Ever caught yourself wondering why you spend on impulse even when you promised to save that month? Or why, despite knowing better, you put off investing until “next payday”? Turns out, your money habits are rarely just logical. They’re deeply tied to emotions, social pressure, and even how we feel on a given day.

This struggle isn’t just yours! Over 90% of Gen Z consumers worry about their personal financial situation, while nearly 40% are actively taking steps to manage the pinch of inflation. And that's why understanding your financial behaviour matters.

In this blog, we’ll explore what financial behaviour really means, how psychology shapes your money habits, and most importantly, how you can build better ones. Curious to understand your spending patterns and take control of your finances? Let’s get started.

At A Glance:

- Your financial behaviour shapes how you earn, spend, save, and invest, often more than income does.

- Behavioural finance explains the hidden biases that influence your money decisions and market reactions.

- Common biases like confirmation bias and loss aversion can cloud rational financial judgment.

- Reflective thinking and better planning can reduce impulsive spending and improve control.

- Small, consistent actions like budgeting, saving, and mindful debt management can strengthen long-term money discipline.

What Exactly Is Financial Behaviour?

Let’s kick things off with the basics first. Financial behaviour simply means how you spend, save, and manage your money. Every decision you make with your money, from grabbing that extra coffee to investing in a SIP, says something about your financial behaviour.

Think of it as your financial personality. It reflects your habits, emotions, and choices when it comes to handling money. Understanding it can help you predict and improve your future financial stability.

Here’s a quick look at some common financial behaviour types you might relate to:

| Type | Traits | Money Habits |

| Spender | Loves shopping and luxury | Buys often, high-risk investor |

| Thrifty | Prefers saving and comparing prices | Avoids debt, low-risk saver |

| Shopper | Spends emotionally but with some control | Enjoys buying but stops before overspending |

| Debtor | Spends more than earns | Poor planning, often in debt |

| Investor | Thinks long-term | Balances spending and investing wisely |

Once you recognise which type you relate to, you can start adjusting your money habits accordingly.

Now that you know what financial behaviour means, let’s see why it sometimes leads to irrational money moves.

How Does Behavioural Finance Work?

Here’s where things get interesting. Behavioural finance digs into why people make certain financial choices, especially the not-so-logical ones.

Even though traditional finance assumes people make rational decisions, in reality, emotions and biases often sneak in. You might buy something impulsively because everyone else is buying it, or delay saving because it feels boring. That’s behavioural finance at play.

Here’s how it generally works:

- Emotions influence money decisions: Fear, excitement, or even stress can push you to spend or invest impulsively.

- Biases shape your judgment: People often rely on shortcuts or “gut feelings” instead of facts.

- Mental and physical health matter: Your overall well-being can affect how you think about money and risk.

- Market reactions reflect human behaviour: Large rallies or sell-offs often happen because people follow each other’s financial moves.

In short, your financial choices aren’t just about logic, but also about psychology. But what exactly drives these patterns? Let’s look at the key concepts that quietly drive your financial choices.

