You're halfway through the month, and your bank balance is already running thin. Rent is due, groceries need a refill, and college fees are around the corner. Sound familiar?

For many young Indians, students, professionals, and freelancers, running out of cash before the month-end is a common struggle. The anxiety of not knowing where your money went or how to stretch it till payday can be overwhelming.

Cash planning isn't just about tracking expenses or saving. It's about taking charge of your finances, so surprises don’t throw you off. Whether you're living on a student allowance, managing EMIs as a salaried employee, or dealing with irregular income as an entrepreneur, smart cash planning keeps you prepared, reduces debt, and builds financial security.

In this blog, we’ll simplify what cash planning means, why it matters, and how you can apply easy strategies to manage money better.

At a glance

- Cash planning is your money roadmap. Track income and expenses, prioritise needs over wants, and build an emergency buffer to avoid month-end crunches.

- Young Indians need it more than ever. Irregular income and sudden expenses make cash planning key for students, professionals, and freelancers.

- Avoid money leaks: Small spends add up, unchecked credit leads to debt, and ignoring irregular expenses causes stress.

- Short-term credit helps in emergencies: Platforms like Pocketly offer quick, collateral-free loans (₹1,000–₹25,000) with interest from 2% monthly and 1%–8% processing fees.

- Wealth grows with discipline: Save early, track spending, review weekly, and use financial tools wisely to reach long-term goals.

What is Cash Planning?

Cash planning is the practice of tracking, managing, and controlling your cash inflows and outflows to stay financially stable. It helps you understand how much money you have, where it comes from, where it goes, and how to optimise it for your needs.

Unlike budgeting, which mainly limits spending, cash planning takes a broader approach by balancing income, expenses, savings, and emergency funds.

- Income can be irregular, students rely on allowances, professionals face month-end crunches, and freelancers have fluctuating earnings.

- A clear cash plan prevents overspending early in the month and helps you manage essentials later.

- It prepares you for emergencies, medical bills, urgent travel, repairs, etc.

- Helps you decide when to use savings or opt for short-term external support if needed.

With the basics clear, let’s look at why cash planning is so essential in today’s financial landscape.

Also Read: Financial Planning Tips for Young Adults

Why Cash Planning Matters for Young Indians

Cash planning is not just a financial exercise. It is a life skill that directly impacts your peace of mind, opportunities, and long-term goals. Here is why it matters:

Builds Financial Independence

When you know exactly where your money is going, you make conscious decisions instead of reactive ones. You are not dependent on borrowing from friends or family every time an unexpected expense comes up. Financial independence starts with understanding your cash flow, and cash planning gives you that clarity.

Prevents Month-End Cash Crunches

One of the biggest pain points for young Indians is running out of money before the next salary or allowance arrives. Cash planning helps you distribute your income throughout the month, ensuring you have enough for essentials at all times. By tracking inflows and outflows, you can spot spending patterns and adjust before cash runs dry.

For young Indians facing immediate cash needs, Pocketly has simplified this process by offering fast, collateral-free loans with minimal paperwork

Prepares You for Emergencies

Life is unpredictable. Medical emergencies, sudden travel needs, or urgent repairs can happen without warning. A solid cash plan includes setting aside a small emergency buffer, even if it is just ₹1,000 to ₹2,000 initially. This buffer acts as a safety net, reducing the stress of unexpected expenses.

Helps You Make Better Spending Decisions

Without cash planning, it is easy to spend impulsively on things you do not really need. When you have a clear picture of your finances, you can prioritise expenses better. Do you really need that subscription service, or can you redirect that money towards something more important?

Reduces Dependence on High-Cost Credit

Many young Indians turn to credit cards or informal loans when cash runs out. These options often come with high interest rates and can trap you in a debt cycle. Cash planning helps you avoid unnecessary borrowing, and when you do need financial support, you can make informed choices about short-term loans that fit your repayment capacity.

Sets the Foundation for Future Wealth

The habits you build today shape your financial future. Good cash planning teaches you discipline, helps you save consistently, and prepares you for bigger financial goals like buying a vehicle, pursuing higher education, or starting a business.

Understanding why cash planning matters is important, but knowing how to do it effectively is what makes the real difference. Let's look at the fundamental principles that make any cash plan work.

