Struggling to manage your lifestyle expenses when they pile up unexpectedly? Whether it’s a spontaneous trip, dining out, or picking up a new gadget, these small indulgences can add up fast and throw your budget off balance. This is a common challenge for young Indians, students, professionals, and entrepreneurs, especially when the month-end cash flow is tight or unexpected bills show up.

When your actual spending doesn’t align with your budget, it can lead to financial stress, missed payments, and constant pressure to stay on top. It’s more than just numbers; it affects your overall peace of mind.

In this blog, we’ll share actionable tips to help you close the gap between your budget and lifestyle expenses, so you can take control of your finances without sacrificing the things you love.

TL;DR

- A budget is your financial plan, while expenses are what you actually spend. The gap between them can cause financial stress.

- Common reasons expenses exceed the budget include untracked spending, emergency costs, and lifestyle inflation.

- To bridge the gap, track all expenses, review your budget regularly, and create an emergency fund.

- Pocketly offers quick, short-term loans to help cover urgent expenses, with flexible repayment options and no collateral.

- Prevent overspending by setting realistic budgets, tracking spending, and only using loans when absolutely necessary.

What is a Budget?

A budget is kown as a financial plan that allocates your income to various expenses. It helps manage money by ensuring enough funds for essential needs while allowing for savings and discretionary spending.

- Predicts where money goes each month

- Helps control spending and avoid debt

- Ensures savings for future goals

- Balances essential and non-essential expenses

What Are Expenses?

Expenses are the amounts spent on goods, services, or obligations within a specific time period. They can be fixed or variable, impacting your budget.

- Fixed expenses: Rent, loan payments

- Variable expenses: Groceries, dining out

- Reflect real-time spending, which may not match budgeted amounts

- Managing fluctuations is key to staying within budget

Budget vs Expenses: A Side-by-Side Comparison

To better understand how a budget and expenses work together, it's important to compare the two. Here’s a side-by-side look at the key differences between your planned budget and actual spending:

| Aspect | Budget | Expenses |

| Definition | A financial plan for allocating income. | Actual amounts spent on goods/services. |

| Purpose | To predict and plan financial allocation. | Reflects real-time spending behavior. |

| Nature | Set in advance, based on expected income. | It can fluctuate based on actual spending. |

| Impact | Helps control spending and avoid debt. | It can cause financial strain if exceeded. |

| Categories | Essential and non-essential expenses. | Fixed (e.g., rent) and variable (e.g., groceries). |

| Adjustments | Can be modified if needed, based on trends. | May need adjustments when spending exceeds the budget. |

| Focus | Managing future income and expenditures. | Represents actual spending and its alignment with the budget. |

