Ever been asked for a TAN and found yourself Googling it on the spot? You’re not alone. If you’re getting paid for your work, handling vendor payments, or filing TDS, a TAN might already be on your radar. And if it’s not, it should be.

For many, it’s one of those tax terms that sounds complicated until you realise how closely it’s tied to your filings. Misunderstanding it or quoting it wrong can lead to rejected returns, delayed refunds, or unexpected penalties.

This guide breaks down everything you need to know, from the TAN card’s full form to how to apply and why it’s essential for smooth tax filing. Read along to understand how TAN fits into your financial responsibilities and how to handle it the right way.

TL;DR

- TAN card's full form is Tax Deduction and Collection Account Number, used for TDS/TCS.

- The TAN format is a 10-character alphanumeric ID with a region and applicant-based structure.

- Businesses, employers, and payers deducting tax must apply for a TAN.

- Failing to quote TAN can result in penalties up to ₹10,000.

- You can apply online or offline through Form 49B with a ₹77 fee.

What Is TAN's Full Form?

A TAN card's full form is- Tax Deduction and Collection Account Number. This 10-digit alphanumeric code is issued by the Income Tax Department of India to organisations responsible for deducting or collecting tax at source.

If a company deducts TDS (Tax Deducted at Source) or collects TCS (Tax Collected at Source), it must mention the TAN in all related documents. This number helps the tax department track every deduction and collection accurately.

TAN plays a key role in tax compliance, especially for businesses and institutions. It isn’t the same as PAN. While PAN tracks income and tax payments, TAN focuses on reporting TDS and TCS.

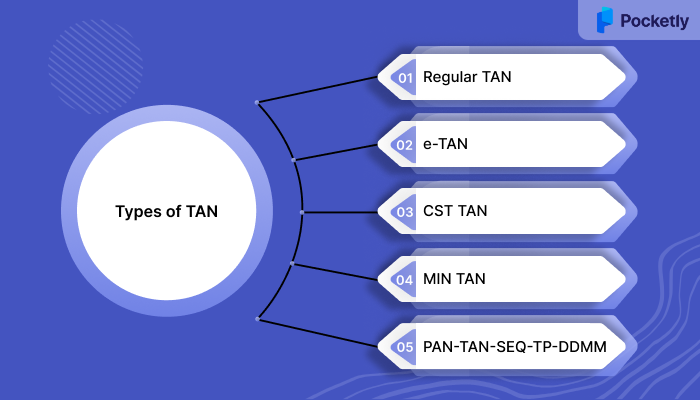

Types of TAN:

There isn’t just one fixed type of TAN. Depending on the nature of the taxpayer and filing method, TAN can fall under various categories:

- Regular TAN: Most commonly issued to entities responsible for TDS or TCS.

- e-TAN: Issued for online/electronic tax return filings.

- CST TAN: Allocated to entities involved in the interstate sale or purchase of goods.

- MIN TAN: Assigned for identification where deduction isn’t necessary, but TAN is still required.

- PAN-TAN-SEQ-TP-DDMM: Typically used for trusts or temporary assignments with specific tracking needs.

While the types may vary, every TAN follows a standard format that helps the system keep things organised.

Structure Of TAN

TAN's standard structure ensures that each TAN is unique, traceable, and easy to verify across systems. Whether you're an employer, business owner, or part of a government body, your TAN will follow the same 10-character alphanumeric pattern.

Here’s how to understand it:

- First three letters: Indicate the city or region where the TAN was issued.

- Fourth letter: Reflects the first letter of the entity or individual’s name.

- Next five digits: A random number generated by the system for uniqueness.

- Last character: A check alphabet used for validation purposes.

For example, take the TAN ABCP12345D.

Here, ‘ABC’ refers to the issuing location, and ‘P’ shows the name of the applicant begins with ‘P’. The numbers ‘12345’ are randomly assigned, and ‘D’ serves as a system-generated check character.

This format is the same for everyone across India, ensuring consistency. If you ever come across a document and want to verify whether the TAN is valid, you can use this structure to cross-check it. It also helps avoid duplication or errors during filing.

Now that you understand the common query "what is TAN’s full form", you might be wondering if you need to apply for one. Let’s find out.

Who Should Apply For TAN?

