Did you manage to save anything this month, or did you end up procrastinating again? Saving money always feels like something you'll “start next month”, once things settle down. But somehow, that next month never quite arrives.

Recent data shows that India’s gross savings have declined by 30% for 2023–24, with more people spending freely on both essentials and discretionary items. It’s clear that traditional saving habits aren’t keeping up with today’s fast-paced lifestyle. But does that mean saving is out of reach? Not at all!

The best part about building better saving habits is that it’s never too late to start. This blog will walk you through simple, practical ways to build lasting saving habits and take control of your finances, starting right now.

Brief Breakdown:

- Building simple saving habits helps you handle expenses, emergencies, and long-term financial goals effectively.

- Build mindful habits like delaying non-essential buys and using round-up apps to grow savings effortlessly.

- Adopt practical tips like automating transfers to a savings account or setting spending limits per category to stay disciplined.

- Overcoming common challenges, like lifestyle creep or lack of goals, ensures your savings grow steadily.

Why India’s Saving Habits Need A Makeover?

Ever wondered why saving feels harder now, even though you’re earning more than your parents did at your age? The answer lies in how India’s approach to money has changed over time.

Shift from Savings to Spending

Earlier, saving came before spending. But with easy digital payments and instant credit, that habit has faded. Convenience has replaced caution, and “save first” has turned into “spend now, think later.”

Credit and Comfort Over Control

Online shopping, UPI, and credit cards have made buying effortless, sure, but also a little too tempting. Young earners often get pulled in by lifestyle upgrades, sales, and “no-cost EMI” offers, spending more than they plan to.

Still Learning the Basics of Money

Many people use financial tools without understanding them. Budgeting, tracking expenses, or setting goals probably sound boring or complicated. But without these basics, your income can disappear before you even realise where it went.

Education Drains the Savings Jar

High tuition fees, rent, and daily costs leave little space to save. For students and young professionals, saving feels like a luxury rather than a necessity. That’s why education becomes the reason they postpone saving altogether.

Different Cities, Different Mindsets

In smaller towns, people still believe in saving first. In cities, though, lifestyle expenses and social media trends push spending higher. Slowly, even cautious savers are finding it hard to resist the “you only live once” mindset.

Your saving habits aren’t gone; they just need a little direction. With a few mindful changes, you can bring back the balance between spending smart and saving better.

Also Read: Financial Planning in Your 30s: Smart Money Guide (2025)

