Ever found yourself in a situation where your expenses don’t wait for payday? Perhaps a medical emergency arose, or your rent is due, and your salary is still a few days away. In moments like these, you need money, and you need it fast. That’s where a cash loan can make all the difference.

Cash loans are designed for exactly these situations. They’re quick, simple, and often require just a few basic documents. Whether it’s to cover a short-term gap or manage an urgent cost, cash loans give you instant access to funds, without the long wait or complicated bank procedures.

In this guide, we’ll break down exactly what a cash loan is, how it works, when to consider one, and how to apply for it the right way so you can make wise financial choices when you need them most.

TL;DR (Key Takeaways)

- A short-term, unsecured loan designed to meet urgent financial needs without collateral, typically with quick approval and minimal documentation.

- Cash loans are ideal for medical emergencies, unexpected bills, tuition fees, or covering rent when your salary is delayed.

- Fast approval, no collateral, flexible loan amounts, and easy online access make cash loans a convenient option for immediate financial relief.

- Instalment loans, payday loans, and credit card cash advances, each with its own features and repayment structures.

- Pocketly offers instant cash loans, flexible amounts, and transparent fees, making it a wise choice for urgent financial support with minimal paperwork.

What Is a Cash Loan?

A cash loan is a type of short-term loan in which a borrower receives a lump sum upfront, which they are required to repay over a specific period, typically with interest. Unlike traditional loans, which are often restricted to particular purposes, cash loans are versatile and designed for quick financial needs, such as emergencies, utility bills, or unexpected expenses.

The funds can be received either directly in your bank account or in physical cash, depending on the lender. Cash loans are typically unsecured, meaning you don’t have to provide any collateral, making them more accessible to a range of borrowers, even those with minimal credit history.

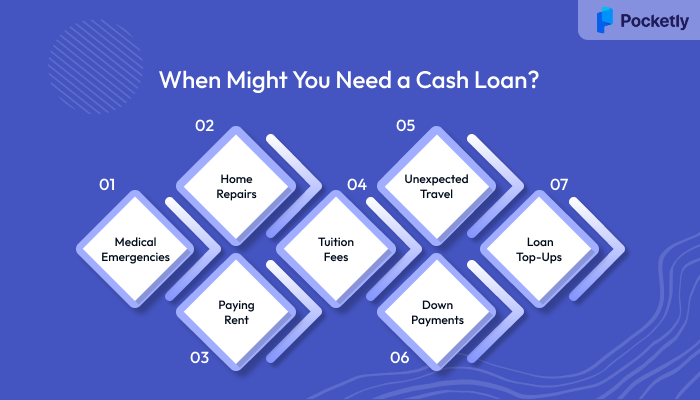

When Might You Need a Cash Loan?

Life doesn’t always go according to plan, and sometimes, your expenses can’t wait. Whether it’s a sudden emergency or a time-sensitive payment, a cash loan can help you bridge the gap quickly and conveniently.

Here are some common situations where a cash loan can be incredibly useful:

- Medical Emergencies: From unexpected hospital visits to urgent treatments or medicines, having access to quick cash can make all the difference in getting the care you or your loved ones need.

- Home Repairs or Renovation: Broken appliances, plumbing issues, or essential maintenance can’t always be postponed. A cash loan helps you fix these problems promptly without disrupting your daily routine.

- Paying Rent or Utility Bills: If your income is delayed or stretched thin, a short-term loan can help you avoid penalties or service interruptions for essentials like electricity, water, or gas.

- Tuition Fees or Educational Expenses: School or college fees often come at once, and they aren’t cheap. Whether it’s your education or your child’s, a cash loan can help you cover tuition, books, or exam fees on time.

- Unexpected Travel or Family Obligations: Emergencies don’t come with a heads-up. A cash loan allows you to book urgent travel or take care of family-related costs without added financial stress.

- Down Payments or Time-Sensitive Deals: Planning a large purchase like a vehicle, property, or business asset? A cash loan ensures you don’t miss out on opportunities because you’re short on funds.

- Debt Consolidation or Loan Top-Ups: If you're juggling multiple debts, a single cash loan can help you pay off high-interest obligations and simplify your finances.

Whatever the situation, a cash loan gives you the flexibility to manage urgent expenses without waiting, helping you stay in control when it matters most.

