Ever wondered why your money seems to disappear faster than your salary hits your account? You’re not alone. From late-night online orders to impulsive “treat yourself” moments, small choices add up faster than we realise. For many young Indians, these habits quietly shape their financial future.

According to recent data, nearly 62.82% of discretionary expenses in India come from lifestyle purchases like fashion, personal care, and everyday indulgences. It’s not that spending on these things is wrong; it’s just that unchecked habits can easily drain your wallet before you even notice.

This blog dives into spending habits that secretly cost you and how to fix them fast. Whether you’re figuring out your first salary or simply want to build better money habits, you’ll find simple tips to spend smarter and stay financially balanced.

Key Highlights:

- Your spending habits reveal how you manage money and shape your long-term financial stability.

- Most young earners overspend on lifestyle purchases, making it harder to save consistently.

- Tracking expenses daily helps reveal spending patterns and encourages more mindful money management.

- Breaking habits like impulse buys or payday splurges can quickly improve your financial control.

- Simple practices like using cash or shopping with a list reduce emotional and unnecessary spending.

Understanding Different Types Of Spenders

Noticed how some people save every rupee while others swipe their cards without a second thought? Before fixing your spending habits, you first need to know what kind of spender you are. Everyone handles money differently, and knowing your style can help you make smarter choices.

Here’s a quick look at some common types of spenders:

| Type of Spender | Key Traits | Potential Challenge |

| Impulsive Spender | Buys on emotion or excitement | Ends up regretting purchases later |

| Frugal Spender | Focuses on savings and value | Misses out on comfort or experiences |

| Conscious Spender | Weighs purchases carefully | May overthink or delay useful buys |

| Status Spender | Loves brand names and recognition | Spends more than earns |

| Necessity Spender | Buys only essentials | Rarely treats self or upgrades |

No type is “bad” in itself, but if you recognise yourself in one of these, you can start understanding why your wallet feels lighter than expected. Once you know that, it’s easier to identify the patterns that keep you broke, especially if you’re just starting to earn.

