Money moves fast today, sometimes faster than you can keep up with.

One tap on UPI for a snack, a quick cab, a late-night food order, or a split payment with friends feels harmless in the moment. Add a few subscriptions quietly renewing in the background, and suddenly your balance drops without any “big” purchase to blame.

None of these feels like “real” expenses in the moment. But together, they drain your balance before you notice. It’s not irresponsibility, it’s the speed and invisibility of today’s spending. Between classes, work, commuting, and social plans, money slips out in tiny amounts.

By the time you reach the middle or end of the month, you’re left wondering, “Where did everything go?”

Expense analytics changes that.

It shows you exactly how your money flows, including the patterns, habits, and leaks you may not notice in daily life. Instead of restricting you, it gives you clarity.

And with clarity comes control: you can plan more effectively, avoid unexpected shortages, and make decisions that align with your goals.

Let’s break it down and understand how expense analytics can help you take control of your money.

Key Takeaways

- Digital spending through UPI, subscriptions, and micro-transactions makes expenses easy to ignore and harder to track.

- Expense analytics goes beyond listing transactions; it reveals patterns, behaviours, and leaks you don’t notice day-to-day.

- Understanding your spending helps prevent month-end shortages, improves cash flow, and supports smarter short-term goal planning.

- Simple tools like UPI history, bank statements, notes apps, and basic trackers are enough to get meaningful insights.

- When your analysis shows a genuine short-term gap, platforms like Pocketly can help you manage urgent expenses responsibly.

What Is Expense Analytics?

Let's understand how it is different from tracking.

Tracking your expenses is just writing down what you spent: a list.

Expense analysis goes a step further: it helps you understand why you spent, how often, and in what patterns.

For example, tracking tells you you spent ₹2,500 on food delivery last month; analysis shows that most of it happened after 10 PM on weekdays when you were tired.

Tracking records the numbers. Analysis explains the behaviour behind those numbers, and that’s where the real value lies.

How It Empowers Better Decisions

Once you understand your spending patterns, decisions become easier. You don’t need strict budgets or complicated tools, just clarity. Analytics helps you:

- Predict when money usually gets tight

- Spot the habits that drain your balance quietly

- Allocate money more confidently to essentials and goals

- Avoid panic decisions at the end of the month

- Make adjustments that actually fit your lifestyle

Expense analytics gives you control without pressure. It replaces guesswork with insight, so you can manage your money based on facts, not assumptions.

