After a long day of classes or a stressful meeting, it’s easy to open an online shopping app just to “browse.” Minutes later, you’re checking out items you never planned to buy. This habit, often called retail therapy, is more accurately known as emotional spending.

For many young Indians navigating fast-paced digital lives, emotions like stress, boredom, or anxiety quietly drive spending decisions. While the short-term relief feels comforting, it often leads to regret, tighter budgets, and ongoing financial stress.

Understanding this pattern is the first step toward healthier money habits.

Key Takeaways

- Recognise that stress, boredom, and social media are the primary drivers of impulsive purchases.

- Check your physical and emotional state (Hungry, Angry, Lonely, Tired) before spending money.

- Use the 24-hour rule to allow emotional impulses to cool before completing a transaction.

- Keep a spending log to understand the link between your moods and your expenses.

- For unexpected cash flow gaps, use transparent platforms like Pocketly to bridge the move

to your next paycheck.

What is Emotional Spending?

At its core, emotional spending is the act of buying items to satisfy an emotional need rather than a functional one. Unlike a rational purchase, where you buy a textbook because you have an exam or groceries because the fridge is empty, emotional purchases are triggered by your internal state.

Whether you are feeling low, lonely, stressed, or even excessively happy, your brain seeks a quick way to regulate these emotions, and shopping is often the easiest path.

The psychological connection to our finances is much stronger than most of us care to admit. Every time you scan a UPI QR code for an unplanned purchase, your brain's reward system lights up.

For a young professional in a high-pressure city like Bengaluru or Mumbai, a ₹500 gourmet coffee or a ₹2,000 skincare product might feel like a well-deserved treat.

However, when these "treats" become a frequent coping mechanism, they transition from self-care into a detrimental financial habit that can derail your long-term wellness.

Common Causes and Triggers of Emotional Spending

Understanding why we spend is just as important as knowing how much we spend. For many young Indians, emotional spending is often a subconscious reaction to external pressures or internal moods that require a quick "fix".

- Stress and Workplace Burnout: When faced with high-pressure deadlines or academic stress, your brain seeks a "dopamine hit" to counteract cortisol. Buying a new gadget or ordering an expensive meal becomes a way to feel in control and rewarded after a difficult day.

- The FOMO Effect (Social Comparison): Scrolling through Instagram and seeing peers with the latest fashion or luxury lifestyle creates a sense of inadequacy. This "Fear Of Missing Out" triggers spending to maintain a social status that feels "correct" in your digital circle.

- Boredom and Late-Night Scrolling: Many impulsive purchases happen during downtime. When you are bored at night, shopping apps offer a form of entertainment, leading to "scroll-and-click" habits that result in packages you don't actually need arriving at your door.

- Celebration and High-Mood Spiking: It is not just sadness that triggers spending. Extreme happiness or celebrating a small win can lead to "over-celebrating" where you spend significantly more than planned because you feel you "deserve" it in the moment.

- Loneliness and Seeking Connection: Sometimes, buying something new is a way to fill a void or feel connected to a trend. The interaction with a delivery person or the excitement of a new item can temporarily mask feelings of isolation.

- Digital Payment Detachment: The ease of UPI and "One-Tap" payments in India reduces the "pain of paying". Because you don't physically see cash leaving your hand, it is much easier to succumb to emotional spending without realising the cumulative cost.

- Also Read: Financial Planning Tips for Young Adults

The Long-Term Effects of Emotional Spending on Your Life

While a single impulsive purchase might seem harmless, the cumulative effect of emotional spending can be devastating to your financial health. It is not just about the money lost; it is about the opportunities missed.

When your income is constantly drained by impulsive buys, you lose the ability to build a robust credit profile or save for significant milestones.

Beyond the bank balance, this habit often leads to a cycle of guilt and shame. You buy something to feel better, then feel worse because you spent money you didn't have, which leads to more stress, triggering yet another round of spending.

This cycle can eventually lead to high-interest debt, making it difficult to qualify for essential financial products later in life. Recognising these patterns early is crucial to breaking the chain of financial anxiety.

Techniques for Managing Emotional Spending Effectively

Breaking the habit of impulsive buying requires creating "mental friction" between your impulse and the transaction. By implementing these techniques, you can ensure that your hard-earned money is used for things that truly add value to your life.

- The HALT Method: Before you scan a QR code or enter an OTP, ask yourself if you are Hungry, Angry, Lonely, or Tired. If you are any of these, your decision is likely driven by emotion; address the physical need first before deciding to buy.