Also Read: How to Manage Monthly Expenses Smartly in 2025

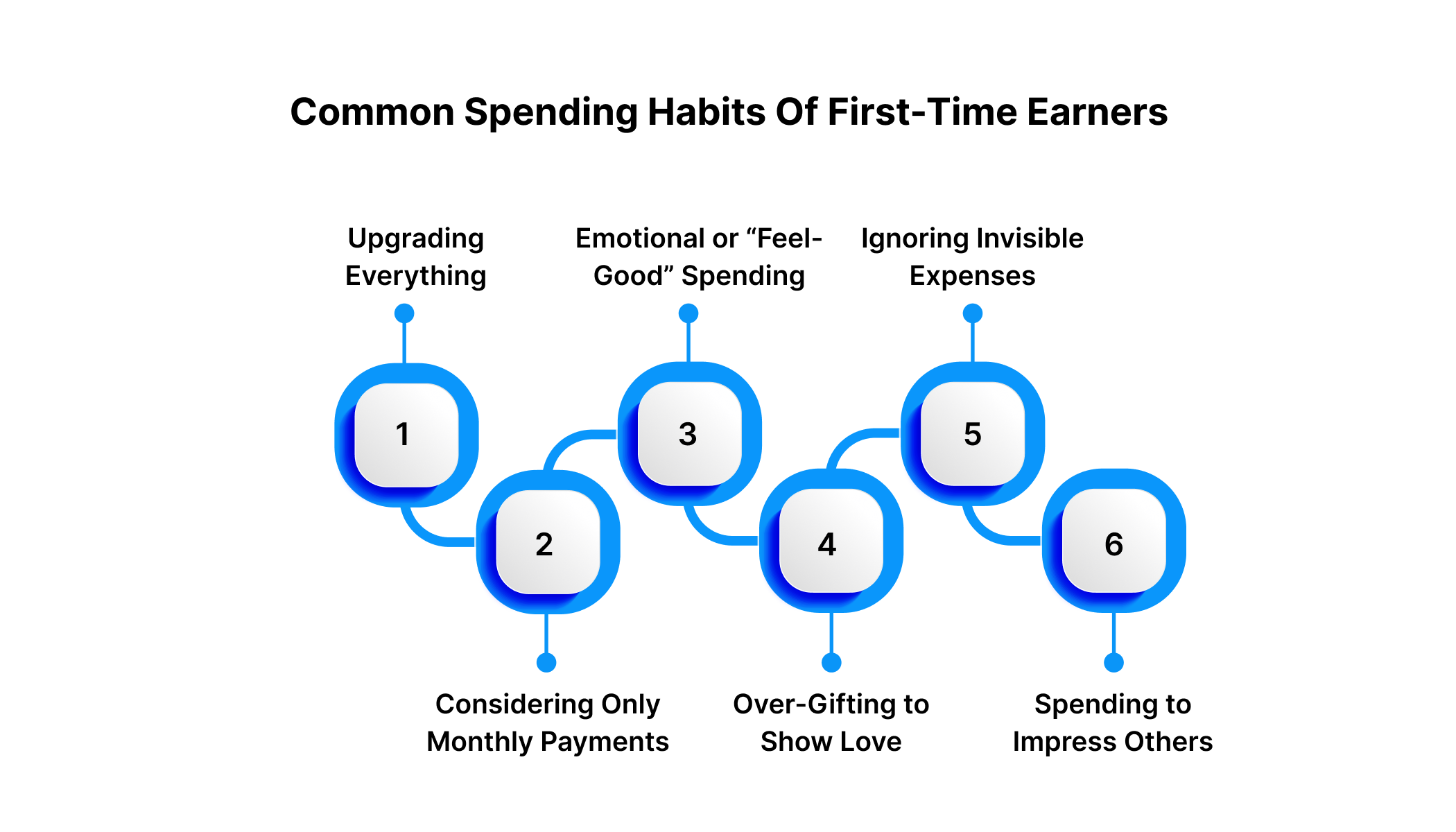

Common Spending Habits Of First-Time Earners

Remember that first paycheck? It probably felt like freedom wrapped in excitement. But for most first-time earners, that excitement can quickly turn into overspending.

Here are some spending patterns that often show someone is still new to managing money:

Upgrading Everything Too Soon

When you start earning, it’s natural to want a lifestyle upgrade. You feel like you’ve earned it after years of studying or internships. But upgrading all at once can drain your savings before you even realise it.

- Example: You buy a new phone, get new clothes, and order a gaming chair all in the same month. By the 20th, you’re already waiting for your next salary.

Considering Only Monthly Payments

Easy EMIs or “Pay Later” options make purchases look smaller and more manageable. The issue is that multiple small payments pile up quickly, and you may not track how much you’re actually spending overall.

- Example: You sign up for a few EMIs at once- a phone, a subscription box, and a new watch. The total feels small monthly, but soon half your income goes to repayments.

Emotional or “Feel-Good” Spending

When emotions run high, logic often takes a backseat. You might shop to celebrate, relieve stress, or reward yourself. This kind of spending feels good in the moment, but can lead to regret later.

- Example: After a rough week, you splurge on food delivery and online shopping just to feel better. The joy fades quickly, but the dent in your account stays.

Over-Gifting to Show Love

It’s sweet to want to make friends or family feel special, but trying to express affection through expensive gifts can harm your financial health. Meaningful gestures don’t have to cost a fortune.

- Example: You spend half your salary on a birthday gift for a friend, then struggle with your own expenses for the rest of the month.

Ignoring Invisible Expenses

Not all spending is obvious. Auto-renewals, delivery charges, and subscriptions can quietly drain your account. These small deductions often go unnoticed until your balance suddenly looks low.

- Example: You forget about multiple streaming and app subscriptions, plus a few delivery fees. By month-end, these small charges have eaten a big chunk of your budget.

Spending to Impress Others

Many young earners fall into the habit of showing success through expensive purchases or outings. It’s easy to feel pressured when everyone around you seems to be “living it up.”

- Example: You join every weekend party, split expensive bills, or buy trendy clothes just to fit in. In reality, it leaves you broke and stressed by the next week.

When you understand how first-time earners think about money, it’s easy to notice how those same patterns echo across Gen Z as a whole.

Got carried away with your first few paychecks? It happens to the best of us. When a real emergency hits, Pocketly lets you borrow responsibly with quick approvals, simple KYC, and no collateral.