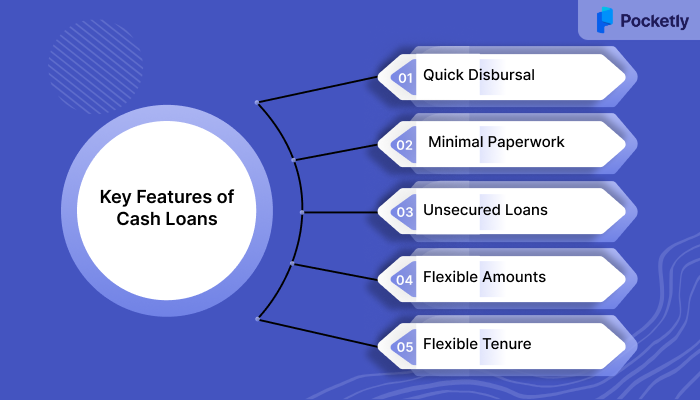

Features and Benefits of Cash Loans

Cash loans are gaining popularity for a good reason they’re simple, fast, and accessible when you need funds the most. Whether it’s a medical bill, a short-term cash crunch, or a personal emergency, a cash loan offers a practical solution without the formalities of traditional banking.

Below are the standout features and benefits that make cash loans a go-to option for many borrowers:

Key Features

- Quick Approval and Disbursal: Most cash loans are approved within hours and disbursed on the same day, making them ideal for addressing urgent financial needs.

- Minimal Documentation: Unlike traditional loans, you don't need to provide heaps of paperwork. Basic ID and income proof are usually enough.

- No Collateral Required: These loans are unsecured, meaning you don't need to pledge your assets, making them perfect for salaried and self-employed individuals alike.

- Flexible Loan Amounts: Suppose you need ₹1,000 or ₹1,00,000, lenders offer varying amounts based on your eligibility and repayment capacity.

- Short to Medium Tenure Options: You can choose repayment periods that range from a few weeks to a few years, depending on the type of loan.

Main Benefits

- Covers Emergency Expenses: From medical costs to unexpected travel, cash loans provide a safety net during urgent situations.

- Improves Financial Independence: Instead of borrowing from friends or family, you can handle expenses privately and responsibly.

- Accessible Even with a Limited Credit History: Many digital lenders approve borrowers with no credit score or a low credit score, especially for smaller amounts.

- Online Convenience: Apply, upload documents, and track your loan status—all from your phone or computer.

- Boosts Credit Score (If Repaid On Time): Timely repayments of cash loans are often reported to credit bureaus, and this will help you build or improve your credit history.

Cash loans combine speed, simplicity, and flexibility, offering a smart financial lifeline when life takes an unexpected turn.

To understand more about cash loans and flow, read our guide on Understanding Cash Flow: Definition, Types, and Analysis

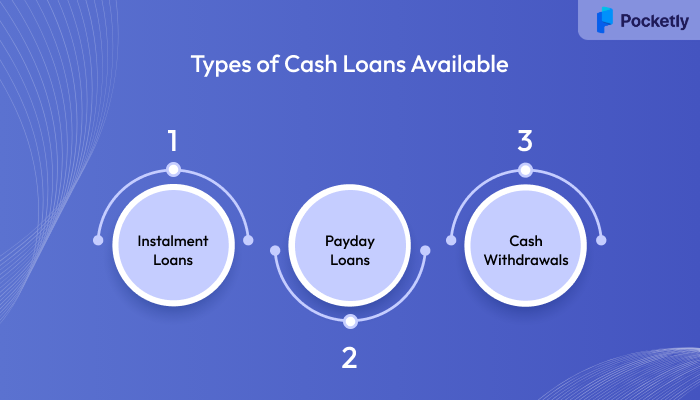

Types of Cash Loans Available

Cash loans come in several forms to suit different needs and borrowing styles. Whether you need a quick fix until payday or a more structured repayment plan, there's likely a cash loan option that fits. Understanding each type will help you choose the right one for your situation, without paying more than necessary.

Let’s explore the most common types of cash loans available in India:

1. Instalment Loans

An instalment loan is a personal loan that lets you borrow a fixed amount and repay it in equal monthly instalments (EMIs) over a specific period, usually 3 to 36 months.

How it works: Once approved, the loan amount is transferred to your bank account. You’ll then repay it in EMIs that include both principal and interest. Interest rates and tenure vary based on your profile and the lender’s policy.

Features & Benefits:

- Predictable repayment schedule

- Suitable for medium- to long-term needs

- Improves credit score with timely repayments

- Can be used for personal, medical, or family expenses

Example: You borrow ₹50,000 to cover a medical procedure and repay it in 12 monthly EMIs of ₹4,500. This structure helps you manage costs without straining your monthly budget.

2. Payday Loans

A payday loan is a short-term loan designed to cover urgent expenses until your next salary is credited. It’s usually a small amount borrowed for a short duration.

How it works: You borrow an amount say ₹5,000 or ₹10,000 expected to be repaid in full (along with interest) by your next payday, typically within 15 to 30 days.

Features & Benefits:

- Quick approval, often within minutes

- Minimal paperwork required

- Great for emergencies like sudden bills or travel

- Doesn’t require a strong credit history

Example: You borrow ₹8,000 to pay your rent because your salary is delayed. You repay the full amount with interest once your salary is credited, typically within a few weeks.

