A credit score is a crucial part of your financial identity. It helps lenders understand how likely you are to repay borrowed money. When your credit score is zero or negative, it indicates a lack of credit history or issues with how you've managed credit in the past.

This can make it harder to secure loans, obtain credit cards, or even rent a home. While a poor score may feel like a setback, it’s not a permanent barrier. With the right steps and commitment, it’s possible to rebuild and improve your credit over time. Understanding what a zero or negative score means is the first step in regaining control of your financial future.

In this blog, we’ll explore what does it means when your credit score is 0, how it affects your financial life, and the steps you can take to improve it.

Key Takeaways

- Zero or Negative Credit Scores stem from either a lack of credit history or poor credit management, such as missed payments or defaults.

- Timely payments and low credit utilisation are great ways to improve your score and demonstrate responsible credit behaviour.

- Credit-building loans and secured cards are excellent options for those starting from scratch or rebuilding their credit.

- Monitoring your credit report continuously helps you spot errors and dispute inaccuracies that can negatively impact your score.

- Secured loans, credit builder loans, and peer-to-peer lending can help individuals with a low credit score gain access to credit while rebuilding their credit history.

Understanding Zero and Negative Credit Scores

A zero credit score (0) indicates a lack of credit history. This often happens when there has been less than 6 months of credit activity, meaning the credit bureaus don’t have enough information to generate a score. If you’ve recently opened your first credit account or haven’t used credit for a while, your score may be zero.

A negative credit score refers to a score that falls below the 300-350 range, signalling poor credit management. This could be due to late payments, defaults, or bankruptcies that have severely damaged your credit history. In some cases, a negative score can also result from having no active credit accounts, making it harder for lenders to determine your financial behaviour.

What are the Causes of a Zero or Negative Credit Score?

A zero or negative credit score, although it results from either a lack of credit history or poor credit management, there are other factors like high credit utilisation that come into play. Understanding these causes is quintessential to addressing and preventing future credit issues.

Here are the key reasons why your credit score could be zero or negative:

- Lack of Credit History (Zero Score): No credit activity, such as not having any credit cards or loans, results in a zero score since there’s no data to assess your creditworthiness.

- Late or Missed Payments (Negative Score): Payment delays of 30+ days on credit cards, loans, or bills damage your score and can stay on your record for up to seven years.

- Defaults or Collections (Negative Score): Unpaid debts sent to collections or defaulted loans lower your score, indicating high financial risk.

- Bankruptcies or Debt Settlements (Negative Score): Filing for bankruptcy or settling debt reduces your score and remains on your record for several years.

- High Credit Utilisation (Negative Score): Overusing your credit limit or having high balances relative to your credit limit signals poor credit management and lowers your score.

- No Active Credit Accounts (Negative Score): Not having active credit accounts or closing old accounts leaves you with little or no credit history, affecting your score.

Also Read: All About Being a Guarantor in Personal Loans

These factors don't exist in isolation; they're all evaluated through a systematic approach that credit bureaus use to assess your financial reliability, where the CIBIL's scoring methodology weighs each element differently.

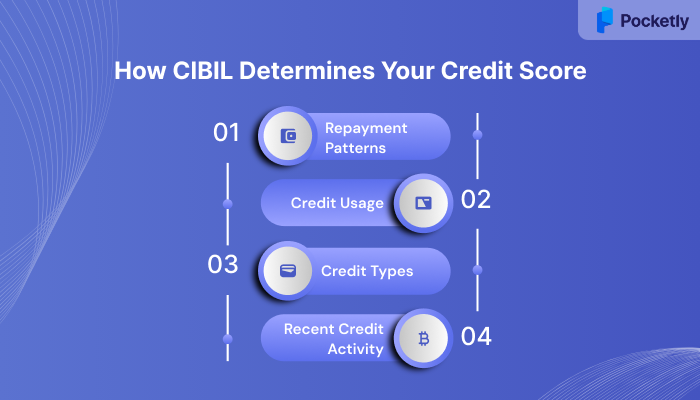

How CIBIL Determines Your Credit Score

Your credit score is not just a number; it’s a reflection of how you manage credit. CIBIL calculates your score by considering various elements of your credit behaviour, each contributing differently to your overall score. Let’s dive into the key factors that shape your credit score:

1. Repayment Patterns: A large portion of your score, 30%, depends on how consistently you repay your bills and loans. Timely payments help build a positive credit, while missed/late payments can have the opposite effect.

2. Credit Usage: 25% of your score is determined by your overall credit usage. This includes how much credit you’ve borrowed and how much of your available credit is used. Maintaining a good balance between credit utilisation and available credit is the key.

3. Length of Credit History and Credit Types: 25% of your score is influenced by how old your credit history is and the types of credit products you have. A longer credit history with a mix of secured and unsecured loans and credit cards strengthens your score.

4. Recent Credit Activity: The remaining 20% of your score is based on your current credit activity. This includes the number of credit accounts you have, ongoing loans, and any recent inquiries.

Now that you understand how CIBIL scores are calculated, you can target specific areas for improvement. The most effective strategies focus on the high-impact factors while building sustainable financial habits that support long-term credit health.