- The 48-Hour Cooling-Off Rule: For any non-essential item, force yourself to wait for at least two days before completing the purchase. Most of the time, the emotional urgency will fade, and you will realise the item was a want, not a need.

- Unsubscribe from Temptation: Go through your inbox and SMS alerts and unsubscribe from brands that constantly send "Flash Sale" or "Limited Time Offer" notifications. Reducing the number of triggers you see daily makes it significantly easier to stay disciplined.

- Set an "Impulse Fund": Instead of banning treats entirely, allocate a small, fixed amount (e.g., ₹1,000) for unplanned purchases. Once this is spent, you must wait until the next month, which allows for small joys without ruining your budget.

- The Hourly Wage Calculation: Before buying an item, divide its cost by your hourly income. If a pair of shoes costs ten hours of your work, ask yourself if the shoes are worth that much of your life energy and time.

- Remove Saved Payment Details: Delete your saved card details and UPI IDs from shopping apps. Having to manually enter your details every time provides a crucial few seconds to rethink your decision and stop an emotional splurge.

- Also Read: How to Take Control of Your Money in 2026

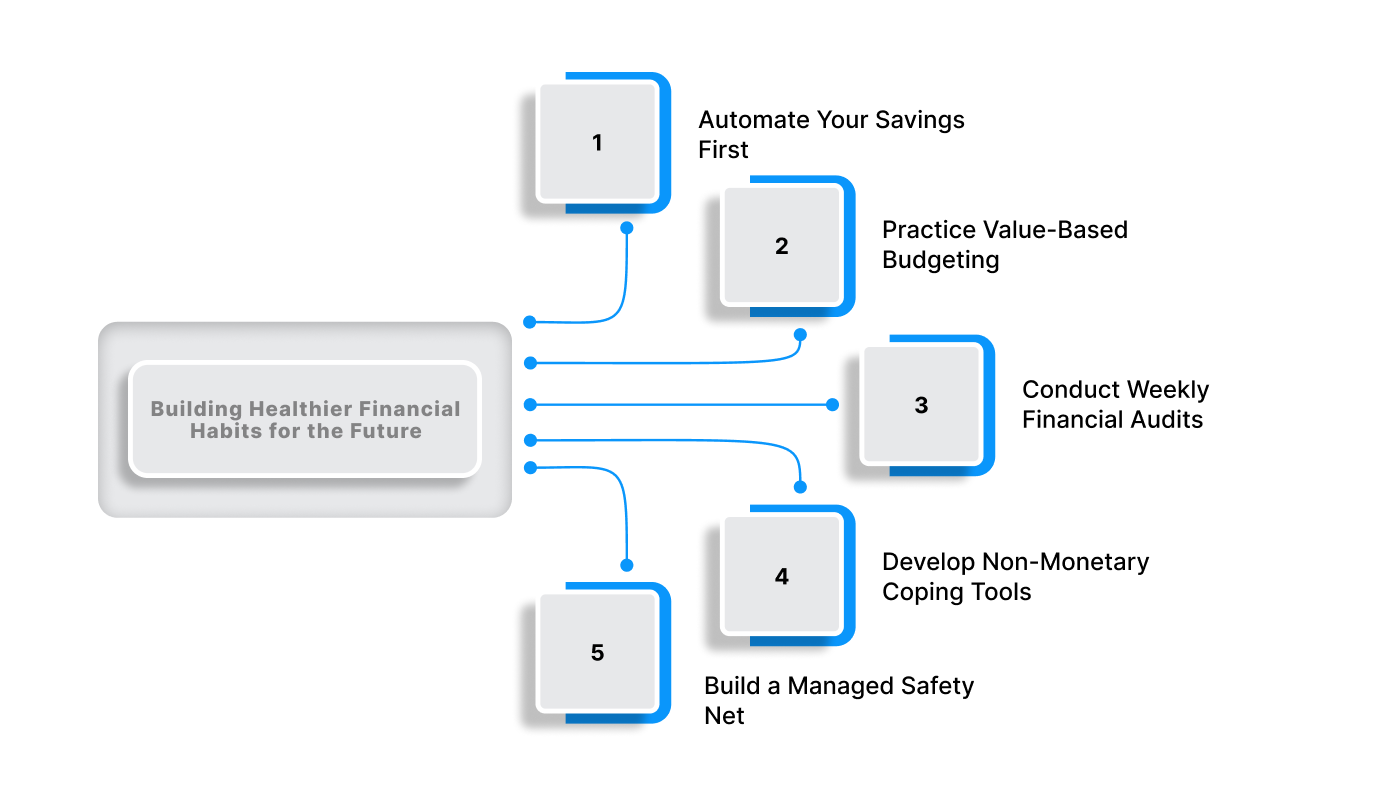

Building Healthier Financial Habits for the Future

Shifting your mindset from "spending to feel better" to "saving to feel secure" is a journey that pays off in long-term wellness. Building a stable financial future starts with small, consistent actions that replace temporary thrills with permanent security.