Not every taxpayer needs a TAN! It’s mostly for people or organisations who are entitled to deduct or collect tax on behalf of the government.

Here’s a list of those who must apply for TAN:

- Businesses: Companies that deduct tax from employee salaries, payments to vendors, etc.

- Government Bodies: Government entities that deduct tax from their employees or contractors.

- Banks/Financial Institutions: Institutions involved in charging tax on interest payments.

- Non-Profit Organisations: Some organisations that deduct tax before paying service providers.

Even if you're not making large payments, the law still requires you to deduct tax once it crosses a certain limit. Getting a TAN is just the beginning; using it correctly is what keeps your filings safe from delays or penalties.

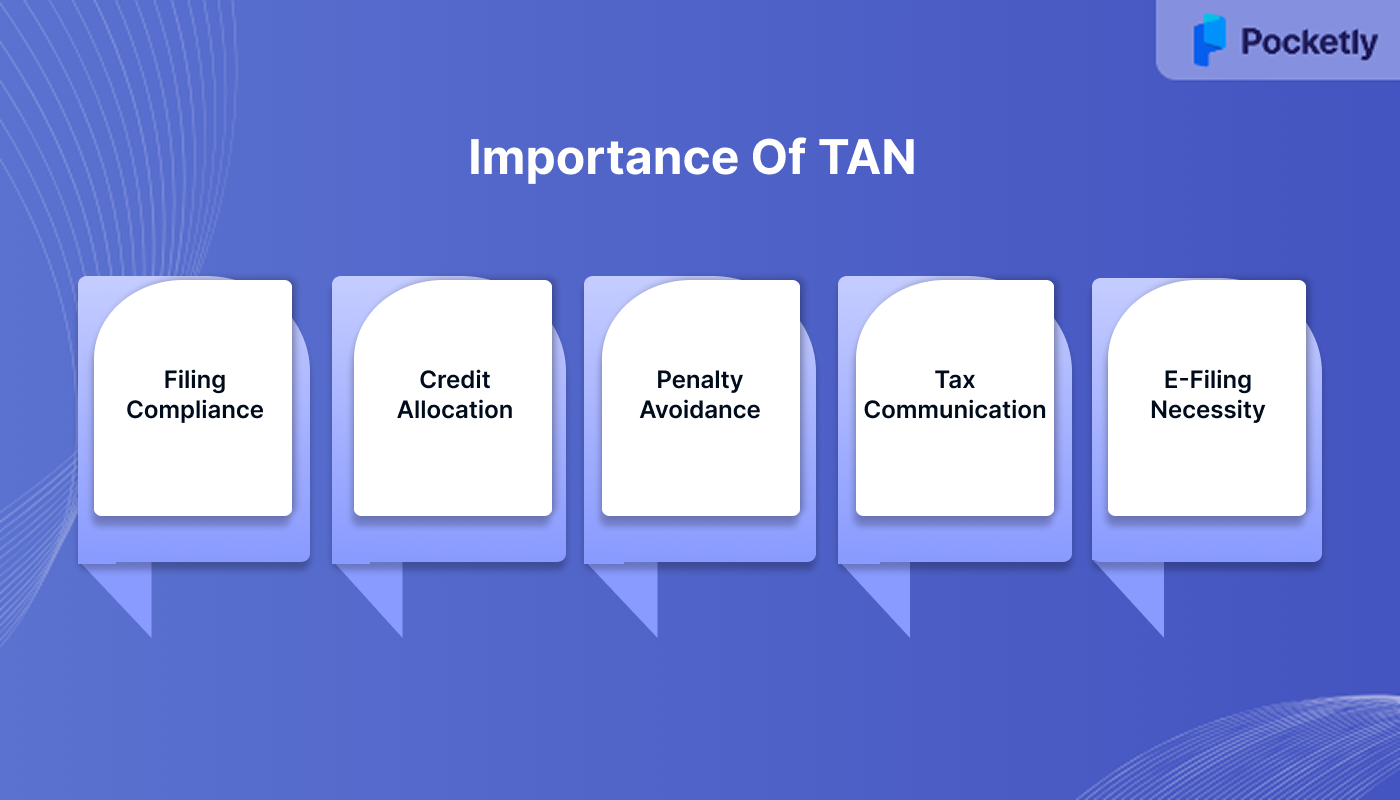

Importance Of TAN

TAN isn’t just a formal code. It acts as your official identity when you deduct or collect tax. Quoting it correctly helps the government trace transactions and ensures your tax returns go through without trouble.