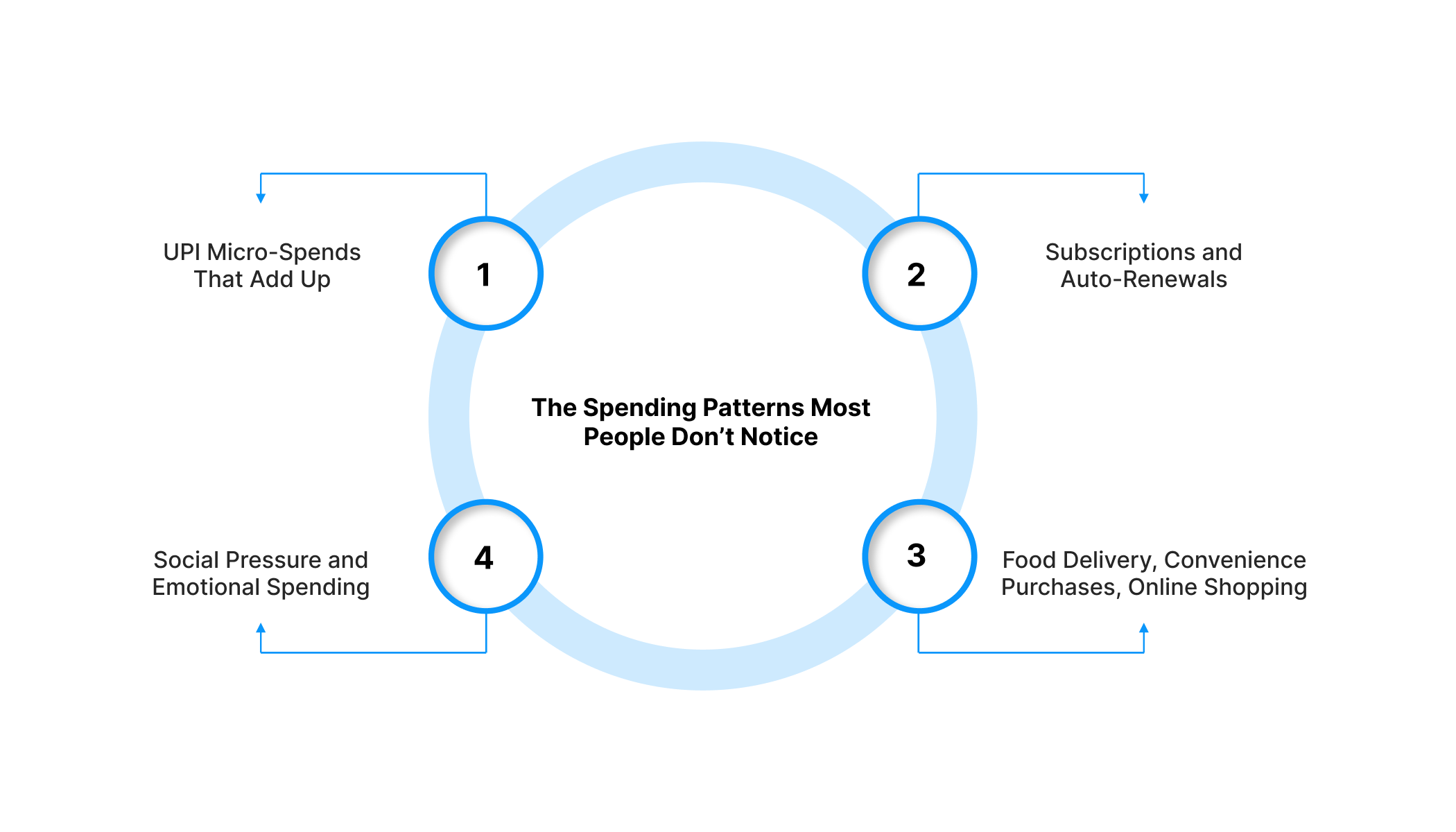

The Spending Patterns Most People Don’t Notice

You might think you know where your money goes, but the real leaks often come from patterns you don’t notice in daily life.

UPI Micro-Spends That Add Up

UPI makes spending so fast that you barely register it.

₹60 for chai, ₹120 for a quick snack, ₹40 for a top-up, ₹150 for an auto, individually harmless, collectively heavy.

Most people make 20–60 UPI payments a month, and even an average spend of ₹80 adds up to ₹1,600–₹4,800 without realising it.

The pattern is simple: it’s not the big purchases that break your budget; it’s the tiny repeat payments you never think about.

Expense analytics helps surface these micro-leaks so you understand where your money is actually going.

Subscriptions and Auto-Renewals

Streaming platforms, cloud storage, fitness apps, note-taking apps, and delivery memberships keep renewing in the background.

Many users forget they’re even paying for half of them. A student or salaried person often has 6–10 small subscriptions, each ₹99–₹499. One or two seem manageable; ₹1,000–₹2,500/month combined is the real story.

Auto-renewals also hit at unpredictable times, usually when you least expect them.

Expense analytics helps you see which subscriptions you use and which ones silently drain your balance.

Food Delivery, Convenience Purchases, Online Shopping

Apps are designed to reduce friction, offer one-tap ordering, fast delivery, and personalised recommendations.

Because of this, convenience spending becomes emotional spending. A ₹250 meal becomes ₹350 with delivery + taxes. Add two or three such orders a week, and you’re up to ₹3,000–₹5,000/month.

Convenience stores, quick commerce apps, and flash sales also create a pattern: small, frequent purchases driven by mood, not need.

Analytics highlights these spending spikes so you can see when and why they happen.

Social Pressure and Emotional Spending

A major leak most people don’t acknowledge is social spending, going out because friends are going, ordering food because everyone is ordering, matching lifestyles you can’t afford yet.

