When you work for yourself, money does not always come in on the same day every month. Clients may pay early, late, or after a follow-up, while your expenses still fall within fixed timelines. Rent, materials, electricity, and daily spending do not wait for pending invoices.

This is why cash flow matters.

Cash flow management involves balancing the inflow and outflow of money, ensuring there are sufficient highly liquid assets to cover expenses. Without it, businesses risk struggling to meet financial obligations.

In the sections ahead, we will explore why cash flow is important for self-employed people in India, the main objectives behind managing it well, the common reasons cash flow issues occur in flexible income work, and how simple habits can help improve financial comfort over time.

Key Takeaways

- Cash Flow Management is Crucial: For self-employed businesses, managing cash flow is key to meeting expenses and maintaining operations.

- Cash Flow Objectives: Focus on liquidity, optimising working capital, forecasting cash movements, and planning for unexpected costs.

- Assess Your Cash Position: Regularly track liquid assets, forecast inflows and outflows, and calculate liquidity ratios to spot potential gaps.

- Quick Cash Flow Practices: Open a dedicated business account, invoice promptly, negotiate supplier terms, and cut unnecessary costs.

- Structured Approach Prevents Problems: Following clear objectives and processes helps mitigate cash shortages and reduces reliance on expensive credit.

What is Cash Flow Management and Why Is It Important for Your Business?

Cash flow management is the process of tracking and controlling the movement of funds within a business to meet operational needs. It involves overseeing cash inflows (payments from customers, sales, etc.) and cash outflows (expenses such as rent, salaries, utilities), while also managing working capital to maintain financial stability.

Why is it important for your business?

- Timely payments: Helps you meet obligations to suppliers, employees, and creditors on time, avoiding late fees and maintaining strong relationships.

- Prevents cash shortages: Minimises the risk of running out of funds to cover day-to-day operations.

- Supports informed decision-making: Provides a clear picture of your financial health, aiding strategic decisions regarding investments, cost management, and expansion.

- Enables growth: Adequate cash flow allows you to take advantage of new opportunities, such as investing in equipment, expanding your product line, or hiring staff.

- Helps with regulatory compliance: Proper cash flow management helps to meet tax obligations, file financial statements, and stay compliant with industry regulations.

Also Read: Understanding How Positive Cash Flow Works and Why It's Important

To manage your cash flow effectively, you need clear targets to work toward. Setting specific cash flow objectives gives your business measurable goals that keep your finances on track and help you maintain the stability discussed above.

