Monthly subscriptions like Netflix, Spotify, gym memberships, and cloud storage are part of everyday life for many young Indians. A common question is whether these payments can help build or improve your credit score.

The short answer: Not directly. In India, paying for subscriptions like Netflix or Spotify doesn’t automatically impact your credit score. However, if you pay these through credit cards or Buy Now, Pay Later (BNPL) services, and consistently pay on time, this can strengthen your credit history, which is a key factor in determining your score.

Your payment history makes up the largest portion of your credit score, so timely repayments are crucial. Responsible use of credit products for subscriptions can lead to a better score and open doors to better financial opportunities.

In this article, we will explore how to optimise your subscriptions for credit-building and find short-term financial solutions to help you achieve your goal.

Quick Glance

- Monthly subscriptions like Netflix, Spotify, and gym memberships do not directly build credit. However, using credit cards or Buy Now, Pay Later (BNPL) services for these payments can contribute positively to your credit history if paid on time.

- Payment history is the most important factor in determining your credit score, and consistent, on-time payments for subscriptions via credit products can improve your score.

- Using credit cards for subscriptions and BNPL services that report to credit bureaus helps build a positive payment history, which is crucial for credit score improvement.

- Auto-pay for bills can help ensure timely payments, which supports credit-building. Canceling auto-pay won’t hurt your score unless it leads to missed payments.

- To boost your credit score, focus on on-time payments, maintaining low credit utilization, and keeping a longer credit history. Tools like Pocketly can help cover short-term cash gaps to ensure you never miss a payment and keep your credit history on track.

Why Having a Good Credit Score Matters

In India, your credit score, also known as the CIBIL score, is a three-digit number ranging from 300 to 900. This score is used by lenders to assess your creditworthiness when applying for loans or credit cards. A higher score indicates a lower risk to the lender, while a lower score suggests you may be a higher-risk borrower.

In India, your credit score, also known as the CIBIL score, is a three-digit number ranging from 300 to 900. This score is used by lenders to assess your creditworthiness when applying for loans or credit cards. A higher score indicates a lower risk to the lender, while a lower score suggests you may be a higher-risk borrower.

