Overspending can get out of control fast. What starts as a one-time treat can become a habit, causing money problems and missed chances. For many young Indians, students, professionals, and entrepreneurs, this problem becomes especially evident during month-end shortages or when unexpected expenses arise.

The rise of digital transactions has made spending easier than ever, but it has also led to more impulsive buying. With no tangible exchange of cash, it’s easy to lose track of where your money is going, and before you know it, your bank balance takes a hit.

In this blog, we’ll break down the reasons behind overspending, the impact it has on your financial health, and practical steps to take control. Plus, we’ll show you how Pocketly can help bridge the gap when cash flow issues arise, giving you the financial flexibility to get back on track.

TL;DR

- Overspending can quickly lead to debt, stress, and missed financial goals, especially when emotional or impulse spending takes over.

- Track your spending, set a budget, and avoid unnecessary purchases to stay on top of your finances.

- Prevent overspending by identifying triggers like peer pressure, easy digital payments, and a lack of financial planning.

- If overspending causes a cash flow issue, take control by adjusting your budget and limiting impulse buys.

- Pocketly offers quick loans from ₹1,000 to ₹25,000 with fast approval to help you bridge the gap when overspending puts pressure on your finances.

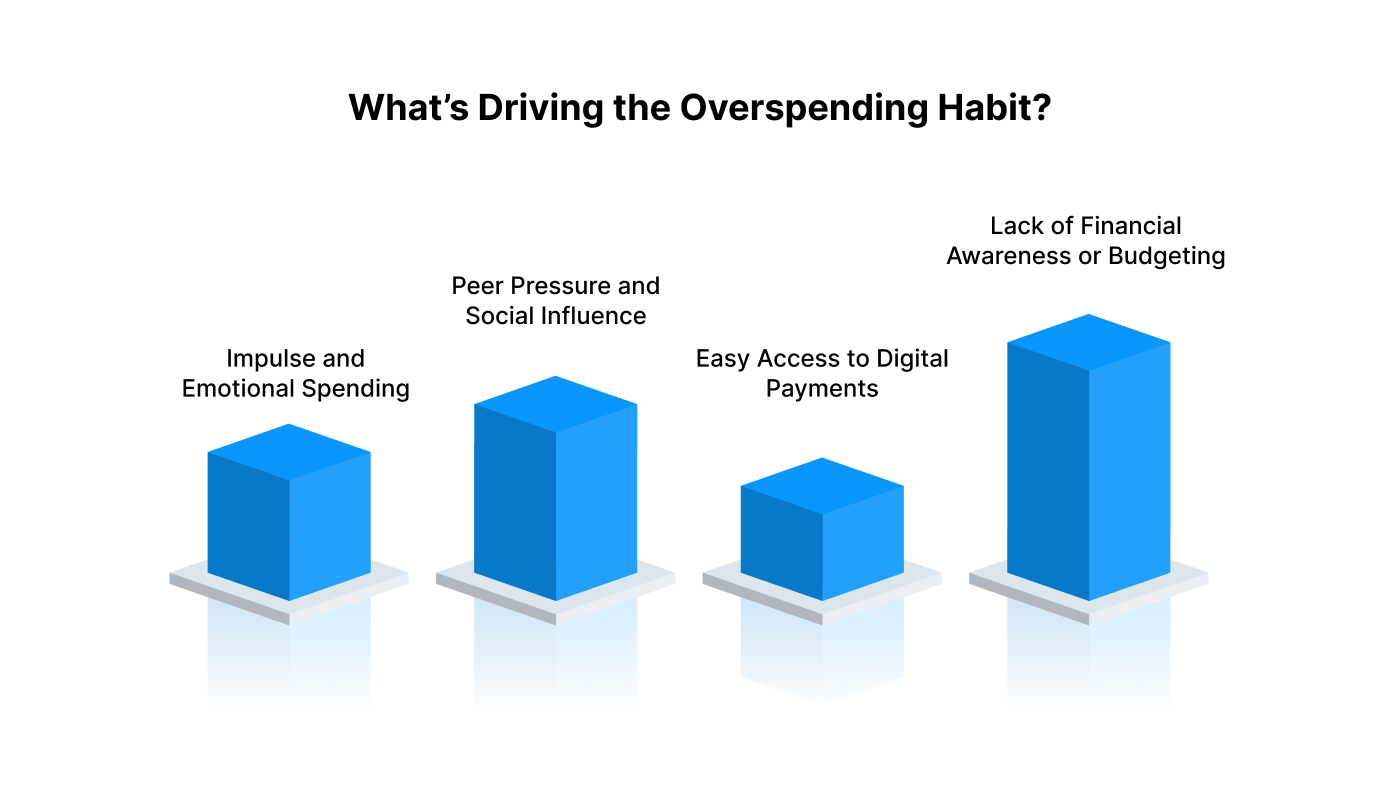

What’s Driving the Overspending Habit?

