Picture this: it’s the 28th, rent is due, groceries are pending, and a pile of utility bills stares at you. As a student or young professional in India, you’ve likely felt that month-end crunch. The water bill you forgot, the electricity charges that shot up, and the internet payment due tomorrow.

Suddenly, your budget feels shaky, and you’re figuring out how to manage everything before your next salary or stipend. Utility bills aren’t just payments; they affect your credit profile, and when managed poorly, they cause unavoidable stress.

This guide covers what utility bills are, common types, smart payment tips, and how to handle them during cash shortages.

Key Takeaways

- Utility bills include electricity, water, gas, internet, mobile, and DTH services that vary in cost and billing cycles. Understanding each type helps you budget better and avoid surprises.

- Beyond keeping services running, utility bills serve as valid address proof for official purposes and reflect your financial discipline, making timely payments crucial for your overall credit behaviour.

- Common payment mistakes like missing due dates, ignoring notifications, and not reviewing bill details lead to late fees, service disconnections, and reconnection charges that often exceed the original bill amount.

- Smart management strategies like creating a bill calendar, tracking consumption patterns, using auto-pay for fixed bills, and building a dedicated buffer fund prevent cash crunches and reduce utility costs significantly.

- When facing temporary cash shortages, Pocketly provides quick loans from ₹1,000 to ₹25,000 (interest starting at 2% per month, processing fees 1% to 8%) to cover urgent bills, helping you avoid disconnection penalties and maintain uninterrupted services until your next payday.

What Are Utility Bills?

A utility bill is a monthly statement you receive for essential services used at your home or office. These bills charge you for services like electricity, water, gas, and internet connectivity that keep your daily life running smoothly. The utility bill calculates what you've consumed and tells you what you owe.

Key Components of a Utility Bill

Every utility bill contains specific information:

- Consumer details: Your name, address, and unique consumer number

- Billing period: The dates for which charges apply (usually one month)

- Current and previous readings: Meter readings showing consumption

- Unit consumed: The actual amount of service used (kilowatt hours, litres, cubic meters)

- Rate per unit: The cost charged for each unit consumed

- Fixed charges: Basic service charges regardless of consumption

- Taxes and surcharges: GST and other applicable government taxes

- Total amount due: Final payable amount after all calculations

- Due date: Last date for payment without penalty

- Payment options: Available methods to clear the bill

Understanding these components helps you spot errors, track consumption patterns, and budget better for upcoming months. Now let's explore the different types you'll encounter as an independent adult in India.