Also read: How to Manage Monthly Expenses Smartly in 2025

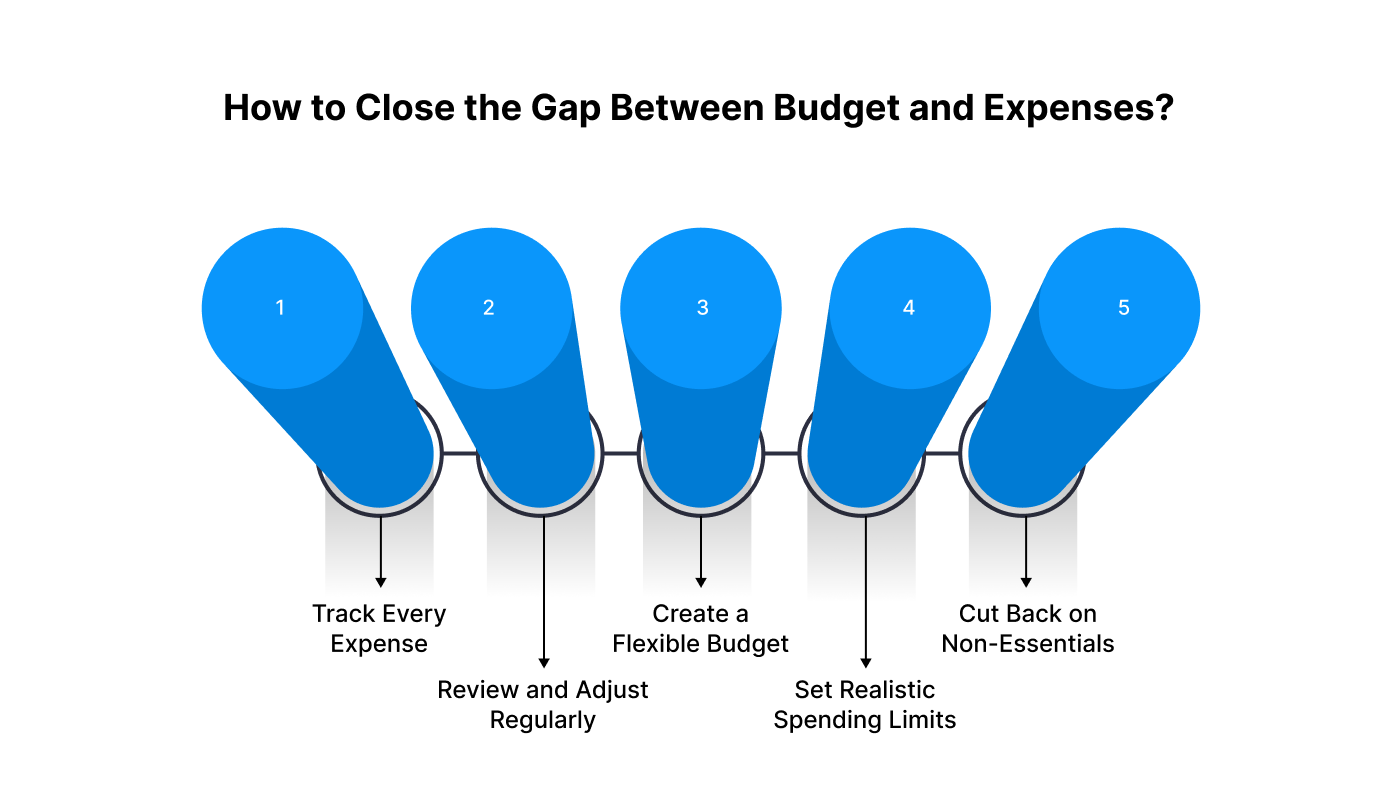

How to Close the Gap Between Budget and Expenses?

Closing the gap between your budget and expenses is essential to maintaining financial stability. Here are the steps you can take to bring your spending in line with your planned budget:

1. Track Every Expense

Consistently monitor where your money is going by using budgeting apps or spreadsheets. Categorise your expenses to see where you’re overspending.

Example: Using a budgeting app like Mint, you can track all your expenses, whether it's groceries, entertainment, or shopping, and see exactly where your money goes each month.

2. Review and Adjust Regularly

Set aside time each month to compare your budget with your actual spending. Regular reviews help you identify discrepancies and make the necessary adjustments.

Example: At the end of the month, compare your expected grocery budget to actual spending. If you’ve spent ₹1,500 more than planned, adjust next month’s grocery budget or find ways to reduce non-essentials.

3. Create a Flexible Budget

A rigid budget can be difficult to stick to. Include room for emergencies and occasional indulgences so unexpected expenses don’t throw you off track.

Example: If your monthly entertainment budget is ₹2,000 but you unexpectedly need to pay for an urgent family trip, you can adjust other categories like dining out to keep things balanced.

4. Set Realistic Spending Limits

Be honest about your spending habits. If you tend to overspend in certain areas, adjust your budget to set more realistic limits based on your actual expenditure.

Example: If you find that dining out regularly exceeds your budget, set a more realistic monthly limit for food and try to cook more at home to stay within your budget.

5. Cut Back on Non-Essentials

Identify areas where you can cut spending, such as dining out, subscriptions, or impulse purchases, to bring your expenses in line with your budget.

Example: You could cancel a subscription service you rarely use or limit yourself to eating out just once a week, freeing up money for savings or other priorities.

While budgeting is key to financial success, sometimes unexpected expenses can throw off your plans. Pocketly helps bridge the gap between your budget and actual expenses with quick, short-term loans.

With amounts ranging from ₹1,000 to ₹25,000 and flexible repayment options, Pocketly provides immediate relief when cash flow is tight, ensuring that your lifestyle doesn’t take a hit.

Also read: Best Expense Tracker Apps In India For 2025

How to Adjust Your Budget for Future Expenses?