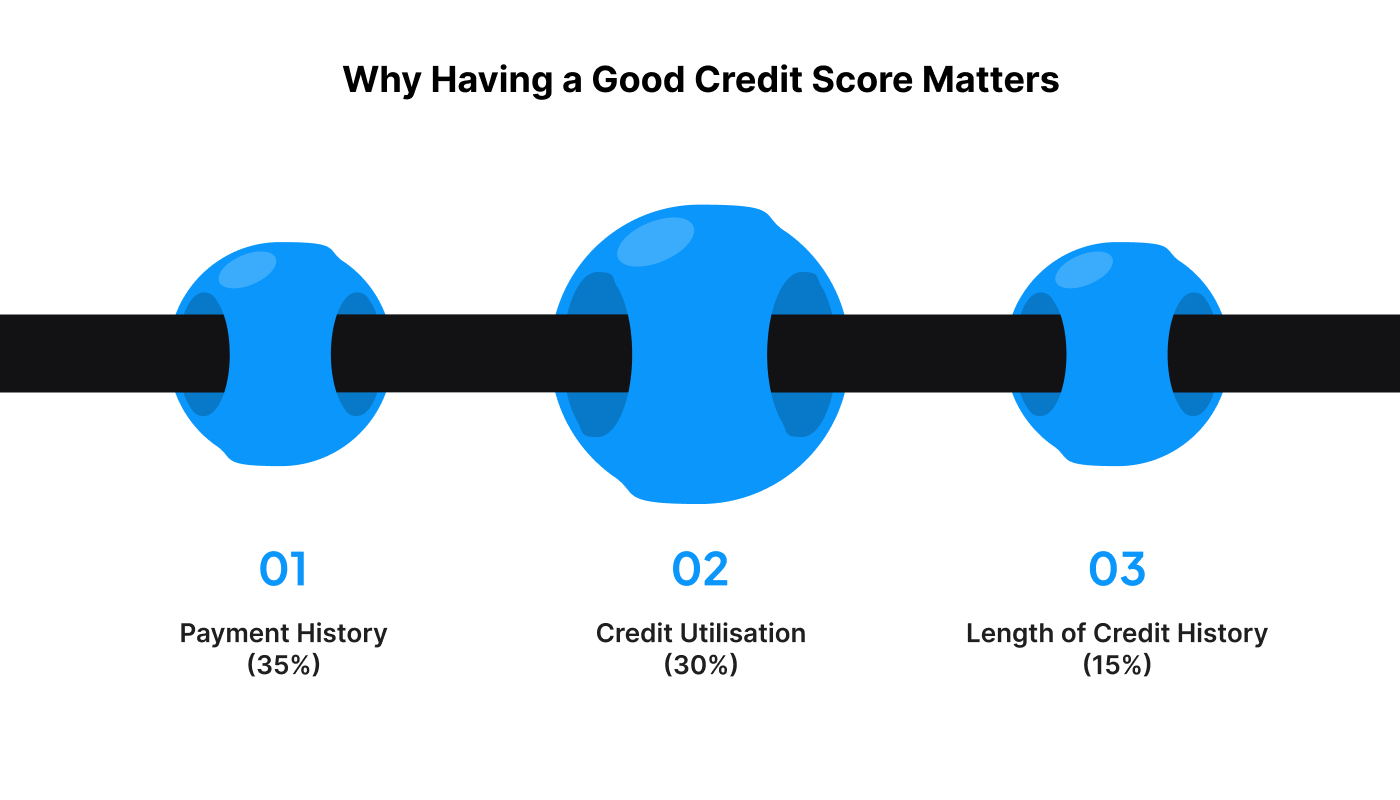

Key Components of a Credit Score:

- Payment History (35%): This is the most important factor, accounting for the majority of your score. Timely payments on loans, credit cards, and bills directly impact your score. The more consistent you are with your payments, the better your score will be.

- Credit Utilisation (30%): This refers to how much of your available credit you're using. If you're using a large percentage of your credit limit, it can negatively impact your score. Ideally, you should aim to use less than 30% of your available credit to keep your score healthy.

- Length of Credit History (15%): A longer credit history shows lenders how responsible you’ve been with managing credit over time. This means it’s better to keep old credit accounts open, even if you're not using them actively.

Now that we understand what a credit score is and the key factors that influence it, let’s dive into how monthly subscriptions can play a role in improving your credit history.

Suggested read: How to Download and Check Your CIBIL Report Online

Do Monthly Subscriptions Directly Build Your Credit Score?

Most monthly subscription services, such as Netflix, Spotify, and various apps, do not automatically report payments to credit bureaus. This means that paying for these services does not directly impact your credit score.

Most monthly subscription services, such as Netflix, Spotify, and various apps, do not automatically report payments to credit bureaus. This means that paying for these services does not directly impact your credit score.