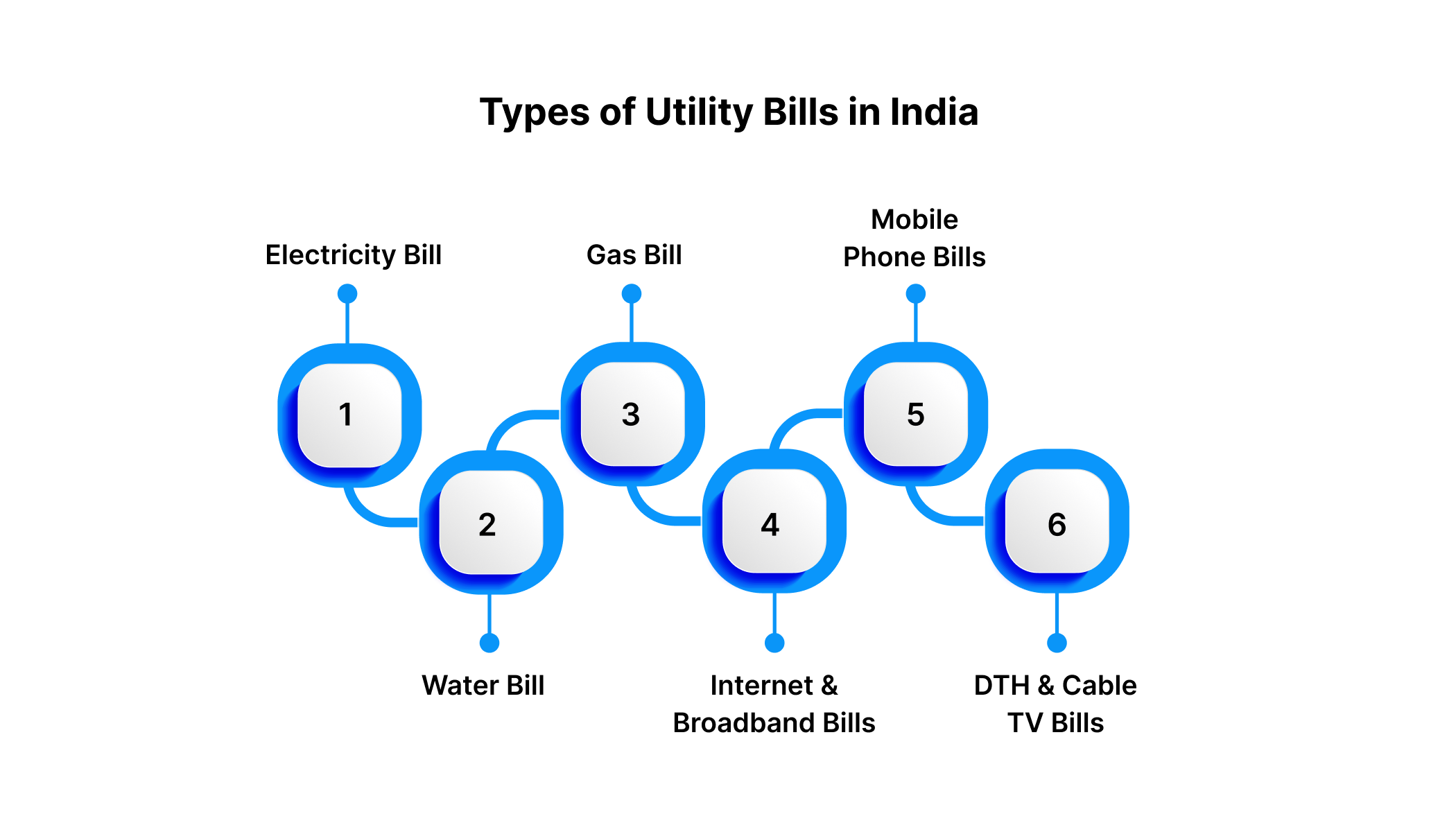

Types of Utility Bills in India

Different utility services mean different bills landing in your mailbox or inbox. Let's break down the most common ones you'll encounter.

1. Electricity Bill

Your electricity bill is probably your most variable utility expense. It fluctuates based on usage, seasonal changes, and appliances you run.

Power distribution companies like BESCOM, MSEDCL, or TATA Power calculate charges based on meter readings. In India, electricity rates work on a slab system. The more you consume, the higher the rate you pay per unit.

What affects your electricity bill:

- Air conditioner and geyser usage (the biggest contributors)

- Number of electronic devices running

- Old, inefficient appliances

- Time of usage (some states have time-based rates)

- Seasonal temperature changes

Most urban areas now offer online payment through state electricity board apps or payment platforms.

If you're trying to understand how to save on your monthly electricity expenses, small changes in consumption habits can make a big difference without sacrificing comfort.

2. Water Bill

Municipal corporations or local water boards issue water bills, typically every month or quarter. Many Indian cities still charge a fixed rate rather than metered consumption, though this is changing.

However, areas facing water scarcity may see higher charges or require private water tanker services, which significantly increase costs.

Common water bill charges include:

- Metered consumption charges (where meters exist)

- Fixed monthly service charge

- Sewerage and drainage charges

- Water conservation cess

3. Gas Bill (LPG and Piped Gas)

PNG users receive monthly bills from providers like IGL, MGL, or Gujarat Gas. LPG cylinder users pay upfront when booking through Indian Oil, BPCL, or HPCL, with subsidies credited later. PNG is usually more economical for heavy cooking, though availability is limited to select areas.

4. Internet and Broadband Bills

Your internet connection, whether fiber broadband, cable internet, or mobile data plans, comes with monthly charges. Providers like Jio Fiber, Airtel Xstream, ACT Fibernet, or local cable operators issue these bills.

Internet bills are usually fixed monthly amounts based on your chosen plan, making them easier to budget for. However, exceeding data limits or adding premium services can increase charges.