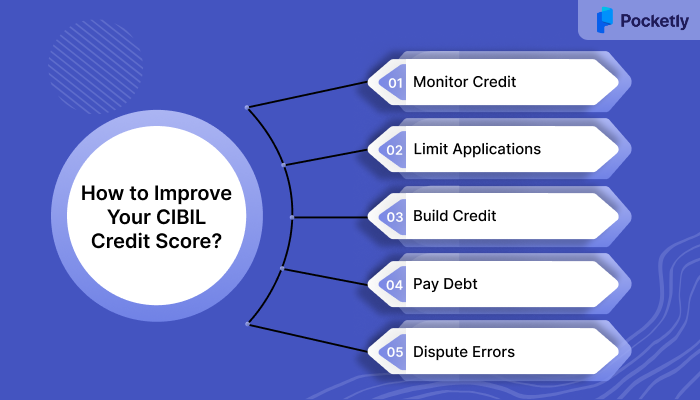

How to Improve Your CIBIL Credit Score?

Improving your CIBIL credit score requires careful attention to your credit habits and consistent efforts over time. Here are some strategies to make note of to build a stronger credit profile:

1. Regularly Monitor Your CIBIL Credit Report

Keeping an eye on your CIBIL credit report helps in monitoring your progress and spotting any errors or fraudulent activity that could harm your score. You are entitled to one free report per year, and checking it regularly ensures that the data is accurate and up-to-date. If there are discrepancies, address them promptly to avoid any negative impact on your score.

2. Limit Credit Applications and Avoid Multiple Loans Simultaneously

Applying for too many credit products within a short period can negatively affect your score. Each application results in a hard, and multiple inquiries in a short time may signal financial instability. Moreover, applying for several loans at once can also reduce your chances of getting approved, as lenders may view you as a high-risk borrower. Be strategic in your credit applications, applying only when absolutely necessary.

3.Consider Loan Products That Help Build Credit

Credit builder loans or secured loans are designed specifically to help individuals with limited or poor credit history. These loans are reported to credit bureaus, and making timely payments can help establish a solid credit record. By managing these products responsibly, you can gradually improve your credit score and show to lenders that you can manage debt effectively.

4. Pay Down Existing Debt

One of the most beneficial ways to improve your credit score is to lower your existing debt, especially high-interest credit card balances. The lower your debt-to-credit ratio, the more favourable it will be to your credit score. Focusing on paying off high balances can also improve your credit utilisation rate, which accounts for a significant portion of your credit score.

5. Dispute Inaccuracies and Ensure Accurate Data in Your Credit Profile

If you find errors in your CIBIL report, such as incorrect payment history or wrongly listed accounts, it’s crucial to dispute them promptly. Errors can lower your credit score unnecessarily. Make sure that the data in your credit profile is accurate and up-to-date so that any impact on your credit score can be avoided.

Also Read: Ways to Improve CIBIL Score from 600 to 750

While these improvement strategies work well for existing credit profiles, those starting from zero or recovering from severely damaged credit need a more structured approach. Let’s take a look.

Steps to Build a Credit Score (CIBIL Score) from Zero or Negative

Securing credit with a zero or negative score can be challenging, but it's not impossible. Lenders may see you as a higher risk, but there are ways to improve your chances of approval. Here are effective strategies to help you secure credit despite a low or non-existent score:

1. Start with a Secured Credit Card

A secured credit card requires a deposit, which will serve as your credit limit, reducing the lender’s risk. It works like any other credit card, and your payment history is disclosed to the credit bureaus. Using a secured card can help in rebuilding your credit over time.

Tip: Make small purchases and pay them off in full each month to avoid interest charges and improve your credit score.

2. Apply for a Credit Builder Loan

A credit builder loan is for individuals with limited or no credit history. You borrow a small sum of money that is deposited into a savings account, and from that you make monthly payments, and once the loan is fully paid off, you will get access to the funds. During the repayment period, your payments are reported to the credit bureaus, helping to build or improve your credit score.

Tip: Consistently make on-time payments to improve your credit score and build a credit history.

3. Get a Co-Signer

If you have a negative credit score, you can increase your chances of getting credit points by applying with a co-signer. A co-signer with a stronger credit history agrees to take responsibility for the loan if you are not able to repay the loan. This reduces the lender’s risk and makes them more likely to approve your application.

Tip: Be sure you’re able to make payments on time, as any missed payments will also affect the co-signer’s credit.

4. Seek a Lender Who Specialises in High-Risk Borrowers

Some lenders specialise in offering credit to individuals with low or negative credit scores. These lenders typically have higher approval rates, but they may charge a higher rate of interest to cover the risk.

Tip: Compare rates and fees across multiple lenders to find the most affordable option for your situation.

5. Offer Collateral for a Secured Loan

If you have assets like a car or savings, you can consider offering them as collateral for a secured loan. It reduces the lender's risk since the collateral can be seized if you fail in repaying the loan. By offering collateral, you make it more likely to secure a personal loan despite having a low credit score.