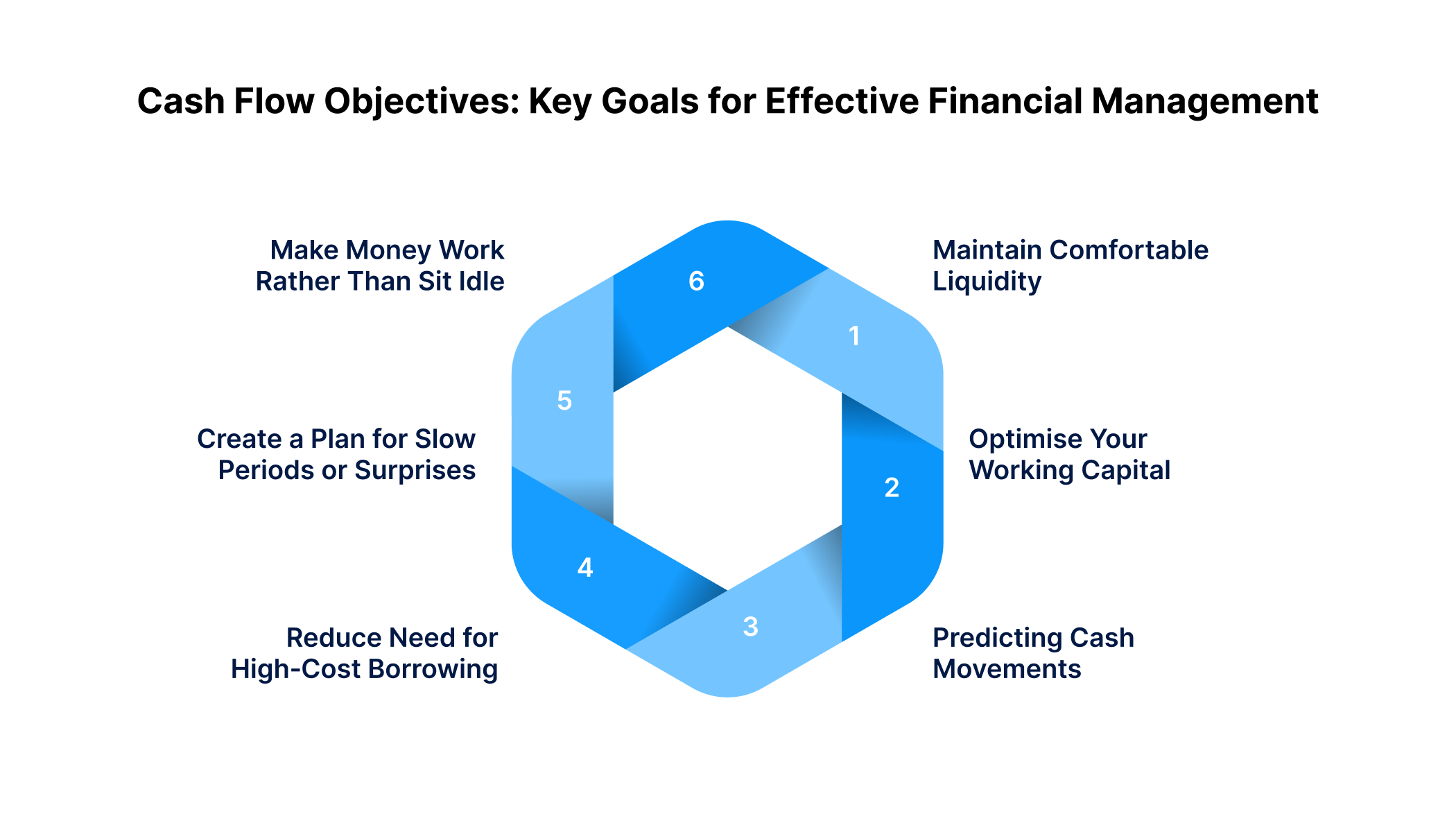

Cash Flow Objectives: Key Goals for Effective Financial Management

Cash flow objectives refer to the specific financial goals that a business sets in order to manage its cash flow. These objectives are designed so that the business has enough liquidity to cover daily expenses.

This is especially important for small businesses or freelancing ventures where a clear cash flow objective gives you direction and checkpoints that keep you on track and ready for what’s ahead. Here are the major objectives you should aim for:

1. Maintain Comfortable Liquidity

Make sure you have quick access to enough cash or highly liquid assets (like money in the bank, easy‑to‑convert deposits) so you can cover everyday expenses, supplier payments, tools, or unexpected costs without stress.

2. Optimise Your Working Capital

Working capital is the difference between what you owe soon (suppliers, utilities) and what you expect to receive (clients, sales). Keeping this “gap” in check means you aren’t locked waiting for money to arrive while bills stack up.

3. Predicting Cash Movements

It involves forecasting when money will come into the business (inflows) and when it will need to be paid out (outflows). By setting clear expectations for these cash movements, businesses can avoid surprises, plan for lean periods, and prevent last-minute stress about meeting costs or missing new opportunities.

4. Reduce Need for High‑Cost Borrowing

When your cash flow is well‑managed, you are less likely to rely on emergency loans or high‑interest credit. That saves you money and keeps your business lean.

5. Create a Plan for Slow Periods or Surprises

Every business has ups and downs. One objective is to prepare for lean weeks (e.g., seasonal dips, delayed payments) by forecasting ahead and having a modest reserve or strategy to bridge the gap.

6. Make Money Work Rather Than Sit Idle

If your cash is merely sitting in your bank with no purpose, you’re missing out. One goal is to use surplus cash wisely, maybe for a small tool upgrade, restocking at a lower cost, or paying off an expensive obligation.

Having objectives is the first step, but you need practical methods to achieve them. The key functions of cash flow management are the core activities that help you meet these objectives.