3. Credit Card Cash Advances

A credit card cash advance allows you to withdraw physical cash from an ATM using your credit card, up to a certain percentage of your total credit limit.

How it works: You use your credit card to withdraw money directly, usually from an ATM. Interest starts accruing immediately, and there’s typically no interest-free period for this feature.

Features & Benefits:

- Instant access to cash via ATM

- No separate loan application needed

- Useful in emergencies when other options aren’t available

- Limits based on your card's cash withdrawal feature

Example: You withdraw ₹10,000 using your credit card to pay for an urgent car repair. While it’s convenient, you’ll want to repay it quickly to avoid high interest charges.

Eligibility and Documentation for Cash Loans

Most cash loan providers aim to keep the process quick and stress-free. That’s why their eligibility criteria are fairly straightforward, and the documentation required is kept to a minimum. Here's what you’ll generally need to apply for a cash loan:

1. Eligibility Criteria

- Age Requirement – Usually between 18 to 40 years, depending on the lender.

- Income Source – Open to salaried employees, self-employed individuals, and freelancers. Some apps may have minimum income requirements.

- Credit Score – While some apps require a good credit score (650+), others approve loans based on transaction history or spending patterns.

- Citizenship – Must be an Indian resident with a valid bank account and an active mobile number.

2. Documents Required

- Identity Proof – Aadhaar Card, PAN Card, or Voter ID.

- Address Proof – Aadhaar Card, Passport, Utility Bill, or Rental Agreement.

- Income Proof – Salary slips, bank statements (for salaried individuals), or ITR filings (for self-employed individuals).

- Bank Details – A valid bank account for loan disbursal and EMI payments.

Since most apps follow a 100% digital process, you can upload these documents online for instant verification, making the loan approval process quick and seamless.

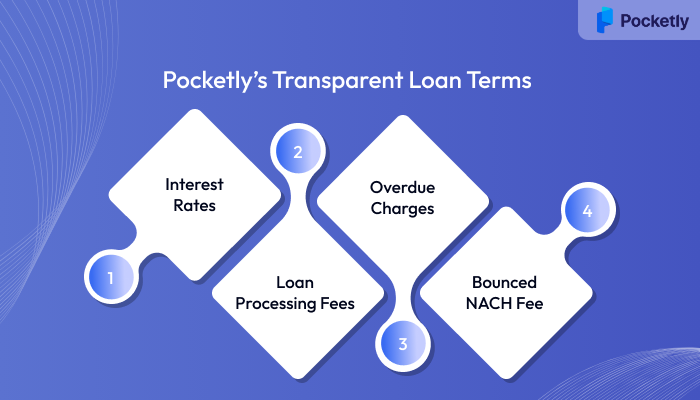

Pocketly’s Transparent Loan Terms

At Pocketly, we ensure complete transparency in lending, so you always know what to expect—no hidden charges, no surprises. Whether you’re borrowing ₹1,000, ₹5,000, or a higher amount up to ₹25,000 our clear terms help you plan your finances with ease.

- Interest Rates – Starting at 2% per month, adjusted based on your credit rating and repayment duration to offer fair and affordable rates.

- Loan Processing Fees – A one-time fee ranging from 1% to 8% is deducted post-approval, making the process smooth and hassle-free.

- Overdue Charges – Late EMI payments incur a small penalty to encourage timely repayments and help maintain your credit score.

- Bounced NACH Fee – If your account lacks sufficient funds on the due date, a nominal charge is applied. Keeping your balance updated helps avoid this fee.

With these transparent loan terms, borrowing becomes stress-free and convenient. Apply for your instant cash loan with Pocketly today!

Also, read our guide on Exploring Different Types of Loan Repayment Methods.

Considerations for Choosing Cash Loan Providers

With so many cash loan apps and lenders available today, it’s easy to get overwhelmed by the choices. But not every provider offers the same level of reliability, transparency, or support. To ensure a safe and stress-free borrowing experience, it's important to look beyond just the interest rate and carefully evaluate the lender’s reputation and policies.

Here are a few key things to consider before choosing a cash loan provider:

What to Look For:

- Regulatory Compliance: Make sure the lender is registered with the RBI or partnered with a licensed NBFC. This helps ensure your data and money are in safe hands.

- Transparent Terms and Conditions: Check if the provider clearly outlines interest rates, fees, EMI schedules, and late payment charges without hidden surprises.

- Customer Reviews and Ratings: Go through user feedback on Google Play, App Store, and review sites to see how reliable and user-friendly the platform really is.

- Interest Rates and Fees: Compare offers from different providers. Low interest rates are ideal, but also pay attention to processing fees and penalty charges.

