Introduction

When tax season comes around every year, most salaried people are rushed to find receipts, fill out forms, and last-minute ways to save money. But planning for taxes isn't just something you do in March; you do it all year long.

There are a few easy and legal things you can do to lower your taxable income, save more, and get more out of your money. The Indian Income Tax Act lets you get tax breaks and deductions for things like investments, health insurance, home loans, and saving for retirement. You just need to know how to use them correctly.

We'll talk about the best ways for salaried people to save money on taxes for FY 2025–26 in this blog.

At a Glance

- Don't wait until the end of the year to do it. Starting in April, plan and invest in tax-saving options to spread payments and maximise returns.

- Compare the old and new tax regimes annually based on deductions and income. Your tax bill can vary greatly with the right choice.

- To maximise savings, use the ₹1.5 lakh limit for PPF, ELSS, NPS, Life Insurance, and Home Loan Principal Repayment.

- Consider other powerful deductions like 80D (health insurance), 24(b) (home loan interest), 80E (education loan), and 80G (donations).

- Optimise HRA, LTA, meal coupons, and standard deduction to lower taxable income without investment legally.

- Tax planning is about building wealth, financial security, and peace of mind for the future, not just saving money this year.

- Consult a tax advisor or financial planner to stay compliant and maximise benefits.

What is Income Tax and How Does it Apply to Salary?

Income tax is a percentage of your annual income paid to the government. It's a major government revenue source for public services, infrastructure, healthcare, education, and more.

Salary earners have income tax deducted from their paychecks through Tax Deducted at Source. Your employer estimates your annual income, applies the tax slab, and deducts tax before crediting your salary.

Salary income includes allowances, bonuses, commissions, and perquisites (rent-free housing, car facilities, etc.). To reduce your taxable income, you can claim deductions and exemptions under the Income Tax Act, 1961.

In simple terms, taxes depend on:

- Your total annual income,

- The tax regime you choose (old or new), and

- The deductions and exemptions you claim under eligible sections.

Understanding how income tax affects your salary helps you plan, comply, and avoid overpaying.

Choose the right tax regime after understanding how your salary is taxed. Choosing between the government's old and new options can significantly impact your tax bill.

Must Read: Tax Exemptions and Benefits on Personal Loans: What to Know

Difference between Old Tax Regime and New Tax Regime (FY 2025–26)

Here’s a clear comparison between the Old Tax Regime and New Tax Regime for FY 2025–26, along with tips on when each might be more beneficial:

| Feature | Old Tax Regime | New Tax Regime |

| Tax slabs & rates | Generally higher slab rates, but offset by deductions and exemptions | Lower slab rates but fewer deductions/exemptions |

| Deductions & Exemptions Available | Wide range: Section 80C, 80D, HRA, home loan interest under Section 24, 80E, 80G, etc. | Very limited. Only specific exemptions like standard deduction, 87A rebate, certain allowances, etc. |

| Standard Deduction | ₹50,000 | ₹75,000 |

| Rebate u/s 87A | For incomes up to ₹5 lakh (in the old regime) | Extended to incomes up to ₹12 lakh under the new regime (i.e., for FY 2025–26) |

| Home Loan Interest (self-occupied) | Deductible up to ₹2 lakh under Section 24 | Not available for self-occupied under the new regime |

| HRA & Other Allowances | Can claim HRA, LTA, transport allowance, reimbursements, etc. | Many of these exemptions are disallowed in the new regime or severely limited |

| Flexibility | Beneficial for individuals with significant deductions and expenses that qualify under various sections | Beneficial if you have minimal deductions or prefer simpler tax calculation |

| Suitability | Higher income earners who invest heavily in tax-saving instruments, pay home loan interest, etc. | Individuals with simpler financial profiles and fewer tax-saving investments |

After covering the basics, consider the best ways to lower your taxable income. Here are some of the best tax-saving tips for salaried workers.