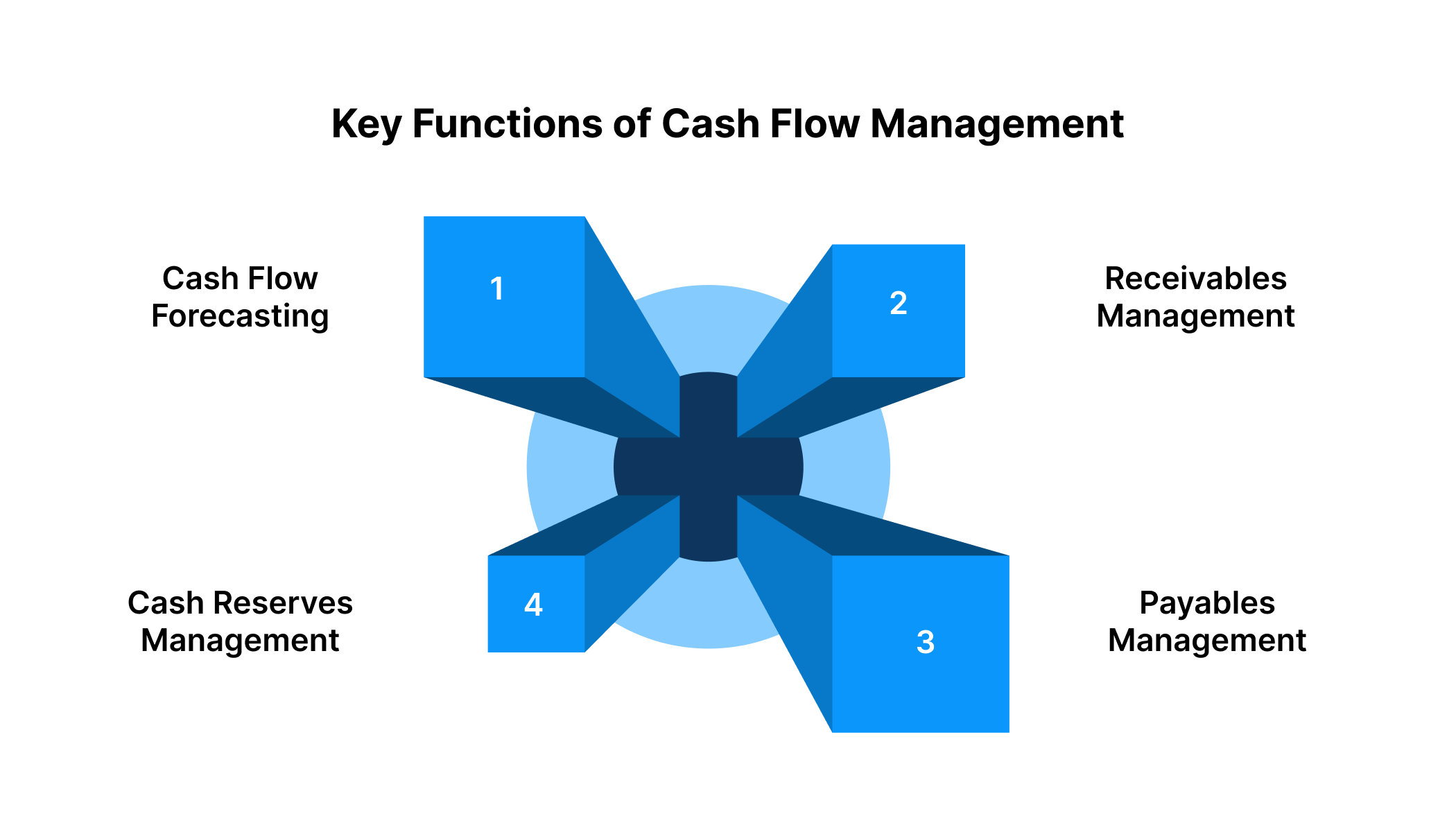

Key Functions of Cash Flow Management

Effective cash flow management involves more than just tracking money in and out. It’s about controlling and optimising various aspects of your finances to ensure you can meet your business obligations while keeping funds available for growth. Here are the key functions that form the backbone of efficient cash flow management:

1. Cash Flow Forecasting

Cash flow forecasting, which is the inflow and outflow, is based on historical data and expected business activity. It’s a vital tool for planning periods of high or low revenue. This helps maintain enough funds to cover expenses during slow months.

2. Receivables Management

Managing payments from clients or customers is crucial for maintaining steady cash flow. Late payments can disrupt cash flow and lead to liquidity issues. A clear process for invoicing, follow-ups, and payment tracking is essential to maintain a steady flow of incoming funds.

3. Payables Management

Managing payables involves meeting obligations to suppliers, employees, and creditors on time. Delaying payments can damage relationships and incur penalties, but paying too quickly can strain cash reserves. It’s about striking the right balance and timing payments effectively.

4. Cash Reserves Management

Keeping cash in reserves provides a buffer for unforeseen expenses and adds stability during tough or periods of low income. Keeping aside a portion of earnings as an emergency fund will help.

If you find yourself in need of quick liquidity, Pocketly offers personal loans ranging from ₹1,000 to ₹25,000. With minimal documentation and fast approval, you can access the funds you need to keep your business running smoothly without the long wait.

