Starting and registering a lending business in India requires a solid understanding of the regulatory framework, market needs, and financial strategies. The demand for accessible and flexible credit solutions is rapidly growing, with businesses and consumers increasingly seeking alternative financing options.

The digital lending market in India is expected to reach USD 2,377.1 million by 2030, growing at a compound annual growth rate (CAGR) of 29% from 2024. This growth is driven by the rise of fintech platforms, offering ample opportunities for new entrants, yet posing challenges related to compliance, risk management, and capital requirements.

This blog will walk you through the key steps to establish a lending business in India, covering everything from regulatory compliance to the infrastructure needed for success.

Key Takeaways

- Securing RBI licenses and meeting KYC, tax, and operational regulations are essential for a legal lending business in India.

- Different lending models have varied NOF thresholds, with NBFCs needing ₹2 crore and Infrastructure Finance Companies requiring ₹300 crore.

- NBFCs, P2P lending, and microfinance offer flexibility and scalability for new businesses entering the market.

- Meeting age, business structure, and documentation requirements is crucial for registration.

- Digital lending platforms and fintech innovations are transforming the lending space, guided by RBI’s Digital Lending Guidelines.

Understanding Money Lending Business

A money lending business provides loans to individuals or businesses in exchange for interest, often with agreed-upon repayment terms. These businesses can either be traditional lenders with a brick-and-mortar or modern digital lending platforms.

Money lenders offer unsecured or secured loans depending on their business model, using various criteria such as creditworthiness, income, or collateral to assess borrowers.

In India, money lending businesses must operate in compliance with the Reserve Bank of India (RBI) guidelines, ensuring transparency and fair practices.

The business can be highly profitable, as it makes credit accessible to a wide range of people who may not be able to access traditional bank loans. However, it also comes with risks like defaults and regulatory challenges, which require careful planning, effective risk management, and an understanding of financial laws.