Here’s why having and using your TAN matters:

Mandatory for Filing TDS/TCS Returns

You must quote a valid TAN while filing TDS or TCS returns. It’s also required on tax payment challans, certificates, and every form submitted for tax deduction or collection.

Ensures Proper Tax Credit Allocation

TAN helps link your deductions to the correct PAN holders. This ensures the tax you deduct appears in the recipient’s account and avoids mismatch or credit issues during return processing.

Avoids Penalties and Notices

Failing to quote TAN, or quoting it incorrectly, can lead to a penalty of ₹10,000 as per Section 272B. It may also trigger compliance notices from the Income Tax Department.

Smooth Communication with Tax Authorities

TAN acts as a reference for all official communication with the Income Tax Department. It helps track submissions, resolve queries, and manage correspondence linked to tax filings or deductions.

Needed for E-Filing and Refund Claims

You need a TAN to file TDS/TCS returns online and claim refunds on excess tax deducted. Without it, refund processing and digital compliance become difficult and time-consuming.

Skipping your TAN may not seem like a big deal until returns fail, refunds stall, or penalties show up. Here’s what happens when it’s missing from your filings.

What Happens If TAN Is Not Quoted?

Leaving out your TAN while filing returns comes with real consequences. The Income Tax Department treats it as a compliance issue and may not process your TDS or TCS filings.

If you don’t apply for a TAN or quote the wrong one, you could face a penalty of up to ₹10,000 under Section 272B or 272BB of the Income Tax Act. It also increases the risk of refund delays, notices, and unnecessary back-and-forth with the tax department.

So, how do you apply for a TAN and make sure your records stay compliant? Let’s look at the process.

How To Apply For The TAN Application Process?

Applying for a TAN is simple and doesn’t require much documentation. You can choose either the online or offline method, based on your comfort level.

In both cases, you’ll need to fill out Form 49B, verify your details, and pay the application fee. The Income Tax Department will then issue your TAN, usually through NSDL.

Online Application

Applying for TAN online is straightforward. Here’s how to do it:

- Visit the Official NSDL Website: Go to the NSDL TIN website to start the process.

- Fill out the Form: Complete the online form with the necessary details. This will include basic information such as your name, address, and type of deductor.

- Submit the Form: After filling out Form 49B, submit it online. You will receive an acknowledgement number upon submission.

- Payment: Pay the processing fee online via net banking, debit card, or credit card.

- Acknowledge Receipt: Print the acknowledgement page, sign it, and send it to NSDL with the necessary documents.

Once your application is verified, you will be allotted the TAN and NSDL will send the details to your registered address or email.

Tip: Don’t forget to preserve your acknowledgement page until your TAN is issued.