To ensure your budget remains aligned with your financial goals and future expenses, follow these practical steps:

1. Review Past Spending to Identify Patterns

The first step in adjusting your budget is to review your past spending. Look at your expenses over the past few months to identify areas where you may have overspent. By analysing your spending habits, you can adjust categories and set more realistic goals moving forward.

For example, if you’ve consistently overspent on dining out, you’ll know to set a more conservative limit for that category next month.

2. Anticipate Future Costs and Plan Ahead

Planning for future expenses is key to avoiding surprises. Consider expected costs like yearly subscriptions, insurance premiums, or seasonal purchases. By allocating funds in advance, you prevent these expenses from throwing off your budget.

For instance, if you know your car insurance renewal is coming up, start setting aside funds each month so you’re not caught off guard when the bill arrives.

3. Create an Emergency Fund for Unexpected Events

An emergency fund is vital for retaining financial stability. Set aside a part of your income each month for unexpected events, such as medical expenses or home repairs. Aim to save three to six months’ worth of daily expenses. This cushion will allow you to cover emergencies without disrupting your budget or relying on credit.

4. Trim Unnecessary Expenses and Reallocate Funds

To keep your budget on track, look for areas where you can cut back. This could include dining out less, reducing entertainment expenses, or avoiding impulse purchases. By trimming these non-essential costs, you free up funds that can be reallocated to more important categories like savings or debt repayment. Even small reductions can add up over time, helping you achieve your financial goals faster.

5. Adjust for Income Changes and Avoid Lifestyle Inflation

If your income increases, resist the temptation to inflate your lifestyle. Instead of upgrading your spending, use the extra funds to boost your long-term financial goals. You can allocate the additional income to paying off debt, increasing savings, or investing for the future.

This approach ensures that your financial growth is reliable and centred on long-term success rather than short-term indulgences.

By following these steps, you can adapt your budget to better manage future expenses and achieve long-term financial stability.

