Ever wondered why everyone talks about taxes the moment you get your first job or start earning on your own? If terms like slabs, TDS or deductions feel confusing, you’re not alone. Most young earners find taxes overwhelming simply because no one explains them in a simple, practical way.

Understanding income tax basic concepts actually makes managing money much easier. It helps you plan better, avoid penalties and keep more of what you earn. And if you're someone juggling studies, work or a side hustle, knowing how tax works can save you from last-minute stress during filing season.

In this blog, we’ll break down income tax in the most beginner-friendly way, explain key terms, and walk through income slabs. Read along to see how deductions work so you can file confidently and stay financially prepared throughout the year.

Quick View:

- Income tax is charged on your yearly earnings, and your filing depends on your previous and assessment year.

- Income is grouped into five heads, including salary, house property, capital gains, and more.

- The old regime offers more deductions; the new regime has simpler slabs with limited exemptions.

- Deductions under Sections 80C to 80U and rebates under Section 87A help reduce your tax bill.

- Calculating tax involves adding total income, subtracting deductions, applying the right slab, and adjusting TDS or advance tax.

What Is Income Tax?

Income tax is a direct tax you pay on the money you earn in a financial year. Whether you’re working your first job, freelancing, or running a small side business, understanding income tax basic concepts helps you avoid surprises during tax season. Every individual must report their income annually and pay tax according to the rules set under the Income Tax Act, 1961.

In simple words, you share a part of your earnings with the government so it can run public services like roads, schools, and digital infrastructure. You file this information through an Income Tax Return (ITR), which shows what you earned and how much tax you owe.

Key Income Tax Terms You Should Know

Here are the most important concepts you’ll come across while learning income tax basic concepts:

- Assessee: Anyone who must pay income tax, including individuals, HUFs, companies, firms, and LLPs.

- Assessment: The review process where the Income Tax Department checks your filed return.

- Gross Total Income (GTI): Your income from all sources before deductions.

- Net Taxable Income: The amount you pay tax on after subtracting eligible deductions.

- Self-Assessment Tax: Tax you pay on your own before filing, usually when TDS and advance tax do not cover your full liability.

- Form 16: A document given by your employer showing your salary details, exemptions, deductions, and TDS.

- TDS (Tax Deducted at Source): A portion of income is deducted upfront by your employer or payer. It appears in Form 26AS and helps reduce your final tax.

Previous Year (PY) vs Assessment Year (AY):

| Term | What It Means |

| Previous Year (PY) | The year you earn your income, from 1 April to 31 March. |

| Assessment Year (AY) | The year after the PY, when you file your return for that income. |

Now that you know the basic language of taxes, let’s explore what types of income the government actually taxes.

