Are you a young professional constantly juggling month-end expenses? Do sudden costs push you toward high-interest credit? You’re not alone. With 62% of Indian organisations now prioritising financial wellbeing, it’s clear that money stress affects productivity, mental health, and quality of life.

Between student loans, family responsibilities, and career growth, many young Indians see their paycheques vanish before the next month even begins. But building financial success isn’t about earning six figures or mastering complex investments—it starts with simple, consistent habits.

Research shows behaviour matters more than knowledge when it comes to true financial wellness. In this guide, we’ll break down 10 practical financial habits tailored for young Indians, real, actionable strategies to help you handle emergencies, reduce stress, and build long-term wealth.

At a glance:

- Financial success starts with budgeting and tracking every rupee you spend. The 50/30/20 rule helps allocate income effectively across essentials, wants, and savings.

- Build an emergency fund covering 3 to 6 months of expenses before aggressive investing. This prevents expensive debt cycles during unexpected situations.

- Start investing early with small amounts through SIPs and diversified mutual funds. Time and compound interest matter more than large initial investments.

- Eliminate high-interest debt aggressively while managing credit cards wisely. Pay full balances monthly and keep utilisation below 30% to build strong credit scores.

- When temporary cash shortages threaten your financial discipline, Pocketly offers transparent short-term loans from ₹1,000 to ₹25,000 with interest starting at 2% per month, helping you maintain savings and investment habits without derailing long-term goals.

What is Financial Success and Why Does It Matter for You

The reality in India is sobering. Only 27% of Indian adults meet the minimum financial literacy level. Financial success is not about becoming a crorepati or retiring at 30. Financial success means:

- No month-end anxiety: Your salary lasts comfortably until the next paycheque arrives without borrowing or juggling bill payments

- Emergency readiness: Unexpected medical bills, vehicle repairs, or job loss do not throw you into immediate crisis mode

- Goal achievement: You actively work towards meaningful objectives like higher education, property ownership, or starting your own business

- Debt freedom: You are either completely debt-free or managing debt responsibly without high-interest traps destroying your finances

- Growing wealth: Your money works for you through smart investments, building towards long-term financial independence and security

- Peace of mind: You sleep well knowing your finances are under control and your future looks secure

Financial pressure forces you to stay in unfulfilling jobs because you cannot risk income gaps. Success gives you the freedom to take calculated risks, switch careers, or start ventures aligning with your actual passions and talents.

Higher studies, travel, entrepreneurship, none come to life without financial planning. With the right foundation, dreams turn into actionable goals with timelines and resources. Now, let's explore the 10 habits that can transform your financial life.