Must Read: Understanding the Importance of Financial Education

Tax Saving Tips for Salaried Individuals

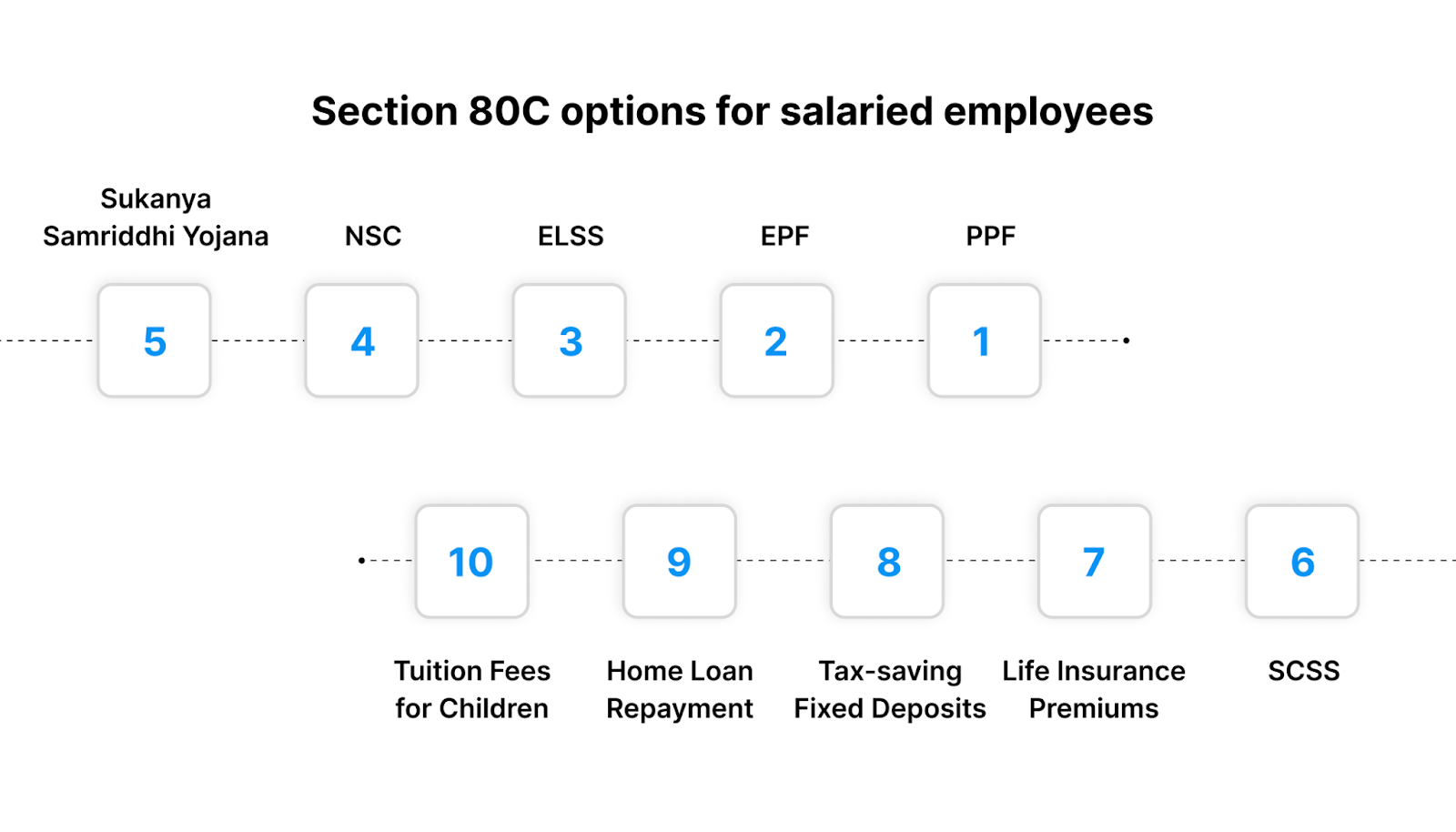

Section 80C of the Income Tax Act, 1961, is the best way for salaried workers to save taxes. Invest in approved government schemes and financial instruments to claim deductions of up to ₹1.5 lakh per financial year. These reduce taxes and encourage long-term savings.