While these functions provide a strong foundation, self-employed professionals and small business owners face specific challenges that can disrupt cash flow. Understanding these common problems helps you prepare for them before they become critical issues.

Why Cash Flow Problems Happen More Often for the Self-Employed

Managing cash flow is crucial, but it can be tricky for businesses when faced with common challenges that disrupt financial stability. These issues are often beyond your control, but understanding them can help you plan for them and minimise their impact.

Here are some of the most common cash flow problems businesses encounter:

- Delayed Payments from Clients: One of the biggest cash flow issues for businesses is delayed payments. If your clients don’t pay on time, you could be struggling to cover costs. This is common in businesses with irregular payment cycles or long invoicing terms.

- Seasonal Fluctuations in Revenue: Many businesses, like those in retail or tourism, experience seasonal sales spikes. However, when business slows down during off-seasons, cash flow can dip. Without proper management, this can lead to periods of financial strain.

- Inaccurate Cash Flow Projections: When cash flow isn’t tracked properly, projections can be inaccurate. If you fail to estimate future cash inflows and outflows accurately, you might end up overspending or facing an unexpected shortage.

- Excessive Inventory or Overhead Costs: Holding too much inventory or having high fixed costs (like rent or equipment) can drain your cash reserves. If you’re not managing expenses rightly, you may find yourself with excess stock or ongoing overhead costs that don’t align with current revenue.

- Unforeseen Expenses: Emergencies or unplanned costs, like equipment breakdowns, legal fees, or sudden price hikes from suppliers, can easily throw your cash flow out of balance. Having a safety net or contingency plan can help prevent a crisis.

Knowing what can go wrong is useful, but you need a practical method to assess your current financial situation. The following step-by-step process shows you how to quickly evaluate your cash position and identify potential shortfalls before they impact your business.

How to Understand Your Cash Position Quickly and Manage It: A Simple Process

Understanding where your business stands financially is the first step in managing your cash flow. With irregular income and fluctuating expenses, it’s vital to have a clear picture of your cash position at any given time. This process will help you assess your financial health and take action to avoid cash flow issues before they happen.

Step 1: Take a Snapshot of Your Cash Position

- List your highly liquid assets: This includes cash in the bank, digital wallet balances, and any short-term deposits that can be accessed easily within 7-10 days.

- List your short-term obligations: These are expenses that must be paid in the next 30 days, including rent, utilities, supplier payments, and any other fixed costs.

- Calculate a simple liquidity ratio: Liquid assets ÷ Short-term obligations. If this ratio is less than 1, it signals that you might have a cash shortfall.

- Example: You have ₹15,000 in your bank, but your payments due are ₹20,000. Your liquidity ratio is 0.75, which indicates a shortfall. You’ll need to plan for this gap.

Step 2: Map Expected Inflows vs. Outflows Over the Next 30-60 Days

- Expected inflows: Write down payments you expect to receive from clients or sales over the next 30-60 days.

- Expected outflows: Write down the expenses you need to cover in that same period.

- Look for timing mismatches: For example, if you’re expecting ₹10,000 from a client in 45 days but your rent is due in 10 days, you know there’s a gap.

- Mini-tool for visual tracking: Use a simple table like this to map inflows and outflows:

| Week | Expected Inflow | Required Outflow | Net Cash Position |

| Week 1 | ₹0 | ₹8,000 | –₹8,000 |

| Week 2 | ₹0 | ₹4,000 | –₹12,000 |

| Week 3 | ₹10,000 | ₹3,000 | –₹5,000 |

Note: The net cash position is the carry-forward amount from the previous week, adding or subtracting from that the current week's inflows and outflows.

In the above table, the business is facing a liquidity gap until Week 3 when the expected inflow finally starts to come in.

Step 3: Decide Your Response Based on the Gap

If you find a gap between inflows and outflows, ask yourself:

- Can I delay any payments? Talk to suppliers to extend payment terms.

- Can I accelerate any inflows? Ask clients for partial payments or push sales during slower periods.

- Do I need short-term credit? An instant personal loan (e.g., ₹5,000 to ₹10,000) can help cover the gap until payments arrive.

Example: You might take a cash loan to cover an early rent payment, knowing a larger client payment is coming in later.

Step 4: Review Weekly and Adjust

Track your actual vs. planned cash flow weekly.

- If a client payment is delayed, update your plan to reflect that.

- Use a “variance” concept: Actual – Planned = Variance. If your plan showed ₹5,000 in inflow but you received ₹2,000, you’re ₹3,000 short.