Also Read: Financial Planning Tips for Young Adults

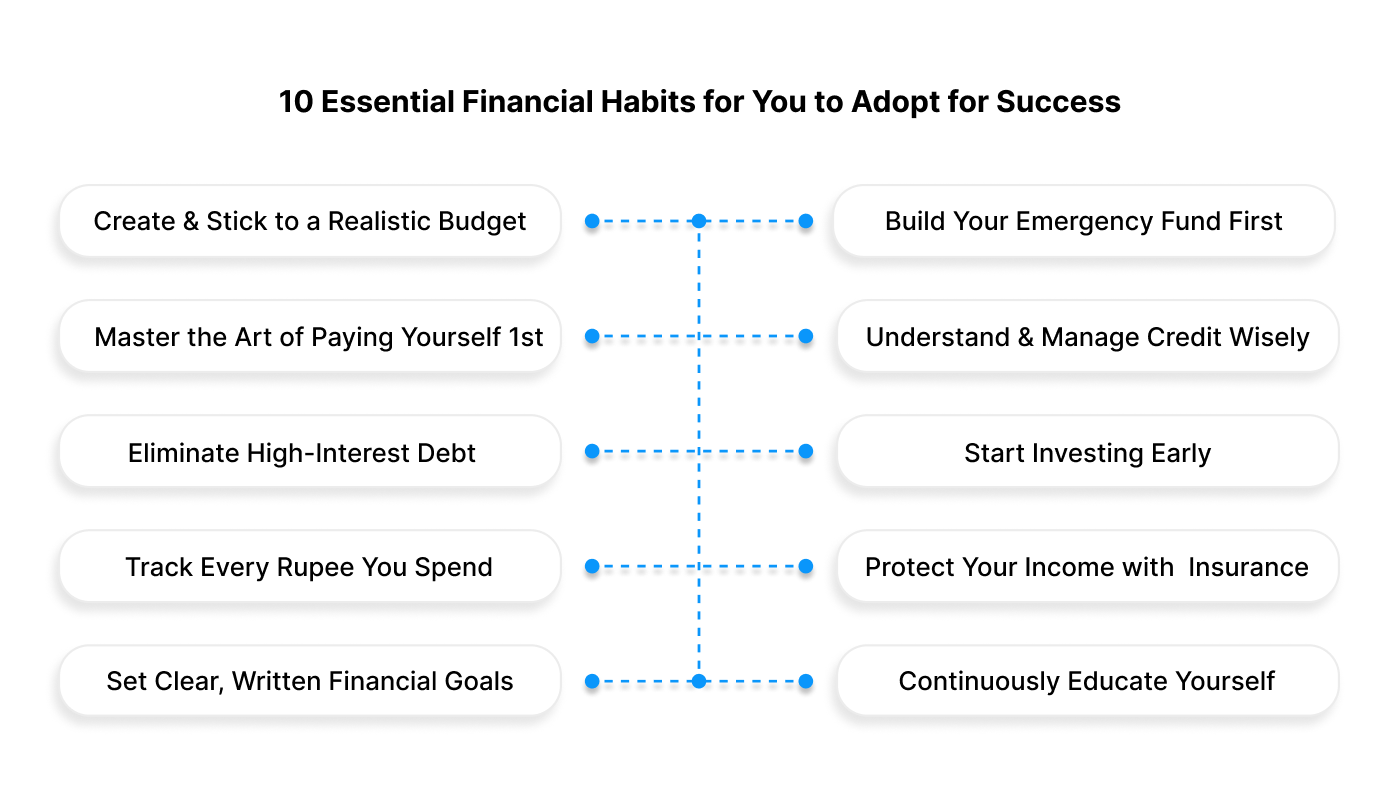

10 Essential Financial Habits for You to Adopt for Success

Financial success is completely achievable through consistent habits. You do not need a finance degree or a high-paying job. You need the right practices, discipline, and sometimes access to responsible financial tools when temporary shortages arise.

1. Create and Stick to a Realistic Budget

A budget isn’t a restriction. It’s control. Think of it as a spending plan that aligns your money with your priorities. Track every rupee for a month using a notebook or app to see where your money really goes. Then divide expenses into three buckets:

- Essentials (50%): Rent, groceries, utilities, loan EMIs, transport

- Wants (30%): Eating out, shopping, entertainment

- Savings & Investments (20%): Emergency fund, future goals

Adjust the percentages to suit your life, save more if you live with parents, or increase essentials if you support a family. Visibility drives better decisions. A daily ₹200 coffee becomes ₹6,000 a month, still okay if it fits your plan, but now it’s intentional. Review your budget monthly and use any tool you’ll stick to.

2. Build Your Emergency Fund First

Life throws surprises, cracked phone screens, medical bills, and job issues. Without a safety net, you fall into costly debt. Try to build an emergency fund.

Aim for 3–6 months of essential expenses. For example, if basics cost ₹25,000/month, target ₹75,000–₹1,50,000

- Begin small—even ₹500 monthly counts

- Keep it in a separate savings account or liquid mutual fund

- Treat it as untouchable unless truly urgent

Remember: an emergency fund is not for planned expenses like vacations or festivals. It exists solely to prevent good financial habits from collapsing when unexpected costs arise.

Facing a month-end shortage while building your emergency fund? Pocketly’s short-term loans with transparent interest from 2%/month offer quick relief. Fast approval and instant transfer help you manage expenses without touching your savings or paying high card interest.

3. Master the Art of Paying Yourself First

Most people save after spending. Successful people spend after saving, a mindset shift that builds wealth over time.

"Pay yourself first" means transferring money to savings/investments as soon as your salary arrives. Set up an auto-transfer so that saving happens before spending.

Start with 10% if 20% feels heavy. Consistency matters more than amount; ₹2,000 saved monthly beats ₹10,000 saved occasionally.