Use Section 80C Deductions (Up to ₹1.5 Lakh)

Here are the top 10 Section 80C options for salaried employees:

- PPF (Public Provident Fund)

A reliable long-term savings option supported by the Indian government is the Public Provident Fund. It comes with a 15-year maturity period, which can be extended in blocks of five years, making it ideal for retirement planning. The minimum investment is ₹500, with a maximum annual limit of ₹1.5 lakh. The PPF has a government-declared interest rate (usually 7–8%) and is tax-free because it is Exempt-Exempt-Exempt (EEE).

- EPF (Employees Provident Fund)

The EPFO manages the EPF, a mandatory savings scheme for salaried workers. Both the employer and employee contribute 12% of the basic salary and dearness allowance monthly. The scheme has an 8.25% annual interest rate. Employee EPF contributions are tax-deductible under Section 80C, and maturity and interest are tax-free after five years of continuous service. It's one of the easiest ways to build retirement savings automatically.

- ELSS (Equity Linked Savings Scheme)

ELSSs are market-linked mutual funds that invest mostly in stocks and equity-related instruments. It generates wealth and reduces taxes. Its three-year lock-in period is the shortest among Section 80C options, and long-term returns can reach 12–18%. Deductions under Section 80C are limited to ₹1.5 lakh, while long-term capital gains above ₹1.25 lakh are taxed at 12.5%. ELSS is for moderate-to-high-risk investors who want market growth and tax savings.

- NSC (National Savings Certificate)

National Savings Certificates are government-backed fixed-income investments available at post offices. The five-year loan has a fixed interest rate of 7–8% compounded annually. Invest ₹1,000 or more, without any maximum, and receive a deduction under Section 80C. Interest is automatically reinvested every year except the last. Conservative investors seeking steady, guaranteed returns will love it because it is deductible.

- Sukanya Samriddhi Yojana

The Sukanya Samriddhi Yojana is available only to parents of girls under 10. You can invest between ₹250 and ₹1.5 lakh per year, and the account matures when the girl turns 21 years old. The scheme has one of India's highest small-savings interest rates (8.2%), and principal, interest, and maturity are tax-free. After 18, girls can withdraw partially from education. Parents who want to secure their daughter's future should consider this tax-saving and goal-oriented option.

- SCSS (Senior Citizen Savings Scheme)

For seniors 60 or older (or 55+ for voluntary retirement), the SCSS is a safe long-term investment. Investments up to ₹30 lakh are allowed for a five-year tenure, with the option to extend by three years. The scheme has a competitive quarterly interest rate of 8.2%. SCSS investments are deductible under Section 80C, but interest is taxable. Retirees seeking regular income, capital safety, and tax benefits should consider it.

- Life Insurance Premiums (with 10(10D) benefits)

Premiums for life insurance policies for yourself, spouse, or children are deductible up to ₹1.5 lakh per year under Section 80C. The maturity proceeds are tax-free under Section 10(10D) if the premium paid does not exceed 10% of the sum assured (for policies issued after April 1, 2012). Life insurance is a powerful financial tool that protects and reassures your family.

- Tax-saving Fixed Deposits

Salary earners' most traditional and low-risk option is tax-saving fixed deposits. They require a five-year lock-in and offer 6–7% interest, depending on the bank. Investments up to ₹1.5 lakh are eligible under Section 80C. Interest is taxable according to your income tax bracket. Individuals seeking tax deductions, guaranteed returns, and capital safety should consider FDs.

- Home Loan Principal Repayment

Under Section 80C, you can deduct the principal portion of your home loan EMI up to ₹1.5 lakh per financial year. In addition, Section 24(b) allows for a deduction of up to ₹2 lakh for self-occupied property interest. However, to retain the benefits, you must not sell the property within five years of taking possession. Home loans are a good way to save taxes and build wealth.