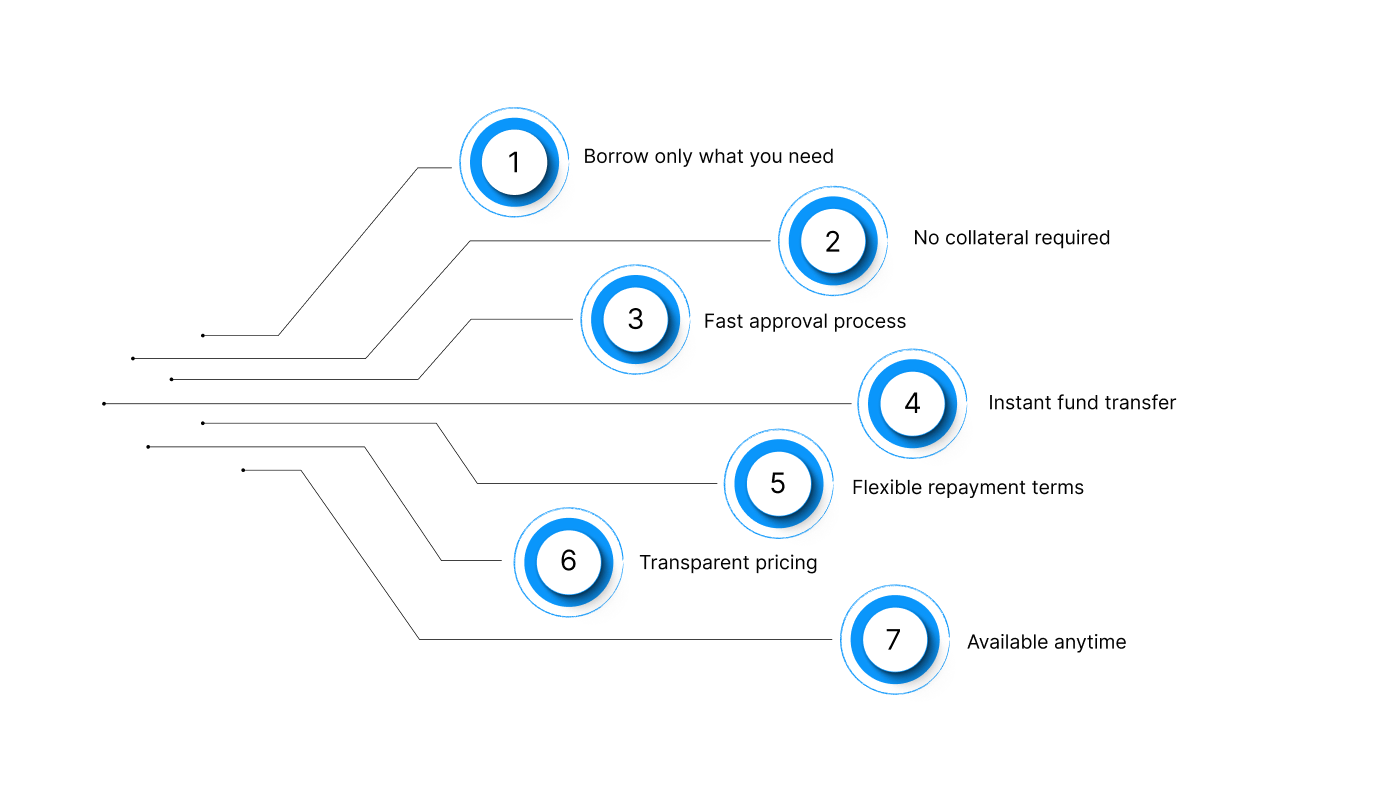

Unexpected Expenses? Pocketly Can Help You Bridge the Gap

When unplanned expenses like emergency repairs, surprise bills, or sudden financial needs pop up, Pocketly is here to offer quick support, ensuring you stay on track with your budget.

Here’s why Pocketly is the right choice:

- Borrow only what you need: Loan amounts from ₹1,000 to ₹25,000, so you don’t borrow more than necessary.

- No collateral required: No need for assets or guarantors, quick and easy approval without the paperwork.

- Fast approval process: Instant decision-making after quick KYC verification, giving you fast access to funds.

- Instant fund transfer: Get the funds you need directly into your bank account right after approval.

- Flexible repayment terms: Choose a repayment plan that aligns with your financial situation.

- Transparent pricing: Interest rates starting at just 2% per month, with processing fees between 1% and 8%.

- Available anytime: Access loans through Pocketly’s simple mobile app, 24/7, wherever you are.

With Pocketly, you can manage surprise expenses easily through quick, secure loans provided by regulated NBFCs. You get clear terms, no hidden charges, and the flexibility to handle those unexpected moments without the financial strain.

Conclusion

Managing the gap between your budget and actual expenses is crucial for financial stability, but it doesn’t have to be overwhelming. By tracking your spending, adjusting your budget regularly, and cutting back on additional expenses, you can stay on top of your finances.

It’s all about proactive management, reviewing your spending, prioritising essentials, and creating room in your budget for flexibility. When unexpected expenses arise and threaten to throw you off course, take action before they escalate. Short-term loans can provide the breathing room you need to bridge the gap without derailing your financial goals.

Download the Pocketly app now on iOS or Android to access quick funds and stay in control when your expenses exceed your budget. With flexible loan options and transparent pricing, Pocketly ensures you’re always prepared for life’s financial surprises.

FAQs

1. What’s the difference between a budget and expenses?

A budget is a financial plan outlining expected income and expenses, while expenses are the actual amounts spent during the month. The difference between the two can create financial strain if expenses exceed the budget.

2. Why do my expenses keep exceeding my budget?

Common reasons include untracked spending, emergency expenses, lifestyle inflation, and impulse purchases. Regularly reviewing your budget and tracking expenses can help prevent this.

3. How can I manage my budget vs expenses more effectively?

To manage better, track every expense, regularly review your budget, set realistic spending categories, and create an emergency fund for unexpected costs.

4. How can Pocketly help when my expenses exceed my budget?

Pocketly offers quick, short-term loans to help bridge the gap when your expenses exceed your budget. With flexible repayment terms, no collateral required, and instant bank transfers, it’s a simple solution for managing cash flow.

5. How can I avoid debt while bridging the gap between my budget and expenses?

Use short-term loans only when necessary, stick to borrowing limits, and make quick repayments. Additionally, build a buffer in your budget for unforeseen expenses to reduce reliance on loans.