Where to put this money?

- First, build your emergency fund

- Then split into:

- Short-term goals: vacation, new phone

- Long-term goals: retirement, property

Once automated, you naturally adjust to the remaining income. You won’t even feel the cut.

4. Understand and Manage Credit Wisely

Credit cards and loans can build wealth or create chaos. The key is knowing how to use them. Credit cards offer convenience and rewards, but unpaid balances attract 14–46% annual interest. A ₹10,000 swipe can become ₹14,000 if you only pay the minimum.

Smart credit card rules:

- Spend only what you already have (treat it like a debit card)

- Pay the full bill every month to avoid interest

- Keep utilisation below 30%

- Set reminders to never miss due dates

Your credit score affects loan approvals and interest rates. Building it early gives long-term benefits. For loans, always check the true repayment cost. Ask: Is this essential? Can I delay it? How much will I repay in total?

If you need short-term funds, Pocketly offers quick personal loans (₹1,000–₹25,000) with transparent interest from 2%/month and processing fees of 1–8%. No collateral, fast approval, and clear terms, helping you manage urgencies without falling into debt traps.

5. Eliminate High-Interest Debt Aggressively

Not all debt is equal. A home loan at 8% is manageable. Credit card debt at ~40% is a financial emergency. High interest grows faster than investments, like filling a bucket with a hole in it.

Debt elimination strategy:

- List all debts with interest rates + balances

- Pay minimums on all

- Direct all extra money to the highest-interest debt first

- After clearing it, move to the next

- Repeat until debt-free

This avalanche method saves the most on interest. The snowball method (smallest balances first) boosts motivation, and both work if you stay consistent.

Cut expenses temporarily to speed up repayments. Avoid taking on new debt while clearing old ones. If emergencies hit, use transparent short-term options instead of rolling credit card debt at high rates.

6. Start Investing Early, Even with Small Amounts

You don’t need lakhs to invest. Starting early with small amounts beats starting late with big amounts. Compound interest grows your money over time.

₹5,000/month at 12% from age 25 reaches ₹1.5+ crore by 60. Start at 35, and you’ll need ₹15,000/month for the same result.

Smart investment options for young Indians:

- SIPs in mutual funds (start at ₹500)

- PPF for tax-free, secure returns

- NPS for retirement + tax benefits

- Index funds for simple diversification

- FDs for short-term, low-risk parking

Begin with what you understand. A simple diversified SIP works great for beginners. Learn gradually and expand. Avoid mistakes like chasing tips, stopping SIPs during market dips, or putting all money in one asset.

Short one month? Instead of skipping investments, Pocketly’s small short-term loans can help you stay consistent. A ₹5,000 loan to maintain your SIP often yields higher long-term gains than the short borrowing cost.

7. Track Every Rupee You Spend

You can’t improve what you don’t measure. Tracking expenses may feel boring, but it exposes spending patterns you never noticed. Track every expense for one month, chai, bus fare, subscriptions, everything. Use notes, apps, or a tiny notebook. The goal is visibility, not perfection.

What most people discover:

- Small daily spends become big monthly totals.

- Subscriptions quietly drain money.

- Impulse buys take a surprising share.

- Essentials often cost less than assumed.

With awareness, habits shift naturally. You don’t stop enjoying, you spend consciously instead of mindlessly. Stick with one method for at least three months.

Review weekly at first, then monthly. Notice patterns, weekend splurges, stress spending, etc. Understanding triggers helps you fix them.

8. Protect Your Income with Adequate Insurance

Insurance feels like paying for nothing until you need it. One medical emergency can erase years of savings. The younger and healthier you are, the cheaper your insurance is, so start early.

Must-have insurance for young adults:

- Health insurance: Medical costs are rising. Get ₹5 lakh+ coverage. Employer cover is good, but personal cover ensures continuity.

- Term life insurance: If anyone depends on your income. A ₹1 crore cover can cost ₹500–₹800/month for a 25-year-old non-smoker.

- Personal accident insurance: Vital if you commute or ride two-wheelers.

Avoid investment-cum-insurance plans initially. Buy pure term insurance and invest separately for better returns. Review your policies yearly. Marriage, job changes, or dependents require coverage updates.