Also Read: Understanding the Basics of Financial Planning and Its Importance

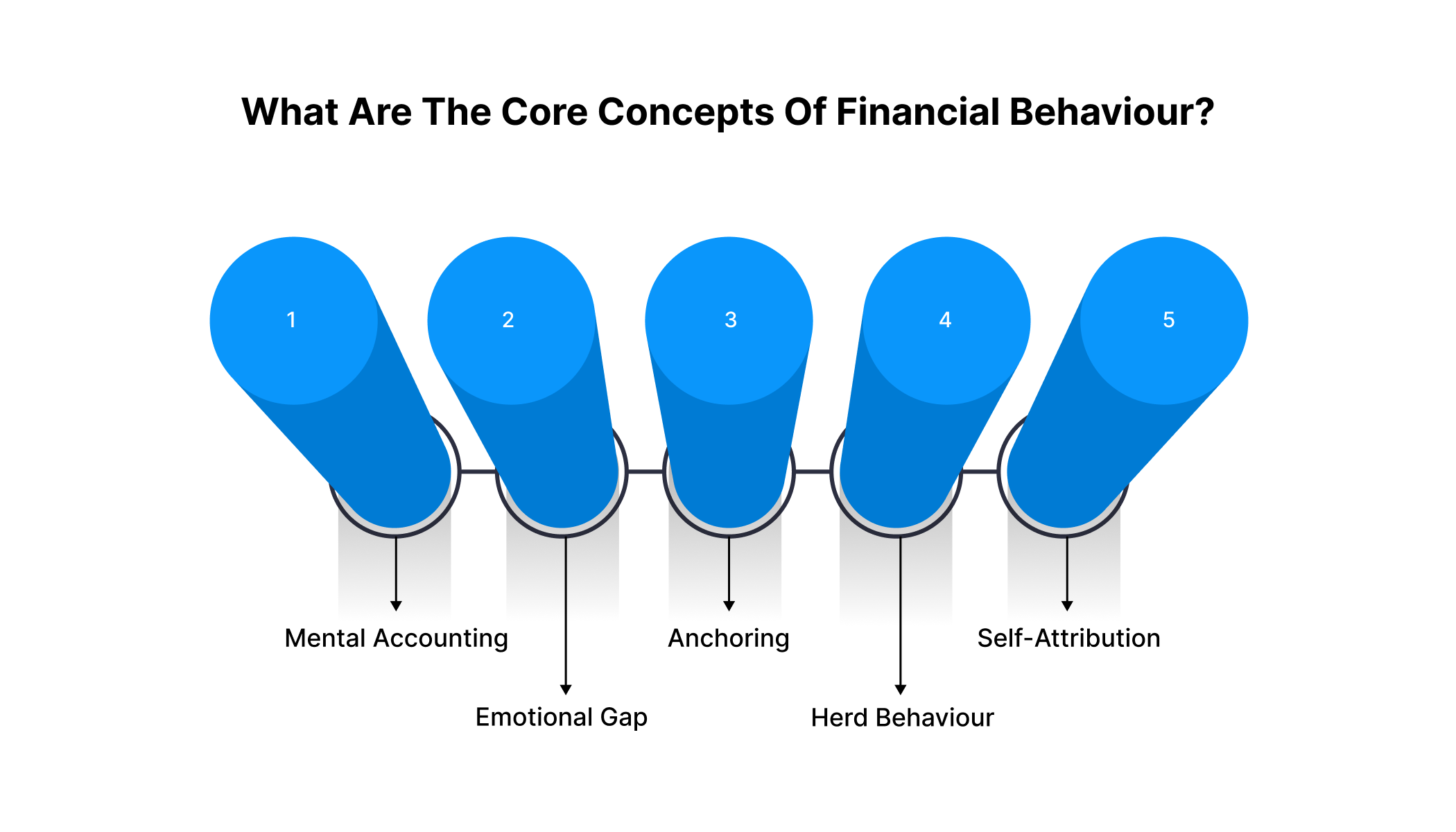

What Are The Core Concepts Of Financial Behaviour?

You might not realise it, but your brain has a few shortcuts that affect your financial decisions. These are called behavioural finance concepts, and knowing them can help you avoid some costly mistakes. Let’s look at these concepts, one by one:

Mental Accounting

We all tend to mentally divide our money into little categories like “food,” “travel,” or “shopping.” It feels organised, but it can sometimes stop you from using money wisely when things change. Instead of seeing your funds as flexible, you treat them like locked boxes.

- Example: You’ve saved up ₹5,000 for a weekend trip, but suddenly your phone screen cracks. Even though fixing it is more important, you still hesitate to use that “trip money.” This, being too rigid with your money compartments, is mental accounting.

Emotional Gap

Emotions play a huge role in how you handle money. When you’re happy, anxious, or stressed, you might act quickly instead of thinking things through. This emotional gap often leads to impulsive decisions that you regret later, like panic spending or selling.

- Example: Think about exam season when stress is high, so you might treat yourself to random online shopping to feel better. Or when markets fall, you panic and sell your investments too soon. Both are emotional reactions, not rational financial decisions.

Anchoring

Anchoring happens when your brain sticks to the first number or idea it sees and uses it as a reference for all future decisions. It feels logical, but it limits your thinking. This bias makes you compare everything to that “anchor,” even when it’s irrelevant.