Also Read: Understanding Differences between Form 16, Form 16A and Form 16B

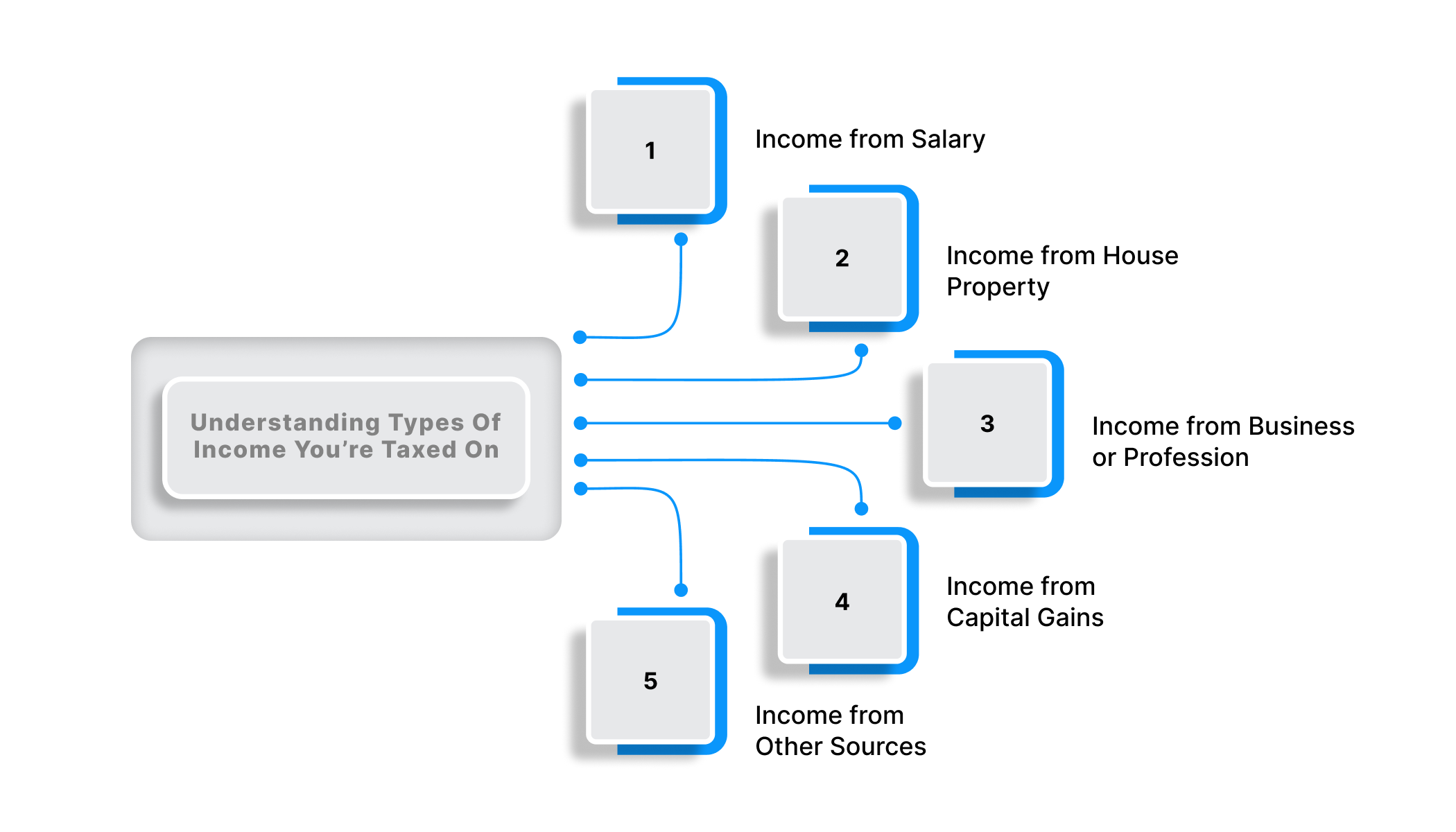

Understanding Types Of Income You’re Taxed On

You might assume income tax applies only to your monthly salary, but the law groups income into five categories. Knowing these helps you calculate your total taxable income efficiently:

Income from Salary

This includes your monthly earnings from an employer. Your payslip and Form 16 show your income breakup, exemptions, and TDS. If your income crosses the basic exemption limit, tax gets deducted automatically.

Income from House Property

If you earn rent from a property you own, it falls here. Even a single room rented out counts. The property must not be used for your business for it to fit under this category.

Income from Business or Profession

If you freelance, sell products online, consult, or run a small business, your income comes under this head. Your profit is taxed as per your income slab.

Income from Capital Gains

Capital gains arise when you sell an asset like shares, property, or jewellery for a profit. These gains are taxed differently based on how long you held the asset.

- Short-term gains: Asset held for less than 12 months (for shares) or 24 months (for property). Taxed at slab rates or 20%.

- Long-term gains: Assets held longer than these periods. Usually taxed at 12.5%.

Income from Other Sources

Any income that doesn’t fit into the other heads is included here. This often catches people off guard.

Common examples include:

- Interest on fixed deposits

- Lottery or prize winnings

- Gifts above ₹50,000 (in certain cases)

- Dividends

- Rental income from non-residential property

With these income tax basic concepts in place, you now have a clear picture of what “income” really means for tax purposes. Now, let's move ahead to see how these incomes eventually get taxed under different systems.

