Managing your money can feel overwhelming, especially when unexpected expenses pop up. Whether it’s a large purchase, an impulse buy, or simply not budgeting properly, these missteps can lead to unnecessary stress and financial instability. You might find yourself constantly playing catch-up, feeling like your financial goals are slipping further away.

The reality is that without strong money habits, it's easy to fall into cycles of overspending and poor planning. The pressure to keep up with bills, save for the future, and live life on your terms becomes a daily challenge. But there’s good news: you can take control. With the right approach and consistent effort, developing better money habits is entirely within your reach.

In this blog, we’ll walk you through the money habits that can reshape your financial future and help you build a solid foundation for lasting financial health. By making small but meaningful changes, you can turn your financial situation around and start achieving your goals.

TL;DR

- Track your spending to understand where your money is going and spot areas for savings.

- Build and stick to a budget to prioritise essentials, savings, and financial goals.

- Pay yourself first by saving or investing a portion of your income right away.

- Avoid impulse purchases by taking time to consider if they’re really necessary.

- Build an emergency fund and invest regularly to prepare for unexpected expenses and long-term growth.

What Are Money Habits and Why Do They Matter?

Money habits are the behaviours and choices you make regularly regarding your finances. They determine how you spend, save, invest, and manage debt, ultimately shaping your financial well-being.

Here’s why they matter:

- Build Wealth: Good habits like saving regularly and investing wisely can help you build wealth over time.

- Achieve Financial Goals: Establishing a budget and sticking to it ensures you’re always working towards your financial goals.

- Reduce Financial Stress: Effective money habits, like tracking your spending and avoiding impulse purchases, can help reduce financial anxiety.

- Prevent Debt: Properly managing your expenses and paying off high-interest debt allows you to avoid falling into debt traps.

In short, the right money habits create a solid foundation for financial stability and growth, while poor habits can lead to unnecessary challenges and setbacks.