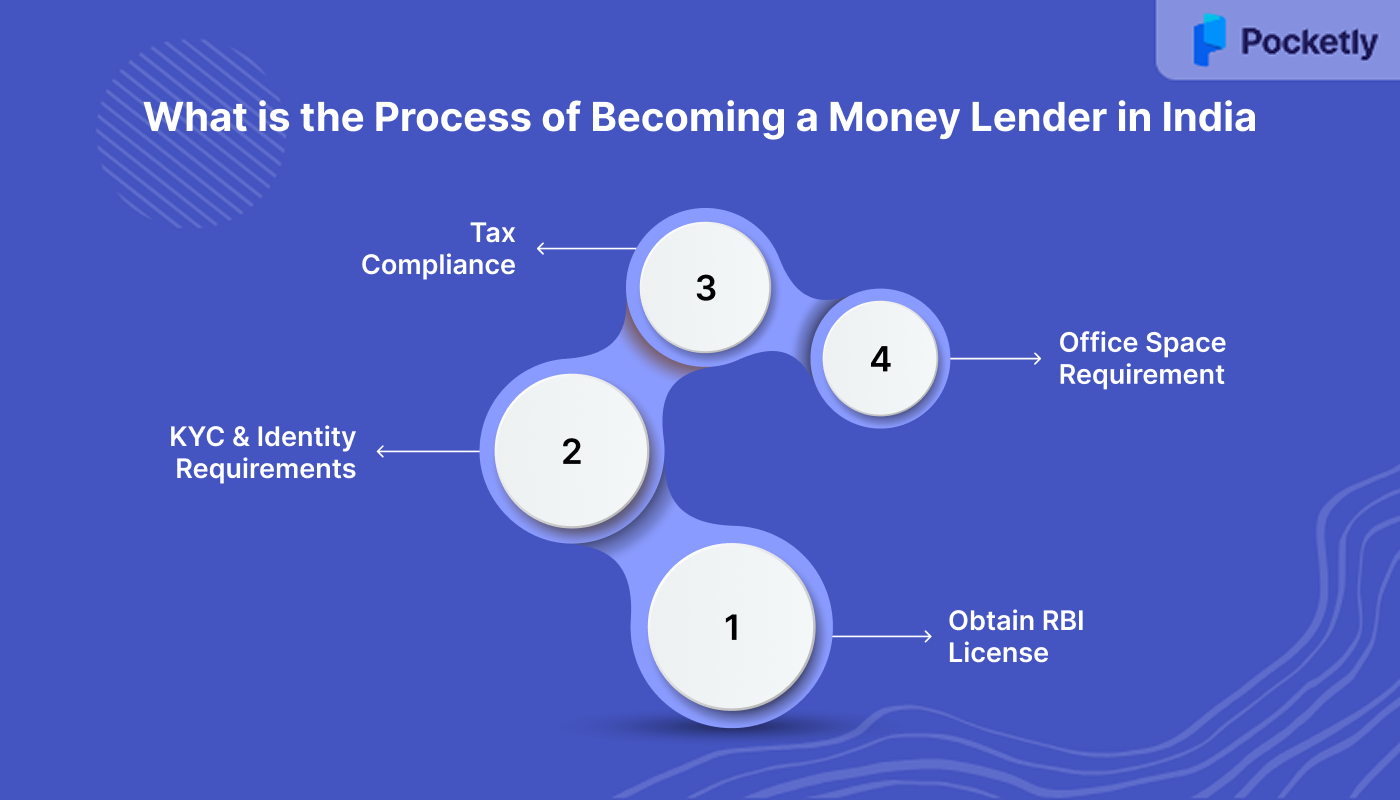

What is the Process of Becoming a Money Lender in India

Becoming a licensed money lender in India is not an overly complex process, but it does require adherence to specific regulations and compliance with the law.

To begin, the applicant must secure a license from the Reserve Bank of India (RBI), which regulates the money lending business under the Credit Information Companies (Regulation) Act, 2005.

- Obtain RBI License: You must apply for a money lender's license through the RBI or the relevant state authority to operate legally. Without this license, money lending is considered illegal in India.

- KYC and Identity Requirements: As part of the application process, you'll need to provide essential documents like your PAN card and maintain an active bank account. You will also need to meet the Know Your Customer (KYC) norms, which are mandatory for financial operations in India.

- Tax Compliance: Money lenders must file annual tax returns as per Indian tax laws, ensuring that all income earned is taxed appropriately.

- Office Space Requirement: Money lenders are required to have a dedicated office space for their business, which must be duly licensed by the local municipal corporation.

Although becoming a money lender in India does have risks and responsibilities involved. This profession requires careful consideration of legal, financial, and operational factors to build a legitimate lending business.

What are the Eligibility and Document Requirements to Register a Lending Business in India?

Establishing a lending business in India necessitates adherence to specific eligibility criteria set by regulatory authorities. These requirements ensure that only qualified individuals or entities engage in lending activities, promote responsible financial practices, and protect consumers.

1. Legal Structure of the Business

- Individual: An individual can operate as a sole proprietor, bearing full responsibility for business obligations.

- Partnership: Two or more individuals can form a partnership firm, sharing liabilities and profits.

- Company: A private limited company or limited liability partnership (LLP) can be established, offering limited liability protection.

2. Age and Citizenship

- Minimum Age: Applicants must be at least 21 years old.

- Citizenship: Only Indian citizens are eligible to register a lending business.

- Regulatory Compliance

- Reserve Bank of India (RBI) Registration: Entities operating as NBFCs must obtain a Certificate of Registration from the RBI.

- State Licensing: Depending on the nature and scale of operations, state-specific licenses may be necessary.

3. Documentation and Application

- Application Form: Complete the prescribed application form available at the relevant authority's office or online portal.

- Identity Proof: Provide valid identification documents such as a PAN card, an Aadhaar card, or a passport.

- Address Proof: Submit proof of business and residential addresses.

- Financial Statements: Present audited financial statements, including balance sheets and profit & loss accounts.

- Business Plan: Outline the business model, target market, and financial projections.

4. Background Check

- Criminal Record: Applicants should have a clean criminal record, especially concerning financial crimes.