Typical internet bill inclusions:

- Base plan charges (speed and data limits)

- Router rental (if applicable)

- Installation and activation charges (usually one-time)

- OTT platform subscriptions (bundled offers)

- GST at 18%

5. Mobile Phone Bills

Postpaid mobile connections generate monthly bills, while prepaid users pay in advance. Telecom providers like Jio, Airtel, VI, and BSNL offer both options.

Most young Indians prefer prepaid due to better control over spending. Postpaid suits those wanting uninterrupted service and consolidated billing with additional family connections.

6. DTH and Cable TV Bills

Direct-to-Home (DTH) services or cable TV subscriptions are either prepaid (most common) or postpaid. Providers include Tata Sky, Dish TV, Airtel Digital TV, and local cable operators.

With the rise of OTT platforms, many young Indians are cutting cable subscriptions. However, for families, DTH remains a regular utility expense.

Also Read: Should You Save for an Emergency Fund or Pay Off Debt?

Why Utility Bills Matter Beyond Just Payment

You might wonder why keeping utility bills organised matters so much. Beyond keeping services running, these bills serve important purposes in your financial life.

Proof of Address and Identity

Utility bills are government-recognized address proofs accepted for:

- Opening bank accounts

- Applying for credit cards or loans

- Passport applications

- Driving licence issuance

- Aadhaar address updates

- Rental agreements

Landlords and financial institutions trust utility bills because they confirm you actually live at the stated address. A bill older than three months usually doesn't work, so keeping recent copies handy helps.

Credit Profile Building

While utility bills don't directly appear on CIBIL reports like loans or credit cards, your payment behaviour matters. Consistent late payments can be reported by some utility providers, especially for postpaid connections.

More importantly, the discipline of paying bills on time builds financial habits that reflect in other areas. If you struggle with utility bill deadlines, you'll likely face challenges managing loan EMIs or credit card dues.

Rental and Lease Requirements

When you rent a new place, landlords often ask for previous utility bills. This helps them:

- Verify your identity and past address

- Understand typical utility consumption and costs

- Check for any pending disputes or dues

- Confirm you're a responsible tenant

Having organised utility bill records makes moving into new accommodations smoother.

While paying bills seems straightforward, many people unknowingly make mistakes that cost them money and create unnecessary hassles.

Also Read: Can Paying Bills Help Build a Credit Score?