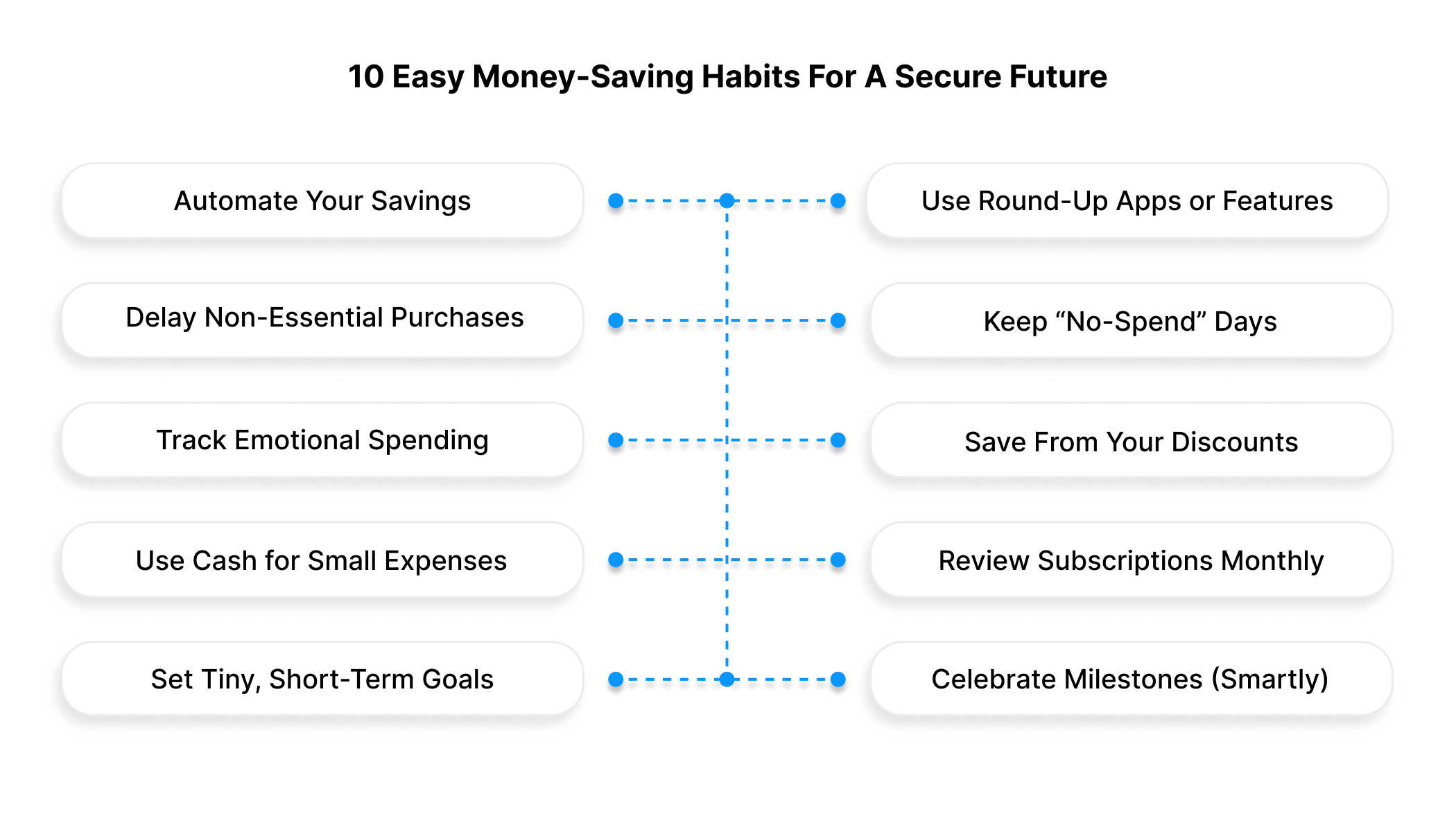

10 Easy Money-Saving Habits For A Secure Future

Building better money habits isn’t about strict rules or cutting out all fun. It’s about small, smart choices that quietly grow into lifelong discipline. These aren’t the usual “skip coffee” tips; they’re everyday habits that help you make thoughtful decisions:

1. Automate Your Savings

If you wait till the end of the month to save, chances are there won’t be much left. The best trick? Pay yourself first.

Set up an automatic transfer from your main account to a savings account as soon as your salary comes in. You’ll adjust your spending automatically when that amount isn’t lying around in your account.

2. Use Round-Up Apps or Features

Round-up saving tools make saving effortless. For instance, if you spend ₹245 on a meal, ₹5 gets added to your savings automatically.

It’s barely noticeable, yet over time these tiny amounts can grow into a nice emergency fund. If your bank doesn’t have this feature, use budgeting apps that let you manually “round up” and transfer the difference once a week.

3. Delay Non-Essential Purchases

That new phone case or sale outfit looks tempting, right? But if you wait for 48 hours before buying, your brain gets time to think if you really need it.

Most of the time, the excitement fades, and you skip the purchase altogether. This small pause helps you make more intentional choices and reduces impulsive spending caused by ads or discounts.

4. Keep “No-Spend” Days

Challenge yourself to have at least one no-spend day a week. Cook your meals, skip online shopping and find free entertainment like walks, online courses or hanging out with friends at home.

These “no-spend” days reset your spending patterns and remind you that fun doesn’t always have to cost money.

5. Track Emotional Spending

People often spend when they’re stressed, bored, or just scrolling through social media. Notice these patterns. Maybe you order food every time you’re working late or buy things after a bad day.

Once you identify these triggers, you can redirect that emotion. For instance, go for a quick walk, call a friend or put that money into your “mood fund” instead of spending it.

6. Save From Your Discounts

Whenever you use a coupon, cashback, or discount, save that amount right away. Let’s say you got ₹150 off on groceries. Move ₹150 to your savings account the same day.

You won’t miss that money because you were already prepared to spend it. It’s an easy way to make offers and deals that actually benefit you long-term.

7. Use Cash for Small Expenses

Try using cash for everyday spends like snacks, autos, or street food. Physically handing out money creates a stronger sense of spending than just tapping your phone.