- Financial History: A history of bankruptcy or financial instability may disqualify an applicant from registration.

5. Additional Requirements for Specific Lending Models

- Microfinance Institutions (MFIs): Should focus on providing small loans to underserved populations and comply with MFI-specific regulations.

Meeting these specific eligibility criteria is crucial for legally operating a lending business in India. Non-compliance can lead to penalties, including fines and imprisonment, as per the Money Lending Act and other relevant laws.

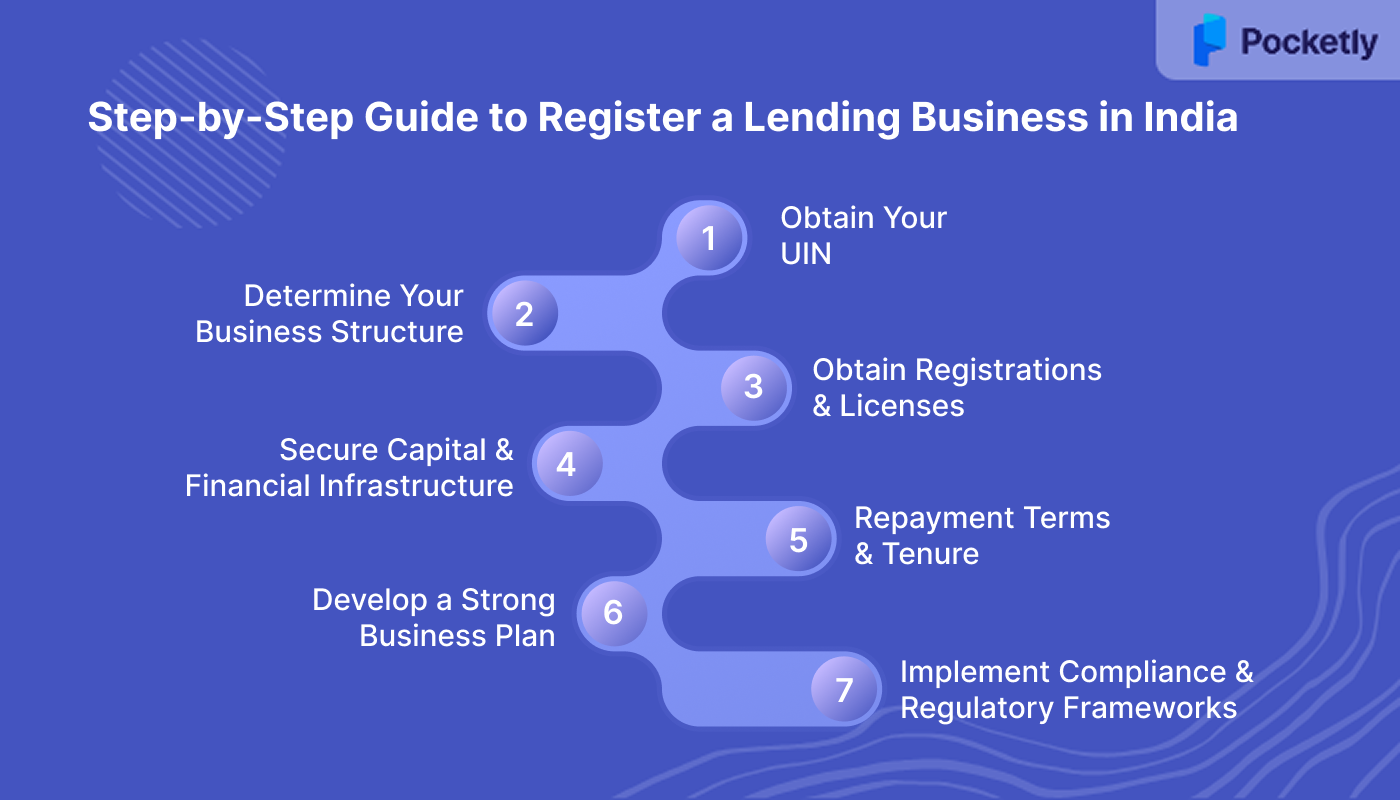

Step-by-Step Guide to Register a Lending Business in India

Establishing a legal lending business in India involves a structured process governed by regulatory frameworks to ensure transparency, accountability, and consumer protection. Below is a detailed, step-by-step guide to help you navigate the registration process:

Step 1: Obtain Your Unique Identification Number (UIN)

To legally operate as a money lender in India, your business must first secure a Unique Identification Number (UIN). This unique identifier is issued by the Registrar of Companies (ROC) and is required to formalise your lending business. The steps to obtain the UIN are as follows:

- Access the ROC Portal: Visit the official website of the Registrar of Companies specific to your state and fill out the UIN application.

- Prepare Required Documents: Gather essential documents such as proof of identity, business address, and any other necessary paperwork.

- Submit Application and Pay Fees: Submit your application along with the required fees for processing.

- Approval and Issuance: The ROC will verify your application, and once approved, your business will be issued the UIN.

Step 2: Determine Your Business Structure

Decide on the legal structure of your lending business. The most common options are:

- Sole Proprietorship: Ideal for individual entrepreneurs.

- Partnership Firm: Suitable for two or more individuals sharing responsibilities.

- Private Limited Company (Pvt Ltd): Offers limited liability protection and is suitable for scaling operations.

- Limited Liability Partnership (LLP): Combines the benefits of a partnership and a company.

Each structure has its own registration process and regulatory requirements. For instance, a Private Limited Company must be registered under the Companies Act, 2013, through the Ministry of Corporate Affairs (MCA) portal.

Step 3: Obtain Necessary Registrations and Licenses

Depending on your business model and scale, you may need to obtain specific licenses:

- Non-Banking Financial Company (NBFC) License: If you plan to operate as an NBFC, you must obtain a Certificate of Registration (CoR) from the Reserve Bank of India (RBI). This involves meeting the RBI's eligibility criteria, including a minimum Net Owned Fund (NOF) of ₹2 crore. The application process also includes submitting a Detailed Project Report (DPR) and audited financial statements.

- Money Lending License: For traditional money lending operations, apply for a money lending license from the respective state government. The application process involves submitting an application form, identity proof, address proof, and paying the prescribed fee. For example, in Tamil Nadu, the application is submitted to the Tahsildar's office.

- Goods and Services Tax (GST) Registration: If your annual turnover exceeds the prescribed threshold, GST registration is mandatory. This allows you to collect tax on behalf of the government and claim input tax credit.

Step 4: Secure Capital and Financial Infrastructure

Ensure that your business has adequate capital to operate legally and effectively:

- Minimum Capital Requirements: For NBFCs, the RBI mandates a minimum NOF of ₹2 crore. This capital must be deposited in a scheduled commercial bank as a fixed deposit, and a 'No Lien' certificate must be obtained.

- Business Bank Account: Open a dedicated business bank account to manage all financial transactions, ensuring transparency and ease of auditing.

Step 5: Develop a Strong Business Plan

A comprehensive business plan is crucial for guiding your operations and attracting investors:

- Market Analysis: Assess the demand for lending services in your target market, identify competitors, and understand customer needs.

- Operational Strategy: Define your lending processes, including loan approval criteria, interest rates, repayment schedules, and collection methods.

- Risk Management: Implement strategies to mitigate risks such as defaults, fraud, and regulatory changes.

- Financial Projections: Provide detailed forecasts of income, expenses, and profitability over the next 3-5 years.

Step 6: Implement Compliance and Regulatory Frameworks

Adhere to all legal and regulatory requirements to operate within the law:

- Know Your Customer (KYC) Norms: Establish procedures to verify the identity of your clients, as mandated by the RBI and the Prevention of Money Laundering Act, 2002.

- Anti-Money Laundering (AML) Policies: Develop and enforce policies to prevent money laundering activities.

- Data Protection: Ensure the confidentiality and security of customer data, complying with applicable data protection laws.

Step 7: Launch and Monitor Operations

Once all legalities are in place, commence your lending operations:

- Marketing and Outreach: Promote your services through various channels to attract customers.