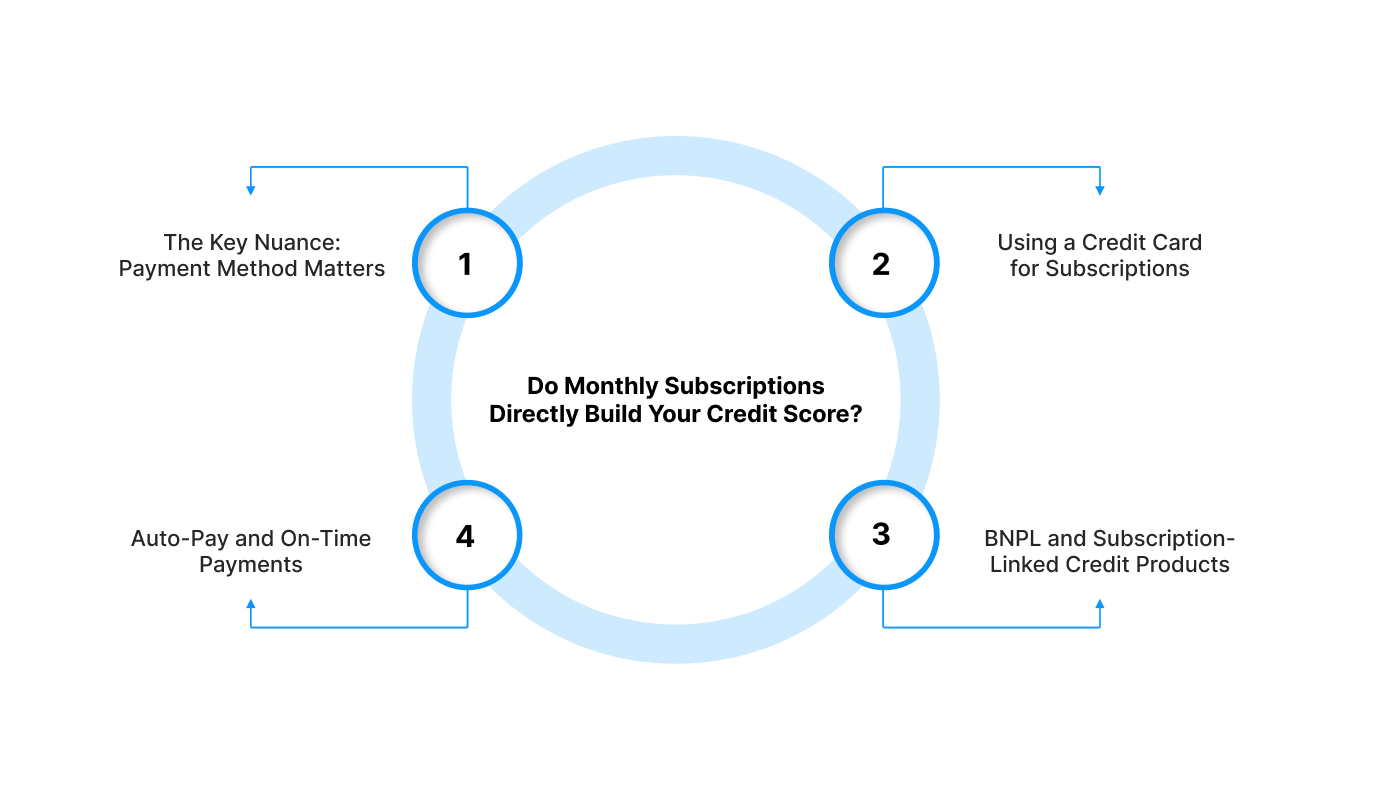

The Key Nuance: Payment Method Matters

What truly matters is the payment method used. If you’re paying for subscriptions with a credit card or Buy Now, Pay Later (BNPL) service, and the provider reports to credit bureaus, these payments can have a positive effect on your credit history.

Timely payments made through these methods contribute to your payment history, which is the largest factor in calculating your credit score. Responsible use of credit products for subscription payments can thus improve your credit history over time.

Using a Credit Card for Subscriptions

When you use a credit card to pay for subscriptions like Netflix or Spotify, and consistently pay your credit card bill on time, it builds a positive payment history.

For early-career users and young professionals, using small, recurring payments like subscriptions is a great way to demonstrate financial responsibility. By maintaining consistent payments, you’re showing lenders that you can manage credit wisely, even with small amounts.

BNPL and Subscription-Linked Credit Products

Some Buy Now, Pay Later (BNPL) plans or subscription-linked credit products may be reported to credit bureaus, if the provider reports this data. In these cases, your timely repayments will contribute positively to your credit history.

However, it’s important to manage BNPL products carefully. Late or missed payments can seriously damage your credit score, especially since they tend to have higher interest rates and more strict repayment schedules. Always make sure you can repay the full amount before using BNPL for subscriptions.

Auto-Pay and On-Time Payments to Build Consistency

Setting up auto-pay for your credit card or subscription bills ensures that you never miss a payment. By automating your payments, you can easily build consistency in your payment history, which is a key factor in improving your credit score.

That said, canceling autopay for your subscriptions won’t hurt your credit score on its own, but missing a payment can have a negative impact. Therefore, it's important to either maintain auto-pay or manually ensure that payments are made on time to avoid any gaps in your credit history.

While using credit instruments for subscription payments can help improve your credit history, there are other key habits and strategies to focus on for stronger and more sustainable credit building.

Also Read: Getting A Personal Loan without CIBIL and Income Proof Online.

Other Ways to Improve Your Credit Score

In addition to using subscription payments responsibly, there are several other strategies you can implement to strengthen your credit score over time. Here are some ways:

Keep Credit Utilisation Low

Your credit utilisation ratio (the percentage of your available credit that you use) plays a big role in your credit score. It’s recommended to use less than 30% of your available credit limit at any time.

A lower credit utilisation ratio signals to lenders that you manage credit responsibly and don’t rely too heavily on borrowed money. For example, if you have a credit limit of ₹50,000, try to keep your outstanding balance below ₹15,000. This demonstrates that you are not overburdening yourself with debt.