- Automate Your Savings First: Use the "Pay Yourself First" rule. Set up an automatic transfer to your savings or investment account the moment your salary or allowance hits your bank. This ensures your goals are met before emotional spending can occur.

- Practice Value-Based Budgeting: Instead of a restrictive budget, list the top three things that truly make you happy (e.g., travel, education, health). Direct your "wants" budget toward these areas exclusively to ensure your spending reflects your true self.

- Conduct Weekly Financial Audits: Spend 15 minutes every Sunday reviewing your transactions from the week. Reflecting on your purchases while they are fresh in your mind helps you identify emotional patterns you might have missed in the moment.

- Develop Non-Monetary Coping Tools: Create a list of activities that make you feel good but don't cost money, such as a workout, a hobby, or calling a friend. When you feel the urge to shop emotionally, pick an item from this list instead.

- Build a Managed Safety Net: Understand that life happens. Having a clear plan for emergencies, including knowing how to use responsible platforms like Pocketly for short-term gaps, removes the panic that often leads to poor financial decisions.

- Also Read: Financial Planning in Your 30s: Smart Money Guide (2025)

How Pocketly Supports Your Financial Independence

Even the most disciplined individuals can occasionally face a financial shortfall, especially if a period of emotional spending has coincided with an unexpected emergency. In these moments, it is important to have a transparent and reliable way to manage your cash flow without falling into a debt trap.

Pocketly is designed specifically for young Indians—students, salaried professionals, and entrepreneurs, who need a bridge to their next paycheck or allowance. We offer a smart, simple, and entirely digital platform to access short-term funds when you need them most.

- Flexible Loan Amounts: We provide personal loans ranging from ₹1,000 to ₹25,000, tailored to fit small, immediate needs.

- Quick and Digital KYC: No physical documents are required. Our process is entirely digital, ensuring a hassle-free experience for the tech-savvy generation.

- Transparent Costs: Our interest rates start at 2% per month, with a processing fee of 1-8%. There are no hidden charges or annual fees.

- Instant Disbursal: Once approved, the funds are transferred directly into your bank account, providing instant relief during month-end crunches.

Steps to Apply for a Pocketly Loan:

- Download the App: Available on both the Google Play Store and Apple App Store.

- Complete KYC: Provide your basic details through our secure, paperless process.

- Choose Your Amount: Select a loan amount between ₹1,000 and ₹25,000.

- Instant Approval: Get your funds transferred to your bank account in minutes.

Conclusion

Controlling emotional spending is a vital skill for anyone looking to achieve long-term financial wellness. By identifying your triggers and implementing strategies like the 24-hour rule, you can move from impulsive habits to intentional choices.

Remember, money is a tool to build the life you want, not just a way to manage how you feel in the moment. While building these habits takes time, the resulting peace of mind is worth every bit of effort.

For those moments when life gets unpredictable, Pocketly is here to provide the support you need to stay on track.

Take the first step toward smarter financial management. Download the Pocketly app today on iOS or Android and experience a more transparent way to borrow.

FAQs

1. Is emotional spending the same as an addiction?

While emotional spending is a common habit driven by feelings, if it becomes uncontrollable and destructive, it may border on compulsive buying disorder. If you find yourself unable to stop despite severe consequences, seeking professional help is a wise step.

2. Can I still treat myself while managing my spending?

Absolutely! The goal of mindful finance is to allocate money for things you love. By setting a specific "fun budget," you can treat yourself without the guilt of overspending or impacting your essentials.

3. How do I stop spending when I am bored at night?

The best way is to create a physical barrier. Delete shopping apps from your phone or use "app timers" to lock them after a certain hour. Replacing the habit with reading or a meditation app can also help reset your brain.

4. What should I do if my emotional spending has caused debt?

First, stop all non-essential spending immediately. Create a clear repayment plan and consider using a small, transparent loan from Pocketly to consolidate urgent debts and manage your immediate cash flow until your next income.

5. How does Pocketly ensure my data is safe?

Pocketly uses bank-grade encryption and follows all security protocols mandated for digital lending platforms. As a platform owned by an RBI Registered NBFC, Speel Finance Company Private Limited, we prioritise transparency and user privacy.