- Customer Support: Provide assistance to borrowers for inquiries, repayments, and resolving issues.

- Regular Audits and Reporting: Conduct periodic audits to ensure compliance and assess financial health.

The registration process naturally leads to one of the most critical aspects, Capital requirements and Net Owned Fund calculations, that determine the scale and sustainability of your lending venture.

Understanding Capital and Net Owned Fund (NOF) Requirements for Lending Businesses in India

Establishing a lending business in India requires a clear understanding of capital requirements and the concept of Net Owned Fund (NOF). These financial prerequisites are not merely regulatory formalities; they are foundational elements that determine the scale, scope, and sustainability of your operations.

What is Net Owned Fund (NOF)?

NOF is a critical metric that reflects the financial health and operational capacity of a lending business. It is defined as the aggregate of:

- Paid-up equity capital

- Free reserves

- Balance in share premium account

- Capital reserves representing surplus arising out of the sale of assets

From this total, deductions are made for:

- Accumulated balance of loss

- Deferred revenue expenditure

- Other intangible assets

- Investments in subsidiaries, group companies, and other NBFCs

- Book value of debentures, bonds, outstanding loans, and advances

The resulting figure represents the NOF, which must meet or exceed the prescribed minimum for the specific type of lending business you intend to operate.

Capital Requirements Across Lending Models

The capital needed varies significantly based on the type of lending entity:

- Microfinance Institutions (MFIs): Designed to provide small loans to underserved communities, MFIs have a relatively lower capital requirement. The Reserve Bank of India (RBI) mandates a minimum NOF of ₹5 crore for MFIs.

- Non-Banking Financial Companies (NBFCs): NBFCs, which offer a broader range of financial services, face higher capital thresholds. For instance, Specialized NBFCs (IFCs) have a minimum NOF of ₹300 crore.

| Business Type | Description | NOF Requirements |

| NBFC-Investment and Credit Companies (NBFC-ICC) | Entities engaged in investment and lending activities. | ₹10 crore |

| NBFC-Microfinance Institutions (NBFC-MFI) | Focused on providing microloans with phased NOF requirements. | ₹5 crore by March 31, 2025, ₹7 crore by March 31, 2027 and ₹10 crore by March 31, 2029 |

| NBFC-Peer-to-Peer (P2P) Lending Platforms | Platforms that facilitate lending between individuals. | ₹2 crore |

| NBFCs – Infrastructure Finance Companies (IFCs) | Specializes in funding large infrastructure projects | ₹300 crore |

What are the Strategies for Building Financial Strength?

Securing the necessary capital and NOF is an important step in establishing a lending business. Here are strategies to build financial strength:

- Initial Capital Infusion: Founders can inject personal funds into the business to meet the initial capital requirements. This shows commitment and provides a financial cushion during the startup phase.

- Venture Capital Investment: Attracting venture capital can provide significant funding to meet NOF requirements and support business expansion. Investors seek equity stakes in exchange for their investment.

- Strategic Partnerships: Collaborating with established financial institutions can provide access to capital and enhance credibility.

- Reinvesting Profits: As the business becomes profitable, reinvesting earnings can gradually build the NOF, reducing reliance on external funding sources.

Understanding and adhering to capital and NOF requirements is essential for the successful establishment and operation of a lending business in India. By ensuring compliance, you lay a solid foundation for sustainable growth and regulatory adherence.