- Example: You see a pair of headphones originally priced at ₹5,000 but now selling for ₹3,000. Even if ₹3,000 is still pricey for your budget, you convince yourself it’s a deal. That’s your brain "anchored" to the higher price tag.

Herd Behaviour

We humans love following the crowd, especially when it comes to money. Herd behaviour is when you copy what others are doing because it feels safer than making your own choices. But what works for them might not work for you.

- Example: Let’s say everyone in your group is investing in the same trending stock or crypto. You join in, even if you barely understand it, just to avoid missing out. Later, when the hype drops and the price crashes, you’re left regretting the move.

Self-Attribution

This concept is all about confidence, sometimes too much of it. When your financial decisions work out, you take all the credit. But when they don’t, you blame luck or timing. Over time, this creates overconfidence and riskier behaviour.

- Example: Suppose you make a quick profit from one stock pick. You start believing you’ve cracked the market and begin investing more aggressively without proper research. Soon, one wrong move wipes out your earlier gains, all because you trusted your “lucky streak.

All these concepts connect in real life, creating subtle biases that guide your money habits, usually without you noticing.

Also Read: Top 8 Financial Planning Strategies for Salaried Employees

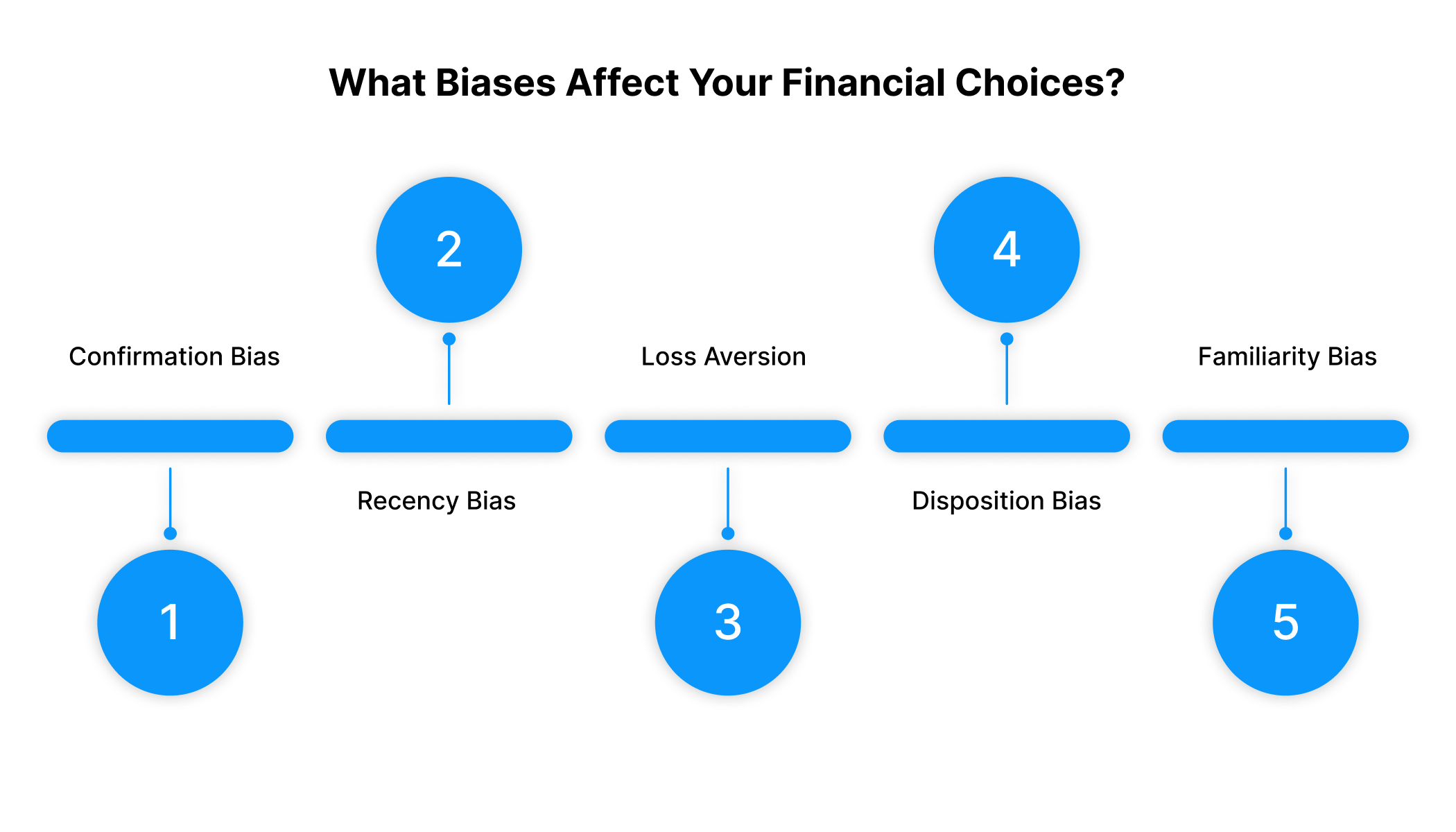

What Biases Affect Your Financial Choices?

Even when you think you’re being smart with money, your brain can trick you into making not-so-great decisions. These mental shortcuts, called financial biases, shape how you spend, save, and even borrow. Let’s look at a few common ones that might sound oddly familiar:

Confirmation Bias

You know that feeling when you’ve already made up your mind and then look for proof that you’re right? That’s confirmation bias.

If you believe a certain loan type is the best or that “credit cards are dangerous,” you’ll mostly notice opinions that support that belief. It can stop you from comparing options or learning what’s actually better for you.

Recency Bias

Recency bias gives too much importance to recent events. It happens when you judge your financial choices based on what’s happened recently.

If you overspent last month and ended up broke, you might become too scared to spend at all this month, even on essentials. This way, you focus too much on short-term memories instead of long-term patterns.

Loss Aversion

People hate losing money way more than they enjoy gaining it. So, you might hesitate to try something new, like opening a savings account or trying a budget app, because you’re scared it “won’t work out.”