What Are The Gen Z Spending Habits?

Gen Z in India isn’t just spending differently; they’re spending deliberately. This generation blends digital comfort with practical thinking, showing that financial awareness is no longer something to “grow into” later.

Here’s how their choices are shaping modern spending behaviour:

Value-Driven Shopping

Today’s young consumers look beyond flashy brands. They care about value, authenticity, and whether a product or service feels worth the price. Ethical and affordable options attract more attention than expensive labels that lack transparency.

Digital-First Spending

Shopping, food delivery, subscriptions, travel bookings, nearly everything now happens online. The growing dependence on mobile apps and social platforms has turned convenience into a default spending habit. However, this constant digital access also makes it easier to lose track of smaller, frequent payments.

Flexible Payment Preferences

Buy Now Pay Later services and UPI dominate the way Gen Z pays. These options make purchases seamless, but they also create a risk of invisible debt if spending isn’t tracked carefully. A mix of flexibility and discipline has become essential.

Experiences Over Possessions

Compared to previous generations, Gen Z tends to prioritise experiences like concerts, travel, dining, and events over material goods. It’s a shift from owning things to living moments, reflecting a desire for connection rather than accumulation.

Cautious yet Optimistic Outlook

Despite economic uncertainty, Gen Z remains hopeful about the future. Many are choosing to save more, learn about financial planning, and avoid large commitments like property purchases until they feel ready. They maintain a balance between caution and curiosity.

Gen Z’s spending patterns reflect confidence and convenience, but they also reveal a few blind spots.