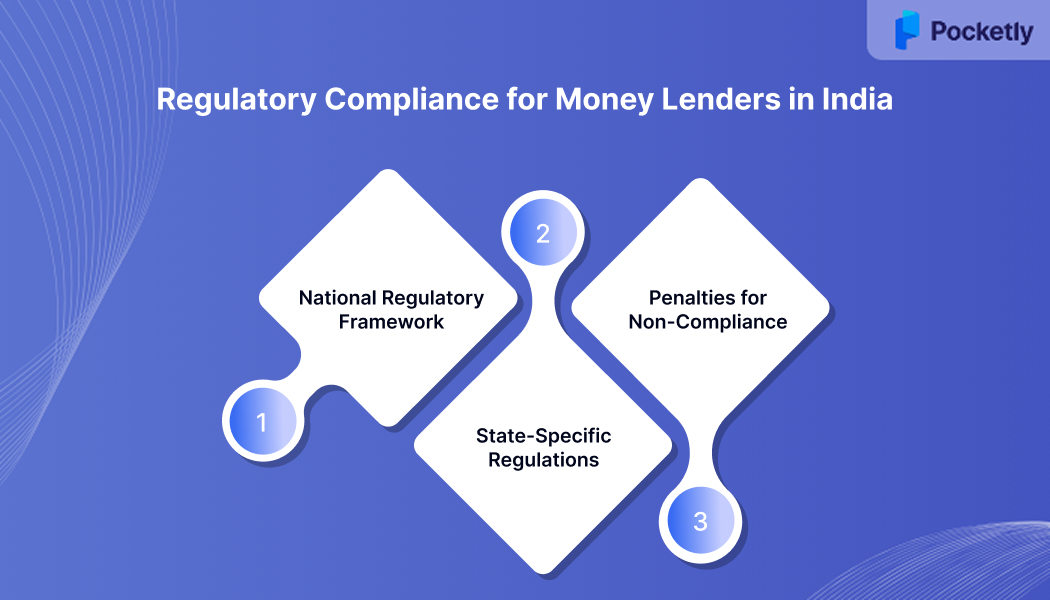

Regulatory Compliance for Money Lenders in India

Operating a money lending business in India requires adherence to a comprehensive regulatory framework to ensure transparency, protect borrowers, and maintain financial stability. This framework encompasses national laws, state-specific regulations, and guidelines issued by regulatory bodies like the Reserve Bank of India (RBI).

1. National Regulatory Framework

The RBI plays a pivotal role in overseeing non-banking financial companies (NBFCs) and other lending entities. Key regulations include:

- Fair Practices Code: Mandates transparency in loan terms, clear communication with borrowers, and ethical recovery practices.

- Digital Lending Guidelines (2025): Establishes norms for digital lending platforms, including the requirement for loan disbursements to be made directly into the borrower's bank account and repayments to be routed through the lender's account.

- Co-lending Framework: Facilitates partnerships between banks and NBFCs, allowing them to jointly lend to underserved sectors, with shared risk and reward structures.

A. Prevention of Money Laundering Act (PMLA), 2002

Under the PMLA, lending institutions are required to:

- Conduct Customer Due Diligence (CDD): Verify the identity of borrowers, including beneficial owners.

- Monitor Transactions: Identify and report suspicious activities that may involve money laundering or terrorist financing.

- Maintain Records: Keep detailed records of transactions and customer information for specified periods.

B. Securitisation and Reconstruction of Financial Assets and Enforcement of Security Interest Act (SARFAESI), 2002

This Act empowers banks and financial institutions to:

- Take Possession of Secured Assets: In case of default, lenders can take possession of mortgaged properties without court intervention.

- Auction Assets: Sell the assets to recover dues, streamlining the recovery process.

2. State-Specific Regulations

Individual states have enacted their own money lending laws to address regional needs and challenges. For instance:

- Jammu and Kashmir: The Money Lenders and Accredited Loan Providers Act, 2010, requires lenders to register with the state authority to maintain proper records, and adhere to prescribed interest rate ceilings.

- Mizoram: The Mizoram Money Lenders and Accredited Loan Providers Regulation Rules, 2010, stipulate registration processes, maintenance of accounts, and submission of returns to the registering authority.

These state-specific laws are in addition to national regulations and must be complied with by lenders operating within those jurisdictions.

3. Penalties for Non-Compliance

Failure to adhere to regulatory requirements can result in:

- Fines and Penalties: Monetary penalties for violations of prescribed laws and regulations.

- Cancellation of Registration: Revocation of licenses or registrations for non-compliance.

- Legal Action: Criminal charges for serious offenses, such as fraudulent practices or money laundering activities.

