated NCB, reducing potential discounts on future premiums.