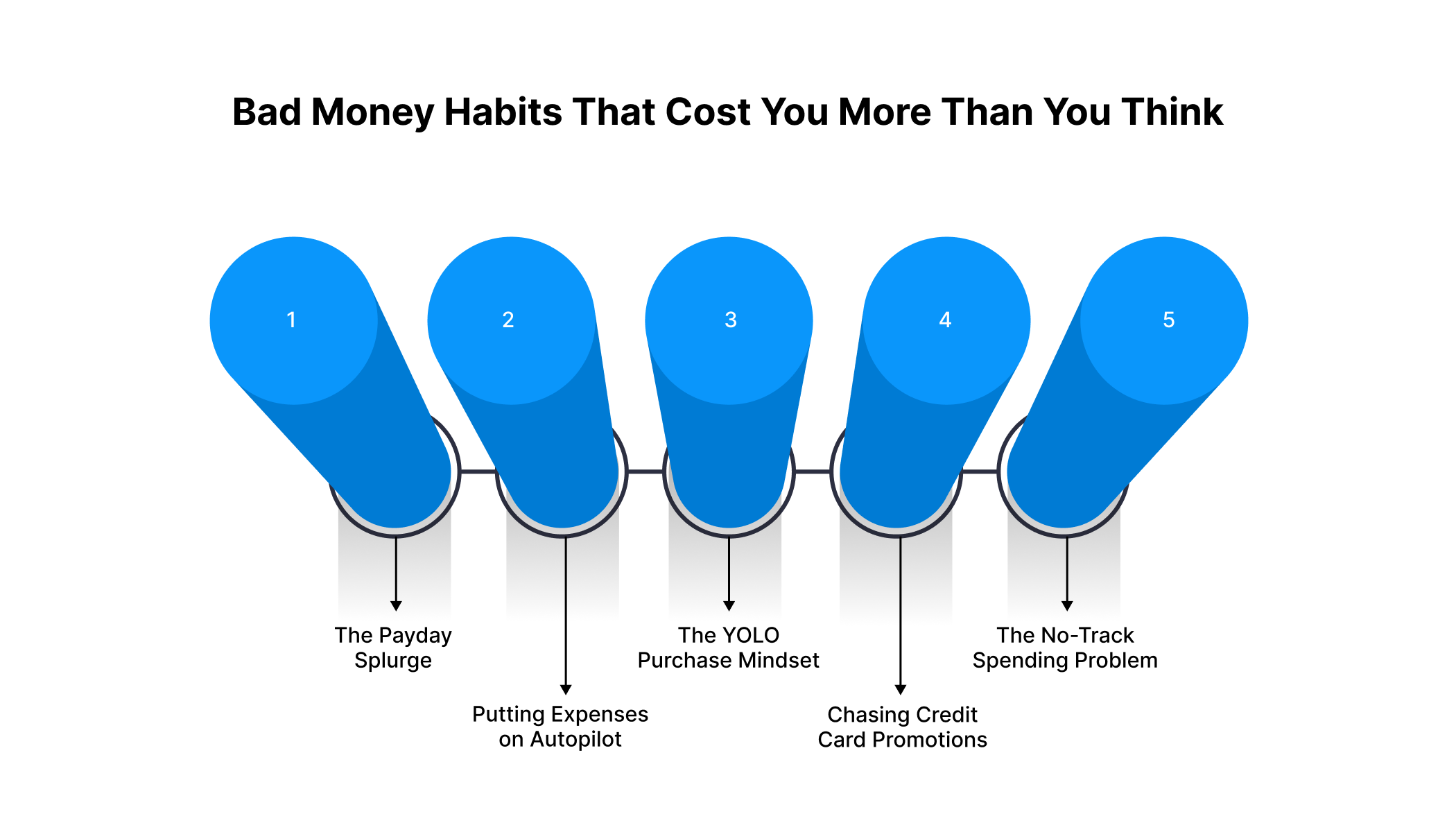

5 Bad Money Habits That Cost You More Than You Think

Let’s be honest, most people don’t plan to waste money. It just happens in small, sneaky ways that seem harmless at first. But over time, these small leaks can turn into full-blown drains on your finances. Below are six money habits that quietly eat into your wallet:

1. The Payday Splurge

That “treat yourself” moment right after your salary hits different, right? The first few days after payday often feel like a mini festival, ordering food, adding to the cart, or upgrading gadgets. The problem starts when this excitement becomes routine.

Fix it: Give yourself a “spend cap” for fun purchases right after payday. Move a chunk of your salary to a separate savings account before you start spending.

2. Putting Expenses on Autopilot

Automatic payments can be convenient, but they also make it easy to ignore where your money’s going. Subscriptions, monthly app charges, or memberships you no longer use keep draining your account quietly.

Fix it: Review your auto-pay list once every two months. Cancel the subscriptions you don’t use or downgrade to basic plans.

3. The YOLO Purchase Mindset

Impulse buying “just because you deserve it” is something most young earners relate to. Emotional spending feels good in the moment, but it can mess with your monthly budget.

Fix it: Next time you feel tempted, use the 24-hour rule by waiting a day before making the purchase. Chances are, the urge will pass.

4. Chasing Credit Card Promotions

Those “10% instant discount” banners can be hard to ignore, but spending to earn cashback often backfires. You end up buying things you don’t actually need just to “save” money.

Fix it: Only use discounts for things you’ve already planned to buy. Otherwise, that “deal” isn’t really saving you anything.

5. The No-Track Spending Problem

If you don’t track where your money goes, you’ll always feel like it disappears too fast. Most people underestimate their daily expenses; those coffees, cabs, and online orders add up faster than expected.

Fix it: Use a spending app or maintain a simple tracker on your phone. When you actually see your expenses, cutting back becomes much easier.

So, you've called out the bad habits; now it’s time to fix them. Let’s see how simple tracking tricks can help you get your money back on track.

Also Read: Top 10 Tips to Spend and Save Money Wisely

How Can You Track Your Spending Better?

Tracking isn’t about restriction, but about understanding your patterns. Once you know where your money’s going, you’ll be able to make smarter choices naturally. Here’s how to start and stick with it.

Choose Your Tracking Period

Start small with a 7-day challenge to record every expense, from snacks to online orders. Once that feels easy, expand to a month for a full view of your financial patterns.

Pick A Tracking Method

Everyone tracks differently:

- Use an app: Handy for instant updates and category insights.

- Manual notes: Great if you prefer writing things down daily.

- Bank statements: Review them weekly to spot spending trends.

Make It a Habit

Track every day for consistency. Don’t aim to change your spending right away, just observe. Awareness itself triggers better decisions.