Add emotional spending on top: buying to reward yourself, to destress after work, or to feel better on bad days. These aren’t “wrong”; they’re human. But without awareness, they pile up fast.

Expense analytics reveals not just the amount spent, but the context: weekend spikes, mood-based buys, “just this once” patterns.

Once you see these trends clearly, you gain the power to control them instead of feeling guilty later.

Why Analysing Your Expenses Makes Life Easier

A little awareness goes a long way. Analysing your expenses helps you avoid surprises, stay prepared, and make choices that genuinely fit your lifestyle.

Preventing Month-End Shortages

Month-end shortages usually don’t happen because you overspend at once; they happen because you spend small amounts frequently without noticing.

Expense analytics shows you when during the month your spending spikes, which categories drain you the fastest, and the exact week you usually run out.

With this visibility, you can adjust earlier instead of struggling in the last 7–10 days. Knowing your patterns reduces panic, borrowing pressure, and last-minute stress.

Improving Cash Flow Awareness

Your cash flow is simply the rhythm of money entering and leaving your account.

Most people only think about how much they earn and how much they spend, but not when they do it. Expense analytics highlights your timing:

- High-spend days vs low-spend days

- Weeks where expenses pile up

- Days you’re more likely to make impulse purchases

When you understand the timing of your money, you make smoother decisions and avoid unpredictable drops in your balance.

Reducing Wasteful Spending

Waste usually is unused subscriptions, repeated convenience orders, emotional buys, and forgotten payments.

Analytics helps you separate useful spends from habit-driven spends.

With clear categories and totals, you instantly see which expenses don’t add value to your life. It's about identifying the 2–3 small leaks that, when fixed, improve your financial comfort the most.

Planning for Short-Term Goals (Travel, Gadgets, Fees, Lifestyle)

Whether you want a new phone, a weekend trip, a certificate course, or money for an upcoming fee, planning becomes far easier when you know your spending patterns. Expense analytics shows:

- How much can you realistically set aside?

- Which categories can you reduce temporarily?

- How long will it take to reach your target?

Instead of guessing or hoping you’ll save “whatever’s left,” you plan with real numbers, and that makes your goals feel achievable, not distant.