Maintain a Longer Credit History

A longer credit history provides lenders with more data to assess your creditworthiness. The longer you’ve been using credit responsibly, the more confident lenders will be in your ability to manage debt. Therefore, it’s advisable to keep older credit accounts open, even if you’re not using them frequently.

Closing old accounts may shorten your credit history and negatively impact your score, so maintaining a diverse mix of older accounts can help strengthen your credit profile.

With these strategies in mind, let’s explore how to monitor and build your credit score more actively, keeping you on the right track to financial success.

Also Read: Top 10 Tips to Spend and Save Money Wisely

How to Monitor and Track Your Credit Growth

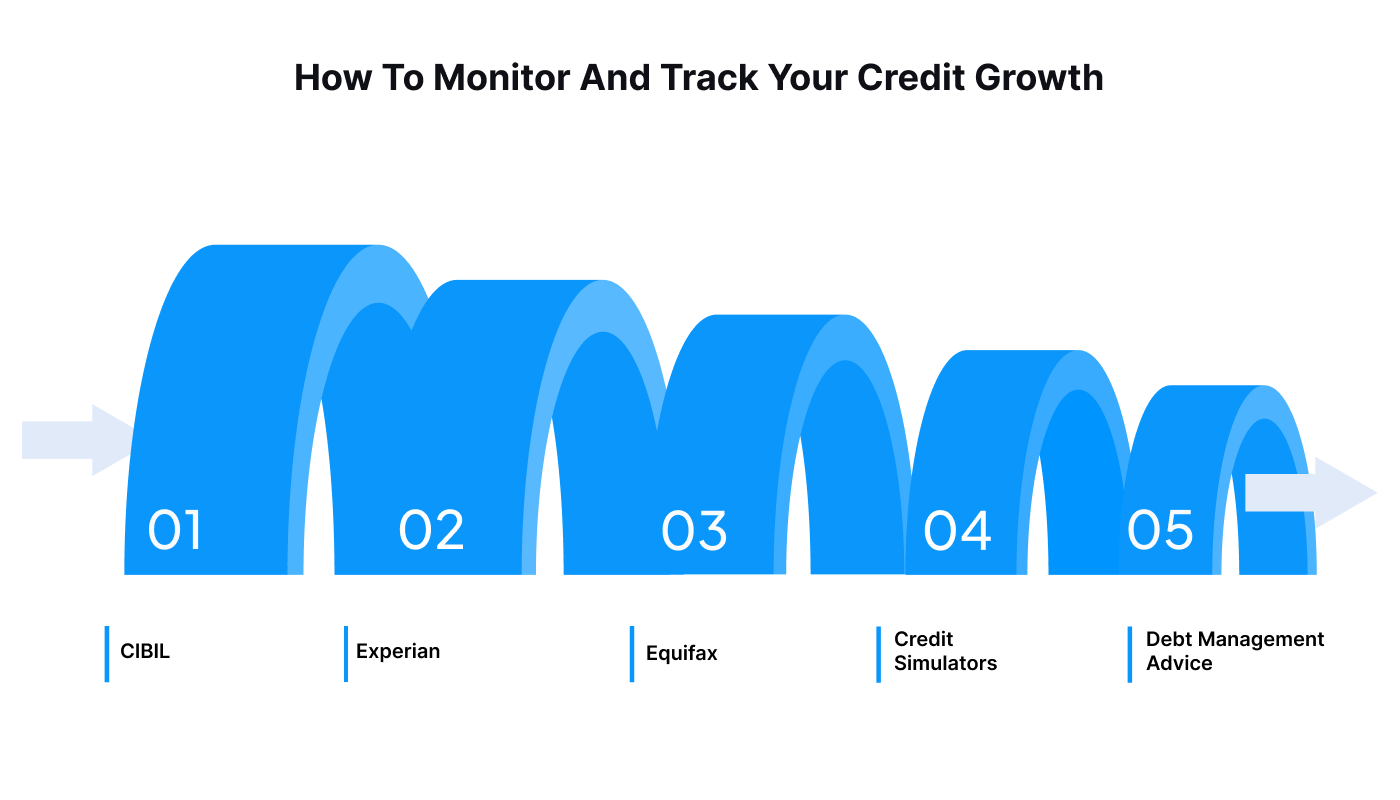

Monitoring your credit growth is key to managing your finances and improving your credit score. Regular tracking allows you to understand your credit position, spot any issues early, and take proactive steps to ensure financial stability. Here's how you can effectively monitor and track your credit score:

Monitoring your credit growth is key to managing your finances and improving your credit score. Regular tracking allows you to understand your credit position, spot any issues early, and take proactive steps to ensure financial stability. Here's how you can effectively monitor and track your credit score:

Credit Score Monitoring Platforms (Paid/Premium)

These platforms give you real-time insights into your credit profile, tracking key metrics like credit score changes, payment history, and credit utilisation. They help you stay informed about your financial health.