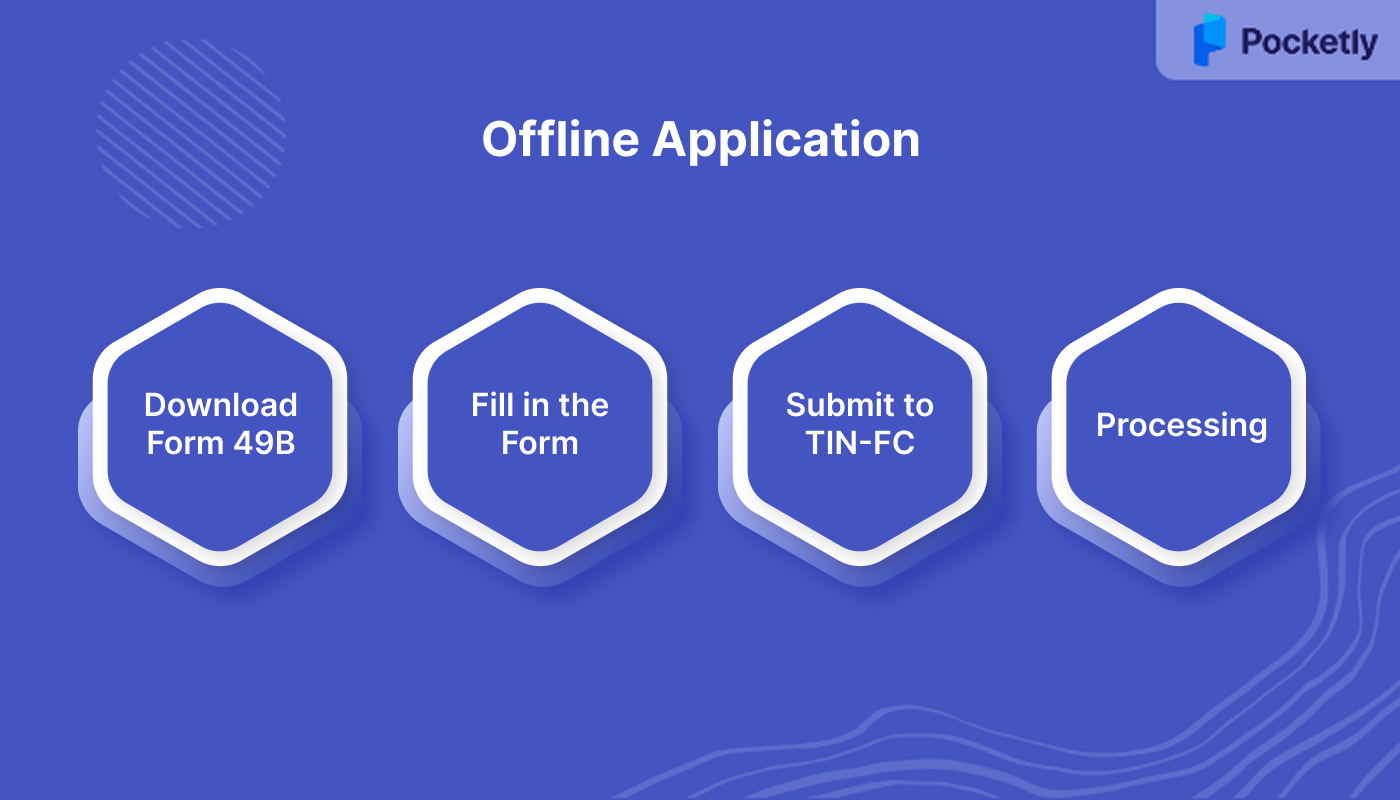

Offline Application

If you're not comfortable with online procedures, you can also apply offline by going to your nearest TIN-Facilitation Centre (TIN-FC). Here’s how:

- Download Form 49B: You can download Form 49B (application for TAN) from the official website or obtain it from any TIN-Facilitation Centre (TIN-FC).

- Fill in the Form: Complete all the details in the form. Ensure that there are no errors, as this can delay the processing.

- Submit to TIN-FC: Submit the filled-out form to the nearest TIN-Facilitation Centre along with the processing fee.

- Processing: Once submitted, the TIN-FC will process your application and send your TAN details to your registered address.

TAN Application Processing Fee

The processing fee for applying for a Tax Deduction Account Number (TAN) is ₹77. This includes a ₹65 application charge and ₹12 for Goods and Services Tax (GST).

Payments are accepted online via net banking, debit/credit cards, or offline through demand drafts or cheques. This amount is uniform across India, regardless of your application mode or location.

Check The Status

Once you've applied for a TAN, you'll receive a 14-digit acknowledgement number on the confirmation page. You can use this number to track the status of your application online.

To check the status:

Visit the NSDL-TIN official portal and select the ‘TAN’ option. Then click on ‘Know Status of Application’. Choose your applicant type, enter the acknowledgement number, and fill in the captcha shown on screen. Select ‘Submit’ to view the current status of your application. This helps you confirm whether your TAN has been issued or is still in process.