Income Tax Slabs & Rates For FY 2025–26

The rate you pay depends on the tax regime you choose and the income slab you fall under. Don’t worry if it sounds confusing right now; this section breaks it down in a clean and simple way.

Old Tax Regime

The old regime gives you plenty of deductions and exemptions, but it’s also more detailed and requires record-keeping. It’s preferred by people who invest regularly or pay expenses that qualify for deductions.

For individuals below 60 years

| Income Slab | Tax Rate |

| Up to ₹2,50,000 | 0% |

| ₹2,50,001 – ₹5,00,000 | 5% |

| ₹5,00,001 – ₹10,00,000 | 20% |

| Above ₹10,00,000 | 30% |

For senior citizens (60–79 years)

| Income Slab | Tax Rate |

| Up to ₹3,00,000 | 0% |

| ₹3,00,001 – ₹5,00,000 | 5% |

| ₹5,00,001 – ₹10,00,000 | 20% |

| Above ₹10,00,000 | 30% |

For individuals below 60 years

| Income Slab | Tax Rate |

| Up to ₹5,00,000 | 0% |

| ₹5,00,001 – ₹10,00,000 | 20% |

| Above ₹10,00,000 | 30% |

New Tax Regime

The new regime is now the default choice. It reduces your tax rate but removes most deductions. Many first-time taxpayers prefer it because the maths is easier.

| Income Range (₹) | Tax Rate |

| 0 – 4,00,000 | 0% |

| 4,00,001 – 8,00,000 | 5% |

| 8,00,001 – 12,00,000 | 10% |

| 12,00,001 – 16,00,000 | 15% |

| 16,00,001 – 20,00,000 | 20% |

| 20,00,001 – 24,00,000 | 25% |

| Above 24,00,001 | 30% |

Key Updates For FY 2025–26

A few tax rules for the year have been refreshed, so here’s what matters most:

- A rebate of up to ₹60,000 for incomes below ₹12 lakh (new regime).

- Standard deduction of ₹75,000 for salaried individuals in the new regime.

- Leave encashment exemption increased to ₹25 lakh for non-government employees.

- Long-term capital gains exemption capped at ₹10 crore for reinvested amounts.

These numbers may look heavy now, but they’ll make a lot more sense when we move to deductions. And that’s exactly what comes next.

Tax Deductions And Rebates

If you’ve ever wondered why two people earning the same salary pay different taxes, the answer lies in deductions. These reduce your taxable income and lower the amount of tax you pay. Think of them as small financial cushions built into the tax system.

Popular Deductions Under Section 80C

Section 80C lets you reduce up to ₹1.5 lakh from your taxable income. Here are the options young earners commonly use:

- PPF: A long-term, low-risk savings scheme where deposits (up to ₹1.5 lakh a year) qualify for tax benefits.

- Tax-Saving FD: A 5-year fixed deposit that offers guaranteed returns and allows tax deduction on the invested amount.

- ELSS: A tax-saving mutual fund with a 3-year lock-in period, offering market-linked returns and 80C benefits.

What Deductions Are Allowed Under Each Regime?

Not every deduction is available in both systems, so here is a simple explanation:

- Old Regime: Almost all deductions under Sections 80C–80U allowed. Good if you invest in tax-saving options or have home loan interest, insurance premiums, etc.

- New Regime: Most deductions removed. Only a few benefits remain, including deduction on interest for let-out property (Section 24B) and deduction for the employer’s NPS contribution.

Understanding Tax Rebates (Section 87A)

Rebates directly reduce the tax you pay, not your income:

- Under the new regime: Individuals with income up to ₹12 lakh get a rebate of up to ₹60,000.

- Under the old regime: Individuals earning up to ₹5 lakh get a rebate of up to ₹12,500.

These benefits are particularly helpful for students and early professionals who are starting with modest incomes.

Also Read: Understanding TAN and Its Application

How TDS Works?

TDS (Tax Deducted at Source) is the tax cut before money reaches you. The person paying you deducts a set percentage and deposits it with the government. You later get credit for this deducted amount when you file your return.

Here’s how it usually works:

- Your employer estimates your yearly income and deducts tax every month based on the slab you fall under.