Also Read: Financial Planning in Your 30s: Smart Money Guide (2025)

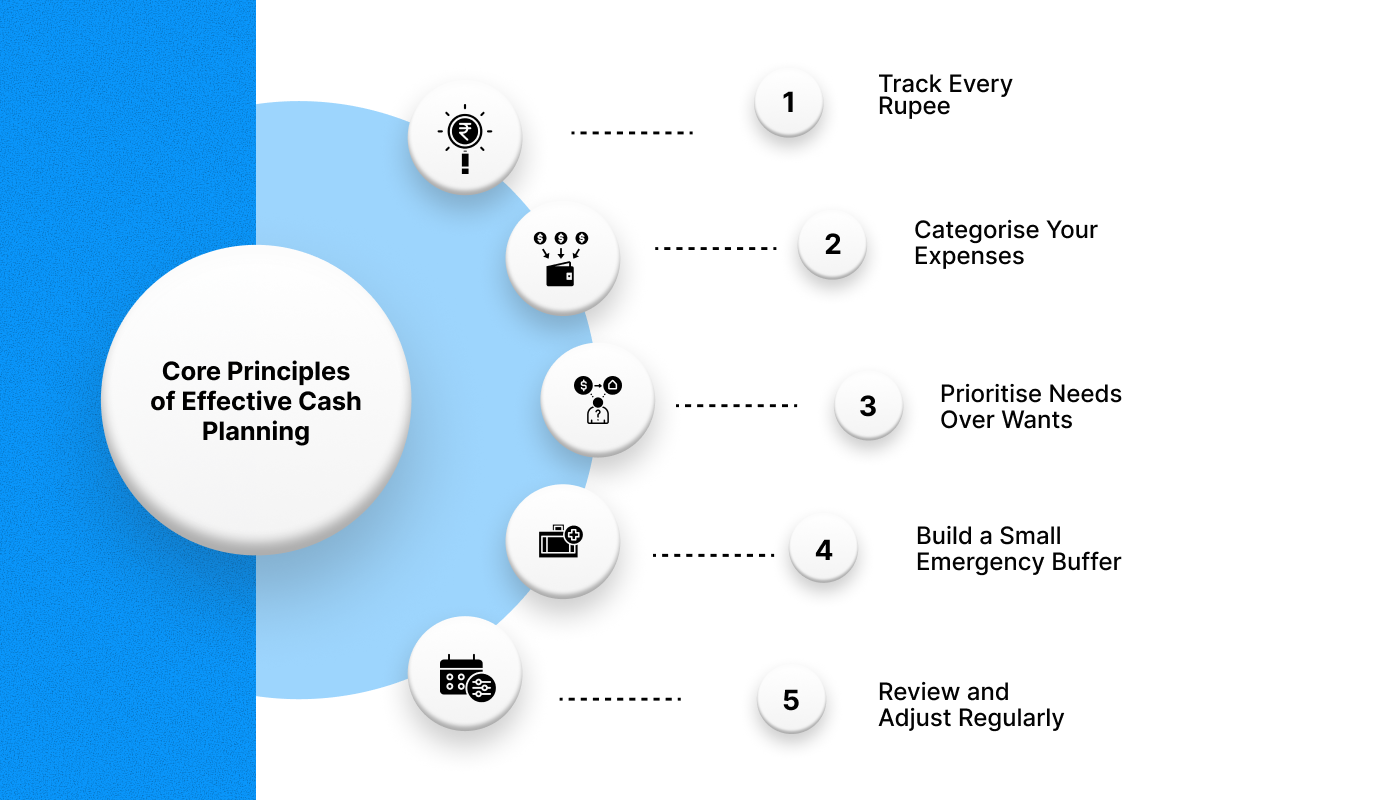

Core Principles of Effective Cash Planning

Cash planning isn’t complex, just consistent. Here’s what makes it work:

- Track Every Rupee: You can't manage what you don't measure. Note every income and expense, whether through an app, spreadsheet, or a simple notebook. Even small spends add up.

- Categorise Your Expenses: Group expenses into essentials (rent, groceries), discretionary (food outings, entertainment), and savings/investments. This shows where your money actually goes.

- Prioritise Needs Over Wants: Needs are non-negotiable; wants are optional. Focus on essentials first so you never fall short later in the month.

- Build a Small Emergency Buffer: Saving even ₹500–₹1,000 monthly can grow into a safety cushion. It helps you handle surprises without draining your main funds or taking loans.

- Review and Adjust Regularly: Income and expenses change, your plan should too. Review weekly or monthly and tweak it as you go. Progress matters more than perfection.

Now that you know the basics, let’s look at common mistakes young Indians make while managing cash, and how to avoid them.