- Tuition Fees for Children

Parents can deduct tuition for up to two children in Indian schools, colleges, or universities. Only tuition, not donations or development charges, is eligible for deduction under Section 80C, up to a maximum of ₹1.5 lakh. Families looking to reduce taxable income while paying for school will benefit from this.

Must Read: What is an Instant Loan: Types, Features & Benefits

Tax Benefits Under Section 80CCD(1B) via NPS

The NPS is one of the best long-term investments for salaried workers looking to save tax and build a retirement fund. Under Section 80CCD(1B), you can deduct up to ₹50,000 beyond the ₹1.5 lakh limit under Section 80C. Investing in NPS can result in a total deduction of ₹2 lakh. NPS investments include equity, government bonds, and corporate debt for diversification and long-term growth. NPS offers flexibility and tax efficiency for early retirees.

The employer contribution to your NPS account is tax-exempt under Section 80CCD(2). Above your individual limits under Sections 80C and 80CCD(1B), you can deduct this. The limit is 14% of the government salary (Basic + DA) and 10% for others. This benefit lowers your taxable income and builds a strong retirement fund without cost.

Save on Health Insurance Premiums Under Section 80D

Health insurance is another big Section 80D tax-saving tool. Salaried individuals can deduct up to ₹25,000 for premiums paid for themselves, spouses, and dependent children. If you pay health insurance premiums for your parents, you can deduct ₹25,000 (or ₹50,000 for senior citizens).

You can claim ₹5,000 for preventive health check-ups within the limit. Senior citizen families can deduct up to ₹1 lakh per year. It protects against rising medical costs and provides tax benefits.

Claim House Rent Allowance (HRA) or Section 80GG

Under Section 10(13A), you can claim a tax exemption if you live in a rented house and receive HRA as part of your salary. Salary, rent, and city (metro or non-metro) determine the exemption amount. To claim exemption, provide rent receipts and the landlord's PAN (if rent exceeds ₹1 lakh annually).

Section 80GG lets you deduct HRA even if you're self-employed or your employer doesn't provide it. Deductible amounts include ₹60,000 per year, 25% of total income, or rent paid minus 10% of total revenue.

Claim Home Loan Interest Deduction Under Section 24(b)

Under Section 24(b), home loan interest can save you a lot of tax. Salaried individuals can deduct up to ₹2 lakh for self-occupied property. Interest deductions for rented properties are unlimited, but the total loss from house property can be adjusted against other income and is limited to ₹2 lakh. Under Sections 80EE (₹50,000) and 80EEA (₹1.5 lakh), first-time homebuyers can claim additional deductions if their property value and loan amount meet eligibility requirements.

Save Tax on Education Loan Interest Under Section 80E

Under Section 80E, you can deduct interest on higher education loans for yourself, your spouse, or your children. No upper limit on deduction amount, but benefit can be claimed for 8 years or until interest is repaid, whichever comes first. Education loans are practical and tax-efficient for Indian and international studies, thanks to this provision.

Get Deductions for Charitable Donations Under Section 80G

Contributions made to approved relief funds or charitable institutions can earn you a 50% or 100% deduction under Section 80G, depending on the organisation’s category. To qualify, donations must be made via cheque, draft, or digital mode; cash donations exceeding ₹2,000 do not qualify.

Keep proper receipts and the organisation’s PAN handy when claiming this deduction. Apart from reducing your tax liability, this also supports social causes and national welfare initiatives.

Claim Deductions on Interest Income (80TTA/80TTB)

Tax relief is available for savings account interest. Non-senior citizens can deduct up to ₹10,000 from savings account interest under Section 80TTA. Section 80TTB offers a ₹50,000 deduction limit for senior citizens, including fixed deposit interest. Small but useful deductions can help salaried workers save and lower their taxable income.

Use the Section 87A Rebate (New Tax Regime Benefit)

Section 87A gives low-income taxpayers a full tax rebate, reducing their tax liability to zero. Individuals with taxable income up to ₹7 lakh under the new tax regime are eligible for this rebate in FY 2024-25. Increased to ₹12 lakh in FY 2025–26, those earning up to this amount are no longer subject to tax liability. Middle-income salaried workers with fewer deductions benefit greatly.