- Banks deduct TDS on fixed deposit interest, usually at 10% if your PAN is updated.

- Rent, commission, professional fees and contractor payments may also involve TDS.

- You receive a TDS certificate (like Form 16 from your employer or details in Form 26AS), which shows how much tax has already been deducted for you.

Why does this matter to you?

Because TDS reduces the burden of paying tax all at once. And, if an extra tax was deducted, you can claim the refund when you file your return.

Now that TDS makes sense, the next question is, how do you calculate your tax and file your return without confusion? Let's see.

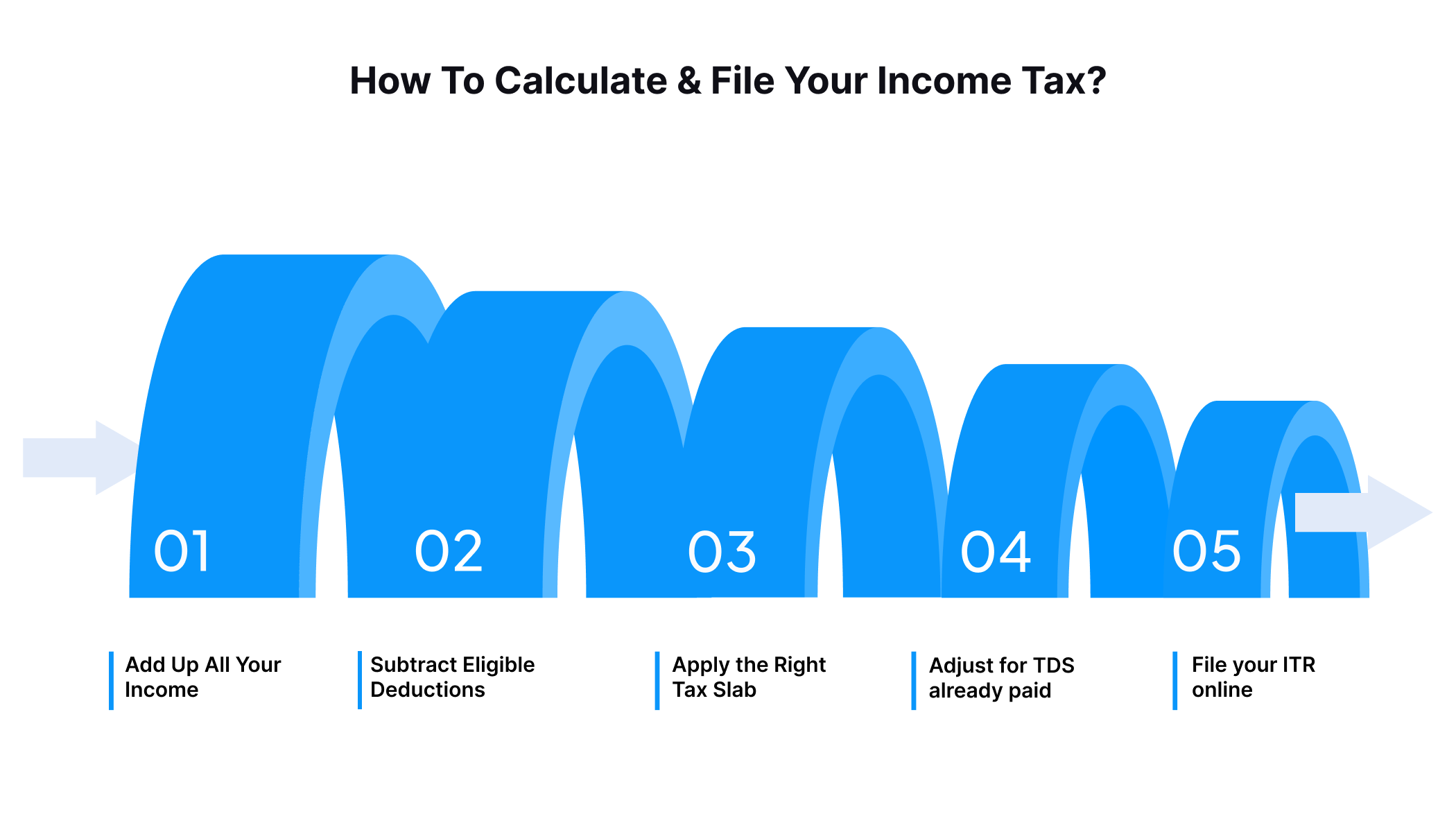

How To Calculate & File Your Income Tax?