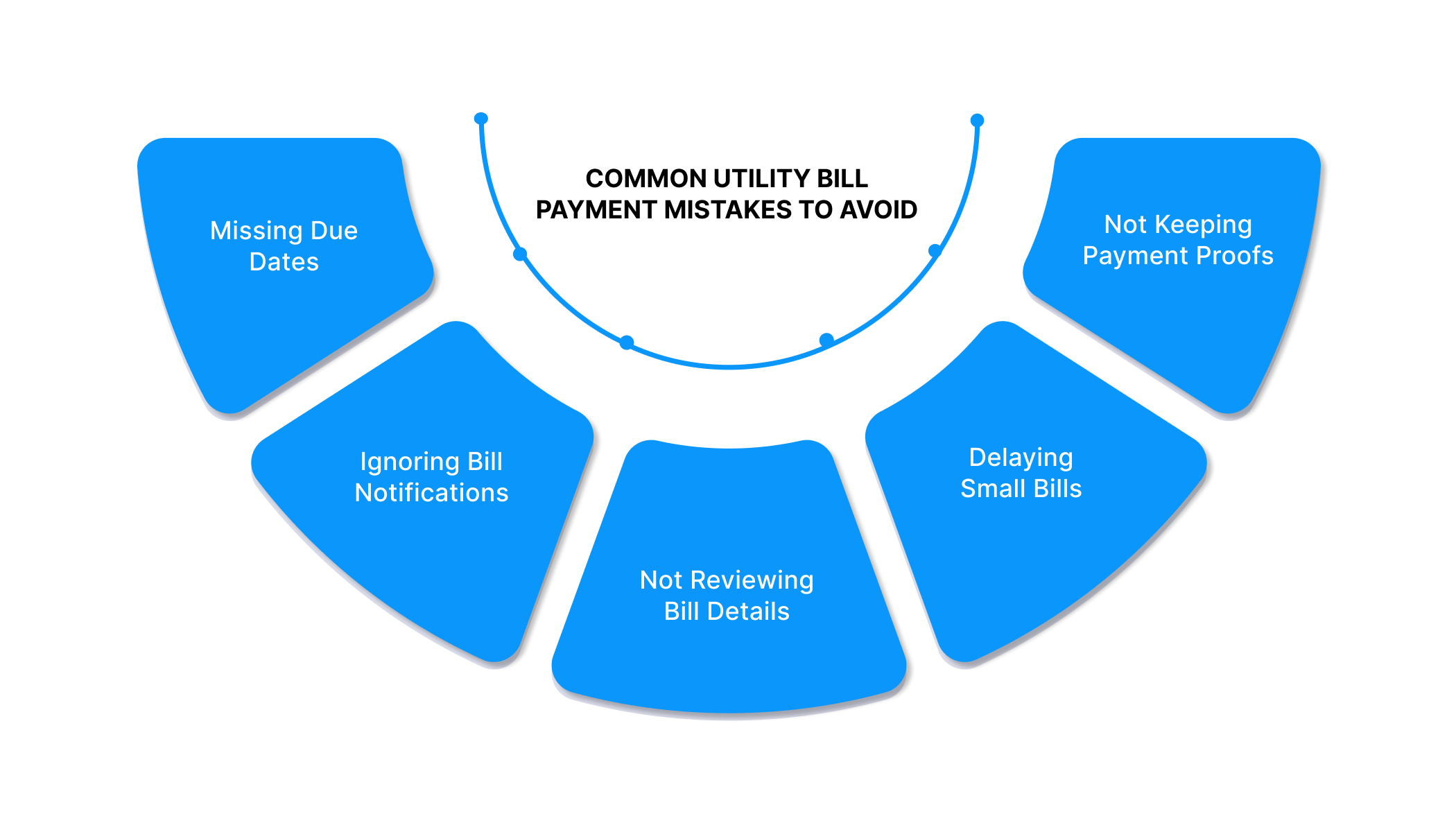

Common Utility Bill Payment Mistakes to Avoid

Even simple bill payments can go wrong if you're not careful. Avoiding these common mistakes saves money and prevents service disconnection.

1. Missing Due Dates

Late fees add up fast, and utilities often charge 2–5% monthly on overdue bills. If you're short on cash and nearing the due date, Pocketly's instant loans (₹1,000–₹25,000) with 2% monthly interest and 1–8% processing fees help you avoid penalties and disconnection until your salary arrives.

Tip: Set reminders a week before due dates and enable payment notifications.

2. Ignoring Bill Notifications

Whether emails, SMS, or physical bills, ignoring notifications means you might miss important information about rate changes, maintenance schedules, or payment deadlines.

Solution: Create a dedicated folder for utility bills in your email. Check it regularly.

3. Not Reviewing Bill Details

Blindly paying without checking meter readings or consumption patterns can mean you're paying for errors. Wrong meter readings, applied penalties you shouldn't owe, or calculation mistakes happen more often than you think.

Solution: Spend two minutes reviewing each bill before payment. Compare current consumption with previous months. If something looks off, contact customer care immediately.

4. Delaying Small Bills

Thinking "it's just ₹200, I'll pay it later" leads to piled-up dues across multiple utilities. Small amounts add up, and you face multiple late fees.

Solution: Pay all bills together, regardless of amount, to maintain a clear slate.

5. Not Keeping Payment Proofs

Without payment receipts, you can't prove you've cleared dues if disputes arise. Services might get disconnected even after payment if the utility company's system doesn't reflect it immediately.

Solution: Screenshot online payment confirmations. Keep SMS receipts. Download payment receipts from apps and save them in cloud storage.

Even with the best planning, sometimes financial emergencies make paying bills on time impossible. When that happens, knowing your options can prevent bigger problems down the line.

Also Read: Struggling With Money? Try Budget Optimisation Hacks

What to Do When You Can't Pay Utility Bills on Time

Financial emergencies happen. You might face unexpected medical expenses, job loss, or delays in salary that make paying utility bills difficult. Here's how to handle such situations.

Contact the Utility Provider Immediately

Don’t wait till the due date passes. Contact customer care, explain your situation, and request options like extended deadlines, instalments, temporary service continuation, or a late-fee waiver. Many utilities offer hardship support during tough times.