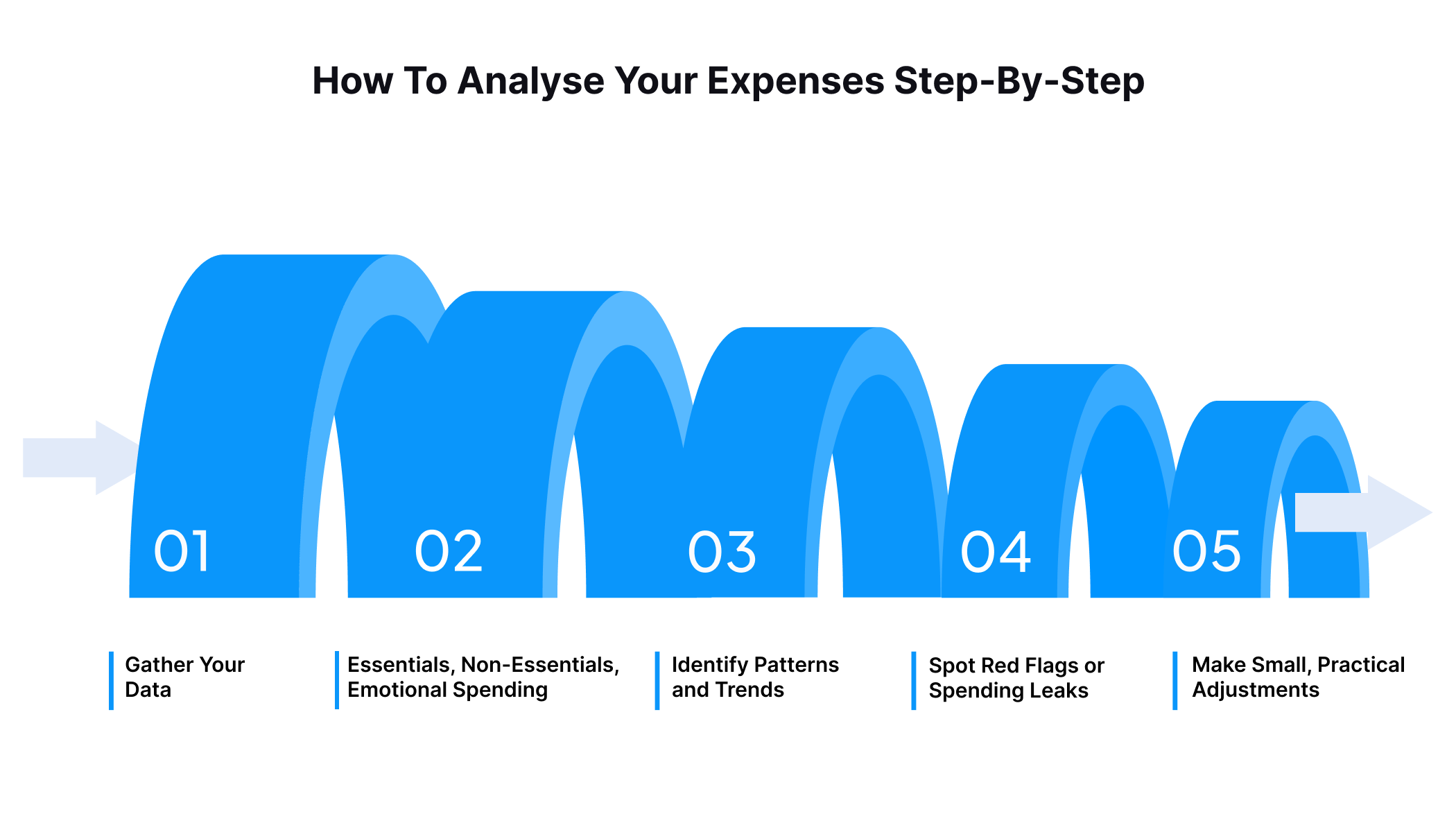

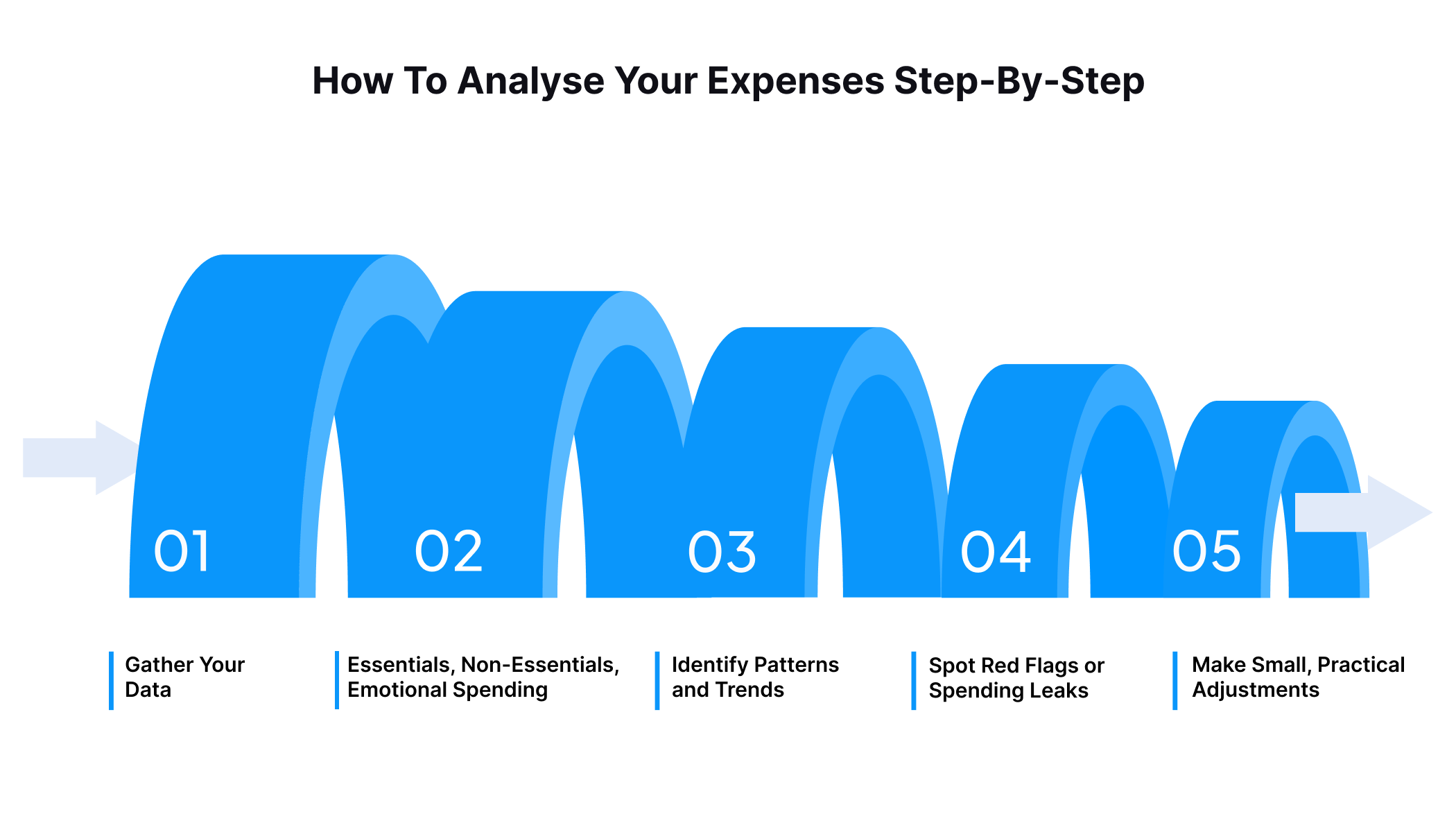

How to Analyse Your Expenses Step-by-Step

Analysing your expenses is easier than it sounds; you just need the right steps to break it down.

Step 1: Gather Your Data (UPI, Bank, SMS Alerts, Notes)

Start by collecting all the places where your money moves.

Check your UPI history, bank app statements, SMS transaction alerts, and even the small spends you may have noted down.

This gives you a complete picture of every payment, not just the ones you remember. The goal is to see all your expenses in one place so nothing slips through the cracks.

Step 2: Categorise Into Essentials, Non-Essentials, Emotional Spends

Once you have your data, group each spend into simple categories:

- Essentials: rent, groceries, transport, bills

- Non-essentials: food delivery, entertainment, shopping

- Emotional spends: late-night orders, stress buys, social pressure spends

Not to judge your choices, it’s to understand what each category does to your monthly flow.

Step 3: Identify Patterns and Trends (Daily/Weekly/Monthly)

Look for repeated behaviours.

- Are you spending most on weekends?

- Do your food orders spike after work?

- Is the first week of the month always your highest spending phase?

Patterns reveal when you’re most likely to spend, which is something you can’t see from individual transactions. These trends are the foundation of your money habits.

Step 4: Spot Red Flags or Spending Leaks

Red flags are expenses that don’t help you or don’t match your priorities.

These might be forgotten subscriptions, impulse buys, random convenience charges, or repeat low-value transactions that add up fast.

Spending leaks are the small, frequent amounts you never notice, but that drain your balance over the month.

Highlighting these helps you see exactly where money slips away without any real benefit.

Step 5: Make Small, Practical Adjustments

Now that you have insights, focus on small changes, not big cuts.

You might reduce one food order per week, turn off an unused subscription, or set aside a tiny buffer amount for mid-month.

The goal is to make realistic tweaks that prevent shortages and create smoother cash flow.

Even one small adjustment per category makes a noticeable difference.

Simple Tools You Can Use for Personal Expense Analytics

Digital payments are already part of your daily routine, and the tools you use every day can give you surprisingly clear insights into your spending, if you know where to look.

UPI and Bank App Statements

Your UPI and bank apps already hold the most accurate record of your spending.

UPI histories show every micro-payment, while bank statements reveal bigger patterns like bill payments, ATM withdrawals, and subscriptions.

Reviewing these once a week gives you a reliable snapshot of where your money is going without needing any extra apps.

