Are you constantly waiting for payments to clear while expenses keep piling up? Or maybe you find yourself in a tough spot when income fluctuates. These situations might feel familiar, especially if you're running a small business and still finding your rhythm.

82% of small businesses today fail because of cash flow problems, which makes knowing the warning signs early utmost important. When your inflows and outflows stop moving in sync, even minor delays can start affecting your daily decisions and financial confidence. These shifts can quietly build into bigger issues if not managed early.

In this blog, we’ll break down what really causes these cash gaps, how they affect your business and the practical steps to regain control. Let’s make your financial foundation stronger from here.

Here’s The Short Version:

- Cash flow problems arise when outgoing expenses exceed incoming funds, disrupting regular business operations.

- Common causes include poor planning, delayed payments, high expenses, weak reserves, and unclear financial visibility.

- Cash flow issues can damage credit, strain vendor relationships, and affect team morale over time.

- Simple strategies like budgeting systems, scenario planning and healthy borrowing improve day-to-day cash stability.

- Improving cash management helps you stay prepared for slow months, emergencies, and growth-related expenses.

What Are Cash Flow Problems For Businesses?

Running a business in India often feels like balancing many moving parts. Cash flow problems appear when your available cash cannot cover your day-to-day costs. This often shows up as difficulty paying rent, salaries, vendors, or even managing small operational costs.

For many young entrepreneurs, this feels a lot like running your month on a tight budget where expenses don’t slow down, but income does. Even if your business idea is strong, inconsistent cash flow can make everyday decisions stressful and limit how confidently you can grow.

Since these issues usually build up slowly, it helps to recognise what triggers them. So, let’s move ahead to the most common causes you should watch out for.

Also Read: Benefits of Cash Flow Statement Analysis

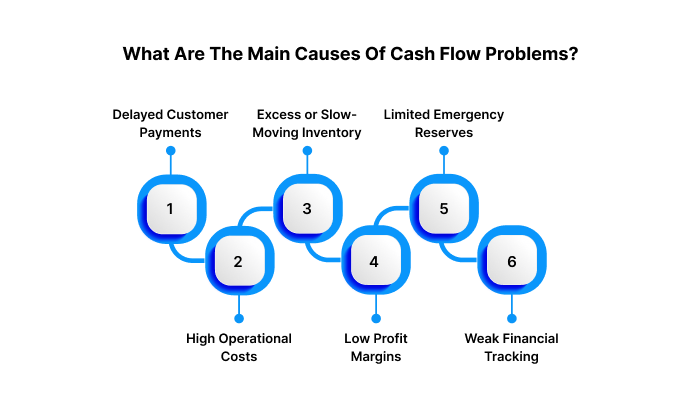

What Are The Main Causes Of Cash Flow Problems?

Cash flow challenges often come from habits, misjudgements or delays that seem minor at first. When they continue for months, they push your finances out of balance. Here are the key reasons responsible:

Delayed Customer Payments

When clients take longer to pay, it becomes harder to manage your monthly routine. Many young freelancers, small agencies and consultants face this regularly because payments depend on follow-ups.

- Example: You may finish a design project this week, but receive the final payment after six weeks, creating a long cash gap.

High Operational Costs

Expenses like rent, software tools, travel and utilities can quietly pile up. If they rise faster than your income, you’ll feel constant pressure even during a good sales month.

- Example: A small team might pay for five premium tools but only use two actively, losing cash every month.

Excess or Slow-Moving Inventory

Buying too much stock locks your money in products that aren’t selling. This usually happens when forecasts are too optimistic or when demand changes suddenly.

- Example: A café owner may stock extra festive bakery items expecting high demand, only to watch half of them expire unsold.

Low Profit Margins

Offering heavy discounts or pricing your service too low might attract customers, but it reduces the money left to run operations. With thin margins, even a strong sales month can feel tight.

- Example: A freelance photographer might quote very low rates to get clients, leaving little to cover equipment, travel and editing tools.

Limited Emergency Reserves

Without a safety cushion, even one slow month can push you into debt. Many young founders skip building reserves early on, making the business vulnerable to sudden dips.