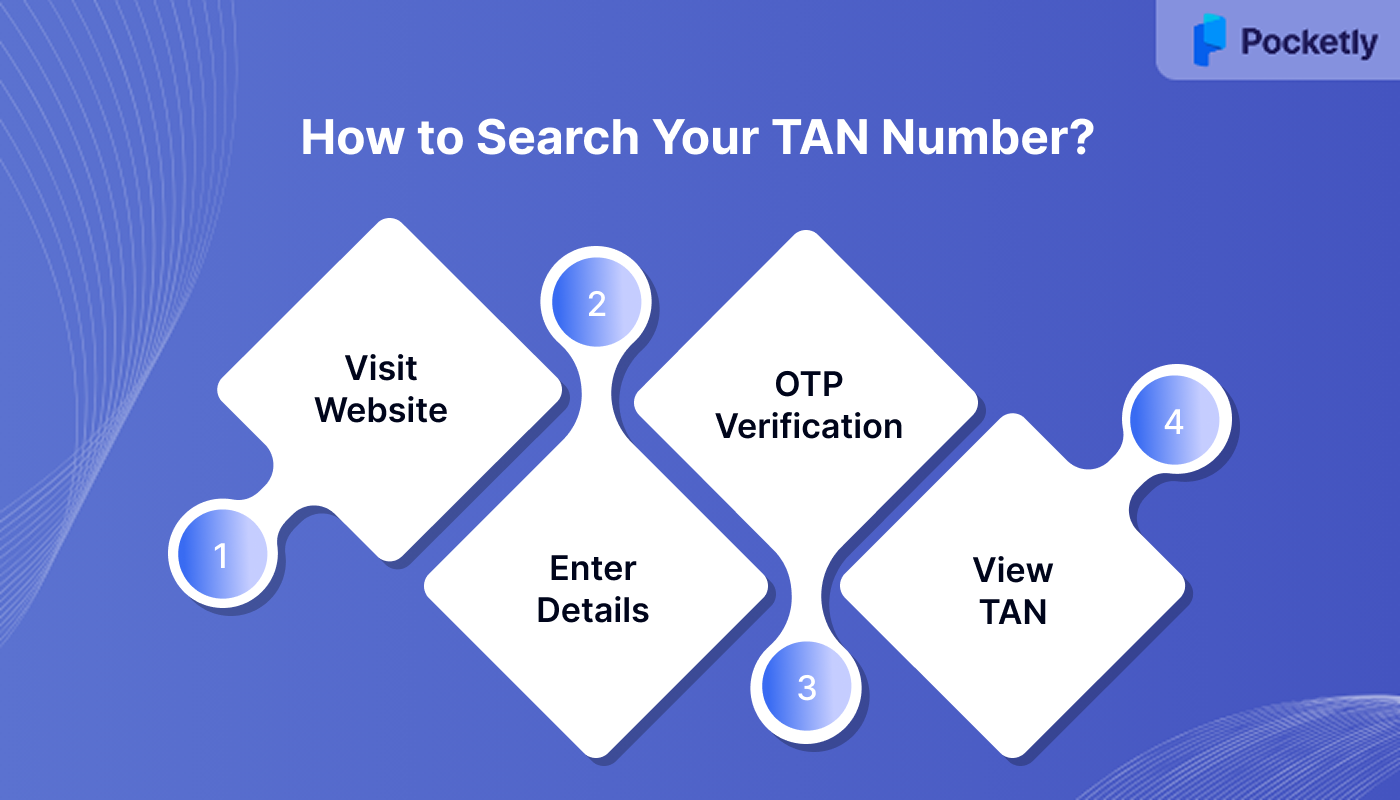

How to Search Your TAN Number?

If you've lost or forgotten your TAN, you don’t need to panic. The Income Tax Department’s e-filing portal allows you to search and retrieve TAN details quickly.

Step 1: Visit the Official Website

Start by visiting the Income Tax Department's official website. Look for the ‘Know your TAN’ option under the 'Quick Links' section on the homepage.

Step 2: Enter Required Details

Next, select the category of deductor and enter the deductor's name, state, and your registered mobile number. This helps refine the search results to the correct TAN.

Step 3: OTP Verification

Once you've entered the necessary details, click on ‘Continue’. An OTP will be sent to your registered mobile number for verification. Enter the OTP in the given field to proceed.

Step 4: View TAN Details

After successfully verifying the OTP, a list of matching records will be displayed. Click on the relevant TAN from the list to view the complete details, including the deductor's information.

By following these simple steps, you can easily retrieve your TAN details and ensure your tax compliance remains on track.