Also Read: Top 8 Financial Planning Strategies for Salaried Employees

Common Cash Planning Mistakes Young Indians Make

Even with good intentions, many young people slip into these money traps. Avoid them to stay financially steady:

- Ignoring Small Expenses: Daily chai-samosa breaks, autos, quick online buys, small spends pile up fast. Track them regularly.

- Not Accounting for Irregular Income: Freelancers and gig workers earn unevenly. Plan based on your lowest monthly income so you never overcommit.

- Overusing Credit: Credit cards and BNPL feel convenient, but interest can reach 36–48% annually. Use credit responsibly and clear dues on time.

- Skipping Irregular Expense Planning: Annual fees, festivals, insurance—these aren’t monthly but entirely predictable. Set aside a little every month to prepare.

- No Repayment Strategy: If you borrow, know how much, why, and when you'll repay. A clear plan prevents loans from turning into stress.

You've seen what to avoid, now it's time for action. Next, let’s build a practical step-by-step cash plan you can start today.

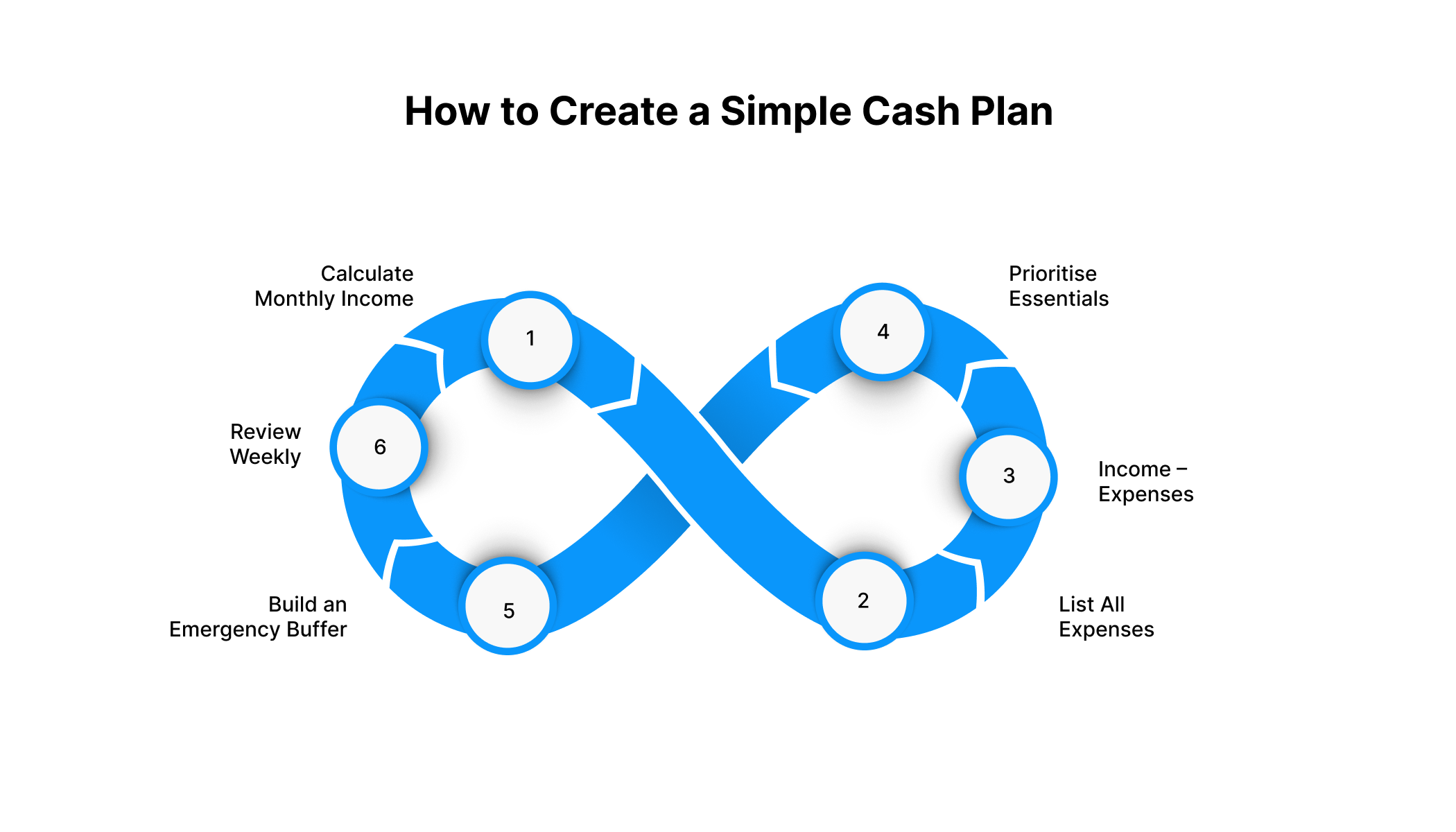

How to Create a Simple Cash Plan

You don’t need complex tools to manage money. Follow this easy step-by-step process:

- Step 1: Calculate Monthly Income: List all income sources—salary, allowance, freelance work, etc. If income varies, use a 3-month average or plan using the lowest expected amount.