You’ll think twice before making small, unnecessary buys that add up by month-end. Once a week, withdraw a fixed amount and challenge yourself to stick to it for daily use.

8. Review Subscriptions Monthly

Auto-renewals are silent money drainers. Set a reminder on the first of every month to review your subscriptions. If you haven’t used an app, streaming service or gym membership in the last few weeks, cancel it immediately.

You could split the cost of OTT subscriptions and Wi-Fi if you live with friends or flatmates. Even saving ₹500 a month from unused plans equals ₹6,000 a year, which is enough to start an emergency fund or SIP.

9. Set Tiny, Short-Term Goals

Big goals can feel overwhelming. Instead, aim to save ₹1,000 a week or ₹5,000 a month. Smaller targets give a quicker sense of achievement and help you stay consistent.

You can even gamify it. Track progress on an app, or reward yourself every time you hit a milestone without spending more.

10. Celebrate Milestones (Smartly)

Saving habits are about balance, not punishment. When you reach a goal, treat yourself, but keep it budget-friendly.

Maybe cook your favourite meal at home or plan a simple day out. Celebrating small wins keeps you motivated to stick with your saving journey without guilt.

Think there’s no more room to save? Let's look at some clever ways to trim daily costs without feeling deprived.

Smart Tips To Save Money Effortlessly

Ready to make your savings grow without turning into a money expert? Here’s how you can save smartly while still enjoying life:

Be Energy-Savvy at Home

- Unplug chargers and devices when not in use to avoid “vampire energy” loss.

- Use LED bulbs and natural light during the day.

- Keep your AC at 24–26°C and clean filters regularly for efficiency.

Shop with a List and Time Limit

- Plan meals weekly and make a shopping list to avoid impulse buys.

- Buy non-perishables in bulk or when on discount.

- Give yourself 15–20 minutes to shop so you focus and prevent unnecessary browsing.

Review Your Insurance and Phone Plans

- Compare annual insurance premiums before renewal; don’t auto-renew blindly.

- Ask your provider for loyalty discounts or better data plans.

- Cancel add-ons or services you don’t actually use.

Learn to DIY Small Tasks

- Watch short tutorials for basic home repairs, decor, or cooking hacks.

- Fixing small issues early can save costly professional visits later.

- Pick one skill a month, from sewing to budgeting spreadsheets.

Use Public Transport or Carpool

- Share rides with friends or use metro/bus passes for regular commutes.

- Cycle or walk for short errands. This not only saves money but also keeps you fit.

- Split cab fares for weekend outings or work trips.

Cut Down the “Little Luxuries” Smartly

- Limit café visits or order smaller sizes of your usual treats.

- Set a “fun budget” each month so you can spend guilt-free within limits.

- Swap one weekend outing for a home movie night or potluck with friends.

Small wins add up fast, but real saving problems usually come from deeper money habits.