Understanding the reasons behind overspending is the first step in preventing it. By recognising the triggers, you can take control of your finances and avoid unnecessary expenses. Here are some of the most common causes:

1. Impulse and Emotional Spending

Sometimes we make purchases not because we need them, but because they provide immediate gratification. Emotional spending can be triggered by stress, boredom, or even excitement. When you're feeling down or celebrating a small victory, it's easy to indulge in a purchase to lift your mood.

For example, after a stressful day at work, you might decide to treat yourself to a shopping spree online, purchasing items you don’t really need. These impulse buys can add up over time, leading to unnecessary financial strain.

By recognising emotional triggers, you can take steps to manage these impulses and make more intentional choices.

2. Peer Pressure and Social Influence

With social media and peer pressure, it’s easy to feel the need to keep up with others. Whether it’s the latest gadget, a fashionable outfit, or a luxurious dinner out, the desire to fit in or impress others can lead us into overspending.

For instance, you might feel compelled to buy the latest smartphone because your friends all have it, even though your current phone is still working perfectly. The pressure to match the lifestyle of those around us can push us to overspend, even when it’s beyond our means.

By acknowledging the influence of social media and peer expectations, you can make more mindful spending decisions based on your own needs and priorities.

3. Easy Access to Digital Payments

The rise of cashless payments has made it easier than ever to spend money without thinking twice. Digital wallets, UPI, and credit cards allow us to pay with just a tap or a swipe, which means the physical act of handing over cash is no longer part of the process.

For example, you might make multiple small purchases throughout the day using your phone, like ordering a coffee or buying a snack, without realising how much it adds up. The convenience of these digital transactions often makes us lose track of our budget.

By monitoring your spending regularly and setting limits on digital purchases, you can regain control over your finances and prevent impulse buys from accumulating.

4. Lack of Financial Awareness or Budgeting

Not tracking your spending or having a solid budget can lead to overspending without even realising it. Without a clear understanding of where your money is going, it’s easy to fall into the trap of thinking you have more than you actually do.

For example, you might end up spending more than expected on entertainment or dining out because you haven’t kept track of those expenses. A lack of financial strategy and budgeting can lead to unchecked spending, leaving you without savings or reaching the end of the month short on funds.

Setting a budget and tracking your spending regularly helps you stay on top of your finances, preventing unnecessary expenditures and keeping you on track with your financial goals.

Also read: 7 Best Budgeting Apps In India 2025

How Overspending Affects Your Financial Health?

Overspending can have a serious ripple effect on your financial well-being. While it may feel harmless in the moment, the long-term consequences can be overwhelming. Here’s how overspending impacts your finances:

| Impact | Explanation |

| Increased Debt | Dependence on credit cards or loans to cover expenses can lead to accumulating debt with high interest rates. |

| Stressed Cash Flow | Constant overspending disrupts your monthly budget, leaving little for savings or emergencies. |

| Missed Financial Goals | Overspending delays important goals like building an emergency fund, saving for major purchases, or investing. |

| Mental and Emotional Stress | Worrying about finances and managing debt can cause significant stress and affect your overall well-being. |

| Lower Credit Score | Accumulating debt and missing payments negatively impact your credit score, making future borrowing harder. |

How to Recognise You Have an Overspending Problem

Most people think they have a good grasp on their spending, but without paying attention to where the money actually goes, it’s easy to miss the small things that add up over time.

1. You Run Out of Money Before Payday

If you’re often scraping by before your next paycheck, it’s a sign that your spending habits need to be reassessed. The issue could be buying too many non-essentials or not budgeting properly for fixed expenses.

For example, if you’re constantly relying on credit or dipping into savings just to make it through the month, it's time to take a closer look at your monthly spending.

2. You Don’t Track Your Expenses

When you’re not tracking your expenses, it’s easy to overlook where the money is going. Small daily purchases like coffee, snacks, or takeout—add up quickly.

Start tracking every single expense, no matter how small. This way, you can see exactly where your money is going and make adjustments before things get out of hand.

3. You Use Credit Cards Too Often

Relying on credit to pay everyday expenses is a red flag. If you’re using credit cards to pay for things that should come from your monthly income, you’re essentially overspending.

For instance, using a credit card to pay for groceries or treating yourself to an expensive dinner might seem harmless, but it leads to accumulating debt that’s difficult to pay off later.

4. You Feel Anxious About Money

If thinking about your finances makes you feel stressed, it’s likely that you’re overspending without realising it. Financial anxiety often comes from not having a clear picture of your spending and knowing deep down that things are not under control.

If you’re feeling this stress regularly, it might be time to sit down, reassess your spending, and adjust your budget to relieve the financial pressure.

5. You Avoid Checking Your Bank Balance

If you find yourself avoiding your bank balance or not wanting to check your account, it's a sign that you’re not facing your spending habits head-on.

Make it a routine to check your account regularly. Knowing where you stand financially will help you stay on top of your expenditures and prevent any unpleasant surprises.