This fear often keeps people stuck in the same money cycle, even when change could actually help.

Disposition Bias

This is when emotions take over your money logic. You might spend just because you’re in a good mood or avoid checking your account because you know it’ll stress you out. Or maybe you keep a subscription you barely use just because you once liked it.

These little habits pile up and affect your bigger financial picture.

Familiarity Bias

We all love comfort zones, even with money. You might trust only one digital wallet or loan app because you’ve used it for years, even if better options exist. Or maybe you always eat at the same cafés or order from the same apps because “it’s easy.”

Familiarity feels safe, but it can quietly limit your financial growth and choices.

Once you spot these sneaky biases, you’re halfway there. The next step begins when you tackle them and start making smarter, calmer money decisions.

Caught in a spending spiral? Stay mindful of your money moves and use Pocketly’s short-term loans for real emergencies when you truly need them, not just when emotions say so.

How Can You Fix Behavioural Finance Biases?

Everyone faces biases; the difference lies in how you manage them. Most financial biases can be fixed by doing two simple things: thinking reflectively and planning proactively.

Here’s how these two approaches can completely change the way you handle money:

Reflective Decisions

Reflective thinking means pausing before acting. Instead of following your first instinct, you take a moment to question why you’re making a financial choice. This helps separate emotion from logic and encourages thoughtful evaluation.

How it helps you beat biases:

- Helps you recognise when emotions are taking over (like FOMO or guilt spending).

- Encourages you to look at facts before reacting.

- Builds awareness so you can spot biases like recency or confirmation bias in action.

- Over time, it makes your financial decisions calmer and more rational.

Thorough Planning & Execution

Planning isn’t just about budgets and spreadsheets; it’s about knowing your goals, preparing for the unexpected, and following through. When you plan and execute smartly, you reduce the need for “impulsive fixes.”

How it helps you beat biases:

- Helps prevent panic-driven choices (like borrowing or investing without research).

- Encourages consistency where you save, spend, and invest based on goals, not moods.

- Makes it easier to track progress and adjust when needed.

- Turns money management from guesswork into a structured process.