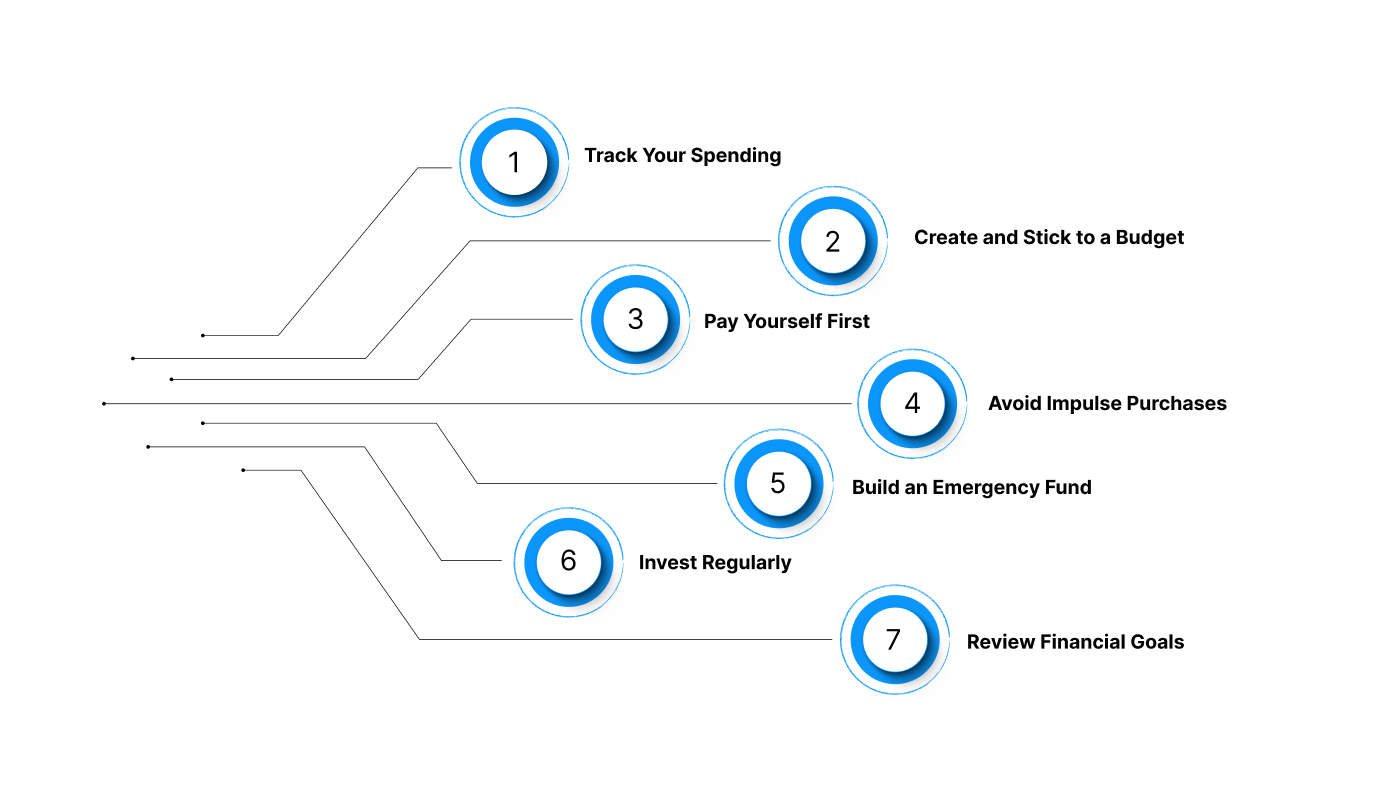

Mastering Your Money: 7 Habits That Lead to Financial Freedom

Developing strong money habits is key to long-term financial success. Here are some habits to start practising today to improve your financial health:

1. Track Your Spending

We often spend money without fully understanding where it’s going. Tracking your spending helps bring awareness to your financial habits and helps you make adjustments where necessary. For example, you may realise that dining out or frequent takeout is taking a significant portion of your monthly budget, even though it’s not essential.

When you track your expenses, you can identify patterns and areas where you might be overspending. This gives you the opportunity to redirect those funds toward savings or other more meaningful expenses. By making tracking a regular habit, you can stay in control of your finances and make more informed choices.

2. Create and Stick to a Budget

Having a budget means setting limits for your spending and sticking to them. It helps you allocate funds for essentials like rent, utilities, and food, as well as for savings and investments. The goal isn’t to restrict yourself, but to ensure that you’re prioritising your needs before your wants.

For instance, you might decide to set aside a fixed amount each month for entertainment, ensuring you don’t overspend and are aware of how much is left for other expenses. Sticking to your budget can bring peace of mind and ensure you’re saving for long-term goals, while still allowing room for enjoyment.

3. Pay Yourself First

Paying yourself first means prioritising savings before you pay for anything else. When you set aside a portion of your income for savings or investments right when you get paid, it ensures that you're consistently building a financial cushion without having to rely on leftover funds.

For example, if you earn ₹50,000 a month, you might choose to save ₹5,000 automatically into a savings account as soon as you’re paid. This habit helps ensure that your savings are consistent, and you’re not left scrambling at the end of the month to find money for your future goals.

4. Avoid Impulse Purchases

We’ve all experienced the urge to buy something on a whim, whether it’s a new gadget, trendy clothes, or a sale item we don’t need. These impulse purchases can quickly add up, putting a strain on your budget. Emotional triggers, like stress or boredom, often lead us to make these unplanned purchases.

Instead of making a quick decision, take a moment to pause and consider if the purchase is necessary. You can give yourself a cooling-off period, like 24 hours, to evaluate if you still want the item. This small change can help you resist unnecessary spending and redirect your money toward more important goals.

5. Build an Emergency Fund

Life is uncertain, and having an emergency fund provides a financial safety net when unexpected situations arise. Whether it’s a medical emergency, a sudden job loss, or urgent home repairs, an emergency fund ensures you’re not caught off guard financially.

Start by saving a small amount each month, even if it’s just ₹2,000, until you reach enough to cover three to six months' worth of expenses. This fund will give you the peace of mind to face emergencies without relying on credit cards or loans.

6. Invest Regularly

Investing helps your money grow over time, enabling you to build wealth and attain long-term financial goals like retirement or buying a home. By regularly putting money into investments such as stocks, bonds, or mutual funds, you allow your savings to work for you.

For example, you might decide to invest ₹5,000 each month in a mutual fund. Over time, your consistent investments and the power of compounding interest can significantly increase your wealth. The key is to start early and invest regularly, no matter how small the amount.

7. Review Financial Goals

Financial goals can change over time as life circumstances evolve. Regularly reviewing and revising your financial goals ensures that you stay on track and make the necessary changes to achieve what you want.

For example, if you’ve recently bought a home, you may need to adjust your savings goals to account for mortgage payments or other home-related expenses. By reviewing your goals every few months, you can stay focused on what counts most and make informed decisions about your money.