Also read: How to Manage Monthly Expenses Smartly in 2025

Steps to Take Control of Your Overspending

It’s one thing to recognise overspending, but taking action is the key to breaking the cycle. Here’s how you can start managing your expenses effectively:

1. Not Setting a Budget

Many people fail to set a clear budget, thinking it’s too restrictive or unnecessary. However, not having a budget can lead to overspending and financial stress.

Without a budget, it’s easy to lose track of your spending and go beyond your means, leaving you with little room for savings or emergencies.

Example: If you’re not tracking your spending, you might end up overspending on dining out or shopping, and before you know it, your expenses surpass your income. Creating a simple budget can help you allocate funds for essentials and discretionary spending, keeping your finances in check.

2. Impulse Buying Online

Online shopping makes it easier than ever to make impulse purchases. The convenience of one-click purchasing and special deals can lead to overspending.

Buying things you don’t need in the moment can quickly add up and extend your budget, especially when done frequently.

Example: Purchasing items on sale or gadgets you don’t actually need can cost you ₹1,500–₹2,000 a month. Over a few months, this can add ₹6,000–₹8,000 to your spending, money that could be better spent on savings or debt reduction.

3. Not Reviewing Subscription Services

Many people forget about the subscriptions they’ve signed up for or keep paying for services they no longer use. This leads to wasted money on things you don’t need.

Unchecked subscriptions, like streaming services or app subscriptions, can quietly drain your finances over time.

Example: You may be paying ₹500 a month for a gym membership you rarely use. That adds up to ₹6,000 a year, money you could redirect toward savings or more essential expenses.

4. Not Setting Clear Financial Goals

Without clear financial goals, it’s easy to spend without thinking about the bigger picture. Setting goals helps you stay determined and motivated to manage your finances.

When you don’t have a goal, it’s harder to see the importance of saving or budgeting, leading to overspending on short-term desires.

Example: If your goal is to save ₹50,000 for an emergency fund but you’re constantly overspending on non-essentials, you may end up delaying your savings and facing stress when unexpected costs arise.

5. Ignoring Sales and Discounts

It’s easy to be tempted by “great deals” or sales, but buying items just because they’re on discount can be a form of overspending.

Discounts can trick you into thinking you’re saving money when, in reality, you’re still spending more than necessary on things you don’t need.

Example: You see a 50% off deal for a new jacket you don’t really need, but you buy it anyway. While the deal may seem good, you’ve spent ₹3,000 on an item you didn’t plan to buy, ultimately affecting your budget.

Facing the Overspending Problem? Pocketly’s Here to Help You Stay on Track

Overspending can happen to anyone, whether it’s from an impulse purchase, unexpected indulgence, or not sticking to a budget. When it happens, Pocketly is here to offer quick, flexible financial solutions to help you regain control of your spending and avoid falling deeper into debt.

Here’s why Pocketly stands out:

- Borrow only what you need: Loans ranging from ₹1,000 to ₹25,000, so you’re never over-borrowing.

- No collateral required: Skip the paperwork, no assets or guarantors needed.

- Fast approval: Quick KYC verification and an instant decision, so you can act fast.

- Instant transfer: Funds are credited directly to your account right after approval.

- Flexible repayment options: Select a repayment plan that suits your budget and cash flow.

- Clear, transparent pricing: Interest rates starting at just 2% per month, with processing fees between 1% and 8%.

- Available anytime, anywhere: Access funds 24/7 via our easy-to-use mobile app.

With Pocketly, you get access to loans through regulated NBFCs, ensuring clear terms and no hidden charges. When overspending puts your finances under pressure, Pocketly gives you the flexibility to manage and stay on track without the stress.

Conclusion

Overspending can disrupt your finances, but it doesn’t have to derail your financial stability. By tracking your expenses, setting a clear budget, and avoiding impulse buys, you can stay in control of your spending.

Take charge of your finances by consistently reviewing your spending, prioritising necessary expenses, and sticking to your financial goals. When overspending happens, don’t let it spiral out of control; take action early. Short-term loans can offer the flexibility you need to stay on track without further financial stress.

Download the Pocketly app today on iOS or Android to access quick funds whenever overspending threatens your budget, giving you the financial liberty to manage your expenses with ease.

FAQs

1. What is the overspending problem?

Overspending occurs when you spend more than you can afford, often without realising it. It can result in debt, financial stress, and missed financial goals.

2. How can I stop overspending?

To stop overspending, track every expense, set a realistic budget, avoid impulse buys, and create financial goals to keep yourself on track.

3. Can digital payments contribute to overspending?

Yes, digital payments make spending easier and less tangible, which can lead to impulse buying and overspending without feeling the immediate impact.

4. How does Pocketly help with overspending?

Pocketly offers quick, short-term loans ranging from ₹1,000 to ₹25,000 to help you manage cash flow issues caused by overspending, with fast approval and flexible repayment options.

5. Are there risks to using short-term loans for overspending?

While short-term loans can offer immediate relief, they should be used responsibly. It’s important to have a plan to pay them off quickly to avoid accumulating debt.