For example, under the Jammu and Kashmir Money Lenders and Accredited Loan Providers Act, 2010, penalties are prescribed for offenses like charging excessive interest rates and maintaining false records.

Benefits of Starting a Lending Business in India

Starting a lending business in India offers several advantages, driven by a growing demand for credit, supportive government initiatives, and technological advancements. Here are some key benefits:

- Expanding Market Opportunity: India's vast population and expanding middle class have led to an increasing need for accessible credit, especially among underserved segments.

- Government Support: Initiatives like the Pradhan Mantri SVANidhi Scheme provide micro-credit to street vendors, promoting financial inclusion and entrepreneurship.

- Technological Advancements: The introduction of platforms like the Unified Lending Interface (ULI) by the RBI aims to streamline the lending process, making it more efficient and transparent.

- Profitability Potential: Companies like LenDenClub have demonstrated significant profitability, with a reported net profit of ₹34 crore in FY25, indicating a lucrative market for lending businesses.

- Diverse Lending Models: Options such as peer-to-peer lending and co-lending partnerships with banks offer flexibility and scalability for new entrants in the lending market.

- Financial Inclusion Impact: Lending businesses contribute to financial inclusion by providing credit access to individuals and small businesses that may be underserved by traditional banks.

- Regulatory Clarity: The RBI's regulatory frameworks, including the Digital Lending Guidelines, offer a structured environment for operating lending businesses, ensuring compliance and consumer protection.

For Borrowers, lending businesses in India provide benefits like access to credit and flexible eligibility. Institutions, such as NBFCs and P2P platforms offer instant personal loan approvals with minimal documentation, addressing urgent financial needs. One such is Pocketly, a digital lending platform that simplifies access to quick personal loans.