Also read: 7 Best Budgeting Apps In India 2025

Avoid These 5 Money Mistakes to Take Control of Your Finances

Certain money habits can hold you back from achieving financial success. Below are money habits to avoid, with actionable steps to mitigate their impact:

1. Impulse Spending

Impulse spending occurs when we make spontaneous purchases without considering their necessity. This habit often leads to overspending and debt accumulation, especially when purchases are driven by emotions such as stress or excitement. Over time, small, unnecessary purchases can add up significantly, disrupting your financial goals.

Mitigation: To manage impulse spending, create a shopping list and stick to it. When tempted to make an unplanned purchase, pause for 24 hours to assess whether it’s truly necessary. If the urge persists, it might be worth considering, but give yourself time to reflect on the purchase before acting.

2. Living Beyond Your Means

Living beyond your means, where you spend more than you earn, is a direct route to financial instability. This habit can lead to mounting debt, high interest payments, and a reliance on credit to cover everyday expenses. Over time, it compromises your financial independence and makes it difficult to save or invest.

Mitigation: To avoid living beyond your means, create a budget that includes both essential and non-essential expenses. Cut back on luxuries and focus on controlling unnecessary spending. Try to reduce non-essential costs, like eating out or subscription services, and ensure that your spending aligns with your income.

3. Ignoring Savings

Failing to save regularly means you’re unprepared for emergencies or future financial goals, such as buying a home or retiring comfortably. This habit leaves you vulnerable when unexpected expenses arise and can result in reliance on credit or loans to cover urgent costs.

Mitigation: Set up automatic transfers to your savings account, so you save a portion of your income each month before paying for anything else. Treat savings as a non-negotiable expense, just like rent or utilities. Start with small amounts, and gradually increase your savings as your financial situation improves.

4. Relying on Credit Cards

Depending on credit cards for regular purchases can quickly lead to high-interest debt. The temptation to carry a balance month-to-month without paying it off fully can result in fees and long-term financial strain. Over time, credit card debt can damage your credit score, which makes it more challenging to secure loans in the future.

Mitigation: Use credit cards responsibly by paying off the balance in full every month to avoid interest. Only use credit for necessary purchases, and aim to pay off any balance as soon as possible. Consider restricting the number of credit cards you hold to prevent the temptation to overspend.

5. Avoiding Financial Planning

Avoiding financial planning means that you have no clear goals or roadmap for managing your money. This absence of clarity can lead to bad decision-making, such as overspending, taking on unnecessary debt, or missing out on opportunities to grow your wealth.

Mitigation: Create a detailed financial plan that includes budgeting, saving, investing, and debt repayment goals. Break down your targets into practical steps, and review your financial situation regularly to make adjustments. By actively managing your finances, you’ll make informed decisions that align with your long-term objectives.

Additional Tips to Fine-Tune Your Money Management

Building strong money habits goes beyond budgeting and saving. Here are some additional tips to help you improve your financial health and create lasting habits that drive success:

1. Start Small and Build Gradually

Trying to overhaul all your money habits at once can feel overwhelming. Instead, start with one small change, like saving an extra ₹500 a month or cutting back on eating out. As you get comfortable, gradually introduce more changes to improve your financial habits.

2. Use Cash for Discretionary Spending

One effective way to control spending is to use cash instead of cards for discretionary purchases. This method helps limit your spending because when the cash runs out, you can’t buy any more until next month. It helps you stay mindful of your budget.

3. Build Relationships with Financial Advisors

Having a professional in your corner can make a significant difference in managing your money. Financial advisors help you understand investment options, tax strategies, and long-term savings plans. Start by consulting one for advice on major financial decisions.

4. Regularly Review and Adjust Your Goals

Life changes, and so do your financial goals. Periodically review and modify your goals to make sure they fit with your current financial situation. This lets you stay on track and adapt to any changes that may come up, like a career shift or unexpected expenses.

5. Celebrate Small Wins Along the Way

Achieving big financial goals takes time, so celebrate the small wins. Whether it’s settling off a credit card, saving an emergency fund, or remaining true to your budget for a month, recognising and celebrating progress can keep you driven and reinforce positive habits.

Also read: How to Manage Monthly Expenses Smartly in 2025

What Successful People Do Differently with Their Money

Here are some relatable scenarios that demonstrate how good money habits can lead to better financial outcomes:

1. Young Salaried Professional: Managing Monthly Expenses

For many young professionals, tracking spending is a breakthrough. By reviewing monthly expenses and categorising them into needs, wants, and savings, they can see where money is slipping away. A quick glance might reveal overspending on things like eating out or subscriptions you don’t use.