Premiums may feel like money lost, but they protect everything you’re building. One uninsured event can wipe out your progress.

9. Set Clear, Written Financial Goals

Goals turn dreams into plans. “I want to be rich” is vague. “Save ₹5 lakh for a car in 3 years” is actionable. Write your financial goals and categorise them:

- Short-term (≤1 year): emergency fund, credit card payoff, laptop

- Medium-term (1–5 years): car, down payment, wedding, higher studies

- Long-term (5+ years): retirement, children’s education, financial freedom

For each goal, define:

- Amount needed

- Deadline

- Monthly savings required

- Investment option

Review quarterly and adjust for life changes, promotions, job shifts, and new priorities. Flexibility is fine, quitting isn’t. Share big goals with someone for accountability. Writing them down and tracking progress keeps you committed.

If unexpected expenses interrupt your plan, short-term Pocketly loans can cover temporary gaps so your savings goals stay on track. Borrow only what’s needed and resume your monthly targets quickly.

10. Continuously Educate Yourself About Money

Since most schools don’t teach personal finance, learning about money becomes your responsibility and a lifelong asset. The financial world evolves constantly, so staying informed helps you make smarter decisions and spot opportunities.

How to build financial knowledge:

- Read one finance book every quarter

- Follow credible Indian finance blogs/YouTube channels

- Listen to podcasts during commutes.

- Take free courses

- Read business news occasionally.

- Join finance communities (but verify advice yourself)

Master basics first, such as budgeting, saving, investing, taxes, and credit. Advanced topics (crypto, derivatives) can come later. Avoid get-rich-quick promises , high return + no risk = red flag. Real wealth grows through consistent investing and patience.

Learn enough to make confident decisions, and seek experts for complex matters like tax or estate planning. The more you learn, the fewer mistakes you make and the more opportunities you catch.