Being reflective helps you catch biases in the moment, while planning helps you avoid them altogether. When you build these habits, you’ll notice that money decisions start feeling less stressful and a lot more within your control.

Also Read: Understanding Financial Literacy: Importance And Benefits

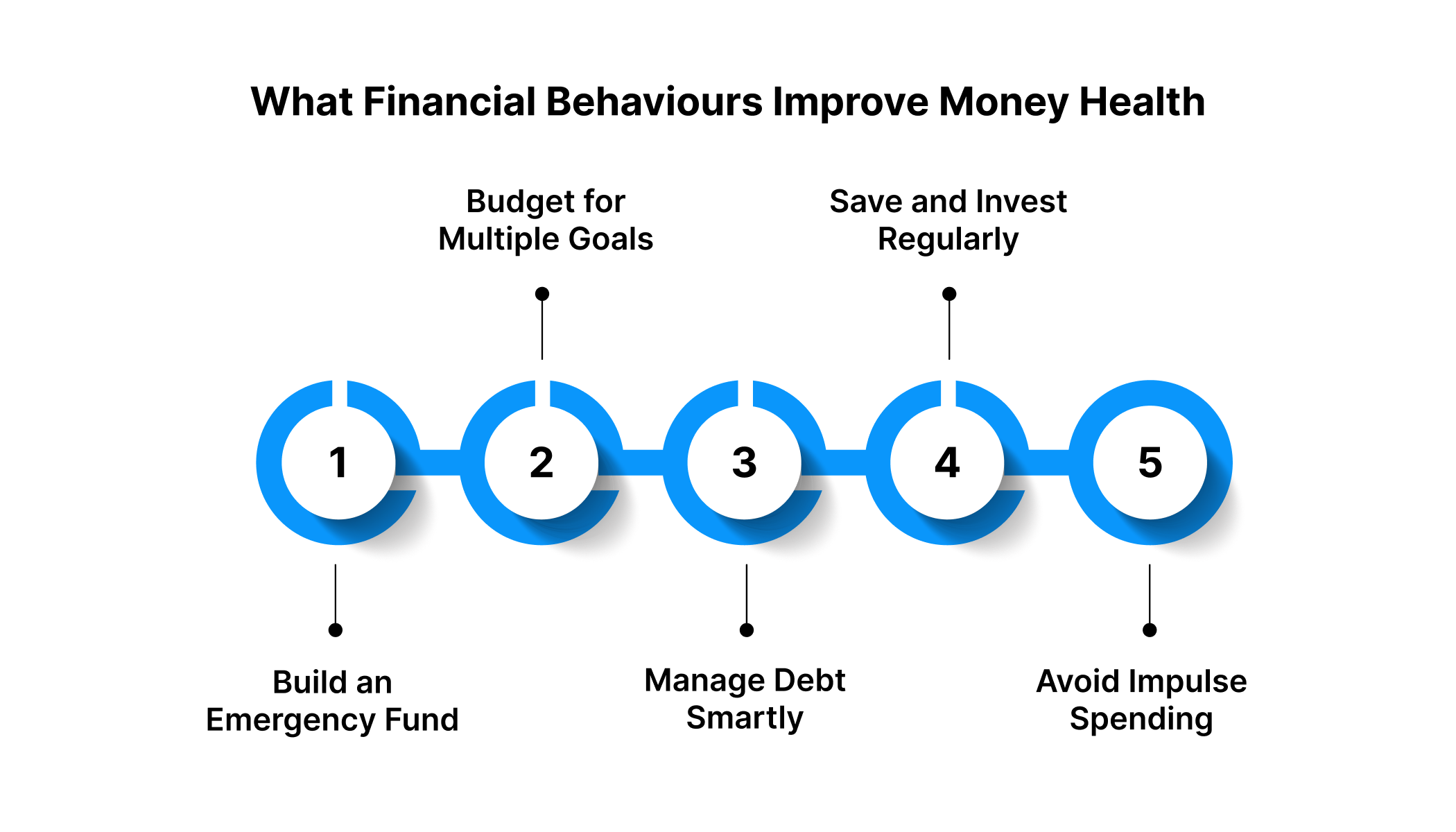

What Financial Behaviours Improve Money Health: 5 Habits

Your financial health isn’t built overnight. It’s a mix of discipline, planning, and mindful choices. Here are 5 habits that can make a real difference:

1. Build an Emergency Fund

Life doesn’t always give you a warning before throwing an expense your way. Setting aside even a small amount each month builds a cushion for sudden costs like medical bills or laptop repairs.