Maximize Exemptions Through Allowances and Perks

Salaried workers can save tax by maximising employer-provided tax-free allowances and reimbursements. The standard deduction has been raised to ₹75,000 for FY 2025-26. Examples of exemptions include domestic travel LTA, meal coupons, mobile/Internet reimbursements, and a ₹3,200/month transport allowance for disabled employees. To reduce taxable income without investment, incorporate these components into your salary.

Restructure Your Salary for Maximum Tax Benefits

Legally reducing taxes through salary restructuring is smart. Work with your employer to include tax-free HRA, LTA, gratuity, employer EPF/NPS contributions, and conveyance or communication reimbursements. This maximises take-home pay and ensures tax compliance. Salary structuring can significantly reduce annual tax outgo for high earners.

Tax-Saving for Young Professionals

Young earners can maximise savings by investing early in ELSS, NPS, and SIPs. If your income is below the taxable limit, filing an Income Tax Return (ITR) helps prove income, claim refunds, and build credit. Early tax planning instils financial discipline and prepares you for future tax obligations as your income grows.

Tax-Saving for Entrepreneurs & Freelancers

Private Limited Companies and LLPs are better tax structures for entrepreneurs and freelancers. Sections 80C, 80D, and 44AD allow small businesses with a turnover up to ₹2 crore to claim deductions, simplifying tax filing. They can use GST's Input Tax Credit (ITC) to offset purchase taxes against sales taxes. Salaries to family members in business operations are another legal way to reduce taxable profit and preserve family wealth.