- CIBIL: One of India’s most popular credit monitoring tools, CIBIL provides full credit reports and tracks changes in your credit score. You can also access your CIBIL score on a regular basis, with alerts for significant changes.

- Experian: Another well-known credit monitoring platform, offering comprehensive credit reports and score tracking. It also offers credit score simulators to help you understand the potential impact of your actions on your score.

- Equifax: Provides regular access to your credit reports and score, along with insights into how to improve your score.

Some platforms also offer tools and services to actively improve your score by providing insights into specific areas that need attention. For example:

- Credit Simulators: Tools like Experian’s credit simulator allow you to see how different actions (like paying off debt or increasing credit limits) will affect your score.

- Debt Management Advice: Some services give personalized advice on how to manage or consolidate debt to lower your credit utilisation.

These are valuable for anyone looking to take a more active approach to improving their credit score.

Free Credit Score Monitoring Platforms

Many platforms offer one-time free credit reports or allow you to check your score a few times a year. Apps like Credit Mantri, BankBazaar, and Credit Karma are all great examples of free platforms where you can regularly track your credit score. These tools are especially useful for students, young professionals, or anyone looking to stay on top of their financial health without spending extra money.

Regular monitoring helps you stay mindful of your credit utilisation, payment history, and other key factors that determine your score.

Now let’s look at a smart way to manage finances when cash flow gets tight, without harming your credit behaviour.

Also Read: How to Manage Monthly Expenses Smartly in 2025

How Pocketly Helps Support Your Credit Journey

Managing your credit and finances can be difficult, especially when you're balancing monthly subscriptions like Netflix, Spotify, or gym memberships with your other financial commitments. Even with timely payments, unexpected cash gaps can occur, whether due to a missed paycheck or an emergency.

This is where Pocketly comes in, a digital lending platform providing a flexible solution to ensure that you never miss a subscription payment or bill, helping you maintain a healthy credit score.

Here’s how Pocketly can support your credit journey:

- Quick Access to Short-Term Funds: Pocketly offers instant loans ranging from ₹1,000 to ₹25,000. Use these funds to cover urgent subscription payments or other unexpected expenses, preventing missed payments and the negative impact on your credit score.

- Simple and Fast Process: The entire process is online, with no collateral required. Complete a quick KYC, get instant approval, and receive funds directly into your bank account.

- Responsible Use and On-Time Repayment: With interest rates starting at 2% per month and transparent processing fees (1%-8%), Pocketly gives you the flexibility to borrow only when needed and make on-time repayments, which is crucial for improving your credit score.

Download the Pocketly app today for quick, flexible financial support. Manage your monthly subscriptions and ensure your credit history stays on track!

Conclusion

While monthly subscriptions alone do not directly impact your credit score, paying them through credit instruments like credit cards or Buy Now, Pay Later (BNPL) services can positively affect your payment history, which is the largest factor in determining your credit score. By maintaining responsible payment habits, you can strengthen your credit profile over time.

Remember, it's not just about having subscriptions, but how consistently and timely you pay for them that matters most.

Explore Pocketly for quick, flexible support that helps you stay consistent with payments, ensuring you stay on top of your credit health.

Download the Pocketly app on iOS or Android to manage your finances and protect your credit health.

FAQs

1. Do monthly subscriptions help build credit?

No, most subscription payments alone don’t directly affect credit scores unless paid through credit products that report to credit bureaus.

2. Can paying Netflix or Spotify on time boost my credit?

If paid via credit card and you repay the card on time every month, it contributes positively to your payment history.

3. Does cancelling subscription autopay hurt my credit score?

No, cancelling autopay does not affect your score unless it leads to a missed payment.

4. What matters most for building credit?

Timely payments across credit cards and loans are the most impactful factor for credit score improvement.

5. Does Buy Now, Pay Later affect credit?

BNPL may affect credit if the provider reports payment behaviour; missed payments can harm your score.