Also Read: 11 Successful Tips On How To Save Money While In College

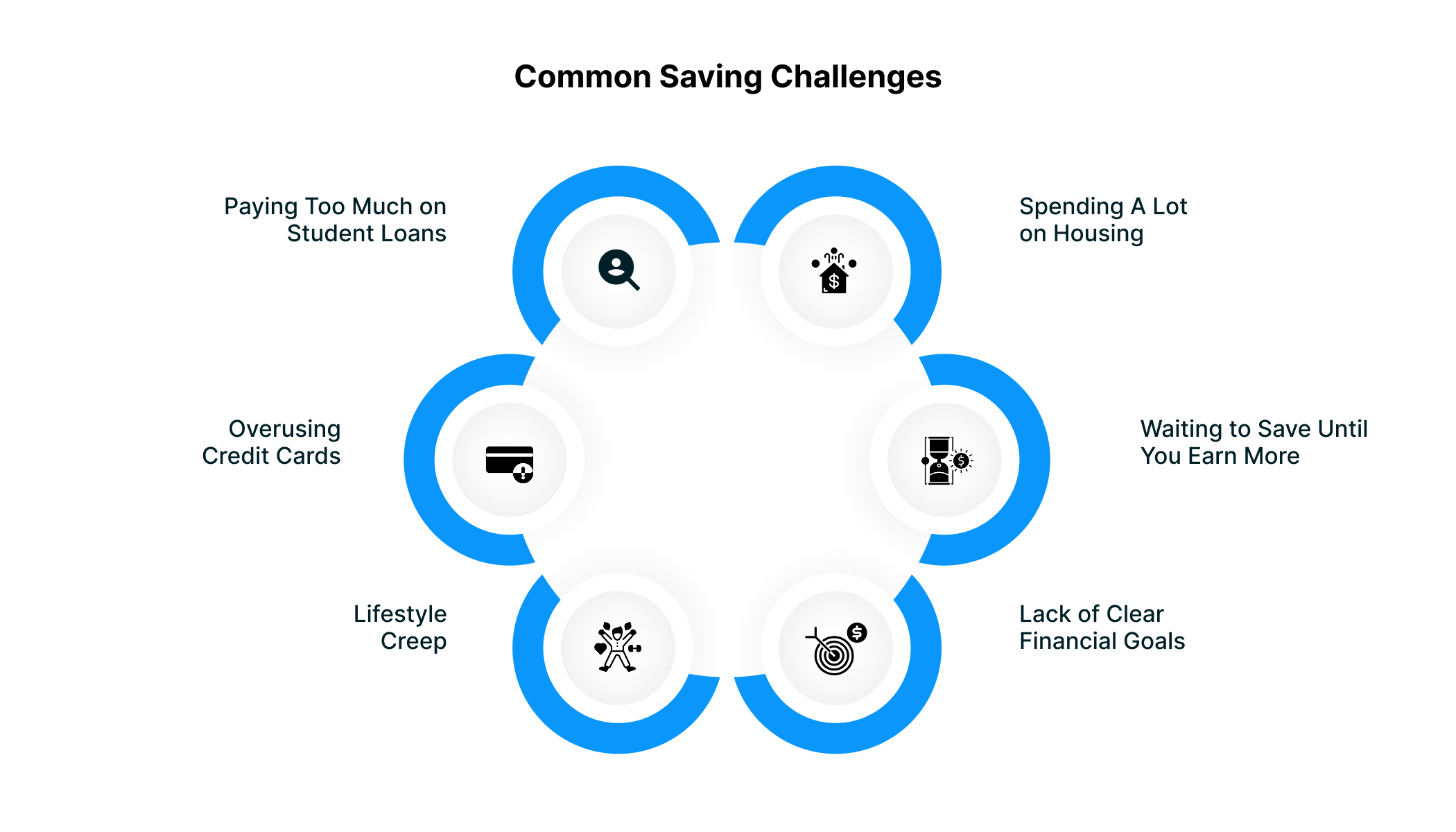

Common Saving Challenges (and How To Fix Them)

You might have the best intentions to save, but somehow, your bank balance doesn’t reflect it. It’s not always a lack of discipline; sometimes it’s just daily money habits or common traps that quietly drain your cash. Let’s look at a few of them and how you can turn things around:

Spending A Lot on Housing

Spending A Lot on Housing

Many young Indians stretch their budgets to afford homes close to work or in posh areas. Paying more than 30% of your income on rent or EMI limits what you can save.

- Solution: Consider moving to a nearby, affordable location or sharing your space. Even a ₹5,000 rent reduction can add up to ₹60,000 saved a year.

Waiting to Save Until You Earn More

It’s tempting to think you’ll start saving once your salary increases, but a higher income often means higher expenses.

- Solution: Start now, even if it’s ₹500 or ₹1,000 a month. Gradually increase the amount every time your income rises to stay ahead of lifestyle creep.

Lack of Clear Financial Goals

Vague saving goals make it hard to stay motivated. Without a purpose, it’s easy to dip into your savings for impulsive spends.

- Solution: Set specific targets like ₹50,000 for travel or an emergency fund and track your progress monthly to stay inspired.

Lifestyle Creep

With every raise, it’s tempting to upgrade your phone, wardrobe, or car—but that’s how savings slip.

- Solution: Fix a savings percentage (say 20% of income) before spending more. Ask yourself before every upgrade: Does it really add value long-term?

Overusing Credit Cards

Easy access to credit often leads to overspending and interest charges. Swiping without tracking can make spending feel painless until the bill hits.

- Solution: Limit card use to essentials and switch to debit for better expense control. Set spending alerts or pay small amounts through the month instead of waiting for the full bill.

Paying Too Much on Student Loans

High-interest education loans can hold back your ability to save early in your career.

- Solution: Explore refinancing or platforms offering flexible repayment, like Pocketly, to reduce EMIs and free up more room for savings each month.