Must Read: Understanding KYC: Meaning, Importance and Various Types

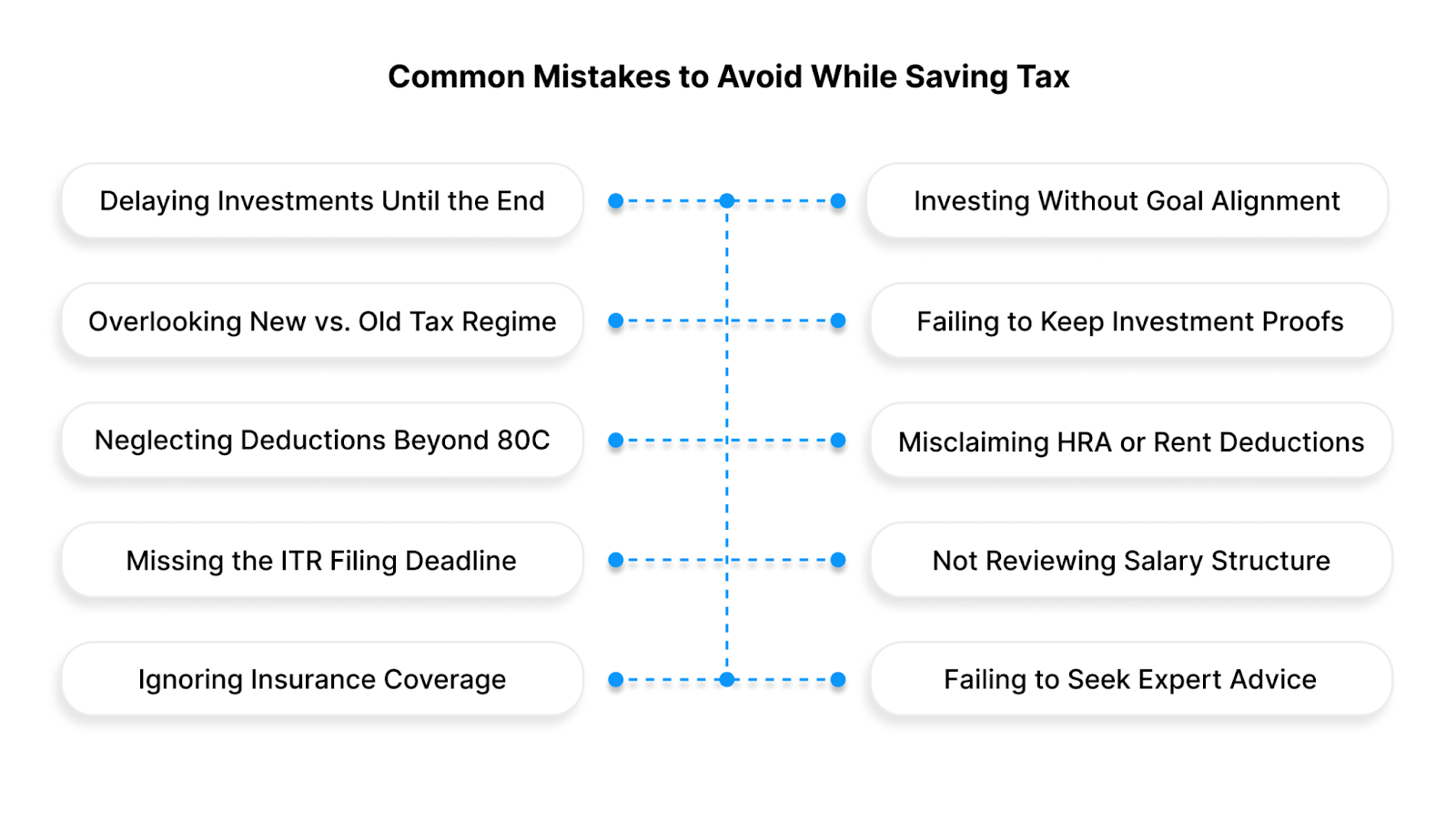

Common Mistakes to Avoid While Saving Tax

Financial planning requires tax-saving, but many salaried people make mistakes that reduce their savings or incur penalties. Understanding these common financial mistakes can help you make better, more compliant decisions.

Alt text: Common Mistakes to Avoid While Saving Tax

1. Waiting Until the Last Minute to Invest

One of the biggest mistakes is starting tax-saving investments late in the year. This causes hasty decisions, poor fund selection, and missed returns. Instead, invest early, preferably at the start of the year. This improves planning, spreads financial burdens, and lets investments grow.

2. Investing Without Aligning to Financial Goals

Many people buy tax-saving instruments to lower their taxes without considering their financial goals or risk tolerance. For example, high-risk ELSS funds may not be suitable for short-term liquidity. Always link tax-saving investments to long-term goals like retirement, education, or home ownership to maximise tax savings.

3. Ignoring the New vs. Old Tax Regime Comparison

With the new tax regime, salaried individuals can choose between the old regime with exemptions and deductions or the new regime with lower tax rates but no deductions. Many taxpayers overpay because they don't compare the two. An online tax calculator or tax professional can help you determine which regime is best for your income and deductions each year.

4. Not Keeping Proper Investment Proofs

Investment receipts, rent receipts, insurance premium statements, and donation certificates are essential for tax deductions. Submitting these proofs late to your employer may increase TDS deductions. Organise your tax documents year-round and keep digital copies for filing season.

5. Overlooking Deductions Beyond Section 80C

Most taxpayers are aware of the ₹1.5 lakh limit under Section 80C, but overlook useful deductions like 80D (health insurance), 80CCD(1B) (NPS), 24(b) (home loan interest), and 80E (education loan interest). If planned well, these extra sections can save you a lot. Only focusing on 80C means missing out on tax benefits.

6. Not Claiming HRA or Rent Deductions Properly

Employees often forget to claim House Rent Allowance (HRA) or provide incomplete details, such as missing landlord PAN or rent receipts. Non-HRA recipients don't claim Section 80GG benefits. Make sure you calculate and submit your HRA exemption correctly to avoid losing this valuable deduction.

7. Missing the ITR Filing Deadline

Late Income Tax Returns (ITRs) can result in Section 234F penalties and interest. You also lose deductions and loss carryover. Salaried individuals must file early and double-check their information by July 31 of each assessment year.