Reflect On The Data

At the end of your tracking period, review your records:

| Expense Type | Avg, Monthly Spend | How To Cut |

| Food Delivery | ₹2,000–₹3,000 | Try home cooking 2 days/week |

| Cabs & Autos | ₹1,200–₹2,000 | Try public transport or split rides |

| Weekend Outings | ₹1,500–₹3,000 | Limit to once a week & split with friends |

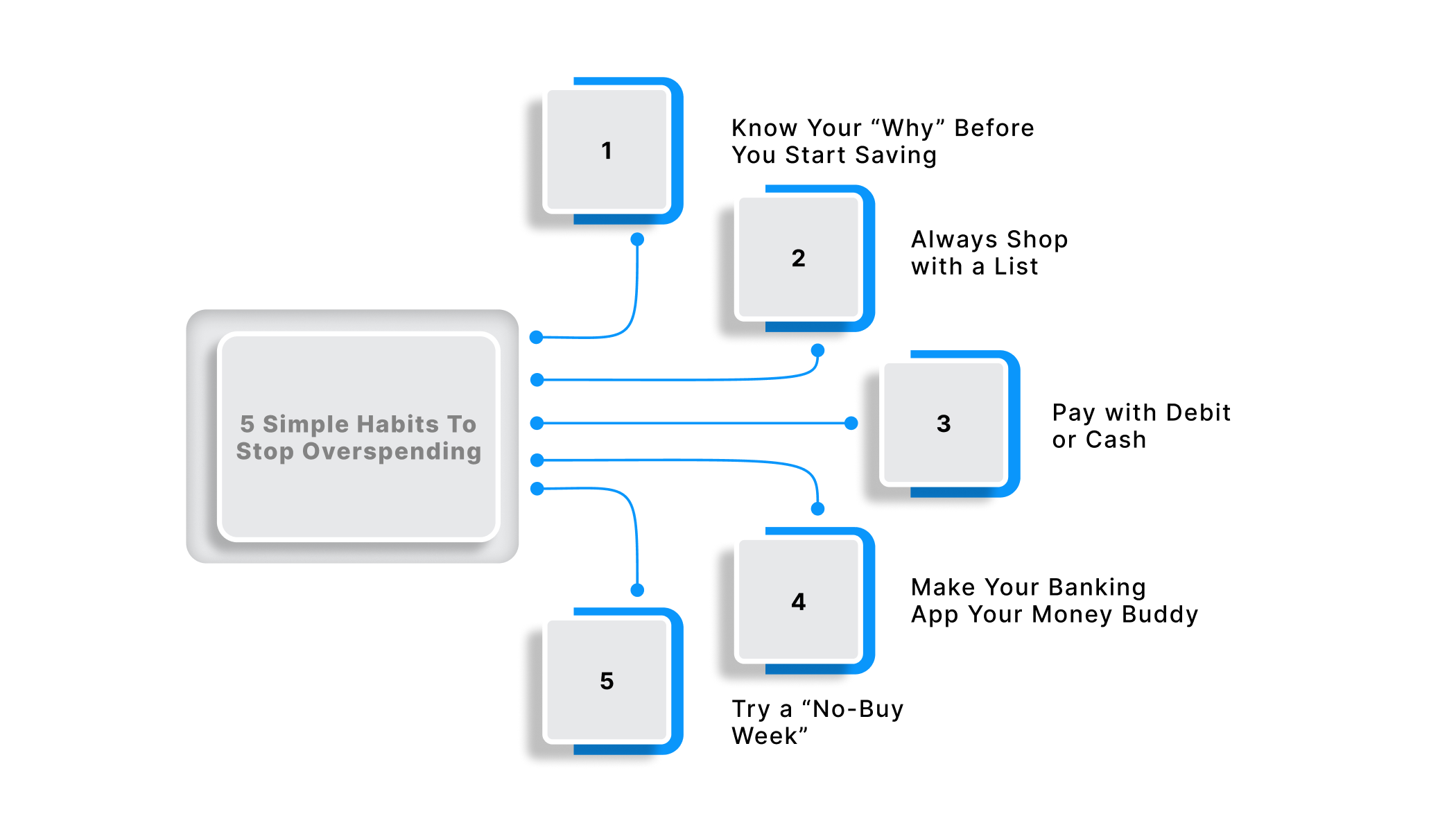

5 Simple Habits To Stop Overspending

Curbing overspending isn’t about saying “no” to everything but about saying “yes” to the right things. Try these simple yet effective habits to make your money go further:

1. Know Your “Why” Before You Start Saving

Understanding your reason makes it easier to stay on track:

- Think about what matters most to you, like saving for a trip or clearing debts.