Cutting back on these small indulgences frees up cash for more important goals. This simple habit doesn’t just keep your finances in check; it helps build a strong foundation for future savings.

2. Student on a Limited Budget: Smart Budgeting

Living on a student budget means every penny counts. The trick is allocating funds smartly, groceries, transport, and some fun, and sticking to it. Tracking spending in an app can quickly reveal where you’re leaking money, whether it’s unnecessary purchases or last-minute takeaways.

Setting clear boundaries for each category allows you to focus on saving, even if it’s just a small amount each month. Consistent budgeting today means fewer financial headaches tomorrow.

3. Self‑Employed Entrepreneur: Planning for Irregular Income

As a self-employed entrepreneur, income can be unpredictable. That’s where the habit of saving a percentage from every payment comes in. Even in lean months, this small habit ensures that you’re not left scrambling when the bills come due.

Whether it’s putting aside 20% or 30%, this cushion smooths out income fluctuations, keeping you grounded financially. No matter how much or little you earn, this habit builds long-term stability.

4. Retiree: Consistent Savings and Investments

For retirees, managing fixed income is all about balance. By reviewing expenses regularly, you can catch unnecessary costs, like higher utility bills in winter, and adjust accordingly. The key is consistently putting aside a portion of your pension into low-risk investments. This keeps your money growing and adds a safety net for unexpected expenses.

These small, steady habits keep your finances on track, so you can enjoy your retirement without financial stress.

Feeling Stressed About Your Finances? Pocketly Offers Quick Solutions

Building strong money habits is key to financial stability, but sometimes, life throws unexpected expenses your way. Whether it's a month-end shortage, impulse spending, or a missed budget, Pocketly is here to help you get back on track with quick, reliable financial solutions.

Here’s why Pocketly is your go-to solution:

- Borrow only what you need: Loans from ₹1,000 to ₹25,000, designed to fit your needs without over-borrowing.

- No collateral required: Skip the hassle of paperwork or needing assets and guarantors.

- Fast approval: Instant KYC verification and quick decision-making to get you the funds you need.

- Instant transfer: Money is directly credited to your account, right after approval.

- Flexible repayment options: Pick a repayment plan that meets your cash flow and budget.

- Clear, transparent pricing: Interest rates starting at 2% per month and processing fees between 1% and 8%.

- Available 24/7: Access funds anytime through the easy-to-use Pocketly app.

Pocketly partners with regulated NBFCs to offer you secure, transparent loans without hidden fees. So, when life’s unexpected costs challenge your money habits, Pocketly gives you the flexibility to manage your finances with ease.

Conclusion

Managing money habits effectively is the key to long-term financial success, but it doesn’t happen overnight. By taking small steps like tracking your spending, creating a budget, and automating savings, you can start building a solid financial foundation.

Stay consistent in reviewing your finances, adjusting when needed, and prioritising your goals. If you find yourself in a situation where your financial habits slip, don’t let it spiral out of control; take action early. Short-term loans can offer the flexibility you need to stay on track without added stress.

Download the Pocketly app today on iOS or Android to access quick, hassle-free funds whenever you need to manage unexpected expenses, ensuring you maintain control of your finances.

FAQs

1. What are money habits?

Money habits are the regular behaviours and actions that influence how you manage your finances. These include spending, saving, budgeting, and investing, which collectively shape your financial outcomes. Developing positive money habits leads to greater financial stability and helps you achieve long-term goals.

2. Why are good money habits important?

Good money habits are essential because they help you stay on point with your finances, avoid unnecessary debt, and make informed financial decisions. They also allow you to build savings and ensure that money is being spent in ways that align with your financial goals. Over time, good habits lead to financial independence and peace of mind.

3. How can I develop better money habits?

To develop better money habits, start by tracking your spending and setting clear financial goals. Automate savings and bill payments to ensure consistency in managing your finances. Regularly review your finances and adjust as needed to ensure your habits align with your goals.

4. How long does it take to build a money habit?

Building a money habit typically takes a few weeks to a couple of months, depending on your consistency. The more regularly you practice a habit, the more automatic it becomes. It’s important to stay committed and patient during the process for lasting change.

5. What’s the first money habit I should work on?

The first money habit to work on is tracking your spending. By understanding where your money is going, you can identify areas to save and adjust your budget accordingly. Once you gain control over your spending, it becomes easier to develop other healthy financial habits.