- Example: If sales drop for a month, you might struggle to pay rent and salaries without borrowing or using personal savings.

Weak Financial Tracking

Inaccurate bookkeeping or irregular tracking can give a misleading picture of your finances. When you don’t know exactly what’s coming in or going out, planning cash flow becomes tricky.

- Example: A solo entrepreneur may record expenses late and miscalculate available cash, leading to overspending.

Now that you know the hidden causes, let’s look at what happens when cash flow becomes unstable and how it affects your daily operations.

How Do Cash Flow Problems Impact Your Business?

Cash flow problems affect more than your bank balance. They cause a ripple effect that touches every part of your work, from planning and performance to even long-term stability. Here are the most significant areas where the effects show up:

Difficulty Getting Future Credit

- Late repayments can hurt your credit profile.

- Banks become less willing to offer business loans.

- This limits future plans like expansion or upgrading equipment.

Vendor Trust Issues

- Delayed payments can strain relationships with suppliers.

- They may reduce support or offer less flexible terms.

- This can affect pricing, delivery and overall operations.

Drop in Team Morale

- When salaries or reimbursements are delayed, frustration increases.

- Work quality may dip because of uncertainty.

- Small teams feel this impact much faster.

Serious Risk of Business Shutdown

- If problems continue without correction, operations may become unsustainable.

- Many early-stage ventures shut down not due to lack of ideas, but lack of cash visibility.

Seeing the impact makes it clear why cash flow deserves your attention. Once you recognise the common problems, you can start fixing them before they turn into setbacks.

Struggling to stay on top of bills because clients pay late? Pocketly’s fast, no-collateral loans can help you manage essentials and protect your credit. With flexible EMIs, it’s an easy way to stay steady during tight months.

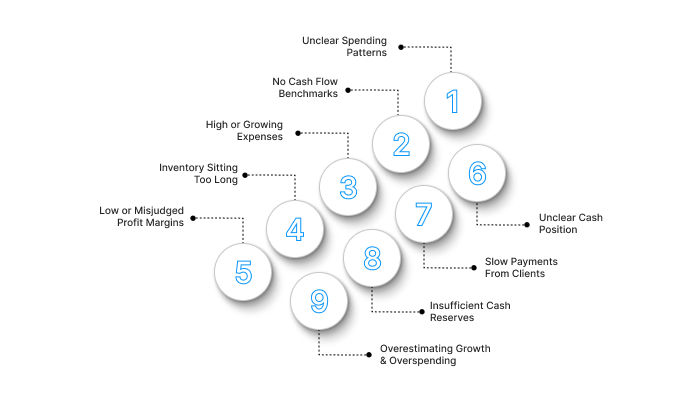

Common Cash Flow Problems And Their Solutions

Cash flow problems often come from patterns that many entrepreneurs don’t notice at first. Many of these issues look simple, but they slowly weaken your financial stability. Let’s break down the most common ones, each with a short solution you can put into action when required:

1. Unclear Spending Patterns

Some businesses know they are running short on cash but do not understand what is causing it. When spending is scattered across apps, tools, subscriptions and operations, it becomes difficult to identify which areas are draining cash.

- Expenses are spread across multiple categories without proper review

- Subscriptions or tools that aren’t used actively

- Personal and business expenses are mixed unintentionally

Solution: Break expenses into clear groups and review which categories absorb the most cash. A basic spreadsheet works if you update it consistently.

2. No Cash Flow Benchmarks

Without benchmarks, it becomes hard to judge whether your spending levels are reasonable. Most young professionals build budgets based on guesswork rather than comparisons or data.

- No clarity on ideal spending ratios

- Sudden spikes in marketing, operations or travel

- Difficulty setting limits for different teams

Solution: Use industry ranges or speak to a financial expert to set monthly spending benchmarks.

3. High or Growing Expenses

Some expenses creep up slowly over time. Rent increases, rising software costs, tax payments or even team outings can collectively push you into a cash crunch if not monitored.

- Paying for premium tools you don’t fully use

- Increasing vendor costs without negotiation

- Routine spending that keeps rising unnoticed

Solution: Shortlist the non-essential expenses and renegotiate key vendor contracts.