Prioritize Which Bills to Pay First

If funds are limited, prioritise smartly:

- Priority 1: Water & electricity: Highest impact if cut off.

- Priority 2: Mobile & internet: Essential for work/communication.

- Priority 3: Gas & entertainment: Manageable alternatives.

This helps avoid disconnections, high reconnection fees, and delays.

Avoid Service Disconnection

Once services get disconnected, reconnection involves additional fees, possible security deposits, and several days of waiting. Sometimes, reconnection charges exceed the original bill amount.

Paying even a partial amount before the disconnection date often prevents service cutoff and shows good faith to the utility provider.

Look for Short-Term Financial Solutions

When bills stack up before payday, short-term loans can help you avoid penalties and disconnection. A missed payment can mean spoiled food, no internet for work, or no water at home. Taking a small loan to pay bills on time often costs less than late fees, reconnection charges, and the hassle of service disruption.

Lending platforms like Pocketly get the month-end crunch. Borrow from ₹1,000 with interest starting at 2% per month and processing fees of 1–8%. Quick application, fast approval, and instant transfer help you clear urgent bills on time.

Need Quick Funds for Urgent Bills? Pocketly Can Help

Short on cash before the month-end? When rent, bills, and expenses pile up, Pocketly offers quick personal loans to help you manage utility payments or unexpected costs without borrowing from friends or family.

What makes Pocketly different:

- Small loan amounts from ₹1,000 to ₹25,000 (borrow only what you need)

- No collateral required (no assets to pledge, no guarantors needed)

- Fast approval process (quick KYC verification and instant decision)

- Direct bank transfer (funds credited to your account immediately after approval)

- Flexible repayment (choose a tenure that matches your cash flow)

- Transparent pricing with interest rates starting at 2% per month and processing fees between 1% and 8% of the loan amount

- Available 24/7 through a simple mobile app

Pocketly partners with regulated NBFCs for safe, compliant loans, clear terms, no hidden charges. When bills hit during a tight week, Pocketly helps you manage payments without disturbing essentials or falling behind.

Conclusion

Utility bills are part of independent living, but they don’t have to cause stress. Understanding bill types, paying them on time, and tracking usage keep finances in control.

Treat bills as priority expenses. So review regularly, pay before the due date, and stay organised to avoid late fees or disconnections. When cash flow is tight, act quickly instead of letting dues pile up. Short-term solutions can help you bridge temporary gaps without risking service cutoff.

Download the Pocketly app now on iOS and Android to access quick funds when needed, perfect for clearing urgent utility bills or unexpected expenses, giving you financial flexibility anytime.

Frequently Asked Questions

Q1. Can I use a utility bill that's more than three months old as address proof?

No, most institutions require utility bills dated within the last three months for address verification. Banks, government offices, and other organisations need recent proof to confirm you currently reside at the stated address. If you've moved recently, request a bill at your new address as soon as possible.

Q2. What happens to my CIBIL score if I miss utility bill payments?

Most utility providers don't directly report to credit bureaus like CIBIL. However, postpaid mobile connections and some broadband providers do report payment behaviour. Additionally, if unpaid bills go to collection agencies, they can file legal cases that indirectly affect your credit profile. It's best to maintain timely payments for all bills.

Q3. How can I reduce my electricity bill without compromising on comfort?

Switch to LED bulbs, use 5-star rated appliances, set the AC temperature to 24-25°C instead of lower, turn off appliances at the power socket instead of using standby mode, use natural light during daytime, and run washing machines and dishwashers with full loads. These changes can reduce bills by 15% to 25% without affecting your lifestyle.

Q4. Is it safe to pay utility bills through third-party apps like Paytm or PhonePe?

Yes, reputable payment platforms use secure, encrypted connections and are registered with BBPS (Bharat Bill Payment System), making them safe for utility bill payments. Always ensure you're using the official app from trusted sources like Google Play Store or Apple App Store. Check for the BBPS logo, which indicates the platform meets government security standards.

Q5. Can landlords legally disconnect utilities if I'm behind on rent but bills are paid?

No, if utility connections are in your name and you're paying the bills directly to utility providers, landlords cannot legally disconnect them even if rent is pending. However, if utilities are in the landlord's name and included in your rent, non-payment of rent might lead to disconnection. Always clarify utility payment arrangements in your rental agreement to avoid disputes.