8. Not Reviewing Salary Structure

Many salaried individuals overlook the tax-saving potential within their salary structure itself. Failing to optimise allowances such as HRA, LTA, meal coupons, and reimbursements can lead to unnecessary taxes. Discuss with your HR or employer to restructure your salary components in a way that maximises exemptions and take-home pay.

9. Ignoring Health and Life Insurance Coverage

Only seeing health or life insurance as a tax-saving tool, some employees skip it. These are essential to financial security. Saving becomes pointless without adequate coverage, as emergency expenses could exceed your budget. Take advantage of Sections 80C and 80D tax benefits by making sure your family's insurance coverage matches their needs.

10. Failing to Seek Expert Advice

Tax laws evolve frequently, and what worked last year may not apply this year. Relying solely on word-of-mouth advice or outdated information can lead to compliance errors. When in doubt, consult a qualified tax professional who can help you make the most of available deductions and stay aligned with the latest tax reforms.

Of course, effective tax planning goes hand-in-hand with good money management. That’s where tools like Pocketly can make your financial journey simpler.

Must Read: Explaining the Vital and Positive Role of Credit with Examples

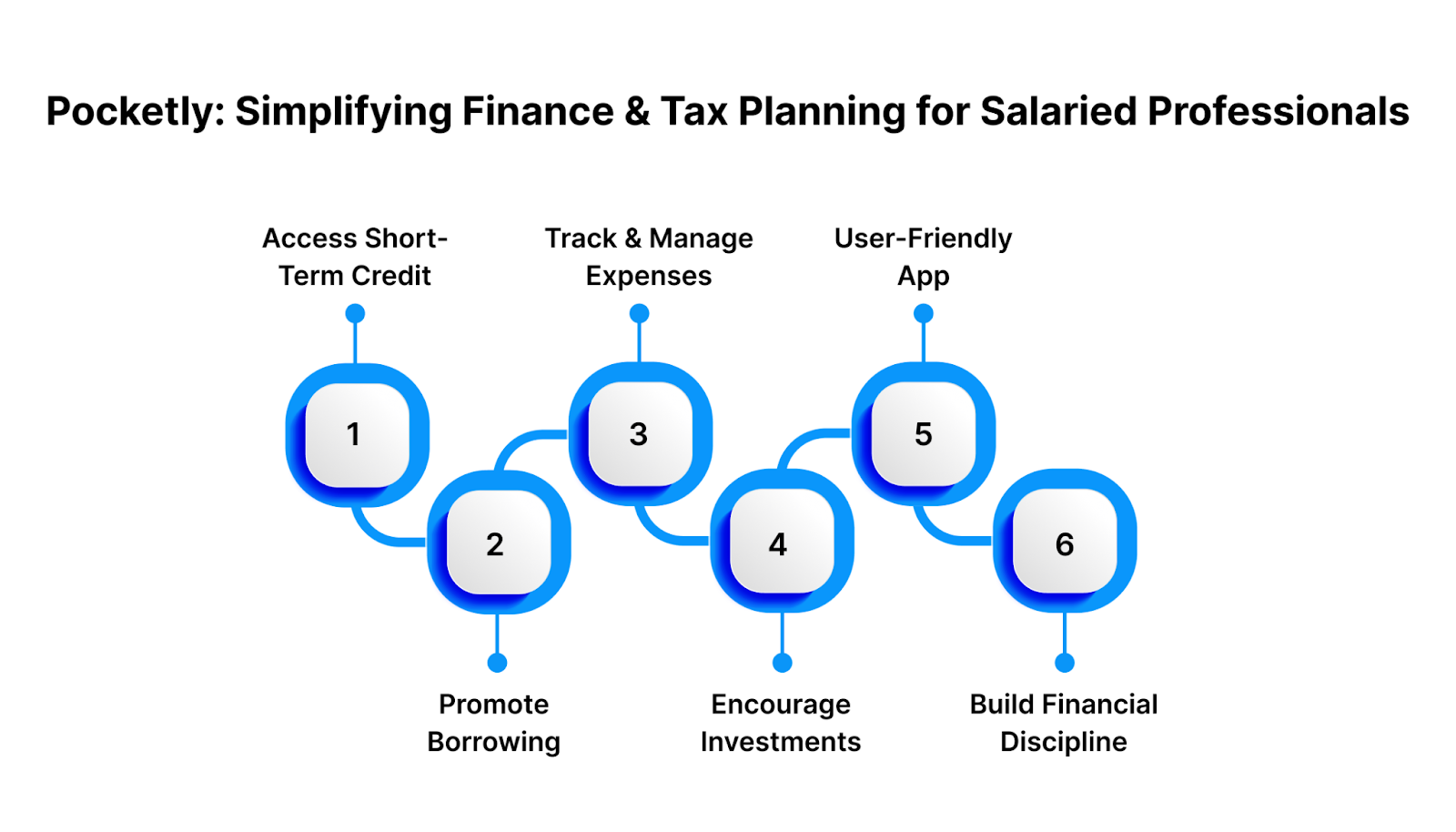

Pocketly: Simplifying Finance and Smarter Tax Planning for Salaried Professionals

Pocketly helps salaried individuals manage their finances with ease while encouraging smarter money habits and tax-efficient decisions. Here’s how it can support your financial journey:

- Access Instant Short-Term Credit: Get quick, hassle-free access to funds during emergencies without lengthy paperwork or hidden charges.

- Promote Responsible Borrowing: Build a strong repayment history that improves your credit score and financial credibility over time.

- Track and Manage Expenses: Monitor where your money goes each month, helping you plan savings and identify opportunities for tax-efficient spending.

- Encourage Smarter Investments: By managing short-term credit better, you can free up funds for long-term investments like ELSS, NPS, or health insurance, which offer tax benefits.

- Transparent and User-Friendly App: Enjoy a seamless digital experience with complete clarity on repayment terms and interest rates.

- Build Financial Discipline: Pocketly empowers you to form consistent money habits, spend mindfully, borrow wisely, and invest regularly.