Tip: Keep at least three months of basic expenses in a savings account that’s easy to access.

2. Budget for Multiple Goals

Budgeting isn’t about restriction; it’s about direction. A simple rule like 50/30/20 (50% needs, 30% wants, 20% savings or debt) can help you balance fun with responsibility.

Tip: Automate transfers so saving happens without effort.

3. Manage Debt Smartly

Debt isn’t always bad. The problem comes when repayments eat into your essentials. Pay off high-interest loans first, and avoid borrowing for things that lose value quickly.

Tip: Use tools like Pocketly, which offer quick, collateral-free short-term loans with flexible repayment options. It’s a practical way to manage genuine emergencies without adding long-term financial stress.

4. Save and Invest Regularly

Saving protects you, but investing grows your money. Even small SIPs or mutual fund investments can build wealth over time. Start small and stay consistent; your future self will thank you.

Tip: Choose low-risk investment options until you’re confident in the basics.

5. Avoid Impulse Spending

Impulse purchases feel great in the moment, but drain your finances fast. Ask yourself: “Do I need this, or just want it right now?” That pause can save you a lot later.

Tip: Keep a weekly spending tracker to see where your money truly goes.

How Pocketly Encourages Smarter Financial Behaviour

Sometimes, even the best money habits can’t save you from unexpected expenses like a sudden medical bill or an overdue rent. That’s where Pocketly steps in, helping you stay financially steady without falling into bad debt habits.

Pocketly is a digital lending platform designed for young Indians who need short-term cash support. You can borrow anywhere between ₹1,000 to ₹25,000, with interest starting at just 2% per month and a processing fee between 1–8% of the loan amount.

Unlike traditional loans, Pocketly keeps things simple, transparent, and quick:

Here’s how it works:

- Sign up using your mobile number (just two clicks!).

- Upload your KYC with Aadhaar and PAN for an easy, paperless process.

- Verify your profile through quick online or video KYC.

- Add your bank details for direct transfer.

- Choose your loan amount and repayment plan.

- Get funds credited instantly into your bank account.

With no collateral, no hidden fees, and 24/7 support, Pocketly helps you handle cash flow gaps smartly instead of turning to risky credit options. Over time, timely repayments can even increase your credit limit, which is a small step toward healthier financial behaviour.

Final Takeaway

At the end of the day, financial behaviour isn’t just about saving or spending wisely, but also about understanding why you make those choices. Once you identify your patterns, it becomes easier to make informed money decisions. Practising small but consistent habits like saving early can go a long way in improving your overall financial well-being.

And if planning for long-term goals or managing sudden expenses feels difficult, there’s always help at hand with Pocketly. We help you manage short-term needs responsibly without disrupting your bigger financial plans.

Download Pocketly today on iOS or Android to manage emergencies smartly, build better money habits, and take one step closer to financial confidence.

FAQ’s

Which practice might help me to take over my financial behavior?

Start by tracking your income and expenses regularly. This helps you understand your spending patterns, control impulsive purchases, and make more mindful financial decisions over time.

What is the psychology of money?

The psychology of money explores how emotions, beliefs, and habits influence the way people spend, save, and invest. It helps explain why we don’t always make rational financial choices, even when we know what’s best.

Is financial anxiety normal?

Yes, financial anxiety is completely normal, especially when dealing with debts, bills, or unexpected expenses. The key is to address it through planning, budgeting, and seeking reliable financial support when needed.

What is an example of a good financial behaviour?

Creating and sticking to a monthly budget is a great example. It helps you plan expenses, save consistently, and avoid unnecessary financial stress.

What are the 4 types of financial decisions?

The four main types are spending, saving, investing, and borrowing decisions. Each plays a crucial role in shaping your overall financial stability and future goals.