Tip: Ensure you can repay the loan, as failing to do so can result in losing your collateral.

6. Build a Relationship with Your Bank

Suppose you have an existing account with a bank or financial institution. In that case, they (lenders) may be more willing to approve a loan or credit card despite a low score, especially if you have a history of managing your account responsibly.

Tip: Talk to a bank representative about your credit situation and inquire about their options for customers with poor or no credit history.

7. Keep Credit Utilisation Low and Payments Timely

If you have existing credit, focus on improving your credit utilisation ratio and making timely payments. Even with a negative score, these actions demonstrate your commitment to improving your financial behaviour, and thereby increase your chances of securing more credit in the future.

Tip: Keep your credit card balance under 30% of your available credit and set up reminders for payment dates.

8. Use Alternative Credit Data

Some lenders may consider alternative credit data when reviewing your application. This could include rent payments, utility bills, or phone payments, which can help build a case for your reliability. If traditional credit data is not in your favour, these factors may improve your chances of approval.

Tip: Check if the lender accepts alternative credit data, and be sure to document your payment history for these bills.

By following these strategies, you can secure credit despite a zero or negative credit score. It’s important to stay patient, as rebuilding your credit takes time.

Also Read: Understanding the Ideal CIBIL Score Range for Personal Loan Applications

How to Get Loans Despite a Zero or Negative Credit Score

While a traditional lender may be hesitant to offer loans in such instances, there are other alternate options to increase your chances of loan approval. Here are some effective ways to get loans even with a poor credit score:

1. Consider applying for a secured loan under which you offer collateral, such as a car or savings, to increase your chances of approval.

2. Explore credit builder loans, which help establish or rebuild credit by reporting payments to credit bureaus.

3. Look into micro-lenders or alternative lenders, who may offer loans with more lenient credit requirements.

4. Check out peer-to-peer lending platforms, which connect borrowers with individual investors who are flexible in credit history.

5. Use buy now, pay later options, which allow you to make purchases and split payments into installments. While they don’t require a credit score check, consistent payments can improve your credit standing.

6. Offer larger security deposits for loans or credit cards, reducing the lender’s risk and increasing your chances of approval.

7. Consider microloans, which are small loans offered by non-traditional lenders with less stringent credit criteria. These can be easier to access, even with a low credit score.

Exploring different lending options becomes easier with platforms that cater to individuals with varied credit backgrounds. Modern lending platforms are designed to bridge the gap between traditional banking limitations and real financial needs.

How Pocketly Can Help You Build Your Credit Score

Pocketly offers a flexible solution to help you manage finances while you work on improving your credit score. With simple personal loan applications, competitive interest rates, and quick disbursals, it’s an ideal option for those looking to establish or rebuild their credit. Here are some of the key features:

- Loan Amounts: Borrow from ₹1,000 to ₹25,000 with customizable repayment terms.

- Affordable Interest Rates: Starting at 2% per month.

- Transparent Processing Fees: Fees range from 1% to 8% of the loan amount.

- Minimal Documentation: Quick and easy KYC process for fast approval.

- Instant Loan Disbursal: Loan amounts are transferred directly to your bank account with no delays.

Conclusion

A zero or negative credit score may initially feel like an obstacle, but with the right steps, it’s possible to rebuild your credit and regain control of your financial future. From understanding the causes of low scores to exploring strategies like secured loans, credit builder loans, and responsible credit card usage, you can take meaningful actions to improve your credit profile. Building your credit takes time, but with persistence and the right approach, you'll be able to open doors to better financial opportunities.

Pocketly is a digital lending platform that provides short-term loans for students and professionals. With easy loan access and minimal documentation, it’s an ideal option to meet urgent needs while building credit. Download the Pocketly app now for Android or iOS to get started on your credit-building journey.

FAQs

1. Is it possible to get a loan with a CIBIL score of 0?

Yes, you can still get a loan with a CIBIL score of 0, but your options may be limited. Lenders may offer secured loans or loans with higher interest rates to mitigate the risk. Using a credit builder loan or applying for a secured credit card could also help establish or improve your credit history.

2. What is a minus 1 CIBIL score?

A minus 1 CIBIL score typically means that there is insufficient or no credit history available for assessment. It indicates that no recent credit activity has been reported to the bureaus, which may occur when you haven't used any credit for a while or are new to credit.

3. Does CIBIL reset after 7 years?

No, CIBIL scores do not reset after 7 years. Negative marks such as late payments, default payments, or bankruptcies can be on your credit report for up to 7 years, but your score can improve with responsible credit use and timely payments.

4. How do I delete my CIBIL history?

You cannot directly delete your CIBIL history, but you can dispute any inaccuracies or errors on your report. If a debt is resolved or an entry is incorrect, you can request its removal. Otherwise, negative marks naturally fade after the designated time period (typically 7 years).

5. How long does it take to update CIBIL after paying all debts?

It can take up to 30-45 days for your CIBIL report to reflect the changes after settling all debts. Once the payment is processed and reported to the credit bureaus, the updated information will be reflected in your CIBIL score.