4. Inventory Sitting Too Long

For small retail or product-based ventures, buying excess stock locks up money that could be used elsewhere. This is a common issue for ecommerce sellers and offline stores.

- Over-ordering based on optimistic predictions

- Slow-moving products holding cash hostage

- High storage or warehouse costs

Solution: Order in smaller batches and review what sells fastest to refine stock planning.

5. Low or Misjudged Profit Margins

If your pricing doesn’t match your real costs, you’ll always struggle with cash. Many people underprice their offerings to attract customers, only to face liquidity issues later.

- Offering big discounts too frequently

- Selling products with very thin margins

- Miscalculating the cost of production or delivery

Solution: Re-evaluate pricing and remove products or services that consistently reduce profits.

6. Unclear Cash Position

Not knowing your available cash can lead to poor decisions. Without accurate numbers, you might spend more than intended or delay important payments.

- Delayed bookkeeping

- No weekly or monthly cash reviews

- Expenses recorded late or incorrectly

Solution: Set a weekly routine to update your cash flow statement.

7. Slow Payments From Clients

Delayed inflows are one of the biggest reasons service providers and freelancers struggle with smooth operations. When payments are late, it’s tough to handle recurring bills.

- Clients ignoring reminders

- Long credit cycles

- Delivering the project, but waiting weeks to get paid

Solution: Send invoices early, follow up consistently and encourage timely payments with small incentives.

8. Insufficient Cash Reserves

Without a backup fund, even minor dips in sales can disrupt your finances. Most professionals skip building reserves in the early years.

- Using personal savings to manage business expenses

- Struggling during slow months

- Difficulty handling unexpected repairs or bills

Solution: Set aside a small percentage of each month’s earnings to build a rainy-day buffer.

9. Overestimating Growth and Overspending

Rapid expansion feels exciting, but it usually demands higher spending. If projections don’t match reality, you’re left with expenses you can’t sustain.

- Hiring too fast

- Ordering more stock than needed

- Spending on branding or offices before steady revenue

Solution: Grow in steady stages and validate demand before increasing expenses.

With these cash flow problems out of the way, the next step is to manage cash better every month, not just during a crisis.

Also Read: Understanding Cash Inflow and Outflow: Definitions, Differences, and Importance

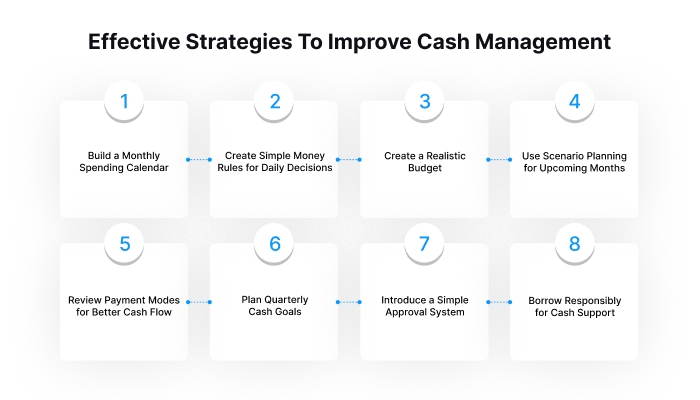

Effective Strategies To Improve Cash Management

Improving cash management isn’t only about avoiding mistakes. It’s also about building simple everyday systems that help you stay in control. These strategies give you a clearer picture of your finances, help you plan ahead:

Build a Monthly Spending Calendar

A spending calendar helps you map out when money leaves your account during the month. When you can see salary dates, vendor payments and renewals in one place, you’ll avoid last-minute stress.

Set Simple Money Rules for Daily Decisions

Money rules act like guardrails when you’re unsure about a purchase. You might create rules such as “review subscription renewals every quarter”. These micro-rules prevent emotional or impulse-driven spending.

Create Tiered Budget Buckets

Instead of one overall budget, divide your money into three pockets: essentials, growth and flexible spending. Essentials stay constant, growth spending supports expansion, and the flexible bucket covers nice-to-have expenses.

It helps you maintain balance. Even if your income fluctuates, you always know which bucket can be trimmed and which must remain untouched.