Now that we’ve covered the most practical tax-saving strategies and financial tools, let’s sum it all up and see how you can take action right away.

Conclusion

Saving tax is about financial discipline and future security, not just lowering your annual liability. By using deductions wisely, investing in NPS or ELSS, and sticking to your plan, you can maximise every rupee. A solid tax-saving strategy gives you stability, peace of mind, and long-term wealth growth, whether you're starting or managing multiple financial goals.

Early planning, the right investment mix, and tax compliance are key. You can achieve financial freedom by aligning your tax-saving strategy with your life goals.

Prepared to manage your finances and simplify tax planning? Start smart financial planning with Pocketly today.

Download Pocketly on Android or iOS to easily manage short-term credit, build responsible financial habits, and track your money.

FAQs

1. What are the best tax-saving options for salaried individuals in India?

The best tax-saving options are ELSS mutual funds, PPF, NPS, health insurance premiums (Section 80D), home loan interest (Section 24), and donations (Section 80G). HRA and LTA are also available depending on your salary structure.

2. Which is better — the old tax regime or the new tax regime?

Depends on income and deductions. The old regime allows deductions and exemptions (80C, 80D, HRA, etc.), while the new regime has lower tax rates but few deductions. For large tax-saving investments, the old regime may be better. If you prefer a simpler system and don't deduct much, the new regime may lower your tax burden.

3. How much tax can I save under Section 80C?

Under Section 80C, you can claim deductions up to ₹1.5 lakh per financial year. Eligible investments include ELSS, PPF, EPF, life insurance premiums, NSC, Sukanya Samriddhi Yojana, and home loan principal repayments.

4. Can I save tax without making new investments?

Yes. You can still reduce your taxable income through existing expenses and benefits like HRA, standard deduction, education loan interest (80E), or health insurance premiums (80D). Even if you don’t invest in new schemes, these existing deductions can help you save tax legally.

5. How can I plan my taxes better for next year?

The beginning of the financial year is best. Instead of investing in March, review both tax regimes, calculate deductions, and invest gradually. Track spending, plan investments, and save taxes with Pocketly's financial insights.