Fixing the basics frees up cash. Now, let’s put that money to work for your goals.

How Can You Grow Your Savings?

So, you’ve built your savings; now what? Letting your cash sit idle in a low-interest account won’t do much. The trick lies in choosing the right mix of short- and long-term options that suit your needs and risk comfort:

| Goal Type | When You’ll Need It | Where to Park Your Money |

| Short-term (1–3 years) | Emergency fund, travel, gadgets | High-interest savings accounts, Fixed Deposits, Liquid Mutual Funds |

| Medium-term (3–7 years) | Car, wedding, higher education | Recurring Deposits, Hybrid or Balanced Mutual Funds |

| Long-term (7+ years) | Retirement, property, child’s education | Equity Mutual Funds, Index Funds, SIPs, PPF |

Quick tips:

- Compare: Always compare interest rates and fees before opening any savings or investment account.

- Diversify: Mix low-risk (FDs, savings) with high-return (mutual funds, SIPs).

- Liquidity: Don’t lock all your money where it’s hard to access.

Also Read: Top 10 Tips to Spend and Save Money Wisely

How Do You Stay Consistent With Your Saving Habits?

Sticking to your savings plan can feel tough when unexpected expenses keep popping up. But with a few simple tweaks, you can make saving second nature:

Sticking to your savings plan can feel tough when unexpected expenses keep popping up. But with a few simple tweaks, you can make saving second nature:

- Automate Everything: Set up an auto-transfer right after payday so your savings are sorted before you even think about spending.

- Make Small, Regular Contributions: Don’t wait to have a big amount to save; small, steady deposits add up faster than you’d think.

- Track and Celebrate Progress: Keep an eye on your growing balance, and give yourself a little credit (not a splurge!) when you stay on track.

- Review and Adjust: Life changes, and so do expenses. Review your plan every few months to stay realistic and consistent.

How Pocketly Helps You Borrow Smart and Save Better

Good saving habits don’t just help you grow money; they also keep you from falling into unhealthy debt. Still, there are moments when managing expenses and repayments becomes tricky. Instead of dipping into your savings or using high-interest credit cards, Pocketly offers a safer bridge.

Pocketly is a digital lending platform (not an NBFC) built for students and young professionals who face short-term cash shortages. It provides instant, collateral-free personal loans from ₹1,000 to ₹25,000, with interest rates starting at 2% per month and a processing fee of 1–8% of the loan amount.

Here’s how you can borrow responsibly with Pocketly:

- Quick Sign-up: Register in just two clicks using your mobile number.

- Paperless KYC: Upload your Aadhaar and PAN for simple verification.

- Bank Details: Add your bank account securely for instant fund transfer.

- Choose Loan Terms: Select the amount and tenure that fit your repayment capacity.

- Receive Funds: Approved loans are credited directly to your account in minutes.

With 24/7 customer support, no hidden charges, and flexible repayment options, Pocketly helps you stay financially steady.

Conclusion

Building healthy saving habits takes time, consistency, and a bit of discipline, but it pays off. When you start tracking your spending, cutting back on impulse buys, and making smarter financial choices, you set yourself up for long-term stability.

But staying disciplined doesn’t mean you’ll never hit a cash crunch. The key is to handle those moments without derailing your progress. That’s where having a reliable backup like Pocketly can help. It bridges short-term gaps so your savings can stay untouched and your financial routine doesn’t fall apart.

Download Pocketly on iOS or Android to stay in control of your money with one smart habit at a time.

FAQ’s

What are common money-saving habits in Indian middle-class households?

Most Indian households prefer tried-and-tested methods like fixed deposits, recurring deposits, and saving through gold or chit funds. Many also keep a portion of their monthly income aside in cash or digital savings for emergencies.

Is the 50/20/30 rule good for saving?

Yes, it’s a simple and effective saving habit. You spend 50% on needs, 30% on wants, and save or invest the remaining 20%, helping you stay balanced without overcomplicating things.

How do I build the habit of saving first and spending later?

Start by automating your savings or setting a monthly transfer to a separate account. Treat your savings like a non-negotiable expense, just like rent or groceries, until it becomes second nature.

How to automate monthly savings using digital wallets?

Many apps and wallets let you set recurring transfers or “auto-save” options that move a small amount to your savings every month. This way, you save consistently without needing to think about it.