Use Scenario Planning for Upcoming Months

Scenario planning helps you prepare for different financial outcomes. You estimate what your cash position will look like during good, average and slow months. This approach helps you make calm decisions during unpredictable periods, especially if you run a seasonal or project-based business.

Review Payment Modes for Better Cash Flow

The way you make payments affects your monthly liquidity. Choosing the right payment method can give you breathing room.

Use payment modes with longer billing cycles for purchases, and shift recurring expenses to predictable dates. This way, you avoid paying lump sums when instalments are available without extra cost.

Plan Quarterly Cash Goals

Long-term goals are useful, but quarterly targets create realistic checkpoints. They help you adjust your plans before small issues turn into crises.

Setting goals such as “reduce unnecessary expenses by 5% this quarter” or “increase prepaid orders by two clients”. This keeps progress measurable.

Introduce a Simple Approval System

Even small teams benefit from having one clear rule for who approves which type of spending. It reduces confusion and prevents unplanned outflows.

When every purchase goes through a quick approval step, you naturally avoid unnecessary payments and maintain smoother cash discipline.

Use Healthy Borrowing as a Cash Support Tool

Borrowing isn’t a bad thing when it’s planned well. Short-term loans can help you manage temporary cash gaps without disturbing your operations or personal savings. The key is to borrow only what you need and choose lenders who offer transparent terms and predictable repayment schedules.

Also Read: Understanding How Positive Cash Flow Works and Why It's Important

How Pocketly Supports You During Cash Flow Crisis

When cash flow feels tight, having a quick and reliable backup can ease a lot of pressure. Pocketly is a digital lending platform built for such moments, offering flexible personal loans ranging from ₹1,000 to ₹25,000. The interest starts at 2% per month, and the processing fee varies between 1-8% of the loan amount, with no hidden charges.

You can apply anytime because the process is fully online, quick and designed for minimal effort. There is no collateral, and only basic KYC documents are required. You also get flexible EMIs, so you can pay the minimum due and clear the rest when your cash situation improves. Their support team is available 24/7 whenever you need help.

How to apply:

- Sign up with your mobile number.

- Upload Aadhaar, PAN and personal details.

- Complete video KYC if required.

- Add your bank details.

- Choose the loan amount and tenure.

- Receive the amount directly in your bank account.

Pocketly makes short-term financial gaps easier to manage, giving you space to handle emergencies with confidence.

Final Verdict

Managing your business finances becomes much easier when you understand the early signs of cash flow problems and know how to respond to them. Once you recognise what triggers these issues, you can take steady steps to protect your operations and avoid unnecessary pressure.

By building stronger cash habits, planning ahead and keeping a close eye on your spending patterns, you create a more stable financial foundation. These steps not only reduce stress but also help you make clearer decisions during uncertain periods.

And when sudden expenses appear, or you need short-term support while you work on long-term solutions, Pocketly can make the situation easier to manage. Download Pocketly on iOS or Android for quick access to small emergency loans whenever you need them.

FAQ’s

What are the five rules of cash flow?

The five common rules are: tracking your income and expenses regularly, keeping enough cash for short-term needs, avoiding unnecessary spending, collecting payments on time and planning ahead for seasonal or unexpected dips.

How do you know if you have a cash flow problem?

You may notice frequent delays in paying bills, difficulty covering routine expenses or a growing dependence on short-term credit. If your bank balance drops faster than it recovers, it’s a clear sign that your inflows are not matching your outflows.

Is negative cash flow a problem?

Negative cash flow can be an issue if it continues for many months, as it suggests your business spends more than it earns. Occasional dips are normal, but repeated shortages can affect stability and long-term growth.

What are examples of cash flow problems?

Common examples include unpaid customer invoices, rising overhead costs, excess inventory and unpredictable sales cycles. These issues reduce the cash available for daily operations and make financial planning more difficult.

Can ChatGPT create a cash flow statement?

Yes, ChatGPT can create a cash flow statement if you provide the necessary financial details such as income, expenses, receivables and payables. It can help you structure and format the statement, but it should not replace professional financial advice.