- Remember how overspending felt the last time it messed up your plans.

- Keep your bigger goal in mind whenever you’re tempted to buy something unnecessary.

2. Always Shop with a List

A list might sound basic, but it’s a real money-saver:

- Write down what you actually need before opening an app or entering a store.

- Stick to that list, even if something else looks tempting.

- If shopping online, leave your cart overnight and see if you still want it the next day.

3. Pay with Debit or Cash

Spending money you already have helps you stay grounded:

- Cash spending feels more real because you see your money leave your hand.

- Debit cards are safer since you can only use what’s in your account.

- If you use a credit card, pay it off right after the purchase to avoid going overboard.

4. Make Your Banking App Your Money Buddy

Your mobile banking app can do more than just show your balance:

- Set alerts to track your spending and avoid crossing limits.

- Schedule auto-savings to move money to your savings before you can spend it.

- Check your app before making any major purchase to see if it truly fits your budget.

5. Try a “No-Buy Week”

Take a short break from spending to reset your habits:

- Pick a week to skip all non-essential shopping and focus only on needs.

- Fill that time with free activities or hobbies you enjoy.

- Notice how much you save just by avoiding small, routine purchases.

Also Read: 6 Simple Budgeting Tips for Better Money Management

How Pocketly Encourages Smart Spending with Smart Borrowing

When money runs short between paydays, quick fixes can often lead to bigger money problems. That’s where Pocketly steps in, not as a financial shortcut, but as a smarter way to manage short-term cash needs.

Pocketly is a digital lending platform offering collateral-free personal loans from ₹1,000 to ₹25,000, perfect for handling genuine emergencies or unexpected expenses. With interest rates starting from 2% per month and a processing fee of 1–8%, you stay fully aware of your borrowing costs.

Here’s how it works:

- Step 1: Sign up in just 2 clicks.

- Step 2: Complete a simple KYC using Aadhaar and PAN.

- Step 3: Enter your bank details securely.

- Step 4: Choose your loan amount and tenure.

- Step 5: Get instant approval and direct transfer.

With a 100% online process, no hidden charges, no collateral, flexible EMIs, and 24/7 support, Pocketly helps you manage emergencies responsibly, without falling into unhealthy spending cycles.

Wrapping Up

Money doesn’t change who you are; it magnifies your habits. If you spend mindlessly, more money won’t fix that. But if you stay intentional, even small amounts can help you build freedom and control.

The key isn’t to stop spending altogether. It’s to understand your spending habits, question your impulses, and make conscious choices that align with your goals. You don’t have to be flawless with money; you just have to stay aware of where it’s going.

And when unexpected expenses arise, you don’t have to panic or fall back into poor habits; Pocketly’s got your back. Our reliable, digital lending platform offers quick, responsible short-term loans when you need them most.

Download Pocketly today on iOS or Android to handle emergencies smartly and keep your spending on track.

FAQ’s

What are some common spending habits that keep people from saving for the future?

Frequent impulse buys, eating out too often, and ignoring small recurring expenses can silently drain your income. These habits make it hard to set aside money for future goals.

What strategies can help me be financially stable early on?

Start by tracking every rupee you spend, setting short-term savings targets, and avoiding lifestyle upgrades as your income grows. Consistency in these small steps builds long-term stability.

Do people tend to spend less when using cash than credit cards?

Yes, paying with cash makes you more aware of the money leaving your hands. It creates a physical connection to your spending, which helps you think twice before making unnecessary purchases.

What tools can I use to track my spending?

Simple methods like maintaining a spreadsheet, journaling expenses, or using built-in features on your bank app can help you track your daily spending.

How to reduce spending habits?

Identify what triggers your overspending, plan your purchases ahead, and set weekly or monthly budgets. Over time, mindful awareness becomes your best tool for cutting down unnecessary expenses.