Also Read: Top 8 Financial Planning Strategies for Salaried Employees

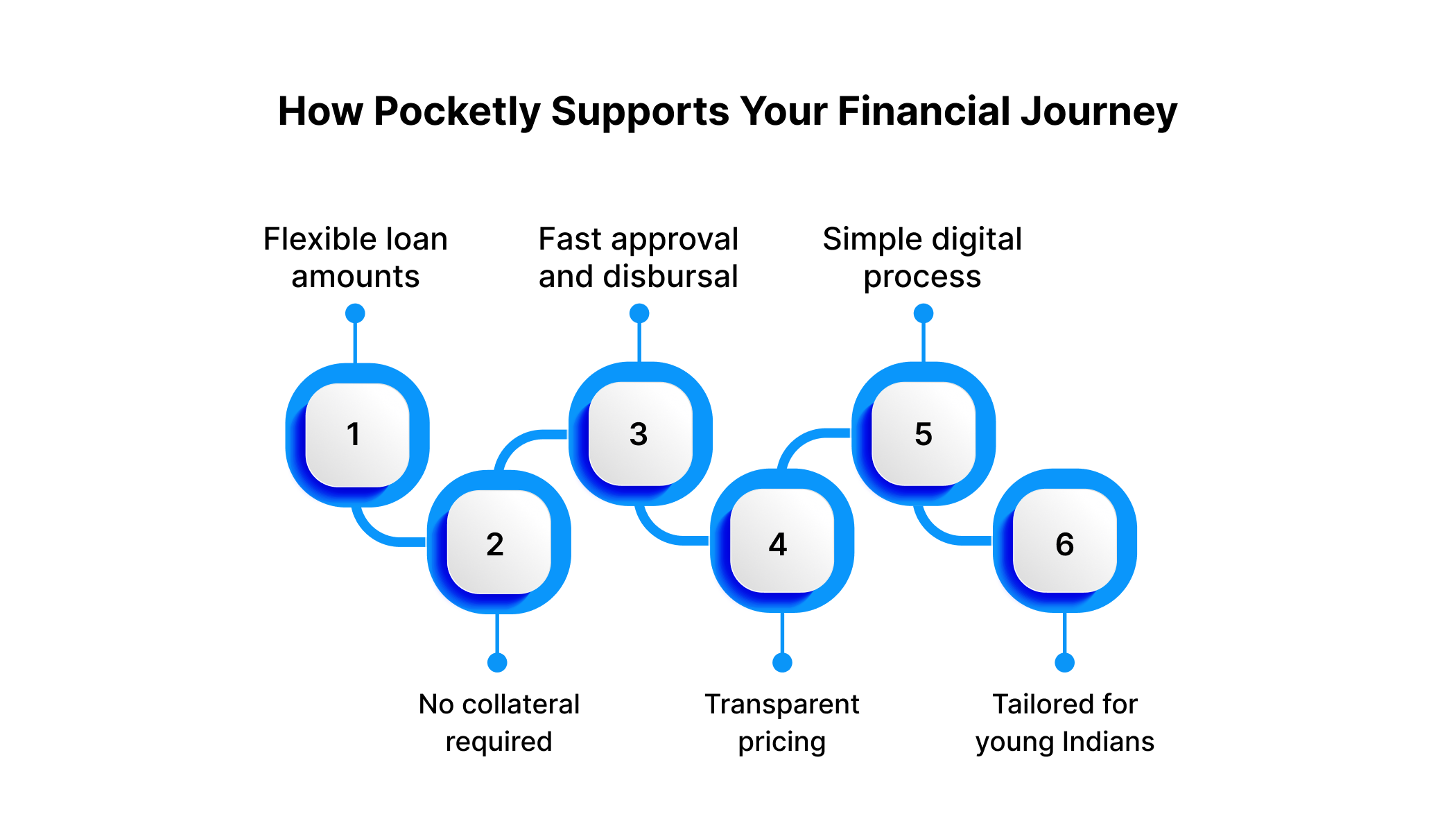

How Pocketly Supports Your Financial Journey

Building healthy money habits takes time. But emergencies, month-end shortages, or unavoidable expenses can disrupt savings, investments, or your budget. That’s where Pocketly becomes a reliable partner for young Indians.

Pocketly offers flexible, transparent short-term loans so you can manage immediate expenses without derailing your financial progress.

Here's what Pocketly offers:

- Flexible loan amounts: From ₹1,000 for minor emergencies to ₹25,000 for larger unexpected expenses

- No collateral required: Your creditworthiness determines eligibility, not property ownership

- Fast approval and disbursal: Funds transferred directly to your bank account within hours of approval

- Transparent pricing: Interest rates starting from 2% per month, with processing fees between 1% to 8% of the loan amount

- Simple digital process: Complete KYC and application entirely online through the mobile app

- Tailored for young Indians: Designed specifically for students, salaried professionals, and self-employed individuals.

Whether you're a student, professional, or self-employed, Pocketly offers short-term financial support responsibly.

Also Read: How to Take Control of Your Money in 2026

Conclusion

Financial success for young Indians isn’t about high salaries or risky investments. It’s about practical daily habits. From budgeting and emergency funds to smart credit use and early investing, these habits tackle real challenges like cash crunches, debt, and unexpected expenses.

Start small, track spending, save automatically, or set a goal, and build momentum toward financial confidence, wealth, and freedom. And when unexpected situations arise that threaten to derail your progress, remember that Pocketly’s responsible short-term financial solutions exist.

Download the Pocketly app on iOS and Android to have quick access to transparent, flexible loans when you genuinely need them, keeping your financial journey on track even when life throws curveballs.

Frequently Asked Questions

1. How much should I save from my salary as a young professional in India?

Aim for 20% of income; adjust based on expenses. Start with a sustainable amount, automate savings, and increase gradually.

2. Should I invest in stocks or mutual funds as a beginner?

Start with mutual fund SIPs for diversification and professional management. Consider stocks later after gaining knowledge.

3. How do I handle financial pressure from family obligations while building savings?

Allocate a fixed percentage for family support, communicate limits, and secure your financial foundation first. Consider term insurance for protection.

4. What's the difference between good debt and bad debt, and which should I prioritise?

Good debt finances appreciating assets; bad debt funds depreciating items or high-interest loans. Pay off bad debt first, manage good debt while saving and investing.

5. How can I start investing when I’m struggling to save?

Track expenses to free up even ₹500–₹1,000 monthly. Start small, automate investments, and increase gradually. Small, consistent steps matter more than waiting for large sums.