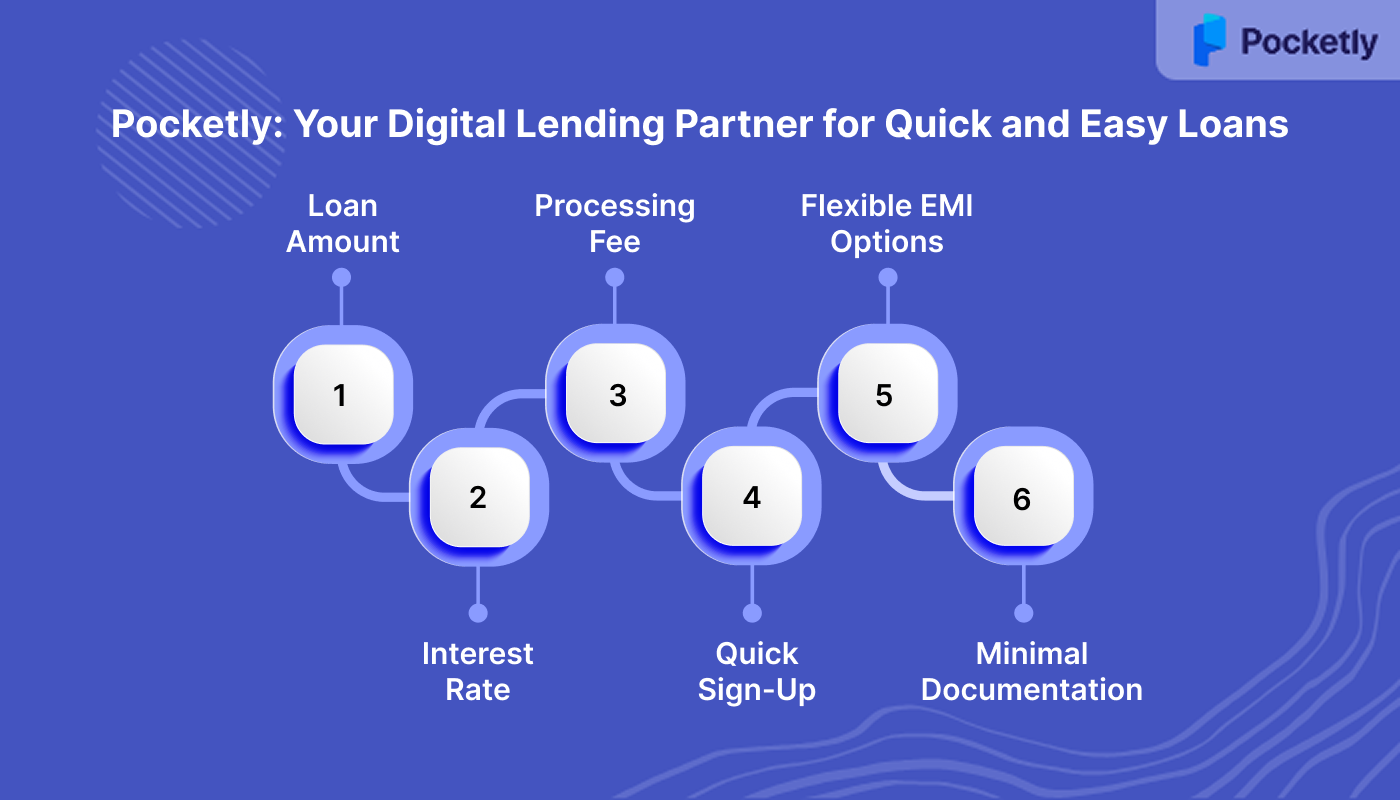

Pocketly: Your Digital Lending Partner for Quick and Easy Loans

Pocketly is a user-friendly digital lending platform designed to provide quick, hassle-free loans to students, professionals, and loan for self-employed individuals in India. With a seamless application process, Pocketly offers flexible loan amounts, affordable interest rates, and convenient repayment terms. Here's a breakdown of Pocketly's key features:

- Loan Amount: Ranges from ₹1,000 to ₹25,000, catering to various financial needs.

- Interest Rate: Starts at an affordable 2% per month, ensuring cost-effective loans.

- Processing Fee: Charges between 1% to 8%, based on the loan amount and tenure.

- Quick Sign-Up: 2-click sign-up process, making it simple and fast to get started.

- Flexible EMI Options: Choose from loan repayment modes and schedules that fit your financial situation.

- Minimal Documentation: No physical paperwork required, fully digital process for convenience.

With these features, Pocketly makes it easy to get the financial support you need, whenever you need it.

Conclusion

Starting a lending business in India offers lucrative opportunities amidst growing credit demand, evolving technology, and strong government support for financial inclusion. By following the necessary steps, ensuring compliance with regulatory frameworks, and understanding capital and NOF requirements, entrepreneurs can successfully establish their lending operations.

With a clear focus on serving borrowers’ needs while managing risks, lending businesses can succeed in this market. Whether you’re considering becoming a money lender or starting an NBFC, understanding these foundational steps and regulations will give you a competitive edge in the lending sector.

Pocketly provides a seamless solution for personal loans with a simple application process and flexible repayment options. Download now on iOS or Android to access quick loans with minimal documentation.

FAQs

1. What is the law for money-lending in India?

Money lending in India is governed by the Reserve Bank of India (RBI) and state-specific regulations under the Money Lenders Act. Money lenders must register with the RBI or state authorities and comply with regulatory requirements.

2. Is P2P lending tax free?

No, P2P lending is not tax-free in India. The interest earned by lenders is taxable under the Income Tax Act, and both the platform and the lenders must comply with tax regulations.

3. Is private lending legal in India?

Yes, private lending is legal in India as long as it complies with applicable regulations and the Money Lending Act. Private lenders must ensure proper documentation and follow the RBI's guidelines for lending practices.

4. Is GST registration mandatory for NBFC?

Yes, GST registration is mandatory for Non-Banking Financial Companies (NBFCs) if their turnover exceeds the prescribed threshold limit. This enables them to collect and claim input tax credits on their services.

5. How to get a small finance license?

To get a small finance license, an applicant must apply to the RBI, meet eligibility criteria such as a minimum NOF of ₹5 crore, and submit a Detailed Project Report (DPR) along with financial and operational plans.