- Step 2: List All Expenses: Note fixed expenses (rent, utilities, EMIs) and variable ones (groceries, transport, entertainment). Add irregular expenses by dividing annual costs into monthly chunks.

- Step 3: Income – Expenses: Check if you have a surplus or deficit. Surplus goes toward savings or your emergency fund; deficit means cutting costs or boosting income.

- Step 4: Prioritise Essentials: Cover needs first, rent, food, transport, repayments. Wants come later, only if your budget allows.

- Step 5: Build an Emergency Buffer: Save even ₹500–₹1,000 monthly in a separate account. It becomes your safety net for sudden expenses. Digital lending platforms like Pocketly can help you here by offering loans in flexible terms and low interest rates.

- Step 6: Review Weekly: Track progress every week and adjust as needed. Early corrections prevent bigger financial issues.

Even with planning, unexpected needs arise. Knowing when to use short-term credit responsibly is key to smart cash management.

Bridging Cash Gaps with Pocketly: Your Partner for Financial Flexibility

Managing cash flow can be challenging, especially when unexpected expenses arise. Pocketly understands the financial needs of young Indians and offers flexible personal loans designed to bridge short-term cash shortages without the hassle of traditional lending.

Pocketly provides quick, transparent, and collateral-free personal loans tailored for students, salaried individuals, and self-employed professionals. Here is what makes Pocketly different:

- Flexible Loan Amounts: Borrow from ₹1,000 to ₹25,000 based on your actual needs.

- Transparent Pricing: Interest rates starting from 2% per month with processing fees between 1% to 8% of the loan amount. No hidden charges.

- No Collateral Required: Access funds without pledging assets or providing guarantors.

- Fast Approval and Disbursal: Instant digital KYC and quick fund transfers directly to your bank account.

- Flexible Repayment Options: Choose repayment terms that align with your cash flow, with the option for partial repayments and early loan closure.

Pocketly acts as a Digital Lending Platform on behalf of registered NBFCs, ensuring all lending practises comply with regulatory standards. Whether you need funds for an emergency, unexpected expenses, or a month-end shortfall, Pocketly offers a reliable solution without disrupting your financial stability.

Conclusion

Cash planning isn’t about restricting yourself. It’s about making informed choices and taking control of your money. For young Indians balancing studies, work, and personal goals, a good cash plan builds the foundation for financial independence and long-term stability.

By tracking income and expenses, prioritising essentials, building an emergency buffer, and using financial tools wisely, you can avoid month-end stress, manage emergencies, and move closer to your goals. Financial planning is a journey. Start small, stay consistent, and keep improving.

And when unexpected expenses arise, smart solutions like Pocketly can help you bridge the gap. Download the Pocketly app now on iOS and Android and take your first step toward better cash management.

Frequently Asked Questions

1. How much should I keep in my emergency fund?

Ideally, save 3–6 months of expenses. If you're starting out, aim for ₹5,000–₹10,000 first to handle small emergencies like medical needs or repairs, then gradually build up. Start small and stay consistent.

2. What’s the difference between cash planning and budgeting?

Budgeting allocates income across expenses to control spending. Cash planning focuses on when money comes in and goes out to ensure liquidity. Budgeting manages spending; cash planning ensures cash is available when needed.

3. Can I do cash planning if my income is irregular?

Yes—it's even more important. Calculate average earnings over 3–6 months and plan based on your lowest expected income. Save surplus during high-earning months to cover lean periods.

4. How do I choose between saving and investing?

Save for short-term needs and emergencies (use accessible accounts). Invest for long-term goals like retirement or education. Build your emergency fund first, then start investing with a clear goal and time frame.

5. What if I miss a loan repayment?

Missed payments hurt your credit score and incur charges. If you expect a delay, contact your lender early—platforms like Pocketly may offer rescheduling options. Never ignore overdue payments; communicate proactively.