- Ease of Application: Choose platforms with a simple, fully digital application process—no need for in-person visits or complex forms.

- Speed of Approval and Disbursal: If you’re applying for a cash loan in an emergency, opt for providers known for same-day approval and quick transfers.

- Customer Support: A responsive customer care team is essential, especially if you face issues during the loan process or repayment.

Choosing the right provider doesn’t just help you get funds faster—it ensures you borrow safely, responsibly, and without unnecessary stress.

And if you're still unsure about which lending platform to trust during an emergency, don’t stress. Pocketly is here to help. With a simple application process, lightning-fast approvals, and complete transparency, Pocketly makes borrowing easy, safe, and reliable, just the way it should be when you need urgent financial support.

Pocketly: Fast, Flexible Cash Loans When You Need Them Most

Made for young Indians, students, first-jobbers, freelancers, and salaried professionals, Pocketly offers instant cash loans that are flexible, fast, and genuinely stress-free. Whether you need ₹1,000 to get through the week or ₹25,000 to cover a bigger financial gap, Pocketly has your back.

Here’s how Pocketly helps you get the funds when you need them most:

- Instant Approvals and Quick Disbursal: Pocketly prides itself on fast approvals, getting you the money you need almost instantly.

- Flexible Loan Amounts:

- Whether you need ₹1,000 for a small expense or ₹25,000 for something more significant, Pocketly offers a range of loan options to suit your needs.

- Minimal Documentation:

- Forget long forms and endless paperwork. Pocketly requires only essential documentation, making the process smooth and hassle-free.

- Transparent Fees:

- With Pocketly, there are no hidden charges. You’ll know exactly what the interest and fees are upfront, allowing you to plan confidently.

- Credit-Friendly:

- Even if your credit score isn’t ideal, Pocketly gives you a chance. It’s designed to be accessible, making it a great option when traditional lenders might turn you down.

- Flexible Repayment Options:

- Pick a repayment schedule that suits you, with options designed to fit comfortably within your budget.

How to Apply for a Personal Loan via Pocketly

With just minimal yet simple steps, you can get the funds you need without delays.

- Download and Sign Up:

- Start by downloading the Pocketly app from the App Store or Play Store. Create an account using your mobile number; it’s fast, secure, and user-friendly.

- Upload Your Documents:

- No more dealing with endless paperwork. Simply upload your KYC documents through the app, it’s quick, secure, and straightforward, taking only a few minutes.

- Select Your Loan Amount:

- Choose an amount that suits your needs, whether it’s a smaller sum of ₹1,000 or something larger, like ₹25,000. Pocketly ensures flexibility to cater to your requirements.

- Quick Approval:

- Once your application is submitted, Pocketly’s system reviews it instantly. Most loans are approved within minutes, eliminating the usual waiting period.

- Receive Funds Immediately:

- Once approved, the loan amount is credited directly to your bank account. This swift process ensures that you have the money exactly when you need it.

Pocketly offers fast approvals, minimal paperwork, and flexible repayments to suit your needs.

Conclusion

Cash loans can be a real lifesaver when an unexpected expense catches you off guard. Whether it's a medical emergency, tuition fees, an overdue bill, or an urgent travel plan, having access to quick and flexible funds can ease a lot of stress. With minimal paperwork, fast approvals, and no need for collateral, cash loans are designed to help you manage short-term financial needs without the wait.

But as with any borrowing decision, it's essential to choose a trusted platform, understand the terms, and borrow responsibly.

If you're looking for a fast, reliable, and easy-to-use solution, Pocketly makes it simple. With transparent terms, instant approvals, and loan options tailored to your needs, it's a smart choice for anyone who needs cash without the complications.

Need funds now? Download the Pocketly app and get started in minutes.

FAQs

How quickly can I get a cash loan?

Most cash loans are approved within a few hours, and many lenders disburse the funds on the same day, sometimes even within minutes, depending on your eligibility and documentation.

Do I need a good credit score to apply for a cash loan?

Not necessarily. While a good credit score can improve your chances and secure better terms, many lenders, especially digital platforms like Pocketly, consider applicants with low or no credit history, particularly for smaller loan amounts.

What loan amounts can I apply for?

You can borrow ₹1000 to ₹25,000, depending on your eligibility and needs. It’s perfect for covering small and urgent expenses.

How fast can I get the loan?

Approval takes just a few minutes, and funds are transferred to your bank account shortly after. Pocketly ensures a quick and seamless process.

What documents are needed?

Only basic KYC documents—PAN card, Aadhaar card, and bank statement—all uploaded online. You don’t need to deal with any physical paperwork.

Do I need a credit score?

No credit score is required. Pocketly welcomes first-time borrowers, too. It’s designed for everyone, including those new to credit.