Notes App or Google Sheets

If you don’t want anything complicated, your phone’s Notes app or a simple Google Sheet is more than enough.

As discussed before, create three columns: essentials, non-essentials, and emotional spends, and log your payments as they happen or at the end of the day.

Even a basic list helps you see how much you spend in each category and highlights habits you usually overlook.

Expense-Tracking Apps (Non-Brand)

If you prefer automation, basic expense-tracking apps can automatically read SMS alerts and tag your expenses.

They categorise transactions, show monthly trends, and highlight spikes.

These tools help you notice patterns like weekend overspending or subscription renewals without manually recording anything.

Creating Simple Category Dashboards

A personal dashboard doesn’t need fancy software; a basic sheet with monthly totals works well.

You can create categories like food, transport, entertainment, subscriptions, and emergencies. Add simple totals and you instantly see which category dominates your spending.

This helps you make clearer decisions, especially when planning for short-term goals or avoiding month-end shortages.

In short, you don’t need complex software to understand your spending; even simple tools can reveal patterns that help you stay in control of your money.

Now think, sometimes your expense analysis shows gaps you didn’t expect, a week where spending spiked, a subscription renewal you forgot about, a sudden repair, or an urgent college or work-related cost.

These situations create short-term pressure even when you’ve been careful.

When the gap is genuine and time-sensitive, having quick access to support can prevent your month from derailing.

Responsible Short Term Support: Pocketly

Pocketly is designed for moments when you need small, immediate financial help. It’s not meant for long-term borrowing or lifestyle spending, only for short, unavoidable gaps that analytics help you notice early.

The goal is to give you a reliable safety net so you can manage urgent needs without stress.

Transparency in Loan Amounts, Interest Rates, and Fees

Pocketly offers small personal loans between ₹1,000 and ₹25,000.

- Interest rate: starts at 2% per month

- Processing fee: 1–8%, based on the loan amount and profile

- All charges are shown upfront, so you know exactly what you’re paying before you proceed.

Quick KYC and Instant Transfer

The entire process is digital.

- Complete a quick KYC, no physical documents required.

- Choose your required amount.

- Get instant approval.

- Receive funds directly in your bank account within minutes.

This helps you handle time-sensitive expenses without delays.

Pocketly Is a Digital Lending Platform

Pocketly does not lend money directly. It acts as a digital lending platform in partnership with registered NBFCs:

- Fairassets Technologies India Private Limited

- NDX Financial Services Private Limited

- Speel Finance Company Private Limited

These NBFCs issue the loans, while Pocketly provides the technology and user experience.

If you ever face a genuine short-term gap, Pocketly can help you manage it smoothly. Download the app to explore your options.

Conclusion: Build Smarter Spending Habits with Better Insights

Understanding how you spend is one of the simplest ways to take control of your money.

When you can clearly see your patterns, the small leaks, the timing of your expenses, and the habits that shape your month, managing your finances stops feeling confusing.

Expense analytics gives you that clarity.

It helps you plan better, stay prepared for surprises, and make decisions that genuinely support your goals.

Small insights lead to smarter habits, and smarter habits lead to a more confident, stress-free relationship with money.

FAQs

1. What is personal expense analytics?

Personal expense analytics means understanding how, when, and why you spend money. It goes beyond tracking transactions and helps you spot patterns, habits, and small leaks that affect your monthly cash flow.

2. How does analysing expenses prevent shortages?

By reviewing your spending patterns, you can see which days or categories drain your balance the fastest. This helps you adjust early in the month instead of running out of money unexpectedly.

3. What’s the easiest way to track expenses in India?

Your UPI apps, bank statements, and SMS alerts already provide most of the data you need. Combining them with a simple Notes app or Google Sheet is enough to get a clear picture of your spending.

4. Why do UPI micro-spends add up so fast?

Because each payment feels small and harmless, you don’t notice how often you make them. Over a month, dozens of ₹50–₹150 transactions can add up to several thousand rupees without you realising it.

5. When should someone consider short-term support like Pocketly?

Short-term support makes sense when you face an unavoidable expense and your analysis shows you don’t have enough to cover it. If the need is genuine and you can repay on time, Pocketly can help you bridge the gap responsibly.