- Reflect on why the variance occurred (late payments, unplanned expenses) and adjust future forecasts accordingly.

Step 5: Build a Small Reserve and Use Metrics

- Create a buffer: Aim to keep liquid cash that covers 10-20% of your upcoming 30-day expenses.

- Monitor your Cash Buffer Ratio: Liquid Assets ÷ 30-Day Obligations. This simple metric will give you a quick view of whether you have a healthy cash cushion.

- Example: If your liquid assets are ₹4,000 and your obligations are ₹24,000, your ratio is 0.17. Set a target ratio of 0.20 to give yourself a stronger buffer.

- Keep this ratio in mind; if it falls below your target, take action to improve your liquidity.

Understanding your cash position gives you the data you need, but sustainable cash flow requires building good habits into your routine.

5 Simple and Actionable Cash Flow Management Practices You Can Start This Week

When you’re running a small business or working independently, smoother cash flow doesn’t come from large overhauls; it comes from consistent, practical steps. Below are five focused practices you can begin this week.

- Use a Dedicated Business Bank Account: Opening and using a separate bank account for business earns you clarity. Mixing personal and business funds makes it hard to track actual inflows and outflows; it increases the risk of misallocating funds.

- Send Invoices Immediately & Offer Incentives for Early Payment: Getting paid on time improves your inflow profile. A delay of even a few days can ripple into a cash shortage.

- Negotiate Payment Terms with Suppliers & Align Them to Your Income Pattern: If your business pays suppliers before you get paid by clients, you’ll continuously experience cash gaps. Research advises mapping payables to match revenue timing.

- Track Your Monthly Outflows and Identify Non‑Essential Costs: Unplanned or recurring minor expenses add up and can erode your liquidity. Create a list of all monthly business expenses. Highlight any “nice‑to‑have” costs (e.g., premium software upgrade) and pick one to stop or reduce this month.

- Keep a Short‑Term Cash Buffer and Re‑check It Weekly: Having a small buffer of liquid funds guards you against minor delays or unexpected costs. Decide on a target buffer (for example, cash equal to 10‑15% of your next 30‑day obligations).

Even with strong cash flow practices in place, unexpected gaps can still occur, whether from delayed client payments, emergency expenses, or seasonal slowdowns. Quick access to short-term funding can help you bridge these gaps without disrupting your operations.

How Pocketly Can Help Bridge Your Cash Flow Gaps

Pocketly provides a simple, fast personal loan solution. Whether you're dealing with delayed payments, unexpected costs, or seasonal dips, Pocketly’s loans for the self-employed help you maintain business liquidity without the stress of lengthy paperwork or high interest.

- Personal loans ranging from ₹1,000 to ₹25,000. With minimal documentation and fast disbursement.

- Rate of Interest: Starting from 2% per month

- Processing Fee: 1-8% of the loan amount

- Quick and Simple Process: Fast approval and minimal paperwork, available directly via the Pocketly app.

- No Hidden Fees: Transparent loan structure with clear terms.

Conclusion

Managing cash flow is crucial for the stability and growth of any business. By understanding the key objectives and functions of cash flow management, businesses can avoid common issues like late payments, seasonal fluctuations, and unexpected expenses.

Whether you’re a small business owner or self-employed, implementing simple strategies like forecasting, tracking inflows and outflows, and building a cash reserve will help you maintain liquidity and avoid financial strain. By applying these practices, you’ll be able to manage your cash flow and keep your business on solid ground.

With Pocketly’s instant personal loan options, we help you cover temporary gaps in your cash flow without delays. Download the Pocketly app today on iOS or Android and take control of your finances.

FAQs

1. What are the 7 steps to prepare a statement of cash flows?

The 7 steps to prepare a statement of cash flows include identifying operating activities, adjusting for non-cash transactions, calculating working capital changes, tracking investing activities, recording financing activities, summing up the cash flow from all sections, and reconciling the net cash change.

2. What is a good cash flow?

A good cash flow means consistently having more cash coming in than going out, allowing the business to cover its expenses, invest in growth, and remain financially stable.

3. What are the five rules of cash flow?

The five rules of cash flow are maintaining liquidity, tracking inflows and outflows regularly, controlling expenses, prioritising timely payments, and setting aside reserves for unexpected costs.

4. What is a positive cash flow example?

A positive cash flow example is when a business generates more revenue than it spends, enabling it to reinvest in growth or pay off liabilities.

5. Why is cash flow important than profit?

Cash flow is more important than profit because a business needs available cash to pay its bills and sustain operations, even if it’s profitable on paper.