Pocketly: Quick Loans to Support Your Tax Journey

When you’re managing your financial journey, whether it’s applying for a TAN or seeking instant funds, Pocketly can be your go-to solution. As a digital lending platform, Pocketly offers short-term loans, ideal for students, salaried professionals, and self-employed individuals.

While TAN is essential for tax compliance, your financial needs are just as well-managed with this platform. The application process is fast, simple, and entirely digital, with no collateral or physical documents required. With a streamlined KYC process and 24/7 customer support, you can access funds quickly and easily, whenever you need them.

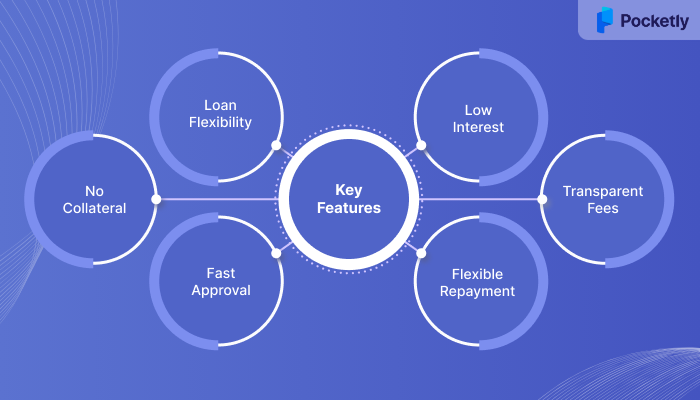

Key Features:

- Flexible Loan Amounts: Borrow anywhere between ₹1,000 to ₹25,000 based on your needs.

- No Collateral Required: Unlike traditional banks, Pocketly doesn't ask for any security against the loan, making it easier to get access to funds.

- Quick Approval and Instant Disbursal: Loans are approved swiftly, and the funds are transferred directly into your bank account, often within minutes.

- Low Interest Rates: Interest rates start as low as 2% per month, with no hidden charges or annual fees.

- Transparent Charges: A processing fee of 1% to 8% applies based on the loan amount.

- Flexible Repayment Options: You can repay the loan in flexible EMI plans, from 1 to 6 months, to fit your financial situation.

How To Apply For A Loan?

To get started, simply download the Pocketly app from the Play Store or App Store. Register using your basic details, complete the quick KYC process, and select your loan amount and tenure. Once verified, the amount will be transferred directly to your bank account.

So, as you get your TAN to stay tax-compliant, keep Pocketly in mind for times when expenses come knocking early.

Conclusion

Now that you know a TAN card’s full form, its structure, and how it applies, staying tax-compliant should feel a lot simpler. Your TAN links every TDS or TCS payment back to you as the deductor. Without it, even accurate tax filings can fall through the cracks.

If you're responsible for issuing TDS certificates or filing returns, quoting your TAN becomes essential. It keeps your filings traceable, compliant, and free from unnecessary delays or penalties.

As you take charge of your tax responsibilities, it’s also smart to stay ready for unexpected expenses. And when things get tight, because they do, Pocketly can give you the breathing room you need.

Download the Pocketly app on Android or iOS and get access to quick, short-term loans, made just for young go-getters like you.

FAQ’s

Are PAN and TAN the same?

No, PAN and TAN serve different purposes. PAN (Permanent Account Number) is for identifying taxpayers, while TAN (Tax Deduction and Collection Account Number) is specifically for entities deducting or collecting tax at source.

Why is a TAN number required?

A TAN is mandatory for anyone responsible for deducting or collecting tax at source. It helps the Income Tax Department track tax deductions and ensures compliance with tax laws, avoiding penalties for incorrect or missing TAN quotes.

How to download the TAN certificate?

You can download your TAN certificate by visiting the Income Tax Department’s e-filing portal. After logging in, use the ‘Know Your TAN’ option and enter the required details to access and download your certificate.

How many days does it take to get a TAN number?

Typically, the TAN number is issued within 7 to 10 working days after submitting a complete application and the required fees. Online applications may be processed faster, but delivery times depend on verification and postal services.

Can I get TAN from PAN?

No, you cannot get a TAN directly from a PAN. However, you can log in to the Income Tax Department website, use the ‘Know Your PAN’ service, and then check the associated TAN details by entering your login credentials.