If this is your first time handling taxes, don’t worry. Once you understand the flow, filing an ITR becomes a yearly routine rather than a stressful task. Let us start from the basics and move step-by-step:

Step 1: Add Up All Your Income

Your income is usually a mix of different sources. Here are the main heads used during filing:

| Income Head | What It Includes |

| Salary | Basic pay, allowances, bonuses, pensions |

| House Property | Rent received or deemed rent |

| Capital Gains | Profits from selling shares or property |

| Business/Profession | Freelance income, consultancy, small business earnings |

| Other Sources | FD interest, savings interest, gifts, family pension |

Step 2: Subtract Eligible Deductions

Use deductions you qualify for (like 80C investments, health insurance, education loan interest, etc.) to bring down your taxable income.

Step 3: Apply the Right Tax Slab

Once deductions are subtracted, the remaining figure becomes your taxable income. You then apply the slab rate based on the regime you’ve chosen. This gives you your total tax for the year.

Step 4: Adjust for TDS already paid

Check Form 26AS or AIS to see how much tax was already deducted.

- If TDS is more than your actual tax, you get a refund.

- If it’s less, you pay the remaining amount before filing.

Step 5: File your ITR online

Choose the right ITR form, enter your income details, verify the pre-filled TDS information, pay any pending tax and e-verify the return. Once verified, your return is officially filed, and any refund due will be processed to your bank account.

Also Read: Top Tax Saving Tips for Salaried Individuals

When Tax Deadlines Create Cash Gaps, Pocketly Can Help

Handling taxes or planning your payments can sometimes squeeze your monthly budget. If you ever find yourself short on funds during these moments, Pocketly offers a practical and safe solution without complicating your finances.

Pocketly is a digital lending platform that provides quick, collateral-free short-term loans. You can borrow any amount from ₹1,000 to ₹25,000, with interest starting at 2% per month and a processing fee of 1–8%. Approval is fast, and funds reach your bank in minutes.

How the loan process works:

- Sign up in just two taps using your mobile number

- Upload Aadhaar, PAN and complete simple KYC

- Add your bank details securely

- Choose your loan amount and tenure

- Get funds transferred directly within minutes

You also get flexible EMIs, no hidden charges, a fully online journey, and 24/7 support whenever you need help. For unexpected tax-time cash shortages, Pocketly keeps things simple and stress-free.

Bottom Line

As you wrap your head around the income tax basic concepts, knowing your tax slabs, deductions, TDS and ITR steps will make handling your finances much smoother. The goal isn’t just to file taxes correctly, but to make informed decisions that keep you compliant and confident year after year.

And as you manage your finances more responsibly, you may still encounter months where expenses bunch up, or refunds get delayed. For those short-term gaps, Pocketly can be a simple, dependable companion, helping you stay afloat without disrupting your long-term financial plans.

If you ever need quick, small-ticket support, you can always download Pocketly on iOS or Android and access funds when it matters most.

FAQ’s

What are the basic rules of income tax?

Income tax is charged based on your total taxable income for the financial year. You pay tax according to the slab you fall under, and eligible deductions can reduce the amount you owe.

How much tax do I pay on a ₹70,000 salary?

If your annual income is ₹70,000, it falls below the taxable limit under both tax regimes. This means you are not required to pay income tax. However, you may still file a return if you want to keep your records updated or claim refunds for any TDS.

What is the minimum salary to pay taxes?

Under the old tax regime, tax becomes applicable once your annual income crosses ₹2.5 lakh. Under the new regime, the threshold is ₹3 lakh. Below these limits, you are not required to pay income tax.

What is the point of an income tax?

Income tax helps the government fund essential public services like infrastructure, healthcare and education. It also supports welfare schemes and national development.